Christopher Helin Federal truck, City Ice Delivery Co. 1934

“The nation now faces a complete collapse of the yen and all assets denominated in that currency. This is clearly Japan’s last stand and there is no real exit strategy except to explicitly default on its debt.”

• Japan’s Last Stand (Michael Pento)

Shortly after the bubble burst, Japan embarked on a series of stimulus packages totaling more than $100 trillion yen–leaving an economy that was once built on savings to eventually be saddled with a debt to GDP ratio that now exceeds 240%–the highest in the industrialized world. Making matters worse, the BOJ has more recently engaged in an enormous campaign to completely vanquish deflation, despite the fact that the money supply has been in a steady uptrend for decades. At the end of 2012, we were introduced to Abenomics, which is Premier Shinzo Abe’s plan to put government spending and central-bank money printing on steroids. His strategy is crushing real household incomes (down 6%) and caused GDP to contract 7.1% in Q2.

With the rumored delay of its sales tax, Japan is clearly making no legitimate attempt to pay down its onerous debt levels. Therefore, one has to assume this huge addition to their QE is an attempt to reduce debt through devaluation and achieve growth by creating asset bubbles larger than the ones previously responsible for Japan’s multiple lost decades. This will not return Japan back to the days of its “economic miracle”, where the economy grew on a foundation of savings, investment and production. [..] The sad reality is that Japan is quickly surpassing the bubble economy achieved during the late 1980’s. Its equity and bond markets have become more disconnected from reality than at any other time in its history.

The nation now faces a complete collapse of the yen and all assets denominated in that currency. This is clearly Japan’s last stand and there is no real exit strategy except to explicitly default on its debt. But an economic collapse and a sovereign debt default on the world’s third largest economy will contain massive economic ramifications on a global scale. Japan should be the first nation to face such a collapse. Unfortunately; China, Europe and the U.S. will also soon face the consequences that arise when a nation’s insolvent condition is coupled with the complete abrogation of free markets by government intervention.

“Japan has actually been treading water for a long-time – going all the way back to July 1989 when the monumental bubble created by the BOJ during the 1980s was cresting. Japan’s index of total industrial production during July of that peak bubble year printed at 96.8. So here’s the real shocker: It was still printing at 96.8 in July 2014.”

• Why Japan’s Money Printing Madness Matters (David Stockman)

This is getting hard to believe. The announcement that Japan has plunged into a triple dip recession should have been lights out for Abenomics. But, no, its madman prime minister has now called a snap election to enlist more public support for his campaign to destroy what remains of Japan’s economy. And what’s worse, he’s not likely to be stopped by the electorate or even the leadership of Japan Inc, which presumably should know better. Here’s what Japan leading brokerage had to say about the “unexpected” 1.6% drop in Q3 GDP – compared to the consensus expectation of a 2.2% gain and after the upward revised shrinkage of 7.3% in Q2. We think that the economy is gradually improving,” said Tomo Kinoshita, an economist at Nomura Securities.

“There’s no reason to be pessimistic about the economy going forward.” Really? How in the world can an economist perched at the epicenter of Japan Inc. think that its economy is improving when Japan’s constant dollar GDP has now fallen back to pre-Abenomics levels; and, in fact, is no higher than it was in late 2007 prior to the “financial crisis”? Indeed, aside from the Q1 pull-forward of spending to beat the consumption tax increase, Japan’s economy has remained stranded on the flat-line it attained after world trade recovered from its 2008-2009 plunge. But that’s only the most recent iteration of the stagnation story. Japan has actually been treading water for a long-time – going all the way back to July 1989 when the monumental bubble created by the BOJ during the 1980s was cresting. Japan’s index of total industrial production during July of that peak bubble year printed at 96.8. So here’s the real shocker: It was still printing at 96.8 in July 2014.

That’s right – after 25 years of the greatest government debt and money printing spree in recorded history, Japan’s industrial production has gone exactly nowhere. Given that baleful history and the self-evident failure of the Keynesian elixir to cure Japan’s economic stagnation problem, it might be asked why the entire country seemingly moves in lock-step toward bankruptcy behind the sheer foolishness of Abenomics. That’s especially the case because even the short-run impacts have been self-evidently damaging to the real economy and have been utterly inconsistent with promised results. To wit, Abenomics was supposed to send exports soaring and the trade accounts back into the black, thereby adding to GDP and household incomes. But what it has actually done has been to slash the global purchasing power of the yen by 35% since early 2013, causing Japan’s bill for imported energy, industrial materials and manufactured components and consumer goods to soar.

There is no repair manual. Other than full restructuring, default, and grave loss of face (which Abe will never accept, he’d much rather try nation-wide seppuku)

• New Repair Manual Needed For Japan’s Broken Economy (CNBC)

Japan is looking for new ideas to fix its badly broken economy. Amid fresh signs of economic contraction, Japanese Prime Minister Shinzo Abe on Tuesday called for an early election and put on hold a scheduled sales tax increase. The news came a day after data showed the world’s third-biggest economy unexpectedly shrank for a second-consecutive quarter in July-September, after the initial sales tax hike clobbered consumer spending. Abe is hoping the snap election – expected Dec. 14 – will give him a fresh mandate for his three-pronged economic revival plan known as “Abenomics” that includes massive government spending, and easy money credit policy and a package of reforms designed to spur growth. But he acknowledged Tuesday that he may need to come up with a new plan.

“I am aware that critics say ‘Abenomics’ is a failure and not working but I have not heard one concrete idea what to do instead. … Are our economic policies mistaken, or correct? Is there another option?” he asked at a televised news conference. “This is the only way to end deflation and revive the economy.” The appeal for new ideas should come as no surprise. Japan’s much-heralded, three-pronged Abenomics revival plan is beginning to look like a two-legged stool.

More stimulus is utterly useless. I haven’t seen recent numbers, but the ratio of GDP generated per added dollar of debt must be way below zero. That’s where it all stops.

• Kuroda Wins Wider Majority, Warns Inflation Could Dip Below 1% (Bloomberg)

Bank of Japan Governor Haruhiko Kuroda secured a wider majority today and warned inflation could fall below 1% after the world’s third-largest economy slid into recession. The BOJ board voted 8-1 to continue expanding the monetary base at an annual pace of 80 trillion yen ($683 billion) following a split decision to increase stimulus last month. Prime Minister Shinzo Abe is delaying a sales-tax increase and will lift spending as Kuroda implements unprecedented asset purchases. The central bank is targeting price gains of 2% in an economy that unexpectedly contracted in the quarter through September as Japan struggles to pull out of two decades of stagnation. “The BOJ will have to bolster stimulus again,” Takuji Aida, an economist at SocGen, said before today’s announcement.

“The economy is much weaker than expected and it will become clearer that the economy and inflation are veering away from the BOJ’s scenario.” Consumer prices excluding fresh food rose 3% in September from a year earlier, slowing from a 3.1% gain in August. Stripping out the effects of April’s increase in the sales tax, the central bank’s core measure of inflation was 1% in September, a level Kuroda said in July wouldn’t be breached. The yen is trading near a seven-year low. The prime minister has called an early election in a bid to extend his term and salvage his Abenomics policies. He delayed for 18 months the increase in the sales tax to 10%, after a bump to 8% in April helped tip Japan into its fourth recession since 2008. The economy shrank an annualized 1.6% last quarter following a 7.3% contraction in April-to-June.

Central bankers have come to pretend they control lots of things they absolutely don’t: “We wanted to control the federal funds rate, but ran into trouble because long-term rates did not, as they always had previously, respond to the rise in short-term rates .. ”

• Yellen Inherits Greenspan’s Conundrum as Long Rates Sink (Bloomberg)

Alan Greenspan couldn’t control long-term interest rates a decade ago, and bond investors are betting Janet Yellen’s luck will be no better. When then-Federal Reserve Chairman Greenspan raised the benchmark overnight rate from 2004 to 2006, long-term borrowing costs failed to increase, thwarting his attempts to tighten credit and curb excesses that contributed to the worst financial crisis in 80 years. “We wanted to control the federal funds rate, but ran into trouble because long-term rates did not, as they always had previously, respond to the rise in short-term rates,” Greenspan said in an interview last week. He called this a “conundrum” during congressional testimony in 2005. The bond market is signaling that past may be prologue as Yellen’s Fed prepares to raise rates next year.

The yield on the 10-year U.S. Treasury note has fallen 0.71%age point in 2014 even as the Fed wound down its bond-buying program and mapped out a strategy to raise the benchmark federal funds rate from near zero, where it has been since 2008. Most Fed policy makers expect the central bank will raise the federal funds rate, which represents the cost of overnight loans among banks, some time next year, according to projections released in September. The stakes are higher this time because rates are lower and the yield curve is flatter.

Raising short-term rates in the face of stable or falling long-term rates could lead to a situation where the Fed “quickly inverts the yield curve and turns credit creation on its head,” said Tim Duy, an economics professor at the University of Oregon and a former U.S. Treasury economist. An inverted yield curve occurs when short-term securities yield more than longer-dated bonds. That discourages banks from extending credit because they finance long-term loans with short-term debt. Inverted yield curves typically precede recessions. Duy said the Fed has few options if long rates don’t rise after increases in the federal funds rate: the Fed would have little scope to raise the benchmark further, and not much room to cut if the economy were to slump. “I’m sort of wondering, what’s the game plan here,” Duy said.

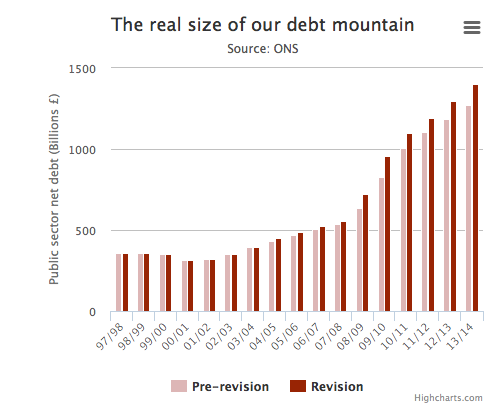

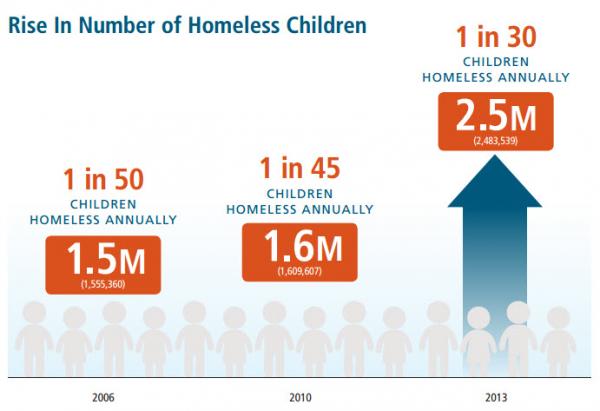

That graph hurts the eye. Do we really want to live in a world where this happens?

• Mission Accomplished: Stocks & Homeless Kids Hit All-Time Highs (Simon Black)

Something is dreadfully wrong with this picture. In a report just released today by the National Center on Family Homelessness, a team of academics has demonstrated that the number of homeless children in the Land of the Free now stands at 2.5 million. This is far and away an all-time high and constitutes roughly one out of every 30 children in America. The report goes on to explain that among the major causes of this problem are the continuing impacts of the Great Recession that began in 2008. Funny thing, someone ought to tell these homeless kids that the economy is doing great. Of course, we know this to be true because the stock market is near its all-time high. The Dow Jones Industrial Average now stands at 17,633, just off its all-time high. Also near its all-time highs is the bond market, and coincidentally, the US debt – which is now within spitting distance of $18 trillion.

In other words, if these kids ever do manage to pick themselves up off the streets, they’ll work their entire lives to pay off a debt that they never signed up for. And it all comes down to a completely perverse, corrupt, debt-based paper money system. Yes, no matter what happens in the world, there are always going to be rich and poor. And as painful as it may be, there will always be homeless children. That’s not really the point. For the most part, financial wealth used to be something that people had to work to achieve. They had to produce something valuable for consumers. They had to develop new technologies and be innovative. They had to take chances and in many cases risk it all. That’s less and less the case today. Today one’s station in life is much more tied to how you grew up. If you were born poor, you have a 70% chance of staying poor (according to a recent study from the Pew Charitable Trust). And needless to say, if you’re born rich, you’re going to stay rich. Much of that is due to the monetary system.

This is what QE has brought us. This and homeless children.

• Rich Hoard Cash As Their Wealth Reaches Record High (CNBC)

The amount of individuals that hold more than $30 million in assets has climbed to a new record in 2014, according to a global survey on Wednesday, which also warned that a lack of diversification meant that this wealth is not protected from shocks to the financial system 12,040 of these new ultra high net worth (UHNW) individuals were minted in the year ending June 2014, said the Wealth-X and UBS World Ultra Wealth Report released on Wednesday. This meant a 6% increase from last year which pushed the global population of these millionaires to a record 211,275.

With the annual gross domestic product of the U.S. closing in on the $17 trillion mark, according to the World Bank, this means that the ultra-rich now have almost twice the wealth of the world’s largest economy. Nonetheless, Simon Smiles, chief investment officer at UBS Wealth Management, warned of the risks the wealthy few face. “This report finds that UHNW individuals hold nearly 25% – an extremely high proportion – of their net worth in cash,” he said in Wednesday’s accompanying press release. Fearing that their millions are being eroded away with inflation, Smiles also said that holding government bonds from Germany and the U.S. is no longer safe. The return outlook for these fixed income assets is highly and negatively “asymmetric,” he added.

“Wealth concentration is perhaps the biggest risk facing UHNW individuals,” he said. “Individuals have over two thirds of their wealth in their core businesses.” The majority of the millionaires are self-made and are involved in founder-owned private businesses, according to the report. The value of these private company holdings represents almost twice the amount that they hold in public company stakes, it said. Thus, this disproportionality exposes the rich to “exogenous shocks,” according to Smiles, such as technological change, new regulations and fresh upheavals in the world of geopolitics. The new report also predicted that the global UHNW population will reach 250,000 individuals in the next five years, an increase of 18% from this year’s figures.

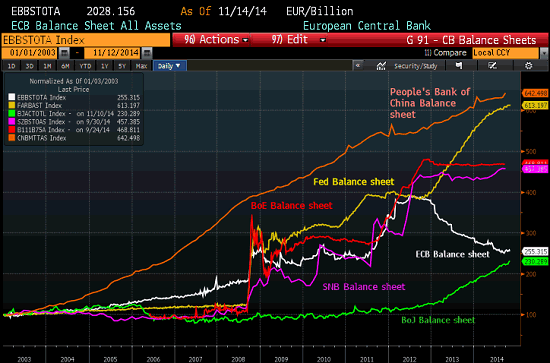

“By the time the Fed and the Bank of England made their moves in 2008 to bail out toppling megabanks, other financial institutions, and the largest investors in the world, the balance sheet of the PBOC had nearly quadrupled.”

• China’s Central Bank Makes The Fed Look Like A Bunch Of Amateurs (WolfStreet)

The phenomenal credit expansion in China has taken many forms and has accomplished many phenomenal things, from building entire ghost cities to turning ambient air into a toxic cocktail. In the process, the credit bubble turned China into the second largest economy. Some of this freshly created money has been spread around. Hence, the growing middle class. Those with significant accumulation of wealth are trying to get some of it out of China before it all blows up or before the corruption crackdown or a purge or some other business misfortune takes it all down. In China’s state-controlled system, credit expansion is largely done by state-owned banks that have to keep lending no matter what. Then there’s the increasingly important shadow banking system. And finally, the People’s Bank of China – and no central bank is a match for it.

The chart below compares the growth of the balance sheets of the major central banks, starting in 2003, when the index was set at 100. While the other central banks – except for the ECB – kept their balance sheets nearly level between 2003 and the Financial Crisis, the PBOC’s balance sheet (top orange line) ballooned. By the time the Fed (yellow line) and the Bank of England (red line) made their moves in 2008 to bail out toppling megabanks, other financial institutions, and the largest investors in the world, the balance sheet of the PBOC had nearly quadrupled. Note the tiny Swiss National Bank (purple line) which is desperately trying to defend its franc cap by buying euros and dollars and selling newly printed francs. It works, but for how long? And note the Bank of Japan (green line) at the bottom. In 2003, after years of QE, its balance sheet was already relatively large, but in 2012, and particularly in early 2013, it set out on a record-setting binge, from an already large base.

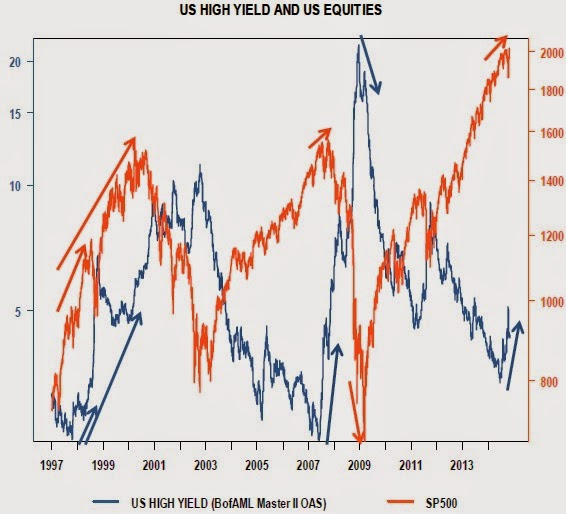

“The fact that all this is happening while bullish sentiment in the US is at record highs is of particular worry. Everyone is expecting higher equities due to lower yields and depressed food and energy prices. But when everyone is thinking alike, no one is really thinking….”

• US Equity-Credit Divergence: A Warning (RCube)

Major equity/credit divergences should always be taken very seriously. They were among the best forward looking indicators at almost every major turning point for equities over the last 20 years. To recap: In 1998, equities were rallying hard, but US HY spreads failed to print new lows. Instead, they started widening in late 1997. Credit was telling us back then that Asia and Russia were severely slowing down while corporate balance sheet health was deteriorating. It preceded the 1998 crash. In 1999/2000, the divergence was even more pronounced. The S&P500 not only recovered from the Asian crisis but rallied strongly during the Tech bubble. US HY spreads had bottomed 3 years earlier! Corporate balance sheet were at the time very stretched. As a result, banks were tightening lending standards. The equity market eventually crashed, tracking the signal sent by widening credit spreads.

During 2007/2008, credit spreads bottomed in May 2007 and started widening immediately after, while equities kept moving higher for another 5 months (October 2007). Spreads were telling us just like in 2000 that private sector leverage had reach such an elevated level that banks were starting to close the credit flows. Again, the divergence timed the bear market that followed. In 2008/2009, spreads topped out in December while equities made new lows that were not confirmed by a new high on HY spreads. At that time, corporate balance sheet had started to adjust violently to the crisis. Capex had been cut to zero, the corporate sector was issuing equity (net positive liquidity impact) and cash flows had already bottomed and were starting to rise. Balance sheet health was improving, as evidenced by tightening credit spreads.

The bullish divergence timed the end of the bear market. In 2011, spreads bottomed in February while equities made a new high in April, as spreads widened further due to the European sovereign crisis. Equities reversed shortly after. Today, the divergence is visible again. US High Yield spreads bottomed in June and have widened substantially since then. Equities are still printing new highs. Are US HY spreads telling us that global growth is weaker than expected, a message also sent by flattening yield curves, depressed bond yields, defensive massive outperformance relative to cyclicals. Is it Europe? Russia? Emerging Markets? The fact that all this is happening while bullish sentiment in the US is at record highs is of particular worry. Everyone is expecting higher equities due to lower yields and depressed food and energy prices. But when everyone is thinking alike, no one is really thinking….

As long as Europe is full of implicitly TBTP banks, it’s all lip service.

• ECB Plans ‘Intrusive’ Probe of Banks’ Risk-Weight Models (Bloomberg)

The European Central Bank plans to clamp down on the complex models lenders use to gauge the risk of their assets, as it works to restore trust in the euro area’s financial system. The ECB, newly installed as the euro area’s single supervisor, plans to scrutinize lenders’ models and eliminate variations across the currency bloc, top policy makers have said. The Frankfurt-based central bank didn’t look at the way banks calculate asset risk in its year-long balance-sheet probe, completed last month. The Basel Committee on Banking Supervision said last week that variations among countries “undermine confidence” in capital ratios, the core measure of financial strength used to score banks in the ECB’s health check.

The ECB will “critically review the calculation of risk-weighted assets,” Sabine Lautenschlaeger, a member of the central bank’s Executive Board, said at a conference in Frankfurt today. “We want to reduce excessive variability, thereby restoring confidence in the calculation of risk-weighted assets.” Korbinian Ibel, who heads an ECB microprudential supervision department, said the central bank will be “intrusive” with model approvals and risk analysis. The ECB defines risk-weighted assets as “a measure of a bank’s total assets and off-balance sheet exposures weighted by their associated risk.” There are cases from across the euro area of banks that have boosted their capital levels thanks to making greater use of internal models, or by making changes to them.

Deutsche Bank adjusted its risk models in the last three months of 2012 to help lift its capital ratio even as the firm’s biggest quarterly loss since the 2008 financial crisis reduced its equity reserves. The bank cut risk-weighted assets by €55 billion ($68 billion) in the fourth quarter of 2012, almost half of which was achieved by modifying risk models and processes. Raiffeisen Bank’s main shareholder Raiffeisen Zentralbank, or RZB, was found with a €2.13 billion capital gap in the European Banking Authority’s 2011 stress test. It turned this shortfall into a surplus by the EBA’s June 2012 deadline without raising a cent of fresh cash. The biggest contribution to fill the gap, €1.45 billion, came from a “capital cleanup” that included measures reducing risk weightings such as switching to internal ratings from standardized ratings in some of its eastern European subsidiaries.

Pushing Draghi et al into additional debt.

• ECB Entering ‘Very Dangerous Territory’ Warns S&P (AEP)

The European Central Bank’s plans for €1 trillion of monetary stimulus is fraught with risk and is likely to fail without full-blown bond purchases, Standard & Poor’s has warned. The agency said the ECB’s blitz of ultra-cheap loans to banks (TLTROs) cannot generate more than €40bn of net stimulus once old loans are repaid, given regulatory curbs imposed on lenders. Jean-Michel Six, the agency’s chief European economist, said ‘doves’ on the ECB’s governing council know that the loan plan is unworkable but are going through the motions in order to persuade German-led ‘hawks’ that all conventional measures have been exhausted, even if this means a debilitating delay. “Risks of a triple-dip recession have increased,” said Mr Six. “The ECB has one last arrow and that is quantitative easing of €1 trillion, needed to restore the M3 money supply to trend growth.”

The ECB has suggested – with caveats – that it will boost its balance sheet by €1 trillion, saying this will be spread between TLTRO loans and asset purchases. The lower the share of TLTRO loans in this total, the more it will be forced to expand QE in the teeth of opppostion from Germany. “The ECB is moving into very dangerous territory,” said Mr Six. “Their own credibility is at risk as they take on more risk, but it is necessary. The agency also said the Bank of England has greatly under-estimated the degree of slack in the British economy and risks killing the recovery by tightening too soon “We don’t see any tangible signs of a housing bubble, except in a few streets in London,” said Mr Six. “The UK is cooling off. It is nothing to be alarmed about, but we think a premature rate rise could put the recovery in jeopardy. There is a long way to go before deciding the horse is going too fast and needs to be reined in.”

Key officials at the ECB continue to fight out their differences in public. Jens Weidmann, the head of the Bundesbank, said there was nothing automatic about further stimulus and underlined that the €1 trillion rise in the balance sheet was an expectation rather than a target. He also warned that it would encourage governments to relax fiscal austerity, an argument that most economists find baffling and not within the policy jurisdiction of a central bank official. “The purchase of government bonds – independently of legal limits – would set significant, additional false incentives,” he said. By contrast, the ECB’s president Mario Draghi has been nudging further towards full QE, stating explicitly that government bonds might be added to the mix of assets to be purchased.

How is that possible?

• ECB’s Stress Test Failed to Restore Trust in Banks (Bloomberg)

Europe still hasn’t regained investor confidence in its banks. The European Central Bank’s stress tests of the region’s lenders failed to provide an accurate gauge of their financial stability, according to 51% of respondents to the latest quarterly poll of investors, traders and analysts who are Bloomberg subscribers. The results were viewed as accurate by 32% of the people who responded, while 17% said they weren’t sure. The tests followed three previous efforts by another European regulator that were deemed unreliable after some banks that passed collapsed a few months later. Investors expected the ECB to take a tougher approach before it took over as the single supervisor of euro-zone banks this month.

While 25 of the 130 institutions failed the ECB’s test, an even smaller subset was asked to raise $8 billion of capital. “We’ve improved the banks with some more capital and more transparency, but it wasn’t good enough,” said Michael Nicoletos, managing director of Athens-based AppleTree Capital GS SA, which oversees about $45 million of investments. He participated in last week’s Bloomberg Global Poll. “I’m sure there are some banks that are in worse shape than they appeared in the test.” “Regulators never look forward,” said Florin Bota-Avram, a trader at Cluj-Napoca, Romania-based Banca Transilvania SA who participated in the poll. “They want to prevent the future crisis by looking at the past, but the future is always different than the past.”

How to profit from Draghi’s desperation. Think Mario doesn’t know this: “Many European banks are capital constrained, so I don’t see the ECB’s ABS purchase program necessarily as a game changer”? I think he knows. But he’s a Goldman man.

• Goldman Sachs Says Boosting Asset-Backed Debt Business in Europe (Bloomberg)

Goldman Sachs says it’s adding staff to its European asset-backed securities business as the bank prepares for a resurgence in the $305 billion market that shrank more than 40% over the past four years. New securities will be generated as hedge funds and private equity firms seek to repackage debt as they enter the direct lending market, according to Simone Verri, who is co-head of financial institutions group financing at Goldman in London. Investors buying bad loans from the region’s banks will also want to securitize the assets, he said. “We have invested a lot in this opportunity by hiring more people, especially for ABS structuring,” said Verri, a partner at the New York-based investment bank. “The specialty finance players and quasi-banking sector could use ABS to fund loan origination and that’s a very attractive commercial opportunity in the medium term.”

Oaktree Capital, the biggest distressed debt investor, and New York-based KKR have raised direct lending funds in Europe as banks retreat from the market because of new capital regulations. Financial firms will offload more than €100 billion ($125 billion) of loans this year after they restructured their balance sheets because of the European Central Bank’s asset quality review and stress tests, according to PricewaterhouseCoopers. Lenders create asset-backed notes by bundling individual loans such as mortgages, auto credit and credit-card debt into tradable bonds. “Buyers of loan portfolios need financing and they can get that either from an investment bank or eventually via selling ABS backed by these loans,” said Verri. “This could be an important development as non-performing loan disposals will improve banks’ balance sheets and risk capital.”

ECB President Mario Draghi has put asset-backed bonds at the center of his plans to stimulate the euro-area economy because the securities allow the transfer of risk from banks to investors, which may encourage lenders to offer more credit to companies. The central bank will buy the notes as part of a plan to expand its balance sheet by as much as €1 trillion. While the program signals the ABS market has been rehabilitated after being blamed for worsening the financial crisis, its impact on bank lending will be limited, said Verri. “Many European banks are capital constrained, so I don’t see the ECB’s ABS purchase program necessarily as a game changer,” said Verri. “It doesn’t address capital needs and therefore it doesn’t necessarily unlock credit origination.”

Ambrose found a new patient. Has he tackled all EU countries by now?

• Belgium New Sick Man Of Europe On Debt-Trap Fears (AEP)

Belgium is creeping back onto the eurozone’s danger list as economic woes spread deeper into the EMU-core, and protracted slump poisons debt dynamics. Fitch Ratings has issued a downgrade alert, warning that the country’s primary budget surplus is evaporating. It said public debt will reach 106.9pc of GDP next year. New accounting rules known as ESA2010 have revealed that Belgium is poorer than previously thought, lifting the debt ratio by 3.3pc of GDP overnight. This is in stark contrast to the upgrade for Britain, Ireland, and Finland, all deemed to be richer and therefore less troubled by debt. The agency placed Belgium on negative watch, deeming it ever further out of line among its AA-rated peers worldwide. The median debt ratio is 37pc. “Public debt dynamics have deteriorated owing to weaker real GDP growth and worse fiscal performance,” it said.

Yields on 10-year Belgian bonds have fallen to an historic low of 1.07pc – sliding in lockstep with German Bunds – but it is unclear whether this can last if markets start to focus on the economic fundamentals of EMU once again. The country is caught in a debt compound trap, much like southern European states. The toxic mix of near-zero growth and very low inflation is automatically causing the debt trajectory to ratchet upwards. The ratio was 99.7pc in 2013. Belgium has so far failed to reach “escape velocity” after stagnating for almost three years. The European Commission has cut its growth estimate to 0.9pc this year and in 2015, too low to stabilize the debt. Belgium has been in consumer price deflation for the last eight months, when adjusted for taxes. The Commission said the debt ratio will reach 107.8pc by 2016, and warned that it could spiral much higher if there is a deflationary shock. Indeed, it came out worse than Italy in the stress test scenario.

The troika.

• Why Greek Bond Yields Are Spiking (CNBC)

The cost of borrowing for embattled euro zone nation Greece got even more expensive on Thursday, as investors shunned the country’s sovereign debt ahead of tough negotiations with its international creditors. The yield on its 10-year sovereign spiked to 8.401% on Wednesday morning, after pushing sharply higher on Tuesday afternoon. At the beginning of the week, yields were trading around 8.042%. Yields this week have not reached the 9% level hit in mid-October when negative sentiment surrounding Greece spread to global markets. However, rising debt yields do highlight that the country’s economic woes are far from over, with a crucial deadline in early December looming large on the horizon.

“Greece still has sizeable financing needs in 2015 and it remains up in the air how these will be covered, which is likely to be causing market nervousness,” Sarah Pemberton, the European economist at Capital Economics, told CNBC via email. It comes as Athens attempts to exit its bailout program – which has been hugely unpopular in the country – ahead of schedule. The government is hoping to strike a deal with the so-called “Troika” of bailout monitors – the European Union, International Monetary Fund (IMF) and European Central Bank (ECB) – before a December 8 deadline. One stumbling block to this plan is Greece’s fiscal gap for 2015, with both sides unable to agree how large it could be and how it should be addressed.

And bringing Venezuela to its knees in the process.

• US Shale And OPEC Oil: Game Of Chicken? (CNBC)

The political rhetoric surrounding the recent drop in oil prices shows no signs of slowing, with Venezuela said that oil producing countries could soon meet to discuss the tumbling commodity. In a televised address late Monday, Venezuela President Nicolas Maduro said that a gathering of both OPEC countries and non-OPEC countries was being planned, according to the Associated Press. The discussions would be in the lead-up to a crucial OPEC meeting which is taking place in Vienna on November 27, and although Maduro was slim on details, he said he was confident that fellow OPEC nations would join together to help prices recover. It comes as Venezuela Foreign Minister Rafael Ramirez is currently on a tour of oil-producing nations including Russia and the Gulf States.

Global oil prices have plunged since peaking in June. From around $115 a barrel, Brent crude has lost around a third of its price and was trading near four-year lows on Tuesday at $79. Weak demand, a strong dollar and booming U.S. oil production are the three main reasons behind the fall, according to the International Energy Agency (IEA), which warned of a “new chapter” for oil markets, which could even affect the social stability of some countries. This shift was further underlined on Tuesday, when Reuters reported that Iraq was looking to base its 2015 budget on an oil price of $80 per barrel. The OPEC nations – which include the main swing producer, Saudi Arabia – are seen as key to the market, as they could agree to cut production and provide a floor for the price. However, political ramblings and a lack of formal production quotas have led many analysts to say that OPEC is unlikely to announce new policy at the end of the month.

Fire in the hole!

• What Blows Up First: Shale Oil Junk Bonds (John Rubino)

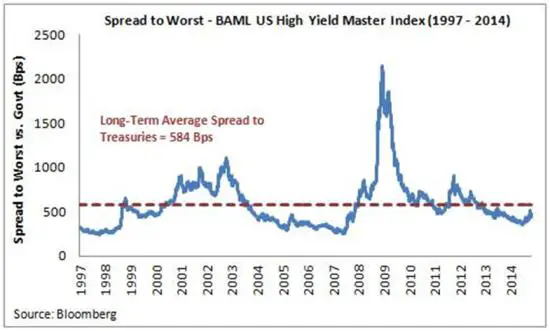

One of the surest signs that a bubble is about to burst is junk bonds behaving like respectable paper. That is, their yields drop to mid-single digits, they start appearing with liberal loan covenants that display a high degree of trust in the issuer, and they start reporting really low default rates that lead the gullible to view them as “safe”. So everyone from pension funds to retirees start loading up in the expectation of banking an extra few points of yield with minimal risk. This pretty much sums up today’s fixed income world. And if past is prologue, soon to come will be a brutally rude awakening. Most of the following charts are from a long, very well-done cautionary article by Nottingham Advisors’ Lawrence Whistler: Junk yield premiums over US Treasuries are back down to housing bubble levels:

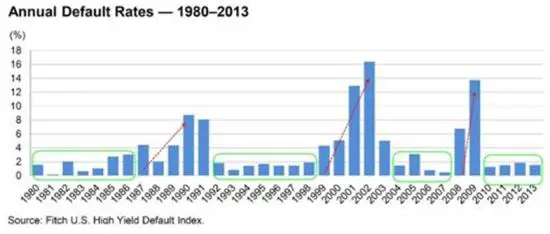

So are default rates:

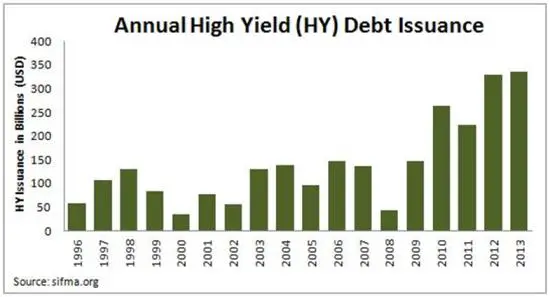

The supply of junk bonds is way higher than before the previous two market crashes:

[..] Here’s what happened to the various classes of debt the last time things got this out of whack (junk is purple):

More junk bonds.

• “$1.6 Trillion in Junk Bond Defaults Coming” (Daily Wealth)

Martin Fridson is – without question – the biggest name in his field. (He has been for decades. Right now, he’s extremely concerned… Last week, he shared his big concerns at our investment conference in the Dominican Republic. Fridson rules the world of speculative bonds. In his presentation, Fridson showed how high-yield bonds are just as good an investment (if not better) than stocks – during normal times. But times are not normal today… and Fridson is worried. He sees “the next junk-bond implosion” arriving as early as 2016, and lasting through 2019. In Fridson’s base case (not his pessimistic case), he sees $1.6 trillion dollars in total speculative bond defaults over the course of the next junk-bond implosion. Interest rates have fallen so low in America that investors have been “reaching” for yield. They have been buying much riskier investments, just to get a bit more interest to live on. And that’s dangerous…

Fridson’s base case is built relatively simply… based on historical cycles in high-yield bonds, and based on reversion to the mean over the long run. He explained this on Stansberry Radio last month: Right now the yield on the high-yield index is right around 6%. The long-run average on that is more like 9.5%… I think over five years, that it’s a very strong likelihood that we’re going to be back up to at least average levels at some point. So as the yield goes up, the price goes down, and that cuts into your return… If you just look at historical experience, you’d actually expect a slightly negative rate of return over the next five years. People are buying high-yield bonds today, expecting to earn 6%. They are not expecting to lose money. But if interest rates rise eventually on high-yield bonds – as Fridson expects – these people will lose money. Fridson expects that – in the worst of it – the interest rate on high-yield bonds will soar to more than 10%age points above Treasury bonds. Remember, bond prices go down when interest rates go up – so investors will lose a lot of money as that happens.

There is nothing at Bloomberg anymore about Putin and Ukraine that’s not a political agenda.

• Ukraine Says It Is Ready for ‘Total War’ as Nations Dispute Truce Format (Bloomberg)

Ukraine and Russia clashed over how to move toward a new cease-fire agreement, after President Petro Poroshenko said his country is ready for “total war” with Vladimir Putin’s forces. As NATO Secretary General Jens Stoltenberg criticized Russia for staging a “serious military buildup” and sending troops and weapons across its western border, Ukrainian Prime Minister Arseniy Yatsenyuk advocated new “Geneva format” talks including the U.S. to de-escalate the crisis. Russia said that framework, which followed April talks in the Swiss city that excluded pro-Russian separatists, would skirt a process that led to a Sept. 5 cease-fire in Minsk, Belarus. “There is the Minsk format,” Russian Foreign Minister Sergei Lavrov said today in the Belarusian capital. “Attempts to dissolve this format, to present it in a way that the insurgents, representatives of the southeast, may sit aside while the ‘grownups’ agree on what to do – such attempts are completely illusory.”

Anybody doubt any of it?

• Putin Says United States Wants To Subdue Russia But It Won’t Succeed (Reuters)

Russian President Vladimir Putin on Tuesday accused the United States of wanting to subdue Moscow but warned Washington it would never succeed. “They (United States) do not want to humiliate us, they want to subdue us, solve their problems at our expense,” Putin told a meeting with a core support group, the People’s Front, triggering loud applause. “No one in history ever managed to achieve this with Russia, and no one ever will.”

Support your local olive grower!

• Blighted Harvest Drives Olive Oil Price Pressures (AP)

If your favorite bottle of Mediterranean olive oil starts costing more, blame unseasonable European weather – and tiny insects. High spring temperatures, a cool summer and abundant rain are taking a big bite out of the olive harvest in some key regions of Italy, Spain, France and Portugal. Those conditions have also helped the proliferation of the olive fly and olive moth, which are calamitous blights. The shortfall could translate into higher shelf prices for some olive oils and is dealing another blow to southern Europe’s bruised economies as they limp out of a protracted financial crisis. “The law of supply and demand is a basic law of the market,” said Joaquim Freire de Andrade, president of growers’ association Olivum in Portugal’s southern Alentejo region, the country’s olive heartland.

“It’s a tough year.” Olive oil is big business in southern European Union countries. They are the source of more than 70% of the world’s olive oil, bringing export revenue of almost €1.8 billion ($2.2 billion) last year. The United States imported just over $800 million of that. For some European growers, this year’s harvest is a bust. In Spain, the world’s biggest producer, the young farmers’ association Asaja says 2014 is “another disaster” after a calamitous harvest two years ago. Spain’s output is forecast to plunge by more than 50%, with a drop of at least 60% in the southern Andalucia region.