DPC Up Sutter Street from Grant Avenue, San Francisco 1906

Travel day today, so an early Debt Rattle

Abe won’t mind.

• Asia Currencies Head Down The Jackson Hole (CNBC)

The newly resurgent dollar pressured Asian currencies as markets revived bets that the U.S. Federal Reserve could possibly raise interest rates as soon as next month. The advances in regional currencies were substantial. The dollar was fetching 102.03 yen at 9:51 a.m. HK/SIN, after flirting with levels around 100 yen just before the Fed’s conclave in Jackson Hole, Wyoming. The Australian dollar also felt the sting, fetching $0.7534 Monday morning, down from nearly $0.77 on Friday. The Singapore dollar was also lower, with the greenback fetching S$1.3614 Monday morning, up from as little as S$1.3469 on Friday.

The Malaysian ringgit also fell, with the dollar fetching 4.0425 ringgit on Monday morning, compared with as little as 4.0100 ringgit on Friday. The dollar index, which measures the greenback’s performance against a basket of currencies, jumped to 95.525 on Monday morning, from as low as 94.246 on Friday. Analysts pointed to Fed Chair Janet Yellen’s speech at the conclave on Friday as the reason for the newly resurgent dollar. While markets still saw December as the most likely timing for a Fed rate hike, Yellen opened the door to a September hike when she said the case for a rate hike strengthened in recent months.

Not making Merkel happy.

• German Economy Minister Says EU-US TTiP Talks Have Failed (AP)

Free trade talks between the European Union and the United States have failed, Germany’s economy minister said Sunday, citing a lack of progress on any of the major sections of the long-running negotiations. Both Washington and Brussels have pushed for a deal by the end of the year, despite strong misgivings among some EU member states over the Trans-Atlantic Trade and Investment Partnership, or TTIP. Sigmar Gabriel, who is also Germany’s vice chancellor, compared the TTIP negotiations unfavorably with a free trade deal forged between the 28-nation EU and Canada, which he said was fairer for both sides. “In my opinion, the negotiations with the United States have de facto failed, even though nobody is really admitting it,” Gabriel said during a question-and-answer session with citizens in Berlin.

He noted that in 14 rounds of talks, the two sides haven’t agreed on a single common item out of 27 chapters being discussed. Gabriel accused Washington of being “angry” about the deal that the EU struck with Canada, known as CETA, because it contains elements the U.S. doesn’t want to see in the TTIP. “We mustn’t submit to the American proposals,” said Gabriel, who is also the head of Germany’s center-left Social Democratic Party. In Washington, there was no immediate comment from the office of the U.S. trade representative. Christian Wigand, a spokesman for the European Commission, the EU’s executive arm and which is leading the TTIP negotiations, said Sunday that the institution had no comment or reaction at this time.

Gabriel’s ministry isn’t directly involved in the negotiations with Washington because trade agreements are negotiated at the EU level. But such a damning verdict from a leading official in Europe’s biggest economy is likely to make further talks between the EU executive and the Obama administration harder. Gabriel’s comments contrast with those of Chancellor Angela Merkel, who said last month that TTIP was “absolutely in Europe’s interest.” Popular opposition to a free trade agreement with the United States is strong in Germany. Campaigners have called for nationwide protests against the talks on Sept. 17 — about year before Germany’s next general election.

Same guy.

• UK Must Pay For Brexit Or EU Is In ‘Deep Trouble’, Says German Minister (G.)

German economy minister Sigmar Gabriel has said that Britain must not be allowed to “keep the nice things” that come with EU membership without taking responsibility for the fallout from Brexit. As Theresa May called a cabinet meeting to discuss the UK government’s Brexit strategy on Wednesday, Gabriel warned if the issue was badly handled and other member countries followed Britain’s lead, Europe would go “down the drain”. “Brexit is bad but it won’t hurt us as much economically as some fear – it’s more of a psychological problem and it’s a huge problem politically,” he told a news conference. The world now regarded Europe as an unstable continent, said Gabriel, who is the deputy to chancellor Angela Merkel in Germany’s governing coalition. “If we organise Brexit in the wrong way, then we’ll be in deep trouble, so now we need to make sure that we don’t allow Britain to keep the nice things, so to speak, related to Europe while taking no responsibility,” Gabriel said.

Still same guy.

• German Vice Chancellor Says Can’t See Turkey In EU Anytime Soon (R.)

German Vice Chancellor Sigmar Gabriel said on Sunday he did not see Turkey joining the EU during his political career, adding that the bloc would not be in a position to take Turkey in even if Ankara met all the entry requirements tomorrow. Turkey started talks about joining the European Union in 2005 but has made little progress despite an initial burst of reforms. Many EU countries are wary about the possibility of the large, mainly Muslim country becoming a member of the bloc and Europe has long worried that Turkey’s anti-terrorism laws are used to quash dissent. A crackdown since a failed July 15 coup in Turkey has fueled tension between Ankara and Brussels.

“Even if you’re very optimistic about my political career, I certainly won’t see Turkey becoming a member of this EU,” Gabriel, 56, told a news conference on Sunday. “With the state we’re in, we’re not even in a position to take in a city state,” said Gabriel, leader of the Social Democrats (SPD) – the junior coalition partner in Chancellor Angela Merkel’s government. He said one logistical problem was Turkey’s large population, which stands at about 79 million according to the World Bank. “How would that work in a European Union that is currently losing one of its most important member states, that has been rattled, that doesn’t know how it should reorganise itself?,” he added, referring to Britain’s recent vote to leave the bloc.

He said Turkey might instead, in the distant future, become a partner “in an outer ring” of a changed EU. Earlier this month, Turkish Foreign Minister Mevlut Cavusoglu said his government could stop helping to stem the flow of refugees and migrants to Europe if Brussels failed to relax travel rules for Turks from October. Visa-free access to the EU — the main reward for Ankara’s collaboration in choking off the influx of migrants — has been subject to delays due to a dispute over the anti-terrorism legislation, as well as the post-coup crackdown. Gabriel said in an interview on Saturday that Merkel’s conservatives had “underestimated” the challenge of integrating record migrant arrivals.

Problem of course is there are no markets, there are only central banks. So no price discovery.

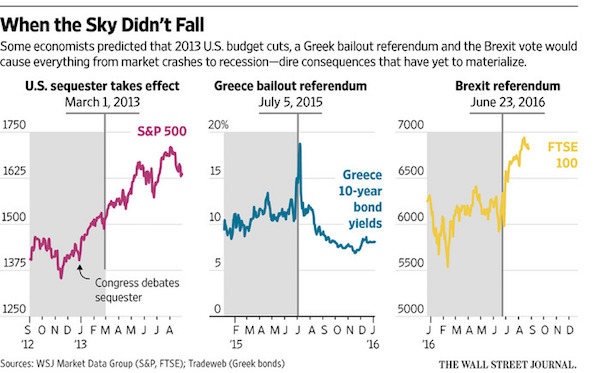

• Brexit, Grexit: When The Sky Didn’t Fall (WSJ)

Some economists warned the U.S. congressional budget battles in 2013, which led to sharp spending cuts known as sequestration, could throw the economy back into recession. The economy grew 2.7% that year. Then, in 2010 and 2012, some economists warned the Federal Reserve’s massive bond-buying program would cause hyperinflation, soaring commodity prices and a collapse of the dollar. Nothing of the sort occurred. Warnings abounded in 2015 that if Greece rejected an international bailout, it could spark a sovereign default or a banking crisis or Greece being cast off the euro. Greece’s economy is far from a success story, but it hasn’t gone bankrupt. Its banking system has been battered and drained of deposits, but hasn’t collapsed. It remains in the euro.

So what about Brexit? It’s now been two months since British voters on June 23 cast their ballots to exit from the European Union, and it’s becoming unclear if the recession so many feared will materialize—at least in the near term. It’s worth revisiting the level of concern prior to the vote. George Osborne, the Chancellor of the Exchequer, said a vote for Brexit would cause a “DIY recession.” In the immediate aftermath of the vote, many market economists forecast recession would begin almost immediately. In the days after the vote, global stock markets indeed fell sharply. Perhaps if it had been just a little bit worse, a broader panic would have sent things into a spiral. Instead, markets have rebounded. The FTSE 100 climbed to near-record levels by the middle of August. Nor has the wider economy shown many signs of a coming downturn.

What good’s a clue if you’re clueless?

• TTIP’s ‘Failure’ Signals Clues About UK’s Post-Brexit Trading (Ind.)

The apparent failure of the EU-US trade talks signalled by German Vice-Chancellor Sigmar Gabriel should come as little surprise – for good and bad reasons – and contains some interesting clues about the UK’s post-Brexit trading future. One “good” reason for the negotiators being unable to agree so far on a single chapter of the 27 in the draft Transatlantic Trade and Investment Partnership is that the Europeans are deeply suspicious about how much power will be given to large multinational companies in the process. The secret “court” for settling disputes is absurdly opaque and unaccountable, for example. That would be bad enough across most areas of the economy, but when it impinges on the way the NHS operates for the public good, it is plainly unacceptable.

Anti-business sentiment is often facile and hypocritical, or worse, but TTIP just offers up too many egregious potential abuses to be comfortable with. It could be made more politically palatable, at any rate, and we should always remember that free trade is good for the long-term prosperity of all. Globalisation, unfashionable as it is, has done more good than harm, not least lifting 500 million Chinese out of poverty. TTIP could be made to work, in other words. The “bad” reason for the difficulties TTIP finds itself in is because the EU’s disparate membership can’t agree on what they want, as so often. This, then, supports the Leave camp who argue that the very size and complexity of the EU makes important trade deals such as this impossible to secure. They point to similar failures on EU trade with China and India.

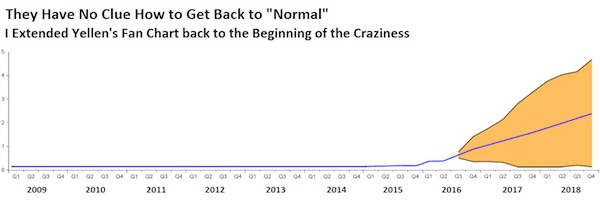

As I’ve said so often: They have no clue.

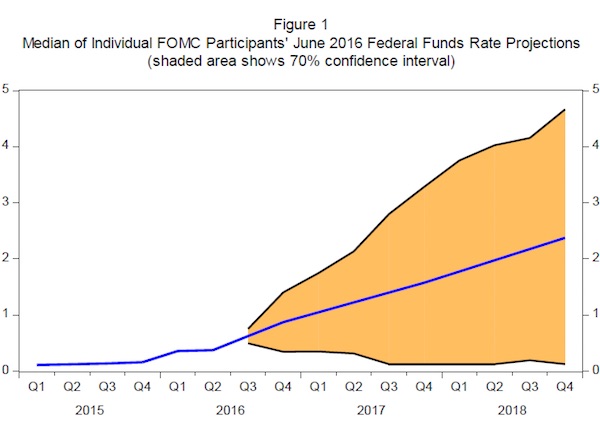

• The 11 Bone-Chilling Things I Gleaned from Yellen’s Chart (WS)

At the Symposium in Jackson Hole, so feverishly anticipated by the entire world, Fed Chair Janet Yellen gave an even more feverishly anticipated speech on Friday, in which she said the same stuff she’d been saying all along, such as these nuggets: “And, as ever, the economic outlook is uncertain, and so monetary policy is not on a preset course.” “Our ability to predict how the federal funds rate will evolve over time is quite limited because monetary policy will need to respond to whatever disturbances may buffet the economy.” To document this, she supplied the fan chart below, adding this explanation: “The line in the center is the median path for the federal funds rate based on the FOMC’s Summary of Economic Projections in June.” “The shaded region, which is based on the historical accuracy of private and government forecasters, shows a 70% probability that the federal funds rate will be between 0 and 3.25% at the end of next year and between 0 and 4.5% at the end of 2018.”

1. They have no clue about what might happen next. Their forecasts and “forward guidance” are either figments of their imagination or just efforts to manipulate the markets.

2. They have no clue how to get out of what initially was an emergency treatment of a Fed-sponsored financial system in full and self-inflicted collapse, but is now the “new normal” treatment for an economy buckling under its Fed-encouraged debt.

[..] 11. They’re trying to make us forget how long this insanity has been going on. Yellen’s chart begins in Q1 2015. But the Fed’s historic craziness began in 2008. So that we can remember for just how long the Fed has inflicted its policies on the economy, I have added to Yellen’s chart the prior six years, for a total of eight years. It shows that they have no clue about how to get back to normal, and that they have instead changed the definition of normal:

Tyler.

• “If This Does Not Disqualify Hillary For The Presidency, What Will?” (ZH)

This is the week that the steady drip, drip, drip of details about Hillary Clinton’s server turned into a waterfall. This is the week that we finally learned why Mrs. Clinton used a private communications setup, and what it hid. This is the week, in short, that we found out that the infamous server was designed to hide that Mrs. Clinton for three years served as the U.S. Secretary of the Clinton Foundation.

In March this column argued that while Mrs. Clinton’s mishandling of classified information was important, it missed the bigger point. The Democratic nominee obviously didn’t set up her server with the express purpose of exposing national secrets—that was incidental. She set up the server to keep secret the details of the Clintons’ private life—a life built around an elaborate and sweeping money-raising and self-promoting entity known as the Clinton Foundation.

Had Secretary Clinton kept the foundation at arm’s length while in office—as obvious ethical standards would have dictated—there would never have been any need for a private server, or even private email. The vast majority of her electronic communications would have related to her job at the State Department, with maybe that occasional yoga schedule. And those Freedom of Information Act officers would have had little difficulty—when later going through a state.gov email—screening out the clearly “personal” before making her records public. This is how it works for everybody else.

Mrs. Clinton’s problem—as we now know from this week’s release of emails from Huma Abedin’s private Clinton-server account—was that there was no divide between public and private. Mrs. Clinton’s State Department and her family foundation were one seamless entity—employing the same people, comparing schedules, mixing foundation donors with State supplicants. This is why she maintained a secret server, and why she deleted 15,000 emails that should have been turned over to the government.

Most of the focus on this week’s Abedin emails has centered on the disturbing examples of Clinton Foundation executive Doug Band negotiating State favors for foundation donors. But equally instructive in the 725 pages released by Judicial Watch is the frequency and banality of most of the email interaction. Mr. Band asks if Hillary’s doing this conference, or having that meeting, and when she’s going to Brazil. Ms. Abedin responds that she’s working on it, or will get this or that answer. These aren’t the emails of mere casual acquaintances; they don’t even bother with salutations or signoffs. These are the emails of two people engaged in the same purpose—serving the State-Clinton Foundation nexus.

The other undernoted but important revelation is that the media has been looking in the wrong place. The focus is on Mrs. Clinton’s missing emails, and no doubt those 15,000 FBI-recovered texts contain nuggets. Then again, Mrs. Clinton was a busy woman, and most of the details of her daily State/foundation life would have been handled by trusted aides. This is why they, too, had private email. Top marks to Judicial Watch for pursuing Ms. Abedin’s file from the start. A new urgency needs to go into seeing similar emails of former Clinton Chief of Staff Cheryl Mills.

Mostly, we learned this week that Mrs. Clinton’s foundation issue goes far beyond the “appearance” of a conflict of interest. This is straight-up pay to play. When Mr. Band sends an email demanding a Hillary meeting with the crown prince of Bahrain and notes that he’s a “good friend of ours,” what Mr. Band means is that the crown prince had contributed millions to a Clinton Global Initiative scholarship program, and therefore has bought face time. It doesn’t get more clear-cut, folks. That’s highlighted by the Associated Press’s extraordinary finding this week that of the 154 outside people Mrs. Clinton met with in the first years of her tenure, more than half were Clinton Foundation donors. Clinton apologists, like Vox’s Matthew Yglesias, are claiming that statistic is overblown, because the 154 doesn’t include thousands of meetings held with foreign diplomats and U.S. officials.

Nice try. As the nation’s top diplomat, Mrs. Clinton was obliged to meet with diplomats and officials—not with others. Only a blessed few outsiders scored meetings with the harried secretary of state and, surprise, most of the blessed were Clinton Foundation donors. Mrs. Clinton’s only whisper of grace is that it remains (as it always does in potential cases of corruption) hard to connect the dots. There are “quids” (foundation donations) and “quos” (Bahrain arms deals) all over the place, but no precise evidence of “pros.” Count on the Clinton menagerie to dwell in that sliver of a refuge.

But does it even matter? What we discovered this week is that one of the nation’s top officials created a private server that housed proof that she continued a secret, ongoing entwinement with her family foundation – despite ethics agreements – and that she destroyed public records. If that alone doesn’t disqualify her for the presidency, it’s hard to know what would.

Lest we forget.

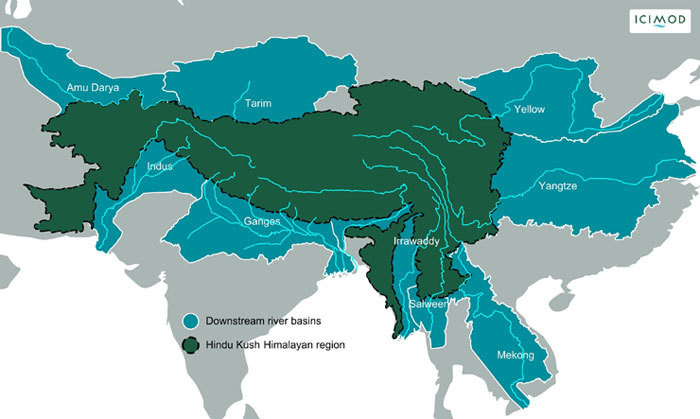

• There Is A Third Pole On Earth, And It’s Melting Quickly (WEF)

When we think of the world’s polar regions, only two usually spring to mind – the North and South. However, there is a region to the south of China and the north of India that is known as the “Third Pole”. That’s because it is the third largest area of frozen water on the planet. Although much smaller than its north and south counterparts, it is still enormous, covering 100,000 square kilometres with some 46,000 glaciers. Scientists conducting research in the area have warned of disturbing global warming trends, and how, if they continue, they could affect the lives of 1.3 billion people. What happens to ice in the polar regions is taken as clear evidence of climate change. When the ice melts, we know that the planet is warming up.

The Earth’s north and south extremities are crucial for regulating the climate, and at the same time are particularly sensitive to global warming. The Third Pole, because it is high above sea level, is also sensitive to changes in temperatures. It also powers life for many thousands of miles. It is estimated that the water that flows from the Third Pole supports 120 million people directly through irrigation systems, and a total of 1.3 billion indirectly through river basins in China, India, Nepal, Pakistan, Bangladesh and Afghanistan. That’s nearly one fifth of the world’s population.

It is remote – the region encompasses the Himalaya-Hindu Kush mountain ranges and the Tibetan Plateau – but 10 of Asia’s largest rivers begin here, including the Yellow river and Yangtze river in China, the Irrawaddy river in Myanmar, the Ganges, which flows through India and Bangladesh, and the trans-boundary Mekong river. Australian TV company ABC was recently invited to visit one of the remote research stations in the Third Pole by lead researcher, Professor Qin Xiang. Scientists have been gathering data from this remote area for over 50 years, and recent findings are disturbing. Among them, the fact that temperatures there have increased by 1.5 degrees – more than double the global average.

As the fighting continues.

• Italy Rescues 1,100 Migrants In Mediterranean In One Day (R.)

About 1,100 migrants were rescued from boats in the Strait of Sicily on Sunday as they tried to reach Europe, Italy’s coastguard said. The migrants were picked up from eight rubber dinghies, one large boat and two punts through 11 rescue operations in the Mediterranean, the coastguard said in a statement. It did not mention the migrants’ country of origin. Latest data from the International Organization for Migration, released on Friday, said some 105,342 migrants have reached Italy by boat this year, many of them setting sail from Libya. An estimated 2,726 men, women and children have died over the same period trying to make the journey, often dangerously packed into small vessels unsuitable for the voyage. Italy has been on the front line of Europe’s migrant crisis for three years, and more than 400,000 have successfully made the voyage to Italy from North Africa since the beginning of 2014, fleeing violence and poverty.

A useful and thorough reminder.

• What Life Will Be Like After An Economic Collapse (Stewart)

If you have been waiting for a public announcement or news headline to let you know that an economic collapse has begun, you are in for the surprise of your life. If history in other countries and in Detroit, Michigan is any indication, there won’t be an announcement. An economic collapse tends to sneak up on a city, region, or country gradually over time. In some cases, the arrival of an economic collapse is so gradual that most people living in it aren’t even aware of it at first. Things just get gradually worse, often so gradually that people and families adjust as best they can until one day they actually realize that it’s not just their home or their neighborhood that has been hit so hard financially, it’s everyone. By that time, it’s often too late to take preventative action.

In March of 2011, Detroit’s population was reported as having fallen to 713,777, the lowest it had been in a century and a full 25% drop from 2000. In December 2011, the state announced its intention to formally review Detroit’s finances. In May of 2013, almost two years later, the city is deemed “clearly insolvent” and in July of 2013, the state representative filed a Chapter 9 bankruptcy petition for Motor City. Detroit became one of the biggest cities to file bankruptcy in history. So we have only to look at what happened in Detroit, Michigan post-bankruptcy, to get an indication of what might soon be widespread across the United States and what is already widespread in countries like Brazil and Venezuela.

Grocery stores and other businesses will fail one by one or be shut down from the riots and looting. In Detroit, the economic collapse left less than 5 national grocery stores for over 700,000 people. Imagine the lines even if food was still being shipped in on trucks. Small independent corner stores and family owned stores become the most convenient place to shop. These are stores with already high prices who make most of their profit from beer, wine, lottery, and cigarettes. Now imagine that shipping schedules have been affected by the economic crisis, this would mean longer lines with less certainty that any food would even be available once you got into the store to shop. People in Venezuela are actually dealing with government-run grocery stores and are limited to two days per week they can shop.