William Rittase Production line at Pioneer Parachute Co., Manchester, CT August 1942

The Financial Times started a series on shadow banking this week, which should be obligatory reading material for everyone who’d like a peek behind the veiled curtain that hides from scrutiny those things financial that would rather not be exposed to daylight, both in the west and – obviously by now – in Asia. Obligatory reading material doesn’t mean everything Financial Times journalists write should be taken for granted, they survey the terrain with the substantial bias that their employer thrives on. Still, that same employer has resources – in more ways than one – that few other sources possess.

Hedge Fund Chiefs And Former Bankers Enter The Shadows

In the six years since the financial crisis, the financial services world has seen all kinds of new institutions take over lending deals and clients that were once the domain of traditional banks. There has also been a parallel transformation: the mutation of bankers into shadow bankers, writes Patrick Jenkins in London. The bosses of many shadow banks – hedge funds, private equity and debt funds, tax-efficient “business development companies” and peer-to-peer lenders – seem increasingly to have been drawn from the upper ranks of the big traditional lenders.

Many bankers have become disillusioned with the old ways of doing things, demotivated by weak market conditions and shrinking ambitions, and frustrated by a mountain of new regulations. The freer world of shadow banking offers welcome liberation. It also presents an opportunity for those with experience in banking because they know where the business opportunities – and the regulatory loopholes – lie. But if the migration of bankers into shadow banking is a clear pattern in western markets, elsewhere it is harder to make such generalisations. Anecdotal evidence in China, one of the biggest – and most concerning – shadow banking markets, suggests a far more eclectic heritage at the helm of big non-bank lenders, a development that adds to the potential risks..

While shadow banking and dark pools and all of their siblings absolutely need to be erased from our own economies if we ever want to make them function in anything remotely resembling a ‘democratic normal’ again, in China the financial and – therefore – political powers lurking in the shadows are at least as dangerous, even if democracy is not the issue there. The reigning Communist Party and PBoC may have expanded their money supply far more than any other nation, including the US and Japan, who themselves have already gone totally insane, but the shadow banks have added much more to that, and the $25 trillion number touted could be a serious underestimation; we just have no way of knowing by how much.

A huge part of both the “official” increase of the money supply and the shadow part, which are far more tightly intertwined than anyone lets on, has been highly leveraged to boot. Over the past 10+ years, the Chinese economy has been a gambling parlor where no-one could lose no matter how crazy their bets became. Problem is, it did get too crazy; there’s so much leveraged debt hidden between local governments and 50 million empty apartments and ‘trust’ companies that not even a ‘normal’ desired low growth of 7% could keep things afloat.

As Beijing wants to enforce the rule that only its own Monopoly money is real, it digs its own downfall; it’s no longer feasible to take out of the economy those building blocks that belong in the shadows, because the entire edifice would crumble. It’s not feasible to leave them in place either, because a large majority of them are made of hot air only. That is Xi and Li’s conundrum in a nutshell. The Communist party saw themselves as architects at a great construction site, but they never bothered to properly check the quality of the bricks and cement that were used. They were far more preoccupied with reaching for the skies and the moon and the stars.

One example of China’s financial madness is of course the closed ports of Qingdao, where investigators and bankers scramble to get a clear(er) picture of which copper, aluminum, iron ore, steel or peanut oil stored inventory belongs to whom, after it was found that the same copper etc. was used as collateral for loans from more than one lender. Therefore, much of what’s stored in the warehouses belongs to several different “owners”, and there’s plenty that doesn’t exist at all except on paper. And there’s no way it’s only Qingdao, the practice became too widespread and too accepted and acceptable, and hence profitable not to have been used all over the country, and often with Communist Party involvement.

Well, that highly irritating loud screeching sound you hear is that of the margin call. Lenders come calling for their money back. And there is no money. What is left is iron ore inventories that have been used to get loans from 3-4-5-10 different lenders, and that just lost 44% of what value they had. Quite a few greedy entrepreneurs are at risk of having their kneecaps redesigned:

China Miners’ Loss Is BHP’s Gain as Iron Prices Slump 44%

Rio Tinto Group and BHP Billiton, two of the world’s biggest iron ore producers, are benefiting as falling iron ore prices pressure smaller rivals in China to shut down. The price of iron ore has plunged 44% from its February 2013 peak on the back of record output. That’s hurting mining companies in China where 20% to 30% of mines have closed, according to the China Metallurgical Mining Enterprise Association. The closures are helping Rio Tinto and BHP which, along with Vale, already control about two thirds of global seaborne supply from their low-cost mines. About $40 billion a year of iron ore is mined in China, the country that’s also the world’s biggest buyer of the steelmaking component.

“Many smaller mines in China have stopped production due to the falling prices,” said Sarah Wang, a Shanghai-based analyst with Masterlink Securities Corp. “It’s the right time for BHP and Rio to seize the opportunity to boost their market share.” BHP, the world’s biggest mining company, last month also flagged the closure of some Chinese ore mines. “Most of them are smaller ones, while the bigger ones are also starting to be affected,” Liu Xiaoliang, the association’s general secretary, said in an interview. “Almost 70% of the ore processing companies have also closed.”

You don’t want to be on the wrong side of any of these deals, least of all in China. It’s not good for your health, or your kneecaps, or digits. The Bloomberg headline that says a 44% price plunge is good for BHP or Rio Tinto needs a fair amount of salt, of course; they just lost a lot of money. And someone’s going to be selling a lot of these assets, at heavy losses, into the markets just to recuperate some cash.

One other thing the FT published, by Harvard political economy professor Benjamin Friedman, needs a bit of our attention. I think the best way start off with is through Mike Mish Shedlock, who in a reaction to one of FT’s shadow articles speaks truth to nonsense:

The Financial Times states “The concern is that financing could disappear for the most leveraged and riskiest parts of the economy, from real estate developers to steel mills. China’s investment-reliant growth could come to an abrupt end.” That’s ridiculous. The concern ought to be that absurd lending to unprofitable, poorly-managed companies and State-Owned-Enterprises (SOEs), continues, not that it ends. The longer malinvestment foolishness continues, the bigger the ultimate crash.

Mish sets the tone, and the principle, in a clear and concise manner: cut the crap, let’s get this thing back on its feet. Most people, including FT writers, have come to see the central bank largesse as positive, or necessary, even inevitable. Mish has not, and neither have I. That largesse is the greatest scourge upon us, because it can ultimately lead to one outcome only: it will devastate, obliterate, the man in the street just to keep up appearances of a functioning economy, which in reality ceases to exist the very moment central banks start supporting failed banks and other institutions through asset purchases and other stimuli.

Benjamin Friedman is one of the fools who wish to argue Bernanke, Kuroda and Draghu are doing us a favor. He calls his article “The Perils Of Returning A Central Bank Balance Sheet To ‘Normal’”, but really that should have been “The Perils Of A Functioning Economy”, because that’s what winding down a central bank’s balance sheet would achieve.

This may be complicated by the fact that all central banks are stuck in the same destructive stimulus and too-big-to-fail patterns, but the outcome is crystal clear no matter what: they can’t continue their behavior forever, and the hopes for an escape velocity recovery are imaginary only at this point, see for instance today’s Bloomberg: US Housing Falters as Forecasters See Sales Dropping. The lesson from that, for Yellen and the man in the street alike, is that central banks cannot cure economies, they can only distort them and make them – much – worse. Friedman’s arguments are one dimensional, blinders firmly in place (but if everyone around you wears them, who notices?):

The Perils Of Returning A Central Bank Balance Sheet To ‘Normal’

With the US Federal Reserve on its way to bringing its bond-buying programme to an end, many are asking how to return the central bank’s balance sheet to “normal” – that is, to its pre-crisis size and composition. The same debate is under way at other central banks. Should they sell their bonds, or hold on to them until they mature? And if they are going to sell, which securities should go first? Yet there is another question that is equally important but seldom asked: is it sensible to return central banks’ balance sheets to “normal”? There are good reasons not to.

At the beginning of 2007, the Federal Reserve System’s assets totalled $880bn. Today, the balance sheet stands at $4.3tn, including $2.4tn of Treasuries and $1.7tn of mortgage-backed securities. The reason for buying these assets was not to reduce the federal funds rate, which had reached zero by late 2008, but to lower the interest rates at which loans are extended to people and businesses, stimulating demand. The evidence shows that these bond purchases indeed lowered long-term rates relative to short-term rates, and lowered rates on more-risky compared with less-risky obligations. A conservative estimate is that a $600bn bond purchase (the size of the Fed’s second round of bond buying) lowered long-term interest rates by about 25 basis points: not enormous, but a worthwhile contribution to the US economic recovery.

There is no such thing as “a worthwhile contribution to the US economic recovery”, because there is no such recovery. What people like Friedman see, because they like it that way, is not recovery, it’s the Fed buying all these assets solely in order to keep the economy from functioning, from getting rid of bad and dead elements. It’s the Fed hindering the economy from functioning, for the simple reason that it favors some of its components, i.e. banks et al, which should no longer be alive because they gambled and lost far too big.

The composition of the assets that the central bank buys matters too. Buying mortgage-backed securities narrowed the difference between the interest rate American homeowners paid on their mortgages and the rate at which the US government could borrow. This helped stop house prices from falling and spurred residential construction. Buying or selling bonds gives the Fed a way of influencing longer-term interest rates in general, and mortgage rates in particular. This lever will remain useful long after short-term rates begin to rise. But it will be out of reach if the central bank returns its balance sheet to its pre-crisis state.

Oh, boy, did Americans ever benefit from the Fed bailing out its favorites and paymasters. Low interest rates for loans on grossly overpriced homes, what more can a US citizen ask for?

… no increase in inflation has yet appeared in any economy that has pursued this course. That is because the central banks in question have made it advantageous for banks to redeposit the additional reserves instead of lending against them. This has prevented these asset purchases from triggering what might otherwise be an inflationary flood of credit.

That’s just another way of saying QE doesn’t benefit the real economy, isn’t it? That all the Fed and its purchases do is perpetuate the illusion of a functioning economy while in reality no such thing exists anymore.

For decades, it has been commonly understood that the central bank’s policy interest rate is the only independent instrument of monetary policy. We now see that there are two: the policy interest rate and asset purchases or sales. But the central bank cannot sell what it does not own. To keep this additional policy tool available, the Fed and other central banks should hold on to an ample supply of assets. They should not shrink their balance sheets to the pre-crisis size.

Yes, they should. Central banks should withdraw all stimulus and sell all assets purchased, and let the market decide what they are worth. That is the only way to get a functioning economy back on track. Sure, it’ll be painful, especially for the financial industry. But it will also be real. And we all need a hefty dose of reality, sooner rather than later. If only because it’s the sole way to an actual recovery. But a functioning economy indeed has perils, for those who hold assets that have not been marked to market. It’s ironic, but power in our societies today lies with who holds most of the bad assets. And as long as they can make the rest of us believe that these things have real value, that’s where power will stay. And that’s exactly why today more than ever we need a functioning economy, to turn that wrong around and make it right.

• US Housing Falters as Forecasters See Sales Dropping (Bloomberg)

The two-year-old U.S. housing recovery is faltering. The Mortgage Bankers Association yesterday lowered its new and existing home sales forecast for 2014 to 5.28 million — a decrease of 4.1% that would be the first annual drop in four years. The industry group also cut its prediction on mortgage lending volume for purchases to $751 billion, an 8.7% decline and the first retreat in three years. Bullish forecasts in early 2014 from MBA, Fannie Mae and Freddie Mac have been sideswiped by rising home prices and an economy that isn’t producing higher paying jobs. The share of Americans who said they planned to buy a home in the next six months plunged to 4.9% last month from 7.4% at the end of 2013, the highest in records going back to 1964, according to the Conference Board, a research firm in New York.

“The big housing rally wiped itself out because prices increased too quickly for buyers to keep up,” said Richard Hastings, a consumer strategist at Global Hunter Securities LLC in Charlotte, North Carolina, who predicted the slowdown eight months ago. “The pool of eligible new buyers is collapsing” because of stagnant incomes and lack of credit, he said. The best-qualified homebuyers jumped into the market last year to grab near-record low mortgage rates that averaged about 3.5% after delaying their moving plans during the housing slump, said Nariman Behravesh, chief economist of IHS Inc., a research firm based in Englewood, Colorado. The median price of an existing home gained 11.5% last year, second only to 2005’s 12% increase, the highest on record, according to the National Association of Realtors. This year, price appreciation probably will slow to 5.6%, NAR said.As prices climb, the ability of Americans with stagnant wages to buy homes wanes.

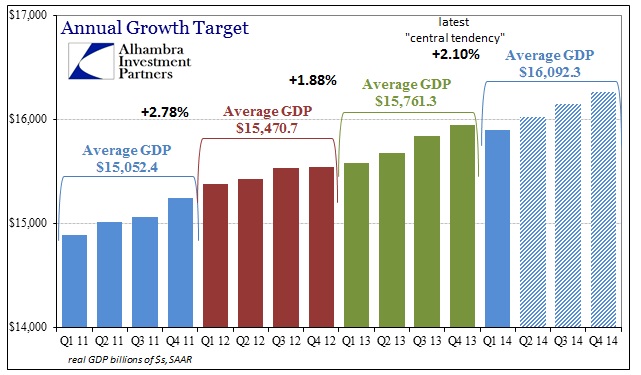

See for yourself how insane present GDP estimates are. And don’t forget this next time you see one of those estimates

• Fed Estimates Run Into The Reality of Compounding (Alhambra)

After marveling at the speed at which the FOMC downgraded, once again, its over-optimism regarding 2014 growth, my good friend Fred Everett started to calculate exactly how daunting a task even hitting the lower end of the reduced range actually might be. It s not just the misstep in Q1 that is the problem, it is the sometime tortuous nature of compounding when it goes in reverse. A decline in GDP is devastating, which Fred s inquiry shows quite well; speaking very much about why negative quarters are always (until now, they would have us believe) absent from growth periods.

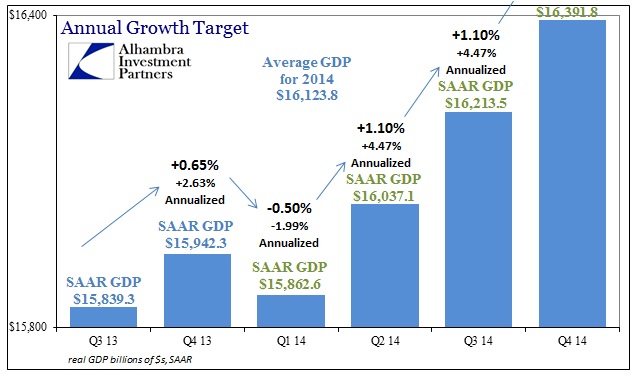

The manner of calculation, according to the BEA, is to start by averaging the four seasonally adjusted annual rates (SAAR) from each quarterly GDP figure. The average of 2012’s four quarters works out to $15.47 trillion; $15.76 for 2013. Thus the annual growth is estimated to be an unexpected weak showing of 1.88% for 2013. To gain the new FOMC central tendency would require an average of $16.092 trillion for 2014.

To hit that target average would mean a quarterly growth rate of about 0.76%, or a 3.07% annual rate per quarter. That actually undershoots the target by about $7 billion, but it would yield a growth rate for 2014 of 2.05%, which would round up to the 2.1% target. In other words, the easiest path for the economy to achieve the new target is just a little less than 3.1% in each and every one of the next three quarters. That would mean no room at all for another stumble. Further, that kind of growth has only happened on two occasions since the Great Recession: in 2010 and toward the end of 2011. There has been nothing like it recently as the economy has clearly downshifted. I know that weather remains the mainstream fixation, but this amounts to hope for some long delayed silver bullet.

But that is not the worst of it, as there are estimates Q1 is going to be revised still lower to as much as a 2% decline (annual rate). Again, due to compounding, that would both be exceptionally rare outside recession and a tall task for this kind of economy to even reach that awfully low 2.05% standard. If the Q1 decline does come in at around 2%, then the pace of growth just to get up to 2.05% jumps to 0.93% per quarter, or a 3.77% annual rate in each of the next three. The last time this artificial economy reached anything like that was 2005 in the halcyon days of the housing bubble. Since we are already down the rabbit hole, we might as well calculate hitting the upper limit of the central tendency since it is clearly included as part of this year s expectation. Assuming that the economy has to both overcome the 2% hole in Q1 while actually hitting the upper end of the new central tendency , sort of defining the tallest order the Fed is expecting, is really nothing short of an exercise in fantasy.

To attain 2.3% growth for 2014 would mean just about 4.5% real GDP growth in each of the next three quarters one of which is nearly finished and doesn’t seem to have even close to that kind of spring in its step. About the only time you see that kind of steady pace is in the presence of a true recovery. Does that mean the Fed s models are looking for exactly that? Probably, but given the circumstances why would they suddenly be right this time? Even the one economic account that somewhat offers a positive trajectory, the Establishment Survey, falls well short of what would fairly be considered a full-on recovery. No wonder the downgrade of the central tendency was so severe. Compounding after a negative quarter is a huge hole for the economy to dig out of. I just don t see how this economy is set for near perfection just to hit that lowered target.

• The Perils Of Returning A Central Bank Balance Sheet To ‘Normal’ (FT)

With the US Federal Reserve on its way to bringing its bond-buying programme to an end, many are asking how to return the central bank’s balance sheet to “normal” – that is, to its pre-crisis size and composition. The same debate is under way at other central banks. Should they sell their bonds, or hold on to them until they mature? And if they are going to sell, which securities should go first? Yet there is another question that is equally important but seldom asked: is it sensible to return central banks’ balance sheets to “normal”? There are good reasons not to.

At the beginning of 2007, the Federal Reserve System’s assets totalled $880bn. Today, the balance sheet stands at $4.3tn, including $2.4tn of Treasuries and $1.7tn of mortgage-backed securities. The reason for buying these assets was not to reduce the federal funds rate, which had reached zero by late 2008, but to lower the interest rates at which loans are extended to people and businesses, stimulating demand. The evidence shows that these bond purchases indeed lowered long-term rates relative to short-term rates, and lowered rates on more-risky compared with less-risky obligations. A conservative estimate is that a $600bn bond purchase (the size of the Fed’s second round of bond buying) lowered long-term interest rates by about 25 basis points: not enormous, but a worthwhile contribution to the US economic recovery. And the effect of lower long-term rates was probably reinforced by higher equity prices and a cheaper dollar.

The composition of the assets that the central bank buys matters too. Buying mortgage-backed securities narrowed the difference between the interest rate American homeowners paid on their mortgages and the rate at which the US government could borrow. This helped stop house prices from falling and spurred residential construction. Buying or selling bonds gives the Fed a way of influencing longer-term interest rates in general, and mortgage rates in particular. This lever will remain useful long after short-term rates begin to rise. But it will be out of reach if the central bank returns its balance sheet to its pre-crisis state.

• Hedge Fund Chiefs And Former Bankers Enter The Shadows (FT)

In the six years since the financial crisis, the financial services world has seen all kinds of new institutions take over lending deals and clients that were once the domain of traditional banks. There has also been a parallel transformation: the mutation of bankers into shadow bankers, writes Patrick Jenkins in London. The bosses of many shadow banks – hedge funds, private equity and debt funds, tax-efficient “business development companies” and peer-to-peer lenders – seem increasingly to have been drawn from the upper ranks of the big traditional lenders.

Many bankers have become disillusioned with the old ways of doing things, demotivated by weak market conditions and shrinking ambitions, and frustrated by a mountain of new regulations. The freer world of shadow banking offers welcome liberation. It also presents an opportunity for those with experience in banking because they know where the business opportunities – and the regulatory loopholes – lie. But if the migration of bankers into shadow banking is a clear pattern in western markets, elsewhere it is harder to make such generalisations. Anecdotal evidence in China, one of the biggest – and most concerning – shadow banking markets, suggests a far more eclectic heritage at the helm of big non-bank lenders, a development that adds to the potential risks. Financial Times reporters around the world meet and profile a sample of the shadow banks and their bosses:.

Nice ….

• New York Federal Reserve Takes On Key Role In Repo Market (FT)

The Federal Reserve Bank of New York has emerged as the single largest player in an important segment of the short-term lending market that was at the epicentre of the financial crisis. The Fed’s decision to quadruple its trading with government money market funds in the repurchase or “repo market” is a sign that the central bank is now engaging more directly with the shadow banking system at the expense of large Wall Street banks. Historically, the repo market was where big banks pawned out their securities such as Treasury bonds to lenders including money market funds, insurers and mutual funds, in exchange for short-term financing. Now the Fed is stepping in to trade as well as it prepares to end its current near-zero interest rate policy.

Armed with a balance sheet of $4.3tn of bonds purchased during quantitative easing, the Fed is using what it calls its reverse repo programme, or RRP, to trade with money funds at a time when tough new regulatory standards have made such borrowing less attractive for the banks. Rather than lending to the banks, money market funds have sharply boosted their dealings with the US central bank. Between September 2013 and the end of May, government money market funds increased their use of repo trades with the New York Fed by $65bn to a total of $87bn, while decreasing their repo holdings with dealer-banks by $38bn, according to a study by Fitch Ratings. The growing presence of the Fed in repo is a signal that it is testing new ways to control short-term interest rates once it starts tightening monetary policy.

• Into The Shadows: Risky Business, Global Threat (FT)

From the window of his office, Qiao Jingshan can look out across downtown Yuncheng and see signs of new construction everywhere. Half-built or empty apartment complexes are scattered across the cityscape bearing names like Eastar Upward , Golden Riverside or Stars and River Mansion. As chief accountant for Yuncheng City Investment, a financing vehicle for the local government, Mr Qiao has played a crucial role in the development of this gritty steelmaking city in central China. His latest job is to sell his company’s trust product a high-interest, deposit-like investment with the proceeds going to a big public heating project for Yuncheng. Despite paying a tempting 9.7% annual interest rate, his product, marketed as Eternal Trust Number 37 , is not catching on with investors. Mr Qiao is worried.

The problem could be that Yuncheng’s property market has hit a rough patch or that a local steel plant has closed. But he blames events outside Yuncheng for his predicament. The near-default of other Chinese financial products recently has set off alarms inside China and in global markets that the country is in the midst of a dangerous credit bubble. Mr Qiao admits the Yuncheng heating project will not provide any returns for his company, an unsettling fact for any investor. But he is dismissive that this is the problem. “All of our investments are public works that should actually be paid for by the local government so when the trust product matures the government should take this project off our hands and give us the money to repay investors”, he says. “Don’t worry, it is impossible for there to be any sort of financial crisis here in Yuncheng.”

• Eternal Trust Number 37 (Mish)

The Financial Times investigates China’s precarious shadow banking system. The first article in the series is Into the Shadows.

From the window of his office, Qiao Jingshan can look out across downtown Yuncheng and see signs of new construction everywhere. Half-built or empty apartment complexes are scattered across the cityscape bearing names like Eastar Upward, Golden Riverside or Stars and River Mansion .As chief accountant for Yuncheng City Investment, a financing vehicle for the local government, Mr Qiao has played a crucial role in the development of this gritty steelmaking city in central China. His latest job is to sell his company’s trust product a high-interest, deposit-like investment with the proceeds going to a big public heating project for Yuncheng. Despite paying a tempting 9.7% annual interest rate, his product, marketed as “Eternal Trust Number 37”, is not catching on with investors.

Supposedly it’s impossible for an investment that yields 9.7% to lose any money. State Owned enterprises investing in economically nonviable projects will never lose money either. Yeah, right. If it looks too good to be true, it is.

Worries about China’s shadow banking system rattled global stock markets this winter, after a wealth management product called Credit Equals Gold was reported to be on the verge of default. It was quickly restructured, only to be followed by concerns about a similar product known as Opulent Blessing . Noting how large the sector has grown, many in China warn that the country could face its own Lehman moment if it were to see a serious run on shadow banks.The [traditional] banks have been very strategic about pushing their weakest assets into these channels, says Charlene Chu, the former Fitch analyst who was one of the first to raise serious questions about the rise of China’s shadow banking sector and who now works for Autonomous, the research group. The weakest institutions and creditors are the ones engaged in shadow banking, where bad decisions and bad risk management are the norm.

The Financial Times states “The concern is that financing could disappear for the most leveraged and riskiest parts of the economy, from real estate developers to steel mills. China’s investment-reliant growth could come to an abrupt end.” That’s ridiculous. The concern ought to be that absurd lending to unprofitable, poorly-managed companies and State-Owned-Enterprises (SOEs), continues, not that it ends. The longer malinvestment foolishness continues, the bigger the ultimate crash.

• China’s Economy Is At A ‘Tipping Point’ (CNBC)

China’s economy is at a “tipping point” and the property sector will determine how it lands, Credit Agricole warns. “We are at a tipping point: either prices, sales and investment in real estate gradually recover as a result of the recent easing of administrative curbs, in which case the economy will rebound in the second half, or the real estate downturn will continue, causing a further slowdown in overall growth and threatening a crisis,” Dariusz Kowalczyk, senior economist/strategist, Asia ex-Japan wrote in a report. A housing market downturn would have widespread consequences because the real estate sector accounts for over 15% of China’s economic output and supports some 40 other industries.

Latest housing sector data show home prices rose at the slowest annual pace so far this year in May. Average new home prices in China’s 70 major cities climbed 5.6% on year, slowing from April’s 6.7% rise. In month-on-month terms, prices dropped 0.2% – the first fall in two years. “Real estate is showing some early signs of bottoming out but remains the economy’s weak spot,” Kowalczyk said. The government began to loosen its grip on the market recently, however it remains to be seen whether its policy easing will prevent a deeper slowdown. In mid-May, the People’s Bank of China’s (PBOC) call on the nation’s major lenders to give priority to first-time home buyers when allocating credit, marked a policy shift for the government which has been on a near-five-year tightening campaign to cool the market.

• China Property Failures “Unavoidable” as $33 Billion in Trusts Due (Bloomberg)

Chinese property trusts face record repayments next year as the real-estate market cools, fueling speculation among bond funds that more developers will collapse. The trusts, which channel money from wealthy individuals to smaller builders that have trouble obtaining financing elsewhere, must repay 203.5 billion yuan ($32.7 billion) in 2015, according to Use Trust, a Chinese research firm. That’s almost double the 109 billion yuan due this year. New issuance of the products slumped to 40.7 billion yuan this quarter, the least in more than two years, Use Trust data show.

“Trust loan defaults will rise substantially,” said Fiona Cheung, head of Asia credit at Manulife Asset Management’s fixed-income team which oversees $44 billion globally. “It won’t be surprising if there are more collapses of China’s property companies. Those companies that suffer from weak sales, that bought land too aggressively last year funded by debt and that have poor access to capital markets will potentially experience cash flow pressure.” JPMorgan Chase & Co. says the real-estate industry poses the biggest near-term risk to growth in the world’s second-largest economy after new home prices dropped in the most cities in two years last month. China’s banking regulator said on June 6 it will monitor developer finances, a sign of concern defaults may spread after the March collapse of Zhejiang Xingrun Real Estate Co., a builder south of Shanghai.

Prices fell in 35 of the 70 cities tracked by the government last month from April, according to a statement by the National Bureau of Statistics on June 18, the most since May 2012. In the financial center of Shanghai, prices decreased 0.3% from April, the first decline in two years. “It’s unavoidable that property trusts will have defaults this and next year,” said Yao Wei, Hong Kong-based China economist at Societe Generale SA. “The industry has come to a turning point. The imbalance between supply and demand is so big that adjustments are needed.”

• China Miners’ Loss Is BHP’s Gain as Iron Prices Slump 44% (Bloomberg)

Rio Tinto Group and BHP Billiton Ltd. (BHP), two of the world’s biggest iron ore producers, are benefiting as falling iron ore prices pressure smaller rivals in China to shut down. The price of iron ore has plunged 44% from its February 2013 peak on the back of record output. That’s hurting mining companies in China where 20% to 30% of mines have closed, according to the China Metallurgical Mining Enterprise Association. The closures are helping Rio Tinto and BHP which, along with Vale, already control about two thirds of global seaborne supply from their low-cost mines. About $40 billion a year of iron ore is mined in China, the country that’s also the world’s biggest buyer of the steelmaking component.

“Many smaller mines in China have stopped production due to the falling prices,” said Sarah Wang, a Shanghai-based analyst with Masterlink Securities Corp. “It’s the right time for BHP and Rio to seize the opportunity to boost their market share.” BHP, the world’s biggest mining company, last month also flagged the closure of some Chinese ore mines. “Most of them are smaller ones, while the bigger ones are also starting to be affected,” Liu Xiaoliang, the association’s general secretary, said in an interview. “Almost 70% of the ore processing companies have also closed.”

Oh really?

• IMF’s Lagarde Urges ECB To Consider QE (CNBC)

The European Central Bank (ECB) should contemplate quantitative easing if inflation in the single currency bloc remains low for a protracted period, says International Monetary Fund (IMF) Managing Director Christine Lagarde. “If inflation was to remain stubbornly low, then we would certainly hope that the ECB would take quantitative easing measures by way of purchasing of sovereign bonds,” Lagarde told CNBC on Thursday. She defines “stubbornly low inflation” as prices remaining well below target in spite of measures being taken to boost inflation. Euro zone consumer prices rose by just 0.5% year-on-year in May, down from 0.7% in April and well short of the ECB’s target of close to 2%.

Unlike other major central banks, the ECB has so far resisted embarking on a quantitative easing program, but has said it stands ready do so if needed. Earlier this month, the central bank unveiled fresh measures to stimulate the economy including taking an unprecedented step on of imposing a negative interest rate on banks for their deposits—in effect charging lenders to park money with it. When asked whether further ECB action may lead to complacency among governments in terms of carrying out structural reforms, Lagarde said: “They all seem convinced that they have to pursue structural reforms, support demand by good solid monetary policy, and continue the fiscal consolidation path they have agreed.”

Yeah, poison the punch bowl. Love the timing.

• Be Ready For Interest Rate Rises, Bank Of England Insider Warns (Guardian)

Britain’s 10 million mortgage payers have been warned to ready themselves for dearer borrowing costs after a Bank of England policymaker said stronger-than-expected growth meant the era of ultra-cheap money was drawing to a close. Ian McCafferty, one of the four external members of Threadneedle Street’s monetary policy committee, said on Thursday that the exact timing of a rate rise remained uncertain, but the Bank wanted to ensure that the many borrowers who have become used to more than five years of official interest rates at 0.5% were not taken by surprise. In an interview with the Guardian, McCafferty said the economy had beaten the Bank’s forecasts so far this year and the survey evidence pointed to further robust expansion ahead.

“There is momentum in the pace of growth, and it looks like it will continue over the rest of the summer,” he said. “Overall, the economy has come a long way in the last 12 to 18 months.” He said the Bank had felt it right to point out the risks that borrowing costs might rise sooner than expected because the City had not responded to the signs that the recovery was continuing to gather pace. “There didn’t seem to be any material shift in expectations about what we might do,” the MPC member said. “Were we to have to go early – and that will depend on how the economy performs over the summer and autumn – I think it would have been damaging if it was portrayed as a surprise. It appeared the markets were more certain of the date of lift-off [for rates] than we were.”

Home › Forums › Debt Rattle Jun 20 2014: The Perils Of A Functioning Economy