DPC Youngstown, Ohio. Steel mill and Mahoning River 1902

Please allow me to revert back again a little to what I wrote earlier today in Will Oil Kill The Zombies? I think we need to be clear on what’s going on here. The oil market actually works. And that’s a rarity in today’s world of manipulated everything, of no mark to market, of huge stock buybacks financed by zero interest rates, you know the story.

We know that the market works because of for instance this article from CNBC:

Oil Pressure Could Sock It To Stocks

“Oil has pretty much spooked people,” said Daniel Greenhaus, chief global strategist at BTIG. “There just isn’t a bid. With everything in energy and the oil price collapsing as it is, who is going to step in and be a buyer now? The answer is nobody.”

b>”It’s (oil) actually much weaker than the futures markets indicate. This is true for crude oil, and it’s true for gasoline. There’s a little bit of a desperation in the crude market,” said Kloza.”The Canadian crude, if you go into the oil sands, is in the $30s, and you talk about Western Canadian Select heavy crude upgrade that comes out of Canada, it’s at $41/$42 a barrel.”

“Bakken is probably about $54.” Kloza said there’s some talk that Venezuelan heavy crude is seeing prices $20 to $22 less than Brent, the international benchmark. Brent futures were at $63.20 per barrel late Thursday.

“In the actual physical market, it’s fallen by even more than the futures market. That’s a telling sign, and it’s telling me that this isn’t over yet. This isn’t the bottoming process. The physical market turns before the futures,” he said.

It’s not about where WTI and Brent are at any given moment. Even if WTI is down another 3.60% today so far at $57.79. Whatever WTI tells us, the real world out there trumps it by a mile and a half. The prices at which oil actually sells in the real world are way below WTO and Brent standards, a very big and scary development. There are tons of parties that will sell at any price they can get. There is no better way to drive prices down further, it’s a vicious circle down a drain.

The market is setting future prices as we go along, that’s the – inevitable – mechanism. It’s called price discovery. We knew ISIS was selling at $30 or so, but tar sands at $30 and both Canada and Venezuela heavy crude at $40, that’s way more than an outlier. At WTI standard prices, too many can’t move nearly enough product anymore, and with credit having been slashed, moving product is the sole way to survive. How much of this ongoing process would you think we have we seen to date?

Here’s one of the first oil-producing countries about which serious alarm bells are raised. It’s not Venezuela or Nigeria, it’s Canada. From MarketWatch:

Falling Oil Threatens Canada’s Bulletproof Banking System

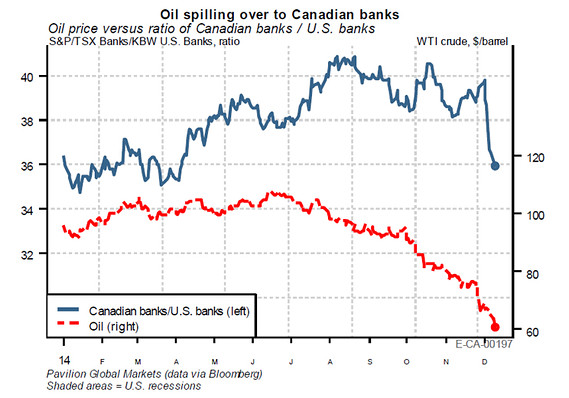

While the U.S. financial system – as well as many international banks – has gotten hopped up on a wide assortment of financial opiates and stumbled through more than a dozen bank-fueled crises through the decades, Canada boasts a stellar track record of banking sobriety. However, a spectacular death spiral in crude-oil futures – West Texas Intermediate settled Thursday at $59.95, a more than five-year low – threatens to deliver a serious shock to the banking system of the U.S.’s northern neighbor, according to a research note published Thursday by Pavilion Global Markets. Canada ranks as one the world’s five largest energy producers and a net exporter of oil, according to the U.S. Energy Information Administration. So, a big drop in oil would pose several risks to Canada’s oil-dependent economy.

“The drop in oil prices, as mentioned above, will have wide-ranging implications on the Canadian economy,” Pavilion strategists Pierre Lapointe and Alex Bellefleur said in the note. It’s not just that Canada’s banks will find themselves saddled with souring loans from underwater energy producers. The problem, Pavilion argues, is that Canada’s employment rate could suffer as oil-related businesses are forced to close.

Here’s how they put it: “In this context, the risk to Canadian banks doesn’t stem necessarily from a narrow view of loans to oil companies, but morefrom a broad macro risk perspective. As employment in the oil industry declines, a negative income and wealth shock to many households will take place, impacting a variety of loans (credit card, mortgage) on Canadian bank balance sheets.”

This is what I’ve been hammering on for weeks: the benefits of cheap oil are no match for the destruction that touches on a thousand different parts of our economies. It doesn’t help that much of both Canadian and American oil, especially the unconventional kinds, were drowning in debt even before oil turned south with a vengeance. But that’s not even the most crucial part.

Our entire economies revolve around oil, it’s not just something that you put in your car, oil is everywhere, it’s built our world and it maintains it.. And therefore the effects of a sudden 40% price drop – and counting – will be felt everywhere. What we’ve seen so far can still be labeled ‘orderly’, but that’s not going to last. Still, look at the bright side: at least you can say that for once in your life you’ve witnessed a functioning market.

Home › Forums › The Oil Market Actually Works, And That Hurts