Pablo Picasso Head of a woman 1939

Miller

.@StephenM: The Biden administration has helped relocate 300,000 unaccompanied minors into the United States. This is the largest human/child trafficking operation in human history. pic.twitter.com/rLKvBiCnz3

— The Dirty Truth (Josh) (@AKA_RealDirty) September 21, 2022

Detroit cringe (I can’t even listen to the end)

WH @PressSec says Biden didn't actually mean the Covid pandemic is over despite saying it: "Just to step back for a second, when he made those comments, he was walking through the Detroit car show, the halls of the Detroit car show, he was looking around." pic.twitter.com/JUMzkkA1P8

— Tom Elliott (@tomselliott) September 21, 2022

Biden. Trump.

Biden. Trump. Together on 60 Minutes. pic.twitter.com/1vuk1OrMo4

— Maze (@mazemoore) September 20, 2022

“We are talking only about those soldiers who have an official status of “reserves” and all of them will have to undergo a special training before being sent to the Ukraine.”

• Russia Will Mobilize About 1.2% Of Her Mobilizational Potential (Saker)

So, after lots of speculation, we now know that the Kremlin has decided to mobilize about 300’000 soldiers from a total mobilizational potential of 25’000’000 soldiers. That’s just a little over 1% of Russia’s mobilizational potential. We are talking only about those soldiers who have an official status of “reserves” and all of them will have to undergo a special training before being sent to the Ukraine. A few comments about this decision: It will take Russia a few months to gather and retrain (refresher courses) these forces and they will not be immediately available to protect the Lugansk, Donetsk, Zaporozhie and Kherson regions during the upcoming referendum on to whether to join Russia or not. The 3rd volunteer army corps is already deployed in the south and could greatly assist in this.

Putin and Shoigu gave several reasons for this decision, including the very long line of contact, the direct involvement of NATO personnel who are now running the Ukronazi regime in Kiev and the threats by the West to dismantle Russia. Shoigu indicated that the UAF lost about 50% of its personnel (over 100’000 soldiers out of a total potential of about 200’000). He also added that most of the Ukrainian weapons systems, which were of Soviet origin, was mostly destroyed. Russian KIAs are just under 6000 soldiers. Shoigu also clearly spelled out that “we are not so much fighting against the Ukraine but against NATO plus the united (collective) West“. Shoigu also mentioned that all of the NATO satellite capabilities (70 military and 200+ civilian satellites) are used against Russia right now.

Finally, Shoigu added that NATO high precision weapons are deliberately used by NATO commanders to terrorize civilians. In other words, Russia is preparing for an escalation of this war in the coming months. She is basically augmenting her forces to a level which could deal with a major NATO escalation in the Ukraine (and elsewhere as not all mobilized forces would have to be combat units; deploying more C4ISR capabilities, logistics/supply forces or civil affairs and counter-terrorism units would also make sense). The other big news of the day is, of course, that Russia will back and accept the outcome of the referendums in the four regions mentioned above.

“The Russian leader pledged to support the plebiscites in terms of security and said his government would respect whatever outcomes they produce..”

• Russia To Begin Partial Mobilization – Putin (RT)

Russian President Vladimir Putin announced a partial military mobilization during an address to the nation on Wednesday morning. He said the Defense Ministry had recommended drawing military reservists into active service as the country faces a protracted conflict in Ukraine and Donbass. The measure is sensible and necessary under the circumstances, Putin said, considering that Russia is fighting “the entire Western military machine” in Ukraine. He has already signed an order for the call-up to start immediately. The move will see the armed forces draw on military reservists only, and those who have completed national service, the president added. He promised that they would be provided with additional training, along with all the benefits due to people involved in active duty.

Defense Minister Sergey Shoigu revealed some details about the mobilization in a separate statement on Wednesday. He said the ministry wanted to call to arms some 300,000 reservists, or just over 1% of Russia’s full mobilization potential. Putin has accused Kiev of backing away from peace talks with Moscow, which he said it had done on the instructions of its Western backers. Instead, the Ukrainian government has doubled down on military action, he said. “After certain compromises [with Moscow] were reached, Kiev received a de facto direct order to derail all agreements. More weapons were pumped into Ukraine. The Kiev regime deployed more gangs of international mercenaries and nationalists, military units trained to NATO standards and under de facto command of Western advisers,” Putin said.

Russian forces sent to Ukraine in February have secured a large portion of territory claimed by the Donetsk and Lugansk People’s Republics, as well as parts of Ukraine, he said. The resulting front line stretches over 1,000km, the president pointed out. He warned the US and its allies against ramping up pressure on Moscow. Western nations are openly pursuing a military defeat of Russia, seeking to push the country into insignificance and to loot its natural wealth, he stated. “Parts of Western elites use every effort to preserve their dominance. That is why they try to block and suppress any sovereign centers of development, so that they can continue to brutally force their will on other nations and peoples, to impose their pseudo-values,” he explained. “Their goal is to weaken, disunite and ultimately destroy our nation.”

Some senior officials in NATO states have even suggested that using tactical nuclear weapons against Russian troops would be justified, according to Putin. The president stressed that Moscow would not hesitate to retaliate to such an attack with its own nuclear weapons. If the territorial integrity of our nation is threatened, we will certainly use all the means that we have to defend Russia and our people. Putin also commented on the upcoming referendums in the two Donbass republics and two regions of Ukraine currently controlled to a large extent by Russian troops. The four entities are putting to a general vote a proposal to ask Moscow to accept them as new parts of the Russian Federation, with polling scheduled to start on Friday.

The Russian leader pledged to support the plebiscites in terms of security and said his government would respect whatever outcomes they produce. Russia’s goal is to protect civilians from the Ukrainian government, which had escalated the persecution of its opponents at home and had been using terrorist tactics against people living in Russia-controlled lands, Putin said.

“..we can expect that the Russian forces will start to degrade Ukrainian infrastructure on a large scale.”

• Russia Announces Partial Mobilization (MoA)

Defense Minister Sergei Shoigu said (video, Sputnik report) that 300,000 reservist will be mobilized. Conscripts and people currently studying will not be send to Ukraine. He also said that, so far, 5,937 Russian soldiers have died during the war in Ukraine. (This number does not include the militia of the DPR and LPR, or the Wagner group, who have done most of the frontline work and thus have had higher losses.) Shoigu puts Ukrainian losses at some 62,000 killed and some 50,000 wounded. (I regard this as a low estimate.) Russia’s total military reserve, people who have previously gone through military training, is 25 million. It also has the equipment to arm those forces.

There are rumors that the Ukraine is preparing for an all out offensive, mobilizing and preparing new units from Kiev and further west for one big push against the Russian and allied forces. It will take a few months to prepare for this. The Ukraine will need much more equipment and ammunition from the ‘west’, including ‘western’ tanks and infantry fighting vehicles, and has yet to train troops to be able to use it. It is likely intending to start the offensive only in spring. The call up Russia announced now may have the intent to draw Kiev into a premature launch of its general offensive. The mobilized Russian troops will take about three months to be ready for war. Russia could thus launch its own offensive during the winter season. In the meantime constant defensive work will continue to severely degrade the Ukrainian units which are currently on or near the frontlines.

With a force of an additional 300,000 troops, far beyond the 100,000 to 150,000 engaged now in the war, the Russia forces could change their tactics from the slow grind that is happening now into a larger scale maneuver war with heavy strikes into the operational depth of the Ukrainian army. Belarus, allied with the Russian Federation, is also in the process of getting ready for war. It could, as it had threatened before, cut of the supply lines from the ‘west’ into the Ukraine in the western part of that country. Should current Ukrainian attacks on civilians and infrastructure in Russia and the Donbas regions continue, we can expect that the Russian forces will start to degrade Ukrainian infrastructure on a large scale. The electricity and railway networks would be the primary targets. s

“The celebrations that will follow these regions joining Russia are likely to be massive: Crimea 2014 times ten.”

• Squelching the Noise about the Ukraine (9Bill)

Earlier this morning, Vladimir Putin gave the order to call up army reservists. According to him, the nature and the goals of the Special Military Operation in the Ukraine remain the same. The reservists will be given contracts (they will in essence become salaried employees). Only those with relevant military experience and training will be called up. Shoigu went into further specifics: just 300.000 reservists will be called up in the first phase (roughly 1% of Russia’s total reservists), which will coincide with the normal, regularly scheduled annual training of reserves. They will be equipped, trained and sent in with the task of shoring up and straightening up the battle front. To be sure, they will also be called upon to provide security and to suppress enemy activity on both sides of the border.

Given the current configuration of the battle front, which includes a toehold on the Kharkov region, all of Lugansk, most of Donetsk, most of Zaporozhye and most of Kherson, their mission could conceivably come to include driving the Ukrainian forces out of the remainder of Donetsk and Kherson regions and perhaps setting up and maintaining a buffer zone to make it impossible for Ukrainian artillery to reach within what will soon become territory of the Russian Federation.

To this end, referenda will be held starting this Friday in all of the above formerly Ukrainian regions except for Kharkov, which is excluded. According to most recent opinion polling, the idea of joining the Russian Federation is very popular in all of the above: 94% in favor in Donetsk, 93% in Lugansk, 87% in Zaporozhye and 80% in Kherson.And why wouldn’t these people want to be part of a peaceful, stable and prosperous state where their native language is the official language rather than stay within a failed state that has been fighting a civil war against them going on nine years? The celebrations that will follow these regions joining Russia are likely to be massive: Crimea 2014 times ten. Finally, I’d like to add a note on the Russian withdrawal from most of the Kharkov region. The region itself is of no consequence to Russia while the city of Kharkov, with its remaining population of around two million and with Ukrainian heavy armor and artillery hiding among high-rise buildings and using civilians as human shields, would be either a hard target, a humanitarian disaster, or both, were the Russians to try to conquer it. Also, although Kharkov is overwhelmingly Russian-speaking, these are some of the most heavily brainwashed, Westernized, Nazified Russian-speakers on the face of the planet and, from a Russian perspective, just not worth the bother.

Good to see people other than Pepe Escobar cover this angle, too.

• Defensive West Smears Samarkand Summit (Lauria)

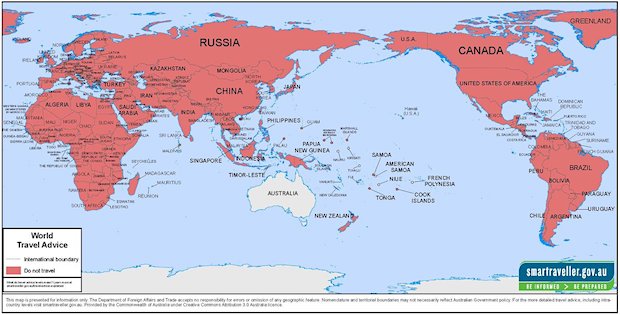

The Shanghai Cooperation Council (SCO)’s summit in the Uzbek capital of Samarkand last Thursday and Friday was a world historical event for the forces creating this separate world representing the majority of humanity. Major economic deals were concluded and Beijing and Moscow further strengthened their budding alliance. In what should be a worrying sign for Washington, many of its Middle East allies, which have also rejected U.S. pressure to sanction Russia, have applied to join the SCO. For years the West rejected overtures from Russia and China to collaborate in a multipolar world. But that would mean giving up its dominant position, maintained from overtly colonial days. Instead the U.S.-led West pushes for total domination. So rather than acknowledge that its attempt to destroy Russia’s economy and bring down its government has instead led to economic chaos in the West and a threat to its global position, Western leaders are doubling down.

By sanctioning Russian energy and other vital exports, and by shutting out its financial system, the West thought Russia would collapse. Instead Moscow has found markets in the world’s most populous nations so that its currency, its industry and its banking system have survived. The Western response to this growing challenge to its hegemony was reflected in the way Western media covered the Samarkand summit. On top of the dismissive tone of its reporting came distortion of facts that misled its Western audiences to the significance of what Samarkand means to the future. The Daily Telegraph began its report, headlined, “Isolated Putin left at Beijing’s mercy as his disastrous war backfires,” with an account about how Putin was humiliated because he was left waiting for the president of Kyrgyzstan. With the headline, “Putin and Xi plot a new world order to challenge America’s might,”

The Times of London took the same line, writing of “Russia’s dependence on China since its disastrous war in Ukraine.” CNN’s report sowed seeds of doubt about the SCO’s unity, writing about the summit from Hong Kong that the “Ukraine war risks exposing regional divisions.” The New York Times report filed from Washington and Beijing, sought to portray the “limits” of “cooperation” between Russia and China. None of these reports focused on an emerging world order that is leaving the U.S. on the outside looking in. Western media instead seized on a few words uttered to try to frame India and China as criticizing Russia’s war in Ukraine. They completely took out of context Indian Prime Minister Narendra Modi’s words that “today’s era is not of war.” CNN reported:

“Indian Prime Minister Narendra Modi appears to have directly rebuffed Moscow’s invasion of Ukraine, telling Russian President Vladimir Putin that now is not the time for war. In what was the latest in a series of setbacks for the Russian leader, Modi told him of the need to ‘move onto a path of peace’ and reminded him of the importance of ‘democracy, diplomacy and dialogue.’” After Putin told Modi during their public comments that Ukraine refuses to negotiate, Modi said, according to the English translation on India’s Foreign Ministry website, “I know that today’s era is not of war and we have spoken to you many times on the phone that democracy, diplomacy and dialogue are such things that touch the world. Today we will get a chance to discuss how we can move forward on the path of peace in the coming days.” It is clear that Modi was criticizing Ukraine for not negotiating, rather than criticizing Russia for the war.

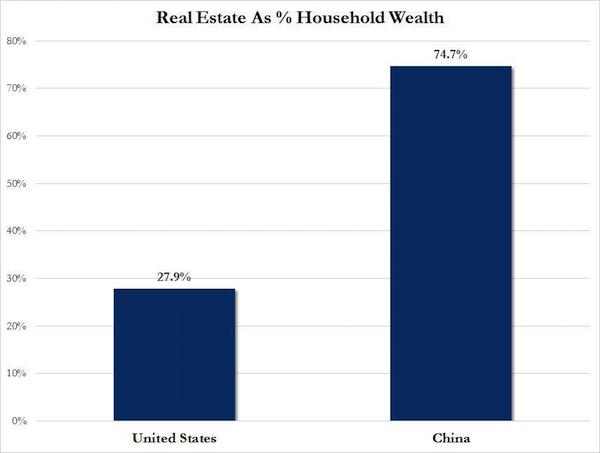

“The Great Reset is basically a debt default and the EU is a disaster that will fall apart.”

• The Plot to Seize Russia & Make It a NATO Vassal – Martin Armstrong (G&E)

Martin Armstrong discusses his new book based on declassified documents where in the 1990s the West, NATO, and Russian oligarchy plotted to seize Moscow, loot Russia, and takeover its natural resources. Yeltsin turned to Putin who was not a communist and is not an oligarch. The Moscow apartment bombings or propaganda surrounding them being a false flag would likely have come from Boris Berezovsky. The Great Reset is basically a debt default and the EU is a disaster that will fall apart. At this point most of the attack on Russia is related to “climate change” and to shut down fossil fuels.

I’m not as negative as Pepe about Guterres. Whatever his faults, I think he’s honestly trying to get the fertilizer to Africa.

• The Real US Agenda In Africa Is Hegemony (Escobar)

In a rational environment, the 77th session of the UN General Assembly (UNGA) would discuss alleviating the trials and tribulations of the Global South, especially Africa. That won’t be the case. Like a deer caught in the geopolitical headlights, UN Secretary-General Antonio Guterres issued platitudes about a gloomy “winter of global discontent,” even as the proverbial imperial doomsayers criticized the UN’s “crisis of faith” and blasted the “unprovoked war” started by Russia. Of course the slow-motion genocide of Donbass russophone residents for eight years would never be recognized as a provocation. Guterres spoke of Afghanistan, “where the economy is in ruins and human rights are being trampled” – but he did not dare to offer context.

In Libya, “divisions continue to jeopardize the country” – once again, no context. Not to mention Iraq, where “ongoing tensions threaten ongoing stability.” Africa has 54 nations as UN members. Any truly representative UNGA meeting should place Africa’s problems at the forefront. Once again, that’s not the case. So it is left to African leaders to offer that much-needed context outside of the UN building in New York. As the only African member of the G20, South African President Cyril Ramaphosa recently urged the US not to “punish” the whole continent by forcing nations to demonize or sanction Russia. Washington’s introduction of legislation dubbed the Countering Malign Russian Activities in Africa Act, he says, “will harm Africa and marginalize the continent.”

South Africa is a BRICS member – a concept that is anathema in the Beltway – and embraces a policy of non-alignment among world powers. An emerging 21st century version of the 1960s Non-Aligned Movement (NAM) is strengthening across the Global South – and especially Africa – much to the revulsion of the US and its minions. Back at the UNGA, Guterres invoked the global fertilizer crisis – again, with no context. Russian diplomacy has repeatedly stressed that Moscow is ready to export 30 million tons of grain and over 20 million tons of fertilizer by the end of 2022. What is left unsaid in the west, is that only the importation of fertilizers to the EU is “allowed,” while transit to Africa is not.

Guterres said he was trying to persuade EU leaders to lift sanctions on Russian fertilizer exports, which directly affect cargo payments and shipping insurance. Russia’s Uralchem, for instance, even offered to supply fertilizers to Africa for free. Yet from the point of view of the US and its EU vassals, the only thing that matters is to counter Russia and China in Africa. Senegal’s President Macky Sall has remarked how this policy is leaving “a bitter taste.”

I took three separate parts of Jorge Vilshes’ latest. Which is very long, I could have picked more pieces. Of course he helps himself by referencing one of my articles. 😉

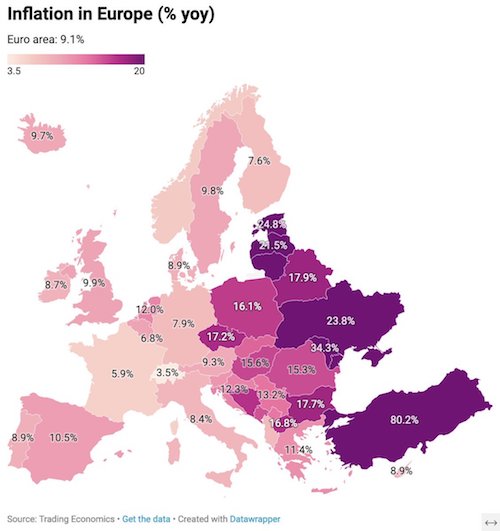

• NATO’s “Green” Masochistic EUthanasia (Vilches)

The German political class has torn up the social contract agreed with its constituents by swiftly ignoring the historical and most successful existential partnership established with Russia since decades ago. In parallel, Anglo-inspired unelected EU bureaucrats take turns to blindly attack Russia with suicidal Wagnerian style based on hollow virtue-signalling nonsense. Now, the German Vice-Chancellor and Minister for Economic Affairs Robert Habeck (a former mediocre poetry translator…) finally and “bitterly” has admitted that Germany — and thus all of Europe — relies on ´cheap energy from Russia´ or else it´d trigger ”the collapse of energy providers” with a dire ´Lehman moment´.

This would crash the German and European economies with widespread bankruptcies unleashed by margin calls as later explained. Thus the “green” solution now found for this Made-In-Europe mess is a deeper and longer proxy Ukraine war, über-high price inflation, $ 500 billion in subsidies for starters with more coming, new ad hoc high taxes and un-applicable price caps in a supply-driven market … with scarcity all around and “no matter what voters may think or how hard their life may get” (sic). So, European businesses will fail per the terrible damage induced all along upstream supply lines including food and fuels. As brilliantly worded by Rachel Mardsen…“The West cut itself off from its sourcing in order to play geopolitics”… and then blame Russia and supposed “extremist enemies of the state”.

So, if recent declarations from German Foreign Minister Annalena (“Kobold”) Baerbock are of any guide, we shall soon witness street crowds blossoming in Europe. With circumvolutionary style, the EU Commission is now also trying to convince everyone that Europe will become “greener” in a hurry. Actually, with its lignite-fired re-commissioned power stations – the largest ever single source of pollution – Europe will turn “browner” fast, not “greener” thus setting the worst possible example to the rest of the world.It also contradicts its supposed ´moral high ground´ Green Plan. Still, EC spokesman Eric Mamer proudly stated that “The Ukraine invasion will help us speed up our move away from fossil fuels”.

“And just like small children do, EU leaders still won´t admit it´s bed-time.”

• 10,000 anti-Russia Sanctions (Vilches)

The EU and the US imposed crippling sanctions on Russia which now finds it impossible – for instance – to comply with energy delivery to Europe. This in turn affects the European entire industry & trade including medicines, fuels, food, heating and everything in between. So the EU complains that Russia is using this energy non-delivery ´excuse´ as a weapon. Actually, sanctions restrict or prohibit trade of anything and everything with Russia from chips to flowers, and also disconnect Russian banks from SWIFT plus block money transfers, penalize all Russian cargo insurance, prohibit Western vessels at Russian ports and access of Russian ships to Europe. So a case in point for nat-gas non-delivery is the NS1 turbines mandatory maintenance/repairs. Contractually, Siemens is the only party allowed to touch them but sanctions do not allow their access per “Contract Violations”.

Europe keeps playing Russian roulette with itself insisting on the game plan of (1) provoking and supporting armed conflict with Russia (2) confiscating Russian assets (2) applying crippling sanctions on everything ´Russian´ (3) betting the farm on militarily winning the Ukraine war — how ??? (4) attempting a regime change in Russia (5) benefit from the spoils (6) simultaneously require Russians to provide whatever the EU may need, or else…??? (7) improvise highly dangerous experiments with well-proven European business models and European livelihoods at stake.

And just like small children do, EU leaders still won´t admit it´s bed-time. So now all that´s left for Main Street Europe is not winning anything other than freezing temperatures, far less food and fuels, ultra high price inflation of anything and everything, and plenty of hardship and discontent. But them all just keep re-arranging the chairs on the deck of an EU sinking Titanic while the orchestra enthusiastically keeps on playing one Strauss vals after another. True enough, Europe is trying its best to unnecessarily divorce Russia. But per Bloomberg – not exactly a pro-Russian mouthpiece — the EU sanctions and new taxes badly hurt Europe while Russia keeps ever improving its geopolitics and finances.

“..as per the German Vice-Chancellor Robert Habeck´s own words, “just expect the worst“. Meaning areas with no energy, no fuels, no power at any price, period. Or as plain Germans would have it, just expect “kaputt”.

Very soon EU sanctions on Russia will start consuming the Europe we know with an ever more self-sufficient and growing Russia just watching the unfortunate scene. For instance, German SMB “Mittelstand” (99% of German GDP) will bankrupt or strain badly. The fact remains that no one has explained exactly what is to be finally gained with the EUthanizing sanctions and new taxes which are not really hurting Russia but are very seriously hurting Europeans and — indirectly — the rest of the world. “Russia rakes in more oil revenue than ever” says the Wall Street Journal by exporting almost as much crude as it did before the conflict in Ukraine… but at much higher prices.

“Now Russia has new buyers, new means of payment, new traders and new ways of financing exports”. By the way, current electricity prices in Germany are already almost ten times higher than a year ago — and keep rising – while the EU’s energy market is rattled by fears over whether highly unstable power plants will be able to provide enough electricity this winter. So it´s not just a matter of even higher prices as grid “wherewithal” is at stake with simply not enough energy available. Unmanageable price inflation is thus unstoppable. From fertilizer to aluminum production and every single commodity in between are all being seriously hindered by current ( self-inflicted ) truly soaring European energy costs.

It´s simple, and as per the German Vice-Chancellor Robert Habeck´s own words, “just expect the worst“. Meaning areas with no energy, no fuels, no power at any price, period. Or as plain Germans would have it, just expect “kaputt”. So this “new” German and European business model does not impress or fly well. And even on the basis of self-righteous exceptionalistic ideologies and newly-found virtuous ´moral´ arguments, current immolation of defenseless Europeans is a nonsensical price to be payed with this freezing green checkmate. Because there are no quick, ready-made, valid replacements of many / most Russian produce Europe depends upon, there is no real grass-roots political support either, and politicians cannot expect people to go along under the extreme hardship conditions soon to come.

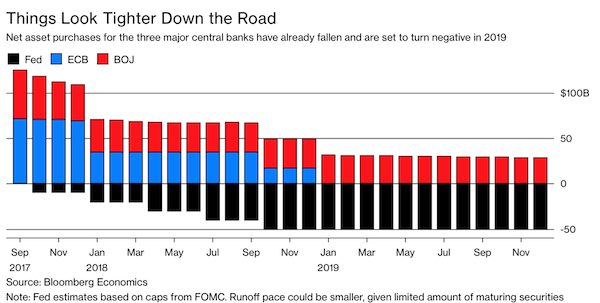

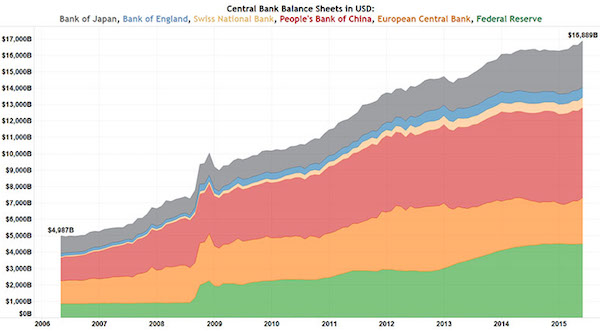

The central banks are not in control.

• Federal Reserve Chair Announces Another 75 Point Rate Hike (CTH)

Federal Reserve Chairman Jerome Powell announced another 75-point increase in federal interest rates today. This is the third consecutive 0.75 percentage point increase. Additionally, Fed policymakers have pledged to continue raising rates as high as 4.6% in 2023. While Powell walked through his reasoning to continue targeting inflation by lowering consumer demand, not once in any of his remarks did he mention energy policy driving up the cost of materials and goods. The Great Pretending continues.:

The Fed chair is trying to manage the economic policy transition by reducing economic activity to match intentionally diminished energy supplies. Lowering economic activity drops demand for energy. Unfortunately, as admitted by Powell on August 26, 2022, in Jackson Hole, this means a period of “some pain” for Americans as the central banks join together in an effort to lower consumption. What does “some pain” mean? It means lower incomes, higher prices, lowered standards of living and more scarce resources. During this transition to owning nothing and being happy about it, the pain is your wealth being stripped as the economy is intentionally diminished.

We will not be able to afford much; we won’t be able to afford the foods we want; we will not be able to purchase anything except the essentials, and those essentials will cost much more; we won’t be able to vacation, travel, or enjoy recreational activities; we won’t be able to afford any indulgences; but at the end of the process, we will learn to live more meager existences based on lowered expectations needed for sustaining the planet. Pay no attention to the elites who don’t have those concerns, comrade.

“..Albion is really in squeaky bum time…”

• The European Central Bank’s Zimbabwean Model (Hayes)

Though the function of European, German, Japanese and Zimbabwean central banks is to enable the credibility and efficiency of the financial side of their respective economies so that the real side of their economies may achieve the nation’s broader macro economic goals, NATO’s central banks have obviously and disastrously abandoned those tasks for reasons this article makes apparent. Because Zimbabwe, like Germany’s Weimar Republic before it, has reached annual inflation rates of 90 sextillion per cent a year, Europe should not be emulating the financial and economic basket case of Harare. Whatever about Zimbabwe, Germany has been famously down this road before and, in a total reversal of earlier post-war policies, seems determined to traverse it again. The European Central Bank, based in Frankfurt, is printing euros as quickly as their colleagues in Zimbabwe are printing Zimbabwean dollars, as the Confederates printed their Greybacks and as Weimar printed their famously worthless marks.

Although Weimar’s woes were many, two of the most pertinent were that the Kaiser borrowed immensely to fund his armies, whose victories were supposed to enable him to repay his nation’s debts, and that the Western allies bled defeated Germany’s resources dry, thus opening the way for Herr Hitler once Weimar fell. Europe’s central banks are following this very policy today. They are doling out billions to ease energy bills, to bribe farmers and, most notoriously, to feed the money laundering Ponzi scheme that is Zelensky’s Kiev junta. The money supply, at more than 15 trillion euros, is at record levels and real interest rates are in negative terrain, pauperizing pensioners but failing to kick start their fuel starved economies. Inflation,.Germany’s bane, is again on the march as too far much money is in search of far too few bags of fire wood; and English toilet paper has increased in price by 50% in the last few months, Albion is really in squeaky bum time.

As the European Central Bank’s leaders presently have no other card to play, they must think their printing presses are enough to prevail in Ukraine and to allow Europeans to both eat and heat themselves this winter. Not only is that wishful thinking on the part of ECB President Christine Lagarde, the ‘multi cultural’ Parisian, who previously fronted the IMF and who held senior Ministerial positions in the French government but it betrays her fundamental ignorance about monetary policy. The main aim of the euro was to have the stability of the German mark and the Dutch guilder and not to be as volatile as Lagarde’s French franc, which was devalued four times since 1945. Unlike Lagarde, the Central Bank of the Federal Republic of Germany, along with that of Japan, seemed to have understood monetary policy, which is best seen as being like the throttle of a motorbike which must, when necessary, allow more fuel to enter the economic engine but which also must not flood it by drowning it in Zimbabwean dollars, French francs, Confederate Greybacks or Lagardean euros.

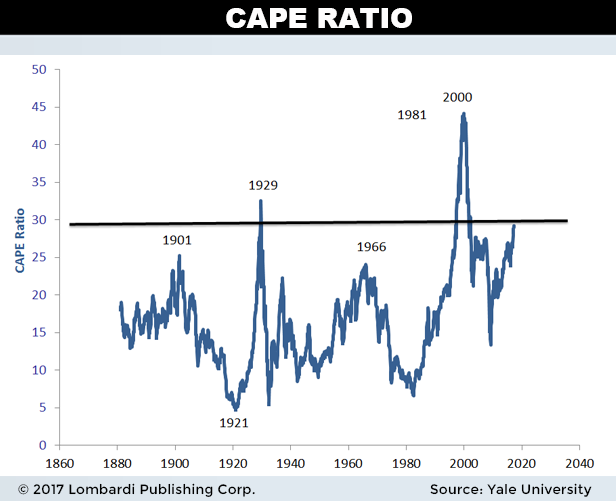

“Today, there is no optimal interest rate that will restore the balance between money demand and money supply ..”

• How the West Poisoned Its Money (Varoufakis)

Negative prices make sense for bads, not goods. When a factory wants to remove toxic waste, it charges a negative price for it: its managers pay someone to get rid of it. But when central banks begin to treat money like car manufacturers treat spent sulfuric acid, or nuclear power stations their radioactive wastewater, one knows that something is rotten in the kingdom of financialized capitalism. Some commentators now hope that Western money is being purified in the flames of inflation and interest-rate hikes. But inflation is not driving the poison out of the West’s money system. After more than a decade of addiction to poisoned money, no obvious detoxification method presents itself. Inflation today is not the same beast the West faced in the 1970s and early 1980s.

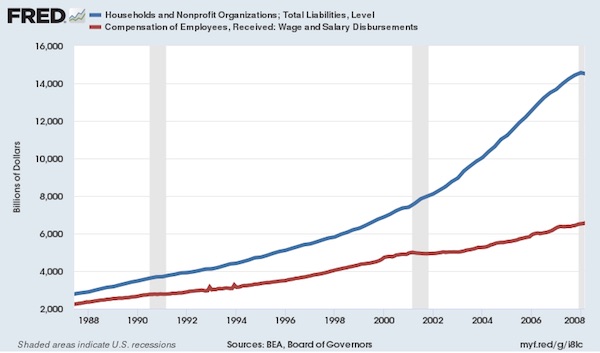

This time around, it threatens labor, capital, and governments in ways that it could not 50 years ago. Back then, labor was organized enough to demand wage increases that averted a cost-of-living crisis, and neither states nor private corporations relied on free money to keep going. Today, there is no optimal interest rate that will restore the balance between money demand and money supply that does not trigger a massive wave of private and public bankruptcy. That is the long-term price of poisoned money. The US government faces the impossible dilemma of curbing domestic inflation and forcing Corporate America and many friendly governments into a solvency crisis that will threaten America’s own stability.

Things are far worse in the eurozone, where policymakers refused to do the obvious once Europe’s banks had failed after 2008: establish a proper federation’s foundation – a fiscal union. Instead, they let the European Central Bank do “whatever it takes” to save the euro. Only by poisoning its own money could the ECB keep the euro show on the road. Today, the ECB owns huge quantities of Italian, Spanish, French, even Greek debt that it can no longer justify holding as a means of achieving its inflation target, but which it cannot renounce without calling the euro’s existence into question.

The archdruid finishes off nuclear power.

Coal had two world-changing effects. The first, the one everyone thinks of, is that it could be used to power steam engines, replacing wind, water, and muscle power first in dozens, then in hundreds, and finally in thousands of uses. The second, less widely known but just as dramatic, is that it could be used via the Bessemer process to produce steel in previously unimaginable amounts. Steel plus steam power drove the industrial revolution, sent railroads scything across continents and steamships driving through oceans, and transformed human life in a galaxy of ways.

Then, about the time coal reserves started to run short, petroleum (and its gaseous form, natural gas) came into general use. More chemically complex than coal, petroleum had even more net energy, and shifted the industrial revolution into overdrive. Airplanes, automobiles, plastics, industrial lubricants, the entire modern chemical industry—the list just keeps on going. Lewis Mumford, one of the twentieth century’s most insightful students of energy and civilization, argued that the distinction between coal-fired technologies and petroleum-fueled technologies was significant enough to define a change of eras: he called the coal period the Paleotechnic Era, and the petroleum period the Neotechnic Era.

The assumption all along was that petroleum would eventually run short and have to be replaced by something else, leading to a third technic era. By 1950 nearly everyone assumed that what would replace it was nuclear power. You have to read books from that time to get a sense of just how inevitable the coming nuclear era was thought to be. Even avant-garde ecological thinkers treated nuclear power as the next inevitable thing. Pick up any of the works of Paolo Soleri, Frank Lloyd Wright’s most innovative student, who imagined humanity settling in gigantic city-sized buildings called arcologies so that the natural world could be allowed to thrive elsewhere. Each of his arcologies was supposed to be powered by its own nuclear power plant.

That, in turn, was where the dream ran off the rails, because it turned out that nuclear power doesn’t pay for itself. It’s not economically viable, because its net energy is so low. Thus it wasn’t Chernobyl or Fukushima Daiichi that brought the nuclear dream to a grinding halt, it was a long series of financial disasters suffered by utilities that got suckered into the nuclear hoopla, above all the bankruptcy of the Washington Public Power Supply System (WPPSS, unfondly remembered as “Whoops!” by the many thousands who lost money on it).

“If Republicans take the House as expected in the midterms, the Democrats now effectively took ownership of Hunter — a political proprietary claim that few would relish.”

• House Democrats Take Ownership of Hunter (Turley)

House Democrats on the Oversight Committee took a vote on Tuesday that could come back to haunt them. All of the 23 Democrats voted not to inquire into the influence peddling scheme of Hunter Biden and the Biden family. Rep. James Comer (R-KY) proposed a “resolution of inquiry” in light of growing evidence of not just a possible multimillion dollar influence peddling operation by Hunter and his uncle, but the knowledge of his father, President Joe Biden. At a minimum, it appears that President Biden’s repeated public denials of any knowledge of these dealings is false. Yet, the Democrats blocked any inquiry into the corruption. If Republicans take the House as expected in the midterms, the Democrats now effectively took ownership of Hunter — a political proprietary claim that few would relish.

The vote comes after 33 senators asked Attorney General Merrick Garland to appoint a special counsel in the matter, a call that I have repeatedly made in prior columns for over two years. Rep. Carolyn Maloney, the chairwoman of the House Oversight Committee, called the resolution a “nakedly partisan effort” and accused Republicans of being “obsessed” with Hunter Biden. The vote, however, reveals a blind avoidance by Democrats of a corrupt scheme that brought in millions for the Biden family and may have benefitted the President himself. Even if no criminal acts are charged, the foreign dealings of Hunter and his uncle were clearly corrupt and leveraged access to Joe Biden to acquire windfall payments from governments and their surrogates. There is no good faith basis to refuse to investigate such a scheme designed to influence U.S. policy and policymakers.

Why wouldn’t the Congress want to know if there was a multimillion dollar influence peddling scheme reaching the very top of our government, including allegations of the involvement of foreign intelligence figures? The vote, however, does bring a modicum of clarity at long last. The House Democrats are now on record as actively blocking efforts to investigate this massive influence peddling scheme. The implications of that vote will likely become more clear if the House switches hands after the midterm elections. The Democratic members are not alone in such a reckoning. The mainstream media has been clearly moving to re-position itself in anticipation of possible criminal charges after years of blocking or downplaying the story.

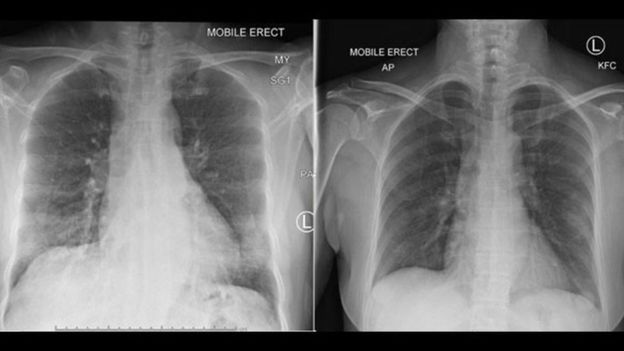

I honestly don’t understand how anyone can promote more vaccines after the New England Journal of Medicine reported Covid Vaccine Destroys Natural Immunity just last week.

• EU Health Regulator Says Covid Pandemic Not Over (R.)

An official at the European Union’s drugs regulator said on Tuesday the Covid-19 pandemic was not over, contradicting US President Joe Biden, and that a planned vaccination campaign in the region during the cold season was key to fighting it. “We in Europe still consider the pandemic as ongoing and it’s important that member states prepare for rollout of the vaccines and especially the adaptive vaccines to prevent further spread of this disease in Europe,” the European Medicines Agency’s (EMA) Chief Medical Officer Steffen Thirstrup told a media briefing, referring to vaccines targeting specific strains of the virus. He was asked to comment on Biden’s remark in an interview broadcast on Sunday that “the pandemic is over”. “I cannot obviously answer why President Biden came to that conclusion,” Thirstrup said.

The World Health Organization has said the pandemic remains a global emergency but the end could be in sight if countries use the tools at their disposal. During the media briefing, EMA officials reaffirmed a call by the agency’s Executive Director Emer Cooke made last week in a Reuters Next Newsmaker interview that people in Europe should take whatever Covid-19 booster is available and recommended to them in the coming months. Apart from the original Covid vaccines, the EMA has in recent weeks endorsed a number of vaccines adapted to the Omicron variant of the virus for use as booster shots to ease the burden from a feared surge in infections during autumn and winter in Europe. The EMA’s head of vaccines strategy, Marco Cavaleri, said the agency was also looking into the use of the adapted shots as a primary course of vaccination and that there were discussions on the types of data that could support such an approval.

Fox MV

MARTHA’S VINEYARD RESIDENT: “I don’t believe anything that comes out of the administration anymore.”

— Benny Johnson (@bennyjohnson) September 20, 2022

Sociopath

https://twitter.com/i/status/1572284911268003840

Hasty

Laura Ingraham: Dems panic at thought of COVID powers being taken away pic.twitter.com/1IEaO6IsQ1

— Wittgenstein (@backtolife_2024) September 21, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.