gurusid

Forum Replies Created

-

AuthorPosts

-

gurusid

ParticipantHi folks,

Update:

Welfare reforms ’cause £19bn hit’

Press AssociationPress Association – Thu, Apr 11, 2013 (Via Yahoo)The Government’s raft of controversial welfare reforms will take almost £19 billion a year out of the UK economy and hit northern England hardest, researchers say.

Residents in the Lancashire resort town of Blackpool will lose out more than anywhere else in Britain when changes to the benefits system kick in, academics at Sheffield Hallam University said.

Former industrial areas including Middlesbrough, Liverpool and Glasgow will also be disproportionately affected. However, wealthier areas, predominantly in the South, such as Cambridge, Surrey and the Cotswolds, will see the smallest financial losses.

Researchers assessed the financial impact of changes made by the Conservative-led coalition to housing benefit – including the so-called bedroom tax on public housing tenants who have unused rooms – disability living allowance, child benefit, tax credits, council tax benefit and several other hand-outs.

Professor Steve Fothergill, from Sheffield Hallam’s Centre for Regional Economic and Social Research, led the study, which was based on a range of official statistics. He said: “A key effect of the welfare reforms will be to widen the gaps in prosperity between the best and worst local economies across Britain. Our figures also show the coalition Government is presiding over national welfare reforms that will impact principally on individuals and communities outside its own political heartlands.”

Generally, the more deprived the local authority, the greater the financial impact, Prof Fothergill found. He said the three regions of northern England – the North West, North East and Yorkshire and Humberside – can expect to lose a total of £5.2 billion a year in benefit income. Much of the south and east of England outside London escapes comparatively lightly.

Researchers calculated the average amount that every working-age adult stands to lose in each region of Britain per year. This average figure allowed them to gauge how much each area would be affected.

Working-age residents in Blackpool will lose an average of £910 each through welfare cuts. Westminster, with its high cost of living, will be the hardest hit London borough. Residents will be £810 out of pocket on average.

However, the Department for Work and Pensions said the reforms will benefit the vast majority of working households. A Government spokesman said: “Around nine out of ten working households will be better off by on average almost £300 a year as a result of changes to the tax and welfare system this month. Raising the personal allowance to £10,000 we will have lifted 2.7m people out of income tax since 2010.

“Our welfare reforms, including reassessing people on incapacity benefit, will help people back into work – which will benefit the economy more than simply abandoning them to claim benefits year after year. These changes are essential to keep the benefits bill sustainable, so that we can continue to support people when they need it most across the UK.”If that’s not deflationary then I don’t know what is. It will be interesting to see how those de-industrialised economies in the north of the UK cope as those benefits acted as a government subsidy to keep the local economies running. These cuts coupled with the abolition of other local industry subsidies such as Yorkshire Forward mean there could be some interesting times ahead up north. The north/south divide could end up as a full blown two-tier economy, a micro version of the EU with parts ot the UK like Greece and Cyprus and others like Germany. Three guesses as to which parts…

L,

Sid.gurusid

ParticipantHi Folks,

Posted these graphics earlier in the back room lifeboat ‘food’ section:

Population has ‘grown’ by over a billion in the last ten years, but even if it remained static, the current population level is unsustainable unless we find another ‘earth’:

These are observed ‘facts’ in nature. Despite our propensity for rapid adaptation and tool use that allows us to exploit our environment to the nth degree, we are still behaving as an insentient and exploitative species, and like all the other ‘exploitative’ species such as yeasts and locusts we seem to recognise only simple behaviours such as growth and consumption. What drives these behaviours apart from the biological imperative to survive? What happens when survival of both the species and the broader ecosystem necessitates a reduction in said population? Social structures have arisen in the past that have ‘culled’ large portions of the population due to religious and political motivations though overall global population has continued to rise. Nature is more effective, with disease and famine. So there are the two horns of a dilemma: let nature take its course, or adapt (as humans are won’t to do) society to radically reduce the population at a global scale?

Growth and de-growth or ‘Décroissance’ (the French have a whole philosophy based upon the mouvements décroissants), it matters little until the population question is recognised and debated openly and intelligently. Despite a third of the worlds population not having any religious belief (maybe they’re ‘economists’ 😆 ) two thirds are influenced strongly by traditions that often have a dim view on effective population control measures such as contraception and women’s education and equal rights, so that’s probably not going to happen. Looks like a return to disease and starvation then… That or some inquisitive aliens:

https://www.youtube.com/watch?v=WfGMYdalClU

L,

Sid.gurusid

ParticipantHi Steve,

In any case, population isn’t “soaring”.

Not sure quite what you mean, I suppose a billion in ten years isn’t soaring… But yes either way nature’s ‘sharp tooth and claw’ in the form of starvation will re-appear shortly:

Regardless of whether it soars or not, the current population level is unsustainable unless we find another ‘earth’:

L,

Sid.gurusid

ParticipantHI Folks,

So was it all a storm in an espresso cup?

(Reuters) –

By Gavin Jones and Naomi O’Leary, ROME | Sat Apr 20, 2013 4:27pm EDTNapolitano elected for second term as Italy president

The Italian parliament on Saturday re-elected 87-year-old President Giorgio Napolitano to serve a second term in an attempt to resolve the political stalemate left by February’s inconclusive election.

As most of parliament cheered his re-election, demonstrators protested outside. By evening the crowd had swelled as thousands of people vented anger at an outcome that was widely seen as perpetuating the grip on the country of a discredited political class and favoring centre-right leader Silvio Berlusconi.

The leader of the anti-establishment 5-Star Movement Beppe Grillo called on “millions” of Italians to protest against Napolitano’s re-election which he called a “coup d’etat.”

However, some are comparing Grillo’s call to Mussollini’s march on Rome in 1922:

Reuters, by Naomi O’Leary; Editing by Jason Webb

…Grillo, who drew hundreds of thousands to a rally in Rome before a February election in which his party of political newcomers claimed one in four votes, declared he was immediately abandoning a campaign in the north of Italy to drive 650 km (410 miles) to the Rome parliament.

“There are decisive moments in the history of a nation,” the former comedian wrote in a blog post titled ‘call to Italians’. “Tonight I will be in front of parliament. I will stay there as long as is necessary. There have to be millions of us.”

Grillo says he is convinced traditional parties he blames for Italy’s economic decline and corruption have already agreed to govern together in a coalition to preserve the status quo.

He described an agreement between leaders of the main center-left, center-right and centrist parties to ask Napolitano to run again to break a political deadlock as a “coup d’etat”.

His words were condemned by mainstream politicians, some of whom said his language and planned protest were reminiscent of wartime dictator Benito Mussolini’s “march on Rome” which marked his rise to power in 1922.

The area around parliament has been blocked off by police barriers and fences since voting began on Thursday, but daily protests have taken place in a square across from the building, with demonstrator heckling deputies as they enter to cast votes.

On Saturday, protesters chanted in favor of the presidential candidate chosen by 5-Star supporters in an online vote, the left-wing academic Stefano Rodota, and held up banners reading “Italy screams for Rodota as president”.Propaganda and spin seek to tell the truth, while the reality is that the industrial model based on cheap energy has run its course (which Grillo is certainly more prepared to face upto), but whoever controls the police controls the state, which currently is the old guard.

L,

Sid.April 18, 2013 at 7:33 pm in reply to: Nicole Foss In Australia: It's No Use Trying To Build A Better Dinosaur #7444gurusid

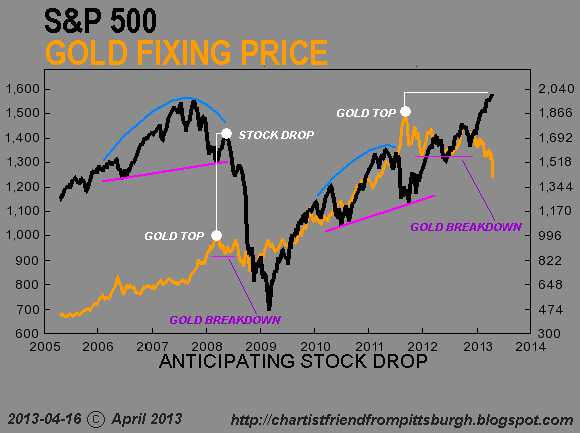

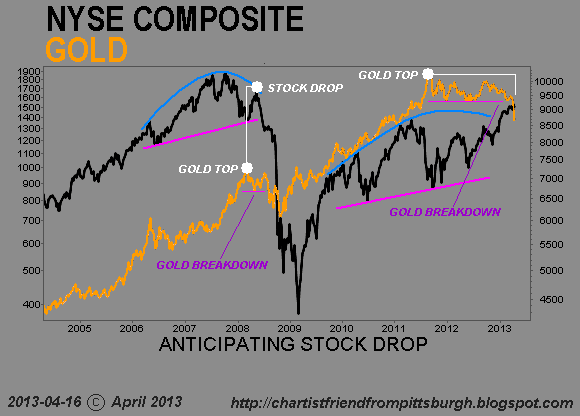

ParticipantHi Chartist,

That sure looks ominous:

&

Hope you don’t mind me showing the charts directly.

Thanks,

L,

Sid.April 18, 2013 at 7:22 pm in reply to: Nicole Foss In Australia: It's No Use Trying To Build A Better Dinosaur #7443gurusid

ParticipantHi Carbon,

The very definition of madness is being outside of the consensus reality of the society that your are [strike]obliged[/strike] forced to participate in. It is very difficult trying to think differently without that psychological conditioning of wanting to conform kicking in. The only way I have found that is remotely useful IMHO, is to consider oneself as an early explorer in new territory. You are marking out new ground and exploring new ways of being. It seems like the hardest thing, but in actual fact it is what humans have done throughout their history. Its only the dumbing down process of mass education (you know being herded into just one age group, controlled with bells and whistles, threats of violence and exclusion, i.e. your average concentration camp experience) that prevents everyone going off and doing their own thing. And it takes energy to swim against the tide; its exhausting. And its why so many people end up compromising in their efforts, and often get quite negative when confronted with the truths that they already know; often the most un-hearing are those who have already heard. They know the score, have felt the pain and exhaustion and just don’t want any more of it. I have seen a lot of this in such movement as the Transitions Towns thing, where people just get burnt out trying to deal with it. They end up instead fighting some more familiar battle to do with a re-assuringly familiar political or environmental agenda, rather than have to radically restructure their own neurons (which is why teenagers are always tired btw – their brains are working overtime – that and your two year old, who is doing much the same thing. Maybe you should join him/her in his/her exploration of their world on their terms – who knows you might actually discover a few things if you can get over the stuckness of your own world view – I bet your toddlers not sleep deprived! – sorry hope that doesn’t sound patronising)). That’s the weird thing about the human brain, it is infinitely reconfigurable, if we let it, and don’t allow other’s opinions of what we’re doing stop us.

Even if the great god TEOTWAWKI doesn’t strike, at least you can say you led an ‘interesting life’… :cheer:

https://www.youtube.com/watch?v=stOoC-Ikx7A

We Shall Not Cease From Exploration – T. S. Eliot (1888-1965) reads the concluding lines of Little Gidding – The fourth and final poem of his Four Quartets:

We shall not cease from exploration

And the end of all our exploring

Will be to arrive where we started

And know the place for the first time.

Through the unknown, unremembered gate

When the last of earth left to discover

Is that which was the beginning;

At the source of the longest river

The voice of the hidden waterfall

And the children in the apple-tree

Not known, because not looked for

But heard, half-heard, in the stillness

Between two waves of the sea.

Quick now, here, now, always —

A condition of complete simplicity

(Costing not less than everything)

And all shall be well and

All manner of thing shall be well

When the tongues of flame are in-folded

Into the crowned knot of fire

And the fire and the rose are one.L,

Sid.April 18, 2013 at 6:53 pm in reply to: Nicole Foss In Australia: It's No Use Trying To Build A Better Dinosaur #7442gurusid

ParticipantHi Folks,

Telegraph, By Andrew Oxlade 12:00PM BST 15 Apr 2013

‘Win win’ for house prices as 1m prepare to buy, say economists

The Ernst & Young Item Club today predicted improvements for the property market, with a million buyers poised to buy.Britain’s property market is a “win-win” scenario in 2013, the influential Ernst & Young Item Club said in its spring forecast today.

It said incomes would edge higher, largely thanks to the rise in the personal tax allowance for most Britons, and predicted that mortgage affordability would improve, with the impact “multiplied” by the Chancellor’s new Help to Buy scheme.

The first phase of the Help to Buy scheme began earlier this month. The Item Club, an independent group of economists, said that with £3.5bn of government funds paying 20pc of the purchase price, the scheme could underpin 100,000 mortgages worth £200,000 each.

The report stated: “We think one million families will move house in the coming year, a sharp increase from the recent level of 800,000, driving higher house prices, additional housing-related spending, and ultimately construction.”

With Help to Buy, those with a 5pc deposit can get an extra 20pc of deposit as a loan from the Government when buying a newbuild home for up to £600,000. The loan is interest free for five years and carries a low rate of interest after that, starting at 1.75pc but rising each year ahead of inflation.

etc.

But in their editorial they question this optimism:

https://www.telegraph.co.uk/finance/comment/telegraph-view/9996408/%5DWin-win-forecast-for-house-prices-may-be-built-on-shaky-foundations.html

It said incomes would edge higher, largely thanks to the rise in the personal tax allowance for most Britons, and predicted that mortgage affordability would continue to improve, pushing up prices.

Home loans are becoming cheaper chiefly because of the Bank of England’s Funding for Lending Scheme, backed by the Government, which is offering £80bn of loans at rates as low of 0.25pc, to banks and building societies. The result has been a fall in mortgage rates, and the Bank is predicting more declines to follow.

…

Rates remain at rock bottom and quantitative easing helps keep mortgage costs pinned down. Demand, therefore, is clearly being supported, by the State if nothing else.On the supply side there are clear constraints. Government forecasts suggest the number of households in England will grow from 21.7m in 2008 to 27.5m in 2033, which implies an average 232,000 homes must be built each year to keep up with demand.

But the most recent figures from the Home Builders Federation show permission was only granted for 45,000 homes in the final quarter of 2012. This was a vast 66pc improvement on a year earlier but the total falls short of a theoretical target of 58,000 required to match projected demand.

Of course, measuring these forces of supply and demand can only ever be theoretical. The notion of a restricted number of places to live on an island nation with an attractive standard of living is compelling for those selling the story of rising house prices.

But history shows the danger of believing the forces of supply and demand can be coordinated into a forecast. In Japan, an island state more densely populated than the UK, the population grew from 123m to 128m between 1990 and 2011 – two decades that saw Japanese house prices plummet.

(Bold in text added)

$200k (australian) mortgage? We got £200 sterling mate! That’s $295,540 (as of 18/4/13) of yer Ozzie dollars! Owzat!

Excuse me if I sound a little mad, but its seems the only suitable response in this current reality. I have a sneaking suspicion that these house prices will be kept high come what may (at least in official statistics) as a way of siphoning off every spare penny (as Illarhghi has pointed out) into the [strike]military-industrial[/strike] housing-government complex (well they got rid of the government-housing complex after all). The delusion and fear of ‘not having your own place’ will trump any affordability issues; these people both young and old, will pay through the nose until they are jobless, penniless and on the streets. And even then they will moan if house prices start to come down… Its more than predatory, its a national psychosis.

L,

Sid.gurusid

ParticipantHi Nassim,

Yes interesting technology. However I think the laws of physics would have something to say about trying to start your car with something as small as your phone battery; you might find you need a large heat-sink to dissipate all the heat generated from trying to effectively short circuit the battery as that is how the battery would see the load of the starter motor. Car batteries have this problem of internal resistance already, and it is one of the reasons for their relatively short life. Its the same problem as found on board the microprocessor chip in your pc and the reason it gets so hot: high current/small space. Then there is the problem of how the battery will work with the rest of the equipment, as it is in effect part of the circuit, here operation of an inverter is adversely affected by the batteries internal characteristics. There have been numerous incidents of laptop and phone batteries catching fire and this is a problem with any small high power battery as in fact they point out:

Other battery experts welcomed the team’s efforts but said it could prove hard to bring the technology to market.

“The challenge is to make a microbattery array that is robust enough and that does not have a single short circuit in the whole array via a process that can be scaled up cheaply,” said Prof Clare Grey from the University of Cambridge’s chemistry department.

University of Oxford’s Prof Peter Edwards – an expert in inorganic chemistry and energy – also expressed doubts.

“This is a very exciting development which demonstrates that high power densities are achievable by such innovations,” he said.

“The challenges are: scaling this up to manufacturing levels; developing a simpler fabrication route; and addressing safety issues.

“I’d want to know if these microbatteries would be more prone to the self-combustion issues that plagued lithium-cobalt oxide batteries which we’ve seen become an issue of concern with Boeing’s Dreamliner jets.”

Prof King acknowledged that safety was an issue due to the fact the current electrolyte was a combustible liquid.

He said that in the test equipment only a microscopic amount of the liquid was used, making the risk of an explosion negligible – but if it were scaled up to large sizes the danger could become “significant”.

However, he added that he soon planned to switch to a safer polymer-based electrolyte to address the issue.

Again it points to there being no panacea for our current energy problems, though that’s not to say that something like this if developed and brought to market wouldn’t be a boon to battery backups – depending upon what they were used for, good ‘ole hyper complexity kicks in right off the bat.

However I am sure it will feature soon in expensive military and high tech gadgets, though it remains to be seen if there will be a commercial market of any description in the near future to bring it to the masses… :unsure:

L,

Sid.gurusid

ParticipantHi Folks,

Going down?:

Gold is headed for its biggest two-day drop in 30 years, as investors continue to sell their holdings in the metal after it entered a bear market. At one point on Monday, the price dropped more than $30 in minutes.

The latest slide came among a wider sell-off in commodities sparked by China reporting weaker than expected growth, raising doubts about the global economy. Slowing growth means inflation looks less of a threat, so can reduce gold’s appeal as a store of wealth when prices are rising.

But the “safe haven” metal had already entered bear market territory last week, loosely defined as a fall of 20pc or more from its peak. On Friday, the spot gold price dropped below $1,500, down from its record intraday high of $1,921.41 in September 2011.

Ole Hansen, Saxo Bank’s head of commodity strategy, said the market was now in “liquidation mode” as people seek to reduce their exposure to the metal, predicting the price could hit $1,300 before finding any kind of support.

“It’s first and foremost this major technical breach we had last week,” he said. “That really killed it off.

…“The Fed has given the signal that there’s a possibility to reduce QE, and that took a lot of trust out of gold,” said Dominic Schnider, an analyst at UBS Wealth Management. “And people recognize that an environment where you have no inflation is a powerful driver to get out of the metal.”

“…an environment where you have no inflation”. Lets see, oh I know ‘negative inflation’? No wait a minute, um, er how about non-flation? Un-flation? Un-inflation? Neg-flation? Dammit, what do you call the whoopi cushion when it goes down, ‘fart-ation?

Kuntsler was all about Gold and ‘bit-coin’ as well today, what he calls Smack Down Time, even the possibility of a conspiracy…. :blink:

L,

Sid.P.S. Got it – Outflation! 😆

gurusid

ParticipantHi Rapier,

I am a bit confused about this boards structure. I am answering in regard to Fed operations.

Yeah its a bit of a pain. If you don’t already know and for others – if you click the ‘reply’ button in the post you want to reply to, then after submitting your post, click the indented or the threaded button in the menu at the top of the page, it should resemble a more logical layout (like this post). Of course if you want to have an in depth discussion on any subject, you can start your own subject by clicking the New topic button. Hope this is of some help,

L,

Sid.gurusid

ParticipantHi William,

Wow he said it (Richard Duncan) “debt deflation death spiral” if credit expansion ceases. (33secs in) Have these guys been reading TAE? Oh, no, he wrote a book called the “New Depression”. Though when they (Peter Schiff) then go on to say that it is the fault of the unemployed people and people employed in non productive ways… you know in things like ‘health care’ you realise they still haven’t got a clue… :whistle:

L,

Sid.gurusid

ParticipantHi Evan,

A similar thing was asked by Oilobserver a while back. Its a difficult subject to broach because it very much depends upon the person asking the question. However there are some generalities that stick out a mile and so are worth extrapolating.

My advice? Get into everything that might be useful in an energy and resource constrained world:

How to grow stuff organically, for instance you can find out how by Wwoofing..

How to treat the sick and injured without recourse to expensive big pharma or high tech hospital gadgets. the Cuban medical system is now one of the most effective in the world, and sends its many doctors to medical crisis all over the world.

Learn how to fix stuff, anything. This is surprisingly easy to do if you have an aptitude for DIY. This is where a course in applied physics would possibly be one of the more useful courses still on offer. But you could probably learn just as much from a local electronics or mechanics group.

Generally things are going to get a lot more constrained with regards to our current (western)energy profligacy. Thus anything to do with energy efficiency and energy conservation is going to be key. Forget about generating more energy, especially with so called renewables; check out Stoneleigh’s Renewable Energy: The Vision and a Dose of Reality and

India Power Outage: The Shape of Things to Come. Things like supplemental systems such as battery backups and small scale local wind/hydro/solar (with battery backups!) will be the biggest growth areas. You need to be like Kelvin Doe, the African teenager who builds power generation plant out of scrap or Malwian William Kamkwamba who educated himself in his local library to build a wind generator.Its going to be this sort of artisan hands on deep knowledge approach as opposed to the current ‘accreditation’ system, which basically certifies that you have done a course at an [strike]education[/strike] dumbing down facility and little else. I am serious here, I personally have spent three stints in supposedly higher ‘education’ two of them at post grad level, and I have noticed the level of so called ‘degree’ inflation, where the quality and depth of study has diminished as the class sizes and fees have risen. Its now been turned into an industry like any other producing disposable goods that have to be upgraded every few years. A true educational experience should have the opposite effect. And that is the key here; to recognise the true meaning of an education. Education as in Educe: 1, bring out or develop from latent or potential existence; elicit. 2 infer; elicit a princliple, number, etc, from data.Origins from middle English from Latin educere educt- ‘lead out’. (from Oxfrod concise dictionary) As in to lead out of darkness.

If your still set on being an entrepreneur, you might want to read Zen and the Art of Motorcycle Maintenace by Robert M. Pirsig. Its more relevant than ever to everything.

On the lines of spirituality, learn to cultivate the higher faculties, especially that of an enquiring mind and the critical thought process. Getting caught up in a cult, religious or otherwise, like most ponzi schemes involves a deadening of the critical thought process. Try to find an exercise to build awareness, whether through yoga or mediation or through a more active ‘art’ such as a traditional kung fu system. That will keep you fit as well. Something like that will also help you learn to get along with others, a skill that will be invaluable especially when dealing with ‘difficult’ people and situations.

Why is this sort of self improvement valuable? Because IMHO ‘work’ (that has any real value or satisfaction) in the future it is going to be about flexibility and adaptability, pretty much as it has always , really. The modern hyper-division and specialisation of labour is going to be one of obstacles going forwards. In fact it already is an obstacle as people made redundant these days often have to retrain to get any other work, so narrowly focused have their abilities become. Rather than focus on a job or a career, focus instead on why you might be here in the first place. Why were you born? What are you really here for? Is it just to collect as many toys and as much money as possible?

Also money will (in all probability) not be all its cracked up to be; we will live much more in a Gift Economy. Thisvideo of Charles Eisenstein says it all really.

So as for a portable profession or business, make yourself as ‘portable’ as possible, then wherever you end up you will be useful.

“We do need a return to individual integrity, self-reliance and old-fashioned gumption. We really do.”

Robert M. Pirsig

L,

Sid.gurusid

ParticipantHi again,

Even ‘bit coin’ has taken a dive:

The bubble bursts on e-currency Bitcoin

By Anne Renaut | AFP – Sat, Apr 13, 2013 07:49 BSTMany saw it coming, but that didn’t stop the Bitcoin bubble from bursting: after rising to dizzying heights, the digital currency suffered its first true crash this week.

The price of the virtual “geek” currency had soared through the stratosphere in recent weeks, trading for a high of $266 on Wednesday — only to come hurtling back to Earth in just three days.

By Friday, a single Bitcoin was worth just $54, according to the Mt. Gox platform, which manages 80 percent of the Bitcoin transactions and had to briefly shut down trading Thursday.

“There was a LOT of short-term speculation happening” from people who wanted to earn a buck from the soaring prices and cash out before the fall, Bitcoin Foundation chief scientist Gavin Andresen told AFP.

“Wild price swings are not good for Bitcoin.”

You don’t say? But it gets better:

Also worrying, the central bank noted, is that the virtual currency has been vulnerable to cyber attacks, including in June 2011, when hackers targeted virtual wallets and wiped some people’s accounts clean.

But that risk has failed to sway many.

For one, Hanke was not entirely convinced by the European Central Bank’s critiques. “If private money starts to become a threat for governments, they come up with many reasons why this is a bad idea,” he said.

And the currency appeared to have at least two high-level champions: the Winklevoss brothers, known in part for accusing Facebook (NasdaqGS: FB – news) founder Mark Zuckerberg of having stolen the idea for the social network from them.

On Thursday, they told The New York Times that they had bought $11 million worth of Bitcoins — that value assessed before the crash — praising it as a mathematical system “free of politics and human error.”

Oh the hubris. But of course, most ‘money’ is in fact little better than hypothetical bit coins… has the Great Financial Whoopi cushion finally started to [strike]deflate[/strike] negatively inflate? :unsure:

L,

Sid.gurusid

ParticipantHi Folks,

‘ello ‘ello ‘ello, what’s all this then?:

Yahoo! Finance UK – Fri, Apr 12, 2013 18:52 BST

After 12 years of boom, gold prices bust

“The scale of the decline has been absolutely breathtaking.”

For the first time in 12 years, the gold price is now officially in decline.“The scale of the decline has been absolutely breathtaking. We tried to rally and that just didn’t get anywhere … there hasn’t been any downside support, it’s like a knife through butter,” Societe Generale analyst Robin Bhar said.

Gold fell below $1,500 an ounce on Friday, a drop of more than 20% from its record 2011 highs, putting it in bear market territory for the first time since 2001.

The metal was heading for a 4.9% decline this week, its third such drop in a row and the biggest since December 2011. It was down some 22% below the record peak hit in September 2011 at $1,920.30.

…

“If Cyprus can break the gold market, then (there are) many reasons to be worried, with Slovenia, Hungary, Portugal, Spain and Italy in line,” Milko Markov, an investment analyst at S.K. Hart Management, said.“It is a make-or-break moment for gold … if the market can’t handle the reallocation and Cyprus, then there is really a need for a bear market.”

Behind the scenes fixing for a new gold buying opportunity for TPTB, or a true sign of [strike]deflationary[/strike] negative inflation forces at work? :huh:

L,

Sid.gurusid

ParticipantHi Folks,

Oh I see, they’ve renamed it:

Negative inflation in Greece from deep recessionInflation in Greece was negative last month for the first time in 45 years. That is because prices are being pushed down by the country’s deep recession. Consumer prices fell by 0.2 percent from March last year. Greece is in its sixth year of recession, hit by austerity policies imposed under a bailout from the European Union and International Monetary Fund which is keeping it from going bankrupt. The government is forecasting the economy will contract by 4.5 percent this year. Data on Tuesday also showed industrial output fell 3.9 percent year-on-year in February after dropping 4.2 percent in the previous month, underscoring the grim state of the Greek economy.

“Negative Inflation” 😆 Anything but ‘deflation’ eh?

L,

Sid.gurusid

ParticipantHi Illarghi,

Throughout the western world it’s been an active collaboration of the governments and the banks and the real estate industry and the builders. For private parties, it’s just a nice one-off windfall (if you’re the boss). But if tax rates remain the same, tripling home prices are such a windfall for any level of government that it’s really worth it to encourage the madness where and whenever you can. It doesn’t get more predictable than that.

Damn right!

Budget 2013: why tens of thousands of homeowners will pay 40pc tax for first time after they die

Tens of thousands more homeowners will be caught in the higher rate tax net because of a sting in the tale of Budget 2013. But, if it’s any comfort, those affected may never know about it because they will begin paying 40pc tax after they die.How so? Because the Treasury papers confirm that the starting point for Inheritance Tax (IHT) is to remain frozen for another five years. So, by 2018 the threshold for this fixed-rate 40pc tax will have been unchanged for a decade.

Bear in mind that many homes which nobody would describe as mansions are worth more than the £325,000 per person nil-rate band for IHT. Plenty of other properties, particularly in the south east, are priced above the point at which couples’ assets become liable; £650,000.

Still more are likely to do so after the Chancellor’s £15.5bn boost to mortgage availability has taken effect. When easier credit increases demand for an asset in fixed supply, the consequences for house prices are as inevitable as they are obvious, which is why builders’ and estate agents’ share prices surged this week.

Add to that:

When a couple bought a London home to raise a family in 1967, they couldn’t have guessed that by the time they hit retirement, the house would be the equivalent of winning the lottery.

Soaring property values have seen the Chelsea townhouse bought for £17,000, rocket to a value of £3 million.

The average house price in the sixties was £4,000, so the home was still expensive at the time it was bought.(average would be for a 2-3bed, this one was 6 bed)

And you can see where that credit hyper expansion went! :silly:

L,

Sid.gurusid

ParticipantHi Illarghi,

Of course the background to all this is in essence a cultural collapse. Dmitri Orlov has categorised five stages of Collapse in a book by the same name; Financial, Commercial, Political, Societal and Cultural. The period since the seventies can be seen as the collapse of an ‘industrial’ culture, through all these stages. The financial mismanagement of such industries as the ‘car’ industry that was partly nationalised in 1975 due to financial and commercial collapse, was then axed politically as the conservatives deemed a nationalised industry as ‘unworkable’. Ideologies aside, the societal and cultural collapse that ensued that manifested as greed and selfishness as ‘societal traits’ matches the definition of ‘Cultural’ collapse put forward by Orlov:

Orlov defines cultural collapse in this way: “Faith in the goodness of humanity is lost. People lose their capacity for ‘kindness, generosity, consideration, affection, honesty, hospitality, compassion, charity.’ Families disband and compete as individuals for scarce resources. The new motto becomes ‘May you die today so that I can die tomorrow’.”

This also matches the description of the “Lonely African” a book by Colin Turnbul that describes the fierce individualism that results from a society forced into hardship.

As for Brands comment in his Thatcher eulogy:

Perhaps he needs to do a little history revision:

George Monbiot

The Guardian, Monday 23 April 2012 20.30 BST:There is one thing you can say for the Holocaust deniers: at least they know what they are denying. In order to sustain the lies they tell, they must engage in strenuous falsification. To dismiss Britain’s colonial atrocities, no such effort is required. Most people appear to be unaware that anything needs to be denied.

The story of benign imperialism, whose overriding purpose was not to seize land, labour and commodities but to teach the natives English, table manners and double-entry book-keeping, is a myth that has been carefully propagated by the rightwing press. But it draws its power from a remarkable national ability to airbrush and disregard our past…

Interrogation under torture was widespread. Many of the men were anally raped, using knives, broken bottles, rifle barrels, snakes and scorpions. A favourite technique was to hold a man upside down, his head in a bucket of water, while sand was rammed into his rectum with a stick. Women were gang-raped by the guards. People were mauled by dogs and electrocuted. The British devised a special tool which they used for first crushing and then ripping off testicles. They used pliers to mutilate women’s breasts. They cut off inmates’ ears and fingers and gouged out their eyes. They dragged people behind Land Rovers until their bodies disintegrated. Men were rolled up in barbed wire and kicked around the compound.

etc.

Of course, the ‘Elite’s’ escapades abroad had been practised at home:

The Land (an occasional magazine about land rights)

Sheep Devour PeopleHowever, as medieval England progressed to modernity, the open field system and the communal pastures came under attack from wealthy landowners who wanted to privatize their use. The first onslaught, during the 14th to 17th centuries, came from landowners who converted arable land over to sheep, with legal support from the Statute of Merton of 1235. Villages were depopulated and several hundred seem to have disappeared. The peasantry responded with a series of ill fated revolts. In the 1381 Peasants’ Revolt, enclosure was an issue, albeit not the main one. In Jack Cade’s rebellion of 1450 land rights were a prominent demand.15 By the time of Kett’s rebellion of 1549 enclosure was a main issue, as it was in the Captain Pouch revolts of 1604-1607 when the terms “leveller” and “digger” appeared, referring to those who levelled the ditches and fences erected by enclosers.16

Here is the ‘modern’ version seen in the Battle of the Bean Fields:

https://www.youtube.com/watch?v=3JCkUZAwvEA

Most people involved lost everything they had, and the following court case against ‘police brutality’ that took years, and which the travellers won, resulted in the small amount of ‘compensation’ awarded going towards court costs. Very ‘British’… :dry:

BTW, the whole ‘New Age Traveller’ movement was based around actually doing something to create an alternative life and livelihood to the rampant de-industrialisation and fiscal capitalism of the day so no surprise it and the ‘Stone Henge’ ‘free’ festival were squashed. :ohmy:

L,

Sid.gurusid

ParticipantHi Ken,

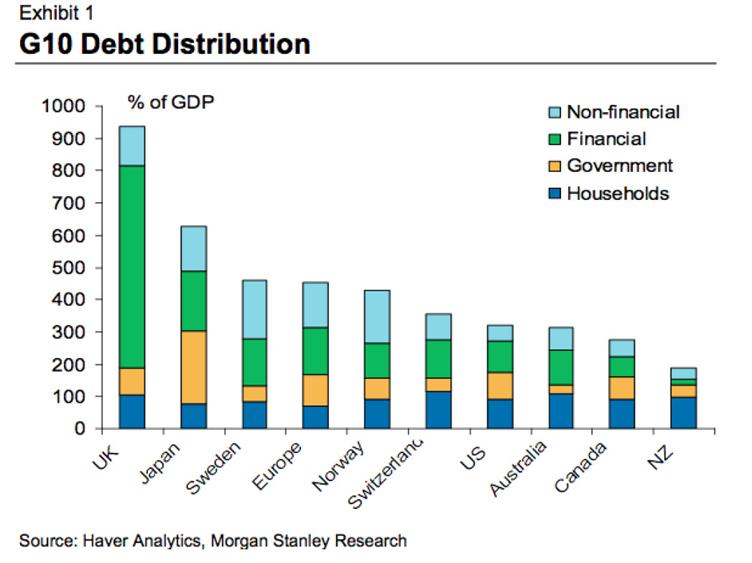

Ah, yes wasn’t sure what you were referring to. I think this is it:

It is a bar chart showing total debt for all sectors and by far the biggest debt at 600% of GDP appears to be ‘financial’ but what that refers to exactly is a bit of a mystery – my guess is it is the various ‘debt instruments’ based in the City of London and the banks, many of which have global investment arms. Our ‘private’ debt – as a % of GDP currently looks comparable to other nations, but when you factor in the fact that the financial services sector accounts for 9#% of that GDP you can get worried, very worried indeed. Especially as the agriculture/industry/services % make-up of the UK is very similar to Cyprus’

UK = GDP by sector agriculture: 0.7%, industry: 21.5%, services: 77.8% (2011 est.)

Cyprus = GDP by sector agriculture 2.3%, industry 16.4%, services 81.2% (2011 est.) (Finance made up about 10% of the ‘service sector’.)Then there is the ‘off balance sheet’ stuff:

Britain risks default unless Government cuts public sector pensions

By Edmund Conway Economics Last updated: June 3rd, 2010…But does this mean Britain is really immune from default? For this one must turn to Carmen Reinhart and Ken Rogoff, who in their opus on financial crises, “This Time Is Different”. They write (emphasis mine):

Why would a government refuse to pay its domestic public debt in full when it can simply inflate the problem away? One answer, of course, is that inflation causes distortions, especially to the banking system and the financial sector. There may be occasions on which, despite the inflation option, the government views repudiation as the lesser, or at least less costly, evil. The potential costs of inflation are especially problematic when the debt is relatively short term or indexed, because the government then has to inflate much more aggressively to achieve a significant real reduction in debt service payments. In other cases, such as in the United States during the Great Depression, default (by abrogation of the gold clause in 1933) was a precondition for reinflating the economy through expansionary fiscal and monetary policy.

Now, tackling the bit in bold: on the one hand, Britain has an extremely long average debt maturity, which helps protect it from the markets. This means that despite running a far smaller deficit this year, Germany is actually issuing more debt than Britain.

But on the other front, Britain is worse-placed. As I’ve written before, I suspect that inflating away Britain’s debt will be far more difficult than some people think – because so many of Britain’s debts are index-linked – in a way that they weren’t before. If you include index-linked gilts (which weren’t around before the 70s), public sector and state pensions and PFI and local government debt, some four fifths of UK debt is linked to inflation.

(Note: Edmund reads Zero Hedge, check out the link at the bottom of article above…)Which brings in one of this sites pet topics ‘inflation’, and in this instance why it could make the situation a lot worse. Pensions themselves are considered a store of wealth, but are in fact a sort of ‘loan to the future ponzi scheme’ (allegedly the money is ‘invested’ to provide a return in the future as opposed to the present, but it rarely happens that way), with ‘interest’ on the loan being paid to the pensioner all the way into the future till the day they die. The thing is the future can be a bit ‘sub-prime’ sometimes… how is the government (in this case, yet alone all those ‘private’ pension funds) going to pay back all those [strike]pension obligations[/strike] loans the future when that future arrives?

But to address your initial point, yes the UK debt wise is probably screwed. Not unlike the rest of the world:

Any way, house prices are set to take off again backed by government guaranteed mortgages (oh so that’s how they get out of paying the pensions?) so all’s well in ol’ Blighty…That should help the Global Debt Clock click a few notches higher!

L,

Sid.gurusid

ParticipantHey Ken,

Don’t get me wrong, I too did not like her one bit. However, as the wise ones say, holding enmity for another is like holding a burning coal, it does you more harm than them. The best way to defeat your demons is to forgive them. And maybe ridicule them: Mrs Bucket, no its pronounced ‘Bouquet’.

Besides, I said she was a ‘patsy’: scapegoat. red herring. person accused of a something as a cover for a bigger more elaborate crime.

She never lost an election dude, and when ‘Labour’ eventually did get back in, their leader was more ‘Thatcherite’ than she was!

There is a lot of myth surrounding debt especially where politics is concerned.

The ‘inconvenient’ truths are that there are historic and systemic forces that shape our lives far beyond that of any individuals control, even those who think they do have some control and influence. We are all about to feel the wrath of those forces, rich or poor, the good the bad and the ugly. How we respond to those events is often going to be down to how we have dealt with our own demons and the automatic responses we are prone to having as conditioned beings. Somehow I think we are all going to find out how little human nature has really changed…

L,

Sid.gurusid

ParticipantHi Folks,

Thatcher was a patsy of history and the neoliberal agenda. She was also very much a product of the cold war, being dubbed the ‘iron lady’ by the Kremlin when she became leader of the opposition Tory party. And lest we forget, the idealogical battle between capitalism and communism was raging in the 1970s. The Vietnam (proxy) war, Baader meinhoff, Red brigade, ETA (proxy terrorists?) etc. The unions ruled the roost in 1970s UK culminating in the 1979 winter of discontent which caused the fall of the Callaghan government.

Rubbish piles up on London street in early ’79.

Public opinion swung enough to let the Tories back in (after the previous conservative Heath Gov’t which in 1974 saw three day weeks due to ‘energy shortages’!). However rampant price increases then called ‘inflation’ were due in part to record high oil prices(!):

This was something that had dogged the 1970s and had caused a lot of the strikes because workers were seeing their earnings eroded and demanded wages keep pace. However the early eighties recession caused mass unemployment, and on the back of it an immediate lessening of union power, you can’t strike if you don’t have a job. Faced with election uncertainty, there was a rearranging of the boundaries in 1983, and this coupled with the victory of the Falklands ‘war’ (war was actually never declared, and it was seen as a ‘territorial dispute’) saw a Tory landslide in 1983. This was the green light to enact the neoliberal deregulation ‘experiment’ -after all, Thatcher was a ‘scientist’, having graduated in chemistry from oxford. That and her ‘iron lady’ will guaranteed her notoriety.It was ironic then that after the Berlin wall fell in 1989, a year later she was ousted from the leadership of the Tory party after an internal party power struggle. She went onto continue representing her constituency until 1992, and still haunted the party conferences into her dotage, outflanking many younger ‘usurpers’.

But the real war during her reign was that of the class war, specifically against the ‘working class’:From the Independent;

Owen Jones, Sunday 16 September 2012Britain’s industrial ruin was unavoidable, Thatcher’s apologists argue. Industry was inefficient and crippled by union bullyboys: Thatcher’s Chancellor Geoffrey Howe told me he “often questioned the suicide note of much of British industry”. But it was sabotage. First, the abolition of exchange controls allowed the City to thrive at the expense of other parts of the economy. Then they allowed the value of the pound to soar, with interest rates hiked to 17 per cent, making borrowing – crucial for manufacturing – prohibitively expensive.

Sir Alan Budd advised the Thatcher government and feared they “never believed for a moment that this was the correct way to bring down inflation”, but rather it was a highly effective means of increasing unemployment, “an extremely desirable way of reducing the strength of the working classes”. Working-class communities were trashed – and, in some cases, never recovered – because of an ideological crusade.

With the ‘Big Bang’ financial de-regulation leaving the UK little more than an ‘offshoring’ fascility for global business, and had led both directly (from lack of regulation) and indirectly (by making money the end all and be all) to the mess we’re in now.

There are many who debate and question whether her influence was as great as others proclaim; having an economic government policy named after you might be more a sign of rising media spin than actual achievement, they don’t call national health strategies ‘Bevanism’.

Nor did she have much ‘political’ opposition, both labour leaders Michael Foot and Neil “turn out the lights” Kinnock lacked the nuances of the new ‘age of spin’.

As for the question of “Did Margaret Thatcher really ‘save’ Britain?”:

Her admirers claim that Margaret Thatcher found a nation on its knees and gave it back its pride and prosperity. But would we have been any worse off if she hadn’t bothered? Andy McSmith investigates

IMHO what she represented was the true middle class little Englander, with her adulation of Churchill, the constant references to ‘Making Britain Great again’, and her loathing of the ‘working class’, despite her feigned aspirations ‘that “they” do better’. She was the Politician for a [strike]declining[/strike] spent empire: keeping up appearances regardless of the consequences was very much her game. She was a naive grocers daughter who got lucky, and was undoubtedly influenced by the American rightwing despite claims the flow of influence was the other way:

“I wasn’t lucky. I deserved it” – Comment on receiving a school prize, aged nine.

“I’ve got a woman’s ability to stick to a job and get on with it when everyone else walks off and leaves it” – Speech, 1975.

– “I stand before you tonight in my green chiffon evening gown, my face softly made up, my fair hair gently waved. The Iron Lady of the Western World? Me? A cold war warrior? Well, yes – if that is how they wish to interpret my defence of values and freedoms fundamental to our way of life” – Speech in 1976 after the Kremlin dubbed her the Iron Lady.

– “I can trust my husband not to fall asleep on a public platform and he usually claps in the right places” – Interview, 1978.

– “Any woman who understands the problems of running a home will be nearer to understanding the problems of running a country” – Election campaign, 1979.

– “If a woman like Eva Peron with no ideals can get that far, think how far I can go with all the ideals that I have” – Interview in 1980.

– “To those waiting with bated breath for that favourite media catchphrase, the U-turn, I have only one thing to say, you turn if you want to. The lady’s not for turning” – Speech at Conservative Party conference, 1980.

– “No one would have remembered the Good Samaritan if he’d only had good intentions. He had money as well” – Television interview, 1980.

– “We knew what we had to do and we went about it and did it. Great Britain is great again” – Comment at end of Falklands conflict.

– “In politics, if you want anything said, ask a man; if you want anything done, ask a woman” – Speech 1982.

– “The battle for women’s rights has been largely won” – Interview, 1982.

– “I owe nothing to women’s lib” – Interview, 1982.

– “Victorian values were the values when our country became great” – TV interview, 1982.

– “I am painted as the greatest little dictator, which is ridiculous – you always take some consultations” – Interview, 1983.

– “Oh, I have got lots of human weaknesses. Who hasn’t?” – Interview, 1983.

– “And what a prize we have to fight for: no less than the chance to banish from our land the dark divisive clouds of Marxist socialism” – Speech to Scottish Tories, 1983.

– “The National Health Service is safe in our hands” – Conservative Party conference, 1983.

– “State socialism is totally alien to the British character” – Interview, 1983.

– “Young people ought not to be idle. It is very bad for them” – Interview, 1984.

– “I love being at the centre of things” – Interview, 1984.

– “This is a man I can do business with” – After her first meeting with Soviet President Mikhail Gorbachev.

“This is a day I was not meant to see” – the Sunday following the Brighton bomb.

– “I think, historically, the term ‘Thatcherism’ will be seen as a compliment” – Speech, 1985.

– “Why, Marks and Spencer of course. Doesn’t everyone?” – When asked where she bought her underwear, 1986.

– “I don’t mind how much my ministers talk, as long as they do what I say” – Interview, 1987.

– “There is no such thing as Society. There are individual men and women, and there are families” – Interview, 1987.

– “I think I have become a bit of an institution – you know the sort of thing people expect to see around the place” – Speech, 1987.

“Had we gone the way of France and got 60% of our electricity from nuclear power, we should not have environmental problems” – Speech, 1988.

– “What’s wrong with British water” – When presented with French Perrier water at a lunch in 1989.

– “We are a grandmother” – On the birth of her grandson, Michael, February, 1989.

– “The Chancellor is unassailable” – Comment about Nigel Lawson only days before he resigned from the Government in 1989.

– “I fight on. I fight to win” – Statement on November 21, 1990, after she was forced into a second ballot in the leadership battle, but she in fact withdrew before it occurred.

– “It’s a funny old world” – Comment after her decision to quit in November 1990, pointing out that she had never lost an election in her life, yet had been forced to stand down.

– “I’m enjoying this” – An interjection in a rumbustious speech she made in the Commons only hours after announcing she would quit.

She only ever appointed a single female cabinet minister, but became the icon for the powerful business woman: if you want it, you have to give up everything else, despite her appearence of the dutiful housewife, she had married into (not for) money, alowing her to pay for the childcare necassary to follow her chosen political career. She also was key in developing what is now called ‘spin’ by employing PR firm Saatchi & Saatchi:

1979 Conservative campaign poster – but oh the ‘irony’, a few years later unemployment was over 3 million.

Keeping up appearences indeed…

https://www.youtube.com/watch?v=RcN8e3wpFH8

What opportunities were lost remain now for historians to debate upon; how we could have rebuilt our infrastructure on the back of the north sea oil and gas boom; how we could have been more influential in the EU – perhaps preventing monetary union; perhaps how we could have been more progressive full stop like some of the Nordic countries have tried, instead of retrenching to some neo-victorian nightmare capitalist freeforall. But maybe thats what happens when empires fail… and greed usurps all ideals. The fact that shortly after she came to power we saw mass rioting in the streets, and that on her death many people celebrated

Loath her or love her, may she rest in peace.

Bye Bye…L,

Sid.gurusid

ParticipantHi Jal,

Nice topic. Looks like Luxembourg might give it up – on the back of pressure from Germany:

From Reuters via yahoo:

Luxembourg says willing to ease banking secrecy – paperBERLIN (Reuters) – Luxembourg is prepared to ease its banking secrecy rules and work more closely with foreign tax authorities, Finance Minister Luc Frieden told a paper, in a comment welcomed by Germany which wants to crack down on tax havens.

Frieden told the Frankfurter Allgemeine Sonntagszeitung there was an international trend towards automatically exchanging information about depositors, adding; “We no longer strictly reject this, in contrast to before.”

“Luxembourg does not rely on clients who want to save tax,” he said.

Last month’s 10 billion euro bailout of Cyprus, whose banking system was swollen by foreign deposits attracted by low taxes and easy regulation, has put the spotlight on tax havens.

Austria and Luxembourg are the only European Union states that do not share with other EU members the identities of EU residents with cross-border bank accounts.

German Finance Minister Wolfgang Schaeuble said he was pleased with the comments from Luxembourg.

“I welcome every step towards automatic information exchange,” he told the Saarbruecker Zeitung newspaper.

Amid growing outrage over the scale of tax evasion, Schaeuble said last week Berlin would push the EU to take legal measures against tax havens. The German government this weekend also urged several German publications to hand over details they have obtained on suspected tax cheats.

(Reporting by Alexandra Hudson; Editing by Jason Webb)

L,

Sid.gurusid

ParticipantHi Evan,

Interesting. You might also like Joseph Tainter:

https://www.youtube.com/watch?v=ddmQhIiVM48Why will taxes always rise? Why is there never enough money for social programs?

One of the big things that occurred in the 1970s when debt really took off was per capita energy use reached a peak in 1977. Also the removal of the US dollar from the gold standard in 1971 has created a truly ‘fiat” currency. Further as the limits to capital(ism) and over production became apparent coupled with the oil crisis, debt and borrowing were seen as ways to continue the myth of eternal economic growth. Its aim was to continue the industrial and technological development. It sounds hard to believe but people genuinely thought that taking out huge loans for such things as infrastructure development (building roads and highways) would work. They had seen how a similar approach, called the Marshal plan had worked in Europe after the WWII. They just did not figure out how compound interest works and the nefarious forces that sought to enslave whole countries to gain access to their resources. Al Bartlett gives a good talk on how the exponential function works:

https://www.youtube.com/watch?v=F-QA2rkpBSYAs for local currencies, such as LETS (Local Exchange and Trading Systems) why not give them a go? Just don’t expect to be able to pay your taxes in them, as Derrick Jenson points out, the men with guns will come looking for you. :dry:

There’s plenty on this site to dig into if you haven’t already, have fun enlightening yourself. :cheer:

L,

Sid.gurusid

ParticipantHi Skip,

Yes, The Automatic Earth has discussed the scarcity of certain items, including some necessities, in the worst of deflation, as factories close due to bankruptcy and lack of credit to start new enterprises. That is a real juggling act. When do you buy that big cast iron wood stove.

This is the problem with both notional and nominal values in that they are psychological speculations. The real value of said stove will be dependant upon many more things such as the availability of wood, the serviceability of the chimney and so forth. May be it would be better to ‘super insulate ones home with the addition of a heat recovery ventilation system? Or maybe just get used to being cold but out of the wind and rain as it always used to be. It starts to come down to the real big issues such as what are real values? What is real worth? What is real wealth? The problem is most people have not been equipped to even begin to think about these things yet alone understand them – its taken me several decades to get past my [strike]education[/strike] dumbing down to really begin to see past all the crap and discover what is of true worth in this human created hell.

This is what I was alluding to when I quoted the alleged North American Indian saying:

It also points to the real problems that Kuntsler and Richard Heinberg discuss of resource depletion across the board. There are a few places left that have reasonably undisturbed resources, but compared to the mess that modern industrial culture has made of the ‘low hanging fruit’ especially of energy resources it is meagre pickings indeed. Ironically some of the richest mineral deposits are now in our landfill sites.

As for things like competitive advantage and import substitution, these have always been economic myths used to hide hegemonic exploitation. Old school went along the lines of: [strike]Rich[/strike] developed country to [strike]poor[/strike] developing country, “You give us your mineral wealth for some cash/loans, and then we’ll give you nice shiny products”, whereas the new school goes along the lines of “you give us nice shiny products made out of your resources and manpower, and we’ll give you lots of our [strike]worthless debt[/strike] currency.”

I await with intrigue to see how Cypriot import substitution is going to work, I guess they could always holiday at home… :unsure:

L,

Sid.gurusid

ParticipantHi Skip,

One complicating factor that further confuses hyper-inflationists is the current dominance of RELATIVE pricing of wealth between countries.

Yes and this points to something i’ve mentioned before and that is currency devaluation, which is again different from inflation. A currency can devalue overnight if faith in it disapears, you don’t have to print loads of it for that to happen. For instance, back in 1992 sterling dropped out of the ERM on ‘black wednesday’ despite panic purchases of sterling to prevent it falling out of the 6% exchange rate range limit of the ERM. It eventually fell by 20%. This is why its key to understand inflation/deflation as currency volume increase/decrease relative to available goods and services. The notional value of the ‘cypriot euro’ – the ones still stuck in the banks – will definitely have a greater risk and hence proportionately lower ‘value’ in terms of trust, and the extra ‘cost’ of that risk for such things as paying for imported stuff (food/fuel) will no doubt go up accordingly. However, the hard copy paper cash on the streets, depending how much there is, might have a higher notional value for a while at least. Of course there could arise some peculiar consequences in this particular economic petridish; with all those euros suddenly turning up – if they make it to the streets – coupled with shortages of certain goods and services you could see some sharp price swings both ways as people seek to offload one set of goods for cash to buy another more desired set of goods, like say food or fuel. A true process of ‘marking to market’ if there ever was one… :blink:

L,

Sid.gurusid

ParticipantHI Skip,

The point of the thread is mainly that this week, this month, undoubtedly this YEAR, people in Cyprus need cash. And we can learn lessons from this painful scenario.

When you lose access to all your cash because your government and banks won’t let you take anything out, then you will do whatever you must to get some cash. Including liquidating gold, even when one truly wants to hold onto it until the total collapse of all fiat currencies. Whenever that is.

Grocery stores in Cyprus may take your gold this week, but at nowhere near the spot price.

Ultimately this points to three critical issues: cash flow, literally having the cash to go about the business of ones life; wealth, in terms of perceived ‘value’ in terms of social status goods and chattels, but mostly ‘monetary’; and fungibility, that is the general exchange-ability of items.

The ‘cash crunch’ coupled with the non-operative banking system is going to cause the whole economy (what’s left of it) to seize up as Zerohedge have pointed out. Wealth is going to be re-assessed in terms of what wealth really means; from access to true power and influence, and the ability to stay alive and in good health via such necessities as eating, something familiar to the developing world, but long forgotten (for about six decades) in the west. And as for being a ‘fun guy’ 😆 , the fungibility of anything in terms of what an items trade value will be worth will depend much less on the spot price of anything, and much more on whether the seller is willing to take said item at all in exchange for say food. Unless at the pointy end of a gun perhaps… :dry:

I expect refugees shortly, and I don’t think they’ll be Syrian:

Refugees in Cyprus Cypriots flee fighting between the island’s Greek and Turkish communities

L,

Sid.gurusid

ParticipantHi Folks,

Alan:: It is in short supply in Cyprus at this moment — or at least it is according to Skip, and I have no trouble believing that, given the crisis there. But it is not in short supply elsewhere. Go down to the bank and withdraw as much as you please. No problem. Provided you’re not in Cyprus.

Actually there is a problem, a big one. In the US for instance, alledgedly if you request any large sum above $5k you will be subject to a SAR (suspicious activity report) to the treasury and over 10k is notified to the IRS. Also depositing cash in largish sums can also arouse suspicion. These measures are to combat the ‘cash economy’ of illegal operations such as drug dealers, though they are not a problem if the transactions legal, it still means TPTB know whose got all the cash… Most ATMs are also automatically limited to small fixed cash amounts per day/week for security purposes. Its a similar in the UK, with limits to cash withdrawals without prior notification. Most large transactions are done by bankers draft.

As for trying to take cash between countries, fuggedaboutit

Maybe that’s why ‘bitcoin’ has become so popular, though watch out for those solar flares. :whistle:

L,

Sid.gurusid

ParticipantHi Folks,

As Dave points out:

I can see this will turn into one of those “internet discussions” I love so much.

As for argument vs. contradiction, here’s Michael Palin and John Cleese:

M.P. “An argument isn’t just contradiction”

J.C. “Can be.”

M.P.“No it can’t. An argument is a collective series of statements to establish a definite proposition.”

J.C. “No it isn’t”.

M.P. “Yes it is, it isn’t just contradiction.”

J.C. “Look if I argue with you I must take up a contrary position”.

M.P. “Well it isn’t just saying ‘no it isn’t.”

J.C. “Yes it is!”

M.P. “Argument is an intellectual process, contradiction is the automatic gainsaying of anything the other person says.”

J.C. “No it isn’t.”

M.P. “Yes it is!”

https://www.youtube.com/watch?v=JkzjBfTDH20

Pretty much sums up most internet forums: Yes you did, no I didn’t, yes it is, no it isn’t, etc. ad nausea. :sick:

L,

Sid.gurusid

ParticipantHi Folks,

Alan said:

(6999)

The headlines clearly state that people want cash.

Yes, of course. They are scared.

They’re desperate for it because it is in short supply.

It is in short supply in Cyprus at this moment, yes. It is obviously not in short supply globally. Cyprus is not the world.

Then writes in the next post:

(7000)

Yes, of course. The same is true of dollars. There’s far more dollars in the electronic system than there is physical dollars. If everyone went to the bank to withdraw their balances in cash, the system could not supply more than a tiny fraction of the demand.Physical cash is better than cash in the electronic system, if you’re a little person (i.e. if holding physical cash is an option for you). I’m all in favor of little people withdrawing their cash from the banks. It is a good idea, at least as an interim measure. All dollars are vulnerable, but physical ones are clearly better than electronic ones.

So is it in ‘short supply’ or not? Maybe its just Unobtainium

Besides, no one should ever be required to do any actual physical work. Our needs should be provided for us with the swipe of a Visa card or the click of a mouse — as a matter of social justice!

That about sums up the whole problem

From a Lebowskian perspective: Monkey fist in the jar dude, monkey fist in the jar. 😆

L,

Sid.gurusid

ParticipantHi Skip,

Great post btw. The problem is people postulate and hypothesise scenarios without understanding the full implications of the Reality that lies behind them, and thus often miss the bigger picture. Also the monkey and the rice jar example mechanism applies as much to the psyche as it does to the body in terms of risk and safety: we keep hold of one set of beliefs thus trapping us in another set of beliefs. From the view over here it looks like Cyprus is a pretty unique case, over 80% of its economy is in the ‘service’ sector, which one would guess given the finance sector apparently accounts for 10%, primarily comes down to ‘tourism’ making up the remaining 70% (+ 25000 ‘ex-pat brits’ along with 40000 Russians), with an unknown small amount down to supporting the local military bases (3000 personnel).

Along with all the other influences from Turks to Greeks not to mention the poor Cypriots themselves, its a real melting pot of cultures. Suffice to say when it comes to collapse, I expect the Russian’s might have prior experience:

Given that debt made up a lot of the ‘money supply’ prior to the crisis, and that that will probably be off the menu for a very long while, all that is left on the island itself will be what ever euros the outside parties such as the UK and the EU physically fly in. But compared to the loss of credit in the Cypriot economy, the over all short term effect is going to be hyper-deflationary. Also illiquidity of many if not all assets is going to be a major problem, as cash in the form of euros and probably increasingly dollars, itself becomes a commodity. Basically the fungibility of any medium of exchange will begin to be tested to the limits, hence the pertinence of Orlov’s quote above – it won’t be what you’ve got (unless Celine Dion cds could become the new local currency 😆 ) but who you know. It remains to be seen how the food situation will pan out as agriculture is only about 2% of GDP, though that could rise as its true value is ‘marked to market’. I reckon it might not be long before emergency food shipments replace emergency cash shipments. As for ‘tourism’, best take a packed lunch… and maybe pack an AK-47. :whistle:

L,

Sid.gurusid

ParticipantHi Jal,

Start somewhere.

Keep a cactus alive

Peyote by any chance?

Perfect example of a once sacred plant used sustainably for thousands of years now being driven to extinction by idiots no doubt out to make a fast buck. :dry:L,

Sid.gurusid

ParticipantHi Folks,

Interesting timing on Russian military exercise:

Putin orders unscheduled Black Sea military exercise

Russian President Vladimir Putin on Thursday ordered unscheduled military exercises involving thousands of troops and dozens of ships in the Black Sea region, the Kremlin said.

The order was presented to Defence Minister Sergei Shoigu in a sealed envelope at 4:00 am (2400 GMT), his spokesman Dmitry Peskov told Russian news agencies, adding the exercises would involve 36 ships and up to 7,000 troops.

Is that loose change or a sabre I hear rattling…

L,

Sid.gurusid

ParticipantHi Glennjef,

Thanks, glad you liked it. If you have any photos of your project it would be great to share them – if you can. I have put a little presentation on google docs which I think people should be able to access:

https://docs.google.com/file/d/0Bx5lxN1pdGX3UTdwNktwNVY0RW8/edit?usp=sharingIt show what can be done in a very urban environment. Also I think its important for many people not to get too ambitious, though I couldn’t grow enough to be anywhere near self sufficient, what I did grow was very nutritious and would have been expensive to buy, such as the garlic. Also making preserves such as chutneys which did last me through the year also saved in money terms. But that is the key here, it not about money in so much as it is about reconnecting with your food supply that which nourishes us an allows us to even think about things like money in the first place! Sorry I know I’m preaching to the converted here, but hopefully if others not so converted read this they might be encouraged to give it a go.

L,

Sid.gurusid

ParticipantHi Folks,

Its all over now:

Spokesman Christos Stylianides told state radio that the charge would be paid as the second largest Greek Cypriot lender is destined to be wound up.

However Russia, which is the source of many large uninsured Cypriot accounts worth up to 20bn euros (£17bn), reacted angrily on Monday to the levy news.

“The stealing of what has already been stolen continues,” Russian Prime Minister Dmitry Medvedev was quoted by news agencies as telling a meeting of government officials.

A spokesman for President Vladimir Putin added that the president has asked the government to restructure a 2.5bn euro (£2.13bn) loan to southern Cyprus.

Russian news agencies quoted Mr Putin’s spokesman, Dmitry Peskov, as saying that the president has instructed the government to work out the terms for restructuring the loan, which was made 2011.

The island’s last-minute deal to secure a 10bn euro (£8.5bn) EU and International Monetary Fund (IMF) approved bailout by eurozone ministers, saved the country from a banking system bankruptcy and eurozone departure.

Key markets across Europe, excluding Italy, reacted positively in midday trading.

The second-largest bank, Popular Bank of Cyprus – known as Laiki – will effectively be shut down and split into a “good bank” and a “bad bank”.

Sub-100,000-euro deposits in Laiki will be safeguarded and transferred to the Bank of Cyprus, the so-called “good bank”, while those above the 100,000-euro limit, which under EU law are not insured, will be frozen and hit with the levy of around 30% to resolve the debt crisis.

The move will yield some 4.2bn euros (£3.6bn) overall – the bulk of the 5.8bn euros (£4.9bn) Cyprus needed to raise as part of the bailout conditions.

etc.

Everything coming up [strike]roses[/strike] olives! Looks like Russia got the boot – 30% ow! …”because I used to love her but its all over now”:

https://www.youtube.com/watch?v=8rI8zV2-DooL,

Sid.gurusid

ParticipantHI Dave,

perhaps your elderly lady could grow a few tomato plants? They’re so easy, and nothing beats a home-grown tomato. I think food engineers have GMOed all the taste out of tomatos these days.

But I digress. And I really don’t mean to trivialize the struggles of someone on a fixed income. I just happen to like home grown tomatoes.

You haven’t digressed at all, you’ve hit the nail on the head. Learn about tomato growing, learn about heirloom varieties, then grow them save the seed, and learn how to preserve the tomatoes via a myriad different techniques from drying to making chutney.

But maybe I digress…

L,

Sid.gurusid

ParticipantHi Skip,

Good post that highlights the real issues. Also,

The reality is they’re coming for you, we just don’t know who THEY are yet.

In the case of Ireland, this guy has had a shot at finding out who some of the banks ‘bond holders’ are:

I suspect similar people to be involved in Cyprus, possibly residing in Russia:

Roman Abramovich, owner of the Chelsea soccer team in England. His fortune is estimated at $14.6 billion. He runs the investment company Evraz through the Cyprus brand Lanebrook

Michael Prochorof, former presidential candidate. His property worth is $13 billion. In 2008 he stated Cyprus as the head office of the company Intergeo Management

Vladimir Lisin is a steel tycoon with a fortune of $15.9 billion, and who has the largest amount of his business in Novolipetsk through the Cypriot company Fletcher Holding

Alexei also Morntasof, also a steel baron, $15.3 billion

Vladimir Potanin, $14.5 billion

Vagkit Alekperof, an oil company owner, $13.5 billion

Suleiman Kerimof, a mining tycoon with a fortune estimated at $6.5 billion

Aliser Ousmanof, an internet businessman and Prime Minister Dimitri Medvedev’s friend with an $18.1 billion

Batourina Elena, wife of the former Moscow Mayor Yury Louskof, whose property worth is $1 billion

Dmitry Rimpolovlef, the biggest shareholder of Cyprus Bank, also the owner of the Monaco football team. His property is more than $9 billionLast year, more than 3,000 Learjets landed and took off from Cyprus, 375 of which were going in Russia and 245 to Great Britain, while 108 went to Ukraine.

Golem also has a similar take on Cyprus’ ‘Nuclear’ option as regards the current crisis:

Cyprus – The ‘nuclear’ option By Golem XIV on March 22, 2013

Either Cypriot members of parliament ignore the will of the Cypriot people or the ECB stops supporting Cypriot banks and they implode. Which would mean either Cyprus leaves the Euro and re-introduces its own currency (which it could do) or it tells its people that ALL their money is now gone.

The problem is the private Cypriot banks spent a great deal of the money deposited in them on buying high yielding Greek bonds/debt which were partially defaulted by Greece with the say-so of the ECB et al. So bear in mind that whatever else Cyprus is guilty of (and there is plenty of guilt to go around) it is NOT a case of a government spending profligately. Cyprus debt to GDP at 87% was lower that the Europe area average of 93%.

…

So does Cyprus have an option? I think they do. A nuclear one.It is true they have no fiscal bullets left. They never really had any. All they ever really had was a little plastic tomahawk they got from Woolies. Even that’s bent now. Even if they decide to let the ECB pull the life support on their banks the EU has said it feels confident no contagion will spread to the rest of Europe. What they mean is financial contagion. The contagion of one defaulted debt, causing another to default causing another. That danger, the EU thinks it has contained. And it may well have.

But Cyprus has one other option – not fiscal but legal.

The nuclear option of Cyprus is to not seize the money in peoples’ accounts but the information about that money. Such as where it came from, if it was criminal or laundered, and if so which banks, businesses and professionals knew about it and helped it on its way. The information which their regulators should have been collecting but never bothered to for the last 15 years. But even so, it is still there. Could still be used.

Cyprus has been laundering money. Its banks and businesses have helped. But so too have the banks and businesses of other countries. To my knowledge there is documentary evidence which implicates at least two huge European banks. A third, a German bank, would, I think, find itself dragged in also. As would dozens if not hundreds of British registered shell companies and the British authorities who do nothing to regulate them, and yet are implicated in four major fraud cases I know of personally.

…The plot thickens.

As regards the problem of:

How do you go about choosing who eats?

More specifically as regards going hungry: