Smart Choices for the Coming Bust – Part 2

Home › Forums › The Automatic Earth Forum › Smart Choices for the Coming Bust – Part 2

- This topic has 22 replies, 9 voices, and was last updated 10 years, 11 months ago by

Professorlocknload.

-

AuthorPosts

-

January 5, 2014 at 1:32 pm #10255

Raúl Ilargi Meijer

KeymasterWilliam Gedney Cornett family, Kentucky. Boy covered in dirt smoking cigarette 1964 Here’s part 2 (actually it’s part 1, I inadvertently mixed them up

[See the full post at: Smart Choices for the Coming Bust – Part 2]January 5, 2014 at 10:46 pm #10263Professorlocknload

ParticipantUsing the opening image as a guide, might be a few tobacco plants could be in order, out behind the barn.

January 6, 2014 at 6:08 pm #10274Raleigh

ParticipantAnd make sure to turn off your idiot box:

“Increasingly the news that has the most impact is the news satirizing the news. In many ways the Comedy Channel has become the most respected news channel, offering a hard hitting take or a parody of a parody.

Saturday Night Live’s take-offs get as much attention as the events and personalities they satirize. Attitude seems to trump information in a culture with a “context of no context.” No wonder so many young people laugh at the news. Mockumentaries may be making more money than documentaries.

And now, even big budget movies compete with characters that make fun of a news media than many feel deserves it, Hilarious and punchy films like Anchorman and Anchorman 2 lampoon news practices in a way that resonates with audiences. In the end of his latest send up on the news, fictional news anchor. “Ron Burgundy“ gets his highest ratings when he denounces his own newscast on the air and then walks off the set.”

‘Happy News Year’: Looking Beyond Top Stories to Examine Our News System

January 6, 2014 at 6:15 pm #10275Raleigh

ParticipantThe Global 1%: Exposing the Transnational Ruling Class

“Even deeper inside the 1 percent of wealthy elites is what David Rothkopf calls the superclass. David Rothkopf, former managing director of Kissinger Associates and deputy undersecretary of commerce for international trade policies, published his book Superclass: the Global Power Elite and the World They Are Making, in 2008.[xxxii] According to Rothkopf, the superclass constitutes approximately 0.0001 percent of the world’s population, comprised of 6,000 to 7,000 people—some say 6,660. They are the Davos-attending, Gulfstream/private jet–flying, money-incrusted, megacorporation-interlocked, policy-building elites of the world, people at the absolute peak of the global power pyramid. They are 94 percent male, predominantly white, and mostly from North America and Europe. These are the people setting the agendas at the Trilateral Commission, Bilderberg Group, G-8, G-20, NATO, the World Bank, and the World Trade Organization. They are from the highest levels of finance capital, transnational corporations, the government, the military, the academy, nongovernmental organizations, spiritual leaders, and other shadow elites. Shadow elites include, for instance, the deep politics of national security organizations in connection with international drug cartels, who extract 8,000 tons of opium from US war zones annually, then launder $500 billion through transnational banks, half of which are US-based.[xxxiii]

Rothkoft’s understanding of the superclass is one based on influence and power. Although there are over 1,000 billionaires in the world, not all are necessarily part of the superclass in terms of influencing global policies. Yet these 1,000 billionaires have twice as much wealth as the 2.5 billion least wealthy people, and they are fully aware of the vast inequalities in the world. The billionaires and the global 1 percent are similar to colonial plantation owners. They know they are a small minority with vast resources and power, yet they must continually worry about the unruly exploited masses rising in rebellion. As a result of these class insecurities, the superclass works hard to protect this structure of concentrated wealth. Protection of capital is the prime reason that NATO countries now account for 85 percent of the world’s defense spending, with the US spending more on military than the rest of the world combined.[xxxiv] Fears of inequality rebellions and other forms of unrest motivate NATO’s global agenda in the war on terror.”

Good article.

January 6, 2014 at 9:21 pm #10276Professorlocknload

ParticipantIt’s always been about influence and power. Everyone, this site included, has something to sell. Human nature, no? The art of finding ways to get over on others, or at least get by at others expense. The politics of power, envy and greed.

Even at local levels, pecking orders are soon established and the group falls into line behind their Alpha Dogs. I sometimes think more than half the people demand oppression, or at least regimentation.

Consent gives them comfort. Cave dwellers seem to prefer close walls. Too much “space” leaves them feeling vulnerable.

Man is a pack animal. Dinner with two wolves and a sheep?

January 6, 2014 at 10:26 pm #10277Cory

ParticipantA question for Stoneleigh

A long time lurker/anonymous poster on TAE – I was a typical homeowner in a suburban setting with a mortgage (we met at one of your talks years ago but I doubt you remember me). Not wanting to suffer a 90% drop in home prices, I sold in late 2008, and started renting, thinking I could sit back, watching prices and rents drop precipitously.

Since then, prices in my area have not dropped but RISEN 30%. Moreover, my rent did not lower but was raised three times such that I now pay more than I did when I first purchased 2004. I fear that I will be getting another rent increase this summer, and if that happens, I will have to move my family out of the area (rentals are very hard to come by).

I wont belabor you all the details of my life, but lets say that unless we see price drops soon, my family life will go from bad to worse. Thus, I have to ask, do you still see massive price drops coming so as to vindicate my decision to sell and rent waiting out the 80-90% collapse for the past 6 years? I assume the answer is yes, but please reassure me this is the case as I truly am at the end of my rope here!

Regards – Cory

January 6, 2014 at 10:51 pm #10278Professorlocknload

Participant@Cory,

Please excuse my butting in, however, no one…NO ONE! knows what the future holds. It may sound cold, but, Hedge Accordingly.No one is coming to save us. We must rely on ourselves.

January 8, 2014 at 12:19 pm #10290boilingfrog

ParticipantOnce again, the “timing” issue. It has cost me, as well. No one expected the lengths to which they have gone (e.g. QE), but now it’s pretty clear that there are no limits. I have switched to viewing it like a melting polar ice cap – we’ll see steady melting, occasionally a big berg will calve off, and then back to the steady melt. Everyday a struggle to find balance between that inevitability/eventuality, and “today”.

January 8, 2014 at 1:06 pm #10291Viscount St. Albans

ParticipantForget Robert Prechter.

Martin Armstrong has been right all along. And he writes better.January 8, 2014 at 1:07 pm #10292Viscount St. Albans

ParticipantThe market has rocket fuel behind it, and it has nothing to do with the economy. Never has been. It has to do with moveable assets in a time of crisis. Marty lays it out better than anyone.

January 8, 2014 at 1:11 pm #10293Viscount St. Albans

ParticipantGo back to 2009. Align Prechter and Armstrong. Both argued for years of virulent deflation and dollar strength. Prechter went all in on stock collapse call because of deflation. Armstrong said just a vigorously that the equity market would see new highs because of deflation. Armstrong also called the market highs and subsequent collapse in Gold and Silver. The man understands.

January 8, 2014 at 4:10 pm #10294Nicole Foss

ModeratorWe are still gong to see that enormous fall. This is not going to play out as a slow squeeze when the final limit is reached. The complacency we see is simply characteristic of a top. It means people have gone back to sleep again and that in itself is a dangerous indicator. The market does not have rocket fuel behind it for the future. QE provided for asset bubbles for a while, but that is almost over now, and the market cannot hold up without it. The housing ‘recovery’ has been an illusion as well. It wouldn’t have happened without the taxpayers being on the hook for all the risk. We are at a very precarious point, perched on the edge of a precipice, but fewer and fewer people see the risk. Extreme complacency, a desire to throw caution to the wind and the insiders selling everything that isn’t nailed down are not signs of health and future prosperity. They are signs of a top, from which the only way is down.

January 8, 2014 at 5:01 pm #10300ted

ParticipantI too have missed out on money in the stock market….I have taken everything out….if it was still in the market how would I feel? Not very confident, being that I could not use it for another 35 years and projecting out there I think the world will be a different place by then. I think 4 years from now the world will be a different place! You have to be patient and go with the fundamentals and if you do that you know the markets are screwed up. The only real uncertainty is how the humans and governments will react. I should become a therapist there will be a lot of people losing their minds or on an optimistic note maybe finding their minds! Ted

January 8, 2014 at 6:04 pm #10301FrankRichards

ParticipantNicole,

With all respect, from someone who has been reading you since TOD, I am becoming sincerely skeptical of an actual, identifiable, macro crunch.

I’m watching peak oil play out month by month. We’ve been on the plateau for six years now, with no silver bullet in sight. Cornucopians, zero. But, a few silver BBs, some ductape, and some conservation, no collapse either. Catastrophists, also zero, since I don’t see how to award a tiny fraction.

Honestly, I lost serious respect for Ilargi when he claimed that Peak Oil has not happened because we have reached a non-catastrophic equilibrium based on demand destruction rather than supply increase. England _could_ have survived peak firewood without coal. The template was in place. It sucked, but peak firewood happened and coal was plan B that happened to come through.

Many have compared the current economic situation to the Gilded Age, and I won’t object at all. An interesting observation is there was not a catastrophe, although things came very close several times. I won’t speak for the red states, but up here in the northeast and the great lakes there is more social fabric left than many people think.

January 8, 2014 at 6:39 pm #10304Nicole Foss

ModeratorSkepticism about a crunch is at its greatest in the final run up to one. The economic foundations have been crumbling for a long time, and at some point they will give way, as will the belief in repayment that is all that sustains the value of financial assets. Social fabric is already very strained in many places where relentless tightening has become the norm. Other places are moving in that direction, being nickeled-and-dimed to death even before a crunch hits. This wears people down over time, leaving them with less capacity to deal with a sharp fall when it comes. It is profoundly sad.

January 8, 2014 at 8:20 pm #10306Raúl Ilargi Meijer

KeymasterHonestly, I lost serious respect for Ilargi when he claimed that Peak Oil has not happened because we have reached a non-catastrophic equilibrium based on demand destruction rather than supply increase.

Really, I said that? In those exact words, or is it paraphrased? Non-catastrophic equilibrium? I wonder. What year was that?

January 8, 2014 at 8:46 pm #10308Raúl Ilargi Meijer

KeymasterAs for that crunch, being skeptical of a crunch is what we do, all the time, day after day after day. But all I see is a crunch that grows in size day by day, because people let themselves get fooled into thinking that not only can debt be paid off with more debt, but that they will actually profit from this being executed in their name, and with their money. Look, the S&P breaks another record! Well, you certainly earned that look, because you’re paying for it.

If people still think we were wrong, and are wrong, about that crunch, let’s talk, but they need something better to bring to the table than S&P records or home prices. Because we can’t have that conversation without looking at debt levels. And I think that’s where the turning point still is, whether in conversations or in real life. You think things are looking up? Okidoke, so what happened to the debt that caused the 2007/8 crisis? Well, personal debt went down a tad (foreclosures), though plastic is all the rage again, bank debt (by far the largest) has been hidden behind a too big to fail wall, and federal debt is on its way out of the ballpark, going going but by no means gone.

But hey, everything seems normal right? Well, unless you’re in Greece, or Italy, or Spain, or Detroit, or you’re in that fast growing American army that just lost your foodstamps and your unemployment benefits. So maybe things seem normal for you because they no longer do for other people? If it looks like what it was before, that must be real, right?, that couldn’t be an temporary illusion bought with debt, like getting a new credit card and use it to pay the mortgage and the kids’ school fees and dentist bills till it’s maxed out after a few weeks or months? How many people do you think went routes just like that? And where are they now?

Does anyone think that the debt pays off itself? And even if you do, please note that it hasn’t so far: it’s only grown. How do you think that will end? How could it possibly end?

January 8, 2014 at 9:02 pm #10309FrankRichards

ParticipantObviously it depends where you are. I’ve moved from New Hampshire to Vermont, staying in the upper Connecticut Valley. I can’t speak for the flatlands, but on both sides of the river, and in Maine and upstate New York as well (Old Worlders, that’s a UK sized chunk of land) things are getting readier every year.

More gardens every year, winter farmer’s markets selling potatoes and onions, not jams and jellies, pellets stoves burning pellets from New Hampshire not Georgia.`

And this is up to the the State government level. Even in New Hampshire, where Kelley Ayotte was running for VP on the Koch Brothers ticket, the libertarians and the hippies had a joint ‘come to Jesus’ moment with her and she got the clue.

I expected this 5 years, you didn’t. I now expect 5 more, which, hey Ilargi, I was wrong about, you don’t. If I’m right, my 5 million of my closest friends and I will be ok. No flying cars, but ok.

January 8, 2014 at 9:57 pm #10313FrankRichards

ParticipantIlargi, what kind of archive search is available? I think it was way back on Blogspot, but you got very vehement that it was all about finance and that Peak Oil would not matter for decades if ever. I’m happy to put some research into finding that sentiment.

Meanwhile, without denying that finance is important, arguably even primary, I will get quite vehement that a lot of things would get better for a lot of people if the oil/other primary energy situation was such that 5 years of $100+ Brent would conjure up another 5 million barrels a day of C&C. Which, you may notice, has not happened.

January 8, 2014 at 10:53 pm #10314ted

ParticipantYes but isn’t all the shale oil being funded by quantitative easing. You take away the FED and how do you finance drilling dry holes before you find a wet one? There would be no Baakan and Eagle Ford…The only thing I wonder about is the actions of humans….it has been said that the FED won’t put the money in the hands of the middle class and I think they might if the Barbarians are at the gate. I think we will be surprised what they do to save their skin. I don’t count anything out…..Ted

January 9, 2014 at 2:46 pm #10347Raúl Ilargi Meijer

KeymasterIt’s funny, in light of the thread above, that Nicole addresses the same topic today in her “Crash on Demand?” article:

It is our view at TAE that for a time energy limits are not likely to manifest, as lack of money will be the limiting factor in a major financial crisis. At the present time, with modestly increasing energy supply, the delusion of far greater increases to come, and falling demand, energy is already ceasing to be a pressing concern. As liquidity dries up, and demand falls much further as a result of both lack of purchasing power and plummeting economic activity, this will be even more the case.

No respect for Nicole, either, then, Frank?!

But it’s even funnier that our old young friend VK disagrees from the other side of the spectrum:

You can’t write the same things you did in 2008!

“It is our view at TAE that for a time energy limits are not likely to manifest, as lack of money will be the limiting factor in a major financial crisis”

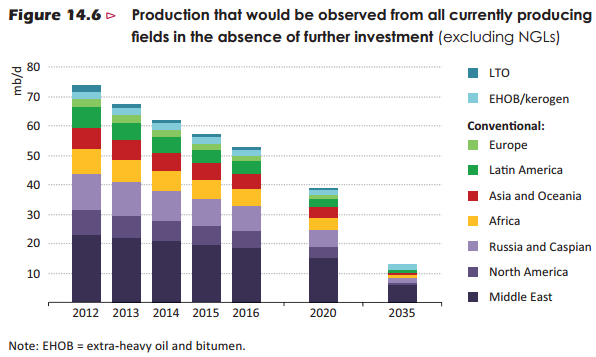

In 6 years we lose 35 Mn bpd without new investments. TAE has to shift from the 2007-2008 mindset.

And to be realistic you have to talk about self defence & guns.

January 9, 2014 at 6:14 pm #10350Cory

ParticipantProflock&load – true, but if anyone does, its Stoneleigh. Just look at not what she writes but the way she writes it. People dont write like this in real life unless they KNOW what they are talking about!

Boiled Frog – agree. Yet, I used to bristle at the TAE posters who asked for timing back in 2008 so it would be hypocritical of me to do that now.

Stoneleigh, thanks for the update. Your words are so reassuring to me that I made the right decision to rent out and wait for the cataclysmic fall before I repurchase a home. In the end, we will be vindicated!

January 10, 2014 at 6:11 pm #10366Professorlocknload

ParticipantA big wild card in the basis for all the latest prognostications is, in the past, deflations took place because real money was involved. Money backed by something of value.

This time around, the dollar is not money, but is the product and property of it’s handler, the government. Unlike real money, it can be revalued, devalued at whim. Impossible in past episodes, short of confiscating the very backer of it as in 1933.

Since there is nothing to confiscate behind the Feds “Bitcurrency” there is nothing with which to price it other than the quantity at which it is being created, or the quantity that is being absorbed by Fed actions.

Sure, some things might drop in price while the necessities might rise, but over all the result will be guided by the owner of the currency to fluctuate between Inflation and disinflation, not deflation.

Deflation is the stuff of Honest Money, which has been driven out of circulation now by dishonest debt currency.

In short, the Greenie has the backing of the “Full Faith and CREDIT of the Federal Reserve,” and the Federal Reserve is backed by the Full Faith and Credit” of the Pentagon.

Used to be, the government had no money, it belonged to the people and was intrusted to the government to do their bidding. Now, the people have no money, it belongs to the government, and they “allow” us to use it.

-

AuthorPosts

- You must be logged in to reply to this topic.

Sorry, the comment form is closed at this time.