Odilon Redon The winged man (The fallen angel) 1880

Tedros

https://twitter.com/i/status/1553858888260325377

Biden ice cream

https://twitter.com/i/status/1554282827046440960

Kamala

https://twitter.com/i/status/1554216124845379588

“No other confirmation of the direct involvement of the United States in hostilities on the territory of Ukraine is required..”

The US made itself a target. And all NATO countries too.

• US Directly Involved In Ukraine Conflict – Moscow (RT)

Statements made by Vadim Skibitsky, a representative of the Main Directorate of Intelligence of the Ministry of Defence of Ukraine, confirm that the United States is directly involved in the ongoing conflict there, according to Russian Foreign Ministry spokeswoman Maria Zakharova. In an interview with the Telegraph published on Monday, Skibitsky refused to answer questions about whose satellites are used for strikes when talking about American HIMARS multiple launch rocket systems. He did acknowledge, however, that they consult with Washington before launching strikes and that Washington has veto power over decision-making.

“No other confirmation of the direct involvement of the United States in hostilities on the territory of Ukraine is required,” Zakharova said on Tuesday, because the US doesn’t just arm and train Ukrainian forces but essentially shoots the weapons themselves. Zakharova stressed that the US is directly involved and that its distance from the situation is irrelevant. “They are fully involved. Now Kiev representatives are talking about their military involvement not only through the supply of weapons, but through personnel management in the ranks of the Ukrainian Armed Forces, direct instructions and the choice of targets,”Zakharova added.

Speculation has been ongoing about Washington’s involvement in the conflict. For example, in April French journalist Georges Malbrunot went viral on social media after claiming to have seen first-hand that Americans are “in charge” of the Ukrainian war effort on the ground.However, he stressed that this was not an official involvement as it was American mercenaries that he met in Ukraine. Nevertheless, skeptics have questioned the veracity of promises by US officials to avoid direct involvement or so-called “boots on the ground.”

“Advises”? They supply the weapons, the intelligence, and have a veto on “decision-making”. They might as well pull the trigger too. And for all we know they do.

• West Advises Ukraine On Strikes With Supplied Weapons – Top Intel Official (RT)

A senior Ukrainian military intelligence official has claimed his agency was getting advice from British and American counterparts on which targets to attack with Western-supplied weapons, like the HIMARS multiple-launch rocket systems. The Americans can ban any strike they don’t like, the general reportedly said. The revelation came on Monday in an interviewthat Major General Vadim Skibitsky gave to The Telegraph newspaper. When discussing Ukraine’s reported successes in destroying Russian military targets with weapons provided by the West, he claimed Ukrainian forces were using “real-time information” to direct fire. “I can’t tell you whether [we are directly tasking] British and American satellites, but we have very good satellite imagery,” the British newspaper cited him as saying.

The general did not claim that US officials were feeding targeting information directly to Ukraine, but said troops were getting feedback from Washington and London before launching rockets. This allows “Washington to stop any potential attacks if they were unhappy with the intended target,” The Telegraph said. US officials have frequently claimed that America does not have direct involvement in Russia’s hostilities with Ukraine, since it would put it at risk of escalating the conflict. Russia and its allies in Donetsk and Lugansk accused Ukraine of using the US-made launchers to strike non-military targets. In a recent incident a rocket attack hit a detention facility, where dozens of Ukrainian POWs were kept. Officials from the Donetsk People’s Republic showed images of what they described as fragments of HIMARS rockets used in the strike.

Over 50 of the prisoners were reported killed in what Russia alleged to be an assassination of potential witnesses and perpetrators of war crimes committed by the Ukrainian side. Kiev denied responsibility for the incident and accused Russia of hitting the prison camp in Elenovka. Ukrainian officials claimed the attack was meant to cover up either abuse of the POWs or the embezzlement of money.

“..the best thing that awaits them if they are captured alive is a trial and maximum prison terms.”

• Russia Strikes Foreign Fighters’ Base In Ukraine (RT)

Over 200 foreign mercenaries have reportedly been killed in a missile strike in southern Ukraine, Russia’s Ministry of Defense reported on Tuesday. The statement also added that over 20 units of military equipment were also destroyed during the attack. In its daily briefing on Telegram, the ministry reported that Russian Aerospace Forces delivered a blow to a temporary deployment point of the Ukrainian ‘foreign legion’ near the city of Nikolaev, using high-precision weapons. As a result, up to 250 foreign mercenaries were eliminated, according to the report. Russia also claims to have neutralized up to 500 nationalist fighters in the Kharkov region via high-precision strikes, as well as “a significant amount” of military equipment.

Last week, Russia also claimed to have killed over 40 foreign mercenaries, most of whom were Polish citizens, after a missile strike on a temporary deployment point near Konstantinovka in the Donetsk People’s Republic (DPR). The week before that, the Russian military claimed it had killed up to 250 such soldiers in the same settlement. Kiev’s international military unit was created in late February at the request of Ukrainian President Vladimir Zelensky, and is officially known as the International Legion of Territorial Defense of Ukraine. In April, the Russian military estimated their numbers at almost 7,000.

However, an updated estimate provided by the Russian defense ministry earlier this month suggests that only about 2,700 of these soldiers remain in Ukraine. Many of them were eliminated while others fled abroad, some complaining about disorder in the ranks of the Ukrainian forces and about poor equipment. Moscow has repeatedly warned that it will not view foreign mercenaries in Ukraine as combatants as defined by the Geneva Convention and that “the best thing that awaits them if they are captured alive is a trial and maximum prison terms.”

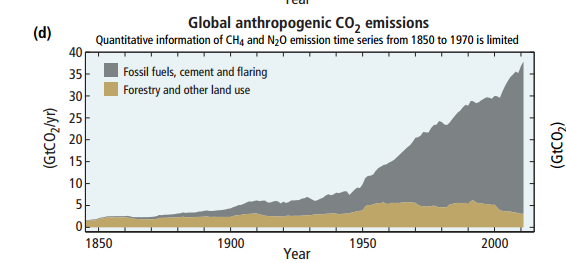

“..developed countries by contrast must take the lead on sharp cuts to their emission..”

• African Nations To Make Case For Big Rise In Fossil Fuel Output (G.)

Leaders of African countries are likely to use the next UN climate summit in November to push for massive new investment in fossil fuels in Africa, according to documents seen by the Guardian. New exploration for gas, and the exploitation of Africa’s vast reserves of oil, would make it close to impossible for the world to limit global heating to 1.5C above pre-industrial levels. However, soaring gas prices have made the prospect of African supplies even more attractive, and developed countries, including EU members, have indicated they would support such developments in the current gas shortage.

The Guardian has seen a technical document prepared by the African Union, comprising most of Africa’s states, for the “second extraordinary session of the specialised technical committee on transport, transcontinental and interregional infrastructure and energy committee”, a meeting of energy ministers that took place by video conference from 14 to 16 June. The five-page document, and accompanying 25-page explanation, indicates that many African countries favour a common position that would inform their negotiating stance at the Cop27 UN climate summit, scheduled for this November in Egypt, which would entail pushing for an expansion of fossil fuel production across the continent.

The document states: “In the short to medium term, fossil fuels, especially natural gas will have to play a crucial role in expanding modern energy access in addition to accelerating the uptake of renewables.”Member states of the African Union will meet again, in Addis Ababa, this week to confirm the stance to be taken. They are expected to argue that Africa must be allowed to benefit from its fossil fuel reserves, as rich countries already have done, and that developed countries by contrast must take the lead on sharp cuts to their emissions.

Of its own choosing.

• EU Facing Winter Energy Crisis – Borrell (RT)

The EU may run out of gas during the upcoming winter season amid supply shortages, the bloc’s senior diplomat Josep Borrell has warned. “Europe is facing a perfect storm: energy prices are up, economic growth is down and winter is coming,” the EU’s high representative for foreign affairs and security policy wrote, in a blog published Monday on the website of the Diplomatic Service of the EU. There is “real uncertainty” over whether the EU will have enough gas and whether it will be able to afford it, Borrell said in the piece, titled “Europe’s energy balancing act,” describing the upcoming winter as “exceptional.” His comments come amid a reduced flow of natural gas from Russia, a major supplier to the bloc. Borrell warned that countries of the continent must prepare for a possible total cut-off by Moscow, and suggested that Europe has struggled to replace Russian supplies.

“The hard truth is that for this winter, we are approaching the limits of what extra gas we can buy from non-Russian sources. So, the bulk will have to come from energy savings, i.e. demand reduction.” he wrote. Last month the EU approved a plan that would see member states voluntarily reduce their gas consumption by 15%, to enable the bloc to accumulate the fuel ahead of winter. In case of an emergency, the voluntary reduction may become mandatory. According to Borrell, the bloc has managed to reduce the share of Russian gas in its imports from 40% at the beginning of the year to around 20% today, by buying more LNG and receiving gas via pipelines from Norway, Algeria and Azerbaijan. Russia has repeatedly said it remains a reliable supplier and honors its contractual obligations, but that international sanctions are preventing pipeline operator Gazprom from delivering gas to the EU at full capacity.

Wood and brown coal. Take that, Putin!

• Netherlands Faces Winter Of Smog – Media (RT)

Smog and particulate pollution will rise in the Netherlands this winter, public health authorities have warned. The rise is linked to more households choosing to burn firewood as gas prices skyrocket. Sales of wood and pellet stoves have increased by 30% since last summer, De Volkskrantreported on Sunday. Demand is now so high, the newspaper reported, that manufacturers are struggling to deliver enough of these stoves. Firewood suppliers, meanwhile, are already running out of stock, and sourcing more logs is a difficult proposition, as the Dutch forestry agency refuses to supply trees to the firewood industry. With gas and electricity bills at record highs, the shift among some consumers to wood burning will have environmental consequences, the National Institute for Public Health (RIVM) warned.

“The sale of wood is linked to consumption and it is indeed expected that this will not have a positive impact on air pollution,” a spokesperson told De Volkskrant. While the institute is investigating what measures can be taken to reduce this pollution risk, its powers are limited at present. It can warn households against lighting fires on days when the smog risk is high, but cannot enforce a ban. Health experts called for a ban last month, telling parliament that such a measure would be necessary in winter when more fires would increase the chance of smog. However, there is currently no other viable heat source to replace either gas or solid fuel, although the RIVM is investigating heat pump technology, according to the newspaper.

The Netherlands is not the only European country where wood fires are making a comeback. Poland gave its citizens permission to hoard timber for burning last month, while Latvians have rushed for firewood collection permits and Hungary has ordered a halt to firewood exports. In the UK, the London Fire Brigade said in May that its officers had responded to 100 house fires in the preceding months, started by people burning wood in open fires to stay warm. While gas prices throughout Europe were steadily rising since the end of the coronavirus pandemic, the increase accelerated sharply since Russia launched its military operation in Ukraine in February. The EU has begun phasing out Russian fuel imports in response, while Russian gas giant Gazprom has said that sanctions are impeding its ability to deliver gas to the region.

The sole voice of reason in the EU. Something has to give.

• EU Is Not Our Boss – Hungary (RT)

Hungarian Prime Minister Viktor Orban lashed out at the European Union on Monday evening in a Facebook post, reminding his followers that Brussels doesn’t dictate European affairs. “The European Union is not in Brussels. The European Union is in Vienna, Budapest and Warsaw, Berlin and Madrid,” the prime minister said. “Brussels is not our boss We are an independent, sovereign Hungarian nation. We make decisions together. If they’re not good for us, we’ll tell them. If they are not good and we can prevent them, the common decision will not be made.” Orban has made international headlines in recent weeks for his blunt statements criticizing the West’s policies. On July 28, the premier blasted NATO’s support for Kiev during a meeting in Vienna with Austrian Chancellor Karl Nehammer.

“The Hungarian assessment is that the concept of NATO supporting Ukraine with weapons and training officers, and the Ukrainians fighting against the Russians, is a construct that has now been shown not to result in a Ukrainian victory,” Orban said at a press conference. The prime minister has been a holdout amongst European leaders in jumping on board Brussels’ harsh sanctions campaign against Russia, particularly a total embargo of Russian natural gas. In his remarks criticizing NATO, Orban also made reference to the fact that sanctions on Moscow are causing serious economic hardship in the bloc. He said that a peaceful settlement needs to be reached in Ukraine because its absence it will spur economic recession in the EU that will be accompanied by political instabiliy.

Or others would do the same.

• Canada’s Travel Ban Had No Scientific Basis (CS)

On August 13, 2021, the Canadian government announced that anyone who hadn’t been vaccinated against Covid would soon be barred from planes and trains. In many cases, The Backward could no longer travel between provinces or leave the country. If you lived in Winnipeg and wanted to visit your mother on her deathbed in London or Hong Kong or, perhaps, Quebec City, you’d better get jabbed—or resign yourself to never seeing your mother again. Jennifer Little, the director-general of COVID Recovery, the secretive government panel that crafted the mandate, called it “one of the strongest vaccination mandates for travelers in the world.” It was draconian and sweeping, and it fit neatly with the public persona that Prime Minister Justin Trudeau had cultivated—that of the sleek, progressive, forward-looking technocrat guided by fact and reason.

The Canadian Medical Association Journal, in a June 2022 article, observed that “Canada had among the most sustained stringent policies regarding restrictions on internal movement.” But recently released court documents—which capture the decision-making behind the travel mandate—indicate that, far from following the science, the prime minister and his Cabinet were focused on politics. (Canadians are hardly alone. As Common Sense recently reported, American public-health agencies have also been politicized.) Two days after announcing the mandate, Trudeau called a snap election—presumably expecting that his Liberal Party, which was in the minority in the House of Commons, would benefit from the announcement and be catapulted into the majority. As it turned out, the Liberals failed to win a majority in the September 2021 election.

In the meantime, roughly five million unvaccinated Canadians were barred from visiting loved ones, working or otherwise traveling. (Trudeau, for his part, stayed in power. Even though the Conservatives have won the popular vote in the past two elections, because of Canada’s parliamentary system, they have been denied the top job.) The court documents are part of a lawsuit filed by two Canadian residents against the government. Until last month, they were under seal. Both plaintiffs are business owners. Both have family in Britain. Both have refused the vaccine on the grounds of bodily autonomy. Both were reluctant to identify their businesses out of fear of losing customers

“..we estimate that lockdowns may claim 20 times more life years than they save..”

• Are Lockdowns Effective in Managing Pandemics? (MDPI)

The present coronavirus crisis caused a major worldwide disruption which has not been experienced for decades. The lockdown-based crisis management was implemented by nearly all the countries, and studies confirming lockdown effectiveness can be found alongside the studies questioning it. In this work, we performed a narrative review of the works studying the above effectiveness, as well as the historic experience of previous pandemics and risk-benefit analysis based on the connection of health and wealth. Our aim was to learn lessons and analyze ways to improve the management of similar events in the future.

The comparative analysis of different countries showed that the assumption of lockdowns’ effectiveness cannot be supported by evidence—neither regarding the present COVID-19 pandemic, nor regarding the 1918–1920 Spanish Flu and other less-severe pandemics in the past. The price tag of lockdowns in terms of public health is high: by using the known connection between health and wealth, we estimate that lockdowns may claim 20 times more life years than they save. It is suggested therefore that a thorough cost-benefit analysis should be performed before imposing any lockdown for either COVID-19 or any future pandemic.

WHO Treaty Christine Anderson

https://twitter.com/i/status/1554364529236234240

“Face masks. Yes, face masks for cows.”

• New Zealand Plans To Tax Farmers For Livestock Burps (TCS)

It seems like governments across the Western world are hellbent on destroying the lives of their farmers, and New Zealand is no different, with the government bringing in a “burp tax” for livestock. It’s become almost a meme to talk about the government taxing you for breathing in oxygen in the age of climate insanity and carbon taxes, but New Zealand is by far the closest to doing so. According to climate radicals in the country, cow and sheep burps are just too harmful to the environment due to the methane released, and they need to be reduced, and farmers need to be taxed into submission. “There is no question that we need to cut the amount of methane we are putting into the atmosphere, and an effective emissions pricing system for agriculture will play a key part in how we achieve that,” New Zealand Climate Change Minister James Shaw told BBC News.

Under the proposed legislation, the government would begin taxing livestock farmers for their gas emissions starting in 2025, with incentives and lower tax rates being offered to farmers that feed their livestock special anti-burp diets and plant more trees to offset their supposed emissions. According to WebMD, other strategies the government is recommending include “face masks for cows that trap and turn methane into water and carbon dioxide, a method that reduces emissions by more than 50% according to Zelp, the company that invented the contraption. Some farmers are already experimenting with feed made from seaweed. And scientists are tinkering with cow genetics to increase their digestive efficiency.” Face masks. Yes, face masks for cows.

Daniel Hale.

• When The Just Go to Prison (Chris Hedges)

Hale, a 34-year-old former Air Force signals intelligence analyst, is serving a 45 month prison sentence, following his conviction under the Espionage Act for disclosing classified documents about the U.S. military’s drone assassination program and its high civilian death toll. The documents are believed to be the source material for “The Drone Papers” published by The Intercept, on October 15, 2015. These documents revealed that between January 2012 and February 2013, U.S. special operations drone airstrikes killed more than 200 people — of which only 35 were the intended targets. According to the documents, over one five-month period of the operation, nearly 90 percent of the people killed in airstrikes were not the intended targets. The civilian dead, usually innocent bystanders, were routinely classified as “enemies killed in action.”

The terrorizing and widespread killing of thousands, perhaps tens of thousands, of civilians was a potent recruiting tool for the Taliban and Iraqi insurgents. The aerial attacks created far more hostile fighters than they eliminated and enraged many in the Muslim world. Hale is composed, articulate and physically fit from his self-imposed regime of daily exercise. We discuss books he has recently read, including John Steinbeck’s novel East of Eden and Nicholson Baker’s Baseless: My Search for Secrets in the Ruins of the Freedom of Information Act, which explores whether the U.S. used biological weapons on China and Korea during World War II and the Korean War. Hale is currently housed in the Communications Management Unit (CMU), a special unit that severely restricts and heavily monitors communications, including our conversation, and visitations.

The decision by The Bureau of Prisons to lock Hale up in the most restrictive wing of a supermax prison ignores the recommendation of the sentencing Judge Liam O’Grady, who suggested that he be placed in a low-security prison hospital facility in Butner, North Carolina, where he could get treatment for his PTSD. Hale is one of a few dozen people of conscience who have sacrificed their careers and their freedom to inform the public about government crimes, fraud and lies. Rather than investigate the crimes that are exposed and hold those who carried them out to account, the two ruling parties wage war on all who speak out. These men and women of conscience are the lifeblood of journalism. Reporters cannot document abuses of power without them.

The silence on the part of the press over Hale’s imprisonment, as well as the persecution and imprisonment of other champions of an open society, such as Julian Assange, is stunningly shortsighted. If our most important public servants, those with the courage to inform the public, continue to be criminalized at this rate, we will cement in place total censorship, resulting in a world where the abuses and crimes of the powerful are shrouded in darkness. Barack Obama weaponized the Espionage Act to prosecute those who provided classified information to the press. The Obama White House, whose assault on civil liberties was worse than those of the Bush administration, used the 1917 Act, designed to prosecute spies, against eight people who leaked information to the media including Assange — although he is not a U.S. citizen, and WikiLeaks is not a U.S.-based publication — along with Edward Snowden, Thomas Drake, Chelsea Manning, Jeffrey Sterling and John Kiriakou, who spent two-and-a-half years in prison for exposing the routine torture of suspects held in black sites.

Also under The Espionage Act, Joshua Schulte, a former CIA software engineer, was convicted on July 13, 2022 of the so-called Vault 7 leak, published by WikiLeaks in 2017, which revealed how the CIA hacked Apple and Android smartphones and turned internet-connected televisions into listening devices. He faces up to 80 years in prison.

I’d like to see that.

• Top Epidemiologist Predicts Insurers Will Go After Covid Vax Makers (JTN)

Yale University epidemiologist Harvey Risch is expecting insurers to seek financial compensation from COVID-19 vaccine makers to cover “early unexpected mortality claims,” as they “they have a major financial risk that they have to figure out how to manage.” Insurers’ actuaries estimated COVID vaccinees would “live longer than they have” based on misrepresentations about “all-cause mortality … from the original [clinical] trials,” Risch told the “Just the News, Not Noise” TV program. In a followup interview he pointed to statements by insurers that offer group life insurance. OneAmerica CEO Scott Davison told a healthcare conference in December that death rates had risen an “unheard of” 40% in the working-age people it insures compared to pre-pandemic rates, when a “one-in-200-year catastrophe” would only bring a 10% increase.

Most claims aren’t filed as COVID-related deaths, he said. Public records show that Lincoln National, a much larger insurer, reported a 163% increase in death benefits paid out in 2021, the first year of the COVID vaccines: $1.4 billion, compared to $500 million in pre-pandemic 2019 and $548 million in 2020. It largely blamed a $41 million operations loss in the first quarter of 2022 on “non-pandemic-related morbidity, including unusual claims adjustments, and less favorable returns within the company’s alternative investment portfolio.” Lincoln Financial Group Vice President of Corporate Communications Kelly DeAngelis told Just the News the 2020 statutory filings didn’t include Lincoln Life Assurance Company of Boston. The 2021 supplement includes results from both companies, which merged that year.

Pfizer attacks

https://twitter.com/i/status/1554122422537916416

1982.

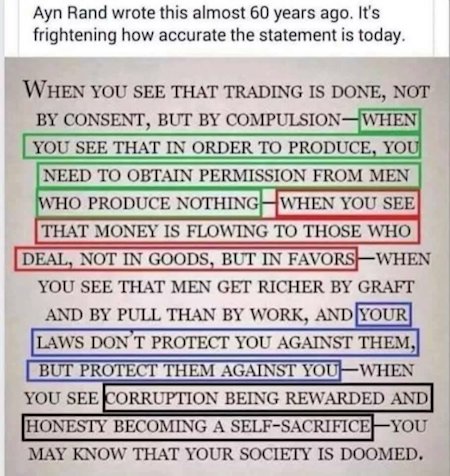

• An Honest Money Would Stop Inflation by Don Werkheiser (Greco)

This little vignette written by Don Werkheiser remains one of the best concise explanations of inflation I’ve ever seen. It was published in the spring 1982 edition of Green Revolution, the journal of the School of Living a non-profit organization with which I was associated throughout the 1980s and into the early 1990s.

A rural village has no money. All trade is by barter. A farmer comes to town and deposits 10 bushels of corn with a man who has a store room. This operator gives the farmer 10 receipts, each redeemable in a bushel of corn. But the farmer asks for receipts in smaller denominations. The storekeeper gives him 40 receipts for 40 pecks. The farmer trades ten of these corn-receipts for other products; they are each accepted at the value of a peck of corn. That acceptance constitutes the issue of corn notes as money. Such receipts are generalized credit instruments. They refer to stored corn, but not to any specific peck of corn. When the seller wants a peck of corn the receipt is redeemed. Otherwise it is spent again, and ownership of a peck of corn is conveyed to the next seller.

The next day the farmer returns to town and spends 10 corn notes (each of one peck of corn in value) for his wife’s birthday present. Now the farmer has doubled the money supply in circulation, but there is no inflation; there are redeemable goods back of them. What then is inflation? We must understand “money” and the storekeeper’s actions. The store room owner noticed that the corn notes were accepted in trade. So he made 40 more “peck-receipts” looking just like corn-receipts and then he spent them into circulation. That is inflation–counterfeit receipts passed as valid receipts. Assume that the counterfeit receipts were accepted at face value. In that case, the counterfeiter effected a robbery of commodities equal in value to 40 packs of corn, while those who accepted them received receipts which measured the extent to which they had been robbed.

So long as confidence lasts, the game would continue and receipts could be spent. New sellers would be holding empty receipts. The game would collapse when all the corn in the warehouse was redeemed, and holders of the 40 counterfeit receipts found no one who would take them in trade. Worse could happen if the counterfeiter had the skills of a politician. If, when confronted by angry holders of his counterfeit receipts he declared himself a benefactor of the community–and showed that the original issue by the farmer was too limited, and that his own issues stimulated industry and trade (he would not mention that the farmers issue was redeemable while his own was not). He noted that most people did not want corn; they wanted a medium of trade that they could use to speed up trade.

They were told: “If the game stopped then, the holders would be losers, but if they continued, they could all buy what they wanted. In fact if they elected him Mayor he would declare pseudo-corn-notes to be legal tender, and he’d also begin a program of public works. Soon everyone would be rich.” An ignorant public agreed. Elected Mayor, the counterfeiter issue another stock of corn-notes called “pecks” and declared them to be worth a peck of corn in the market (but not anywhere redeemable). On each note was a picture of a peck-basket, but what it contained was not specified. Just a peck of value.

I am the change

A great message….. pic.twitter.com/dli2Wcf0Ip

— Harsh Goenka (@hvgoenka) August 1, 2022

???

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.