Harris&Ewing Angelus siren on roof of Evans building, Washington, DC Aug 1918

If and when you see that in 2014 S&P 500 Companies Spend Almost All Profits on Buybacks and Payouts, in a Bloomberg report, how can you not be scared sh*tless about the future of the financial world? And given the power finance has gathered over the real world, how can you not be scared about your own future? I’m open to suggestions, but I don’t see it. Because I think that what we’re looking at here is the imminent demise of the corporate world, and therefore the financial world, and the entire US economy as we know it.

Companies need to invest their earnings into projects that will generate profits, into the development of products and services that they can sell to the world out there. If they instead use their earnings to buy back their own shares, they’re on a fast track to oblivion, because they can’t keep on buying their own shares over and over again. At one point, they’ll own them all.

Apparently, the S&P companies have no projects, innovative or not, that they deem worthy of spending money on. Or, let’s rephrase that just a bit, they have not nearly enough of such projects. Because they do spend, of course they do. It’s not as if they take every dollar that comes in and buy back shares with it. They don’t, it’s not that simple. The problem is that they do buybacks with far too many of their dollars.

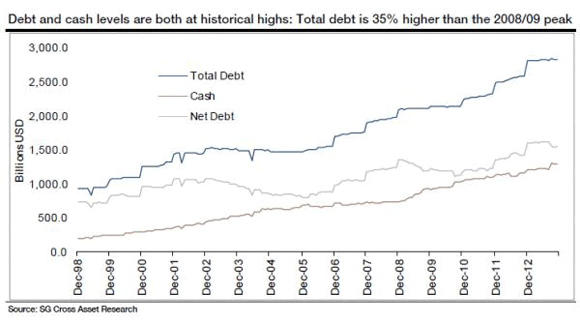

Much of what they buy back shares with is borrowed money. Ultra low rates, what can go wrong, right? Well, here’s what can: these allegedly rich firms are loading up on debt. While their productive qualities, for lack of a better term, get thrown out with the bathwater. Here’s how, and how much, US companies are loading up on debt, graphs courtesy of Tyler Durden:

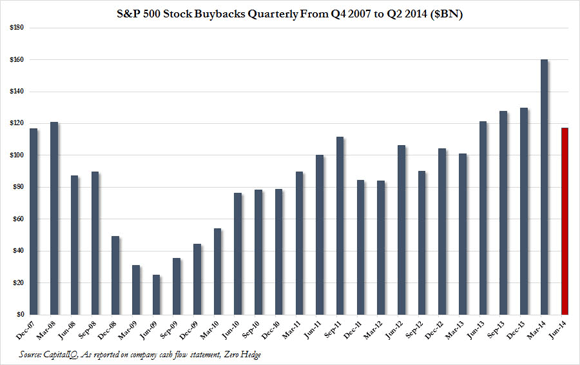

The S&P 500 companies we’re talking about are set to spent almost $1 trillion (equal to 95% of their earnings) on buying back their own stock, and pay out dividends to others who bought and own their stock, this year alone. The details as per Bloomberg:

S&P 500 companies will spend $565 billion on repurchases this year and raise dividends by 12% to $349 billion, based on estimates by Howard Silverblatt, an index analyst at S&P. Profits would reach $964 billion should the 8% growth forecast come true.

And:

Five years of profit growth have left S&P 500 constituents with $3.59 trillion in cash and marketable securities and they’ve raised almost $1.28 trillion in 2014 through bond sales.

So at the exact same moment that the companies dilute their value through huge increases in their debt obligations, they get investors to buy huge amounts of additional debt, backed by, yeah, what exactly after a while? Backed by the fact that their shares are supposed to represent a certain value, ONLY because they’ve used their capital, and then some leveraged some, to lift those same shares. Keep that up and nobody ever has to work anymore?!

And don’t forget, it’s not just the companies themselves that buy their own stock, we know the major central banks, the Fed, Bank of Japan, and People’s Bank of China, also have substantial US stock portfolios. And 50% of US public pension funds are now holding the same US stocks. Everyone puts lipstick on the US corporate pig.

At some point, someone’s bound to see a bubble in there somewhere. The S&P companies gained $3.59 trillion in ‘value’ since 2009, and are set to spend $9.14 billion in buybacks and dividends in 2014. Bloomberg says that “the stocks with the most repurchases gained more than 300% since March 2009”. Looks great, until it doesn’t:

Inevitably, buyback rates are falling. See the red bar there. If and as companies’ actual value gets worse because they don’t invest in productive projects, they delve into more debt, just to buy their own stock, just to keep their stock values up, and the S&P is left hugely bloated, which fools investors into thinking they buy something that has real value. But what has real value?

It’s like there’s a house up for sale, and you’re interested, but the owner asks $20 million, based on the fact that he himself just made an offer of $20 million. The pipes are leaking, and so is the roof, but the realtor says, I tell you man, there’s a $20 million offer on the table. Just to say, in today’s market nobody has a clue what anything is truly worth.

And today’s stock buyers (investors?) are in essence offering $21 million for a house that may not be worth a tenth of the asking price, but they wouldn’t have any way of knowing. All that’s left is blind wagers. A bit more from that Bloomberg piece:

Companies in the Standard & Poor’s 500 really love their shareholders. Maybe too much. They’re poised to spend $914 billion on share buybacks and dividends this year, or about 95% of earnings, data compiled by Bloomberg and S&P Dow Jones Indices show. Money returned to stock owners exceeded profits in the first quarter and may again in the third. The proportion of cash flow used for repurchases has almost doubled over the last decade while it’s slipped for capital investments…

Buybacks have helped fuel one of the strongest rallies of the past 50 years as stocks with the most repurchases gained more than 300% since March 2009. Now, with returns slowing, investors say executives risk snuffing out the bull market unless they start plowing money into their businesses. “You can only go so far with financial engineering before you actually have to have a business with real growth,” Chris Bouffard at Mutual Fund Store said. “Companies have done about all that they can in terms of maximizing the ability to do those buybacks.”

Profits climbed to about $230 billion over the last three months, based on analyst forecasts. That compares with total buybacks and dividends of about $235 billion, assuming repurchases estimated by Silverblatt are evenly divided between the third and fourth quarters. Cash returned to shareholders exceeded profits in the first quarter for the first time since 2009

“We’re at a point you sort of question whether they can continue to rise from here,” Glionna said. “This kind of 100% earnings is a barrier. It can bounce around here and there, but it doesn’t go much above that.”

Excluding the recession years 2001 and 2008, dividends and stock buybacks have represented, on average, 85% of corporate earnings since 1998. The last time payouts exceeded income in 2007, the buyback index fell 4.7%, compared with a 3.5% gain in the S&P 500. Equities peaked that October before losing more than half their value.

CEOs have increased the proportion of cash flow allocated to stock buybacks to more than 30%, almost double where it was in 2002, data from Barclays show. During the same period, the portion used for capital spending has fallen to about 40% from more than 50%.

The reluctance to raise capital investment has left companies with the oldest plants and equipment in almost 60 years. The average age of fixed assets reached 22 years in 2013, the highest level since 1956 …

Stock repurchases worth almost $2 trillion have helped buoy the bull market since March 2009. Even as sales were stuck at an average growth rate of 2.6% a quarter in the past two years, per-share earnings expanded more than twice as fast, 6.1%, data compiled by Bloomberg show.

“Buybacks have become sort of the low-risk medicine in the C suite,” David Lafferty for Natixis, said. “The reality is capital expenditure comes with risk, significant amount of risk, especially in a slow-growth world. Buybacks offer a lot of flexibility.”

“It’s going to be harder and harder to justify using that capital to buy back stocks at record highs,” Tim Courtney at Exencial Wealth Advisors said. “Money has to be diverted to other places to keep operations going. The point of concern is where the future growth is going to come from.”

The take away should be obvious, or so I think:

• While the S&P is at record highs, the US companies it is supposed to reflect have become dramatically less productive. Not just a little bit. They’ve also accumulated a pirate’s fortune in additional debt.

• Through buybacks, S&P companies have, aided by central banks, and Wall Street, created a hugely perverted idea of what their shares are worth. ‘Someone’s buying, so there must be value there’. Well, not if the seller poses as the buyer too.

• The lack of capital invested in productive undertakings spells even more erosion of the US manufacturing base. And that tells you all you need to know about the future of US industry. If companies don’t invest earnings in their own productive futues, who’s going to do it, and why should they?

Company shares have become a purely financial play, not something linked to a company doing well, performing, innovating, exceeding itself. That link is broken. It’s no longer about what you do, but what you can make people believe you do.

How much closer can you get to not having a functional economy? Beats me. There’s nothing there anymore, other than cheap credit and old habits. There’s no there there.

Home › Forums › The Imminent Demise Of The American Economy