Arnold Genthe 17th century Iglesia el Carmen, Antigua, Guatemala 1915

Lots of ‘China back to work’ articles today, because I was curious how that would go. Well, it’s not clear -what a surprise. Beijing put itself on lockdown today, maybe that’s a clear sign. They, too, must have seen that the cruise ship floating off Yokohama found an additional 60 infections. And factories, like trains etc., can be almost as bad as cruise ships in spreading viruses.

The best line on the topic is perhaps that Citi estimates that by Tuesday, only 30% of China’s total workforce will be able to return to work. Much less today. Reuters claims that Foxconn can open its Zhengzhou factories, only to have Nikkei deny it. Nikkei in turn says Shenzhen ordered Foxconn’s plants there shut, but Shenzhen denies that.

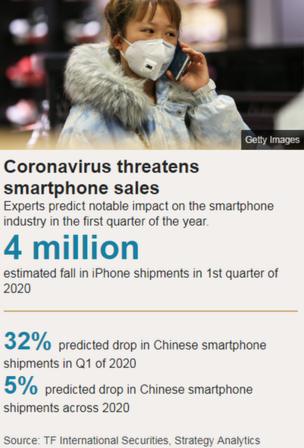

That Amazon, LG, Ericsson and NVIDIA have all withdrawn from a conference as far away as Barcelona should also tell you something about the overall mood. People say: how iPhones fare will tell you a lot. I say: look at the less iconic stuff.

• Deaths 910, up 97 from yesterday’s 813 – people say: Daily Record! I say: every day has been a record so far, or the same as the day before.

• New cases 2,973 from 2,652 yesterday – no more levelling off

• Global confirmed cases 40,614

Hubei

• 29,631 confirmed cases

• 871 deaths

• 1,795 discharged from hospitals

• 73,127 under medical observation

Note: the SCMP app where the numbers below come from appears to have some troubles. The detailed numbers are not there. At first, no numbers at all. Then they re-appeared, and then started counting backward. But they’re about right as official numbers go.

Petri dish. Newer studies suggest the virus can survive 9 days on surfaces. Good luck.

• Japan: 60 More Coronavirus Infections On Diamond Princess Cruise Ship (SCMP)

Testing aboard the Diamond Princess cruise ship in Japan has found 60 more confirmed cases of the novel coronavirus, national broadcaster NHK said on Monday. That brings total cases on the ship docked in Yokohama, south of Tokyo, to 130. Japanese authorities have so far tested about 280 people on board the Diamond Princess, which was placed on a two-week quarantine after a former passenger, who disembarked in Hong Kong last month, was diagnosed with the coronavirus. About 3,700 people are on board the vessel, which usually has a crew of 1,100 and a passenger capacity of 2,670.

The Princess Cruise website describes the ship as “your home away from home” and it will remain so for most passengers at least until February 19. The quarantine period could be extended if necessary, a Japanese government official said. One of those found infected is in serious condition. Many on board are elderly and at greater risk of developing complications from the virus. Mike Ryan, the World Health Organisation’s top emergency expert, said new cases would push back the quarantine. “We need to find a way to break that vicious cycle and find a way of organising the patients on board in a way that we can get people off the ship in due course, Ryan said.

Sure sounds strict.

• Beijing Officially Declares Lockdown (GNews)

As the novel coronavirus spreads from Wuhan, China has been implementing “closed management” by putting 80 cities under lockdown. Today, Beijing authorities also issued a “Strict Closed Management of Residential Communities” in an epidemic prevention and control announcement. It is an official declaration that Beijing, the country’s capital city of China, is now under lockdown. According to the notice, Beijing will further enforce “community closed management” in a strict manner. Outside vehicles and personnel are not allowed to enter the city. People arriving in Beijing must also report their health status and complete the registration of personal information. Those who have left the epidemic area or have physical contact with persons in the epidemic area within 14 days of their arrival at Beijing, shall be inspected or quarantined at home in accordance with the regulations.

They should take the initiative to report their health conditions, and cooperate with relevant management services. They shall not go out. Anyone who refuses to accept epidemic prevention measures such as medical observation and home quarantine constitutes a violation of public security management and shall be severely punished by the public security bureau according to the law. In addition, all public places in the Beijing community that are not essential for people’s living are closed. All agencies and enterprises must strictly strengthen body temperature monitoring. Housing agencies and landlords in Beijing must provide local government with information on rental houses and tenants. This is a measure for epidemic prevention.

I’m still not convinced. But I realize that Xi really really wants it.

• China Slowly Gets Back To Work (R.)

Authorities told businesses to add up to 10 extra days onto Lunar New Year holidays that had been due to finish at the end of January. Even on Monday, a large number of workplaces remained closed and many people worked from home. Few commuters seen during the morning rush-hour on one of Beijing’s busiest subway lines. All were wearing masks. Jin Yang, who works in a department of China’s State Administration of Foreign Exchange, rode a bicycle to work instead of public transport. Staff were told to wear masks, avoid face-to-face meetings and the canteen was closed. Another employee surnamed Chen said the insurance company he worked for had barred people from taking public transport. “I usually take subways but this morning it cost me 200 yuan one way by cab,” he said.

Hubei, the province of 60 million people that is the hardest hit by the outbreak, remains in virtual lockdown, with its train stations and airports shut and its roads sealed off. The extended closure of factories in the world’s second-largest economy has raised concerns about disruptions cascading through global supply chains. China’s central bank has taken a raft of steps to support the economy, including reducing interest rates and flushing the market with liquidity. From Monday, it will provide special funds for banks to re-lend to businesses combating the virus. Taiwan’s Foxconn has received Chinese government approval to resume production at a key plant in the north China city of Zhengzhou, a source with direct knowledge of the situation told Reuters on Monday.

But the southern city of Shenzhen rejected a company request to resume work at a plant there. Tesla, Daimler and Ford Motor are among carmakers that have said that they will restart production at their factories on Monday. Gaming giant Tencent Holdings said it had asked staff to continue working from home until Feb. 21. Samsung Electronics resumed production at its home appliance factory in China on Monday, while it continues to run its chip factory there, a spokeswoman said. It extended the suspension of work at a television factory to Feb. 17. Hyundai said its suppliers in China resumed production but volume was negligible. Kia Motors is suspending production at all three Korean plants due to a shortage of parts, although one of them will resume production on Tuesday.

Beijinng can make iPhones a priority, knowing the west will watch them more than other products. So, bad barometer.

• iPhones Will Display China’s Back-to-Work Power (R.)

The next iPhones will test China’s ability to restart its economy. Apple supplier Foxconn, formally known as Hon Hai Precision Industry, is re-opening a key Chinese plant as authorities ease curbs. But the handset-maker and other companies face labour shortages as workers struggle to travel with ongoing contagion fears around a coronavirus outbreak. It’s a reminder of the complexity of restarting supply chains. Foxconn has won permission to resume operations at its mega Zhengzhou facility in northern China. Production at the plant, which some analysts reckon account for the bulk of the iPhone’s assemblies, has been halted for over two weeks.

The company is still in talks with officials to restart two other major plants, according to Reuters. One, in the southern city of Shenzhen, is focused on new iPhone models slated for this year, local media reports. There are practical limitations, though. Barely 16,000 workers, less than 10% of the workforce, returned to the Zhengzhou factory, Reuters reported on Monday [..] Many employees of Chinese companies crisscrossed the country to go back to their hometowns for the Lunar New Year holiday, that was then extended. Citywide lockdowns make it hard for people to move around. Analysts at Citi estimate that by Tuesday, only 30% of China’s total workforce will be able to return to work.

And that doesn’t factor in the immense challenge of preventing fresh cases of infection on factory floors. Most companies may have to enforce additional quarantines for people returning from virus-hit areas, as well as implement daily temperature checks. Foxconn has even resorted to manufacturing its own surgical face masks – up to two million a day – for its hundreds of thousands of employees. Following China-U.S. trade tension, the current disruption will fuel debate about the merits of companies allowing supply chains to consolidate too much in a single country. China’s looming labour shortage, though, is even more pronounced because the virus outbreak coincided with the holidays.

Or do they?

• Taiwan’s Foxconn Gets OK To Restart Plant In Zhengzhou, China (R.)

Taiwan’s Foxconn has received approval to resume production at a plant in the northern Chinese city of Zhengzhou that had been shuttered due to a coronavirus outbreak, a person with direct knowledge of the matter told Reuters on Monday. About 16,000 people, or under 10% of Foxconn’s workforce in Zhengzhou, have returned to the plant, the person said, adding that company executives were “trying very hard” to negotiate with authorities to resume production in other parts of China. The development comes as the coronavirus outbreak – declared a global health emergency by the WHO – threatens to disrupt Chinese manufacturing and force policymakers to ready measures to stabilize the economy.

At Foxconn, the delayed resumption of operations could impact the global technology supply chain and shipments to customers including Apple Inc, a source with direct knowledge of the matter previously told Reuters. The contract manufacturer is in talks to resume production at key plants including in Shenzhen and Kunshan, said the person on Monday [..] Tens of thousands of Foxconn employees have returned to work following an extended Lunar New Year holiday. They have been told to wear masks, undergo temperature checks and adhere to a specified dining system, showed internal memos reviewed by Reuters. Most senior Taiwanese officials have been told to refrain from returning to China and those who needed to do so required approval from Chairman Liu Young-Way, the person said.

Are these contradictory stories spread on purpose?

• Nikkei Denies Reuters Story That Foxconn Will Restart Production (ZH)

[..] after futures sprinted into the green following a Reuters report that Foxconn had received Chinese government approval to resume production at a key plant in the northern China city of Zhengzhou, Nikkei now denies this, reporting that “Foxconn’s plan to resume production on Monday has been called off by the Chinese authorities due to worries surrounding the coronavirus outbreak” The Japanese publication adds that “the action further worsens the supply chain disruption for global electronics companies, including Apple, Amazon, Google and Huawei. Foxconn is the world’s biggest iPhone assembler, and it makes Huawei smartphones and Amazon Kindle tablets as well as echo speakers, while it also supplies HP, Dell and most the major electronics brands.”

Public health experts in Shenzhen informed Foxconn, which trades as Hon Hai Precision Industry, that its factories there face “high risks of coronavirus infection” after conducting on-site inspections and therefore are not suitable to restart work, four people familiar with the matter told Nikkei. “Violation of epidemic prevention and control could potentially face the death penalty,” the internal meeting memo seen by the Nikkei Asian Review said. More importantly, Foxconn’s Zhengzhou complex, which according to Reuters would reopen on Monday, also canceled plans to resume work on Monday, they said.

Where politics meets business. Local officials feel the heat from all sides.

• Shenzhen Denies Blocking Apple Supplier Foxconn From Resuming Production (R.)

Local Chinese authorities have not blocked Apple supplier Foxconn from resuming production amid a coronavirus outbreak, they said in a statement on Sunday, denying an earlier report in the Nikkei Business Daily. The Nikkei, citing four people familiar with the matter, said on Saturday that public health experts had carried out inspections at Foxconn’s factories and told the company that there was a “high risk of coronavirus infection” at the facilities, making them unsuitable for a production restart. Shenzhen’s Longhua district, where Foxconn’s largest factory is located, said in a statement on its official WeChat account on Sunday that those reports were untrue and that it was still conducting checks, adding that the company would restart production once inspections were completed.

It said it had received proposals from three Foxconn subsidiaries on Feb. 6 detailing how the Taipei-headquartered firm, which makes smartphones for Apple and other brands, planned to put in place epidemic prevention and control measures. The thousands of workers that work in Foxconn’s factories will need to wear masks, undergo temperature checks, and adhere to a dining system considered safe, it said in the statement.

How far is that from Wuhan?

• Amazon Latest To Pull Out Of Major Barcelona Tech Show (BBC)

Amazon is the latest major company to pull out of one of the world’s largest tech shows because of risks posed by coronavirus. Amazon said “due to the outbreak and continued concerns about novel coronavirus” it would no longer take part in Mobile World Congress in Barcelona. The organiser said the event, which attracts 100,000 people, will go ahead. But it admitted other companies are considering whether to attend. South Korea’s LG Electronics, Ericsson, the Swedish telecoms equipment-maker, and US chip company NVIDIA have already withdrawn from the conference which runs between 24-27 February.

The GSMA, which organises the show in the Spanish city, said that while it could “confirm some large exhibitors have decided not to come to the show this year with others still contemplating next steps, we remain more than 2,800 exhibitors strong”. However, it revealed that it had put in place additional measures to “reassure attendees and exhibitors that their health and safety are our paramount concern”. These include a ban on all travellers from China’s Hubei province, the epicentre of the outbreak, while people who have been in China must provide proof they have been outside the country for 14 days.

Most stayed in China. That’s at least something.

• Millions Left Wuhan Before Quarantine. Where Did They Go? (AP)

For weeks after the first reports of a mysterious new virus in Wuhan, millions of people poured out of the central Chinese city, cramming onto buses, trains and planes as the first wave of China’s great Lunar New Year migration broke across the nation. Some carried with them the new virus that has since claimed over 8 00 lives and sickened more than 37,000 people. Officials finally began to seal the borders on Jan. 23. But it was too late. Speaking to reporters a few days after the the city was put under quarantine, the mayor estimated that 5 million people had already left. Where did they go?

An Associated Press analysis of domestic travel patterns using map location data from Chinese tech giant Baidu shows that in the two weeks before Wuhan’s lockdown, nearly 70% of trips out of the central Chinese city were within Hubei province. Baidu has a map app that is similar to Google Maps, which is blocked in China. Another 14% of the trips went to the neighboring provinces of Henan, Hunan, Anhui and Jiangxi. Nearly 2% slipped down to Guangdong province, the coastal manufacturing powerhouse across from Hong Kong, and the rest fanned out across China. The cities outside Hubei province that were top destinations for trips from Wuhan between Jan. 10 and Jan. 24 were Chongqing, a municipality next to Hubei province, Beijing and Shanghai.

The travel patterns broadly track with the early spread of the virus. The majority of confirmed cases and deaths have occurred in China, within Hubei province, followed by high numbers of cases in central China, with pockets of infections in Chongqing, Shanghai and Beijing as well. “It’s definitely too late,” said Jin Dong-Yan, a molecular virologist at Hong Kong University’s School of Biomedical Sciences. “Five million out. That’s a big challenge. Many of them may not come back to Wuhan but hang around somewhere else. To control this outbreak, we have to deal with this. On one hand, we need to identify them. On the other hand, we need to address the issue of stigma and discrimination.”

Too many theories to keep up.

• The Mysterious Origin of the Wuhan Coronavirus (ET)

Scientific studies based on phylogenetic analysis have researched the sequence of the novel coronavirus, compared it to other coronavirus sequences, and found it likely originated in bats. Researchers from the Wuhan Institute of Virology found the genome in the virus found in patients was 96 percent identical to that of an existing bat coronavirus, according to a study published in the journal Nature. But there have been other theories as well. One Chinese study suggested, for example, that snakes were the source of transmission to humans. However, many scientists believe that reptiles are a less likely source and that mammals like rats and pigs, and some birds, have been the primary reservoir for coronaviruses.

With this in mind, phylogenetic studies of viral genome sequences need to be supported by animal studies to confirm the origin of the infection, as well as to determine whether there is an intermediate host. It is not an easy task for a virus to establish zoonotic transmission, and coronaviruses rarely leap from animal to human infection with high transmissibility. There is even less chance to see a coronavirus leap directly from bats to humans. To infect new hosts, mutations need to occur with the viral surface proteins and/or envelope and structural genes, so that the mutated viruses can bind and enter the cells of new species, and efficiently complete the replication cycles in the new hosts. Some scientists have argued that coronaviruses can jump directly to humans, without mutating or passing through an intermediate species.

However, an intermediate host was clearly needed to establish zoonotic transmission to humans in the previous outbreaks of coronaviruses. Many studies suggested that the bat coronavirus jumped from its natural host bats to civets and then to humans during the 2003 SARS outbreak, and it jumped from bats to camels and then to humans for the MERS outbreak. So, civets and camels would serve as intermediate hosts for zoonotic transmission. Because bats were not sold at the Huanan market in Wuhan—the epicenter of the infection—at the time of the outbreak, this suggests the existence of another intermediate animal host that may have transferred the virus to humans. What is the most puzzling is that there have been no reports on the testing of animal samples collected in any epicenters in Wuhan, especially at the Huanan seafood market, to identify what animals might be the host or intermediate hosts of this novel Wuhan coronavirus.

Both the Steele dossier and the black ledger are fabricated files.

• Rick Gates Told Mueller The Black Ledger Was Fabricated (Solomon)

One of Robert Mueller’s pivotal trial witnesses told the special prosecutor’s team in spring 2018 that a key piece of Russia collusion evidence found in Ukraine known as the “black ledger” was fabricated, according to interviews and testimony. The ledger document, which suddenly appeared in Kiev during the 2016 U.S. election, showed alleged cash payments from Russian-backed politicians in Ukraine to ex-Trump campaign chairman Paul Manafort. “The ledger was completely made up,” cooperating witness and Manafort business partner Rick Gates told prosecutors and FBI agents, according to a written summary of an April 2018 special counsel’s interview. In a brief interview with Just the News, Gates confirmed the information in the summary. “The black ledger was a fabrication,” Gates said.

“It was never real, and this fact has since been proven true.” Gates’ account is backed by several Ukrainian officials who stated in interviews dating to 2018 that the ledger was of suspicious origins and could not be corroborated. If true, Gates’ account means the two key pieces of documentary evidence used by the media and FBI to drive the now-debunked Russia collusion narrative — the Steele dossier and the black ledger — were at best uncorroborated and at worst disinformation. His account also raises the possibility that someone fabricated the document in Ukraine in an effort to restart investigative efforts on Manafort’s consulting work or to meddle in the U.S. presidential election.

Much mystery has surrounded the black ledger, which was publicized by the New York Times and other U.S. news outlets in the summer of 2016 and forced Manafort out as one of Trump’s top campaign officials. After gaining wide attention as purported evidence of Russian ties to the Trump campaign, the ledger was never introduced as evidence at Manafort’s 2018 trial or significantly analyzed in Mueller’s final 2019 report, which concluded that Trump did not collude with Russia to influence the 2016 election. No FBI 302 interview reports have been released either showing what the FBI concluded about the ledger. Gates’ interview with the Mueller team now provides a potential clue as to why.

The Automatic Earth will not survive without your support. Please help.