National Photo Co. Federal Clothing Store, Washington, D.C 1925

The time has come. The Automatic Earth has been talking about the inevitability of deflation for years, but the concept only now goes mainstream. Which is a shame, because a lot could have been done to try and mitigate the damage it’s going to do.

Although it’s as inevitable as the laws of thermodynamics, the notion that record debts will always lead to record debt deflation is hardly discussed; you have Steve Keen, Mike Shedlock, and Nicole and yours truly here at The Automatic Earth, and that’s about it (I’m sure I miss one or two, apologies, but I can’t think of any). And although put together we have a reasonable readers base, blogs and websites are still no more than fringe sources compared to the main media where everyone lacks either the intelligence or the courage or both to even think about the notion, no matter how close its certainty may be to that of thermodynamics. They won’t have their world view disturbed by reality.

Well, reality is here. And we can have our 15 minutes of fun watching them try to explain away their expert blinders. Sure, Japan was recognized as being in deflation, but that’s far away, and moreover, no sooner does PM Abe play double or nothing all on red with another huge chuck of public debt, or everyone’s ready to claim he beat the deflation beast. Yeah, we’ll see about that. The next region the pundit choir, all in unison in case they need to claim everyone else was wrong too, declares to be “under the threat” is Europe. Nary a word yet about the US.

And moreover, the only way they think they can now see deflation is in consumer prices, which are nothing but a consequence of what deflation really is: a drop in the combination of money and credit supply, multiplied by the velocity of money. Or, if you will, you can broaden this to include GDP, and thereby arrive at the quantity theory of money: Inflation x Real GDP = Money x Velocity.

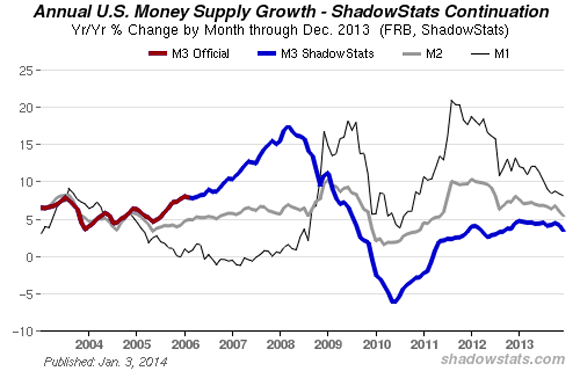

For money supply in the US, it’s best to look at John Williams’ Shadowstats, because as we know M3, the “really broad” money supply, is no longer published by the Fed. Here’s John’s latest update:

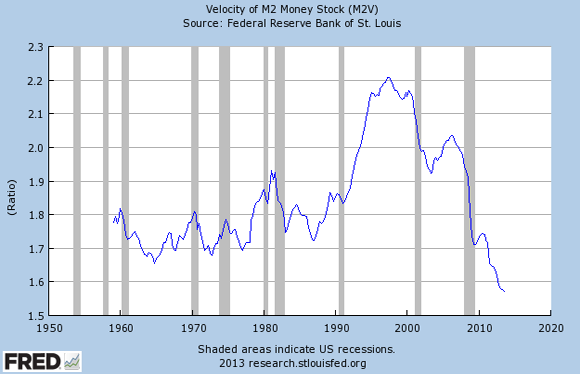

And since there is no reason to assume M3 velocity is shockingly higher than M2 velocity, it seems pretty safe to use a FRED graph for the latter:

What we see if we take the period since the start of Williams’ data, 2003, is that both M2 and M3 money supply have actually fallen a little, while M2 velocity has plunged by 25% or so. Yes, that means, admittedly painted in broad strokes, that the average American spends 25% less than they did in the late 90’s! If you insert that knowledge into the quantity theory of money, Inflation x Real GDP = Money x Velocity, it becomes clear that either GDP or inflation, and probably both, must have gone down quite a bit.

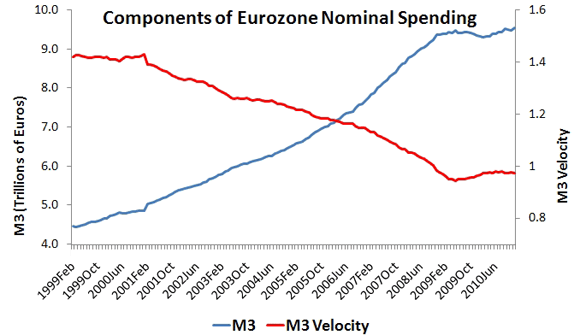

By the way, looking at Europe, it’s clear they, unlike the US, certainly tried to boost one side of the equation, as the other one crumbled. It’s almost funny.

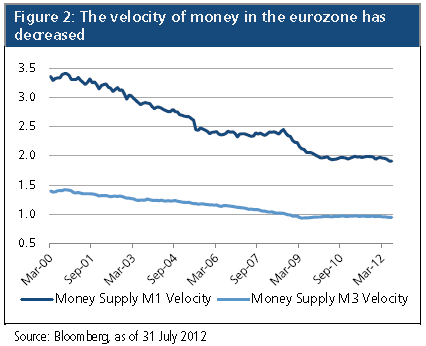

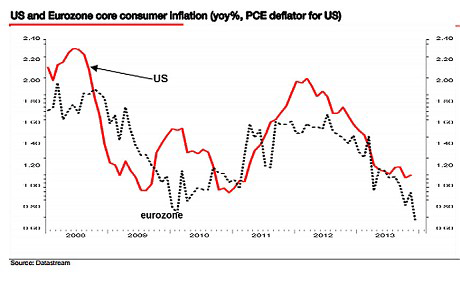

And from a slightly different and more recent angle:

Whether we talk about Europe or the US or Japan (where wages have been falling even faster than prices – the true sting of deflation -, for many years): when people buy less stuff, there is less need for workers to produce it and sales(wo)men to sell it to them. So they will be out of work and have less money to buy stuff, which creates even less need for workers and sales(wo)men, and so on. Deflation really is, sorry but there is no better word, a bitch. And as Japan can tell you, one that’s very hard to get rid off. Deflation is a bitch that really makes herself at home. And Japan has had the luck until 5 years ago that they were suffering deflation in a world where there was still demand for their products. Europe and the US obviously won’t be so lucky.

But if people have less money to spend, they can borrow, right? After all, isn’t that what we’ve all done all the time? And hey, to be fair, it’s not for lack of trying by the head honchos. Over the past 5 years, governments, certainly in the US and UK, have tried very hard to get people to buy homes again (with debt). But that doesn’t fight deflationary forces, since it doesn’t really raise the velocity of money, it may even bring it down: In essence, it puts more debt on people’s shoulders (which will instead conveniently be labeled ‘assets’ as long as prices keep rising), and more debt means less spending elsewhere. Cristmas sales were, overall, gloomy again. And that when people can still buy with plastic.

Another example: QE doesn’t enter in to the real economy, so it doesn’t increase the velocity of money. A large part of QE creates reserves that banks hold at the Fed, with the emphasis on hold, while, as Professor Steve Keen recently suggested in private – dinner – conversation, the part that reaches the shadow banking system is pumped into the stock markets, because shadow banks don’t have accounts with the Fed and they need to put it somewhere. Still, that has little effect on the velocity of money, though one might argue resulting – temporary – higher valuations tempt more people to buy stocks.

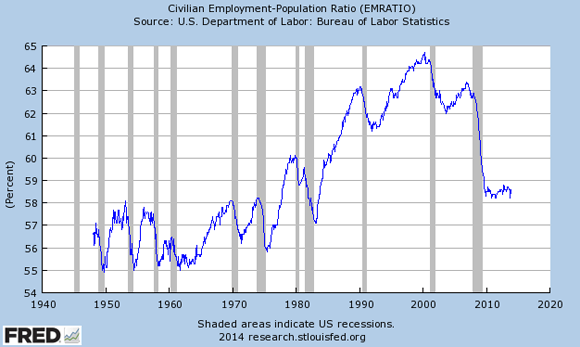

But it’s not about stocks, either, the velocity of money is something that takes place in the street, it’s not something that is controlled by 300 Wall Street bankers, but by 300 million Americans, the ones that make up 70% of GDP. Even if those bankers spend 100 times more on food and clothing than Joe No Blow, the effect will be negligible. It’s not about banks or bankers, it’s about what those 90 million Americans who are no longer part of the labor force spend on a daily basis on food and clothing and heat, and the 40-odd million on foodstamps, and the fast growing segment of the population that depends on incomes at the level of burger flippers and WalMart greeters. The lives all these people find themselves in, and let’s not forget the record low labor participation rate, drag down the velocity of money ever more.

It’s perhaps this complete lack of control the financial system has over the velocity of money that had former Fed Governor Laurence Meyer make the following utterly incredible remarks last July at CNBC. You really should hear this specimen. I guess it’s accepted “policy” that anything you don’t have control over, you just pretend doesn’t exist. As per Meyer: “The word ‘velocity’ doesn’t appear in my vocabulary; the issue is the amount of lending by banks”.

He also asserts that velocity is not a useful concept because it is “too variable”. What on earth is that supposed to mean? That we’re only supposed to take note of things that are constant? For some reason this reminds me of Homer Simpson’s stern declaration that “In this house, we obey the laws of thermodynamics”. Equally convincing at first bite, equally absurd two seconds on. It also reminds me of Steve Keen’s debate with Paul Krugman, in which the latter sought to entirely deny the role of banks in money creation. Sure, just pretend it doesn’t exist, that’s all you need.

Former Fed Governor Meyer: Velocity of Money Means Nothing

Former Federal Reserve Gov. Laurence Meyer told CNBC Tuesday [July 9, 2013] that velocity of money – the rate at which capital is transacted in an economy – shouldn’t concern markets, and he dismissed the metric as a guide in setting central bank policy. The concept is not very useful, Meyer said. “Monetary policy is about affecting rates, which affect financial conditions and affect aggregate demand.”

Velocity of money refers to the rate at which money in circulation is spent on goods and services, and economists use it to determine the expected rate of inflation. An economy with a higher velocity of money can expect a higher rate of inflation.

But Meyer, who now works with Macroeconomic Advisors, said that velocity is “just a definition” that doesn’t help predict much of anything. “Monetary policy is determined by basically a strategy that is embedded in policy rules. I can’t tell you what the money supply is or how fast it’s growing – I don’t care.” he said. “The word ‘money’ is never said in our office [and] probably not by the staff at the Fed,” he added. “Money doesn’t appear in any modern macro model. We have got to get over that, OK? We’re beyond that now.”

It’s not all that easy to silence me, but Larry Meyer managed to do it there for a minute or two. If this is how economic policy in America is decided, it’s no wonder there are 42 million people on foodstamps in what was once the richest nation on earth. Play that 6 minute video! Ben Bernanke is/was a little less absurd in this regard, but only a little, because as scared as he said he was of deflation, he’s always maintained he had it all under control. Sadly, there are debt levels at which debt deflation becomes like thermodynamics, events that can’t be stopped.

And pumping money into banks through QE does nothing to raise the money supply, only the monetary base (something I suspect Ben knows very well, which would mean he’s lied throughout his tenure about stimulating the economy), and Ben and Timothy and Jack Lew’s refusal to restructure bank debt hasn’t exactly helped either, to put it mildly. Bernanke’s claim, when seen in this light, that he had the deflation threat under control, is like saying he had the power to stop the waves from hitting the shore. And I think he’s known that, too, all along. The Buddha of banking my a**. I find it hard to believe he gets to leave as some sort of hero. The man should be under investigation.

But yeah, the press has en masse started to talk about deflation in the EU these days (good luck trying to spot a European politician who agrees, though). Try “deflation” as a search term in Google news, and you’re inundated with articles that include the term. Most still with pundits claiming “they” won’t let it happen, but it has certainly become a very popular word, almost overnight.

I don’t want to bother you with a long string of such pieces, but let me lift out some that I think are interesting. This morning, Royal Dutch Shell issued a strong profit warning, and cited “weaker refining conditions caused by industry overcapacity and weak demand”. The introduction of a new CEO is of course the ideal moment to announce bad news: he can’t be held responsible, he’s cleaning the slate. But I still smell deflation in this. Overcapacity, weak demand, money’s not rolling.

Shell issues shock profit warning as results plummet

Royal Dutch Shell’s new boss Ben van Beurden has admitted the oil firm’s performance was not what he expected from the group in 2013 as he issued a shock profit warning just two weeks after taking over at the helm. Van Beurden – who succeeded Peter Voser as chief executive on 1 January – said the firm’s fourth-quarter figures were expected to be “significantly lower than recent levels of profitability”.

Its fourth quarter underlying earnings are now expected to almost halve to around $2.9 billion. This is set to leave full-year results 23% lower at $19.5 billion. Shell blamed lower oil and gas prices and “weak industry conditions” in downstream oil, as well as higher exploration expenses and lower upstream volumes. Its recent third-quarter figures were badly hit by a 49% drop in downstream profits as a result of weaker refining conditions caused by industry overcapacity and weak demand.

On Wednesday, the incomparable Ambrose Evans-Pritchard took it upon his genius mind to link oil to deflation as well, in his own equally incomparable style (when he starts venting his opinion, you know it’s time to go walk the dog. Ambrose makes a lot of sense here:

Coming ‘oil glut’ may push global economy into deflation

One piece of the jigsaw puzzle is missing to complete the deflation landscape across the West: a slide in oil prices. This is becoming more likely each month. Turmoil across the Middle East and parts of Africa has choked supply over the past two years, keeping Brent crude near $110 a barrel despite a broader commodity slump. Cotton and corn prices have halved, as has the UBS index of industrial metals. Such anomalies rarely last. “We estimate that crude oil is now the mostly richly priced commodity in the world,” says Deutsche Bank in a fresh report.

Michael Lewis, the bank’s commodity strategist, said markets face an “new oil supply glut” as three forces combine. US shale will add 1 million barrels a day (b/d) to global supply for the third year running; Libya will crank up shipments after a near collapse in 2013; and Iran will come out of hibernation. “This will push OPEC spare capacity to levels last seen in the depths of the financial crisis in 2009,” he said.

America is on track to overtake Saudi Arabia as the top global producer of oil by 2016. It will account for more than half of non-OPEC world supply this year. The US Energy Department says US oil imports will drop to 5.5 million b/d by next year, half the level a decade ago. This turns the world’s 89 million b/d market upside-down.

Deutsche Bank said Saudi Arabia may have to slash its output by a quarter to 7.5 million b/d this year to stop the bottom falling out of the market. The Saudis no longer have such money to spare. They are propping up an elephantine welfare nexus to keep a lid on explosive tensions in the Eastern Province, home to Saudi oil and its aggrieved Shia minority. A cut of this size would push the budget into deep deficit.

This comes as Iran makes its peace with the West. Its 30-year vendetta with the US – Iran’s natural ally in many ways – no longer makes sense. President Hassan Rohani is no doubt pushing his luck by describing the nuclear deal as a “surrender” to Iran by the great powers, but let him have his flourish to save face. “It does not matter what they say, it matters what they do,” retorted the White House. [..]

Meanwhile, Libya is picking itself up from the floor after separatist militia forces reduced the country to anarchy last year, blockading key export terminals. The oil minister said this week that crude output has tripled since the summer to more than 600,000 b/d as the El Sharara field comes back on stream. Libya may add 1 million b/d to global supply this year.

Bank of America says a simultaneous return of Iran and Libya could add up to 3 million b/d. Just a third of this “positive supply shock” could shave $20 off the world oil price, unless OPEC’s fractious cartel can slash output quickly enough to offset it. We should expect hot words at OPEC summits, and plenty of cheating. [..]

Oil bulls says global economic recovery is strong enough to soak up any rise in supply. Perhaps, but Simon Ward at Henderson Global Investors says the world money supply rolled over in November and is now flashing amber warnings.

His key gauge – real six-month M1 – for the G7 rich states and E7 emerging market economies has slowed to 2.3% from 3.7% last May. It acts as an early warning indicator, six months ahead. This suggest that global growth may soon fade. “Global risks are rising. The cycle already looks mature by historical standards,” he said. The growth of broad M3 money in the US has slowed to 4.6% even before Fed tapering cuts off stimulus. In the eurozone it is has been near zero for the past six months.

The latest data from China are very weak, with M2 growth falling to 13.6% in December from 14.2% in November as the authorities tighten. It is the change in pace that matters. China looks eerily like the US in 2007 when broad money buckled. The sheer scale of money creation in China has worldwide implications. Zhang Monan from the China Foundation says the money supply is 200% of GDP, and 1.5 times larger than the US money supply in absolute terms. She said debt deflation is now setting in as the central bank tries to rein in credit.

As readers know, my view is that China is riding a $24 trillion credit tiger that it cannot control. Fresh data show that fixed investment surged to $5 trillion last year, more than in the US and Europe combined. This implies yet more excess capacity, transmitting a deflationary impulse worldwide.

A sudden slide in oil prices against this background may not be entirely benign. [..] The risk is that it will “unhinge” inflation expectations as the headline rate keeps dropping. Half of Europe already has one foot in deflation, with prices falling over the past five months once austerity taxes are stripped out. Any shock at this point could start to frighten the horses. [..]

To avoid confusion, let me be clear that the dangers of dwindling oil supplies in the long-run have not gone away. Easy reserves of crude are being depleted. New fields are more costly. Peak oil may have the last laugh. Yet this should not be confused with the short-term risks of deflationary shock.

I recently attended a Transatlantic Dialogue on Energy Security with senior military officers in London and Washington. The message was that shale will come and go – with US tight gas peaking by 2017 – creating a false sense of security as the deeper strategic threat continues to build. That is broadly my view as well. Much drama can intrude along the way.

Sorry for the long quote (the original is quite a bit longer still), but I think Ambrose had something in just about every word I quoted. He even made sure to include that shale oil is no more than a short-term fad, albeit with the potential (and this is because of speculation) to disrupt an entire industry (re: Shell’s losses announced today and its $2.1 billion write-down of shale “assets” last year).

And it’s good for people to ponder the notion that lower gas prices are not – only – a good thing. With the potential to drag down even CPI (consumer inflation) numbers below zero, they can create panic, a huge loss of trust in both political and economic systems, and a severe slide in markets. Shell accounts for close to 19% of the Amsterdam Stock Exchange (AEX), to name an example. In general, seeing deflation as beneficiary is not a very smart thing to do.

Albert Edwards had a noteworthy take on deflation as well, as quoted by Business Insider.

We’re On The Cliff Of Deflation And Markets Don’t Seem To Care

Societe Generale’s Albert Edwards has warned for some time that we are on the precipice of deflation. But in his new note to clients, he seems utterly bemused. Markets just don’t seem to care. “Markets remain stoic about the risks of outright deflation in the US and eurozone for one very simple reason,” he writes.

“They simply do not believe a recession that would trigger outright deflation is on the horizon. Quite the reverse – they believe with all their heart that we are at the start of a self-sustained recovery. That is despite the fact that the US recovery is already noticeably longer than average, and that the classic signs of old age, such as rapidly slowing productivity growth and stagnant corporate profits, can clearly be seen.”

Market expectations of inflation — via the 10-year bond market — have “remained entrenched” above 2% for more than a year, Edwards writes. “A chasm is growing between reality, both on a core and headline basis, and expectations,” he says. “If investors begin to doubt the economy recovery then they will no longer be able to ignore the lurking deflationary threat. Rapid market moves would ensue.”

There’s only one reason for stocks to be as high as they are at present, and it’s obviously not to be found in the real economy it allegedly reflects, but in stimulus from governments and central banks (Greek stocks were up 19% in Q4?!). Take away QE et al and all stock prices will be reflecting is unemployment numbers and foodstamps. I’m quite amused by people who say that since QE has had little effect on the real economy, tapering can’t possibly do much damage. You think? I say: take it away, Janet!

In the end, central banks are powerless when it comes to fighting deflation. Certainly when they have become so politicized and bought up by industry, as the Fed has, that they refuse to restructure debt. When that’s accepted policy, it’s merely a matter of time before the debt drags everything down that’s not bolted fast. The only sensible thing to do when there’s too much debt is to restructure it. But yes, I know, that would sink a too big bank or two, and a bunch of properties in Connecticut and St. Barth’s. And if you got the power to sink an entire nation instead and save your friends, hey …

Of course the reason the Fed does no restructuring and defaulting is to provide more time for private debt to be transferred to the public. If one thing defines Ben Bernanke’s tenure, it’s that. And when that process is deemed to be no longer sufficiently beneficial, we all better make sure we found ourselves adequate shelter from the storm.

I’ll close with a piece Zero Hedge posted from Phoenix Capital Research, where they don’t belive in mincing their words:

Three Points That Refute All Talk of Recovery

For well over five years now we’ve been told that the US was in recovery and that as most the biggest risk was a potential double dip or worse a slow down to the recovery. The reality however was that the US never experienced a real recovery (unless you work at one of the “chosen” firms on Wall Street). Housing has re-entered a bubble driven by liquidity, not first time homebuyers entering the market.

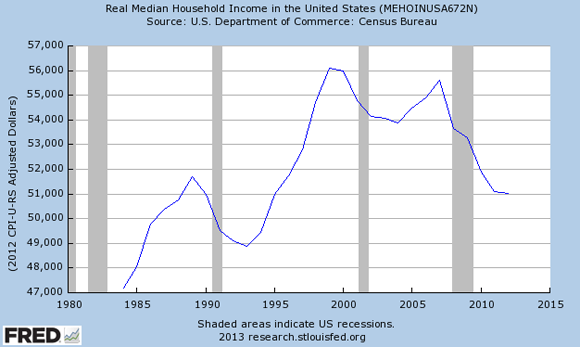

The key relationship for housing is home prices relative to income, NOT nominal prices. Stocks are valued relative to earnings. Homes have to be priced relative to incomes. Today, the median US income is $51K. The median home price is $328K. So homes are priced at 6.4X incomes. To put this into perspective, in 2007, the housing bubble was only marginally higher than this with homes priced at 6.8X incomes. So housing, which is alleged to be in a recovery, is not much more affordable today than it was in 2007… at a time when home prices were more overpriced than at any point in the last 100 YEARs.

Speaking of incomes, they remain WELL below their 2007 peaks… which were in fact below the 2000 peaks. In fact, the median income in the US today is effectively the same as back in 1987.

Again, NO recovery to be seen here. Indeed, the number of people of working age who actually HAVE jobs is back to levels not seen since the 70s. Gotta love that recovery… when the percentage of people working is the same as it was back when the US was in a recession four decades ago!

At the end of the day, the entire economic landscape is very simple to understand. The economy grows when people make more money and spend that money on things including homes. Lower incomes= lower spending= lower economic activity. Sure, you can reflate a credit bubble in which spending rises briefly due to people having easy access to credit… But at the end of the day, all this does is set the stage for another economic collapse when people once again default on their credit card payments/ mortgage payments.

That day of reckoning is coming… It’s just a matter of time.

Amen. Deflation is here to stay, and it’s going to hurt you much more than you care to think.

This article addresses just one of the many issues discussed in Nicole Foss’ new video presentation, Facing the Future, co-presented with Laurence Boomert and available from the Automatic Earth Store. Get your copy now, be much better prepared for 2014, and support The Automatic Earth in the process!

Home › Forums › The Beast Unleashed : Deflation Is Here To Stay