Jackson Pollock Man with knife 1938-40

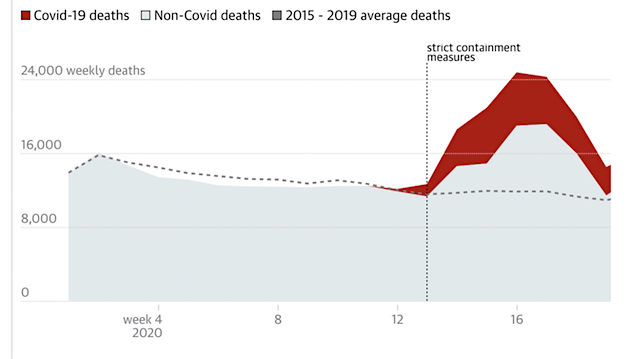

We went from 24/7 negative about Trump to 24/7 positive about Joe Biden. And then they’ll find out that 24/7 positive does not induce clickbait. And then what happens after that?

And really? J-Lo singing Woody Guthrie to celebrate the DC culture?

Here’s the state of your media for the next 4 years:

Today’s best meme:

They’re actually going to do it, they’re going to lower the PCR cycle threshold as soon as Biden comes in? That would be hilarious.

“The notice was released only one hour after President Joe Biden was sworn into office..”

• WHO Warns That PCR COVID Tests Are More Likely To Give False Positives (PM)

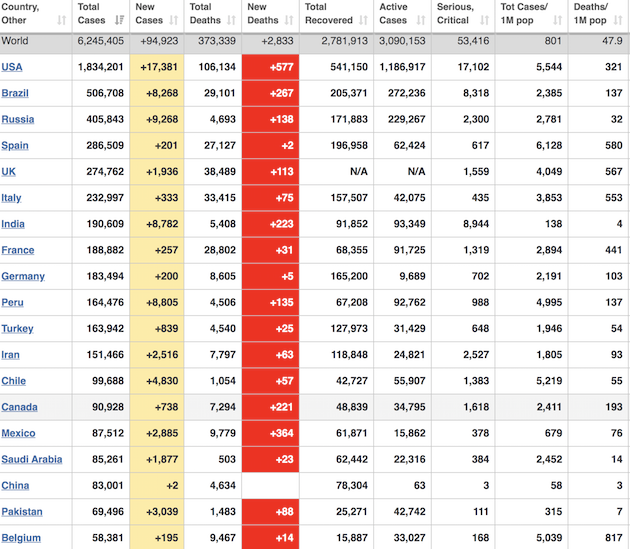

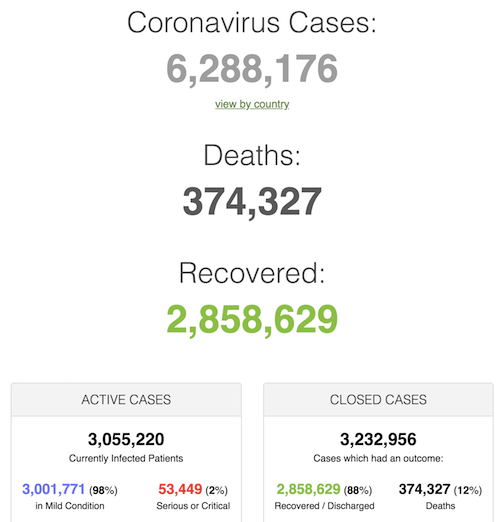

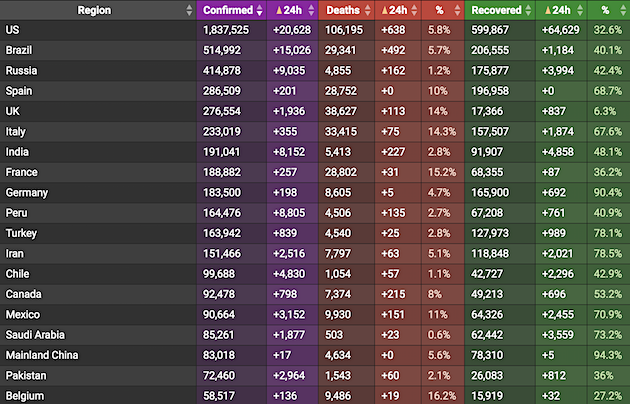

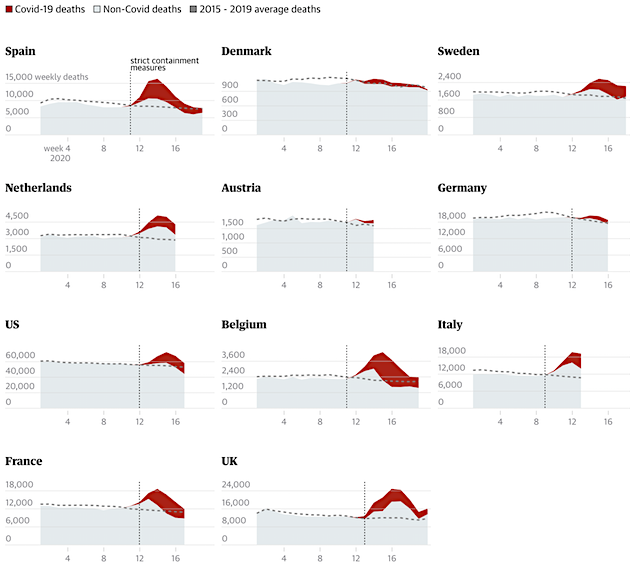

The World Health Organization issued a notice on Wednesday warning medical professionals to follow instructions of PCR tests for coronavirus to avoid getting false positive results. The notice was released only one hour after President Joe Biden was sworn into office, leading some observers to question the timing of the release. If the PCR tests are resulting in false-positives, and that information is now used to mitigate the large positivity numbers, the number of case counts will begin to drop. The optics of a decreasing COVID-case count would be a boon for the launch of the Biden administration. The new guidance states that the “WHO reminds IVD users that disease prevalence alters the predictive value of test results; as disease prevalence decreases, the risk of false positive increases (2).”

The notice reads: “This means that the probability that a person who has a positive result (SARS-CoV-2 detected) is truly infected with SARS-CoV-2 decreases as prevalence decreases, irrespective of the claimed specificity.” Former President Donald Trump has been heavily criticized for his handling of the coronavirus pandemic, with the United States leading the world in both total cases and total deaths, although not per capita, according to official statistics. A big problem for Trump had been the continuous increase in COVID-case counts. If many of those cases were established as extant with the help of PCR tests that were resulting in false-positives, that would mean that the case count for which Trump was criticized was not a factual number.

In the UK, this will be a bitter fight.

• No Decline In Very High COVID Rates During 1st Week Of UK’s 3rd Lockdown (ITV)

The spread of coronavirus did not decline during the first week of England’s third lockdown, a study has shown. The latest React study, from Imperial College London and Ipsos Mori, states that during the initial 10 days of the third Covid-19 lockdown in England, “prevalence of coronavirus was very high with no evidence of decline”. Researchers also found that the prevalence of Covid-19 across England increased by 50% between early December and the second week of January. After testing more than 142,900 volunteers in England between January 6 and 15, they found that one in 63 people were infected. The report, which researchers said does not yet reflect the impact of the national lockdown, also showed there were “worrying suggestions of a recent uptick in infections”.

National prevalence of the virus increased by half, from 0.91% in early December to 1.58%, the latest React study showed. While there was a rise in prevalence across all adult age groups, it was highest in 18- to 24-year-olds, and more than doubled in the over 65s age group. London saw the highest regional prevalence, jumping from 1.21% to 2.8%, while there were also rises in the south east, east of England, West Midlands, south west and north west. The only region to see a decrease was Yorkshire and the Humber, and prevalence remained stable in the East Midlands and north east, but the researchers warned infection numbers are still high even in these areas. Additionally, they found large household sizes, living in a deprived neighbourhood, and areas with higher numbers of black and Asian individuals were associated with increased prevalence.

Better masks only make sense when a virus is more easily transmitted? None of the below makes sense.

• France Issues Warning Over Use Of Homemade Masks Against New Variants (G.)

French health officials have advised people against wearing home-made fabric masks as they offer less protection against highly contagious new Covid-19 variants. The scientific committee, which reports back to the French government, says category 2 masks are unlikely to halt the spread of the “English variant” or new coronavirus strains from Brazil and South Africa. The experts’ advice, presented to ministers on Monday but not published, also suggested France double its social distancing rule from 1m to 2m. France’s Haut Conseil de Santé Publique (high council for public health – HCSP) decided over the weekend that many cloth masks, often preferred because they can be washed and reused, did not guarantee protection against the new variants. “Category 2 or material masks only filter 70%, while category 1 masks, like surgical masks, can go as high as 95% if worn properly.

As the variant is more easily transmitted, it is logical to use masks with the highest filtering power,” Daniel Camus, of the Pasteur Institute in Lille and a HCSP member told France Info. “We are not questioning the masks used up to now … but as we have no new weapons against them (new strains) the only thing we can do is to improve the weapons we already have,” Camus added. Home-made barrier masks made under Europe-wide established specifications are consider category 1. However, even though they are subject to making them more efficient filters, the HSPC said they may not guarantee the correct level of protection. Didier Lepelletier, the co-president of the committee’s Covid-19 working group, said everyone should now choose category 1 masks adding that home-made masks “have not been tested in terms of their performance”.

“Restoring America’s Place in the World”

-Rejoin Paris accord

-Fortify DACA

-Undo Muslim ban

-Stop border wall

-Order unified Covid response

-Eviction/foreclosure freeze —> 3/31

-Extend student loan pause —> 9/30

-Rescind Trump’s 1776 commish

-Undo Trump EO on Census

• Biden To Sign 53 Executive Orders In First 10 Days (Hill)

President Biden is poised to take action on 53 executive items over the next 10 days as he seeks to rapidly reverse some Trump administration policies and implement his own, according to a document outlining the schedule for Biden’s first two weeks in office. The document, which was circulated to individuals close to the administration and obtained by The Hill, shows that Biden will take executive action each weekday through the end of January, with each day centered around specific themes such as climate, economic relief, health care and immigration. The timetable lays out which days Biden is expected to act on anticipated items such as reversing the Mexico City policy, creating a task force to reunite separated migrant families and establishing a policing commission.

The schedule notes that the specifics of certain executive actions are to be determined, reflecting how the Biden team is still hashing out details as it takes office following delays in the transition after the November election. The themes are expected to extend into February, which has been designated around the idea of “Restoring America’s Place in the World,” according to the document. This week, Wednesday’s theme is focused on the inauguration and addressing “four crises” — the coronavirus pandemic, climate, the economy and equity. Among the items Biden will sign are an order mandating masks be worn on federal lands, an extension of eviction moratoriums, a repeal of Trump’s travel ban and a proclamation halting border wall construction.

Thursday’s theme will focus on the pandemic, according to the document. Biden is expected to sign off on executive orders to review the supply chain ahead of any use of the Defense Production Act and to implement public health measures on public transportation, airplanes and trains. Friday’s theme is economic relief, with two executive orders expected to be signed, according to the document. One will direct agencies to take action on Medicaid, Pell grants and unemployment insurance, while the other will restore collective bargaining rights to federal employees and initiate a rollback of a Trump administration rule on Schedule F. The theme for Monday is “Buy American,” and Biden will sign one executive order seeking to ensure agencies use U.S. suppliers.

Or it may be nothing.

• Inaugural Display Symbolizing 56 US States, Territories (JTN)

President-elect Joe Biden’s inauguration decor touting 56 U.S. states and territories provokes new questions about whether Biden will push for new statehood for six U.S. territories, which could aid the Democratic Party in the Electoral College. Under the U.S. Constitution, statehood requires only a simple majority in Congress, which could be achieved if Democrats decide to remove the 60-vote filibuster threshold currently in place in the Senate. As part of the “Field of Flags” display at the National Mall ahead of Biden’s inauguration, the Presidential Inaugural Committee planted nearly 200,000 state and territory flags on Monday night, meant to represent the American people unable to travel to Washington, D.C., for Inauguration Day due to the COVID-19 pandemic and security threats.

Fifty-six pillars of neon blue light, representing the U.S. states and territories, were also lit up for 46 seconds to mark the inauguration of the 46th president of the United States, Joe Biden. The prominent light beams were reminiscent of the grounds of the 9/11 Memorial in Manhattan. Biden has said he supports statehood for Puerto Rico and the District of Columbia. Other U.S. territories with permanent civilian populations include Guam, American Samoa, the Northern Mariana Islands, and the U.S. Virgin Islands.

[..] Historian Jason Steinhauer told Just the News on Tuesday that the National World War II Memorial “serves as a useful reference point for the Field of Flags display” because it contains 56 pillars representing each state and territory from its period, including the District of Columbia. Those 56 pillars represented a different assortment of states and territories from that time period: 48 states, plus the territories of Alaska and Hawaii, the District of Columbia, the Commonwealth of the Philippines, Puerto Rico, Guam, American Samoa, and the U.S. Virgin Islands. Steinhauer noted that memorial opened in 2004, during the George W. Bush administration.

In case you wondered who won.

• Globalist “Manifesto” For Post-Trump Economic “Reset” (ZH)

Proponents of the QAnon “conspiracy theory,” which the NYT can’t seem to stop writing about, are going to love seeing this. A memo that has reportedly been circulating among policymakers on both sides of the aisle for weeks was finally released to the press on Tuesday when Dealbook editor and CNBC “Squawk Box” host Andrew Ross Sorkin got the scoop: a memo penned by a group of senior-level bureaucrats, including – who else? – Henry Kissinger and former British Prime Minister Tony Blair has provided a kind of “blueprint” for the Biden Administration to undo all of President Trump’s trade-war tactics and other policies that didn’t exactly help promote free trade.

As Trump recounted in his farewell video published earlier Tuesday afternoon, his administration dramatically altered the American trade landscape, pulling the US out of the TPP, renegotiating Nafta into the USMCA, and – most consequentially, at things would turn out – the trade war with China, which inspired waves of hysterical lobbying by the Chamber of Commerce and special-interest groups from Big Tech to Wal-Mart and other major retailers, and others. So, as Biden prepares his first 100-day blitz of policy directives, many of the architects of the globalist system created by groups like the Trilateral Commission are joining with a gaggle of former cabinet-level officials (both Dems and GOP) along with the CEO of one of America’s largest banks, former British Labour Party Prime Minister Tony Blair and – who else? – Henry Kissinger, have essentially penned a manifesto that is being circulated among lawmakers, along with top-level officials in the cabinet and the West Wing, to help restore the globalist system that Trump helped to disrupt.

Who better to leak the story to than Andrew Sorkin, who first brought up the existence of the memo during an interview during Tuesday morning’s episode of “Squawk Box” on CNBC during a conversation with Harvard economist Austan Goolsbee. According to Sorkin’s column, “the memo comes from an under-the-radar group of global boldfaced names that act as a private advisory committee to JPMorgan Chase. They include Tony Blair, the former British prime minister; Condoleezza Rice and Henry Kissinger, two former secretaries of state; Robert Gates, the former secretary of defense; Alex Gorsky, chief executive of Johnson & Johnson; Bernard Arnault, chairman of LVMH; and Joseph C. Tsai, executive vice chairman of Alibaba, among others.” The group, which even Sorkin concedes is exclusively staffed with members of the “globalist part of the globalist establishment that fell out of favor during the Trump years, typically meets once a year in a far-flung location with JPMorgan’s chief, Jamie Dimon.”

But we’ll keep the craziest stuff.

• Biden Will Recognize Guaido As Venezuela’s Leader – Blinken (R.)

U.S. President-elect Joe Biden’s administration will continue to recognize Venezuelan opposition leader Juan Guaido as the South American country’s president, Anthony Blinken, Biden’s nominee for secretary of state, said on Tuesday. Blinken told members of the U.S. Senate that Biden would seek to “more effectively target” sanctions on the country, which aim to oust President Nicolas Maduro – who retains control of the country. Blinken said the new administration would look at more humanitarian assistance to the country. The United States, along with dozens of other countries, recognized Guaido – the leader of Venezuela’s opposition-held National Assembly – as the country’s president in January 2019, arguing Maduro’s 2018 re-election was rigged.

“We need an effective policy that can restore Venezuela to democracy, starting with free and fair elections,” Blinken said. Guaido’s push to oust Maduro – who has overseen a collapse in the once-prosperous OPEC nation’s economy and stands accused of corruption and human rights violations – has stalled. Maduro calls Guaido a U.S.-puppet seeking to oust him in a coup. His allies have expressed a desire to engage in negotiations with the Biden administration after years of tensions and escalating U.S. sanctions.

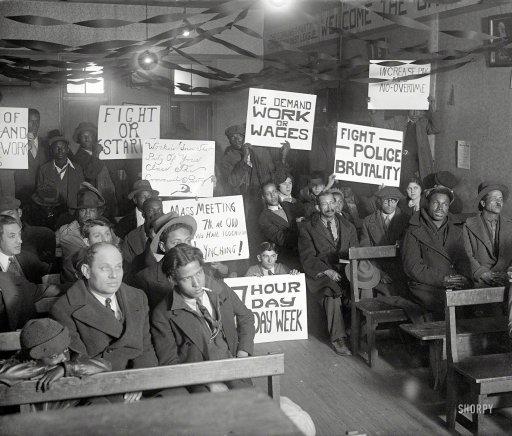

Remember the loud protests?

• US To Keep Embassy In Jerusalem – Blinken (AlJ)

The incoming administration of President-elect Joe Biden will keep the US embassy in Israel in Jerusalem, his nominee for secretary of state affirmed at his Senate confirmation hearing. “Do you agree that Jerusalem is the capital of Israel and do you commit that the United States will keep our embassy in Jerusalem?” asked Republican Senator Ted Cruz of Texas. “Yes and Yes,” said Antony Blinken in testimony on Tuesday. Outgoing President Donald Trump announced the US recognition of Jerusalem as Israel’s capital in December 2017. The US moved its embassy to Israel from Tel Aviv to Jerusalem in May of the following year.

Jerusalem remains at the heart of the decades-long Middle East conflict, with the Palestinian Authority (PA) insisting that East Jerusalem – illegally occupied by Israel since 1967 – should serve as the capital of a Palestinian state. “The only way to ensure Israel’s future as a Jewish, democratic state and to give the Palestinians a state to which they are entitled is through the so-called two-state solution,” Blinken said. “I think realistically, it’s hard to see near-term prospects for moving forward on that. What would be important is to make sure that neither party takes steps that make the already difficult process even more challenging,” he added.

The scariest face of them all. And that’s saying something.

• John Brennan’s ‘List’ Of Ideologies Biden Intel Community Should Go After (ZH)

Well this is alarming and ominous to say the least… Former CIA Director John Brennan told MSNBC in an interview on inauguration day that the intelligence community under newly sworn in President Biden is “moving in laser-like fashion” to try and uncover dangerous plots against the country. Naturally, there’s been much of this worrisome commentary about what political ideologies should be targeted and monitored coming out of NatSec hawks in the wake of the Capitol Hill mayhem of January 6. But this is the first time such a broad array of groups have been so bluntly lumped into a Pro-Trump “insurgency” by an influential media pundit and former spook. Brennan expressly said they are “violent” and remain a domestic threat.

He said in the MSNBC interview without the least concern for violation of Americans’ rights that intelligence agencies should look into “religious extremists, authoritarians, fascists, bigots, racists, nativists, even libertarians…”. He said these belief systems have come together under the umbrella of a supposed pro-Trump movement capable of committing violence. Ah yes, “even libertarians”… “I had white knuckles because of the nature of the threats,” he began by recalling his days as CIA Director. We’ve seen “the growth of this polarization in the United States and domestic violence and White supremacist groups,” he continued. Comparing this “threat” to a foreign insurgency which the US has lately battled overseas, he said it— “brings together an unholy alliance of religious extremists, authoritarians, fascists, bigots, racists, nativists, even libertarians.”

“Neither the FBI nor the NSA has the culture of brutal hostility toward their own country’s population needed to efficiently repress dissidents in the unfolding police state.”

• Call For New “Secret Police” Force to Spy on Trump Supporters (SN)

Perhaps channeling the spirit of the Soviet NKVD, leftists are now literally calling for a new “secret police” unit to be created at the federal level to spy on Trump supporters. In an article published by the Daily Beast, Jeff Stein argues that existing federal agencies like the FBI are ill-equipped to stop “white terror” because they missed signs of the the pre-planning of the Capitol building siege. The solution is to create a new “secret police” (yes, he literally uses those words) in order to “infiltrate and neutralize armed domestic extremists,” which according to the media’s latest narrative potentially includes 70 million Trump voters.

Stein even compares the Capitol breach to 9/11, an attack that killed nearly 3,000 people, and argues that a similar response to that should be directly inwardly against American citizens directed by a new “domestic spy agency.” “One response to the 9/11 tragedy may well get renewed attention after the Capitol assault—especially if armed white nationalists are successful in carrying out more attacks in the coming days and weeks: The call for a secret police,” he writes. The existence of a “secret police” force that subverts constitutional norms to repress the population is of course a hallmark of all dictatorial regimes, but that doesn’t appear to bother self-proclaimed “progressives.”

“Hundreds of Black Lives Matter/Antifa riots, some of which entailed firing mortars at, firebombing, or burning down police stations, did not qualify as domestic terrorism. But the Capitol Riot was terrorism, due to the usual double standard,” points out Dave Blount. He also hits the nail on the head about the real reason why the creation of a new secret police unit would be necessary. “Neither the FBI nor the NSA has the culture of brutal hostility toward their own country’s population needed to efficiently repress dissidents in the unfolding police state.”

Told, you, they will regret the Trump ban. Genie’s out of the bottle.

Mind you, she also said: “After four long years, Europe has a friend in the White House.”

• Silicon Valley CEOs Can’t Decide Laws And Rules – EU Commission President (RT)

European Commission President Ursula von der Leyen has sent a message to US tech companies ahead of President-elect Joe Biden’s inauguration, warning that Silicon Valley CEOs can’t decide their own laws and rules.

During a speech delivered in the European Parliament, von der Leyen laid out a series of areas in which the European Union (EU) is hoping to work with the incoming Biden administration, including climate change and the regulation of American-based tech companies that have an international reach. The EU has been working to introduce global standards for digital companies that provide a clear set of rules and responsibilities for the way they operate and the content that is distributed via their sites. However, rebuffing suggestions from tech giants to allow them to moderate themselves, von der Leyen was clear that governments must now intervene.

“This kind of decision must be taken in accordance with laws and rules…not by an arbitrary decision in the power of Silicon Valley CEOs.” Citing the recent attack on the US Capitol and linking the behavior of those President Donald Trump supporters to division and disinformation that appeared online, von der Leyen said in a tweet that regulation must be imposed on social media sites to “ensure that hate & fake news can no longer spread unchecked.” This is not the first time that the EU has sought to control the power of social media companies and tech giants. Google has been a target of the EU’s antitrust body in recent years, with the search engine having been hit with over $9 billion of fines, and further investigations are underway.

Germany does it “gründlich”.

• Germany Enacts Major Overhaul of Its Competition Regime for the Digital Era (WSGR)

On January 18, 2021, the 10th amendment of the German Act against Restraints of Competition (ARC) entered into force. The so-called “ARC Digitization Act,” designed to modernize German competition law enforcement for the era of big-data, i) creates sweeping new powers for the Federal Cartel Office (FCO) to regulate digital platform companies; ii) expands prohibitions on abuses of market power by firms with “relative market power” and firms that refuse access to data, networks, or infrastructure; and iii) raises the thresholds for German merger control. Because of the potential that large technology companies could be required to make dramatic changes to their current business practices, the FCO is poised to become one of the most consequential competition agencies for large technology companies.

Indeed, FCO President Mundt has repeatedly emphasized the willingness and readiness of his authority “not to squander the head start” and to apply the new rules soon after their entry into force. Under the new Section 19a of the ARC, the FCO gains novel powers to designate certain companies as having “paramount significance for competition across markets.” Upon making such a designation, the FCO can then order such companies to cease engaging in prohibited types of conduct, such as self-preferencing. The ARC Digitization Act also introduces changes to the burden of proof and the appeals process, designed to enhance the FCO’s ability to take swift action. The FCO may issue a decision declaring an undertaking to be of paramount significance for competition across markets.

The factors the FCO may consider in making this determination include:

• its dominant position in one or more markets;

• its financial strength or its access to other resources;

• its vertical integration and its activities on otherwise related markets;

• its access to data relevant for competition; and

• the importance of its activities for third parties’ access to supply and sales markets and its related influence on third parties’ business activities.The qualitative nature of these factors provides the FCO with considerable discretion in making Section 19a declarations. As clarified by the German legislators’ explanatory memo, only a small number of (digital) “ecosystems” is likely to fulfill the threshold of having such “paramount significance.”2 The intended targets of the new rules are large and “often dominant” digital platform companies “with the resources and strategic position to significantly influence the commercial activities of third parties or expand their own activities to new markets and sectors.”3 We expect that the FCO will initially target “GAFA” and a few other (mostly U.S.-based) digital platforms.

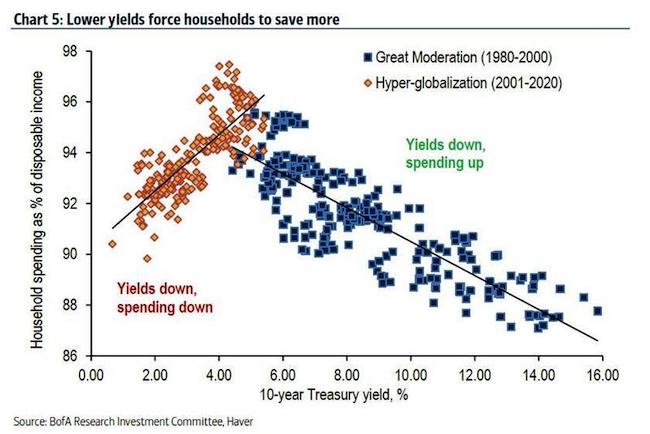

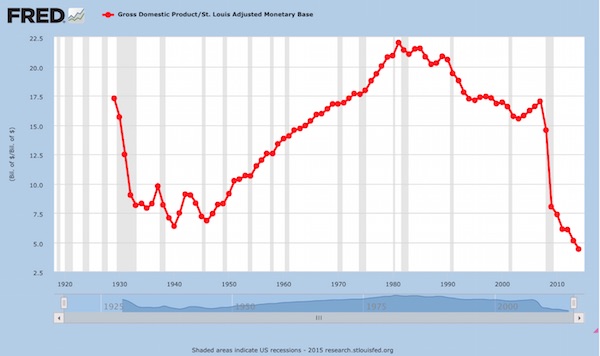

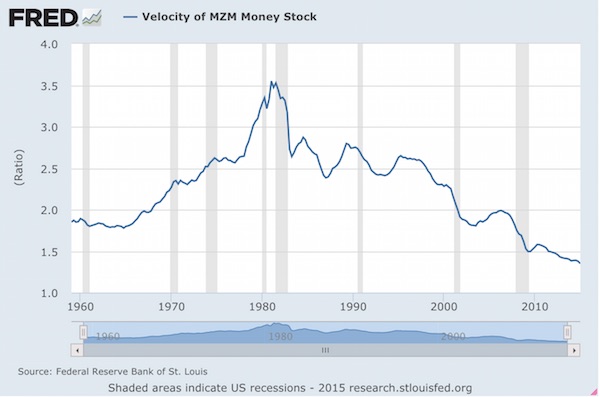

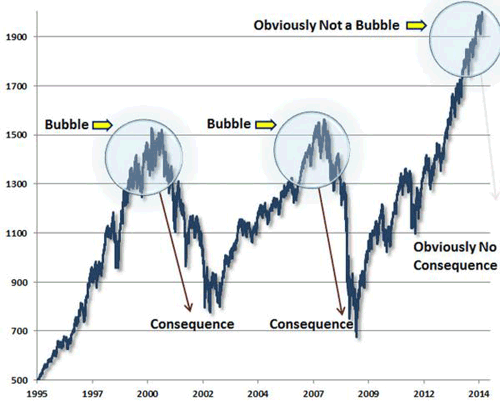

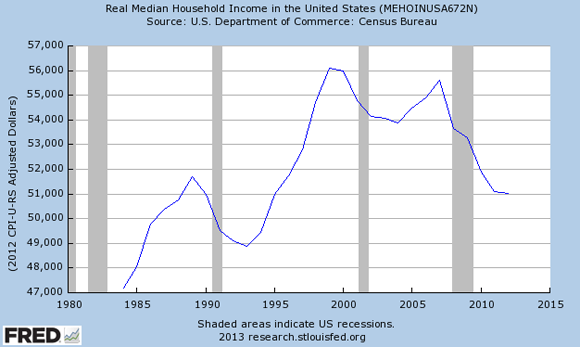

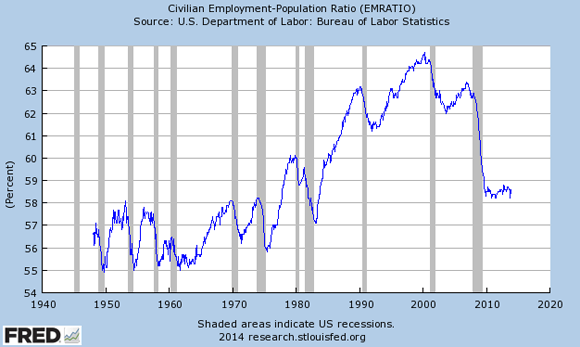

An old favorite theme of mine: What if money doesn’t move?

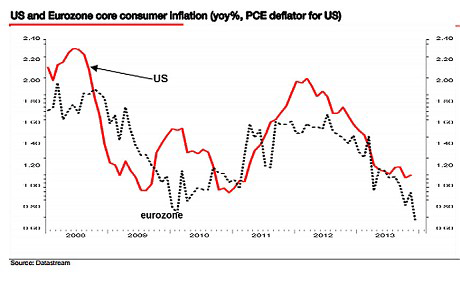

• The Fed’s Inconvenient Truth: Inflation Is “M.I.A.” (RIA)

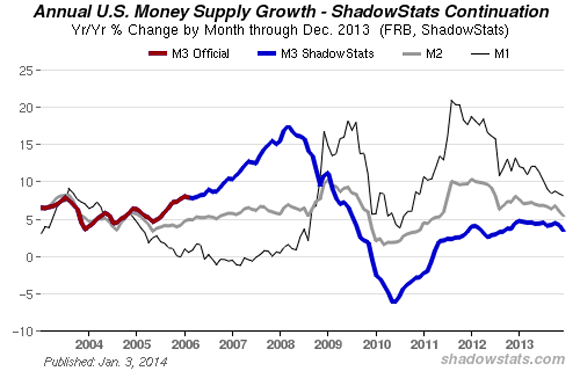

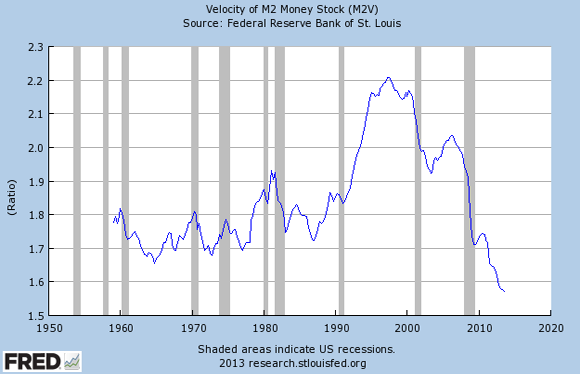

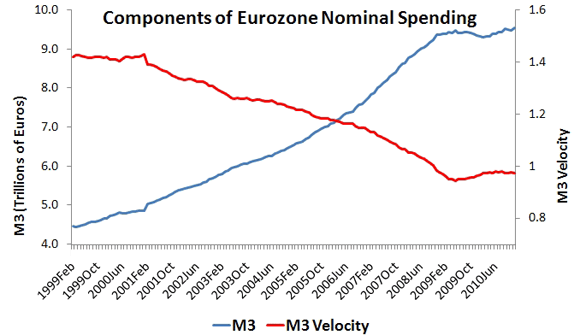

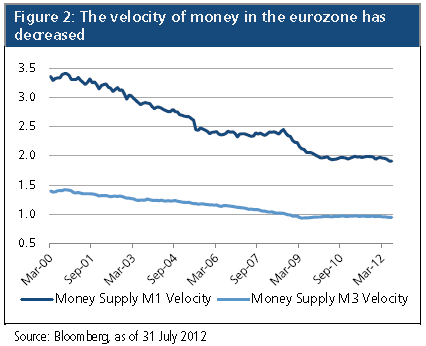

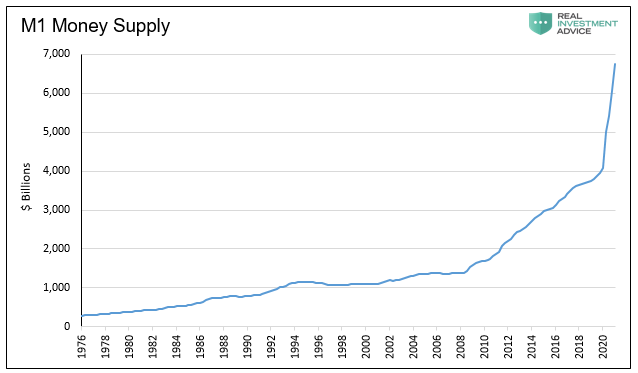

“The amount of money in the US economy is 25% higher than it was at the start of 2020, eclipsing any pace of money growth seen since the Federal Reserve was established (1913)” RB Advisors Deputy CIO Dan Suzuki. In recent weeks we have seen a non-stop flow of ominous statements like the one above. The author is 100% factual and it should be a cause for deep concern. Historically, such surges in the money supply were often met with significant inflation. While the sharp increase in the money supply provides context to the depth of our economic problems, our inflation warning bells are not ringing, at least not yet. Here is why.

Inflation, or aggregate price increases, results from economic activity, along with the amount of money and its velocity. A famous economic formula called the Monetary Exchange Equation uses those factors to create a mathematical identity that precisely determines the inflation rate. We co-authored an article with Brett Freeze entitled Stoking The Embers of Inflation. The article went into great detail about the monetary exchange equation. We summarize a few key points here: Per the inflation identity, the rate of inflation or deflation (%P) is equal to the rate of money growth (%M), plus the change in velocity (%V), less the rate of output growth (%Q).

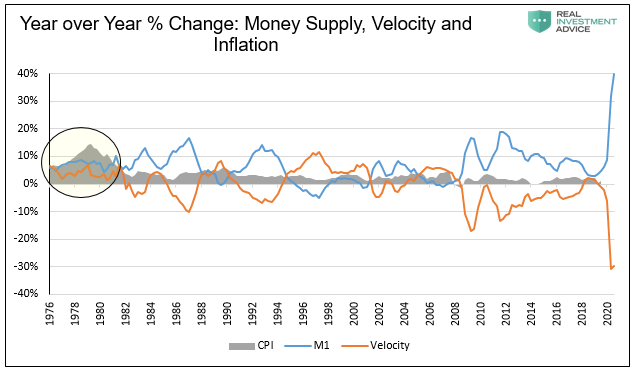

• %M – As noted earlier, the change in the monetary base is a direct function of the Fed’s monetary policy actions. To increase or decrease the monetary base, the Fed buys and sells securities, typically U.S. Treasuries and more recently Mortgage-Backed Securities (MBS). • %V – Velocity is nominal GDP divided by the monetary base (Q/M). Velocity measures people’s willingness to hold cash or how often cash turns over. Lower velocity means that people are hoarding cash, which usually happens during periods of economic weakness, credit stress, and fear for banking institutions’ going-concern.

So if we exclude GDP, inflation is dependent on money supply and velocity changes. Money supply data is published weekly and easily forecastable with the Fed’s QE schedule. Velocity, on the other hand, is posted once a quarter and much more challenging to forecast. As such, let’s dive into velocity. Velocity is a measure of how fast cash circulates in an economy. We consider two extreme examples of money printing and monetary velocity to appreciate the interaction of money supply and velocity. • The Fed prints $10 trillion and buries it in a hole. • The Fed prints $10 trillion, sends each American a $30,000 check, and tells them they have five days to spend it or lose it The two examples have polar opposite effects on prices, despite the same massive increase in the money supply.

In example 1, the Fed does not affect inflation. The $10 trillion is not fungible as long as it stays buried. In example 2, hyperinflation would result as the new money rapidly circulates through the economy and dwarfs the economic system’s production capacity. Essentially, the demand for goods and services outstrips the supply. The amount of money greatly matters, but equally important is how it moves through the economy. The graph below compares the money supply chart above with the velocity of money and inflation.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Medhurst – America Just Replaced One Monster With Another

https://twitter.com/i/status/1325622342370922496

Support the Automatic Earth in 2021. Click at the top of the sidebars to donate with Paypal and Patreon.