Alexander Gardner Lincoln dedicates Gettysburg Monument November 19 1863

The only thing that irks me more than the present US government is the realization that the chances of getting a better one next time around is so close to zero it might as well be frozen solid. And I can’t even vote. I can only imagine what it must feel like to those who can. The entire system has been boxed in so thoroughly it’s a really bad idea to be an American, have an interest in politics, and be claustrophobic, all at the same time. Casting your vote has gone from a right your ancestors died for to an exercise in futility that leaves watching paint miles behind.

All you can really do in America today to match the drive and zest and conviction of those who went before you to ensure that right to vote, which has now been as marginalized as the carrier pigeon, would be passed on to you, is to go out into the streets and shout it out loud. But they’re way ahead of you on that one too: before you can set one foot outside your front door, every single facet of your life that would have led you to express your opinion about what Washington has done to the constitutional rights all those rivers of blood were shed over, will be known in advance.

Not only because you like to play Angry Birds, but it sure helps. There’s something dramatically funny in the fact that Huxley and Orwell described many aspects of our world as it is today a long time ago, and we lack either the brains or the will to admit we’re not anywhere near free. The shackles have gone mental, that’s the only thing that’s changed.

So yes, I can understand that the prevailing mood among Americans is pessimism. The only thing optimistic their leaders and media have to offer, no matter that they do so incessantly and in the same manner detergent is marketed, is stories that can be classified only as science fiction, but without the science.

Economic recovery, a better world, more riches, renewable energy, self-driving cars, smart houses, everlasting progress, robust growth, and a government that is single-mindedly focused on, and admirably dedicated to, protecting you from all evil, especially terrorists, including those who dare set one foot outside their front door to protest the way in which the great legacy of the country’s founders is being squandered to shackle the poor and reinforce the rule of the chosen ones.

225 years after the US Constitution went into effect, we’ve come back to the very same situation that drove the founding fathers, and every soul that fought in their armies, to do battle for the right to have a constitution in the first place (!).

150 years after the bloodiest year of the Civil War that united the States, and included emancipated slaves fighting alongside destitute Irish and Germans, who’s free now? Who feels empowered? Do you really think you’re happier than your great grandparents because they couldn’t go to Wal-Mart to buy plastic doodles? And if you’re not happier, then what has all that blood been shed for? Plastic doodles too?

• Pessimism defines the state of the union (NBC)

As President Barack Obama enters his sixth year in the White House, 68% of Americans say the country is either stagnant or worse off since he took office, according to the latest NBC News/Wall Street Journal poll. Just 31% say the country is better off, and a deep pessimism continues to fuel the public’s mood. Most respondents used words like “divided,” “troubled,” and “deteriorating” to describe the current state of the nation.

On the eve of Tuesday’s State of the Union address, more than six-in-10 Americans believe that the nation is headed in the wrong direction and 70% are dissatisfied with the economy. It’s not just Obama under fire. A whopping 81 percent disapprove of Congress and twice as many Americans now hold negative views about the Republican Party as positive ones.

The NSA using Angry Birds is perhaps not the biggest story of the day, but it has great symbolic value. And no matter what promises Obama and whoever follows him, in his footsteps or not, will make in public, they’ll keep on doing this stuff simply because they can. And they’ll do all of it that they can, all that is technologically possible. And say that if they don’t, everyone else, the Chinese, the Russians, still will. I also love little details like if you switch off your phone, they’l switch it back on for you. I think maybe this will take a big effort from the Anonymous crowd, to enable us to scramble our digital signals beyond recognition. But that will take us supporting them first, and that in turn may turn us into terrorism suspects.

• Angry Bird and Dreamy Smurf Are Watching You

In “Dreamy’s Pen Pals,” a cartoon that first aired in October, 1985, Dreamy is himself the object of surveillance, as Brainy and Clumsy trace his mail, which Papa Smurf has intercepted. The G.C.H.Q.’s Dreamy, in contrast, according to a new report in the Guardian, can “stealthily activate a phone that is apparently turned off,” and accompanies Nosey Smurf (which allows it to turn on an iPhone or Android’s microphone), Tracker Smurf (geolocation), and Paranoid Smurf (which hides the operations).

In the cartoons, Tracker sniffs out truffles; Nosey resembles a caricature of Edward Snowden, causing explosions by failing to heed admonitions about classified information; and there is no Paranoid Smurf—maybe that is just the name for the entire experience, in which spy agencies give you flashbacks to the aqua, saccharine cartoons of your childhood. But screechy animations are not just material for code names. According to the Guardian,

The GCHQ documents set out examples of what information can be extracted from different ad platforms, using perhaps the most popular mobile phone game of all time, Angry Birds—which has reportedly been downloaded more than 1.7bn times—as a case study.

Angry Birds can apparently be used to determine location, as well as a raft of other personal information. (Rovio, the maker of Angry Birds, told the Guardian that it didn’t “have any previous knowledge of this matter.”) The app collection appears to have been a joint project of G.C.H.Q. and the N.S.A. According to the Times, which, along with the Guardian and ProPublica, reported on the documents Monday (they came from Snowden), the agencies “traded recipes” that they used

for grabbing location and planning data when a target uses Google Maps, and for vacuuming up address books, buddy lists, phone logs and the geographic data embedded in photos when someone sends a post to the mobile versions of Facebook, Flickr, LinkedIn, Twitter and other services.

Lost somewhere in the emerging markets field, Russia’s currency too is taking a dive. But since the country has a comfortable trade surplus on account of its energy exports, Putin’s only laughing all the way to the bank. Domestically, a falling Ruble makes little or no difference. However, in 2014 alone, Vlad the President gets 10% more for all of his oil and gas that is sold in dollar denominated contracts. Essentially, western banks and investment funds, by goal-seeking profit, make sure Putin gets much richer, and much more powerful on the international scene. Isn’t life wonderful? And isn’t our free market economic system just working out great? We’re so free, we’ll gladly hand the reins to the Impaler. If there’s a profit in it.

• ‘Mise-Ruble?’ Russia’s currency hits 5-year low (RT)

The ruble has taken a spectacular dive in 2014, so far this year losing about 10%. However, the Central Bank and government think the volatility isn’t a concern, adding that the currency is poised to fall further. On Monday the euro reached a historical high of 47.64, with the dollar close to 35, according to the data from the Central Bank of Russia (CBR).

High volatility has sent the ruble against the euro-dollar basket to lows that were last seen in February 2009. “Since late January 2013 the ruble is off almost 16 percent against the dollar and 17 percent against the euro,” says Chris Weafer, senior partner at Moscow-based consulting firm, Macro Advisoryw, wrote in e-mail to RT. Policymakers and most analysts agree this trend will continue into 2014, as Russia’s Central Bank has reduced regular interventions seeking a free-floating currency by 2015.

The trend of the falling ruble is likely to continue, instead of strengthening, according to Russia’s Economic Development Minister Aleksey Ulyukaev talking to the Davos Economic Forum in Switzerland. The minister cited lackluster economic growth, investor sentiment, and the country’s balance of payments. “There are three main reasons. Foremost – expectations of economic growth; they’ve gone down, which means a lower assessment of all national assets, including a national currency. This is the basic thing,” Interfax quotes Ulyukaev as saying.

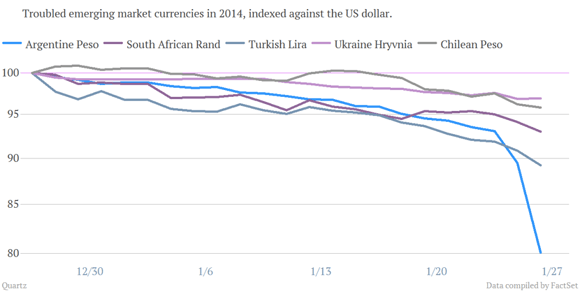

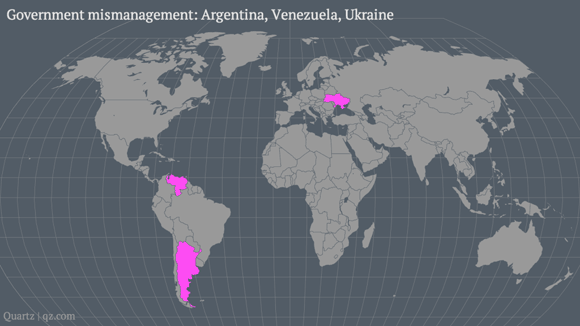

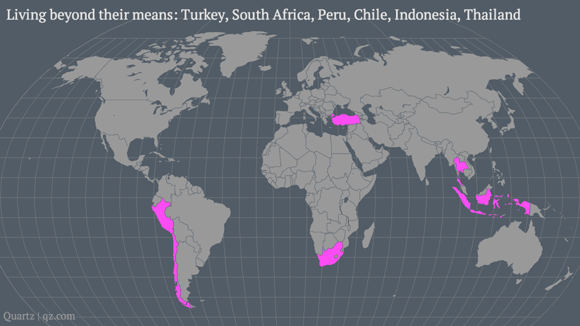

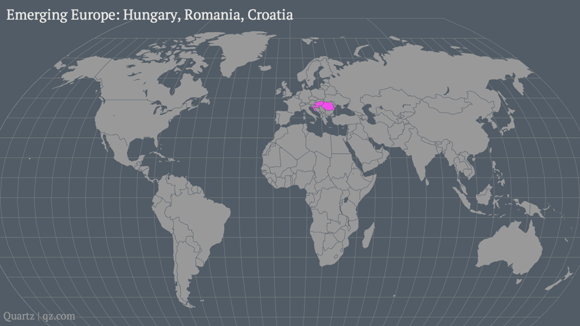

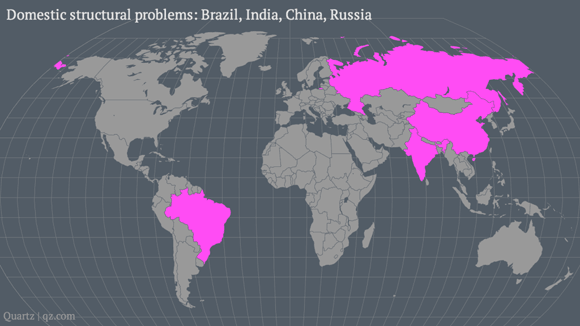

A nice list, with maps(!), from Quartz, of which emerging nations we’re talking about lately exactly. Here goes: Venezuela Argentina Ukraine Hungary Romania Croatia Turkey South Africa Peru Chile Indonesia Thailand Brazil Russia India China. They’re all under pressure for some reason or another, not necessarily the same.

• A global tour of the emerging-markets currency crunch (Qz.com)

The big markets news at the end of last week was the plunge of Argentina’s peso. The sell-off came as many other emerging-market currencies were already sliding:

[..] a smart note from London’s Capital Economics, highlighted by the FT’s Izabella Kaminska, provides a helpful taxonomy of what different emerging economies are going through and, more importantly, whether one country’s problems could prove contagious to others, as happened during the currency crises of the 1990s. We’ve broken it down with the following maps.

In these three countries, trouble comes because of “serial political mismanagement.” Venezuela and Argentina are experiencing massive inflation and troubled relations with the global markets, and absent major changes, are the most likely sites for real trouble. Ukraine, where opposition street protesters have reached a stalemate with the government, is also experiencing real unrest.

These countries have relied on foreign investment and borrowing as investors searched for yield outside developed economies. Now, they are among the most vulnerable to the effects of the Fed taper, and could face years of lowered growth if interest rates start to rise.

These are countries with fragile banking sectors that have been exposed to troubles in the European Union in recent years. Capital Economics mentioned Hungary and Romania, and we would add Croatia to the list as well.

The BRICs aren’t at risk from external factors so much as their own economic institutions, which means they at least have more control of their own fates than some other countries. Whether by opening up sectors run by the state, investing in infrastructure, finding ways to stimulate domestic demand, fighting inflation and corruption or improving financial systems, these countries have the wherewithal to make their way through a troubled global environment—if their policymakers allow it.

This one won’t last, but it’s useful if you wonder why it’s quiet out there today.

• Emerging market rout pauses ahead of Turkey, Fed meetings

Emerging markets steadied after three days of intense selling on Tuesday, as investors waited to see if Turkey, one of the epicenters of the rout, would hike interest rates to defend its battered lira.

Investors have been shaken this week by a huge sell-off in so-called risk assets. They have been hit by jitters about the withdrawal of U.S. monetary stimulus, slowing Chinese growth and country-specific political tensions. The calmer conditions in Asia meant European shares .FTEU3 and periphery euro zone government bonds were able claw back some recent lost ground, but confidence remained brittle. This week’s Federal Reserve meeting also made traders reluctant to place big bets.

But the immediate focus was on whether the central bank of Turkey would bow to market pressure and hike interest rates at an emergency policy meeting later. India surprised markets earlier by doing just that and despite its reluctance to unsettle Turkish voters ahead of this year’s elections, a new Reuters poll showed analysts now expect the central bank to lift rates 225 basis points.

Matt Taibbi outdoes himself in this fantastically gross and snickeringly devastating portrait of Neel Kashkari. He relates how Neel was hurt badly by a Gawker item entitled “Financial Crisis Taking a Toll on Our Favorite Asshole Banker“, so he knows how the Kashkaris will receive his own piece. Must read.

• Bailout Architect Runs For California Governor; World Laughs (Matt Taibbi)

Kashkari was not just a former Goldman banker handed a high government post – he was a former Goldman banker handed a high government post by a former Goldman banker, in this case former Goldman CEO and then-Treasury Secretary Hank Paulson. Neel was also the human parallel to the original TARP proposal written by Paulson, which was famously just three pages long.

Paulson’s TARP proposal was essentially the last, unaired episode of Beavis and Butthead, with the three pages of script just containing a single scene in which Butthead walks into the U.S. Senate and says, “Can you, uh, like, give us 700 billion dollars? Uh-huh-huh.”

Kashkari then was more or less an equally blank slate, a little-known tech banker from Goldman’s San Francisco office who somehow ended up being Paulson’s choice to administer a bailout that Paulson wanted to feature no oversight whatsoever. The original three-page proposal specified no review “by any court of law or any administrative agency.” It never came to that, not exactly – Paulson had to expand his three-page proposal – but it’s worth remembering now that the Treasury’s original plan for the bailout was to give literally unlimited powers to distribute $700 billion of taxpayer money to a low-level banker that prior to 2006, even Hank Paulson had never heard of.

So Kashkari takes the job as bailout czar and starts hurling fistfuls of cash at the banks, in a fashion that turned out later to have been beyond haphazard. Critically, even though the Treasury promised only to give out TARP funds to institutions that were “healthy” and “viable,” Kashkari had no protocol in place to even decide whether a bailout recipient was solvent or not. They forked over billions in cash to failing institutions and then failed to enforce crucial provisions, like for instance measures put in place to prevent executives from bailout-out companies from giving themselves huge bonuses.

Hmm. Deutsche Bank, RBS, who’s next for big losses and bad numbers? Oh wait, these guys are all on the too big to fail list, ain’t they? That means the losses are yours. Until you elect someone who says they’re not. Good luck with that.

• RBS faces £8 billion in full year losses (BBC)

The poisoned legacy of Royal Bank of Scotland’s recklessness and misconduct in the boom years is still wreaking havoc on the giant state-owned bank.

Today it disclosed: £1.9 billion of costs to cover fines and damage claims for mis-selling mortgage bonds in the US, along with other penalties for market manipulation; Another £650 million of losses for mis-selling payment protection insurance; A further £500 million of losses for compensating small businesses who were wrongly sold interest rate hedging products. And it confirmed there will up to £4.5 billion of further losses on bad loans and investments, together with unspecified losses on the accelerated sale of dodgy assets.

In total, this means that RBS is likely to incur losses for the full year of £8 billion. Which is not the biggest losses it has ever disclosed: in 2008 its losses were three times greater. But so long after the great crash of five years ago, such a dreadful performance will shock many. And what will be seen as troubling, this is not the end of the losses. RBS could yet face further big fines and damages claims stemming from alleged manipulation in the foreign exchange market; and it has not yet incurred all possible losses from rigging the LIBOR interest-rate benchmarks.

The British recovery has been entirely borrowed from the British people. Downing Street 10 actively hands out loans that make London unaffordable for all but the 0.1% of people who were born there, but hey, for today numbers look good, so who cares for tomorrow? And who cares for Londoners anyway? The Chinese mob has much more money.

• Global safe haven for property ‘creating ghost towns in London’ (Telegraph)

Mr Ulbrich said he expected the upward price trend in London to continue, though he dismissed concerns that a combination of low interest rates and government schemes such as Help to Buy was creating a UK-wide bubble. However, he warned that demand for multi-million-pound homes had created “ghost towns” in some of the most affluent parts of London.

“What I am concerned about in London is that a lot of high-end residential property is being sold to people who are not using it for themselves – and they’re not even renting it. It’s just vacant because it’s a safe haven for their money. When you walk by our offices in Mayfair in the evening, it’s just a dark and lonely place because there is no life in the street. This is a growing trend.”

Mr Ulbrich said it was difficult to stop this practice as punitive measures such as a tax on vacant properties was unlikely to be an effective deterrent. “It is something local communities have to deal with, because it can develop an area into a wrong direction. “You have countries that put a tax on vacant properties – in Germany they do that. But that wont solve the problem in London because the people who buy a flat in Mayfair for £10m and leave it vacant wont be scared away by a tax of £10,000 or £20,000. It’s not easy to find a solution.”

With US natural gas prices going through the roof and beyond, a lot of bets are due. Hedge funds have a surprisingly hard time profiting from squeezing the last drop out of les miserables, maybe because they’re poised to believe in recovery too.

• Big gains for natural gas fuel big losses for hedge funds (Reuters)

Natural gas was the biggest gainer among commodities last year but the hedge fund that has historically led gains in the space had its first losing year, and many others were down double-digits after being on the wrong side of the market. U.S. gas prices gained more than 26% in 2013, the largest rally in eight years as brutally cold weather boosted gas demand. Prices rose, and toward the end of the year, the market saw wild swings in the spread between the March and April gas contracts.

Investors suspect that natural gas hedge funds lost heavily on spread trades of the March and April contracts, after miscalculating winter and spring gas demand and price action. Prominent funds, from the $1 billion Velite Benchmark Capital in Houston to the smaller Sasco Energy Partners in Connecticut, finished the year down about 20% or more, according to industry sources and performance data obtained by Reuters. “It was a tough year without doubt for most of us. The losses were pretty broad-based,” said Kyle Cooper, managing director of research at Cypress Energy Capital Management in Houston, a small $20 million hedge fund that lost 17%.

Ha! The more people want in, the more the industry is doomed. The losers always step in when it’s too late. Time to get out of Dodge.

• Hedge funds get bigger as returns get smaller (CNN)

Hedge funds just keep getting larger and larger. Too bad their returns aren’t. Money invested in these high-octane investment vehicles surged 17% to a record $2.6 trillion in 2013, according to a report from Hedge Fund Research Inc. But Hedge Fund Research’s Fund Weighted Composite Index posted just a 9.2% gain last year. The S&P 500 surged nearly 30%. So investors could have enjoyed nearly three times the return by simply putting their money in a passively managed exchange-traded fund that mimics that blue chip index.

Hedge funds employ a broad range of sophisticated investment strategies aimed at beating the market without depending on the performance of the broader market. But hedge funds have taken heat in recent years, as high fees and lackluster returns have led some experts to question their value. Even some legendary hedge fund managers couldn’t deliver last year. Bridgewater Associates’ $70 billion All-Weather fund , run by Ray Dalio, fell 3.9% for example.

We had a comment from a Danish reader yesterday asking for our take on Denmark. Arne, here’s take 1.

• Dark lands: the grim truth behind the ‘Scandinavian miracle’ (Guardian)

For the past few years the world has been in thrall to all things Nordic (for which purpose we must of course add Iceland and Finland to the Viking nations of Denmark, Norway and Sweden). “The Sweet Danish Life: Copenhagen: Cool, Creative, Carefree,” simpered National Geographic; “The Nordic Countries: The Next Supermodel”, boomed the Economist; “Copenhagen really is wonderful for so many reasons,” gushed the Guardian.

Whether it is Denmark’s happiness, its restaurants, or TV dramas; Sweden’s gender equality, crime novels and retail giants; Finland’s schools; Norway’s oil wealth and weird songs about foxes; or Iceland’s bounce-back from the financial abyss, we have an insatiable appetite for positive Nordic news stories. After decades dreaming of life among olive trees and vineyards, these days for some reason, we Brits are now projecting our need for the existence of an earthly paradise northwards.

I have contributed to the relentless Tetris shower of print columns on the wonders of Scandinavia myself over the years but now I say: enough! Nu er det nok! Enough with foraging for dinner. Enough with the impractical minimalist interiors. Enough with the envious reports on the abolition of gender-specific pronouns. Enough of the unblinking idolatry of all things knitted, bearded, rye bread-based and licorice-laced. It is time to redress the imbalance, shed a little light Beyond the Wall.

Some things are so simple, just economics and math. But it goes against the grain of thinking that everyone fully deserves their own misery. And their kids too. Are we compassionate people, or are we dog eat dog? It’s cheaper for a community to house their homeless. And care for them. There will always be people who prefer to live on the streets, but why not help those who don’t, and save money in the process? Moreover, here’s thinking that in the same vein you could get at least half the US prison population back out and settled, and you would save untold billions a year.

• Utah Is Ending Homelessness by Giving People Homes (Nation of Change)

In eight years, Utah has quietly reduced homelessness by 74%, and is on track to end homelessness by 2015. How did Utah accomplish this? Simple. Utah solved homelessness by giving people homes.

In 2005, Utah figured out that the annual cost of E.R. visits and jail stays for homeless people was about $16,670 per person, compared to $11,000 to provide each homeless person with an apartment and a social worker. So, the state began giving away apartments, with no strings attached. Each participant in Utah’s Housing First program also gets a caseworker to help them become self-sufficient, but they keep the apartment even if they fail. The program has been so successful that other states are hoping to achieve similar results with programs modeled on Utah’s.

Blue eyes, dark skin, Spain, 7000 years ago. Interesting debate: did white skin only evolve through lack of sunlight, or did agriculture play a part with cereal based diets?

• Ancient European hunter-gatherer had blue eyes, dark skin (CS Monitor)

An ancient European hunter-gatherer man had dark skin and blue eyes, a new genetic analysis has revealed. The analysis of the man, who lived in modern-day Spain only about 7,000 years ago, shows light-skin genes in Europeans evolved much more recently than previously thought.

The findings, which were detailed today (Jan. 26) in the journal Nature, also hint that light skin evolved not to adjust to the lower-light conditions in Europe compared with Africa, but instead to the new diet that emerged after the agricultural revolution, said study co-author Carles Lalueza-Fox, a paleogenomics researcher at Pompeu Fabra University in Spain.

Many scientists have believed that lighter skin gradually arose in Europeans starting around 40,000 years ago, soon after people left tropical Africa for Europe’s higher latitudes. The hunter-gatherer’s dark skin pushes this date forward to only 7,000 years ago, suggesting that at least some humans lived considerably longer than thought in Europe before losing the dark pigmentation that evolved under Africa’s sun. “It was assumed that the lighter skin was something needed in high latitudes, to synthesize vitamin D in places where UV light is lower than in the tropics,” Lalueza-Fox told LiveScience.

Lift your hat to a great man. It doesn’t matter what you think of Pete Seeger, or even if you never heard of him, what a man he was, what a life! There once was Pete Seeger, and now there’s Justin Bieber. Count your blessings, America.

• Pete Seeger, Songwriter and Champion of Folk Music, Dies at 94

Pete Seeger, the singer, folk-song collector and songwriter who spearheaded an American folk revival and spent a long career championing folk music as both a vital heritage and a catalyst for social change, died Monday. He was 94 and lived in Beacon, N.Y. His death was confirmed by his grandson, Kitama Cahill Jackson, who said he died of natural causes at NewYork-Presbyterian Hospital.

Mr. Seeger’s career carried him from singing at labor rallies to the Top 10 to college auditoriums to folk festivals, and from a conviction for contempt of Congress (after defying the House Un-American Activities Committee in the 1950s) to performing on the steps of the Lincoln Memorial at an inaugural concert for Barack Obama.

For Mr. Seeger, folk music and a sense of community were inseparable, and where he saw a community, he saw the possibility of political action. In his hearty tenor, Mr. Seeger, a beanpole of a man who most often played 12-string guitar or five-string banjo, sang topical songs and children’s songs, humorous tunes and earnest anthems, always encouraging listeners to join in. His agenda paralleled the concerns of the American left: He sang for the labor movement in the 1940s and 1950s, for civil rights marches and anti-Vietnam War rallies in the 1960s, and for environmental and antiwar causes in the 1970s and beyond. “We Shall Overcome,” which Mr. Seeger adapted from old spirituals, became a civil rights anthem.

This article addresses just one of the many issues discussed in Nicole Foss’ new video presentation, Facing the Future, co-presented with Laurence Boomert and available from the Automatic Earth Store. Get your copy now, be much better prepared for 2014, and support The Automatic Earth in the process!

Home › Forums › Debt Rattle Jan 28 2014: Squandered Blood and Angry Birds