Unknown GMC truck Associated Oil fuel tanker, San Francisco 1935

Good headline.

• If It Owns a Well or a Mine, It’s Probably in Trouble (NY Times)

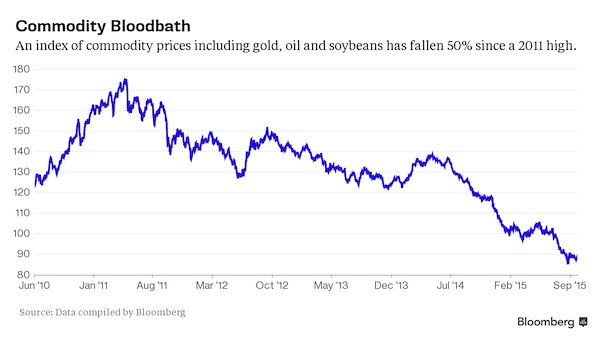

The pain among energy and mining producers worsened again on Tuesday, as one of the industry’s largest players cut its work force by nearly two-thirds and Chinese trade data amplified concerns about the country’s appetite for commodities. The full extent of the shakeout will depend on whether commodities prices have further to fall. And the outlook is shaky, with a swirl of forces battering the markets. The world’s biggest buyer of commodities, China, has pulled back sharply during its economic slowdown. But the world is dealing with gluts in oil, gas, copper and even some grains. “The world of commodities has been turned upside down,” said Daniel Yergin, the energy historian and vice chairman of IHS, a consultant firm.

“Instead of tight supply and strong demand, we have tepid demand and oversupply and overcapacity for commodity production. It’s the end of an era that is not going to come back soon.” The pressure on prices has been significant. Prices for iron ore, the crucial steelmaking ingredient, have fallen by about 40% this year. The Brent crude oil benchmark is now hovering around $40 a barrel, down from more than a $110 since the summer of 2014. Companies are caught in the downdraft. A number of commodity-related businesses have either declared bankruptcy or fallen behind in their debt payments. Even more common are the cutbacks. Nearly 1,200 oil rigs, or two-thirds of the American total, have been decommissioned since late last year.

More than 250,000 workers in the oil and gas industry worldwide have been laid off, with more than a third coming in the United States. The international mining company Anglo American is pulling back broadly, with a goal to reduce the company’s size by 60%. Along with the layoffs announced on Tuesday, the company is suspending its dividend, halving its business units, as well as unloading mines and smelters.

How bad will the holiday shopping season get?

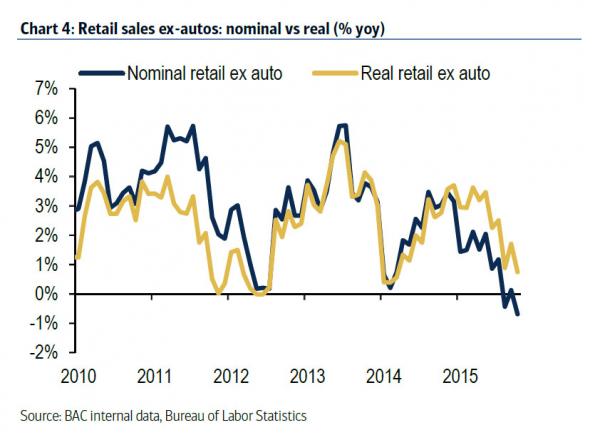

• Credit Card Data Reveals First Core Retail Sales Decline Since Recession (ZH)

While we await the government’s retail sales data on December 11, the last official economic report the Fed will see before its December 16 FOMC decision, Bank of America has been kind enough to provide its own full-month credit card spending data. And while a week ago the same Bank of America disclosed the first holiday spending decline since the recession, in today’s follow up report BofA reveals that if one goes off actual credit card spending – which conveniently resolves the debate if one spends online or in brick and mortar stores as it is all funded by the same credit card – the picture is even more dire. According to the bank’s credit and debit card spending data, core retail sales (those excluding autos which are mostly non-revolving credit funded) just dropped by 0.2% in November, the first annual decline since the financial crisis!

At this point, BofA which recently laid out its bullish 2016 year-end forecast which sees the S&P rising almost as high as 2,300, and is thus conflicted from presenting a version of events that does not foot with its erroenous economic narrative, engages in a desperate attempt to cover up the ugly reality with the following verbiage, which ironically confirms that a Fed hike here would be a major policy error and lead to even more downside once it is digested by the market.

Not usual FT language: “..the forces of technological change and globalisation drive a wedge between the winners and losers in a splintering US society.”

• America’s Middle Class Meltdown (FT)

America’s middle class has shrunk to just half the population for the first time in at least four decades as the forces of technological change and globalisation drive a wedge between the winners and losers in a splintering US society. The ranks of the middle class are now narrowly outnumbered by those in lower and upper income strata combined for the first time since at least the early 1970s, according to the definitions by the Pew Research Center, a non-partisan think-tank in research shared with the Financial Times. The findings come amid an intensifying debate leading up to next year’s presidential election over how to revive the fortunes of the US middle class.

The prevailing view that the middle class is being crushed is helping to feed some of the popular anger that has boosted the populist politics personified by Donald Trump’s candidacy for the Republican presidential nomination. “The middle class is disappearing,” says Alison Fuller, a 25-year-old university graduate working for a medical start-up in Smyrna, Georgia, who sees herself voting for Mr Trump. Pew used one of the broadest income classifications of the middle class, in a new analysis detailing the “hollowing out” of a group that has formed the bedrock of America’s postwar success. The core of American society now represents 50% or less of the adult population, compared with 61% at the end of the 1960s. Strikingly, the change has been driven at least as much by rapid growth in the ranks of prosperous Americans above the level of the middle class as it has by expansion in the numbers of poorer citizens.

Exporting commodities and deflation: “The excess capacity is cosmic.”

• Chinese Devaluation Is A Bigger Danger Than Fed Rate Rises (AEP)

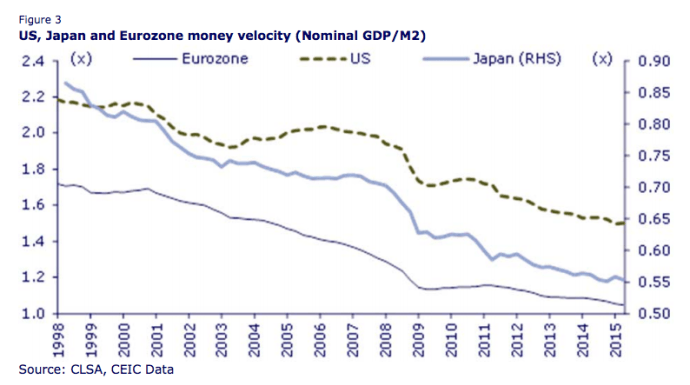

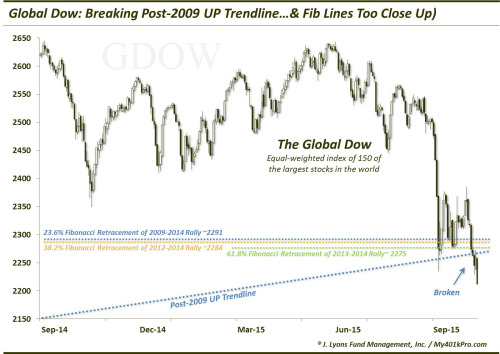

The world has had a year to brace for monetary lift-off by the US Federal Reserve. A near certain rate rise next week will come almost as a relief. Emerging markets have already endured a dollar shock. The currency has risen 20pc since July 2014 in expectation of this moment, based on the Fed’s trade-weighted “broad” dollar index. The tightening of dollar liquidity is what caused a global manufacturing recession and an emerging market crash earlier this year, made worse by China’s fiscal cliff in January and its erratic, stop-start, efforts to wind down a $26 trillion credit boom. The shake-out has been painful: hopefully the dollar effect is largely behind us. The central bank governors of India and Mexico, among others, have been urging the Fed to stop dithering and get on with it. Presumably they have thought long and hard about the consequences for their own economies.

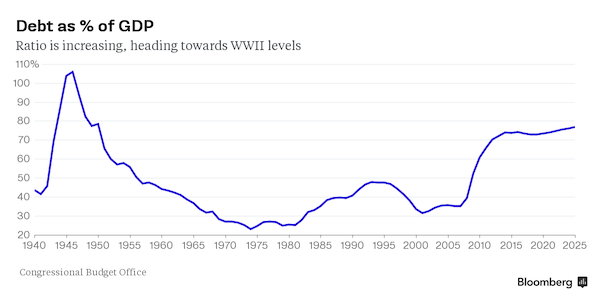

It is a safe bet that Fed chief Janet Yellen will give a “dovish steer”. She has already floated the idea that rates can safely be kept far below zero in real terms for a long time to come, even as unemployment starts to fall beneath the 5pc and test “NAIRU” levels where it turns into inflation. Her apologia draws on a contentious study by Fed staff in Washington that there is more slack in the economy than meets the eye. She argues that after seven years of drought and “supply-side damage” it may make sense to run the economy hotter than would normally be healthy in order to draw discouraged workers back into the labour market and to ignite a long-delayed revival of investment. There are faint echoes of the early 1970s in this line of thinking. Rightly or wrongly, she chose to overlook a competing paper by the Kansas Fed arguing the opposite.

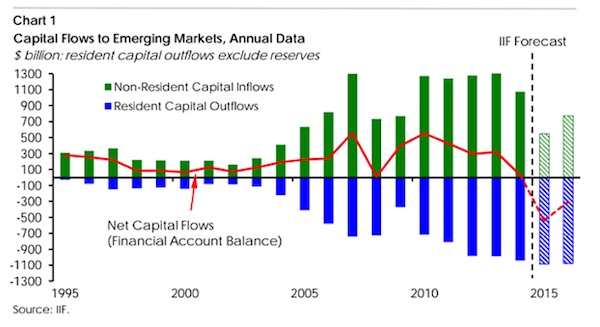

Such a bias towards easy money may contain the seeds of its own destruction if it forces the Fed to slam on the brakes later. But that is a drama for another day. The greater risk for the world over coming months is that China stops trying to hold the line against devaluation, and sends a wave of corrosive deflation through the global economy. Fear that China may join the world’s currency wars is what haunts the elite banks and funds in London. It is why there has been such a neuralgic response to the move this week to let the yuan slip to a five-year low of 6.4260 against the dollar. Bank of America expects the yuan to reach 6.90 next year, setting off a complex chain reaction and a further downward spiral for oil and commodities. Daiwa fears a 20pc slide. My own view is that a fall of this magnitude would set off currency wars across Asia and beyond, replicating the 1998 crisis on a more dangerous scale.

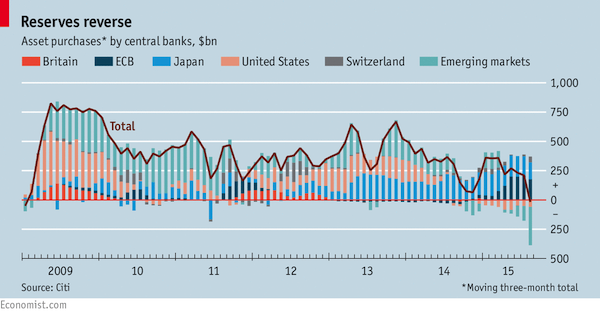

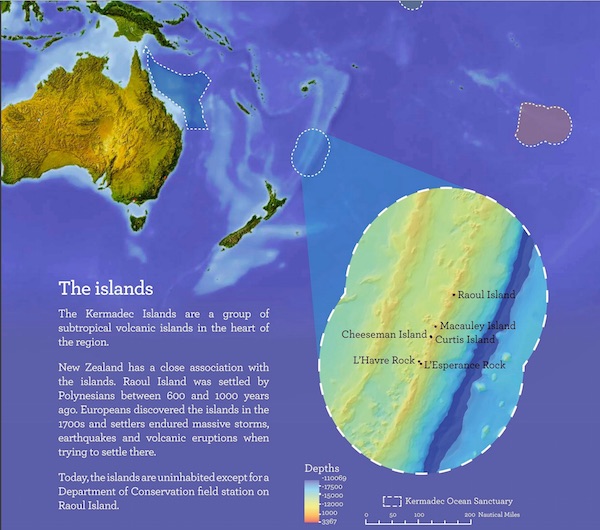

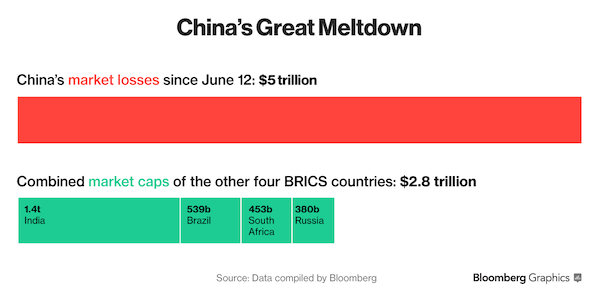

Lest we forget, China’s fixed capital investment has reached $5 trillion a year, as much as in North America and Europe combined. The excess capacity is cosmic. Pressures on China are clearly building up. Capital outflows reached a record $113bn in November. Capital Economics says the central bank (PBOC) probably burned through $57bn of foreign reserves that month defending the yuan peg. A study by the Reserve Bank of Australia calculates that capital outflows reached $300bn in the third quarter, an annual pace of 10pc of GDP. The PBOC had to liquidate $200bn of foreign assets. Defending the currency on this scale is costly. Reserve depletion entails monetary tightening, neutralizing the stimulus from cuts in the reserve requirement ratio (RRR). It makes a “soft landing” that much harder to pull off.

China is trying to find ways to hide debts and losses…

• China Swallows Its Mining Debt Bomb (BBG)

Remember that Bugs Bunny scene where the Tasmanian Devil survives an explosion by eating the bomb? China’s government is trying to do that for its indebted miners. Rather than let the domestic mining industry be dragged down by its $131 billion of debts, the authorities are looking at setting up what amounts to a state-owned “bad bank” to segregate the worst liabilities and allow the remaining businesses to survive. China Minmetals, the metals trader and miner tasked with swallowing up China Metallurgical Group in a state-brokered merger, will be one taker, these people said. That should help with its net debt, which already stood at 136 billion yuan ($22 billion) in December 2014. There’ll be no shortage of others lining up for relief.

Seven of the 17 most debt-laden mining and metals companies worldwide are in China, and all are state-owned or -controlled. Western credit investors have become so chary of miners’ debts that you can pick up bonds with a 100% annual yield if you’re confident the companies will last the year. Anglo American is firing 63 percent of its workforce and selling at least half its mines to cut debt, while Glencore today announced plans to further decrease its borrowings. The political strategist James Carville once joked that he’d like to be reincarnated as the bond market so he could “intimidate everybody.” In China, things are considerably more relaxed. Chalco, one of the top five global aluminum producers, hasn’t generated enough operating income to pay its interest bills in any half-year since 2011. Over the four-year period, interest payments have exceeded earnings by about 29 billion yuan.

It’s a similar picture in China’s coal industry. China Coal Energy, Yanzhou Coal, and Shaanxi Coal, the second-, fourth-, and fifth-biggest domestic producers by sales, have collectively spent 3.3 billion yuan more on interest over the last 12 months than they’ve earned from their operations. This situation can’t go on. While Chalco still has about 47 billion yuan in shareholders’ equity on its balance sheet, it doesn’t have an obvious path back to profitability and most of its excess interest payments were made before aluminum prices started to really slump, back in May. There are also some worrying dates looming: The company has 13.6 billion yuan in bonds maturing next year, and another 20.9 billion yuan in the two years following

Beijing is trying to centralize control.

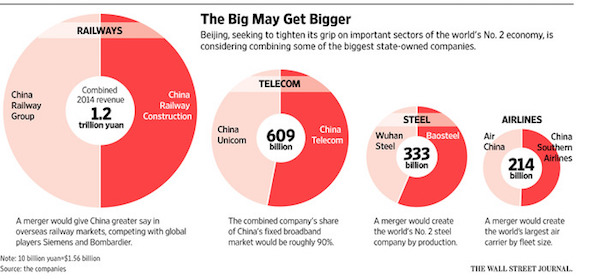

• China’s Plan to Merge Sprawling Firms Risks Curbing Competition (WSJ)

Already massive, China Inc. is about to get bigger—and that may not be good for the country’s economy or consumers. Beijing is considering combining some of its biggest state-owned companies in a move that would tighten its grip over key parts of the world’s No. 2 economy. The government said Tuesday it would merge two of the country’s largest metals companies. Already it has combined train-car makers and nuclear technology firms and is in the process of combining its two largest shipping lines. It is considering combining more companies in areas ranging from telecommunications to air carriers. In recent weeks, shares of major state-owned enterprises like mobile-phone service China Unicom (Hong Kong) and China Telecom and carriers China Southern Airlines and Air China have surged amid speculation they will be next.

China Telecom said it doesn’t comment on speculation, while the others said they haven’t received any information about mergers. Beijing hopes to form national champions that can better compete abroad. But experts say the moves will likely reduce competition, lead to higher prices for consumers and do little to clean up China’s sprawling and largely wasteful portfolio of state-owned enterprises. “China is throwing the gears of reform into reverse,” said Sheng Hong, director of the Unirule Institute of Economics in Beijing, an independent research group. “Unprofitable state-owned companies should be closed, rather than merged,” he said.

[..] Economists say state-owned enterprises are a drag on China’s economy. They enjoy cheap lands, government subsidies and easy access to bank loans. Private firms face barriers to entering sectors such as oil and banking, and state-run companies’ dominance allow them to keep prices high. However, the performance of SOEs has been deteriorating. According to Morgan Stanley, the gap of return-on-assets between SOEs and private enterprises is the widest since the late 1990s. China’s SOEs had an average return-on-assets rate of 4% in 2014, compared with private companies’ 10%, said Kelvin Pang, an analyst at the bank. State-run Economic Information Daily, a newspaper published by the official Xinhua News Agency, reported in April that Beijing was considering merging its biggest state-owned companies to create around 40 national champions from the existing 111.

“The rule change will cut Chesapeake’s inventory by 45%..” Its market cap will fall right along with it.

• Billions of Barrels of Oil Vanish in a Puff of Accounting Smoke (BBG)

In an instant, Chesapeake Energy will erase the equivalent of 1.1 billion barrels of oil from its books. Across the American shale patch, companies are being forced to square their reported oil reserves with hard economic reality. After lobbying for rules that let them claim their vast underground potential at the start of the boom, they must now acknowledge what their investors already know: many prospective wells would lose money with oil hovering below $40 a barrel. Companies such as Chesapeake, founded by fracking pioneer Aubrey McClendon, pushed the Securities and Exchange Commission for an accounting change in 2009 that made it easier to claim reserves from wells that wouldn’t be drilled for years. Inventories almost doubled and investors poured money into the shale boom, enticed by near-bottomless prospects.

But the rule has a catch. It requires that the undrilled wells be profitable at a price determined by an SEC formula, and they must be drilled within five years. Time is up, prices are down, and the rule is about to wipe out billions of barrels of shale drillers’ reserves. The reckoning is coming in the next few months, when the companies report 2015 figures. “There was too much optimism built into their forecasts,” said David Hughes, a fellow at the Post Carbon Institute. “It was a great game while it lasted.” The rule change will cut Chesapeake’s inventory by 45%, regulatory filings show. Chesapeake’s additional discoveries and expansions will offset some of its revisions, the company said in a third-quarter regulatory filing.

“The problem is the risk investors piled on over the past seven years, when they still believed in the Fed’s hype that risks didn’t matter..”

• Bond King Gets Antsy as Junk Bonds, Which Lead Stocks, Spiral to Heck (WS)

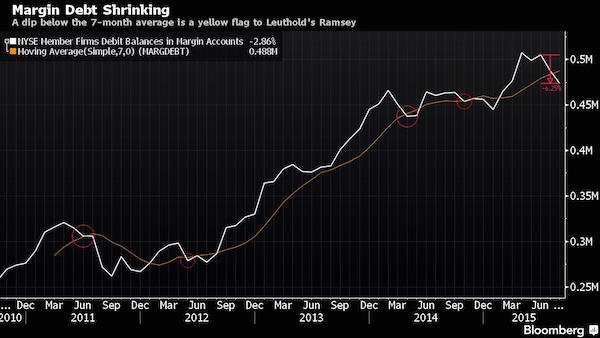

“We are looking at real carnage in the junk bond market,” Jeffrey Gundlach, the bond guru who runs DoubleLine Capital, announced in a webcast on Tuesday. He blamed the Fed. It was “unthinkable” to raise rates, with junk bonds and leveraged loans having such a hard time, he said – as they’re now dragging down his firm’s $80 billion in assets under management. “High-yield spreads have never been this high prior to a Fed rate hike,” he said – as the junk bond market is now in a precarious situation, after seven years of ZIRP and nearly as many years of QE, which made Grundlach a ton of money. When he talks, he wants the Fed to listen. He wants the Fed to move his multi-billion-dollar bets in the right direction. But it’s not a measly quarter-point rate hike that’s the problem. Bond yields move more than that in a single day without breaking a sweat.

The problem is the risk investors piled on over the past seven years, when they still believed in the Fed’s hype that risks didn’t matter, that they should be blindly taken in large quantities without compensation, and that rates would always remain at zero. Those risks that didn’t exist are now coming home to roost. They’re affecting the riskiest parts of the credit spectrum first: lower-rated junk bonds and leveraged loans. Grundlach presumably has plenty of them in his portfolios. Tuesday, the day Grundlach was begging the Fed for mercy, was particularly ugly. The average bid of S&P Capital IQ LCD’s list of 15 large and relatively liquid high-yield bond issues – the “flow-names,” as it calls them, that trade more frequently – dropped 181 basis points to about 87 cents on the dollar, for an average yield of 10%, the worst since July 23, 2009.

Sign of things to come?!

• Banks Buy Protection Against Falling Stock Markets (BBG)

For more than a year, dealers in the U.S. equity derivatives market have noted a widening gap in the price of certain options. If you want to buy a put to protect against losses in the Standard & Poor’s 500 Index, often you’ll pay twice as much as you would for a bullish call betting on gains. New research suggests the divergence is a consequence of financial institutions hoarding insurance against declines in stocks. The pricing anomaly is visible in a value known as skew that measures how much it costs to buy bearish options relative to those that appreciate when shares rise. In 2015, contracts betting on a 10% S&P 500 decline by February have traded at prices averaging 110% more than their bullish counterparts. That compares with a mean premium of 68% since the start of 2005, according to data compiled by Bloomberg.

While various explanations exist including simply nervousness following a six-year bull market, Deutsche Bank says in a Dec. 6 research report that the likeliest explanation may be that demand is being created for downside protection among banks that are subject to stress test evaluations by federal regulators. In short, financial institutions are either hoarding puts or leaving places for them in their models should markets turn turbulent. “Since so many banking institutions are facing these stress tests, the types of protection that help banks do well in these scenarios obtain extra value,” said Rocky Fishman, an equity derivatives strategist at Deutsche Bank. “The way the marketplace has compensated for that is by driving up S&P skew.”

They already are…

• Dividends Could Be the Next Victim of the Commodity Crunch (BBG)

As commodity prices tumble to the lowest since the global financial crisis, the dividends paid by the world’s largest oil producers and miners look increasingly hard to justify. Take the world’s largest 500 companies by sales. Of the 20 expected to pay the highest dividend yields over the next 12 months, 17 are natural resources companies, according to data compiled by Bloomberg. They include BHP Billiton Ltd., the world’s largest miner, with a yield – or dividend divided by share price – of more than 10% on its London shares. Plains All American Pipeline LP tops the list with a yield of 13.7%. Ecopetrol, Colombia’s largest oil producer, has a payout of 11.6%. That compares with an average among all 500 companies of 3.5%. “Investors are suggesting that dividend rates announced as recently as half-year results are generally not sustainable,” said Jeremy Sussman at Clarksons Platou Securities.

“The current environment is among the toughest we have seen across the resource space, putting increased pressure on management teams to deliver cost savings.” Miners Anglo American and Freeport-McMoran have suspended payments to preserve cash, following Glencore Plc earlier in the year. Eni SpA, Italy’s largest oil producer, and Houston-based pipeline owner Kinder Morgan have both reduced dividends. While other chief executive officers, especially at oil producers like Shell and Chevron have promised to keep paying, investors appear to be pricing in the likelihood of more cuts to come. “The fall in oil companies’ share prices and the increase in the dividend yield to historical levels is signaling that the market is fearing a cut,” Ahmed Ben Salem at Oddo & Cie in Paris, said by e-mail.

They should have seen it coming when oil collapsed.

• Copper, Aluminum And Steel Collapse To Crisis Levels (CNN)

It’s no secret that commodities in general have had a horrendous 2015. A nasty combination of overflowing supply and soft demand has wreaked havoc on the industry. But prices for everything from crude oil to industrial metals like aluminum, steel, copper, platinum, and palladium have collapsed even further in recent days. Crude oil crumbled below $37 a barrel on Tuesday for the first time since February 2009. The situation is so bad that this week the Bloomberg Commodity Index, which tracks a wide swath of raw materials, plummeted to its weakest level since June 1999. “Sentiment is horrendous. It’s the worst since the financial crisis – and it’s getting worse every day,” said Garrett Nelson, a BB&T analyst who covers the metals and mining industry.

There was fresh evidence of the sector’s financial stress from De Beers owner Anglo American. The mining giant said it was suspending its dividend and selling off 60% of its assets, which could lead to a reduction of 85,000 jobs. The commodities rout is knocking stock prices, with the Dow falling over 200 points so far this week. It’s also raising concerns about the state of the global economy. “Markets are in the midst of another global growth scare,” analysts at Bespoke Investment Group wrote in a recent report. Soft demand is clearly not helping commodity prices. China and other emerging markets like Brazil have slowed dramatically in recent quarters, lowering their appetite for things like steel, iron ore and crude oil.

More developed markets don’t look great either. Europe’s economy continues to underperform, Japan is barely avoiding recession and U.S. manufacturing activity contracted in November for the first time in three years. But the real driver of the recent commodity crash is on the supply side, compared to the collapse in demand during the Great Recession. Cheap borrowing costs and an inability to predict China’s slowdown led producers to expand too much in recent years. Now they’re flooding the market with too much supply. “There’s a lot of froth and excess production capacity that needs to go away permanently. It’s hard to imagine we’re not in a low-commodity price environment for a fairly long time,” said Nelson.

That means you should brace for more plant closure and announcements like the one announced by Anglo American. In the U.S., roughly 123,000 jobs have disappeared from the mining sector, which includes oil and energy workers, since the end of 2014, according to government statistics. It’s also likely some companies won’t survive the depressed pricing environment. Financial trouble for commodity companies have already lifted global corporate defaults to the highest level since 2009, according to Standard & Poor’s.

Debt addicts getting their fix wherever they can.

• US Companies Turn To European Debt Markets (FT)

US tyremaker Goodyear Dunlop sold a €250m eight-year euro-denominated bond on Wednesday – its first such deal in four years – as US companies raise record amounts in the eurozone. The sale was the latest example of a reverse Yankee — euro-denominated debt issued by US companies. US companies have been the biggest issuers of euro bonds by nationality this year. Last week Ball Corporation, an avionics and packaging company, issued euro and dollar bonds to fund its acquisition of Rexam, a UK drinks maker. “Given the recent [US] disruption, the European market looks more positive,” said Henrik Johnsson, head of the Emea debt syndicate at Deutsche Bank. Diverging monetary policy has reduced the cost of issuing debt in euros as the European Central Bank continues to ease while the Federal Reserve is expected to increase its main interest rate from near zero this month.

Previously companies would issue debt in euros and convert it back into dollars. But the strong dollar has increased the cost of doing this. Many reverse Yankee issuers have significant euro-denominated cash flows and so have a “natural hedge” against exchange rate movements. The sell-off in the debt of US commodity companies – particularly in the energy sector – had been damaging for dollar credit, said Mr Johnsson. “As a matter of investor psychology, you’re not seeing losses in significant portions of your portfolio every day in Europe. It’s the same with fund flows, Europe is consistently receiving inflows.” Market participants expect the trend to continue into next year as successful deals demonstrate the depth of Europe’s markets. US companies have also issued a record amount in dollars, however.

“In the third quarter, for example, GDP was worth €409 billion while the banks were saddled with more than €200 billion of non-paying loans.”

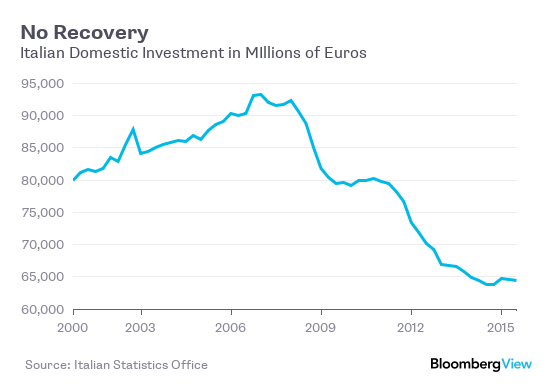

• Italy Needs a Cure for Its Bad-Debt Headache (BBG)

Italy’s economy dragged itself out of recession this year, posting annual growth in GDP of 0.8% in the third quarter. That, though, was only half the pace achieved by the euro zone as a whole. And unless the Italian government gets serious about tackling the bad debts that are crushing the nation’s banking system, its economy will continue to underperform its peers. Economists are only mildly optimistic about Italy’s prospects next year. The consensus forecast is that growth will peak at 1.3% this quarter, slowing for the first three quarters of next year before rallying back to that high by the end of the year. One of the biggest drags on the country’s growth is the sheer volume of non-performing loans, typically defined as debts that have been delinquent for 90 days or more.

Italy’s bad loans have soared to more than €200 billion, a fourfold increase since the end of 2008. Moreover, more and more borrowers have fallen behind even as the economic backdrop has improved. That’s in sharp contrast with Spain, where bad loans peaked at the start of 2014 and have since declined by almost a third. The figures for Italy are even more worrying when you compare them with the growth environment. The burden of bad debts is approaching half of what the economy delivers every three months. In the third quarter, for example, GDP was worth €409 billion while the banks were saddled with more than €200 billion of non-paying loans. If that trend continues, Italy will soon be in a worse position than Spain, even though its economy is 50% bigger.

Here’s the rub: If a euro zone country’s banks are weighed down with bad debts, the ECB’s attempt to boost growth and consumer prices by channeling billions of euros into the economy through its quantitative easing program are doomed to failure. And it’s pretty clear that domestic investment in Italy isn’t showing any evidence of recovery despite the ECB’s best efforts.

“The Swiss should have joined the Euro. What is the point of remaining separate when you surrender all your integrity and sovereignty anyway?”

• Swiss to Give Up EVERYTHING & EVERYBODY (Martin Armstrong)

As of January 1, 2016, Switzerland is handing over the names of everyone who has anything stored in its Swiss freeport customs warehouses. For decades, people have stored precious metals and art in Swiss custom ports — tax-free — as long as they did not take it into Switzerland. Now any hope on trusting Switzerland is totally gone. That’s right — the Swiss handed over everyone with accounts in its banks. Now, they must report the name, address, and item descriptions of anyone storing art in its tax-free custom ports. This also applies to gold, silver, and other precious metals along with anything else of value. Back in 1986, the FBI walked into my office to question me about where Ferdinand Marcos (1917–1989) stored the gold he allegedly stole from the Philippines.

Marcos had been the President of the Philippines from 1965 to 1986 and had actually ruled under martial law from 1972 until 1981. I told them that I had no idea. They never believed me, as always, and pointed out that Ferdinand Marcos was a gold trader before he became president and he made his money as a trader. They told me he was a client and that I had been on the VIP list for the grand opening of Herald Square in NYC, which he funded through a Geneva family. I explained that I never met him, and if he were a client, he must have used a different name. But the rumor was that the gold was stored in the Zurich freeport customs warehouse. His wife, Imelda, was famous for her extravagant displays of wealth that included prime New York City real estate, world-renowned art, outlandish jewelry, and more than a thousand pairs of shoes.

Reportedly, there is a diamond tiara containing a giant 150-carat ruby that is locked up in a vault at the Swiss central bank. Some have valued it at more than US$8 million. The missing gold that people have spent 30 years searching for will surface if there are mandatory reports on whatever is hidden in the dark corners of these warehouses. This action to expose whatever whomever has everywhere in Switzerland may cause many to just sell since they will be taxed by their governments for daring to have private assets. They will not be able to get it out once it sees the light of day for every government is watching.

The Swiss should have joined the Euro. What is the point of remaining separate when you surrender all your integrity and sovereignty anyway? This is what bureaucrats are for. They act on their own circumventing the people. Welcome to the New Age of hunting for loose change. Your sofa and car glove box are next. Oh yeah – what about gold or silver fillings in your mouth? Time to see the dentist?

Good to know one’s history.

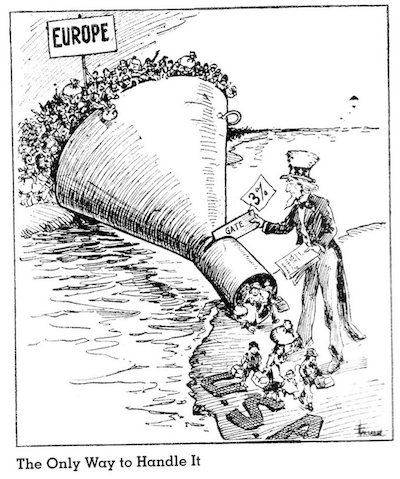

• Trump’s ‘Undesirable’ Muslims of Today Were Yesteryear’s Greeks (Pappas)

There are some things you might not know about Greek immigration to the United States. This history becomes particularly relevant when watching today’s news and political candidates like Donald Trump, supported by huge and vociferous crowds, call for the complete ban of people from entering the United States based on their race or religion. This is nothing new. In fact– today’s “undesirable” Muslims (in Donald Trump’s eyes), were yesteryear’s Greeks. It’s a forgotten history— something that only occasionally comes up by organizations like AHEPA or the occasional historian or sociologist. In fact, many Greek Americans are guilty of not only perpetuating— but also creating— myths of our ancestors coming to this country and being welcomed with open arms.

A look back at history will prove that this usually wasn’t the case for the early Greek immigrants to the United States. Greeks, their race and religion, were seen as “strange” and “dangerous” to America and after decades of open discrimination, Greeks were finally barred— by law— from entering the United States in large numbers. The Immigration Act of 1924 imposed harsh restrictions on Greeks and other non-western European immigrant groups. Under that law, only one hundred Greeks per year were allowed entry into the United States as new immigrants. Much like today, when politicians and activists like Donald Trump use language against a particular ethnic group— like his call to ban all Muslims from entering the United States, the same was the case a hundred years ago. Except then, Greeks were one of the main targets.

There was a strong, loud and active “nativist” movement that was led by people who believed they were the “true Americans” and the immigrants arriving— mainly Greeks, Italians, Chinese and others who were deemed “different” and even “dangerous” to American ideals, were unfit to come to America. As early as 1894 a group of men from Harvard University founded the Immigration Restriction League (IRL), proponents of a United States that should be populated with “British, German and Scandinavian stock” and not by “inferior races.” Their biggest targets were Greeks and Italians and the group had a powerful influence with the general public and leaders in the U.S. government in their efforts to keep “undesirables” out of America.

The well-known cartoon “The Fool Pied Piper” by Samuel Erhart appeared in 1909 portraying Uncle Sam as the Pied Piper playing a pipe labeled “Lax Immigration Laws” and leading a horde of rats labeled “Jail Bird, Murderer, Thief, Criminal, Crook, Kidnapper, Incendiary, Assassin, Convict, Bandit, Fire Brand, White Slaver, and Degenerate” toward America. Some rats carry signs that read “Black Hand,” referring to the Italian Mafia. In the background, rulers from France, Russia, Germany, Italy, Austria-Hungary, Turkey and Greece celebrate the departure of the fleeing rats.

“..Trump does have something very much in common with everybody else. He watches TV….”

• It’s Too Late to Turn Off Trump (Matt Taibbi)

[..] in Donald Trump’s world everything is about him, but Trump’s campaign isn’t about Trump anymore. With his increasingly preposterous run to the White House, the Donald is merely articulating something that runs through the entire culture. It’s hard to believe because Trump the person is so limited in his ability to articulate anything. Even in his books, where he’s allegedly trying to string multiple thoughts together, Trump wanders randomly from impulse to impulse, seemingly without rhyme or reason. He doesn’t think anything through. (He’s brilliantly cast this driving-blind trait as “not being politically correct.”) It’s not an accident that his attention span lasts exactly one news cycle. He’s exactly like the rest of America, except that he’s making news, not following it – starring on TV instead of watching it.

Just like we channel-surf, he focuses as long as he can on whatever mess he’s in, and then he moves on to the next bad idea or incorrect memory that pops into his head. Lots of people have remarked on the irony of this absurd caricature of a spoiled rich kid connecting so well with working-class America. But Trump does have something very much in common with everybody else. He watches TV. That’s his primary experience with reality, and just like most of his voters, he doesn’t realize that it’s a distorted picture. If you got all of your information from TV and movies, you’d have some pretty dumb ideas. You’d be convinced blowing stuff up works, because it always does in our movies. You’d have no empathy for the poor, because there are no poor people in American movies or TV shows – they’re rarely even shown on the news, because advertisers consider them a bummer.

Politically, you’d have no ability to grasp nuance or complexity, since there is none in our mainstream political discussion. All problems, even the most complicated, are boiled down to a few minutes of TV content at most. That’s how issues like the last financial collapse completely flew by Middle America. The truth, with all the intricacies of all those arcane new mortgage-based financial instruments, was much harder to grasp than a story about lazy minorities buying houses they couldn’t afford, which is what Middle America still believes. Trump isn’t just selling these easy answers. He’s also buying them.

Trump is a TV believer. He’s so subsumed in all the crap he’s watched – and you can tell by the cropped syntax in his books and his speech, Trump is a watcher, not a reader – it’s all mixed up in his head. He surely believes he saw that celebration of Muslims in Jersey City, when it was probably a clip of people in Palestine. When he says, “I have a great relationship with the blacks,” what he probably means is that he liked watching The Cosby Show. In this he’s just like millions and millions of Americans, who have all been raised on a mountain of unthreatening caricatures and clichés. TV is a world in which the customer is always right, especially about hard stuff like race and class. Trump’s ideas about Mexicans and Muslims are typical of someone who doesn’t know any, except in the shows he chooses to watch about them.

“Unless Russia can wake up Europe, war is inevitable.”

• War Is On The Horizon: Is It Too Late To Stop It? (Paul Craig Roberts)

[..] Washington is not opposed to terrorism. Washington has been purposely creating terrorism for many years. Terrorism is a weapon that Washington intends to use to destabilize Russia and China by exporting it to the Muslim populations in Russia and China. Washington is using Syria, as it used Ukraine, to demonstrate Russia’s impotence to Europe— and to China, as an impotent Russia is less attractive to China as an ally. For Russia, responsible response to provocation has become a liability, because it encourages more provocation. In other words, Washington and the gullibility of its European vassals have put humanity in a very dangerous situation, as the only choices left to Russia and China are to accept American vassalage or to prepare for war.

Putin must be respected for putting more value on human life than do Washington and its European vassals and avoiding military responses to provocations. However, Russia must do something to make the NATO countries aware that there are serious costs of their accommodation of Washington’s aggression against Russia. For example, the Russian government could decide that it makes no sense to sell energy to European countries that are in a de facto state of war against Russia. With winter upon us, the Russian government could announce that Russia does not sell energy to NATO member countries. Russia would lose the money, but that is cheaper than losing one’s sovereignty or a war. To end the conflict in Ukraine, or to escalate it to a level beyond Europe’s willingness to participate, Russia could accept the requests of the breakaway provinces to be reunited with Russia.

For Kiev to continue the conflict, Ukraine would have to attack Russia herself. The Russian government has relied on responsible, non-provocative responses. Russia has taken the diplomatic approach, relying on European governments coming to their senses, realizing that their national interests diverge from Washington’s, and ceasing to enable Washington’s hegemonic policy. Russia’s policy has failed. To repeat, Russia’s low key, responsible responses have been used by Washington to paint Russia as a paper tiger that no one needs to fear. We are left with the paradox that Russia’s determination to avoid war is leading directly to war. Whether or not the Russian media, Russian people, and the entirety of the Russian government understand this, it must be obvious to the Russian military.

All that Russian military leaders need to do is to look at the composition of the forces sent by NATO to “combat ISIS.” As George Abert notes, the American, French, and British aircraft that have been deployed are jet fighters whose purpose is air-to-air combat, not ground attack. The jet fighters are not deployed to attack ISIS on the ground, but to threaten the Russian fighter-bombers that are attacking ISIS ground targets. There is no doubt that Washington is driving the world toward Armageddon, and Europe is the enabler. Washington’s bought-and-paid-for-puppets in Germany, France, and UK are either stupid, unconcerned, or powerless to escape from Washington’s grip. Unless Russia can wake up Europe, war is inevitable.

Europe’s creating no man’s land.

• Greek Police Move 2,300 Migrants From FYROM Border To Athens (Kath.)

Police on Wednesday rounded up some 2,300 migrants from a makeshift camp near the border with the Former Yugoslav Republic of Macedonia and put them on buses to Athens, where they are to be put up in temporary reception facilities, including two former Olympic venues. The police operation, which Greek authorities heralded last week, was carried out relatively smoothly following weeks of tensions along the border. A group of 30 migrants who initially resisted efforts by police to remove them from the camp on Wednesday morning were briefly detained before being put on a bus to the capital. A total of 45 buses were used to transfer the migrants from a makeshift camp in Idomeni and the surrounding area to the capital, according to a police statement which said most the migrants are from Pakistan, Somalia, Morocco, Algeria and Bangladesh.

The migrants are to be put up in former Olympic venues in Elliniko and Galatsi and in a temporary reception facility for immigrants that opened in Elaionas over the summer. Police officers on Wednesday were stopping buses heading toward Idomeni with more migrants from the Aegean islands and conducting checks. All migrants that are not from Iraq, Afghanistan and Syria – the nationalities that FYROM border guards are allowing to pass – were being taken off the buses and sent to Athens, the official said. Complicating matters, FYROM police were said to have started building a second fence on the Balkan country’s frontier with Greece in a bid to keep out migrants trying to slip through.

The crackdown on the Greek-FYROM border is expected to lead to a buildup of migrants in Greece and encourage traffickers to resort to new routes to Europe. The United Nations refugee agency (UNHCR) indicated on Wednesday that an alternative route traffickers are likely to favor could be via Albania, Montenegro, Croatia and Bosnia.