Edgar Degas Leaving the paddock 1866

Stolen from Gardner Museum March 18 1990, the single largest art theft in the world. Never recovered

Get around a table alright.

• US Willing To Talk Trade With China, No Session Set Yet (R.)

The United States is willing to negotiate with China on trade, but only if talks are serious, as previous attempts produced little progress, a senior U.S. official told Reuters late on Thursday as trade tensions between the two nations escalated. No formal negotiating sessions have been set, the official said. “There is ongoing communications with the Chinese on trade,” said the official, who requested anonymity to discuss the Trump administration’s trade strategy. The official said Republican President Donald Trump, who has already sought $50 billion in new tariffs on China, will insist on “verifiable, enforceable and measurable deliverables” from China in any trade negotiations.

The comments came as Trump said late on Thursday he had instructed U.S. trade officials to consider $100 billion in additional tariffs on China “in light of China’s unfair retaliation” against earlier U.S. trade actions. In a statement, Trump said the U.S. Trade Representative had determined that China “has repeatedly engaged in practices to unfairly obtain America’s intellectual property.” The senior official said: “We’ve had a type of negotiation in different forums where China has made lots of different commitments that they haven’t followed through on. “We don’t want to go down that path. But the president has been clear, the administration has been clear, we’re not trying to start a trade war. We’re simply trying to get fair and reciprocal treatments so we’re open to those conversations.”

The official said China had committed seven times to stopping forced technology transfers, a practice in which China allegedly seeks to obtain U.S. intellectual property (IP) through joint venture requirements, something that China denies. “This president is not going to tolerate hollow commitments or refusal to change bad practices. And if the way that we effectuate that is through negotiations, that’s great,” the official said.

All still just proposals. Waiting for Chinese replies that are not threats.

• Trump Considers New $100 Billion Tariffs On Chinese Goods (G.)

Donald Trump has instructed the US trade representative to consider slapping $100bn in additional tariffs on Chinese goods in an escalating standoff over trade. Trump said in a statement on Thursday that the further tariffs were being considered “in light of China’s unfair retaliation” against earlier US trade actions. He added that the US trade representative had determined that China “has repeatedly engaged in practices to unfairly obtain America’s intellectual property”. The White House said Trump had instructed the Office of the United States Trade Representative, the agency responsible for developing and recommending trade policy, to consider whether the additional tariffs would be appropriate under section 301 and, if so, to identify which products they should apply to.

He’s also instructed his secretary of agriculture “to implement a plan to protect our farmers and agricultural interests”. “Rather than remedy its misconduct, China has chosen to harm our farmers and manufacturers”, Trump said. Trump argues China’s trade practices have led to the closure of American factories and the loss of millions of American jobs. On Friday China’s commerce ministry said Beijing would fight the US ‘at any cost’. China’s state-run tabloid Global Times called Trump’s latest threat “ridiculous” in an editorial on Thursday, noting that it “reflects the deep arrogance of some American elites in their attitude towards China.”

Trump’s move comes one day after China issued a $50bn list of US goods including soybeans and small aircraft for possible tariff hikes. That itself was 11 hours after the White House announced a list of 1,333 Chinese imports, also worth about $50bn, for punitive tariffs of 25%.

Jim Rickards with a good history of US Presidential powers, but also of what China is afraid of: the homefront.

• Trade Is a Matter of Survival for China (Rickards)

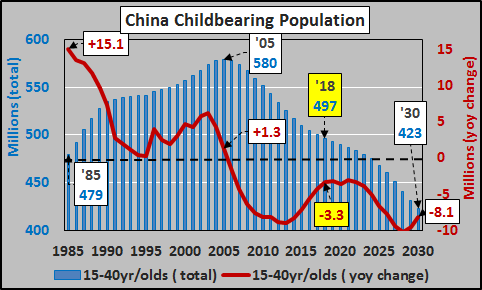

President Trump may now use IEEPA to block a variety of Chinese deals in the U.S. in retaliation for Chinese theft of U.S. intellectual property. With the U.S. using its nuclear option in financial warfare, investors should hope that the Chinese don’t respond in kind. President Trump may not appreciate the extent to which China will go to protect its interests. Trade negotiations are not the art of the deal, as far as China is concerned. Their goal is national survival. China’s economy is not just about providing jobs, goods and services that people want and need. It is about regime survival for a Chinese Communist Party that faces an existential crisis if it fails to deliver. The overriding imperative of the Chinese leadership is to avoid societal unrest.

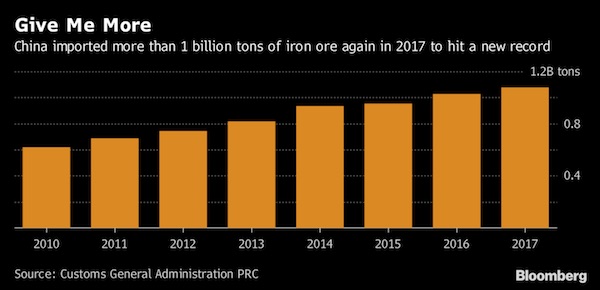

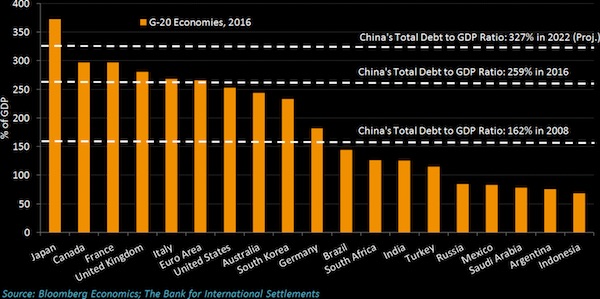

[..] given China’s current economic problem, Beijing’s challenge is becoming more difficult every day. Consider what’s happening in China right now… Growth in GDP is conventionally defined as the sum of consumer spending, investment, government spending (excluding transfer payments) and net exports. Most large economies other than oil-producing nations get most of their growth from consumption, followed by investment, with relatively small contributions from government spending and net exports. A typical composition would show a 65% contribution from consumption plus a 15% contribution from investment. China is nearly the opposite, with about 35% from consumption and 45% from investment.

That might be fine in a fast-growing emerging-market economy like China if the investment component were carefully designed to produce growth in the future as well as short-term jobs and inputs. But that’s not the case. Up to half of China’s investment is a complete waste. It does produce jobs and utilize inputs like cement, steel, copper and glass. But the finished product, whether a city, train station or sports arena, is often a white elephant that will remain unused.

What’s worse is that these white elephants are being financed with debt that can never be repaid. And no allowance has been made for the maintenance that will be needed to keep these white elephants in usable form if demand does rise in the future, which is doubtful. Chinese growth has been reported in recent years as 6.5–10% but is actually closer to 5% or lower once an adjustment is made for the waste. The Chinese landscape is littered with “ghost cities” that have resulted from China’s wasted investment and flawed development model. This wasted infrastructure spending is the beginning of the debt disaster that is coming soon. China is on the horns of a dilemma with no good way out.

It gets harder to act innocent. Why do this in secret if it is to benefit people?

• Facebook Explored Data Sharing Agreement With Hospitals (CNBC)

Facebook has asked several major U.S. hospitals to share anonymized data about their patients, such as illnesses and prescription info, for a proposed research project. Facebook was intending to match it up with user data it had collected, and help the hospitals figure out which patients might need special care or treatment. The proposal never went past the planning phases and has been put on pause after the Cambridge Analytica data leak scandal raised public concerns over how Facebook and others collect and use detailed information about Facebook users. “This work has not progressed past the planning phase, and we have not received, shared, or analyzed anyone’s data,” a Facebook spokesperson told CNBC.

But as recently as last month, the company was talking to several health organizations, including Stanford Medical School and American College of Cardiology, about signing the data-sharing agreement. While the data shared would obscure personally identifiable information, such as the patient’s name, Facebook proposed using a common computer science technique called “hashing” to match individuals who existed in both sets. Facebook says the data would have been used only for research conducted by the medical community.

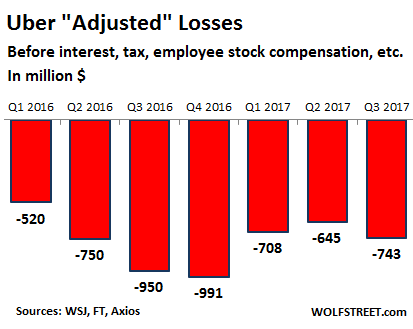

Just make it local. And use the revenues to support your own cities.

• Uber To Suspend Service In Greece After New Legislation (R.)

Ride-hailing service Uber said on Thursday it would suspend its licensed service in Greece after the approval of local legislation which imposes stricter regulation on the sector. Uber, which operates a licensed service in the Greek capital, has faced opposition from local taxi drivers who accuse it of taking their business. “New local regulations were voted on recently with provisions that impact ride-sharing services,” Uber said in a blog post. “We have to assess if and how we can operate within this new framework and so will be suspending uberX in Athens from next Tuesday until we can find an appropriate solution.” Uber operates two services in Athens: UberX, which uses professional licensed drivers, and UberTAXI, which uses taxi drivers.

The new regulations require each trip to start and end in the fleet partner’s designated headquarters or parking area, something Uber does not do. A digital registry of all ride-sharing platforms and their passengers will also be created. The company launched in Europe in 2011, angering some local authorities and taxi drivers who said it did not abide by the same rules on insurance, licensing and safety. Following widespread protests, court battles and bans, Uber has taken a more emollient stance under its new CEO Dara Khosrowshahi, suspending operations in various cities in order to comply with local regulations. UberX launched in Athens in 2015 and more than 450,000 people have used its smartphone app to book a ride.

News of the new regulation last year angered some Athenians and tens of thousands signed a petition launched by Beat – a local ride-sharing service – in favor of ride-hailing services. UberX drivers have to be employed by fleet partners such as car rental companies or tourist agencies and their cars could not be more than seven years old. The data registry and return-to-garage requirement will only apply to ride-hailing services like Uber and Beat, while taxi drivers will be able to use cars that are up to 22 years old.

Too much backlash?!

• HSBC Whistleblower Released By Judge After Swiss Extradition Request (Ind.)

An HSBC whistleblower who leaked data that led to a tax evasion scandal has been released by a Spanish judge after being arrested on an extradition request from Switzerland. Hervé Falciani, a former IT worker at HSBC’s secretive Swiss bank, faces a five-year prison sentence in Switzerland after being convicted in absentia for industrial sabotage in 2015. Police arrested Mr Falciani in Madrid on Wednesday on his way to speak at a conference on whistleblowing. Swiss authorities had requested that he be remanded in custody but he was released without bail on Thursday and ordered to surrender his passport while Spanish authorities consider whether to extradite him.

In 2008, Mr Falciani fled Switzerland, having stolen data on 130,000 HSBC clients, many of whom he suspected of tax evasion. The information uncovered large-scale wrongdoing at the bank that led to investigations in several countries, including the UK. HSBC chief executive Stuart Gulliver later apologised to MPs for “unacceptable” practices at the bank’s Swiss subsidiary which he said had caused “damage to trust and confidence” in the company. Sven Giegold, an MEP and spokesperson for the German Greens on transparency and integrity said on Thursday that Mr Falciani should be awarded a medal for his actions. “Falciani deserves a European Order instead of imprisonment in Switzerland,” Mr Geigold said.

“He was one of the first whistleblowers to pioneer the fight against global tax fraud, followed by many disclosures in Switzerland, Luxembourg, Liechtenstein and other tax havens,” “We should be grateful to him. Europe’s governments should call on the Spanish government not to extradite Falciani. His extradition would be shamefully ungrateful after having profited from his data financially and politically.”

Misuse of public funds. Not what Spain wanted. Just let him go. Germany can’t extradite someone on that.

• German Court Says Carles Puigdemont Can Be Released On Bail (G.)

A court in northern Germany has ruled that the former Catalan president Carles Puigdemont can be released on bail while extradition proceedings continue. The district court in Schleswig set bail for the 55-year-old at €75,000 (£66,000). Puigdemont was arrested on a Spanish-issued warrant upon entering Germany on 25 March as he attempted to drive from Finland to Belgium, where he currently resides. Spain accuses the Catalan separatist of rebellion and corruption after he organised an unsanctioned independence referendum. The Schleswig court said that it considered a charge of misuse of public funds sufficient grounds for an extradition, but that a charge of “rebellion” was not, because the comparable German charge of treason specifies violence.

Proceedings to decide whether to extradite him on corruption charges could continue, it said. “There is a risk of flight,” the court said in its explanation of its decision to grant bail. “But since extradition on rebellion charges is impermissible, the risk of flight is substantially lessened.” Puigdemont has written an open letter from prison, urging Catalonia’s parliament to make another attempt to elect jailed separatist activist Jordi Sànchez as the region’s president. Puigdemont had proposed Sànchez as his number two in the Together for Catalonia party last month, but Spain’s supreme court refused to free him to attend a parliamentary session. Sànchez said in a letter from a Madrid jail published on Thursday that he was ready to try again to be elected.

In that society, no wonder.

• Young People In Britain Have Never Been Unhappier (G.)

Young people’s happiness across every single area of their lives has never been lower, research by the Prince’s Trust has found. The charity, set up by the Prince of Wales, said the results of its annual UK Youth Index, which gauges young people’s happiness and confidence across a range of areas, from working life to mental and physical health, should “ring alarm bells”. The national survey shows young people’s wellbeing has fallen over the last 12 months and is at its lowest level since the study was first commissioned in 2009. The research, based on a survey of 2,194 respondents aged 16 to 25, revealed that three out of five young people regularly feel stressed amid concerns over jobs and money, while one in four felt “hopeless”, and half had experienced a mental health problem.

Almost half said they did not feel they could cope well with setbacks in life, but despite this more than one quarter said they would not ask for help if they were feeling overwhelmed. The index shows that young people are particularly disillusioned with the job market and are concerned about money and future prospects. One in ten said they had lost a job through redundancy or having a contract terminated or not renewed, or being fired, while 54% said they were worried about their finances. The report highlights significant differences between the views held by young men and women, particularly when it comes to how they feel about their future prospects. Young women are more likely to think a lack of self-confidence holds them back and 57% of young women worry about “not being good enough in general”, compared to 41% of men.

Or do they? Is the secret in the synopses?

• Elderly People Grow As Many New Brain Cells As Young (Ind.)

Elderly people grow as many new brain cells as teenagers, according to a new study which counters previous theories that neurons stop developing after adolescence. Healthy men and women continue to produce new neurons throughout life, suggesting older people remain more cognitively and emotionally intact than previously believed, researchers found. For decades it was thought that adult brains were hard-wired and unable to form new cells. But a Columbia University study found older people continued to produce neurons in the hippocampus – a part of the brain important for memory, emotion and cognition – at a similar rate to young people. Researchers examined the brains of 28 previously healthy people who died suddenly between the age of 14 and 79.

“We found that older people have similar ability to make thousands of hippocampal new neurons from progenitor cells as younger people do,” said the study’s lead author Maura Boldrini, associate professor of neurobiology. “We also found equivalent volumes of the hippocampus across ages.” The ability to generate new hippocampal cells, a process known as neurogenesis, declines with age in rodents and primates. Declining production of neurons and shrinkage of parts of the brain which help form of new episodic memories were believed to occur in ageing humans as well, explaining why younger people find it easier to learn skills and languages. But the Columbia University study found similar numbers of newly formed cells in old and young brains.

However, the researchers also noted fewer blood vessels and connections between cells in the older brains, which Ms Boldrini said “may be linked to compromised cognitive-emotional resilience” in the elderly. The findings, published in the journal Cell Stem Cell, are likely to be hotly debated. They come just a month after a University of California study suggested adults do not develop new neurons.

That’s how bad it’s gotten.

• Surgeon General Urges More Americans To Carry Opioid Antidote (CNN)

The US surgeon general issued an advisory Thursday recommending that more Americans carry the opioid overdose-reversing drug, naloxone. The drug, sold under the brand name Narcan (among others), can very quickly restore normal breathing in someone suspected of overdosing on opioids, including heroin and prescription pain medications. Dr. Jerome Adams emphasized that “knowing how to use naloxone and keeping it within reach can save a life.” To make his point, Adams relied on a rarely used tool: the surgeon general’s advisory. The last such advisory was issued more than a decade ago and focused on drinking during pregnancy.

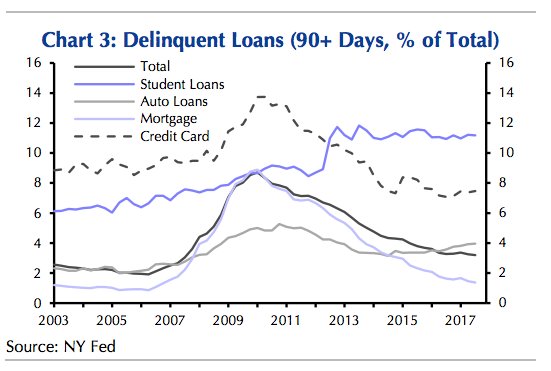

Adams noted that the number of overdose deaths from prescription and illicit opioids doubled in recent years: from 21,089 deaths across the nation in 2010 to 42,249 in 2016. America’s top doctor attributed this “steep increase” to several contributing factors, including “the rapid proliferation of illicitly made fentanyl and other highly potent synthetic opioids” and “an increasing number of individuals receiving higher doses of prescription opioids for long-term management of chronic pain.”

The right discussion, but launched very weakly. On purpose?

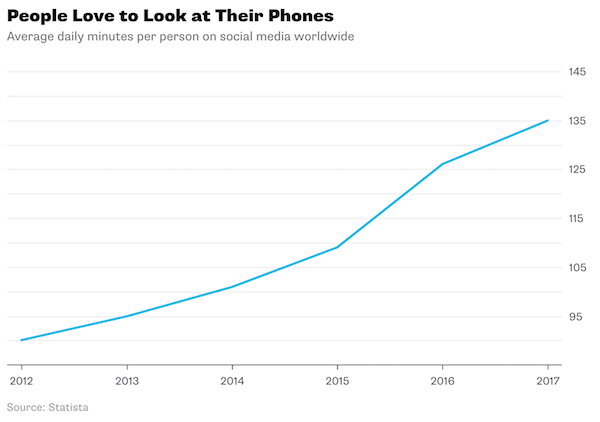

• Social Media Looks Like the New Opiate of the Masses (BBG)

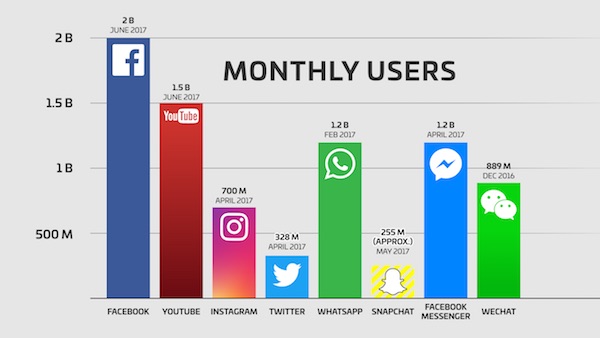

[..] many of us who lived through the shift from Internet 1.0 to the new age of social media can’t help but feel a nagging worry. In addition to concerns about privacy, electoral influence and online abuse, social media seems like it has many of the qualities of an addictive drug. Research isn’t conclusive on whether social-media addiction is real. But it certainly has some negative side effects that loosely resemble the downsides of recreational drugs. In 2011, psychologists Daria Kuss and Mark Griffiths wrote a paper that found: “Negative correlates of [social media] usage include the decrease in real life social community participation and academic achievement, as well as relationship problems, each of which may be indicative of potential addiction.”

Meanwhile, a number of more recent studies find similarities between social-media use and addictive behavior. And experiments found that smartphone deprivation induced anxiety among young people, a phenomenon that certainly has parallels to drug withdrawal. That certainly doesn’t mean that everyone who uses social media is a junkie. Evidence shows that moderate usage is not harmful. That fits with my own experience – I find that I derive great enjoyment from Facebook, which I use in moderation, but am often made anxious and irritable by Twitter, which I use much more. It’s the heaviest users who may be in the most danger — a recent survey found that a quarter of Americans are online “almost constantly.” And social-media use is going up relentlessly worldwide:

“..there is no need for more land to grow sugarcane..”

• Lifting Sugarcane Farming Ban ‘Last Straw’ For Amazon Rainforest (Ind.)

Environmentalists in Brazil have urged the government not to proceed with a change in the law described as the “last straw” for the Amazon rainforest. The Brazilian senate is set to vote on a bill that could see the eight-year-old ban on farming sugarcane for biofuel production in the Amazon lifted. In an open letter, 60 NGOs including Greenpeace and WWF have warned of the implications this decision would have, both for the rainforest itself and the reputation of the biofuels industry. They have been joined in their condemnation of the bill by several former Brazilian environment ministers.

The letter states: “If passed, the bill will be a tragedy for forests and for the biofuel industry in Brazil – the image of which will be damaged to the brink of no return, at a time critical to its success”. There is also concern that Brazil’s Paris climate agreement targets will be compromised if its ethanol production is not sustainable. Supporters of the new bill say it will benefit the economy and help contribute to the national supply of biofuels. However, environmentalists, scientists and even representatives from the biofuels industry say there is no need for more land to grow sugarcane, and the expansion of the industry will further drive deforestation of the rainforest.

Reminds us of that park in India where more poachers than rhinos are killed. Beijing needs to stop this, all of it.

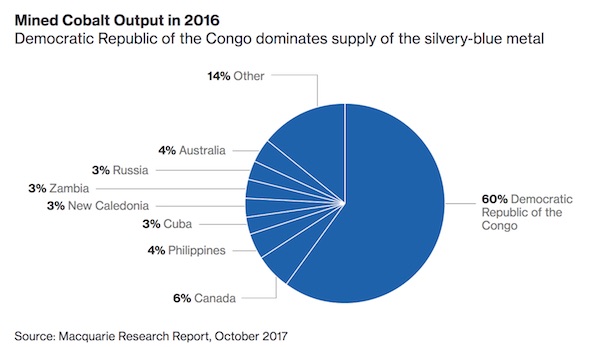

• Bolivia’s Jaguars Under Threat Of Chinese Fang Craze (AFP)

Bolivia’s once-thriving jaguar population is loping into the cross-hairs of a growing threat from poachers responding to growing Chinese demand for the animal’s teeth and skull. Researchers believe there are around 7,000 of the speckled big cats in Bolivia, out of a global population of some 64,000, stretching from North America to Argentina. But such is the appetite in China’s huge underground market that “if controls are not put in place, it can lead to a serious problem” for their survival, warned Fabiola Suarez of the Environment Ministry. Considered vulnerable by conservationists, the jaguar’s future in the South American country is in the hands of anti-trafficking police only now coming to grips with the potential scale of the problem.

Local authorities began getting reports in 2014 of trade in the animal in the northeastern area of Beni, according to Rodrigo Herrera, an advisor to Bolivia’s directorate of Biodiversity at the Environment Ministry. He says the increased presence of Chinese nationals in the South American country has stimulated demand. President Evo Morales’ leftist government has awarded seven billion dollars’ worth of public works contracts to Chinese groups, sparking an influx of workers from the Asian giant. Herrera said each of the cat’s teeth, which measure between eight and 10 centimeters, can fetch up to $100 for poachers, but that figure can reach $5,000 on the Chinese market. The feline’s skull is also prized by traffickers, at rates of up to $1,000. Traffickers also sell the skin, and even the testicles, which along with the ground-down teeth, are prized by some Chinese as an aphrodisiac.