As many of you already know, I have written about economic, financial and industrial/environmental collapse on The Automatic Earth for a few years now. For all human beings who are still fortunate [or unfortunate] enough to exist on this Earth, these are issues of prime and imminent importance. We are now at least four years running into the start of the sub-prime mortgage meltdown, which then morphed into generalized private and public debt crises around the world. Many have predicted that either this year or the next carries the most probability for the next BIG leg down the ladder of financial collapse, including me.

Yet, I was also moved this year to start reflecting on what most people consider to be the more “personal” questions of life, and how the answers to those questions are relevant to the dynamics of collapse. Perhaps it is partly because I started to feel the “collapse blues”… which I’m sure most of the people here have experienced at some time or another – a period of time when you feel like everyone and everything is Doomed, and there’s really nothing you can do about it. We can write and talk and discuss until the cows come home, but only a few people will end up protecting themselves from the inevitable downfall at the end of the day.

So that was a part of the reason for my shift in focus, but by no means the whole thing. The more important part was that I felt there was a big piece of the collapse puzzle that was missing for me, and it had to do with the question of WHY – Why were the sociopathic bankers so reckless and greedy? Why were the shiesty politicians of all stripes so corrupt? Why were the neo-con war hawks so thirsty for blood and oil? Most importantly, though, why could I see hints of all of that sociopathic behavior, all of that corruption, all of that blood-lust and all of that never-ending materialism in everyone around me? My family and my friends were really no different at the end of the day.

Obviously, the average people I know aren’t perpetrating evil at Hitler-like scales, but they have generally accepted and supported a paradigm in which Hitler-like people are much more likely to exist than not. That’s what got me thinking that all of these systemic crises we face now ultimately boil down to existential questions – questions about who are we, where we came from, what our purposes are and why we consistently think and act in the ways that we do over time? And such questions obviously lead you to the realms of history, philosophy and spirituality. To make a somewhat short story even shorter, I took a leap of faith into those realms of knowledge and I came out with what I believe to be very good answers.

Those answers came in the form of Judeo-Christian theology for me. It wasn’t enough to just have the answers, though… I needed to share them with others – and that is how I came to classify myself as an evangelical Christian. And while I have managed to inject some Christian themes into my articles on TAE, and I also managed to get into some fiery debates/discussions on other forums (such as the Doomstead Diner), it simply wasn’t enough for me. What I needed online was a space of my own to devote entirely to my Christian perspective on all manner of modern day concerns. That is why I created my new blog – PICTURING CHRIST.

I want to make clear that this new website is not being supported or endorsed by Ilargi or Stoneleigh, and that the general themes and approach to the subject matter of Collapse are completely different. I would like to see both of these sites and others exist in harmony, providing people with a variety of different perspectives (depending on what they are in a mood to read) and mutually reinforcing the all-important cause for truth. I also cannot over-state my appreciation to Ilargi and Stoneleigh for letting me be a part of their great endeavour on TAE, and right now I plan to continue contributing content here from time to time, while also remaining active in the comment forum (time is always a factor, of course).

I especially appreciate their willingness to let me plug my new blog to the spiritually-inclined readers of TAE, and I appreciate those who wish to follow up on PC with an open, yet critical mind. I will still retain administrative capacities on TAE as well, perhaps acting as the central hub for the distribution of Stoneleigh’s invaluable DVD lectures. My primary focus from here on out, though, will be on alerting readers out there to PC and developing the site to the point where everyone interested will have a chance to read and reflect and contribute.

PC will be all about the interplay between metaphysical philosophy, Christian theology, religious history and the systemic crises of materialism that we face today. It will be about exposing naturalism and materialism for the destructive ideologies that they really are – to the destructive ends that they have taken us – and about giving people an arena to consider and discuss spiritual alternatives. It is true that I am an evangelical Christian, and my posts will be centered around the truth I find in the holy scriptures. However, I also welcome any challenges and alternatives to my views. After all, faith is truly nothing if it is not tested…

I have only been a Christian for about a year now, so I hope to learn a lot more about my own faith from this experience, while hopefully motivating others to learn more about theirs as well. I truly believe that we are living in perhaps the most unique time in all of history, and that the storms looming overhead will leave behind an epic amount of wreckage in their wakes. However, I also believe that it is most important for our souls to be saved on this Earth, rather than our physical bodies. So if anyone here feels similarly or is simply interested in being convinced (or trying their best to convince me why I’m wrong), I encourage you to visit PC and check out the content/discussion.

In addition to the regular posts that will go up, I have added sections for videos and audio files that will deal with all manner of spiritual subjects – such as the NT, the OT, difficult Christian doctrines, numerous fields of apologetics, religious podcasts, the New Age, Eastern religions, and much more. I will continue adding pages and content to the site as time progresses, and I am welcome to any suggestions or input from readers as to what they would like to see or hear. There are already four posts up on the site so far, and I obviously recommend you start with the Intro – An Introduction to Picturing Christ.

However, if you want to know a little more about why I think Christianity provides the ultimate answer to our pervasive problems of Doom & Gloom in modern societies, you can give this one a read – How Doom & Gloom Disappeared with the Protoevangelium.

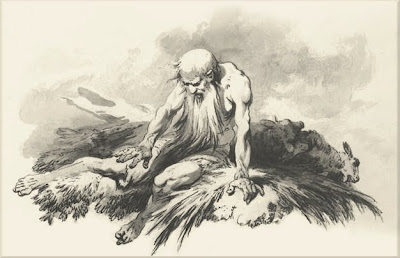

IF you would like to know what I truly mean by “Picturing Christ”, and how this process of picturing can help us navigate the treacherous waters we find ourselves in today (like the waters that Noah found himself immersed in thousands of years ago), you can check out this foundational post – The True Power of Pictures. My second latest post deals with a recent concern of mine over the seeming re-emergence of anti-Semitism in many parts of our increasingly fractured societies – A Few Thoughts on the Jews and Anti-Semitism.

Finally, my latest post deals with the problem of “scapegoating” that is so prevalent in modern society – the process through which people always find other individuals or groups to blame for their own problems, regardless of whether those problems were self-induced or are rightfully attributed to the actions of others. We all need to realize that scapegoating others, whether justified or not, is something that will never help us build our own character and lead us to a place of peace and comfort – The Devil’s Scapegoat

And just so any potential readers know, I am also continuing to work on improving the functionality of the site, including the ease of navigation and the posting of customized comments (fonts, colors, embeds, etc.), among many other things. There are a lot of plugins available on the hosted WordPress platform that I am currently running, so none of that should be a problem. Anyway, to conclude this plug, I would like to thank you all very much for your time and consideration, as well as your previous support of my writings, and I hope we can all continue to interact here at TAE, at PC and at many others forums or physical locations as well!