Salvador Dali Paranoiac Woman-Horse (Invisible Sleeping Woman, Lion, Horse) 1930

ABC

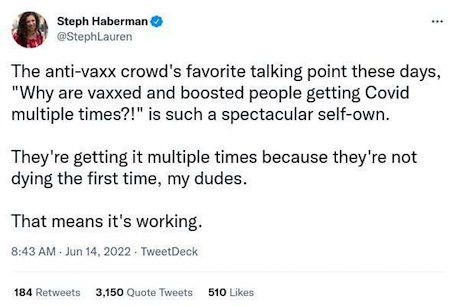

Wow! Finally US Major News Networks reporting Massive Ukrianian Army losses! They even admit Russia is winning all the battles across the country! #PleaseRetweet pic.twitter.com/Zap55HV6W9

— The Truth Matters!!! (@DisInfo_Kills) July 4, 2022

From Elon Musk

“..capitulating to the West is no option for Russia, at this point. Things have gone too far.”

• The New Worldview Of Russia’s Elite (ZBB)

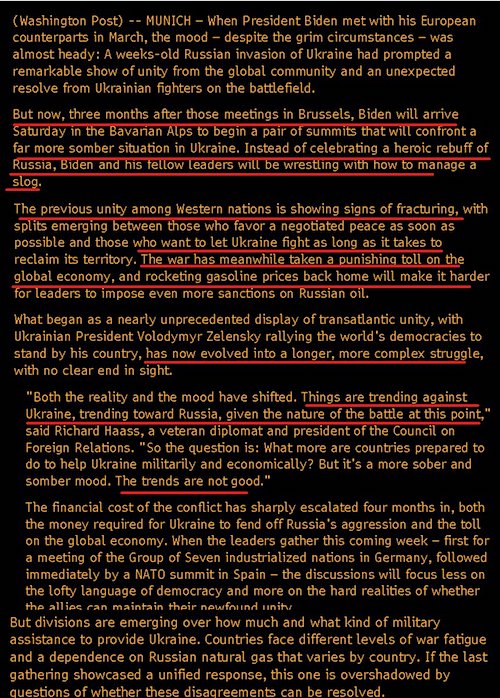

Dmitry Trenin is one of Russia’s key policy influencers as proven by his position on the prestigious Council on Foreign and Defense Policy, which contributes to formulating his country’s approach towards those two interconnected issues. Despite being considered a Western-friendly liberal for most of his career, this member of the elite decisively shifted his worldview in response to Russia’s ongoing special military operation in Ukraine that was commenced in order to defend the integrity of its national security red lines from US-led NATO’s latent threats. His transformation from a foreign policy liberal to a conservative isn’t an outlier but increasingly representative of the rest of his country’s elite as well. He shared some crucial insight into his country’s grand strategy in May in remarks during his Council’s 30th Assembly that were republished by RT at the time…

Russia’s flagship international media outlet once again published his latest thoughts last weekend in a piece titled “Dmitri Trenin: Russia has made a decisive break with the West and is ready to help shape a new world order”. Just like his prior one for that platform, this one also deserves to be analyzed in detail since it confirms the new worldview of the Russian elite that’s responsible for formulating its foreign and defense policies just like he partially is. According to Trenin, this decisive break with the West is both necessary and difficult for three reasons. First, past inertia serves as a major obstacle, though the current conditions of the Collective West united against Russia make this a necessity. Second, Russia’s economic relations have historically been tied with those same Western countries that are now united against it despite having previously fed this Great Power’s growth over the past three decades, which is all the more reason to urgently pioneer viable replacements as soon as possible.

And lastly, the Russian elite culturally regard themselves as part of Western Civilization, yet the latter’s latest “woke” trend is contrary to traditional Russian culture. The respected Russian expert then shared some frank commentary on the matter. In his words, “With the West shunning Russia, trying to isolate and sometimes ‘cancel’ it, Moscow has no choice but to kick its old habits and reach out to the wider world beyond Western Europe and North America. In fact, this is something that successive Russian leaders vowed to do repeatedly, even when relations with the West were much less adversarial, but the Europe-oriented mindset, the apparent ease of trading resources for Western goods and technologies, and the ambition to be accepted into Western elite circles prevented that intention from turning into reality.”

Trenin added, however, “that people start doing the right thing only when there are no other options. And certainly, capitulating to the West is no option for Russia, at this point. Things have gone too far.” From there, he shared some facts that imbue the reader with a sense of cautious optimism that not only will things change for the better, but that they’re already well on their way there. The Global South has “risen spectacularly” since the end of the Old Cold War, with China conducting more trade with Russia than Germany did even prior to the US-led West’s sanctions against it and countries like India, Saudi Arabia, the UAE, Turkiye, and Iran emerging as independently minded close partners too.

OPEC+ is stronger than OPEC.

• Saudis Unwilling To Upset Putin As Biden Begs For More Crude (OP)

The world’s largest crude oil exporter, Saudi Arabia, continues to keep close ties with Russia while the top oil consumer, the United States, pleads with major producers—including the Kingdom—to boost supply to the market and help ease consumers’ pain at the pump. While the U.S. and its Western allies are sanctioning Moscow and banning oil imports from Russia, U.S. President Joe Biden is also turning to Saudi Arabia to ask it to pump more oil as Americans pay on average $5 a gallon for gasoline. The Saudis prefer to keep close ties with Russia in oil policy as the OPEC+ pact and the control over a large portion of global oil supply has benefited both OPEC+ leaders—the Kingdom and Russia—over the past half a decade.

Saudi Arabia, however, could use a little thaw in Saudi-U.S. relations under President Biden, who is no longer talking about the world’s top crude exporter as a “pariah” state. The Saudis are carefully maneuvering to keep Russia as an ally in the OPEC+ group and possibly improve relations with the United States. President Biden—desperate to see relief for American drivers ahead of the midterm elections—has made a U-turn on Saudi Arabia and is expected this month to visit the Kingdom, which he said on the campaign trail would be treated as a “pariah” state during his presidency. But U.S. gasoline prices at $5 a gallon and the loss of part of the Russian supply have made President Biden reconsider and meet with Crown Prince Mohammed bin Salman.

Saudi Arabia has publicly reiterated its “warm” ties with Russia on several occasions since Putin invaded Ukraine, and considers keeping Russia in the OPEC+ alliance an important part of its oil policy. With Russia leading a dozen non-OPEC producers in the pact, Saudi Arabia has more sway over global oil markets with the larger OPEC+ group than with OPEC alone.

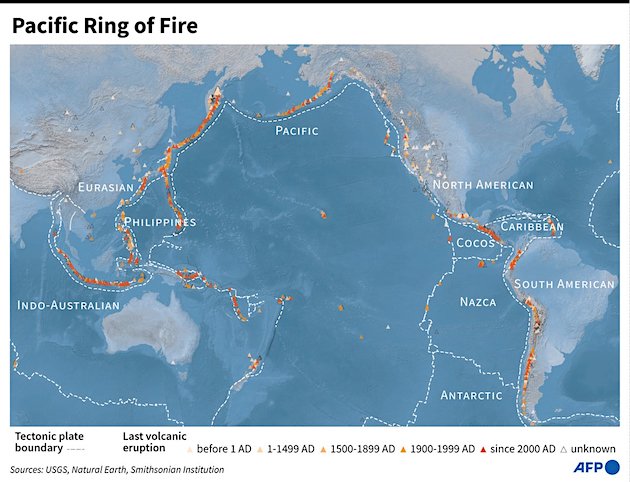

But the length of the NATO-Russia border has doubled.

• Putin Says “No Problem” If Finland, Sweden Join NATO (ZH)

Now with the 30 member nations having signed the NATO accession protocols for Sweden and Finland on Tuesday, which brings them a huge step closer to entering the alliance, Russian President Vladimir Putin has reacted by downplaying it: “Russia has “no problem” if Finland and Sweden join NATO, President Vladimir Putin said on Wednesday. “We don’t have problems with Sweden and Finland like we do with Ukraine,” Putin told a news conference in the Turkmenistan capital of Ashgabat. Finland and Sweden will be formally invited to join the alliance after Turkey dropped its opposition on Tuesday.”

However, he was also quoted as saying he couldn’t rule out that new tensions would emerge in Russian relations with Helsinki and Stockholm now that they’ve abandoned their historic neutrality regarding the Western military alliance. Additionally he suggested a further militarization along the 830-mile Russian-Finnish border, in line with prior comments from top Kremlin officials: “President Vladimir Putin said on Wednesday that Russia would respond in kind if NATO set up infrastructure in Finland and Sweden after they join the US-led military alliance,” according to AFP, though without explaining further. The thrust of his comments appeared to focus on the question of Ukraine joining and Sweden-Finland being “two different things”.

Putin explained in the televised remarks, “They began turning Ukraine into an anti-Russia bridgehead for trying to destabilize Russia itself. They began fighting Russian culture and language. They began to persecute individuals who regarded themselves as part of the Russian world,” in reference to the Ukrainian government post-2014, following the forced ouster of Russian-friendly president Viktor Yanukovych. Two months ago as it emerged that Finland would seriously pursue joining NATO, there were fears this could spark a Russia-NATO war, but now these and other comments of Putin on the question strongly suggest Moscow is willing to de-escalate on the question.

“..the plan was “very encouraging” as it did not require demining of the ports, potential routes had already been identified..”

• Black Sea Grain Deal Is Close, Says Erdogan (Pol.eu)

Moscow and Kyiv may be just days from finalizing an agreement to allow millions of tons of Ukrainian grain to pass through the Black Sea, according to Turkish President Recep Tayyip Erdogan. In peacetime, Ukraine was a vast contributor to global food supplies, but a blockade of its Black Sea ports since the invasion by Russia has prevented the shipping of crops leaving for Egypt, Yemen and other countries in desperate need. Russia has also attacked Ukrainian grain silos and is alleged to have seized stocks. Turkey is attempting to broker a deal between Russia and Ukraine. The government in Kyiv wants Turkey to provide security guarantees to ships carrying the grain through the Black Sea.

“Negotiations are going ahead so that this grain, and sunflower oil, everything can reach the world,” Erdogan told a press conference in Ankara. “In a week or 10 days we will intensify the talks and try to arrive at a result.” The Turkish leader said safe passage for commercial shipping was very important because, while his own country was not yet suffering grain shortages, Africa was already facing “a huge problem.” He was speaking at a joint press conference with Italian Prime Minister Mario Draghi, after talks between the two governments. Draghi said that Turkey had “a central role” in the plan, which he said had been outlined at the G7 meeting of leading economies by U.N. Secretary General António Guterres. “That role is to guarantee the security of ships, and ensure that the ships don’t carry arms” Draghi said.

Draghi said the plan was “very encouraging” as it did not require demining of the ports, potential routes had already been identified, and the working group had been established. The missing element was “the final agreement of the Kremlin,” he said. The deal also has “a very high strategic value” as it could pave the way for a negotiated peace, Draghi added. “In the context of efforts to reach peace, this is a first step to agreement, for an objective that must involve of all of us because it affects the lives of millions of people in the poorest countries,” he said.

His Royal Highness Turki bin Faisal al-Saud, Chairman of the King Faisal Center for Research and Islamic Studies, was the Director General of Al Mukhabarat Al A’amah, Saudi Arabia’s intelligence agency from 1977 to 2001, and has served as Saudi Arabia’s ambassador to the United Kingdom and the United States.

• Rethinking the Global Order (Turki Bin Faisal Al-saud)

The Ukraine crisis itself is a symptom of deeper structural problems in the international order. That order, led by the permanent members of the United Nations Security Council (China, France, Russia, the United Kingdom, and the United States), has failed to live up to the principles of good governance enshrined in the UN Charter. New global orders tend to emerge from major wars. In the case of WWII, the victors created structures designed to preserve international peace and security. But while our increasingly integrated world has changed dramatically since the UN’s founding, our organizing principles still reflect the mentality of the post-war and Cold War era. Within the current framework, a failure to respond to global challenges is a failure of the entire international community.

Can the system be reformed? Calls since the early 1990s to restructure the UN system – the avatar for the broader international order – have consistently fallen on deaf ears. Worse, Russia and China are now using their seats at the helm of the international order to push for a more multipolar system. Rather than working to reform the current framework, they are challenging its validity. Humanity’s collective achievements over the past seven decades are a testament to why we must work together to make the UN system more fair, inclusive, and attentive to people’s needs and aspirations. Indeed, that was the mission of UN Secretary-General Kofi Annan’s High-Level Panel on Threats, Challenges, and Change in 2003.

Consisting of 16 eminent figures from different parts of the world, and chaired by former Thai Prime Minister Anand Panyarachun, the panel analyzed contemporary threats to international peace and security; evaluated how well existing policies and institutions had done in addressing those threats; and offered recommendations aimed at strengthening the UN and enabling it to provide collective security for the twenty-first century. The panel’s final report made clear that all of the UN’s principal organs needed reform, including the Security Council, which the panel argued should be expanded. Unfortunately, the Security Council’s veto-wielding permanent members simply ignored the panel’s recommendations, setting the stage for today’s paralysis and dysfunction.

All of the west is under -its own- threat.

• The Unravelling of the UK and the Western World (Batiushka)

Ever since the collapse of the overseas British Empire, which included most of overseas Ireland, the unity of the UK has been under threat. This is because UK unity was the first step towards the construction of the British Empire, just as the construction of the American Empire began with its internal territorial conquests in North America, from the Native Americans, France, Spain/Mexico and of course from the Civil War. Only then did it look to imperial conquests overseas. Thus the loss of the overseas empire is inevitably leading to the end of the empire in the Isles. What was constructed in the past is now being deconstructed, in reverse order. Ireland (1801) has gone first and will be followed by Scotland (1707) and then Wales (1283) and in turn England (1066) will be regionalised.

As regards this deconstruction, the partial Irish independence of a century ago will undoubtedly turn into full independence and a united Ireland. Then will come the internal disintegration of the island of Great Britain itself. Each of the three countries and races on the island of Great Britain has its own identity. Scotland will not remain in the artificial Union of three centuries ago, though its separation could take several more years yet. The disintegration of the Union between Wales and England will probably take longer and be dependent on international pressures.

International pressures, such as those incurred by the present disastrously backfiring anti-Russian Western sanctions, could precisely be the ones that will lead to the internal collapse of the English/Welsh Union and then to the regionalisation of England. Here we are talking about the unwinding of the millennial Norman history of the island of Britain and a return to national roots, in other words, a radical return, for all. The collapse of the political parties in England and Wales (they have already collapsed in Scotland and they never existed in Ireland) will accompany this collapse.

The gov’t finds the farmers are way too popular. So now they create “shooting incidents”.

Aviation produces a lot of nitrogen too. Holland foud a neat trick: only count the nitrogen produced at ground level, take-off and landing. Voila: 70% of nitrogen gone!

• The Dutch Farmers’ Protest and the War on Food (OffG)

This week, tens of thousands of farmers have gathered from all across the Netherlands to protest government policies which will reduce the number of livestock in the country by up to a third. In a typical example of media weasel-wording, the press reports on this all headline something like “Dutch farmers protest emissions targets”, but this is a massive lie by omission. The government policy being protested is a 25 BILLION Euro investment in “reducing levels of nitrogen pollution” true, but it plans to achieve this by (among other things) “paying some Dutch livestock farmers to relocate or exit the industry”. In real terms, this ultimately means reducing the number of pigs, chickens and cows by about thirty per cent.

That’s what is being protested here – a deliberately shrinking of the farming sector, impacting the livelihood of thousands of farmers, and the food supply of literally hundreds of millions of people. While the scheme is allegedly about limiting nitrogen and ammonia emissions from urine and manure it’s hard not to see this in the broader context of the ongoing created food crisis. The Netherlands produces a massive food surplus and is one of the largest exporters of meat in the world and THE largest in Europe. Reducing its output by a third could have huge implications for the global food supply, especially in Western Europe. Perhaps more troubling is how this could act as a precedent. This isn’t the first “pay farmers not to farm” scheme launched in the last year – both the UK and US have put such schemes in place – but a government paying to reduce it’s own meat production? That is a first.

That it is (allegedly) being done to “protect the environment” makes it a big warning sign for the future. Denmark, Belgium and Germany are already considering similar policies. The Western world seems to be enthusiastically embracing quasi-suicidal policies. I mean, paying farmers to reduce the amount of food they produce…while (notionally) threatened with war…in the midst of a recession…facing record inflation as the cost of living spirals. Does that really make any sense? That’s almost as crazy as refusing new oil and gas leases while the cost of petrol is going up. Indeed, in a world beset by a shortage of fertiliser due to sanctions against Russia and Belarus, it would seem almost mad to complain about a manure surplus, let alone try to reduce it. We’re well past the point where any of this could be considered accidental, aren’t we?

Dutch supermarkets

If you plan on shutting down Dutch Farmers, expect to have no food in Dutch supermarkets

Source: https://t.co/KmIhwW0eSv pic.twitter.com/3vkW63KQgz— Wittgenstein (@backtolife_2023) July 6, 2022

“..the steady encroachment on free speech has been sold as a “virtue” that all good people should applaud..”

• The Woke Inquisitors Have Come for the Freethinking Heretics (Shurk)

Whenever censorship slithers back into polite society, it is always draped in the mantle of “good intentions.” Fifteenth-century Dominican friar Girolamo Savonarola’s “bonfire of the vanities” destroyed anything that could be seen to invite or reflect sin. The notorious 1933 Nazi book burning at the Bebelplatz in Berlin torched some 20,000 books deemed subversive or “un-German”. During Communist China’s decade-long Cultural Revolution in the 1960s and ’70s, the vast majority of China’s traditional scrolls, literature and religious antiquities went up in smoke.

All three atrocities were celebrated as achievements for the “greater good” of society, and people inebriated with “good intentions” set their cultural achievements aflame with fervor and triumph. Much like today’s new censors who claim to “fight hate” because “that’s not who we are,” the arsonists of the past saw themselves as moral paragons, too. They purged anything “obscene” or “traditional” or “old,” so that theocracy, Nazism, or communism could take root and grow. And if Western institutions today are purging ideas once again, then it is past time for people to start asking just what those institutions plan to harvest next. We in the West are running — not walking — toward another “bonfire of the vanities” in which normal people, egged on by their leaders, will eagerly destroy their own culture while claiming to save it.

This time around the “vanities” will be condemned for their racist, sexist, transphobic, anti-science or climate-denying ways, but when they are thrown into the fire, it is dissent and free expression that will burn. There will one day be much disagreement as to how the same Western Civilization that produced the Enlightenment and its hallowed regard for free expression could once again surrender itself to the petty tyranny of censorship. Many will wonder how the West’s much-vaunted “liberal” traditions could meekly fold to the specter of state-controlled speech. The answer is that the West has fallen into the same trap that always catches unsuspecting citizens by surprise: the steady encroachment on free speech has been sold as a “virtue” that all good people should applaud.

Sicks don’t shave. And there are many in Canada. Never had problems. Blackface Trudy does shave.

• 100 Sikh Security Guards Fired For Not Adhering To Toronto’s Mask Mandate (TNC)

Roughly 100 Sikh security guards were let go due to the City of Toronto’s mask mandate, which requires them to be clean-shaven. The World Sikh Organization (WSO) is now demanding the city change what it calls a “discriminatory” rule. According to CBC News, the city has been mandating that security guards wear N95 masks while on the job at settings such as homeless shelters since January. The city confirmed that employees working within the Shelter, Support, and Housing Administration (SSHA) department must wear N95 masks at all times and be clean-shaven so that the masks provide effective protection against Covid-19. For devout Sikhs, leaving their hair uncut is an important part of their faith. In a practice called Kesh, Sikhs allow one’s hair to grow out naturally out of respect for the perfection of God’s creation.

The WSO wants to see the city compensate and rehire the Sikh guards. “I feel very humiliated,” said Birkawal Singh Anand, who works for ASP Security. “If you ask me to clean shave my beard, it’s like peeling off my skin.” When notified of the requirement last month, Anand said that he applied for a religious exemption but was told that would mean he would be demoted to a lower position with lower pay. Many of the guards, who are working towards permanent residency, have had to choose between new jobs that didn’t offer permanent residency, finding a different job, getting laid off or shaving their beards. When CBC News reached out for comment from GardaWorld, a security contractor, they said all employees who are unable to meet the health and safety requirement set out by the city were offered “other and equivalent opportunities within the organization” until the restriction is lifted.

Balpreet Singh, a lawyer with the WSO, said Toronto’s rule feels particularly discriminatory because the policy has remained while nearly all other pandemic restrictions in Ontario have dropped. “These security guards served at the height of the pandemic without these rules, when things were at their worst,” Singh said. “But now when, you know, vaccines are very common and things are opening up, they’re being told: ‘No, you can’t serve here because you’ve got a beard.’”

“The two interlocking cartels, Big Tech and the media, became politically and then economically interdependent in a way that was both illegal and deeply dangerous to a free society.”

• The Media Used Russiagate Conspiracy Theories to Create a News Cartel (GI)

The Wall Street Journal reports that Facebook paid over $20 million to the New York Times and $15 million to the Washington Post in annual fees. Even more valuable than the big checks was Facebook’s ability to push media content to its users. Last year, sources at several publishers were crediting Facebook News with massive traffic surges, but not everyone was equal. “Many other U.S. news publishers are getting payments from Facebook to have their content featured in its news tab, but they only get a fraction of the sums paid to the Washington Post, the New York Times,” the Wall Street Journal noted. Facebook and the media had created a cartel in which media sites created paywalls to raise the value of their content and gain better deals with the social media monopoly.

Zuckerberg’s company offered its biggest media critics big checks in exchange for exclusive deals. Both sides claimed that they were “fighting misinformation” with what was really a shakedown and a cartel. When the media accused Facebook of spreading conservative misinformation, the only defense was providing special privileges for the media. Despite the fundamental illegality of such cartels, Democrat politicians and the media openly pressured Facebook to promote “responsible” journalism, by which they meant their own political content, at the expense of “misinformation”. By then the entire debate about misinformation had boiled down to creating a two-tiered content system across Big Tech that would fund and push media content while suppressing rival material.

This urgent need for a news cartel was described as the best way to meet the “threat to democracy” posed by the “wild west” of the internet. This cynical rhetoric carefully avoided any discussion about the benefits that would flow to the media from this arrangement. Recent entries from the Washington Post, which was being paid $15 million, include, “Facebook Gives Gun Sellers 10 Strikes Before Ban” and “Facebook Fails Again to Detect Hate Speech in Ads”: both of which went viral. The former taps into the new mania over gun control to manufacture yet another crisis involving Facebook. And crises reward the media cartel. The two interlocking cartels, Big Tech and the media, became politically and then economically interdependent in a way that was both illegal and deeply dangerous to a free society.

“Central banks have gone from “whatever it takes” to “no matter what”..

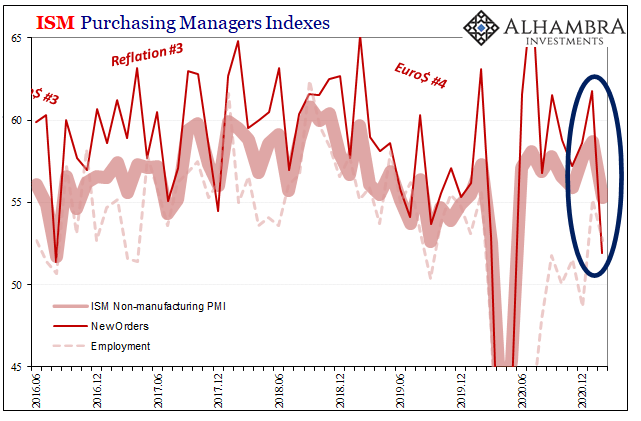

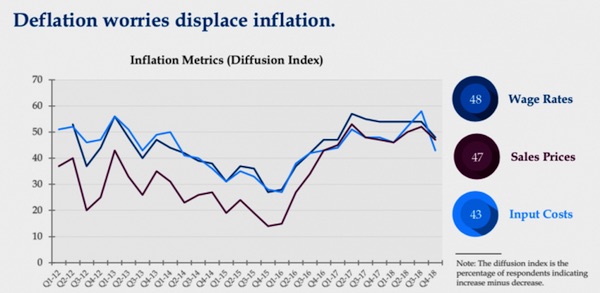

• If Central Banks Do Not Tackle Inflation, Crisis Will Bring Deflation (Lacalle)

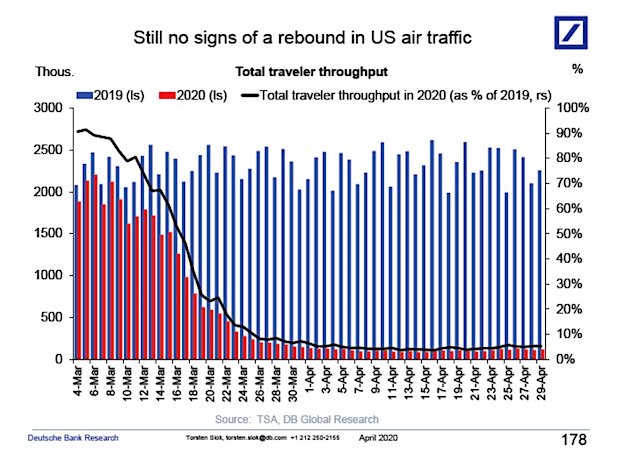

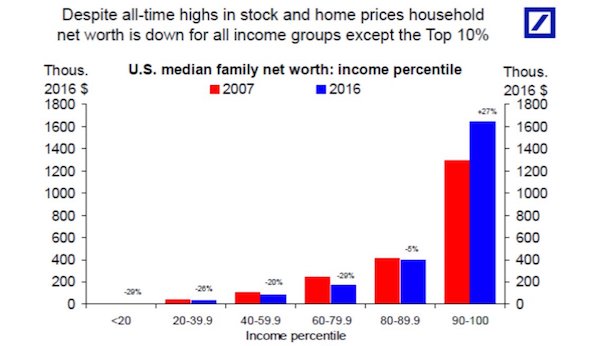

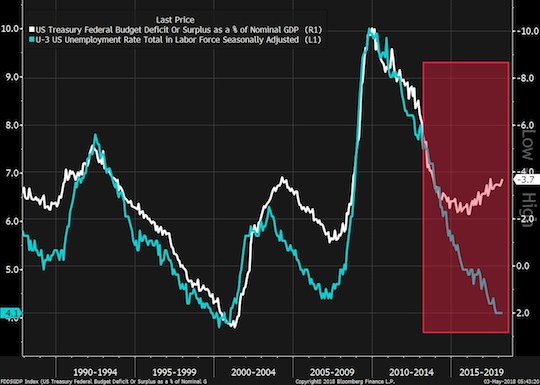

Most market participants have been surprised by the last six months. The total return of the US Treasury Index was the worst since 1788 according to Deutsche Bank. Stocks closed June with one of the largest corrections since 2008. Bonds and equities are falling in unison, driven by rate hikes and normalization of monetary policy. However, there is no such real normalization. The balance sheet of the main central banks has barely moved and remains at all-time highs according to Bloomberg. The ECB continues to ignore the highest inflation rate in the eurozone since the early 90s by keeping negative rates. The Federal Reserve rate hikes have been more aggressive, but it is still injecting billions of dollars in the reverse repo market and monetary aggregates remain excessive.

In the United States, money supply growth (M2) is still much higher than in the quantitative easing years. M2 money supply has risen to 21.8 trillion dollars and yearly change shows a rise of 1.3 trillion dollars, which is more than double the annual figure of the expansion phase of 2008-2011. Money supply (M2) annual growth in the United States was 6.5% in May, 6.6% in the eurozone. Global monetary growth in May was 9.9%, all figures according to Yardeni Research. In the eurozone money supply growth is higher than in the middle of the so-called “Draghi bazooka”, the famous “whatever it takes”. Central banks have gone from “whatever it takes” to “no matter what”. We already explained in a previous article that commodities do not cause inflation, money printing does, and the monetary aspect of inflation is not being addressed properly.

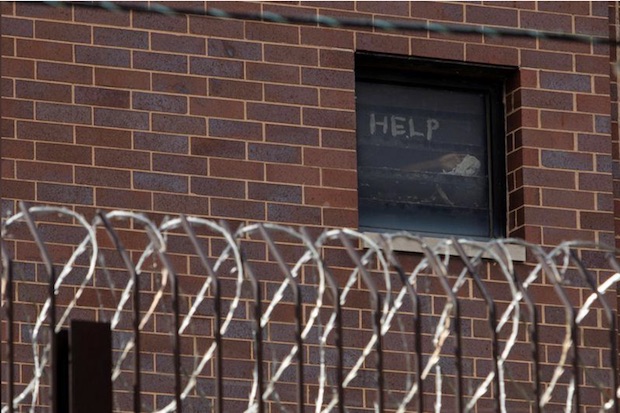

“If they take him to the United States and he is sentenced to the maximum penalty and to die in prison, we must start a campaign to tear down the Statue of Liberty..”

• Mexico President To Raise Assange Case In July Meeting With Biden (Dissenter)

When Mexico President Andrés Manuel López Obrador meets with United States President Joe Biden on July 12, he plans to once again urge the US government to drop the charges against WikiLeaks founder Julian Assange. Obrador is one of the few presidents in the world, who has expressed genuine support for Assange and even offered to engage in talks about asylum in Mexico. “If they take him to the United States and he is sentenced to the maximum penalty and to die in prison, we must start a campaign to tear down the Statue of Liberty,” Obrador said, as he referred to Assange during a press conference on July 4. According to El País, Obrador insisted that the Statue of Liberty would “no longer be a symbol of freedom” if Assange was extradited. He maintained there could be “no silence” on the matter.

The UK government authorized Assange’s extradition on June 17. Assange’s legal team appealed the decision. While it is a welcome development that an ally and neighboring country is challenging the US to uphold press freedom, the remarks from Obrador apparently came while deflecting criticism of Mexico from Reporters Without Borders (RSF). Mexico is one of the more dangerous countries in Latin America for journalists. RSF, which also supports Assange, condemned Mexico after “Yesenia Mollinedo, the founder and editor of the Facebook news outlet El Veraz, and Sheila Johana García, a video reporter for El Veraz,” were “gunned down in broad daylight in Cosoleacaque, in the eastern state of Veracruz.”

“[RSF] is appalled by the murders of three more reporters in less than a week in Mexico, which—subject to confirmation by RSF’s investigations—will bring the total number of Mexican journalists killed in connection with their work since the start of the year to 11,” the press freedom organization declared. With no evidence, Obrador suggested RSF’s statement was part of a “smear campaign against the government of Mexico.” But Obrador is not alone when it comes to invoking the Assange case to deflect responsibility. Several leaders throughout the world, including in China, Russia, and Azerbaijan, have responded to Western criticism of how their governments treat journalists by asking how the US and United Kingdom can claim to support press freedom when Assange is in jail.

George Webb – Klaus Schwab

On the Klaus Schwab trail – of horsepower and human power. Creating artificial substitutes and destroying the natural. Three generations of self serving energy systems. pic.twitter.com/cEpk0Pt1LN

— George Webb – Investigative Journalist (@RealGeorgeWebb1) July 5, 2022