Harris&Ewing Underwood Typewriter Co., Washington, DC 1919

Try and feel sorry. I dare you.

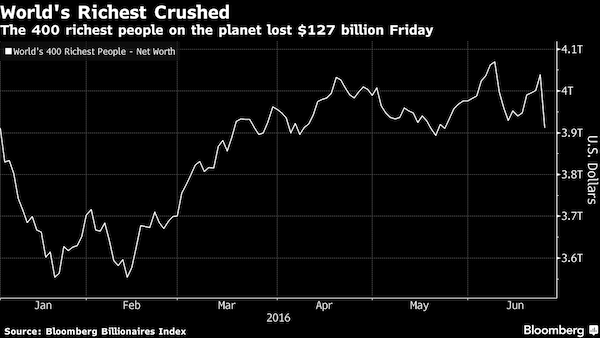

• World’s 400 Richest People Lose $127 Billion on Brexit (BBG)

The world’s 400 richest people lost $127.4 billion Friday as global equity markets reeled from the news that British voters elected to leave the European Union. The billionaires lost 3.2% of their total net worth, bringing the combined sum to $3.9 trillion, according to the Bloomberg Billionaires Index. The biggest decline belonged to Europe’s richest person, Amancio Ortega, who lost more than $6 billion, while nine others dropped more than $1 billion, including Bill Gates, Jeff Bezos and Gerald Cavendish Grosvenor, the wealthiest person in the U.K.

Meaningless. If the euro loses against the dollar, what is lost exactly? Besides, it’s all virtual overkill anyway.

• Global Markets Lose $2.1 Trillion In Brexit Rout (AFP)

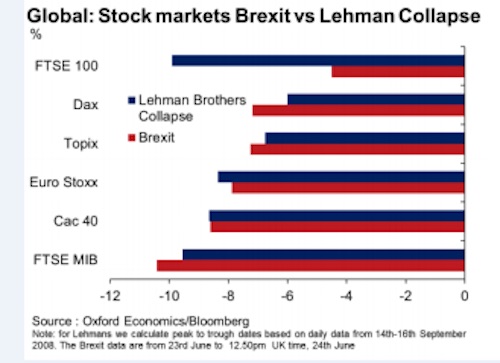

Britain’s shock vote to pull out of the European Union wiped $2.1 trillion from global equity markets Friday as traders panicked in the face of a new threat to the global economy. Investors fled to the safety of gold, the yen and blue-chip bonds as the seismic shift in the structure of Europe left many huge questions hanging, including who will lead Britain following the resignation of Prime Minister David Cameron. The Brexit vote sparked 8% losses in the Tokyo and Paris bourses, nearly 7% in Frankfurt and more than 3% in London and New York. Central banks stepped in to bolster confidence, promising to inject liquidity where needed and appearing to mitigate some of the sharpest losses.

Still, the pound crashed 10% to a 31-year low at one point, before rebounding slightly for a 9.1% loss against the greenback in late trade. The euro also plummeted, dropping 2.6% on the dollar. Benefitting from a massive safety selloff, gold jumped nearly 5% and the yen surged 4.2% against the dollar and 7.0% on the euro. The dollar at one point fell below 100 yen for the first time since November 2013. US 10-year treasury bond yields hit their lowest since 2012 at 1.42% before edging higher, while the German 10-year bund fell into negative territory for the second time in history.

Try Italian banks: “..Monday is where we’re going to see a truer-look at “where the bodies are buried” and a more accurate “price discovery” process than what we’re seeing today..”

• [Friday Was] The Appetizer For Monday (ZH)

RBC’s Charlie McElligott: “I do feel that Monday is where we’re going to see a truer-look at “where the bodies are buried” and a more accurate “price discovery” process than what we’re seeing today (as we’re washing out all the delta one flows which are dwarfing client trading)…lots of discipline being displayed thus far, with low turnovers and folks not chasing.

FTSE (UKX, benchmark equities index) is an absolute CHAMP right, trading -8.7% within the first 10 minutes of the open before clawing-back to all but -1.9% at ‘highs.’ Wrap your head around this: week-to-date, UKX is up over 2.8%! What’s the driver of today’s massive rally? People are getting their arms around the impact of this extraordinarily weak Sterling as a backdoor stimulus for exporters (ironic the power of what a departure from the EU can do vs what x # of kagillions of QE purchases couldn’t get done) and the inevitable rate cut from the BoE.

What I have to continue keeping one eyeball on is SX7E (EU banks index); the thing cannot get off mat. And if that can’t get off the mat, peripheries (and their sovereign debt) won’t either, as we re-enter the EU-crisis-era “Doom Loop” where widening sovereign spreads drag down the banks who are stuffed to the gills with them….vicious cycle, what else is new. FWIW, as I write and we’ve had this massive bounce in equities, Italian stocks (FTSEMIB) are back at their lows. This will likely be the next “hot zone” as we begin playing EU existential dominos (Spanish elections Sunday too).

My model Equity L/S portfolio is -285bps today. That is NOT cool. Elsewhere, from a thematic or factor perspective, we see the implications we spoke about earlier of the RAGINGLY STRONGER DOLLAR smashing the reflation / cyclical beta trade (value, energy, beta all struggling, while momentum mkt neutral works with defensive longs + and fins / biotech / energy -)”

Of his own making.

• Alan Greenspan Says Brexit Is The ‘Tip Of The Iceberg’ For Europe (MW)

The global economy is suffering from even bigger woes than the decision by U.K. voters to leave the European Union, Former Federal Reserve Chairman Alan Greenspan said Friday. ”This is just the tip of the iceberg,” Greenspan said in an interview on CNBC. “The global economy is in real serious trouble.” The rejection of British voters of the status quo in Europe was fueled by a “massive slowing” in the growth rate of real incomes that is widespread across Europe, Greenspan said. This, he said, is creating serious political problems that are not easy to resolve. Behind the slowdown in income is the sharp drop in worker productivity, according to Greenspan. Governments have to cut entitlements to reflect this weakness, he said.

The biggest concern is not a recession, but stagnation, the former Fed chief said. “The euro-area…is failing,” Greenspan said. “Greece is in real serious trouble and it is not going to continue in the euro very much longer irrespective of what is going on currently,” he said. Asked what he would do if he was still Fed chief, Greenspan said: “I would worry.” “This is the worst period I recall since I’ve been in public service,” he said. “There is nothing like it,” he said, including the 23% drop in the Dow Jones Industrial Average on a single day in October 1987.

“..there will be payback, clawback and traumatic deflation of the bubbles. Plenty of it, as far as the eye can see.”

• Bravo Brexit! (David Stockman)

At long last the tyranny of the global financial elite has been slammed good and hard. You can count on them to attempt another central bank based shock and awe campaign to halt and reverse the current sell-off, but it won’t be credible, sustainable or maybe even possible. The central banks and their compatriots at the EU, IMF, White House/Treasury, OECD, G-7 and the rest of the Bubble Finance apparatus have well and truly over-played their hand. They have created a tissue of financial lies; an affront to the very laws of markets, sound money and capitalist prosperity. So there will be payback, clawback and traumatic deflation of the bubbles. Plenty of it, as far as the eye can see.

On the immediate matter of Brexit, the British people have rejected the arrogant rule of the EU superstate and the tyranny of its unelected courts, commissions and bureaucratic overlords. As Donald Trump was quick to point out, they have taken back their country. He urges that Americans do the same, and he might just persuade them. But whether Trumpism captures the White House or not, it is virtually certain that Brexit is a contagious political disease. In response to today’s history-shaking event, determined campaigns for Frexit, Spexit, NExit, Grexit, Italxit, Hungexit and more centrifugal political emissions will next follow. Smaller government – at least in geography – is being given another chance. And that’s a very good thing because more localized democracy everywhere and always is inimical to the rule of centralized financial elites.

The combustible material for more referendums and defections from the EU is certainly available in surging populist parties of both the left and the right throughout the continent. In fact, the next hammer blow to the Brussels/German dictatorship will surely happen in Spain’s general election do-over on Sunday (the December elections resulted in paralysis and no government). When the polls close, the repudiation of the corrupt, hypocritical lapdog government of Prime Minister Rajoy will surely be complete. And properly so; he was just another statist in conservative garb who reformed nothing, left the Spanish economy buried in debt and gave false witness to the notion that the Brussels bureaucrats are the saviors of Europe. So the common people of Europe may be doubly blessed this week with the exit of both David Cameron and Mariano Rajoy. Good riddance to both.

“..It was the first episode of a pan-Europe uprising against the Caesaropapism of the EU Project and its technocrat priesthood.”

• The Sky Has Not Fallen After Brexit But We Face Years Of Hard Labour (AEP)

It is time for Project Grit. We warned over the final weeks of the campaign that a vote to leave the EU would be traumatic, and that is what the country now faces as markets shudder and Westminster is thrown into turmoil. The stunning upset last night marks a point of rupture for the post-war European order. It will be a Herculean task to extract Britain from the EU after 43 years enmeshed in a far-reaching legal and constitutional structure. Scotland and Northern Ireland will now be ejected from the EU against their will, a ghastly state of affairs that could all too easily lead to the internal fragmentation of the Kingdom unless handled with extreme care. The rating agencies are already pricing in a different British destiny. Standard & Poor’s declared that Brexit “spells the end” of the UK’s AAA status.

The only question is whether the downgrade is one notch or two, and that hangs on Holyrood. Moody’s has cocked the trigger too. Just how traumatic Brexit will be depends on whether Parliament can rise to the challenge and fashion a credible trade policy – so far glaringly absent – to safeguard access to European markets and ensure the viability of the City, and it depends exactly how Brussels, Berlin, Paris, Rome, Madrid, and Warsaw react once the dust settles. Both sides are handling nitroglycerin. Angry reproaches are flying in all directions, but let us not forget that the root cause of this unhappy divorce is the conduct of the EU elites themselves. It is they who have pushed Utopian ventures, and mismanaged the consequences disastrously.

It is they who have laid siege to the historic nation states, and who fatally crossed the line of democratic legitimacy with the Lisbon Treaty. This was bound to come to a head, and now it has. The wild moves in stocks, bonds, and currencies this morning were unavoidable, given the positioning of major players in the market, and given that the Treasury, the IMF, and the Davos brotherhood have been deliberately – in some cases recklessly – stirring up a mood of generalized fear.

[..] Some in Europe accuse the British people of strategic nihilism, of setting in motion the disintegration of the EU. It is true that French, Dutch, Italian, and Swedish eurosceptics are now agitating even more loudly for their own referenda, but voters are rising up across the EU in defence of national self-government and cultural ‘terroir’ for parallel reasons. Brexit is not the cause and this is not contagion. The latest PEW survey shows that anger with Brussels is just as great in most of Northwest Europe as it is Britain, and in France it is higher at 61pc. This referendum was never a fight between Britain and Europe, as so widely depicted. It was the first episode of a pan-Europe uprising against the Caesaropapism of the EU Project and its technocrat priesthood. It will not be the last.

No-one got it more wrong than the bookmakers. At least, what they said.

• They Got It Wrong: Swarms of Global Chatterers Misread Brexit (BBG)

A global cohort said before Thursday’s Brexit vote that Britain was unlikely to pull out of the European Union, the post-World War II international project that brought an unprecedented era of prosperity and peace. Yet some were led astray by the belief that free trade’s money and material goods outweighed nationalism and the tug of nostalgia. Conservative U.K. Prime Minister David Cameron called the referendum, presumably confident he would win. He lost, and he’s now resigning. “Brits don’t quit,” Cameron said in an impassioned plea on Tuesday to voters to support remaining in the EU. “We get involved, we take a lead, we make a difference, we get things done.” The Brits quit.

Opinion polls on Brexit were all over the place; the theoretical lead had changed hands dozens of times since September, although “leave” never reached 50% support. Still, betting odds put the chance of remaining at 90% as the polls closed on Thursday. Ladbrokes was offering 4-to-1 on a leave vote, according to The Guardian. Even though most players in the market were actually backing leave, more money was bet on remain by the affluent, who were generally behind staying, Matthew Shaddick, head of political betting at Ladbrokes, wrote in a blog post. Bookies are trying to make money, not help people forecast results, so the vote worked out fine for Ladbrokes, he said.

“Is this just one of the inevitable, normal occasions where an outsider wins, or a fatal blow to the idea of betting markets as being a useful forecasting tool?” Shaddick said. “Maybe unsurprisingly, I tend to think the former, but that doesn’t mean we don’t have to reflect on all of their potential flaws and decide how we best interpret them in the future.” The London-based Political Studies Association surveyed members, journalists, academics and pollsters from May 24 to June 2. Every group got it wrong. Overall, 87% of respondents said Britain was more likely to stay in the EU, 5% said it was likely to leave, and 8% said both sides had an exactly equal chance. The predicted probability of Britain voting to leave the EU: academics, 38%; pollsters, 33%; journalists, 32%; other, 38%; mean, 38%.

The advantages keep coming in.

• UK ‘Leave’ Vote Deflates Hopes For TTIP (R.)

Britain’s looming exit from the European Union is another huge setback for negotiations on a massive U.S.-EU free trade deal that were already stalled by deeply entrenched differences and growing anti-trade sentiment on both sides of the Atlantic. The historic divorce launched by Thursday’s vote will almost certainly further delay substantial progress in the Transatlantic Trade and Investment Partnership (TTIP) talks as the remaining 27 EU states sort out their own new relationship with Britain, trade experts said on Friday. With French and German officials increasingly voicing skepticism about TTIP’s chances for success, the United Kingdom’s departure from the deal could sink hopes of a deal before President Barack Obama leaves office in January.

“This is yet another reason why TTIP will likely be postponed,” said Heather Conley, European program director at the Center for Strategic and International Studies, a think tank in Washington. “But to be honest, TTIP isn’t going anywhere, I believe, before 2018 at the earliest,” she said. U.S. Trade Representative Michael Froman said in a statement on Friday that he was evaluating the UK decision’s impact on TTIP, but would continue to engage with both European and UK counterparts. “The importance of trade and investment is indisputable in our relationships with both the European Union and the United Kingdom,” Froman said. “The economic and strategic rationale for TTIP remains strong.”

Xi can no longer hold off the tide. Q1: what happens to the unemployed? Q2: how are the shadow banks paid off?

• Chinese Bankruptcies Surge More Than 50% In Q1; Worse To Come (ZH)

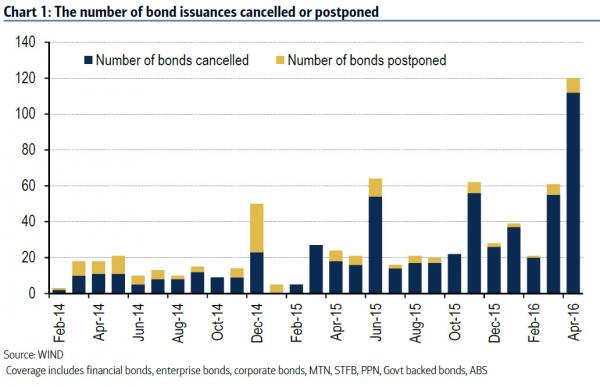

Two months ago, when looking at the soaring number of bond issuance cancellations and postponements as calculated by BofA, we commented that it was only a matter of time before the long overdue tide of corporate defaults, held by for so many years by the Chinese government which would do anything to delay the inevitable, was about to be unleashed. This prediction has indeed been validated and as the FT reports overnight, Chinese bankruptcies have surged this year “as the government uses the legal system to deal with “zombie” companies and reduce industrial overcapacity as part of a broader effort to restructure the economy.”

In just the first quarter of 2016, Chinese courts have accepted 1,028 bankruptcy cases, up a whopping 52.5% from a year earlier, according to the Supreme People’s Court. Just under 20,000 cases were accepted in total between 2008 and 2015. This is surprising because while China’s legislature had approved a modern bankruptcy law in 2007 it had barely been used for years, with debt disputes often handled through backroom negotiations involving local governments. “Bankruptcy isn’t just about creditor-borrower relations. It also touches on social issues like unemployment,” said Wang Xinxin, director of the bankruptcy research centre at Renmin University law school in Beijing. “For a long time many local courts weren’t willing to accept them, or local governments didn’t let them accept.”

However, following the dramatic collapse of global commodity prices, which as we showed last October meant that more than half of local companies could not afford to even make one coupon payment with cash from operations, Beijing had no choice but to throw in the towel. And as the FT adds, “bankruptcy courts have been recruited into China’s drive for “supply-side reform”, which centres on reduction of overcapacity in sectors such as steel, coal and cement.”

Deflation.

• A Look At The Global Economic Malaise Through Deutsche Bank (MW)

I like to keep an eye on major financials, as they are the backbone of the global economy. If the banks have problems, not much else will be doing all that great from a macro perspective. I know there are serious issues with European financials, as collapsing (and in some cases negative) government-bond yields, coupled with negative short-term policy rates, have basically shrunk their net-interest margins as their loans are priced off those rates. The same is the case in Japan. In the U.S, despite a massive flattening of the Treasury yield curve, we have so far been spared from this rather unfortunate banking situation.

So I punched out the ticker “DB” on my screen two Fridays ago and looked at the TV before the chart would load. I looked back at the screen, and I thought I had made a mistake as sometimes the web browser will “remember” ticker symbols on the drop-down quote menu and occasionally the wrong chart would load. It had to be a mistake, as I was looking at the 10-year Treasury yield chart that was just shown on the TV screen seconds earlier, with some futures trader making the comment that the U.S. Treasury market was “breaking out.” I looked closer, and I was stunned. There was no mistake. To that moment, I had not realized that Deutsche Bank’s stock was tracking the 10-year Treasury note yield almost tit for tat. If the Treasury market is breaking out, that would mean Deutsche Bank stock is breaking down, I thought.

It did not take long to figure out why the stock of a major global financial firm — DB, the largest bank in Germany — would follow the 10-year U.S. Treasury yield so closely. As I have explained on numerous occasions in this column, I think we face a global deflationary problem. There are numerous implications for this, but economic growth cycles driven by too much borrowing in the developed world and in many emerging markets — the largest of which is China — are causing that mountain of debt to catch up with faltering economies. Falling long-term U.S. interest rates at a time when the Federal Reserve has not officially given up on a hopelessly-misguided rate-hiking cycle are a symptom of this global deflation.

Banks tend to perform very poorly in a deflationary environment as weak nominal corporate revenues make servicing debts problematic and lending growth tends to suffer. In a deflationary environment, the real value of debts rises as they stay nominally constant; but the assets those debts are financing tend to fall in price, causing rising non-performing loan (NPL) ratios. Combine this with the unorthodox global QE monetary policies and negative short-term interest rates, and you have collapsing net interest margins for many global banks like Deutsche Bank as many yield curves globally, including the one in Germany, have vanished.

One more technocrat government gone on Monday?

• Electoral Surge Of Far Left Likely To Shake Up Spanish Politics (R.)

The parched olive groves and tranquil towns of Spain’s southern Cordoba province are an unlikely backdrop for a political upset that could reverberate across Europe. Yet some locals like 57-year-old Lorenzo Molina, an unemployed librarian, hope they can help deliver just that in a fresh nationwide election on June 26 following an inconclusive December ballot. Gains for an anti-austerity alliance led by the young Podemos party in tightly-contested provinces like this could tip the balance in its bid to lead the next government, and this could turn Spain into the European Union’s next headache after Britain’s June 23 referendum on EU membership. A surge into second place for Unidos Podemos (“Together We Can”) ahead of Spain’s Socialists would make the far-left front a serious contender to form a coalition government, cementing the decline of Spain’s once-mighty center-left in the process.

After radical leftist Syriza’s success in crushing the social democratic Pasok in Greece, a Podemos breakthrough could also buoy euro-skeptic anti-establishment movements in the likes of Italy or France as worsening inequality fuels discontent. For Molina, a dyed-in-the-wool backer of the ex-communists now part of the leftist alliance, it’s a momentous prospect after decades on the fringes of Spanish politics, hankering after this so-called “sorpasso” (eclipse) of the Socialists. “It’s time to air things out,” Molina said on a balmy evening in the city of Cordoba, as an eclectic mix of families and people waving hammer and sickle flags arrived at a rally in a local park. “The Socialists have been in charge of our institutions for many years,” he added, as cries of “Yes we can” rang out among the crowd of several hundred.

The cost of not doing what you’re told. Take heed, Britain and everyone else. All your base are belong to us.

• Regling: Varoufakis’ FinMin Tenure Cost Greece €100 Billion (Kath.)

The cost of Yanis Varoufakis’s tenure as Greece’s Finance Minister during the January-August 2015 period was estimated at around €100 billion, Klaus Regling, head of the European Financial Stability Facility (EFSF) and first managing director of the European Stability Mechanism, told Skai TV. In the interview that aired on Wednesday, Regling noted that during the Varoufakis era, relations between Greece and its lenders were not good, that reforms were halted and that the overall situation at the time did not serve the interests of the Greek economy.

Regling also urged the current Greek government to stick to agreed reforms and noted that the next two months would see negotiations between Greece and its creditors regarding changes in the country’s labor laws, among others, before a second review of the country’s bailout program in September. Regling also argued that some members of the coalition administration did not seem committed to the bailout program, particularly with regard to privatizations and the privatization fund. On the subject of debt relief for Greece, Regling noted that the institutions had agreed on principle, but disagreed over the time frame.

“..Alan Greenspan, former chair of the Federal Reserve, echoed Trump’s comments almost verbatim back in 2011, when the U.S. came close to reaching the debt limit. “The United States can pay any debt it has because we can always print money to do that..”

• Hillary Clinton Adopts The Shorthand Of The Hyperinflation Fearmongers (Dayen)

Deficit hawks often raise the specter of hyperinflation to scare people who disagree with them. And that’s exactly what Hillary Clinton did on Tuesday. Speaking in Columbus, Clinton criticized Donald Trump for saying last month that the U.S. can never default on its debt obligations “because you print the money.” “We know what happened to countries that tried that in the past, like Germany in the ‘20s and Zimbabwe in the ‘90s,” Clinton said. “It drove inflation through the roof and crippled their economies.” But printing money — otherwise known as increasing the money supply – is a routine occurrence for governments that control their own currency.

The Federal Reserve has increased its balance sheet by over $3 trillion since the financial crisis, explicitly to support the economy. (The Fed does this by buying stocks and bonds with electronic cash that didn’t exist before.) In fact, an increasingly influential school of economics, known as Modern Monetary Theory, argues that deficit spending, including through money printing, is critical to promote full employment. Even Alan Greenspan, former chair of the Federal Reserve, echoed Trump’s comments almost verbatim back in 2011, when the U.S. came close to reaching the debt limit. “The United States can pay any debt it has because we can always print money to do that,” Greenspan told “Meet the Press.”

“If you think about it, it is precisely this power that makes U.S. Treasuries [T-Bonds] so safe in the first place,” said Stephanie Kelton, an economics professor at the University of Missouri-Kansas City and a former chief economist to Bernie Sanders on the Senate Budget Committee. Kelton is one of the leading proponents of Modern Monetary Theory. But deficit hawks – typically members of the economic elite who favor small government and correspondingly low taxes, and are terrified of the effect inflation would have on their investments and cash reserves — have repeatedly warned that these perfunctory monetary policy actions would lead to Weimar Germany-levels of chaos.

A mess in the name of Mammon.

• Rural Pennsylvanians Say Fracking ‘Just Ruined Everything’ (CPI)

Sixty years after his service in the Army, Jesse Eakin still completes his outfits with a pin that bears a lesson from the Korean War: Never Impossible. That maxim has been tested by a low-grade but persistent threat far different than the kind Eakin encountered in Korea: well water that’s too dangerous to drink. It gives off a strange odor and bears a yellow tint. It carries sand that clogs faucets in the home Eakin shares with his wife, Shirley, here in southwestern Pennsylvania. The Eakins told the state environmental agency about their bad water nearly seven years ago and hoped for a quick resolution. Like thousands of others who live in the natural gas-rich Marcellus Shale, however, they learned their hopes were misplaced.

Today, the state is still testing their water. The results of those tests will dictate whether a gas exploration and production company is held responsible for providing them with a clean supply. Meanwhile, the Eakins drink donated bottled water and in late 2014 began paying for deliveries of city water to avoid showering in contaminants such as lead and manganese. Since 2007, at least 2,800 water-related complaints have been investigated by the Pennsylvania Department of Environmental Protection’s Oil and Gas Program. Officials found ties to the drilling industry in 279. Another 500 or so cases, including the Eakins’, are open. While regulators try to catch up to natural gas exploration, some residents of the state have gone months, even years, without access to clean water at their homes.

Responding to a public-records request by the Center for Public Integrity, the Department of Environmental Protection, or DEP, provided data on 1,840 complaints lodged since 2010. More than half took longer than the agency’s target of 45 days to resolve. Almost one in 10 took more than a year. The state’s often-plodding response has left hundreds of rural Pennsylvanians in a sort of forced drought, scrambling to pay for water deliveries, seek remedies in court, take out second mortgages or even abandon their homes.

Off the top of my head, over 150,000 landed in Italy so far this year. And Germany has a backlog of 450,000 asylum applications.

• Italy Coastguard Rescues 7,100 In Mediterranean In Two Days (G.)

Ship crews have pulled more than 2,000 refugees from overcrowded boats in the Mediterranean, Italy’s coastguard has said, as people-smugglers stepped up operations during two consecutive days of good weather. More than 7,100 people have now been rescued from international waters since Thursday, many of them on the dangerous journey from Libya. Europe’s worst immigration crisis since the second world war is in its third year, and there has been little sign of any let-up in the flow of people coming from North African to Italy.

Ships belonging to Doctors without Borders, Migrant Offshore Aid Station, Italy’s navy, the EU’s border agency Frontex and the bloc’s anti-people-smuggling mission Sophia all helped take the migrants off nine boats on Friday. About 60,000 boat refugees have been brought to Italy so far this year, according to the interior ministry.