Debt Rattle February 5 2018

Home › Forums › The Automatic Earth Forum › Debt Rattle February 5 2018

- This topic has 11 replies, 4 voices, and was last updated 6 years, 9 months ago by

V. Arnold.

-

AuthorPosts

-

February 5, 2018 at 11:10 am #38682

Raúl Ilargi Meijer

KeymasterHoracio Coppola Calle Corientes at the corner of Reconquista, Buenos Aires 1936 • Global Equity Slump Deepens as Rate Fears Grow (BBG) • Stocks

[See the full post at: Debt Rattle February 5 2018]February 5, 2018 at 12:30 pm #38683V. Arnold

ParticipantImmunology; an interesting subject.

I grew up mostly in Locust Valley, Long Island, N.Y.; from an early age; kindregarten; I was allowed great freedom.

A block and a half from our house was “the woods”; wild for miles, and I took every advantage mostly by myself, to explore every inch of it.

I played with worms, snakes, tortises, turtles, frogs, spiders, dogs, cats, parakeets, and whatever criter I could catch. Dirt, mud, lakes, ponds, streams, and springs were my constant companions.

Oh, yes, immunology; well some smart rascal (male of female, I can’t remember) a few decades back, posited that the very things I did as a kid, created a very healthy immune system because of all the exposure to, wait for it, germs/bacteria/microbes.

Knock on wood, I’m almost never sick, and when I am, it’s usually self induced (rare tho that is).

From everything I read today, kids have been robbed of their very lives; prisoners of overly protective parents and a fascist PC society; bereft of humanity.

Here, in rural Thailand, things are still pretty real and free…

Way more free than that bastion of freedon, the U.S.A.!

RIPFebruary 5, 2018 at 1:11 pm #38684Dr. D

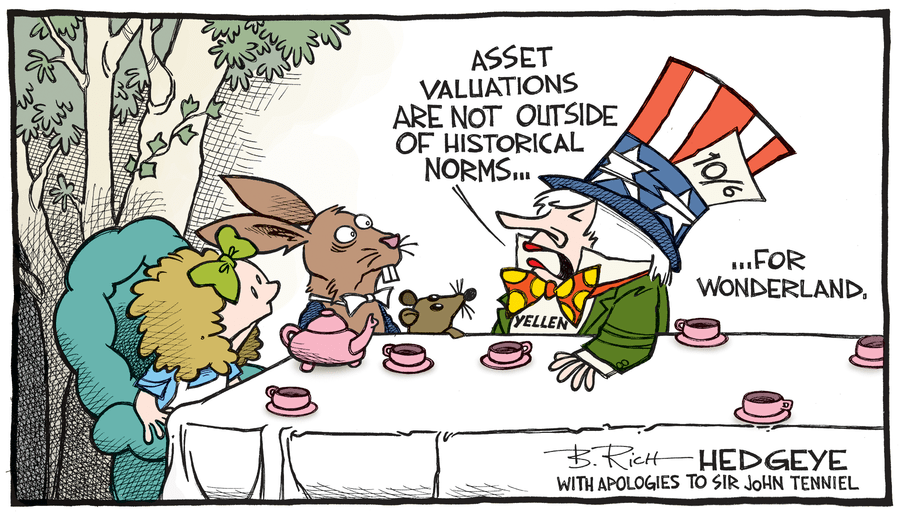

ParticipantYellen for the win!

Charts over 120 year-highs in every metric? “is that a bubble? …it’s very hard to tell.” Or not. At all.

Also doesn’t know what collateral is. Or leverage. “…our overall judgment is that, if there were to be a decline in asset valuations, it would not damage unduly the core of our financial system.” Somehow I think if you have out an 80% loan, or stocks on margin, if the collateral drops 20%, you’re repossessed. And yes, that is not voluntary, which leads to more selling, lower prices, etc. The complete loss of adequate collateral is the definition of “undue damage.”

On markets: “Recoveries don’t die of old age.” Yes Janet, they do. Look at any chart and you’ll see an 8-year, 20-year, 37-year etc cycle. Trees don’t grow to the sky, you might have heard. But when we no longer have markets, but soviet central planning, the sky’s the limit, yes?

PS, We have regulations on banks? First I’ve seen. Anybody planning on using them?

And like I said about ivory towers in the 12 blesse’d cities where journalists live: can’t figure out why Americans don’t use over 10 vacation days when I bet 60% of them don’t have even 5. For any purpose: sick, dying, kids: sucks to be you. You think Bezos is made out of money or something? Get back to that $21K a year, the ambulance is outside if you can’t hack it.

They seem to have pulled the plug on the old system, it’s being swapped out for the new one right now.

February 5, 2018 at 1:34 pm #38685V. Arnold

ParticipantDr. D

I see a huge opportunity for some talented (in cartoon drawing) to put these reports and utterances into a carrton much like Bettle Bailey or Calvin and Hobes, or even Li’L Abner, no, no, Pogo!

That’s it, Pogo…

Anybody?February 5, 2018 at 5:35 pm #38686Dr. D

Participant February 5, 2018 at 5:36 pm #38687

February 5, 2018 at 5:36 pm #38687Dr. D

Participant February 5, 2018 at 5:47 pm #38688

February 5, 2018 at 5:47 pm #38688zerosum

ParticipantHey!

Look!

My morning headlines.And the winners are…

1. He who didn’t play

2. He who lost the least

Ray Dalio Warns: Investors Just Got “A Taste Of What Tightening Will Be Like”

Are Markets Coming To Terms With The Notion Of The Punch-Bowl Running Dry?

Blackstone COO: “Stocks Could Fall As Much As 20% This Year”

Evercore ISI: “The Selloff Is Almost Over”

Cash Open Sparks Stock-Buying-Panic – Nasdaq Green

White House: “We Are Concerned About The Market Selloff”

February 5, 2018 at 5:54 pm #38689zerosum

Participanthttps://market-ticker.org/akcs-www?post=232917

This, incidentally, is likely to bring an end to the market’s euphoria — and not gently either. See, the market folks didn’t count on that trillion dollar issuance, but now it’s happening. Good luck with the “record stock market” nonsense in that environment. If what I expect happens as a result, of which the first rumblings were heard this week, you won’t have any of those gains within the next year or two, and in fact will likely have lost half of Obama’s too.

People say I should be happy that tax rates went down. Really? They didn’t go down for anyone because the deficit is in fact going up. Treasury estimates the hit to be $400 billion this year alone, pushing new issuance to over a trillion dollars. Every single dollar of net newly-printed Treasuries is a tax increase; there’s perhaps $100 billion in “tax cuts” in the economy but $400 billion in increases, so in fact it’s a $300 billion tax increase, not a cut. You won’t see it in your paycheck but you sure as hell will in the price of things you buy and the loss of purchasing power, which will then compound for every year forward — unlike the one-time adjustment to the withholding tables. The so-called tax cuts are a scam and a fraud folks.

February 5, 2018 at 6:05 pm #38690zerosum

ParticipantWhich makes you fell sorry the most, Puerto Rico’s misery or the lost of the Patriots in the super bowl?

February 5, 2018 at 6:20 pm #38691Dr. D

ParticipantI wouldn’t worry about the deficit. We were never going to pay it anyway.

February 5, 2018 at 9:31 pm #38693zerosum

ParticipantFamous sayings:

Lock in your profits

Sell at the highs

Better to be out early than too late

Dumb m0ney vs smart money

Bullies vs Victimes

February 6, 2018 at 3:45 am #38694V. Arnold

ParticipantDr. D

Thanks for those.

I was thinking more along the lines of multi-paneled; but those were good. 🙂 -

AuthorPosts

- You must be logged in to reply to this topic.

Sorry, the comment form is closed at this time.