Shale Is A Pipedream Sold To Greater Fools

Home › Forums › The Automatic Earth Forum › Shale Is A Pipedream Sold To Greater Fools

- This topic has 37 replies, 1 voice, and was last updated 11 years, 4 months ago by

davefairtex.

-

AuthorPosts

-

August 6, 2013 at 12:00 pm #8366

Raúl Ilargi Meijer

KeymasterBob Sandberg "Commuters on train platform, Park Forest, Illinois." July 1954 At a time when perceptions of the real state of economies and m

[See the full post at: Shale Is A Pipedream Sold To Greater Fools]August 6, 2013 at 7:07 pm #8089Golden Oxen

ParticipantThis entire shale episode is a sad one indeed. Not only is it a sham, but the cost to the environment and the amount of glee it has bestowed on the uninformed is frightening. Many liken it to their technology god being proven invincible once again.

Of course the pain will that much greater than it need be at the end. Main Street like Wall Street, only cares about today and not tomorrow; and warnings and exposes of this nature will be ignored as rants from sour grapes peak oil fools.

August 6, 2013 at 7:43 pm #8090jal

ParticipantWould fracking in a coal seam be “a sweet spot”?

August 6, 2013 at 10:54 pm #8091pipefit

ParticipantThe key ratio to look at is the oil:natural gas ratio. (stockcharts dot com symbol $wtic:$natgas). As of yesterday’s (8/5/13) close it was at 31.91:1. But the btu equivalent is 7:1!!!!!

So, on a btu equivalent basis, oil costs more than four times as much as natural gas. This is an indication of current and ongoing intense monetary inflation, bordering on hyperinflation.

Because of the efficiency of modern oil tankers, oil can be sold any where in the world, with transportation costs only a tiny fraction of the cost of the product. Nat gas, on the other hand, cannot be transported beyond the continent where it is produced, except with exceptionally wasteful LNG Tankers.

Therefore, nat gas isn’t near the inflation hedge that crude oil is. We know the monetary hyperinflation machinery is running at full speed. the fed is buying a trillion is bond debt a year, with ‘out of thin air’ money. the USA federal govt. is running a GAAP fiscal deficit of close to $7 trillion ANNUALLY.

Dollars and dollar equivalents are going to completely fail, the only question is when. Much better to own a tanker full of oil when it happens, than a bank account with some (soon to be ) meaningless numbers in it.

The fact that they are chasing lesser and lesser value energy plays is consistent with this analysis. Put your money anywhere but in fiat.

August 6, 2013 at 11:20 pm #8092Raúl Ilargi Meijer

KeymasterWe know the monetary hyperinflation machinery is running at full speed.

I don’t know who “we” are, but I do know I’m not included.

So, on a btu equivalent basis, oil costs more than four times as much as natural gas. This is an indication of current and ongoing intense monetary inflation, bordering on hyperinflation.

No, it isn’t. In this case it’s an indication of more US domestic unconventional natural gas EIA estimates than anybody knows what to do with.

We will not have hyperinflation, we won’t even run a remote risk of doing so, for a long time. We will have massive deflation instead. And just maybe after that some sort of inflation will flare up. Hyperinflation, for now, is nowhere on the horizon. And, as we’ve said lots of times, the deflation will be so destructive to every facet of our societies that everyone will feel silly for ever having thought of hyperinflation. And then scramble to find a bite to eat.

August 7, 2013 at 1:23 am #8093pipefit

Participant“We will not have hyperinflation, we won’t even run a remote risk of doing so, for a long time.”

If by ‘long time’ you mean a ‘several months, or maybe a year’, that is a reasonable statement.

Rising interest rates are inflationary, and falling interest rates are deflationary. You can see this plainly in your solid analysis of the shale gas nonsense. They are buying up leases and drilling deep wells, and doing expensive frack jobs because the cost of capital is low. This has brought, and maintained, a glut of ng to the country. We also have a glut of houses and some other things, also attributable low interest rates.

So if you think the recent bounce in interest rates, such as the 10-yr treasury (stockcharts.com symbol $tnx) is temporary, and that interest rates will resume their 30 year path to ever lower levels, then I’d say your ‘deflation’ call is consistent with that thought.

But the fed is talking ‘tapering’, which would, if it were to happen, push rates up even faster then their current robust upward trajectory. My guess is that they will do only a token amount of ‘tapering’, and that interest rates will continue higher.

The USA dollar has been running basically even with the comatose Euro for almost two years. That gives one a good sense as to how weak it really is.

August 7, 2013 at 5:35 pm #8094davefairtex

Participantpipefit –

Rising rates do not cause monetary inflation – that is, rising rates don’t result in more money being created. Its the opposite. Thought experiment: are you more likely, or less likely, to borrow money if rates move from 4% to 8%, assuming your wages remain stable? Answer: less likely, since that money is more expensive, while your ability to pay does not rise. Less money created through lending = less inflation. That’s why when Volker raised rates to 20% it killed inflation. Nobody borrowing = inflation crushed.

Now then, you may be suggesting that rising rates are an indication of inflation. That I’d be more likely to agree with. The higher rates don’t cause inflation, but they might be reflecting increasing inflation expectations. Kind of like a fever doesn’t cause a viral infection – its just a symptom.

These days, however, I think rising rates are simply an artifact of an unwinding carry trade that ends up with foreign central banks selling their treasury holdings, thus causing the long rates to rise. That, and a rising equity market means money flees bonds for stocks. Lastly, it also could be front-running expectation of Fed tapering. Perhaps more importantly, nobody could actually call a 10 year rate of 2.6% as actually indicating inflation. Take a gander sometime at historical 10 year rates and you’ll see what I mean. [For some reason I can’t insert it inline; it’s in the attached PNG]

Anyone seeing actual hyperinflation right now is not looking at a broad cross-section of data. My sense: its an exercise in wishful thinking. “My models suggest hyperinflation must be occurring, therefore, I’ll select data that backs up my storyline.” Also known as the Texas Sharpshooter Fallacy.

https://en.wikipedia.org/wiki/Texas_sharpshooter_fallacy

A GAAP deficit won’t cause hyperinflation any more than me writing you a check for a billion dollars will end up injecting a billion dollars into the economy.

Another way of putting that: Wimpy’s promise (GAAP deficit) to buy you a hamburger Tuesday does not actually create an increase in demand for hamburgers today (hyperinflation). For that, we have to wait until Tuesday rolls around and even then, Wimpy must make good on his promise. Its the “making good” that causes inflation, rather than the promise.

August 7, 2013 at 6:36 pm #8095gurusid

ParticipantHi Ilargi,

The shale industry has from the start been based on huge, and hugely exaggerated, reserve estimates. This is not an innocent mistake, it’s part of an enormous speculative landgrab. The profits on buying and selling land have been mind-boggling. But now the best land has been traded to the greater fools, and it’s time for profits from actual production. Which turns out to be so far below the initial estimates that even a wealthy corporation like Shell has started to write down its worst assets, for which it realizes there is no greater fool available anymore; Shell itself is the greatest fool.

In the nineteen eighties the oil market was deliberately flooded with North Sea and Alaskan oil and gas to lower prices after the rise in the late seventies. In 1985-6 there was a sharpe drop in price:

This had the effect of economically bankrupting the then Soviet energy industry and the Union itself as much of the money from oil went to pay for grain imports.It is ironic that in the current situation the US has flooded its own market based economy with tales of cheap gas that has crashed the price thus hastening the inevitable energy decline due not least to the waste of fuel not ‘profitable’ to bring to market. That and a lack of proper management and foresight of a declining resource and we all know what that will lead to:

…The fall of the Soviet Union, wrote Gaidar in a 2007 paper, “should serve as a lesson to those who construct policy based on the assumption that oil prices will remain perpetually high.”

Engineer, blogger and author Dmitry Orlov would mostly second that conclusion. He experienced the collapse first hand and attributes much of the chaos to peak oil.

“The Communist regime was so corrupt and stealing as much as they could that they didn’t pay attention to the system. It was on autopilot,” said Orlov in a recent talk.

……But in the mid-1980s, Soviet oil production topped off at 12 million barrels a day due to poor management, old technology and lack of investment. And then oil production started to drop. As oil fields ran dry, the authorities spent more cash to coax more petroleum from aging reservoirs with massive water flooding programs.

But these technological fixes didn’t put much of a dent in the nation’s oil depletion rates.

…

Just before Soviet oil production peaked in 1988 (the event walked hand in hand with a major drop in oil prices), the empire realized that it no longer had enough black gold to pay its bills.

History may not repeat, but it certainly rhymes… the US could become it own Greater Fool – its certainly on ‘auto-pilot’.

Of course similar events won’t stop the Haliburton’s of this world from making huge profits, after all the current ideology is growth at any cost (with side dishes of energy independence) even in the face of a Reality that says otherwise; its no wonder that idealogical driven politicians (US, UK etc) lap this stuff up:

“The only thing greater than profit is ideology, and the only thing greater than ideology is profiting from ideology.”

L,

Sid.August 7, 2013 at 7:04 pm #8096Ken Barrows

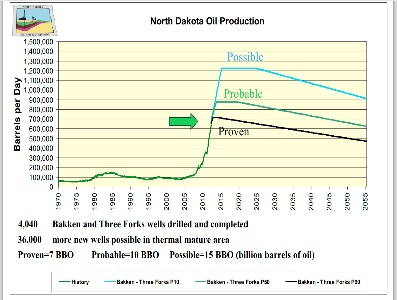

ParticipantBakken May 2013 statistics: 109 additional wells month over month, about 540,000 barrels more month over month. At least $8,000,000 per well. Indeed, the math does not suggest nothing but blue skies (872 million/540,000).

August 7, 2013 at 8:01 pm #8097gurusid

ParticipantHI Ken,

Bakken May 2013 statistics: 109 additional wells month over month, about 540,000 barrels more month over month. At least $8,000,000 per well. Indeed, the math does not suggest nothing but blue skies (872 million/540,000).

=$1614.81 per barrel. (???)

Todays Price (7/Aug/13):

WTI Crude Oil

$105.30Brent Crude Oil

$108.18They will need to produce a lot more at zero further investment cost to bring that price down given depletion rates of 40% – do you have cumulative produced volume against current total investment?

From the ‘Energy & Environmental Research Center (EERC)’:

Oil Recovery Well Per Well

On an individual well basis, ultimate recovery from North Dakota wells range from 500,000 to 900,000 bbl per well, compared to 100,000 to 400,000 bbl per well in the Elm Coulee Field of Montana. Improved hydraulic fracturing technology including more fracturing stages have become significant contributors to improved production. In addition, the productive reservoir section on the North Dakota side of the Williston Basin is thicker and more widely distributed, typical of an unconventional resource play. If the predictions prove to be accurate and are repeatable over a wide area, the Bakken would likely be the most prolific onshore oil play in the United States.

Recoverable does not mean ‘profitable’… :ohmy:

From ‘Oil and Gas Investments’:

Bakken Oil Production: Can the Giant Oil Formation Reach 1 Million Barrels a Day?by Keith Schaefer on December 28, 2012

“…derailed only if oil prices fell a lot”. Luckily that will never ever ever happen… :unsure:

L,

Sid.August 7, 2013 at 11:20 pm #8098Ken Barrows

ParticipantGurusid,

I only offer you a table:

https://www.dmr.nd.gov/oilgas/stats/historicalbakkenoilstats.pdf

I may be underestimating the denominator a bit. However, the calculation of additional barrels/additional cost is multiples of what the oil price is today. We’ll see what future datapoints hold.

August 8, 2013 at 5:52 am #8099gurusid

ParticipantHi Ken,

Its more likely to be $8-16 capital per bbl over the life time given the 500,000 to 900,000 bbls per well quoted above… given ongoing maitenace adn transport costs they reckon cost price comes in at about $90.

Again from ‘Oil and Gas Investments’:

That’s a huge upfront cost. Each well produces approximately 615,000 barrels of oil, meaning the breakeven price for each Bakken well ends up in the $70-$90/barrel range, once taxes, royalties, and expenses are included. If oil prices slump below that level, a lot of people say Bakken wells aren’t worth the cost.

As the wells in the Bakken grow closer together, initial production rates are sliding. According to some sets of data, average first year well output climbed steadily from 2005 to a peak in mid-2010, then declined almost 25% over the following 12 months.

With more wells tapping into the same resources, there is simply less oil pressure available to each well. And when initial well output starts to fall, an accelerating number of new wells must be brought online to sustain overall production volumes.

Energy independence yeah – for a day maybe… 😆

L,

Sid.August 8, 2013 at 7:53 am #8100sumac.carol

ParticipantI’m wondering if the gas flaring is similar to the depression-era farmers dumping their milk in the ditches. I’m also wondering how bad it is for the energy companies to be taking these write-downs – if they can claim losses for tax purposes, does this preclude the possibility of the companies going back to fracking at some point when the price is right? (I’m no fan of fracking, just wondering about this scenario.)

August 8, 2013 at 2:23 pm #8102Raúl Ilargi Meijer

KeymasterI’m wondering if the gas flaring is similar to the depression-era farmers dumping their milk in the ditches.

The milk was ditched primarily because people had no money to pay for it. Gas is flared because there is no infrastructure to bring it to where it can be sold, and building one is not cost effective.

I’m also wondering how bad it is for the energy companies to be taking these write-downs – if they can claim losses for tax purposes, does this preclude the possibility of the companies going back to fracking at some point when the price is right?

The assets Shell is ditching now don’t seem to have any future relevance, or they’d hang on to them. The ones they can gamble on having potential, they do hang on to. And of course they write everything off in “masterful” ways, so the hurt is limited. Big Oil looks more and more like a casino: losing 26% of your output makes you take on risks. They increasingly function like the banks that have the same status they do: too big to fail. Some gambles fail in spectacular fashion, but what choice does Shell have but everything on red?

The Bakken depletion rates point to one thing only really: a short lived bubble. Once it fails as a viable venture, it can’t just be restarted at the flick of a switch, it’s too complex.

As for Shell, just this week, it obtained permission for – more – Arctic drilling, another big wager. They’ll try to get their hands on what they can.

August 8, 2013 at 8:13 pm #8103pipefit

Participantdave said, “A GAAP deficit won’t cause hyperinflation any more than me writing you a check for a billion dollars will end up injecting a billion dollars into the economy.”

True, this is precisely why Ponzi schemes are so successful. Only a fraction of ‘customers’ ask for their money at one time. Right up to the moment of default, people actually believe their investment is safe. You are looking around and seeing that Social Security, Medicare, VA beneficiaries, Fed. Govt. retired workers, etc. are all getting the benefits to which they are legally entitled. The buying power of their benefit checks is dropping at about 9% per year, according to shadowstats.com, but this is perceived as manageable.

But the unfunded liabilities are well over $150 trillion, an order of magnitude bigger than the economy. Time is not on the deflation side. It has been 6 1/2 years since the credit bust started in early 2007, and the fed’s balance sheet has tripled, the budget deficit has soared, the unfunded liabilities are increasing parabolic in fashion, and consumer prices are rising 9%/yr, using the measuring techniques used pre-1980.

The country is getting old and sicker, and the GAAP deficit will become the ‘cash’ deficit over time. Eventually, they will have two choices. They can print money to pay these benefits–hyperinflation, or they can rescind them-deflation. As you well know, the latter will not happen under the current system of govt., representative democracy.

The decision to eliminate benefits, if it happens, will be post military coup. And the complete failure of the even the guise of democracy will be accompanied by the failure of the dollar. So hyperinflation will either be the method of default on obligations, or will precede it.

August 8, 2013 at 9:13 pm #8104Golden Oxen

Participant@Reply Pipefit

Pretty much the way I see things Pipefit. I do think however that when the inflation picks up enough to be noticeable to the masses, but before the hyper sets in, we will see a national sales tax of some sort which will shore up government finances for a brief period and delay the hyper for a while. The stock market orgy that will most likely result from the onslaught of the inflation will likely add to the government coffers as well, witness the internet madness a while back and what it did to tax receipts while it lasted.

Of course a deflationary bust cannot be ruled out as an accident, perhaps brought about by a bond market collapse. The resulting reflation moves, if that were to occur however, would make the current fiat madness seem like a friendly grandmother’s penny poker game.

However it plays out it would appear that gold and silver will come into their own as the Frankenstein monster of fiat money finally dies.

August 8, 2013 at 11:21 pm #8105Ken Barrows

Participantgurusid,

$90/marginal barrel of oil seems pretty close to me. I just cannot wrap my head around $1B capital in new wells per month with about 1M more barrels produced. Seems that $90 figure is going to shoot up or future data will point in another direction.

August 9, 2013 at 2:41 am #8107gurusid

ParticipantHI Ken,

Yeah, to paraphrase a theme used here recently, its like they bought the worst horse in the glue factory and are now trying to make it look like a thoroughbred – and when the young lad by the side of the road points out that its legs aren’t moving and its on wheels, they’ll creatively “write everything off in “masterful” ways, so the hurt is limited” as Ilargi pointed out above.

Welcome to the new normal as they say… :dry:

L,

Sid.August 9, 2013 at 5:06 am #8109pipefit

Participant@dave-you said, “That’s why when Volker raised rates to 20% it killed inflation. Nobody borrowing = inflation crushed.”

A couple of points. First, the fed can’t raise rates by a thousand basis points, like Volker did. In fact, they cannot even raise rates by 25 basis points (1/4 of one percent) without first shrinking their balance sheet by half a trillion dollars!!!

We’re not talking ‘tapering’ here. We’re not talking a halt to bond buying (QE). We’re talking a halt, followed immediately by the sale of a half trillion in current fed holdings. see https://www.hussmanfunds.com/wmc/wmc130617.htm

Secondly, most new money now-a-days is created by government entities, not private banks. For example, almost all of the mortgage market is now in govt. hands, and they are not concerned about making a profit. They have an entirely different agenda.

August 9, 2013 at 5:28 am #8110Professorlocknload

Participant“However it plays out it would appear that gold and silver will come into their own as the Frankenstein monster of fiat money finally dies.”

Yeah, GO, I would imagine a pre-65 quarter will most likely always buy a gallon of gas 😉

Matter of fact, in real terms (Ag), gas is cheap today. Guess the Fed can’t print oil, but it sure as hell can print it’s price, at least until no one will take anything for a gallon, except a silver quarter.

At that point, Ag will have survived another Central Bank and it’s government.

On the politics of it all, the Neo-Bolsheviks are probably in some planning sessions about now, on how to sweep Capital Hill in the event of a collapse of the Funny Buck.

Outta the frying pan and into the fire.

But, not hard to figure out how these survived. https://www.hostzone.com/TsarNicholasIIGoldCoins/

August 9, 2013 at 12:31 pm #8112Raúl Ilargi Meijer

Keymaster• Rising interest rates equal rising inflation does not apply in a situation where the velocity of money is as low as it is today. What the present velocity reflects is that people have no spending power, and if they don’t spend, inflation cannot rise. Higher interest rates will further shrink spending, not grow it. They will also shrink the small recent increase in borrowing.

• As a further indication of how silly the inflation equals rising prices (cost of living) model is, Abe wants to raise taxes. If you see overall cost of living as determining inflation levels, all a government needs to do to fight deflation is raise taxes. Inflation too high? Lower taxes. In Holland this week official inflation numbers went up allegedly due to a new law that raises home rents. Somewhere down the line it should become obvious that this kind of “modeling” doesn’t yield relevant numbers.

You can’t add tax-induced price movements (including sales taxes) to your model, because it would mean it’s dead simple for any government to end either inflation or deflation, and that is nonsense. Just ask Japan. If rising taxes would really influence inflation numbers, Japan could have raised taxes 20 years ago, and never had deflation. The reason this doesn’t work is velocity of money. Which, like in Japan, is already very low in the US.

• Of the $1 quadrillion+ in derivatives out there, at least half are interest rate swaps. Rising interest rates will cause massive deleveraging in the field. If the derivatives behemoth did not exist, a rising inflation story would at least make some more sense. Then again, without the derivatives behemoth, there’s little reason to assume we would have the financial crisis we have right now. And that renders the story moot to begin with.

August 9, 2013 at 9:35 pm #8117pipefit

Participant” The reason this [sales tax increase] doesn’t work is velocity of money. Which, like in Japan, is already very low in the US.”

Fair enough. But I think, generally, you are over emphasizing the importance of velocity of money. If you are in the era of cheap, easy to find, oil, one would expect the price of oil and its products to rise and fall with the velocity of money.

But we are now in the post-cheap oil era. All that is left to explore for, and produce, is expensive, marginal oil, like the Bakken. The velocity of money could go to zero, but nobody is going to sell oil for less than $90/bbl for very long. If they do, they will be broke, or they’ll have an Arab-Spring situation at their door.

If you were correct about velocity of money, the oil companies would be saying, “OMG, look at the velocity of money, it’s falling through the floorboards, we better not drill any marginal oil and gas plays!!!”

The price of oil is set by the marginal barrel. With each passing year, a larger and larger percent of the world’s oil falls into the high cost (> $90/bbl) to find, produce, and refine). Within a decade, that will be the new normal, and the marginal barrel will be at $150, the new price.

There could be a nasty depression, with declining demand. But that won’t bring back low cost oil. Most of it has already been produced and consumed. So time is working very much against the ‘deflation’ outcome.

August 10, 2013 at 1:47 am #8118davefairtex

Participantpipefit –

So just to be clear, you acknowledge that we don’t have hyperinflation now, regardless of the trillion in printed money annually (most of which camps out in Excess Reserves anyway).

And you understand that 10 year rates rising 100 basis points (from 1.6% to 2.6%) aren’t indicators of hyperinflation, and you also realize that rates rising from 1.6% to 2.6% don’t actually cause hyperinflation.

Furthermore, you understand clearly that we can avoid hyperinflation later if we simply default on our unaffordable promises prior to having to make good on them.

And for my part I understand that if we don’t default on our unaffordable promises, and if we simply print vast sums of money to make good on them (maybe even 7 trillion per year) at some point down the road, then that is when we’ll get hyperinflation. And that point might well be 10 years from now.

Does that pretty well sum it up?

One more thing. Price increases are not the same as monetary inflation. You appear to be conflating them in your posts. We might have an environment where we have higher oil prices, but monetary deflation. Talk about a killer outcome.

If overall money and credit decline, that’s monetary deflation. If at the same time the middle east decides to stop pumping oil and prices triple, the price of oil goes up (and so do all related products), but that is NOT monetary inflation. In this example, less money exists at the same time oil prices rise – but those price increases are not due to monetary inflation.

That’s why CPI is not a valid indicator of monetary inflation. The CPI measures the cost of living, but it doesn’t address the underlying reasons

WHY the cost is rising. And if we were to put our Fed hats on, and raise short term interest rates in order to stifle “inflation” at a time when price increases are solely based on oil shortages rather than an increasing money supply – it would just be lunacy.August 10, 2013 at 10:52 am #8119Professorlocknload

ParticipantMight be the “velocity” spoken of here is picking up just a tad, in the West at least 😉

https://thehousingbubbleblog.com/?p=7889

Don’t list a property here and get in the shower. It’ll be sold before you soap down!

August 10, 2013 at 4:13 pm #8120gurusid

ParticipantHi Ilargi,

Of the $1 quadrillion+ in derivatives out there, at least half are interest rate swaps. Rising interest rates will cause massive deleveraging in the field.

Which is probably the real reason the the new Bank of England Governor is linking the interest rate rises to when unemployment levels fall below 7% – clever man – he knows that ain’t gonna happen (2 million being taken off the sick benefit – where are they gonna find work?) – so interest will perpetually remain at effective zero rate for the foreseeable future… :huh:

Meanwhile house prices leap ever upwards, and the gov’t moots plans to cancel the mortgage support scheme before it even starts (in 2014). :silly:

Now what was that analogy of something very fast meeting something very big and solid?… :dry:

L,

Sid.August 10, 2013 at 11:24 pm #8121Professorlocknload

Participant“when price increases are solely based on oil shortages”

Beg to differ. Nominal price increases are based on currency devaluation at present. Again, a silver quarter still purchases a gallon of gas. Commodity for commodity.

Same silver quarter buys 18 fake quarters.

Debasement of the currency is the core cause of nominal oil price increases, not shortages.

Sure, too much funny money can cause shortages by falsely pricing things, but I don’t see that as the case quite yet. And as long as oil is openly traded, it will compensate. Not like in realms where it is “price controlled” which always creates bottle necks.

It’s coming though, when velocity turns on a dime with a mass rush out of the depreciating paper (as now seems to be taking place in cash flowing into Western US RE markets).

Central banks and their governments have no other choice but to “devalue” their obligations.

Unless one can show me a major nations currency destroyed by hyper deflation in history, short of it’s resultant inflationary “solution.”

August 10, 2013 at 11:34 pm #8122Professorlocknload

ParticipantTo add; The dollar is credit. It is no longer backed by things real. Why would I want to hold a “Federal Reserve Note” Bearer Bond IOU in an inflationary, let alone deflationary crisis?

Why would the “promise to pay” factor be any different for a “credit dollar” than it would be on a defaulted bond which backs it? Promise to pay in what, pray tell?

A note is a note is a note.

August 11, 2013 at 4:20 am #8123Nassim

Participantgurusid,

The website you referred to https://johnnyvoid.wordpress.com/ makes interesting reading. Another world.

The headline of the site contains the phrase “narking off the state since 2005”. A check in the dictionary for the meaning of narking does not reveal the probable meaning. Is “sponging” the correct meaning?

If it is, it looks like things are going to become incredibly unpleasant once sterling falls by the wayside.

August 11, 2013 at 6:05 am #8124gurusid

ParticipantHi Nassim,

No, it means 1. being p***ed off about something, or 2. reporting bad behaviour i.e. ‘telling on someone’ – its a slang word. See: urban dictionary here.

As for thinngs getting unpleasant, they already are incredibly unpleasant for many people in these sceptered isles, its just not reported in msm. Large parts of the country have been struggling with basics since the eighties and the loss of the industrial base. The number of people turning to food banks since the start of the school holidays is alarming:

Trust running country’s largest network says some branches have had double the number of requests for emergency parcels since start of school holidays

Not long now before all hell breaks lose and they start detaining people in ‘work camps’ – “arbeit macht frei” n’est pas?

There has never been a better time for a ‘Citizens income’ – but the behaviour of the elite will never allow it – its too compasionate and fair… :dry:

L,

Sid.Admin- is it just all my machines or has the ‘boardcode’ stopped working??? I’m having to type in the smilies 🙁

August 11, 2013 at 6:45 am #8125Nassim

ParticipantThe trouble with a “citizen’s income” is that there seems to be nothing to stop people being multiple citizens and they have no idea who lives in the country and who is entitled to be there in the first place.

I suspect it would be a fantastic magnet for people from poorer countries.

August 11, 2013 at 11:32 am #8126davefairtex

ParticipantProfessor-

You missed my collection of “ifs” that preceded the statement about oil. I’m not claiming that today’s price rises are solely due to oil. I was making a hypothetical statement that said IF such a situation were to arise: IF monetary inflation wasn’t happening and then IF oil prices tripled and then IF the Fed used the skyrocketing CPI as their guide to raising interest rates in an attempt to quell “inflation” it would be severely misguided.

It would be like giving antibiotics to a man with a fever caused by a viral infection. It wouldn’t address the source of the problem, and might even cause harm.

Today, monetary inflation exists, but is relatively mild, especially compared to historical values. I can show you data that backs this up, if you are interested.

And your statement that an original silver quarter minted in 1963 still buys a gallon of gas AND that somehow proves that monetary inflation is happening today is just silly and unworthy of your usual level of insight. I will grant you that monetary inflation caused the devaluation from 1963-2008. That’s easy to see in the data. But then it stopped because our debt bubble popped. In the US, monetary inflation/debasement is debt driven, pure and simple. No debt increase = no monetary inflation.

And now oil’s price moves are due primarily to production expense (that marginal barrel cost) and other Peak Cheap Oil issues as well as perceptions of political risk in the ME.

And your statement that “nothing backs the dollar” is simply silly as well. Its a popular thing to say in the goldbug community and its often repeated, but that’s not the same as it being correct. The dollar is backed by all the assets that exist in the US that are in private hands. As long as a foreigner, armed with an FRN, can use it to buy stuff in the US that people might want, the dollar has solid backing. Once that is no longer true, then yes, the dollar will become completely unbacked. And that’s when it is time to panic.

August 11, 2013 at 6:04 pm #8127gurusid

ParticipantHi Nassim,

Not sure of your logic:

“I suspect it would be a fantastic magnet for people from poorer countries. “

Who by default would not be ‘citizens’. If it was rolled out globally in every country, perhaps they would have more incentive to stay put and improve their lives and their own locality where they are. After all, all the ‘citizens income’ guarantees is the ability to able to afford to live – a fair share of ‘wealth’.

One of the recurring ideas that crops up in alternative economics circles is the citizen’s income. In a nutshell, it’s a universal and unconditional payment made to every adult in the country, every month. This provides everyone with a ‘guaranteed minimum income’, which is an alternative name for it.

We have it in a form in the UK already, through child benefit payments. A full scale citizens income would include adults too, with different rates for different stages of life. Everyone would receive it, and it would replace child benefit, state pensions, unemployment benefits and a host of other tax credits.

Reactions to this idea generally divide in two. The first group is ‘brilliant – free money from the government’. The second comes from those who think about it a moment longer and realise that it would be funded through taxes. Then they ask why you’d want to give benefits to rich people as well as poor people.

A fair question, but there is some sensible thinking behind the idea of the citizens income that makes it more than the national pocket-money scheme it appears at first glance. It’s also one of those ideas that has been advocated by politicians and economists from right across the spectrum. It’s been a recurring policy in the Green Party, but free-marketer Milton Friedman was a fan too. Martin Luther King called for it. So did Napoleon. It was discussed by the Labour Party in Britain in the 50s, and by the Republican Party in the US in the 60s. Bertrand Russell wrote that it allowed society to enjoy the best of anarchism and socialism at the same time, as part of a largely forgotten libertarian socialism movement. There aren’t many ideas that can cross these sorts of ideological boundaries so freely, and when you find one it’s well worth investigating it a little further.

Also:

An example of a ‘mini-basic income’ is the Permanent Fund Dividend which in an annual individual payout to Alaskans. Though the payout is relatively small and only annually distributed, it still goes to show that this kind of program is being used today: https://pfd.alaska.gov

Research from Namibia revealed that the introduction of a Basic Income Guarantee (BIG) led to an increase in economic activity which contradicts critics’ claims that the BIG will lead to laziness and dependency. Learn more about it here: https://bignam.org

Namibia had amazing results in a number of other things as well, namely poverty reduction, which is a pivotal point in and of itself, and a reduction in crime rate by 40%. Now, imagine what a global basic income guarantee could do.

But like I said it won;t happen – its too fair and compassionate for ‘psychopaths’:

From the Guardian

‘If the middle are being squeezed, the poor are being starved’

Look beyond the headline figures at the values underpinning housing policy and its impact on tenants

(bold added)

The psychopaths in control have no concern other than for themselves:

psy·cho·path

/ˈsīkəˌpaTH/

Noun

A person suffering from chronic mental disorder with abnormal or violent social behavior.

Synonyms

psychoSo are you feeling squeezed or starving? :dry:

L,

Sid.August 11, 2013 at 6:06 pm #8128Golden Oxen

ParticipantProfessorlocknload post=7857 wrote: To add; The dollar is credit. It is no longer backed by things real. Why would I want to hold a “Federal Reserve Note” Bearer Bond IOU in an inflationary, let alone deflationary crisis?

Why would the “promise to pay” factor be any different for a “credit dollar” than it would be on a defaulted bond which backs it? Promise to pay in what, pray tell?

A note is a note is a note.

And Promises by governments are meant to be broken, broken, broken.

August 12, 2013 at 2:55 am #8129Nassim

Participantgurusid,

I think this article is pretty close to my thinking on the matter:

What is the point of having countries if the locals don’t have protection from invasion by the poorer 6 billion of the world? In the USA, they are turning these invaders into “citizens”.

I daresay the UK, as usual, will try to catch up with big brother. 🙂

August 12, 2013 at 5:57 am #8130gurusid

ParticipantHi Nassim,

I’m sorry I just don’t get the point you are trying to make. I was talking about a fair an equitable distribution of ‘wealth’ that has been proven to stabilise unstable societies as it is well documented that inequality destroys social order quicker than a despot on crack. People tend to emigrate mostly when desperate and for economic reasons – they cannot afford to live where they are. Besides aren’t you in Oz? Were you born there? :unsure:

L,

Sid.August 12, 2013 at 6:10 am #8131Nassim

ParticipantHi Sid,

Do you think our move to Australia is unrelated to the UK opting to let everyone in?

I suggest you take a look at “Planet of Slums”

https://www.amazon.com/Planet-Slums-Mike-Davis/dp/1844671607

I don’t quite see how undermining the working classes of the UK – by allowing massive imports of cheap labour – is a source of stability. Stability at a much lower quality of life perhaps – and with a much smaller middle class.

August 12, 2013 at 4:06 pm #8133gurusid

Participant???

Yes I know all about that and have commented upon it before. Immigration legal or otherwise is a ruse by TPTB to grow the ‘economy’ through population growth by trying to avoid the demographic shift of ‘developed’ industrial economies. Cameron’s recent visit to India was almost an open invite. Its the ‘growth at any cost’ + slave labour (by flooding the market and slashing wage cost) mentality. But I was not talking about immigration (which you seem to think is a bad thing despite being an emigre yourself???)

My ‘argument’ for a global citizens income/living wage would IMHO reverse this trend and help sustainable development around the world as has been shown in the examples and would also take pressure off population growth – a main driver of mass migration – by giving women equal access to a share of the worlds wealth. But this won’t happen with the current psychos in charge who are fixated upon accumulating ever more for themselves.

We really need to install a ‘new operating system’ before this defunct and decrepit old one boots us all off the planet, rich and poor alike. While a citizens income is no panacea, it offers the potential to stabilise the velocity of money, and also enable smaller more dynamic communities especially if accompanied by land reform. We need to ‘garden’ the earth and restore the environment using tools such as Allen Savory’s holistic land management and the teachings of Robert Hart, Masanobu Fukuoka and Sepp Holzer. With a mass return to the land in an equitable way we might just stand a chance… BAU and we stand no chance at all.:dry:

L,

Sid.August 12, 2013 at 8:38 pm #8136davefairtex

ParticipantOk, this is totally off topic, but I just poked around my charts and noticed … deflation in the eurozone continues. Of course, being this is TAE, a chart showing deflation can’t possibly ever be off topic, now can it?

-

AuthorPosts

- You must be logged in to reply to this topic.

Sorry, the comment form is closed at this time.