John Vachon Auto of migrant fruit worker at gas station, Sturgeon Bay, Wisconsin Jul 1940

The Dow doesn’t often lose over 2% in a day. “..on pace for its first negative year since 2008.”

• Rate Rally Fizzles as Dow Loses 621 Points in 2 Days (WSJ)

In the two days after the Federal Reserve gave investors exactly what they expected, the Dow Jones Industrial Average posted its steepest loss since a late-August plunge. The back-to-back selloff erased 621 points from the blue chips—sending the Dow to its lowest level in two months and wiping out a three-session winning streak logged around the Fed’s liftoff for interest rates. The fizzled rally underscores the difficult backdrop across markets as investors prepare to close out what is shaping up to be worst year for U.S. stocks since the financial crisis. Investors are going into the holidays with grim news from the energy and mining sectors, uncertainty about the stability of markets for low-rated debt and worries about slowing economies overseas.

Meanwhile, public companies have struggled to post higher profits, and investors remain wary of buying stocks that look expensive compared with historical averages. “When you buy a share of stock you’re paying for a piece of future cash flows,” said David Lebovitz, global market strategist, at J.P. Morgan Asset Management, which has about $1.7 trillion under management. “If those cash flows aren’t materializing, it doesn’t make sense.” Investors had taken heart from stronger jobs data and the Fed’s signal that the U.S. economy is strong enough to begin returning rates to a more normal level. But optimism took a back seat at the end of the week. The Dow fell 367.29, or 2.1%, to 17128.55 on Friday, leaving it with a loss of 0.8% for the week. The index is down 3.9% so far in 2015, on pace for its first negative year since 2008.

The S&P 500 fell 1.8% to 2005.55. It ended the week down 2.6% for 2015, on track for first yearly decline since 2011 and its biggest fall since 2008. Both indexes had rallied broadly over the past six years, in part fueled by record-low interest rates. Weaker stocks and crude oil prices Friday added to demand for safe havens, sending investors into Treasurys. The yield on the benchmark 10-year Treasury note fell to 2.197% late Friday from 2.236% Thursday, as investors bid up the price. Yields on the note now aren’t much above where they started the year. “Shorting Treasury bonds which are a safe haven beneficiary when the economic and geopolitical risks are rising is foolhardy,’’ said Jonathan Lewis at Samson Capital Advisors.

They kept the S&P500 neatly just above 2000, for a reason.

• Explaining Today’s “Massive Stop Loss” Quad-Witching Market Waterfall (ZH)

One week ago, and again last night, we previewed today’s main event: an immensely important quad-witching expiration, the year’s last, one which as JPM’s head quant calculated will be the “largest option expiry in many years. There are $1.1 trillion of S&P 500 options expiring on Friday morning. $670Bn of these are puts, of which $215Bn are struck relatively close below the market level, between 1900 and 2050.” What is most important, is that the “pin risk”, or price toward which underlying prices may gravitate if HFTs are unleashed to trigger option stop hunts, is well below current S&P levels: as JPM notes, “clients are net long these puts and will likely hold onto them through the event and until expiry. At the time of the Fed announcement, these put options will essentially look like a massive stop loss order under the market.”

What does this mean? Considering that the bulk of the puts have been layered by the program traders themselves, including CTA trend-followers and various momentum strategist (which work in up markets as well as down), and since the vol surface of today’s market is well-known to everyone in advance, there is a very high probability the implied “stop loss” level will be triggered. Not helping matters will be the dramatic lack of market depth (thank you HFTs and regulators) and overall lack of liquidity, which means even small orders can snowball into dramatic market moves. “While equity volumes look robust, market depth has declined by more than 60% over the last 2 years. With market depth so low, the market does not have capacity to absorb large shocks. This was best illustrated during the August 24th crash.”

[..] the problem is that since over the past 7 years, the entire market has become one giant stop hunt, the very algos which “provide liquidity” will do everything they can to inflict the biggest pain possible to option holders – recall that for every put (or call) buyer, there is also a seller. As such, illiquid markets plus algo liquidity providers makes for an explosive cocktail at a time when the Fed is already worried whether the Fed may have engaged in “policy error.” So what does this mean in simple English? As Reuters again points out, levels to watch are the large imbalances in favor of puts in Dec SPX put contracts at 2050, 2000, 1950, 1900 strikes It further writes that “as SPX moves below these levels market makers who are short these puts would be forced to sell spot futures to hedge, which could exacerbate a market selloff.” In other words, selling which begets even more selling, which begets even more selling.

They might as well close then.

• Hedge Funds Cut Fees To Stem Client Exodus (FT)

Many hedge funds are cutting fees and negotiating with investors to trim some of their hefty costs and avert withdrawals after another mediocre year for returns. The industry has been shifting for several years away from its traditional model of charging 2% of assets and keeping 20% of profit. Some funds are already wooing customers with fees closer to 1% and 15%, people in the industry say. Now pressures are mounting on a wider range of fund managers, as a crowded sector copes with a middling year. The HFRI Fund Weighted Composite index is up 0.3% on the year and returned just under 3% in 2014, according to Hedge Fund Research. Management fees declined this year in every strategy except event driven, falling to a mean of 1.61% from 1.69%, according to JPMorgan’s Capital Introduction Group.

For performance fees, some strategies were impacted more than others, with the biggest declines in global macro, multi-strategy, commodity trading advisers and relative value. When Sir Chris Hohn founded The Children’s Investment Fund about a decade ago, he was an outlier. His $10bn fund charges management fees as low as 1%, depending on how long investors lock up their money. He recently referred to himself as “the antithesis of the classic hedge fund,” because he waived performance fees until the fund crossed a set return hurdle for the year. But others are following his lead in an effort to attract and retain clients amid tough competition.

There are now more than 10,000 hedge funds compared with 610 in 1990, HFR data show, and there are increasing benefits for the larger operators, including lower prime broker costs and better access to company management for research. The client base has also moved away from wealthy individuals, who were happy to take on significant risk in exchange for high returns. Now funds depend on institutional investors such as insurers and pension schemes, who cannot afford to miss minimum return targets and are themselves under pressure from boards that oversee investments. “Most [fund] managers prefer to haggle like rug-salesmen at a bazaar; institutional investors would rather shop at Ikea,” says Simon Ruddick, founder of consultant Albourne.

Nothing new, but nothing learned either.

• History of Junk Bond Meltdowns Points to Trouble (BBG)

The rout in junk bonds is intensifying and there’s blood in the water. After claiming some high-profile casualties – notably Third Avenue Management – the turmoil is raising fears of a larger meltdown in the markets, perhaps even a recession. In other words, is high-yield debt the canary in the credit mine? Academic work on the subject suggests that the difference in the rates for high-risk debt and rock-solid government securities – the so-called risk premium, or high-yield spread – often is a significant harbinger. A paper published in the Oxford Review of Economic Policy in 1999 concluded that the high-yield spread “outperforms other leading financial indicators,” such as the term spread and the federal funds rate. An International Monetary Fund staff paper published in 2003 offered a similar assessment, but added that “abnormally high levels of the high-yield spread have significant short-term predictive power.”

The trouble with these findings is that the pool of data is focused on very recent financial history, which makes it harder to draw broad conclusions. This limitation reflects the conventional wisdom that junk bonds are a recent invention cooked up by the likes of Michael Milken and company, and as a consequence, there are no comparable data sets before the late 1980s. But several economists at Rutgers – Peter Basile, John Landon-Lane and Hugh Rockoff – recently disputed that conclusion in an intriguing working paper that resurrected neglected data on high-yield securities from 1910 to 1955. These forerunners of today’s junk bonds initially merited Aaa or Baa ratings, but lost their appeal once they were downgraded to Ba or worse. Such speculative-grade bonds constituted, on average, approximately a quarter of the total book value of outstanding bonds before the end of World War II.

The authors of the study argue that although other kinds of spreads also have predictive power, “junk bonds may be a more sensitive indicator, perhaps a more sensitive leading indicator, of economic conditions than higher-grade bonds.” While their research opens all sorts of avenues for academic exploration – Was there a decline in lending standards in the late 1920s? Was there a liquidity trap in the late 1930s? – the most intriguing question it raises is about the predictive power of the spread between high-yield and high-quality debt. In theory, this power to predict turning points in the business cycle could manifest in two ways. The first would be a narrowing of the spread, which would mean that investors recognized the worst was over, a trough was imminent and a rebound was in offing. The second would be a spike in the spread, which means that investors anticipated that the economy had peaked and that a contraction was in the offing.

The authors found that a narrowing of the high-yield spread predicted a mere three of 10 troughs. But spikes were another matter: Exceptional bumps in the high-yield spread accurately predicted eight of 10 peaks (and the subsequent declines, most notably the downturn that began in August 1929 and turned into the Great Depression, as well as the recession that began in 1937 after the Fed prematurely hiked rates). It may be too early to read too much into these findings. But when combined with the research on the predictive capacity of the high-yield spread from the 1980s onward, this recent work suggests that the spread is a leading indicator worth watching.

And given the recent spike, something far worse than a junk bond meltdown may be brewing. How bad? In the three months before August 1929, the high-yield spread spiked by 47 basis points, and in the three months before May 1937, it shot up 85 basis points. In the past six weeks of 2015, it has spiked by about 120 basis points. That doesn’t mean we’re headed for disaster: There’s still an apples-and-oranges quality to comparisons of the two eras, despite the best efforts to create a commensurate set of data. But if the spread continues to widen, another downturn – or worse – could be ahead.

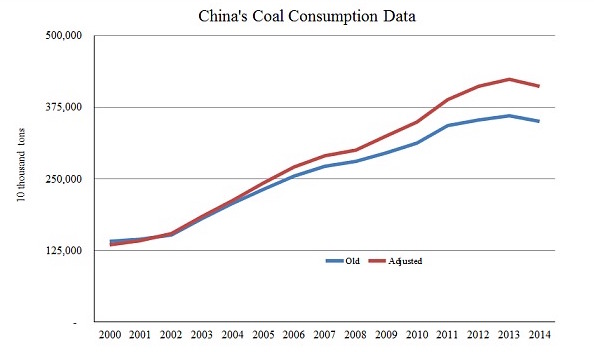

Ambrose is blind: “Crucially, the switch is happening because the country is moving up the technology ladder and switching to a new growth model. ” No, coal use is tumbling because the Chinese economy is.

• IEA Sees ‘Peak Coal’ As Demand For Fossil Fuel Crumbles In China (AEP)

China’s coal consumption has been falling for two years and may never recover as the moment of “peak coal” draws closer, the International Energy Agency (IEA) has said. The energy watchdog has slashed its 2020 forecast for global coal demand by 500m tonnes, warning that the industry risks unstoppable decline as renewable technologies and tougher climate laws shatter previous assumptions. In poignant symbolism, the peak coal report came as miners worked their final shift at Britain’s last surviving deep coal mine at Kellingley in North Yorkshire, closing the chapter on the British industrial revolution. Mines around the world are at increasing risk as prices slump to 12-year lows of $38 a tonne, and the super-cycle gives way to a pervasive glut. The IEA said the $40bn Galilee Basin project in Australia may never become operational.

There is simply not enough demand, even for cheap, open-cast coal. “The golden age of coal seems to be over,” said the IEA’s medium-term market report. “Given the dramatic fall in the cost of solar and wind generation and the stronger climate policies that are anticipated, the question is whether coal prices will ever recover.” “The coal industry is facing huge pressures, and the main reason is China,” said Fatih Birol, the agency’s director. The IEA reported that China’s coal demand fell by 2.9pc in 2014 and the slide has accelerated this year as the steel and cement bubble bursts. The country produced more cement between 2011 and 2013 than the US in the entire 20th century, according to one study. This will never happen again. Crucially, the switch is happening because the country is moving up the technology ladder and switching to a new growth model.

The link between electricity use and economic growth has completely broken down. The “energy intensity” of GDP fell by 4pc in 2014. Mr Birol said China’s coal consumption is likely to flatten out until 2020 before declining, but the definitive tipping point could happen much faster if president Xi Jinping carries out his economic reform drive with real vigour. Coal demand will drop by 9.8pc under the agency’s “peak coal scenario”. The shift is dramatic. China’s coal demand has tripled since 2000 to 3.920m tonnes – half of global consumption – and the big mining companies had assumed that it would continue. The market is now badly out of kilter. Rising demand from India under its electrification drive will not be enough to soak up excess supply or replace the lost demand from China.

“They’ve got this bill that’s kicked around for years and had been too controversial to pass, so they’ve seen an opportunity to push it through without debate. And they’re taking that opportunity.”

• Congress Slips Controversial CISA Law In With Sure-To-Pass Budget Bill (Wired)

Update 12/18/2015 12pm: The House and Senate have now passed the omnibus bill, including the new version of CISA.

Privacy advocates were aghast in October when the Senate passed the Cybersecurity Information Sharing Act by a vote of 74 to 21, leaving intact portions of the law they say make it more amenable to surveillance than actual security. Now, as CISA gets closer to the President’s desk, those privacy critics argue that Congress has quietly stripped out even more of its remaining privacy protections. In a late-night session of Congress, House Speaker Paul Ryan announced a new version of the “omnibus” bill, a massive piece of legislation that deals with much of the federal government’s funding. It now includes a version of CISA as well. Lumping CISA in with the omnibus bill further reduces any chance for debate over its surveillance-friendly provisions, or a White House veto.

And the latest version actually chips away even further at the remaining personal information protections that privacy advocates had fought for in the version of the bill that passed the Senate. “They took a bad bill, and they made it worse,” says Robyn Greene, policy counsel for the Open Technology Institute. CISA had alarmed the privacy community by giving companies the ability to share cybersecurity information with federal agencies, including the NSA, “notwithstanding any other provision of law.” That means CISA’s information-sharing channel, ostensibly created for responding quickly to hacks and breaches, could also provide a loophole in privacy laws that enabled intelligence and law enforcement surveillance without a warrant. The latest version of the bill appended to the omnibus legislation seems to exacerbate that problem.

It creates the ability for the president to set up “portals” for agencies like the FBI and the Office of the Director of National Intelligence, so that companies hand information directly to law enforcement and intelligence agencies instead of to the Department of Homeland Security. And it also changes when information shared for cybersecurity reasons can be used for law enforcement investigations. The earlier bill had only allowed that backchannel use of the data for law enforcement in cases of “imminent threats,” while the new bill requires just a “specific threat,” potentially allowing the search of the data for any specific terms regardless of timeliness. [..] Even in its earlier version, CISA had drawn the opposition of tech firms including Apple, Twitter, and Reddit, as well as the Business Software Alliance and the Computer and Communications Industry Association.

In April, a coalition of 55 civil liberties groups and security experts signed onto an open letter opposing it. In July, the Department of Homeland Security itself warned that the bill could overwhelm the agency with data of “dubious value” at the same time as it “sweep[s] away privacy protections.” That Senate CISA bill was already likely on its way to become law. The White House expressed its support for the bill in August, despite its threat to veto similar legislation in the past. But the inclusion of CISA in the omnibus package may make it even more likely to be signed into law in its current form. Any “nay” vote in the house—or President Obama’s veto—would also threaten the entire budget of the federal government. “They’re kind of pulling a Patriot Act,” says OTI’s Greene. “They’ve got this bill that’s kicked around for years and had been too controversial to pass, so they’ve seen an opportunity to push it through without debate. And they’re taking that opportunity.”

Reality vs hubris.

• US-Mexico Border: Arizona’s Open Door (FT)

Many people in the US today look towards the country’s border with Mexico and tremble. So great are the fears about illegal immigration and the possible infiltration of terrorists that Donald Trump has vaulted to the top of the Republican presidential field by vowing to build a wall between the two countries and make the Mexicans pay for it. So it may come as a surprise to learn about the economic ideas now emerging from Arizona, a solid red state — having voted Republican in 15 of the past 16 presidential elections – that sits cheek by jowl with the Mexican state of Sonora. Arizonan movers and shakers have started to think that bringing in more Mexicans is a good way to stimulate growth.

To make people from south of the border feel more welcome, county planning organisations, municipal officials and business leaders are lining up behind a proposal to transform their entire state into a “free-travel zone” for millions of better-off Mexicans with the money and wherewithal to qualify for a travel document that is widely used in the south-west, but little known elsewhere – a border-crossing card, or BCC. “Fear gets you nowhere. Chances get you somewhere,” says Dennis Smith, executive director of the Maricopa Association of Governments, planning body for the county that includes Phoenix, Arizona’s capital and biggest city. “What do we have to lose? Nothing.” BCC holders are currently allowed to go 75 miles into Arizona, which takes them as far as Tucson, the state’s second-largest city.

But Arizona officials are seeking a change in federal rules that would allow these people to roam across the state, hoping that if the visitors travel further, they will stay longer and spend more money at malls, restaurants and tourist attractions. The desired Mexicans are a far cry from the “murderers” and “rapists” of Mr Trump’s stump speeches. They can afford the $160 fee and offer the proof of employment and family ties back home that are required for a BCC, which is good for 10 years and enables Mexicans to remain in the US for up to 30 days at a time. To stay longer or travel further, they need more documentation. However, Arizona’s charm offensive illustrates the complexity of border politics as the 2016 presidential election approaches. In the US imagination, Mexico looms as both a menace and a market. People want to keep some kinds of Mexicans out — and encourage others to come in.

The impulses are often contradictory. For now, the emphasis in Arizona is shifting toward accommodation. Local planners speak excitedly of integrating the economies of Arizona and Sonora into an “Ari-Son” mega-region, in which cross-border trade will increase and more Mexicans will attend pop concerts or sports events in Phoenix, take family car trips to the Grand Canyon and ski in the state’s northern mountains. “This is vitally important to the state’s economic health,” says Glenn Hamer, chief executive of the Arizona Chamber of Commerce and a former executive director of Arizona’s Republican party. “On the business side, it is a great asset for the state to be close to a market that is growing and becoming more prosperous every single day.”

Yes, it is.

• Bundesbank’s Weidmann: Greek Debt Relief Is Not Urgent (Kath.)

Greece faces relatively low debt servicing needs in the coming years and further debt relief is not a matter of urgency, Greek financial daily Naftemporiki quoted ECB Governing Council member Jens Weidmann as saying on Thursday. “In 2014 interest payments as a percentage of GDP were lower in Greece than in Spain, Portugal and Italy,” Weidmann, head of Germany’s central bank, told the paper. “Taking into account the low refinancing needs for the next years, further debt relief does not seem to be an issue of particularly urgent interest.” Athens has been struggling to legislate reforms agreed with its eurozone partners in exchange for an €86 billion bailout, the third financial aid package to keep it afloat since its debt crisis exploded in 2010.

The government, however, wants some form of debt relief to allow for future growth. Weidmann said the most important task at hand was the full implementation of the agreed economic adjustment program of reforms. “This will not simply increase the ability to grow but also dissolve prevailing uncertainty which acts as a brake for investments,” he told the paper. Weidmann added it was up to the Greek government to decide when to lift capital controls it imposed in late June to stem a flight of deposits.

And this is what can happen when you don’t have the EU to bully you.

• Iceland Bank Collapse Nears End as Creditors Reach Last Accord (BBG)

A seven-year standoff between Iceland and the international creditors of its failed banks is nearing an end after a court approved the last remaining settlement. The agreement signed by the caretakers of LBI hf paves the way for creditor payments from the bank’s 455.6 billion kronur ($3.5 billion) estate. It follows similar deals involving Glitnir Bank hf and Kaupthing Bank hf. The three banks hold combined assets of $17.6 billion, according to their latest financial statements. The banks failed within weeks of each other in 2008 under the weight of $85 billion in debt. Iceland then resorted to capital controls to prevent a total collapse of its $15 billion economy. International creditors, among them the Davidson Kempner Capital Management, Quantum Partners and Taconic Capital Advisors hedge funds, have been unable to access the lenders’ assets.

Glitnir’s administrators said they planned to make the first payments to creditors on Friday. Theodor S. Sigurbergsson, a member of Kaupthing’s winding up committee, said in an interview this week that he expects “to start payments to creditors early next year.”

In June, the government offered creditors in Glitnir, Kaupthing and LBI the option of either paying a 39% exit tax on all their assets or making what it calls a stability contribution of as much as 500 billion kronur by the end of the year. To be eligible for the offer, creditors needed to complete settlements by Dec. 31. Parliament later extended that deadline to March 15. The island’s handling of the financial crisis has won praise from Nobel laureates and the IMF. The krona has strengthened about 8% this year and Iceland’s economy is now growing at a faster pace than the euro-zone average. With Glitnir having been granted an exemption from capital controls on Thursday, Iceland is expected to make a full return to the international financial community during the course of 2016.

It’s a miracle Russia stays so quiet.

• Ukraine Debt Default and EU Sanctions Extension Anger Russia (IT)

Ukraine and Russia are on a collision course over major trade and finance disputes, as the European Union prepares to extend sanctions against Moscow for annexing Crimea and fomenting a bloody conflict in eastern Ukraine. Kiev has refused to meet Sunday’s due date on a $3 billion loan that Moscow gave to authorities led by former Ukrainian president Viktor Yanukovich in December 2013, when they were rocked by huge street protests. Moscow has vowed to take Kiev to court over the disputed bond, which comes due just as Russia gets ready to scrap its free-trade zone with Ukraine in response to the planned January 1st launch of a landmark EU-Ukraine trade pact. “The government of Ukraine is imposing a moratorium on payment of the so-called Russian bond,” Ukrainian prime minister Arseniy Yatsenyuk said on Friday.

“I remind you that Ukraine has agreed to restructure its debt obligations with responsible creditors, who accepted the terms of the Ukrainian side. Russia has refused, despite our many efforts to sign a restructuring deal, to accept our offers.” Russian officials have threatened to launch legal action by the end of the year to reclaim the cash from Ukraine. “By announcing a moratorium on returning this sovereign debt, the Ukrainian side has, you could say, in fact admitted default,” said Kremlin press secretary Dmitry Peskov. Russia long argued that the unpaid debt should block future IMF funding for cash-strapped Ukraine, and Moscow was furious with the lender this week for changing its rules to allow aid to keep flowing to countries that are in arrears. The IMF agreed with Moscow, however, that the bond should be treated as sovereign debt, and told Kiev that it must negotiate with Russia “in good faith” to ensure continued access to a $17.5 billion aid package.

Ukraine relies on the IMF, United States and EU to prop up its ailing economy, and depends on the West to maintain diplomatic pressure on Russia. Diplomats say EU states have agreed to extend sanctions on Russia for another six months from Monday, due to its continuing failure to fulfil a deal aimed at ending an 18-month conflict in eastern Ukraine that has killed more than 9,000 people. “It was an expected decision, we heard nothing new, and it will have no effect on the economy of the Russian Federation, ” said Alexei Ulyukaev, Russia’s minister for economic development. Russia’s economy has been damaged by sanctions and above all by the plunge in the price of oil. The Kremlin has ordered the suspension of a free-trade agreement between Russia and Ukraine from January 1st, when a far-reaching trade deal is due to start between Ukraine and the EU.

Gas is more important than Ukraine.

• Merkel Defends Russian Gas Pipeline Plan (WSJ)

German Chancellor Angela Merkel found herself under pressure on Friday from other Europe Union leaders over her government’s support for a natural-gas pipeline from Russia that others fear could further undermine the economic and political stability of Ukraine. The planned expansion of PAO Gazprom’s Nord Stream pipeline, which ships Russian gas via the Baltic Sea to northern Germany, would add an extra 55 billion cubic meters of gas in capacity—about as much as the company currently transports through Ukraine. Officials in Brussels and Washington as well as Kiev have accused Moscow of using the project, dubbed Nord Stream 2, to deprive Ukraine of much of its remaining political leverage as well as much-needed revenues from transit fees. Ukrainian President Petro Poroshenko on Wednesday called Nord Stream 2 his country’s “greatest concern as of today.”

But Ms. Merkel defended the planned pipeline. “I made clear, along with others, that this is a commercial project; there are private investors,” Ms. Merkel said following talks with the other 27 EU leaders. During the discussion on Nord Stream, the chancellor’s position was attacked by Italian Prime Minister Matteo Renzi and Bulgaria’s Boyko Borisov, while she received some backing from Dutch Premier Mark Rutte. Gazprom holds a 50% stake in the Nord Stream 2 consortium. The other 50% are held in equal parts by Shell, Germany’s E.On and BASF, Austria’s OMV and France’s Engie. Despite the involvement of these private investors, several European Union and U.S. officials have questioned the commercial reasoning behind Nord Stream 2, arguing that existing transit routes from Russia, including the first Nord Stream pipeline and the Ukrainian lines aren’t used at full capacity.

In a recent interview, the U.S. special envoy for international energy affairs, Amos Hochstein, called Nord Stream 2 “an entirely politically motivated project” and warned European authorities against “rushing into” the project. Since relations with Moscow cooled over the conflict in eastern Ukraine, the EU has been working to reduce its dependence on Russian gas. Building Nord Stream 2, however, would concentrate 80% of the bloc’s gas imports from Russia onto a single route, according to the EU’s climate and energy commissioner, Miguel Arias Cañete. “In my perspective, Nord Stream does not help diversification nor would it reduce energy dependence,” said European Council President Donald Tusk, who presided over Friday’s discussions among the 28 EU leaders. He said, however, the EU must avoid politicizing this issue and check whether the pipeline would comply with EU rules, which block companies from controlling both a pipeline and its supply.

“..the mantra of 28 states having the same ultimate objective … is officially dead.”

• The Unraveling Of The European Union Has Begun (MarketWatch)

Whatever spin comes out of the Brussels summit this week, the European Union finds itself in the midst of an existential crisis after the bloc’s most challenging year since the launch of economic and monetary union in 1999. National leaders will continue to do what they do best — muddle through in a fog of obfuscation as they fail again to address the fundamental problems that have led to a string of financial, political and foreign policy crises from the Ukraine incursion through the Greek bailout to a flood of refugees. Even as British Prime Minister David Cameron tries to renegotiate his country’s terms of membership to avoid an exit from the EU, recent elections in Poland, France and Portugal reflect a shift in public opinion to question whether European integration on the current model is such a good idea after all.

Spain faces an election Sunday in which the conservative Popular Party, which has toed the Brussels line on austerity, is sure to lose its majority as voters are poised to create a new political landscape with four major parties and big questions about the future of the country. And Cameron himself is wrestling with a growing momentum in Britain favoring an exit from a Brussels regime that seems increasingly onerous or irrelevant. It is, of course, Cameron’s Conservative Party that historically has championed EU membership, and the EU itself is generally touted as a boon for business and the economy. So it is perhaps telling that recent commentary from a London-based think tank that generally mirrors the relatively conservative views of its central-banking and asset-management constituency is taking an increasingly critical view of Europe.

“There is a sense that the Union is drifting towards some form of calamity — the end of free movement of people, or the exit of Greece from the euro, or the departure of Britain from the Union itself,” John Nugée, a former Bank of England official who is a director of the Official Monetary and Financial Institutions Forum in London, wrote this week after meeting with officials in Asia, who have a pessimistic view of Europe’s situation. “The view from Asia is that the Union is struggling because it falls between two extremes of strength and weakness: It has neither a strong democratic regime nor a strong autocratic one,” Nugée writes in an OMFIF commentary. The EU is instead a “weak democracy” in this view. “The authorities have sufficient strength to try to rule without popular consent,” Nugée observes.

“But they are too weak to ignore the negative populist response such action inevitably incites and which, in turn, exacerbates their initial weakness.” The bottom line, according to this analyst, is that Europe’s leaders are simply overwhelmed. “The complexity of each individual issue seems to make the combined difficulties beyond the capacity of the political system to solve,” Nugée writes. In another OMFIF commentary this week, Antonio Armellini, a former Italian diplomat who represented his country in a number of foreign capitals and international organizations, argued that the British request for special terms “obliges everyone to recognize that the mantra of 28 states having the same ultimate objective … is officially dead.”

“They [EU] have already made these decisions. They are not known for being democratic – [Jean-Claude] Juncker and [Donald] Tusk. There is no democracy in the EU. They pay lip service to democracy, they have decided, what is going to happen. ”

• ‘Cameron’s Battle Against EU Is Like Grappling With A Jellyfish’ (RT)

It’s unlikely that ‘lame duck PM’ David Cameron, would get any concessions over the UK’s EU membership, but he is still banging his head against that brick wall, says investigative journalist Tony Gosling. EU leaders have gathered in Brussels for a summit to partly determine Britain’s future within the union. Prime Minister David Cameron on Thursday pushed for changes to the terms of the country’s EU membership saying that “there is a pathway to a deal in February.” He also emphasized the importance of UK’s demand to constrain access to in-work benefits for EU migrants in Britain. RT: Would the EU be better to lose Britain altogether than sacrifice the main principles. Who’s going to win in this regard?

Tony Gosling: … You can almost pick a tramp from the streets of London – there are plenty more since Cameron came to power – and they probably would make a better job of this than David Cameron, because he first promised this referendum back in 2009, and still we’re waiting. Also we’ve got the situation back in May, when we had a general election that [François] Hollande and [Angela] Merkel made absolutely clear to Cameron – there would be no concessions, but he is still banging his head against that brick wall. No, I don’t think he is going to get these concessions. The battle is almost like he is grappling with a jellyfish, with the EU. They [EU] have already made these decisions. They are not known for being democratic – [Jean-Claude] Juncker and [Donald] Tusk. There is no democracy in the EU. They pay lip service to democracy, they have decided, what is going to happen.

Cameron’s real problem here is that he is looking for this four-year ban on benefits going to migrants coming into Britain. The problem being that four years is just not enough. Those benefits are keep going up to about 40 percent of everybody that comes into Britain’s pay packets. We’ve got a massive problem here with the working poor on benefits. He’s effectively saying that if migrants come to Britain, that they are going to be below the poverty line immediately… And of course, we can’t have that. Anybody in Britain that needs benefits is going to have to get them. We’ve already seen signs of this with things like tent cities springing up across the country…

RT: Are EU leaders growing tired of negotiating with the UK? TG: It almost seems we are the basket case of Europe, doesn’t it? And partly that is because we’ve stayed out of the euro and they wanted us in the euro. But we are in a similar position to many of the countries economically. We’ve got a massive property bubble. We’ve just heard here in Britain – it is so difficult to just to find somewhere to live. The house prices in Britain are now up to 300,000 pounds – that is $450,000 average to buy a house here in Britain. And that is what a classic bubble – massively over inflated house prices; no real market anymore.

Just like Ron Paul does. And me.

• ‘Cancer of Europe’ – Russian Duma Speaker Calls For NATO Dissolution (RT)

State Duma Speaker Sergey Naryshkin has said that Russia is very concerned by continuing NATO expansion, adding that global security would benefit significantly from the dissolution of the military bloc. “My attitude to this organization is special – I see it as a cancerous tumor on the whole European continent. It would only be for the better if this organization is dissolved,” Naryshkin said during a meeting with Serbian lawmakers on Thursday. This dissolution could be conducted in several stages, the Duma speaker suggested. “First of all, the USA should be excluded from the bloc and after this it would be possible to painlessly disband the whole organization,” he said. “This would be a good step towards greater security and stability on the whole European continent.”

Naryshkin also told Serbian lawmakers that Russia was aware of the fact that large numbers of Montenegrin citizens, possibly even the majority of the country’s population, were resisting their nation’s potential entry into NATO. He noted that in late November the Russian State Duma called for the Montenegrin parliament to abandon plans to enter the military bloc, and expressed hope that Serbian politicians would offer some help in persuading Montenegro – which historically has been always close to Serbia – not to make this dangerous step. In early December NATO foreign ministers agreed to invite Montenegro to join the military alliance. In September, Montenegro’s parliament voted for a resolution to support the country’s accession to the military organization. The opposition called for a national referendum on the issue, but failed to push their initiative through the national legislature.

Moscow has promised that a response would follow if Montenegro joined NATO, but added that the details of any such steps are still under consideration. The head of the Russian Upper House Committee for Defense and Security, Viktor Ozerov, said that the step would force Russia to cut a number of joint projects with Montenegro, including military programs. In mid-December Russian Foreign Ministry spokesperson Maria Zakharova said the row over possible NATO membership had revealed deep divisions in Montenegrin society. “We think that the Montenegrin people should have their say in a referendum on this issue. This would be a manifestation of democracy that we call for,” Zakharova said.

Election tomorrow.

• 135 Jobs In 2.5 Years: The Plight Of Spain’s New Working Poor (Guardian)

He has taken on stints as a stable hand, been a door-to-door salesman and set up stages for local concerts: rarely does David Pena turn down a job. “In the past two a half years, I’ve probably had about 135 contracts,” said Pena. Most of them last between one and three days. “It’s a bit tiresome not to ever have anything stable.” Tiresome is perhaps an understatement. The 33-year-old’s disjointed CV stands out as an extreme example of a growing section of Spanish society made up of those ousted from the workforce during the economic crisis and now struggling to land anything but precarious short-term contracts. On Sunday Spaniards will cast their ballots in one of the tightest races in the country’s recent history.

The result promises to offer a glimpse of the national mindset as Spain emerges from a prolonged economic downturn that sent unemployment soaring, triggered painful austerity measures and saw thousands of families evicted. The wide brush of corruption has sent Spaniards’ trust in politicians and institutions plunging in recent years, and given rise to a crop of national newcomers promising a better future. For many, however, the key issue in this campaign is jobs. Unemployment in Spain stands at 21.6% – the highest in the EU after Greece. Mariano Rajoy, the country’s current prime minister, has based his re-election campaign on the economy and its fragile recovery, pointing to more than 1m jobs created in the past two years and one of the fastest growth rates in the eurozone.

Polls suggest that his conservative People’s party (PP) will remain the largest party after Sunday’s election, even it looks likely to lose its majority. Rajoy’s critics point to the dire situation still facing many Spaniards, who, like Pena, have been forced to string together a salary from a series of low-paying contracts that offer scant benefits. Temporary workers now make up more than a quarter of the workforce in Spain. Far from just seasonal work, temporary contracts have become more common among hospital workers, teachers and other public servants. Statistics suggest that short-term work is the definitive feature of the new jobs being created, making up about 90% of the contracts signed this year so far in Spain, with about one in four lasting seven days or less.

But arms sales are booming.

• One Of Every 122 Humans Today Has Been Forced To Flee Their Home (WaPo)

The number of people who have been forced to flee their homes has reached a staggering level, with 2015 on track to break previous records, according to a United Nations report released Friday. People who have been forcibly displaced — including those who fled domestically as well as international refugees and asylum-seekers — has likely “far surpassed 60 million” for the first time, reads the U.N. High Commissioner for Refugees report. Last year, 59.5 million had been displaced. “In a global context, that means that one person in every 122 has been forced to flee their home,” the agency said in a statement. Forced displacement “is now profoundly affecting our times,” High Commissioner for Refugees António Guterres said in a statement.

“It touches the lives of millions of our fellow human beings – both those forced to flee and those who provide them with shelter and protection. Never has there been a greater need for tolerance, compassion and solidarity with people who have lost everything.” War in Syria has become the “single biggest generator worldwide of both new refugees and continuing mass internal and external displacement,” the agency said. More than 4 million Syrians are now refugees – compared t0 less than 20,000 in 2010. Following Syria, most refugees come from Afghanistan, Somalia and South Sudan. The report, which covers the first six months of 2015, found that by June, the world had 20.2 million refugees – nearly 1 million more than a year before.

An average of 4,600 people flee their homes daily, and nearly 1 million refugees and migrants have crossed the Mediterranean to get to Europe so far this year. Turkey, Pakistan and Lebanon host the most refugees. Such a massive flow of people from country to country has also put a strain on host nations, and left unmanaged, this “can increase resentment and abet politicization of refugees,” the report notes.