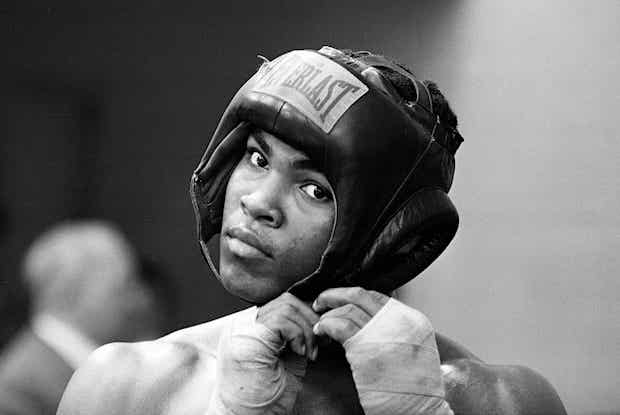

Gerry Cranham Protection for the pretty 1963

Imagine you’re standing across the street from a house that’s on the verge of falling apart, a condemned building, an edifice devoured by rot from bottom to top. Now imagine you see a construction crew arriving to repair it, and they start to fix the roof. You would think that’s not much use if the walls, floor and foundation are just one wolf’s huff and puff away from collapse.

Still, that is what the world’s central banks are doing today: they “fix” the top by bailing out banks and allege that somehow that will fix the rest of the edifice too. In that same analogy, while central banks prop up banks, governments try to support the walls, by bailing out businesses. Again, while the floors and foundations keep on rotting away. And when the floors cave in, so of course will the walls, just like the roof.

There may appear to be some logic to all this, but it’s only the “inner logic” of an economic and political ideology that deals exclusively with how things should be, not how they are. Of course it’s nice to have a shiny new roof, and strong walls. But neither have any value if there are no more floors to support them.

This is what is happening today to our economies and societies. The 2008 crisis wasn’t bad enough to expose the failures of the “inner logic” of the system, but the fallout of COVID19 will be. And it’s not the virus that does it all, or the lockdowns, they merely expose a system that’s been rotting for many years without its floors and foundations ever being repaired.

(And yes, you’re right, the central banks are not merely fixing the roof, they’re gold-plating it for good measure).

So you got the Fed team working on the roof and the government team working on the walls, and absolutely nobody working on the floors and foundations. And at some point you’re going to have to ask what these people actually know about building and construction, even about gravity: are they aware that roofs and walls are infinitely more dependent on solid floors than floors are on them?

Actually, I think they are. They just don’t think it’s possible that the floor may fall out from underneath them (i.e. they deny gravity). But that is what is threatening to happen. Not only in the US, but all over the western world. And if there’s one thing you don’t want to happen to your house, or your economy/society, it’s for the bottom to fall out. Because where will you live?

Still, with headlines such as

“More Than Half Of The US Population Is Not Working”,

“50 Million Americans Have Lost Their Job In Past 6 Weeks”,

“42 Million Unemployed, 25.5% Unemployment Rate”,

“52% Of Small Businesses Expect To Be Out Of Business Within Six Months”,

“53% Of Restaurants Closed Amid Coronavirus Have Shuttered Permanently”,

“US Retail Apocalypse: Over 25,000 Stores Could Close By Year End”,

and more of the same on the way, we should at least consider the possibility of the bottom falling out, and prepare accordingly.

It’s one thing to want to save the businesses, but if you have huge amounts of people who can’t afford to buy anything from them, businesses will inevitably fail in huge numbers. If the bottom threatens to fall out, you need to focus on saving the floor and foundations, the people, not the businesses. Nothing to do with socialism or anything like that, but with preserving your society as a going concern.

The first thing I didn’t quite get, but then again did, was that all the PPP’s and their equivalents, the various global payment protection programs, were aimed at protecting businesses by guaranteeing wages and salaries of their employees. What an odd idea, I thought. After all, if you want to protect wages, there is no reason to do that through a business, you might as well pay the employee directly.

If you pay the business which must then pay the employee, how would that help or protect that business? By giving off the false impression it can still pay the wages? Of course, if you do pay it through businesses, at least no-one can bring up a theme such as Universal Basic Income, anymore than they can MMT. While you in effect practice both, you can also deny practicing either. Pretty smart, right? Neat!

But turn this around for a moment. Say the governments pay the wages and salaries. These are the biggest cost for many if not most businesses, certainly the small ones, which are, obviously, the most vulnerable to sudden events like a pandemic and lockdown. So as a government, you take that liability, and that risk, away.

It would appear that then you can assess much better how viable such a business really is. Because a business that doesn’t have to pay its biggest cost should be able to survive for a few months, even if there’s no revenue coming in, unless it has deeper problems, like -too much- debt. The advantages for everyone are clear: less paperwork for government and business owner, guaranteed wages for employees, and a better view of a business’s financial situation for everyone.

Not that you should pay employees 100% of their wages, as many countries have. You would only do that if you think the problems will be over soon, but in reality you have no idea if they will be. You need to support the lowest-paid people -because they are the bottom that’s about to fall out- but as you work your way up to higher wages, you start taking off a percentage, rinse and repeat, and end up paying maybe $50,000 to people who made $100,000 (and yes, that goes for government employees too).

Why would you hand someone, anyone over $100,000 for not working? Of course there are people with mortgages and car loans that are so elevated that they need more than $100,000 to keep their families alive, but that is a different story. That does not deal with the bottom falling out. For those cases, you need a separate program. Just like you do for businesses that still can’t survive once all their wages have been taken care of by the government.

Obviously, as Midwest small businessman Bruce Wilds said recently in his guest post here, Small Business Firings to Start, for some businesses showrooms, or inventory, taxes, utilities, can be major liabilities. Again, separate program. Support the bottom, the people, first. Because it’s urgent. Because you risk too many people having too little to survive on. In fact, so many that your businesses come under threat from having no customers left.

As one of its first measures, Greece, when it went into lockdown, lowered rents for businesses by 40%, without as much as a plan for how to compensate landlords. That’s the spirit. But it’s a spirit few will understand, let alone politicians. In the end, the reality is that most landlords and mortgage lenders will get less money. For a long time. You can try to help everyone out with cheap loans to individuals and businesses to pay off their mortgages, but that’s a just another short term plan, and has nothing to do with long time views.

And cheap loans won’t save the bottom from falling out. If you put it like that, people will actually understand: you don’t save a failing economy by pouring in cheap money. Any more than a lick of paint will save a condemned building.

But at the same time, that’s all our political systems manage to come up with. While fervently hoping for, counting on, a miraculous recovery, and planning to make the poor pay by raising taxes when we’re “back to normal”. It’s just that there comes a time when the poor have nothing left to pay with, not even for their food. That’s when the bottom falls out.

To be continued. I have much more to say on this. Like: what to do now?

Look, it’s quite simple really: if you ask yourself, or your friends, or someone on the street, if they think the economy will recover within a “reasonable” timeframe, most will say yes. Conditioned by politicians, by the media, and by their own fear of what will be their fate if it doesn’t. But that is a giant blind spot. If half of businesses and half or restaurants are shut for good where ever it is you live, where would that recovery have to come from? Do ask yourself that question, and try not to be afraid of the answer for a moment.

We try to run the Automatic Earth on donations. Since their revenue has collapsed, ads no longer pay for all you read, and your support is now an integral part of the interaction.

Thank you.

Support the Automatic Earth in virustime.