WPA Federal Art Project poster from New York, 1936

At the start of a week that has been dubbed “historical” and “one of the most important moments in Europe’s history”, I can’t seem to forget the statements by Merkel and Sarkozy sometime mid-October, when both solemnly pledged that by the end of that month the euro crisis would be resolved.

We know where that went. And we also know that establishing stronger fiscal ties across the continent, the somewhat vague “plan” that seems to be worked out in all haste, even if it can be accomplished, which is by no means guaranteed, will take a lot of time. Time that Europe almost certainly won’t be allowed.

Merkel, Sarkozy, Monti, Draghi, they’ve lost all credibility in the eyes of the markets. The only thing they still trust them to do is throw more of their people’s funds and future funds as free money at the fire, which the markets can then lap up. At some point, though, the free money will run out.

Satyajit Das has some nice quotes:

The Sovereign Debt Train Wreck

The US is in serious, perhaps irretrievable, financial trouble. Peter Schiff, president of Euro Pacific Capital, identified the state of the Union with characteristic bluntness:

“Our government doesn’t have enough spare cash to bail out a lemonade stand. Our standard of living must decline to reflect years of reckless consumption and the disintegration of our industrial base. Only by swallowing this tough medicine now will our sick economy ever recover.”

There is a lack of political or popular will to take the action necessary to even stabilise the position. The role of US dollars and US government bonds in the financial system mean that the problems are likely to spread rapidly to engulf other nations.

As John Connally, US Treasury Secretary under President Nixon, beligerently observed: “Our dollar, but your problem.”

Connally’s observation is about to be thrown right back into the face of America: “Our euro, but your problem.”

Europe doesn’t have the means to save itself. It will look to the rest of the world, especially the US, to do it instead. The same US that “… doesn’t have enough spare cash to bail out a lemonade stand. Nice dilemma.

As former broker Ann Barnhardt observes: Europe is mathematically impossible. It cannot be saved. [..] You even want to make a start at trying to bail out Europe we are talking $25 trillion just to start. [..] if you were going to bail out the entirety of Europe – you would now be talking about hundreds of trillions of dollars.

Whatever concocted statements or plans come out of the EU summit on Friday, December 9, it doesn’t really matter anymore. The best the Europeans can do is extend and pretend the can down the road for a few more days or weeks. So how about it, America?

Here’s Stoneleigh with our 1000th post on TAE:

Stoneleigh:

Look Back, Look Forward, Look Down. Way Down.

This is the 1000th post at The Automatic Earth, so it seems appropriate to review our message and update our projections – to look back and then look forward. Since the beginning of TAE in January 2008, and before that at The Oil Drum Canada, our purpose has consistently been to warn people that a decades-long credit expansion is ending, and that, as a consequence, we are in the grip of a very serious financial crisis.

The first leg down (October 2007- March 2009) was just a foretaste of what credit crunch really means, and the long sucker rally of March 2009-May 2011 was enough to put people back to sleep again, secure in the mistaken belief that supposedly omnipotent central bankers could postpone any kind of reckoning indefinitely. Now in early December 2011, we are seven months into the next phase of contraction, but most have yet to recognize that the trend has once again turned down.

Financial bubbles are not a new phenomenon, but are in fact quite common in the historical record. Every few decades, a new generation rediscovers the magic of leverage, igniting a rapid expansion of credit, and therefore debt. Every time humanity experiences a bubble, it fails to recognize the pattern.

The lessons of the past are sadly never learned. Each time the optimism is highly contagious. In the larger episodes, it crescendos into euphoria, leading societies into a period of collective madness where risk is embraced and caution is thrown to the wind. Sky-high valuations are readily rationalized – it’s different here, it’s different this time.

We come to believe that just this once there might be a free lunch, that we can have something for nothing. We throw ourselves into ponzi finance, chasing the mirage of speculative gains, often through highly questionable and outright fraudulent practices. Enron, Lehman Brothers, and recently MF Global, are but a few egregious examples of what has become an endemic phenomenon.

The increasing focus on chasing speculative profits parasitizes the real economy to a greater and greater extent over time. After all, why work hard for small profits in the real world, when profits on money chasing its own tail are so much greater for so little effort?

Who even notices the hollowing out of the real economy, or the conversion of large amounts of capital into waste, or the often pointless depletion of non-renewable resources, or the growing structural dependency trap, when there is so much short term material prosperity to pursue?

In such times, the expansionary impulse drives the development of multiple engines of credit expansion. The reserve requirements for fractional reserve banking (already a ponzi scheme) are whittled away to almost nothing. Since the reserve requirement effectively determines the money supply multiplier effect, that multiplier becomes almost infinite.

The extension of credit through the shadow banking system removes the semblance of central bank control over monetary expansion. Securitization and financial innovation also create putative wealth from thin air, using underlying collateral to derive layers of additional illusory value. In this way, excess claims to underlying real wealth are created. The connection between the rapidly expanding virtual worth of the derivative instruments and the real value of the underlying collateral becomes ever more tenuous.

In 2007, Bill Bonner of Agora Financial produced a descriptive example of this process.

Imagine a man who makes his living digging ditches. He may hire himself out at a daily rate of, say, $25. The old capitalists would have paid no attention to him – he is just one of millions of small entrepreneurs getting by in life.

But today’s financial hustlers will spot the opportunity. Let’s take him public, they will say. We’ll raise his daily rate to $30…pay him his $25…and the rest will be our “profit.” We’ll sell shares to the public at a P/E of 20…let’s see, 20 x $5 x 250 days per year = $25,000. All of a sudden, the ditch digger has a capital value of $25,000.

Then, they borrow $20,000 from a hedge fund…and pay it to themselves for structuring the deal. Now, the hustler has $20,000 in his pocket; the hedge fund has a high-yield bond worth $20,000; the shareholders have $25,000 worth of stock; and the poor man is still digging his ditches.

Then, an even more ambitious wheeler-dealer will come along and decide to “roll up” the whole industry – bringing the ditch diggers together into a multi-national consortium. Now they can all do cross-border transactions…including derivatives.

And now ditch-digging is a major business, suitable for large investors…with more investment coverage and a higher P/E ratio. Soon all the world’s banks, pension funds, insurance companies, and hedge funds have some of the ditch digging paper – debt or equity – and billions in fees and commissions have been squeezed out of ditches by the financial industry.

That, patient reader, is the way (the world-over) that industries and assets are now being bought, sold, refinanced, leveraged, re-jigged and resold. In the old days, companies went to investors or to banks for capital and cultivated a relationship with them that was long and fruitful.

Now, it’s all wham-bam-thank-you-ma’am capitalism. Inquiring capitalists now only want to know one thing – how fast can we do this deal? How many points can we get out of it and how much leverage can we get? And whom can we dump it on, when we’re done?

This is – the proper definition of – inflation : an increase in the supply of money plus credit relative to available goods and services. In times of speculative mania, when people no longer care what they pay for something on the grounds that someone else will always pay more, and money is being created with abandon in order to satisfy the acquisitive impulse, credit hyper-expansion constitutes inflation on a massive scale.

Expansion is the only reality many of us have known, hence it is no wonder we imagine it can be a permanent condition.

As John Rubino wrote, credit gains ‘moneyness’ as during periods of ponzi finance, creating excess claims to underlying real wealth:

As the global economy expanded without a hic-up, more and more instruments came to be used as a store of value or medium of exchange or even a standard against which to value other things—in other words, as money.

Thus mortgage-backed bonds and even more exotic things came to be seen as nearly risk-free and infinitely liquid….credit gained “moneyness,” which sent the effective global money supply through the roof.

This in turn allowed the U.S. and its trading partners to keep adding jobs and appearing to grow, despite debt levels that were rising into the stratosphere. For a while there, borrowing actually made the world richer, because both the cash received and the debt created functioned as money.

In the process of credit expansion, we borrow from the future through the creation of debt. Our focus on virtual wealth has very significant real world effects, as it distorts our decision-making in ways that guarantee bust will follow boom. We bring forward tomorrow’s demand to over-consume today, frantically building out productive capacity in order to satisfy that seemingly insatiable demand.

As money supply increase leads the development of productive capacity during this manic phase, increasing purchasing power chases limited supply and consumer prices rise. Increasing virtual wealth also drives up asset prices across the board, strengthening speculative feedback loops that inevitably strain the fabric of our societies, all too easily to the breaking point.

However, concern about the inflationary trend continuing into the future is misplaced. That is where we have come from, but it is not where we are going. Simply extrapolating past trends forward is tempting, but does not constitute meaningful analysis and has no genuine predictive value. It is far more important to be able to identify coming trend changes and to understand where these will lead.

Decades of inflation lie behind us. It is deflation – the contraction of the supply of money plus credit relative to available goods and services – that lies ahead. The threat we are facing is the rapid and chaotic extinguishing of the myriad excess claims to underlying real wealth created during our thirty years of credit hyper-expansion.

Here is another illustrative parable of financialization run amok, looking this time at the real world consequences that follow. Whereas credit expansion pushed up both demand and prices, creating the perception of great wealth in the process, the inevitable bust crashes prices and ruins businesses. The artificial demand boost disappears, but rather than return to its previous level, demand crashes and remains depressed for a long period of time.

The greater the scale of the credit expansion, the greater the effect of bringing demand forward during the boom years, and the greater the crash thereafter. With little demand, there is no price support at anything like previous levels, so prices also fall and remain low, potentially for years, as we saw in the depression of the 1930s.

Helga is the proprietor of a bar.

She realises that virtually all of her customers are unemployed alcoholics and, as such, can no longer afford to patronise her bar. To solve this problem, she comes up with a new marketing plan that allows her customers to drink now, but pay later. Helga keeps track of the drinks consumed on a ledger (thereby granting the customers’ loans).

Word gets around about Helga’s “drink now, pay later” marketing strategy and, as a result, increasing numbers of customers flood into Helga’s bar. Soon she has the largest sales volume for any bar in town. By providing her customers freedom from immediate payment demands, Helga gets no resistance when, at regular intervals, she substantially increases her prices for wine and beer, the most consumed beverages. Consequently, Helga’s gross sales volume increases massively.

A young and dynamic vice-president at the local bank recognises that these customer debts constitute valuable future assets and increases Helga’s borrowing limit. He sees no reason for any undue concern, since he has the debts of the drinkers in Helga’s bar as collateral. Helga, flush with borrowed money, gives in to the increasing demands from her employees and dramatically increases their rates of pay and installs what are the community’s best working conditions.

At the bank’s corporate headquarters, expert traders figure a way to make huge commissions, and transform these customer loans into DRINKBONDS. These “securities” then are bundled and traded on international securities markets. Naive investors don’t really understand that the securities being sold to them as “AA” “Secured Bonds” really are debts of unemployed alcoholics. Nevertheless, the bond prices continuously climb, and the securities soon become the hottest-selling items for some of the nation’s leading brokerage houses.

One day, even though the bond prices are still climbing, a risk manager at the original local bank decides that the time has come to demand payment on the debts incurred by Helga’s bar. He so informs Helga. Helga then demands payment from her alcoholic patrons, but being unemployed they cannot pay back their drinking debts. Since Helga cannot fulfil her loan obligations she is forced into bankruptcy. The bar closes and Helga’s 11 employees lose their jobs and all their accumulated entitlements.

Overnight, DRINKBOND prices drop by 90%. The collapsed bond asset value destroys the bank’s liquidity and prevents it from issuing new loans, thus freezing credit and economic activity in the community. The suppliers of Helga’s bar had granted her generous payment extensions and had invested their firms’ pension funds in DRINKBOND securities. They find they are now faced with having to write off her bad debt and with losing over 90% of the presumed value of the bonds.

Her wine supplier also claims bankruptcy, closing the doors on a family business that had endured for three generations, her beer supplier is taken over by a competitor, who immediately closes the local plant and lays off 150 workers. Fortunately though, the bank, the brokerage houses and their respective executives are saved and bailed out by a multibillion dollar no-strings attached cash infusion from the government.

The funds required for this bailout are obtained by new taxes levied on employed, middle-class, non-drinkers who have never been in Helga’s bar.

When a credit expansion reaches the point where the debt created can no longer be serviced by a hollowed-out real economy, and the marginal productivity of debt becomes negative, continued growth is no longer possible.

Ponzi schemes which can no longer grow implode. The first stage of this process began in 2008, with the first reversal of M3 plus total credit market debt since WWII.

The process of monetary contraction following a ponzi expansion is implosive because it involves the destruction of virtual value – the fairly abrupt realization that the emperor has no clothes. A pertinent analogy is that of a giant game of musical chairs where there is only one chair for every hundred people playing the game. Imagine what happens when the music stops. A few will be lucky and secure a chair. The rest represent excess claims, and those claims are then extinguished.

Credit only functions as a money equivalent during times when the suspension of disbelief can be maintained. Once confidence is lost and a toxic combination of fear and suspicion takes hold, a pile of human promises that obviously cannot be kept ceases to hold the illusion of substance. At that point one can expect is significant contraction in the scope of what constitutes money.

As John Rubino wrote of the 2008 crisis,

When the U.S. housing market—the source of all that mortgage-backed pseudo money—began to tank, hedge funds found out that an asset-backed bond wasn’t exactly the same thing as a stack of hundred dollar bills.

The global economy then started taking inventory of what it was using as money. And it began crossing things off the list. Subprime ABS? Nope, that’s not money. BBB corporate bonds? Nope. High-grade corporates? Alas, no. Credit default swaps? Are you kidding me?….

….No longer able to function as money, these instruments are being “repriced” (a slick little euphemism for “dumped for whatever anyone will pay”), which is causing a cascade failure of the many business models that depend on infinite liquidity.

No market moves only in one direction. The tug of war between greed and fear, and consequent ebb and flow of confidence, mean that the scope of what constitutes money can demonstrate periods of reflation as suspension of disbelief temporarily reasserts itself. The two year sucker rally from March 2009 saw the monetary contraction process reverse temporarily, and a number of factors resumed trajectories characteristic of the expansion years.

As we have said many times, rallies are kind to central authorities, because the supportive psychology of a rally, complete with suspension of disbelief, allows their actions to appear effective, temporarily. Stimulus packages seemed to achieve the desired ends, at least in terms of elevating the markets, suggesting that we were facing a relatively simple problem with a straightforward solution.

A dangerous perception has developed that central bankers are so much wiser and better informed than their predecessors in other times and places, that the lessons of the past have been learned and the pitfalls of the past avoided. This is of course the height of hubris. If a predicament such as this could be so easily resolved, then there would be no similar crises in the historical record. We cannot simply assume that previous central authorities were blind, ignorant, unimaginative or disinterested in self-preservation.

Now that the downtrend has reasserted itself with a vengeance, the supportive psychology of a rally no longer exists. Confidence is ebbing again, and fear is sharply in the ascendancy. We can already see how ineffectual the actions of central authorities are under such circumstances. Everything they do is too little, too late, and every failed attempt to stem staunch the financial hemorrhage only makes them look more desperate, which undermines confidence further in a vicious circle.

Europe is leading the contraction this time, providing a telling example of the powerlessness of central authorities in the face of a collapsing credit ponzi. The stability fund (EFSF) was originally to be €220 billion, but it was obvious long before that was agreed that €220 billion would be grossly insufficient.

Agreement , at the expense of the Slovakian government, was obtained to increase the fund to €440 billion, but by this time there were already public discussions of the need to leverage the fund by a factor of five.

A further agreement to extend the facility to a trillion euros was already behind the curve, as it was common knowledge that at least €2 trillion would be needed, and that would cover only Greece. Clearly, several other members of the eurozone would require the same treatment, and there is no provision for their difficulties.

At the heart of the problem lies the loss of money equivalence of credit instruments previously seen as risk free. As ‘moneyness’ is lost, the effective money supply contracts, and does so very rapidly. This is deflation by definition.

CNBC’s John Carney explains:

It’s easy to miss the contraction of the money supply because it involves a destruction of financial assets that we do not usually think of as “money” but that, in fact, operate as money — or did until relatively recently. The fundamental characteristic of modern fiat money — as opposed to commodity-based money under a gold standard — is that it serves as a medium of exchange. This means dollars or euros, for example. Basically, the local currency.

Within the banking system, however, other financial assets also serve as money. These assets can be used to meet margin calls, collateralize obligations, and make payments. U.S. Treasury bonds are the most obvious example of this kind of money-equivalent financial asset. The U.S. government recognizes the equivalence of Treasury bonds and dollars within the banking system by not requiring banks to hold any reserves against the bonds. They are counted as “cash or cash equivalents” on balance sheets of U.S. public companies.

Over in Europe, sovereign debt issued by euro zone nations also served as a money-equivalent inside the banking system. Banks were not required to hold reserves against sovereign debt. They used them as collateral for obligations, and made inter-bank payments with sovereign bonds. The bonds were, in short, as good as euros.

When the markets turned against nations like Greece and Italy, the cash-equivalency of their bonds came into doubt. It was obvious that they could lose value, and quite rapidly. The debt could no longer be used as collateral, except at extreme discounts.

The discounting of sovereign debt, then, meant that there was less money in the European banking system. If a one million euro bond previously held as a money-equivalent is now worth just 600,000 euros, the holder has lost 400,000 euros. Multiply that across the banking system, and you have millions of euros of money-equivalents simply vanishing.

It is exactly as if some paper-eating plague just started rotting physical euros. The money supply of Europe is vanishing.

The attempt to ring-fence Greece, allowing a one-off 50% haircut for them alone, is also clearly insufficient, given the obvious predicament of Portugal, Ireland, Spain and Italy, and the mounting problems of Belgium, France and Austria. The contagion is rapidly reaching the core of the eurozone, the actions of governments being overtaken by events at every step.

In addition, a decision to declare a 50% haircut not to represent a credit event, thereby triggering credit default swap payouts, is very dangerous. If a 50% haircut is not a credit event, then what protection is afforded by a CDS contract, and what therefore is its monetary value? On the other hand, allowing CDS contracts to be triggered would reveal the huge extent of counter-party risk in the CDS market, similarly demonstrating the worthlessness of this supposed form of insurance.

The CDS market has a built-in meltdown mechanism, and is destined to be a significant factor in credit implosion. The authorities were damned if they did and damned if they didn’t. The price of being in a position of perceived power at such as time is to see one’s reputation go down in flames for being unable to solve the insoluble.

The scale of the European debacle is not yet generally understood. While it is agreed that current stability funding is woefully inadequate, there are few people taking a realistic look at the scale of the potential losses across countries and asset classes.

Ann Barnhardt, who ran a brokerage until recently (when the MF Global collapse led her close it on the grounds of no longer being confident of the safety of her clients’ funds) is one individual who pulls no punches in her assessment of the losses Europe is facing, and the impossibility of repayment.

In an interview with Jim Puplava she looks at the scale of the problem as a whole:

Well, if anybody out there understands fourth grade arithmetic you know from metaphysical certitude that Europe is done. Europe is mathematically impossible. It cannot be saved.

You want to make a start. You even want to make a start at trying to bail out Europe we are talking $25 trillion just to start.

And it would then – if you were going to bail out the entirety of Europe – you would now be talking about hundreds of trillions of dollars.

Okay, people, there isn’t that much wealth or money on the surface of the earth. The total gross domestic product of the entire planet earth is I think just under $70 trillion. And we are talking about in excess of $100 trillion to bail out Europe? This is now mathematically impossible.

It’s not a matter of if the global financial system is going to collapse. Oh, it’s going to collapse. You better trust and understand that. It’s just a matter of when. And these piddling little maneuvers that these people are making, that the Fed is doing.

Oh, we are going to give Europe some money. Okay. What I saw this morning, what the Fed is getting ready to do in terms of Europe, is keep Europe going for another seven days. Well, fantastic. Thanks for that. That is literally the brain dead mindset of these politicians.

All they are doing is looking to kick the can down the road. At first it was kick the can down another 10, 12 years. Then it is kick the can down the road for another year. And then it was well, let’s kick the can down the road for another few months. Now we’re literally to the point where all we can do is kick the can down the road for a matter of a few days. It’s not going to make it.

I will be very surprised if we make it until Christmas.

Over the next year and beyond, we will discover what credit crunch really means. It is an economic seizure, and its effect is devastating. Credit in its myriad forms represents the vast majority of the money supply, and it is about to lose its money equivalency. This will leave only cash, and that cash will be extremely scarce.

Aggravating the effect of crashing the money supply will be a substantial fall in the velocity of money, meaning that money will largely cease to circulate in the economy as people hang on to every penny they can get their hands on.

Money is the lubricant in the engine of the economy in the way that motor oil is the lubricant in a vehicle engine. Attempting to run any kind of engine with insufficient lubricant will result in that engine seizing up.

Without the monetary exchange that we have built into our system at every level, it will not be possible to connect buyers and sellers, producers and consumers.

Nothing moves in an economic depression. This is the polar opposite of the frenetic activity of the inflationary boom years. Instead of the orgy of consumption to which we have become accustomed, we will experience austerity on a scale we cannot yet imagine.

Demand will evaporate, not because people do not have wants, but because they will lack the purchasing power to turn those wants and needs into consumption. Demand is not what we want, but what we can pay for.

We will be looking at falling prices as lack of demand undercuts price support, but because purchasing power will be falling much more quickly than prices, everything will become far less affordable, even as prices fall. As a much larger percentage of the much smaller money supply begins to chase essentials, those will receive relative price support, and will be the least affordable of all.

We must prepare right now for the onset of a long period of deflation and depression. Many people are reluctant to make preparations until they see the roof on fire, but by then it will be too late to take action.

To reiterate the advice TAE has been offering since its inception – hold no debt, hold liquidity in order to maintain freedom of action, gain some control over the essentials of your own existence, and build social capital in your own communities.

There is no time to waste in securing what you have, under your own control to the greatest extent you can manage. The future is at our doorstep, and it does not look like the past as we have known it.

People often ask at our globe-trotting lectures how to go about building community, after we've emphasized the importance of doing exactly that. I wanted to share the best example we've come across so far – Hulbert Street in Fremantle, Western Australia. Its success is a tribute to the two people who made it happen in the ultimate grass-roots experiment – Tim Darby and Shani Graham.

People often ask at our globe-trotting lectures how to go about building community, after we've emphasized the importance of doing exactly that. I wanted to share the best example we've come across so far – Hulbert Street in Fremantle, Western Australia. Its success is a tribute to the two people who made it happen in the ultimate grass-roots experiment – Tim Darby and Shani Graham.

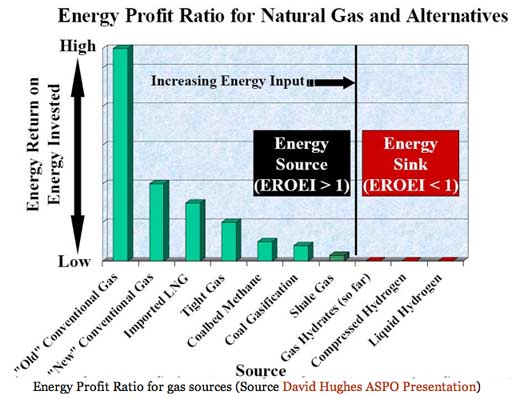

Western Europe is going to find itself very dependent on Russia as an energy supplier in the coming years, and as Eastern Europe already knows, that is an uncomfortable position to be in.

Western Europe is going to find itself very dependent on Russia as an energy supplier in the coming years, and as Eastern Europe already knows, that is an uncomfortable position to be in. The game of ‘shoot the messenger’ is going to be very popular over the next few years, as politicians and bankers seek to cover their own litany of failures and criminality. The expansion phase has been a period when no one cared about the increasingly endemic lies and fraud, because enough people were making money. Almost no one asks the hard questions when things are going well.

The game of ‘shoot the messenger’ is going to be very popular over the next few years, as politicians and bankers seek to cover their own litany of failures and criminality. The expansion phase has been a period when no one cared about the increasingly endemic lies and fraud, because enough people were making money. Almost no one asks the hard questions when things are going well.