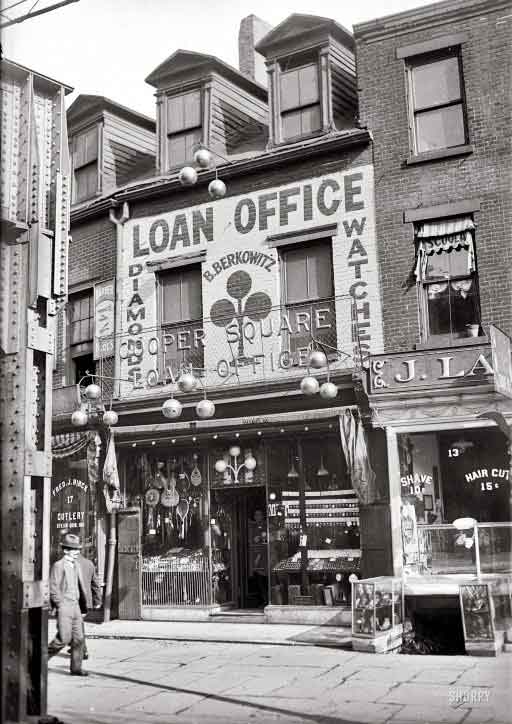

G. G. Bain Pawn Shop, 15 Cooper Square, New York 1920

The other day I stumbled upon an image that got me thinking. I’m still thinking. And I doubt I’ll be done anytime soon. So perhaps it’s a good idea to simply share both the image and my thoughts, and invite you to share what you think, and see where we get. I found it on the site of the University of North Carolina at Chapel Hill School of Education, where it’s part of an ‘exhibit’ of US Government – Office of Price Administration – publicity material on the topic of wartime rationing.

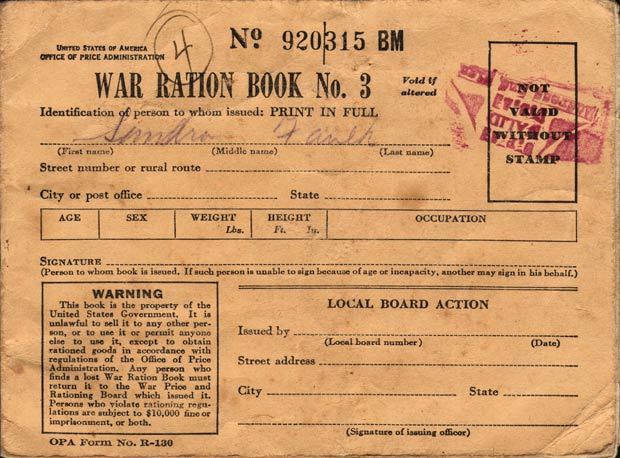

Here’s the front cover of War Ration Book no. 3, issued in 1943 :

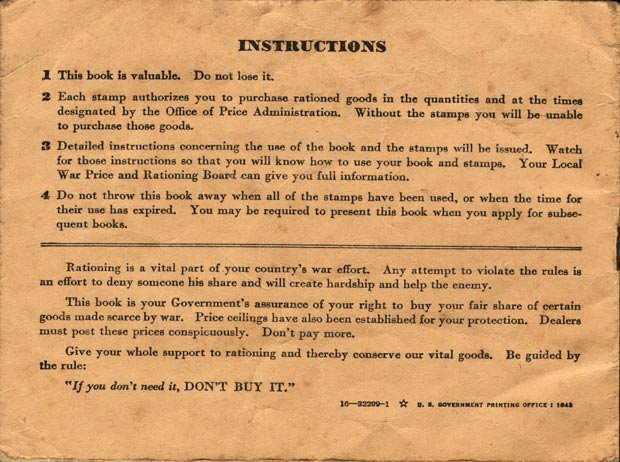

And this is the back cover, the image that first set me off:

It’s that one line in there at the bottom, as I think should perhaps be obvious: If You Don’t Need It, DON’T BUY IT.

There once was a time, and it’s only 70 years ago, which means there are plenty people alive today who also were then, when the US government actually and actively urged its citizens NOT to buy things they didn’t absolutely need.

That makes you think about how things have changed. And why they have. Where once it was considered so unpatriotic to buy more than your fair share it could get you shunned by your neighbors, today’s politicians and bankers tell you to spend spend spend. And if you don’t have enough money to spend you should borrow it.

That difference is probably the best explanation available for why we are in the present deep doodoo. Make no mistake: f the American people would today buy only what they need, the economy would collapse in next to no time. Think Stockholm Syndrome.

And if they don’t borrow enough, fast enough, and take on (more) debt, the political/financial system and the media present that as an ominous negative. Saving is for un-American sissies.

If we don’t continue to buy things we don’t need, and at a rapid and increasing pace, we kill the economy we depend on for our wellbeing. Let that sink in.

If you don’t buy stuff you don’t need, in large quantities, lots of stores will go broke, and tons of people will be laid off, who then won’t be able to purchase enough stuff they don’t need, which will lead to more store closings etc. And at some point during this process we will see deflation emerge: the less we spend as (consumers of ) a nation, or a group of nations, the more the velocity of money will sink. And we’ve seen by now what the effect of QE-esque measures are on that: zilch.

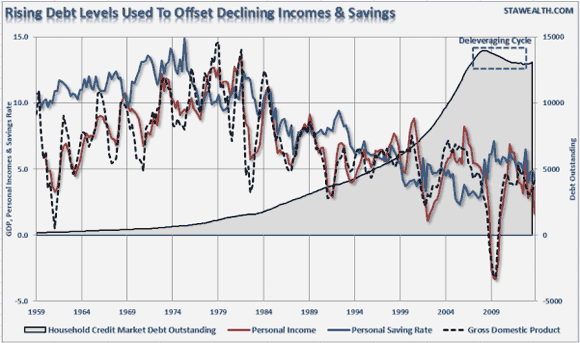

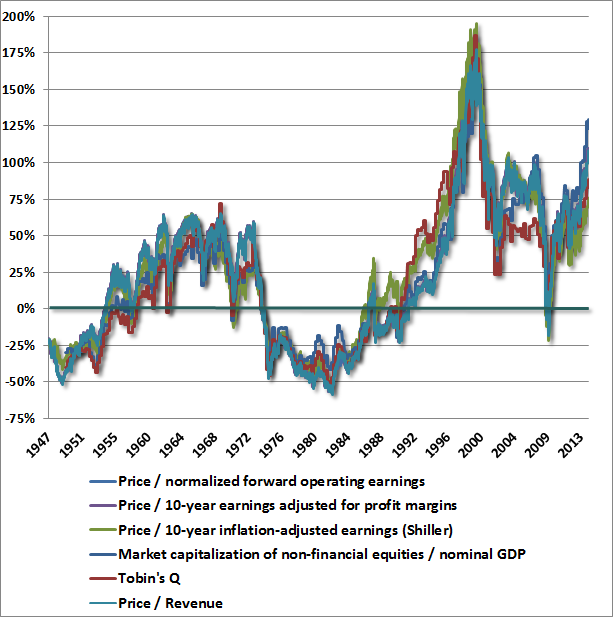

So what happened, how did we get there from here? Well, for one thing, this:

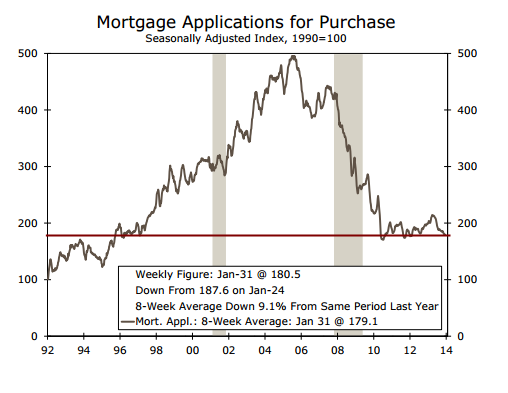

That must be the most depressing chart I’ve seen in a long time. Take a good look: that’s the Red Queen trying to stand still on a treadmill that goes 100 miles an hour.

Income, savings, GDP, all increasingly came to depend not on what people produced, but on what they borrowed, on how much debt they incurred. And that’s of course how we got from “If You Don’t Need It, Don’t Buy It” to “If You Don’t Buy Lots of Stuff You Don’t Need, You’re Doomed”.

The French are familiar with the concept of Les Trente Glorieuses, or the Glorious Thirty, the years 1945-1975 (or 1973, the first oil crisis), the period when the country built a prosperous middle class for the first time in its existence. Just like the US did, though it had a few years’ head start, since it wasn’t occupied. Looking back at that graph, it’s easy to see why. We all had Les Trente Glorieuses on both sides of the big blue divide, but none of us still do. Not even the Chinese, the supposed next major world power. Their empire too was built on debt, and will sink because of it.

It would probably be good, though, for the US to recognize that it had a Glorious Thirty, and not pretend that somehow that period still continues. Because that sort of pretense makes Americans look stupid. It’s over, face it. America blew its shot at greatness through its people, just as France did, and Britain. It’s a new world, don’t you know.

And of course natural resources play a major part: WWII rationing had a lot to do with resources getting scarce. And you’d be inclined to think we don’t have that issue today. But then we do. Just in a slightly different way. Today we can see scarcity coming down the road. And we no longer have any way to pay for ever scarcer resources, other than through credit. It’s not as if we can pay for them in exchange of out manual labor. That even sounds ridiculously outdated. Doing actual work.

But then maybe that’s the secret: Work. Make things. Without destroyng your own living quarters. ‘Cause that would be stupid, right?

All fun aside, the present system is not long for this world. Being stuck with debt when the system dies is a bad idea. Being able to make stuff with your hands is not.

Other than that, let me know what you think about If You Don’t Need It, Don’t Buy It.

To get you in the mood, I’ll leave you with some of the material included in the US Government WWII campaigns. That’s what the entire nation thought about at the time.

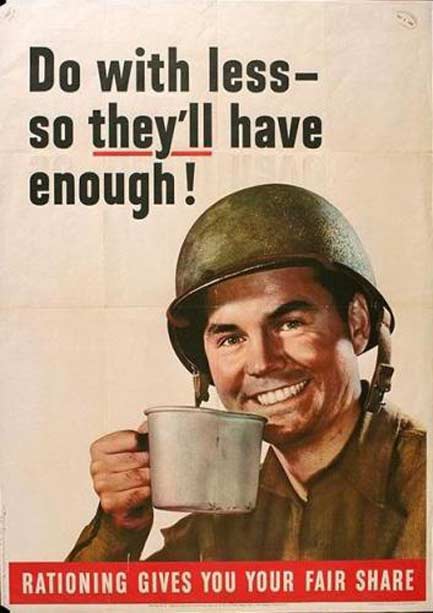

Ask anyone who lived through the war on the U.S. “home front” about World War II and the conversation will quickly turn to rationing. America has always been – and thought of itself as – a land of abundance. Even in the depths of the Depression, there was enough to eat, if only you could afford to buy it. But as soon as the U.S. entered the war in the winter of 1941–42, shortages began. By 1943, it had become every citizen’s duty to cut back on meat, sugar, coffee, canned foods, fuel, shoes, and consumer goods – so “they’ll have enough.”

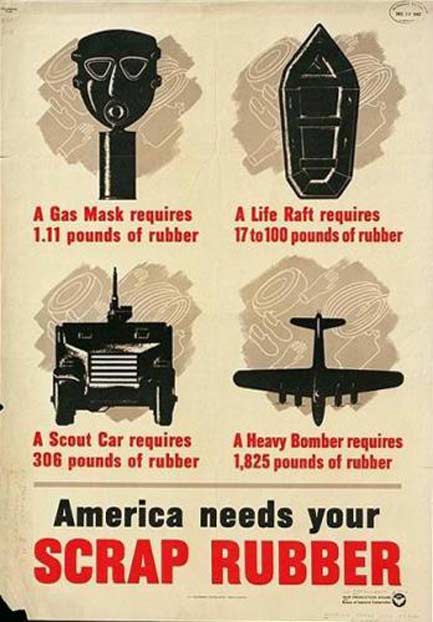

Most of the world’s supply of natural rubber came from rubber tree plantations in Southeast Asia, which were quickly occupied by the Japanese in the first months of 1942. Factories converting to military production needed every scrap of rubber they could find, and citizens were asked to turn in old tires, raincoats, gloves, garden hoses, and rubber shoes for recycling. New tires became almost impossible to buy, and people tell stories of lining the insides of their tires with newspaper to make them last longer.

To save tires, the government asked Americans to cut back on their driving, to save gas by driving more slowly, and to share rides. (The term “carpooling” didn’t exist yet.) These efforts continued throughout the war, as you can see in this 1943 poster. But Americans have never been eager to drive less or more slowly, and by the spring of 1942 it was clear that “voluntary rationing” was a failure.

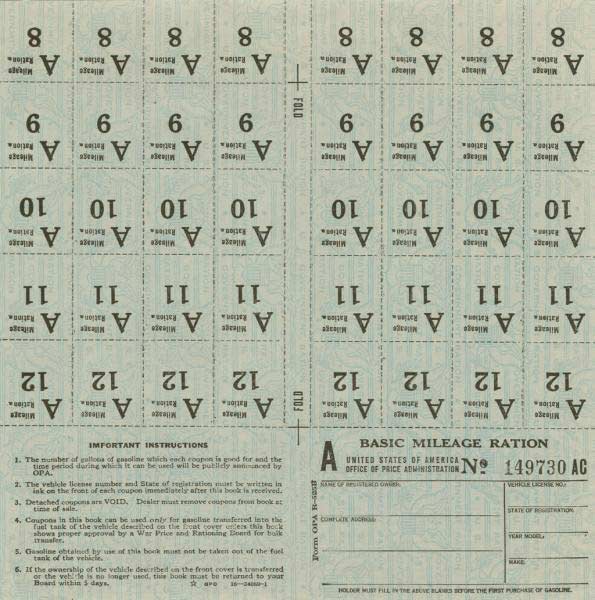

Gasoline was rationed in 17 eastern states beginning in May 1942 and nationwide in December 1942 — not so much to save fuel as to save tires and the rubber they were made of. A nationwide speed limit of 35 miles per hour was also enforced to save wear on tires. To ration gasoline, the government issued coupon stamps. These “A” stamps were worth three to five gallons of gasoline per week for essential activities such as shopping, attending church, and going to the doctor. The letter on the stamp would have matched a sticker on the car’s windshield. People using their cars for work could buy more gasoline, and truckers could buy all they needed.

Although gasoline rationing had begun to conserve tires, by late 1942 other kinds of fuel were also in short supply. The military needed huge quantities of fuel for ships, tanks, and planes, and Americans at home had to make do with less. Fuel oil and kerosene were rationed beginning in 1942, and solid fuels followed in 1943. This poster warned citizens of the coming shortage and advised them to “winterize” their homes — a term that most Americans were hearing for the first time.

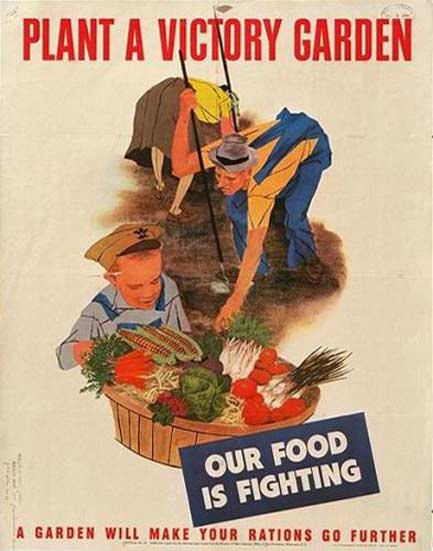

People could avoid the limits imposed by rationing — and save food for soldiers — by planting “victory gardens.” Some 20 million Americans planted gardens in their backyards, in empty lots, and on the rooftops of city buildings.

Talk about ominous: The [Japanese] economy is forecast to shrink 3.9% in the three months from April, according to a Bloomberg poll of economists. I don’t see that reflected in the markets. Are we even awake?

• Bank of Japan Sticks To Easing Plan As Economy Is Forecast To Shrink 3.9% (Bloomberg)

The Bank of Japan maintained record easing, keeping ammunition as an April sales-tax bump threatens to trigger the deepest one-quarter contraction since the March 2011 earthquake. The BOJ kept a pledge to expand the monetary base at a pace of 60 trillion to 70 trillion yen ($677 billion) per year, the central bank said in a statement in Tokyo today, in line with all but one of 34 forecasts in a Bloomberg News poll. The bank lowered its view of exports and lifted its assessments of industrial output and investment.

Governor Haruhiko Kuroda is predicted to face the biggest obstacle yet to his bid to generate 2% inflation as the first sales levy increase in 17 years squeezes households and businesses. Seventy-three% of economists surveyed by Bloomberg forecast the BOJ will add to easing by the end of September to support the world’s third-biggest economy. “The BOJ has to stand ready to act,” Kazuhiko Ogata, chief Japan economist at Credit Agricole SA., said before today’s decision. “Kuroda’s handling of monetary policy will be tested, as he doesn’t want to be seen as passive by moving too late.”

“We will adjust policy without hesitation if achieving 2% inflation becomes problematic or if smooth progress isn’t made toward the goal,” Kuroda told reporters after the decision. Kuroda said he saw no need to change policy now, saying a positive economic cycle is continuing and growth will exceed potential even though it will rise and fall due to the tax increase. Downside risks in the global economy have been falling since last year, he said.

Prime Minister Shinzo Abe is raising the sales levy to 8% in April from 5%, as he tries to rein in a debt load that the International Monetary Fund projects will be equal to 242% of the economy by the end of the year. Tackling Japan’s fiscal challenges is risky for Abe, who is spearheading an effort to end 15 years of falling consumer prices and stoke sustained recovery. The economy is forecast to shrink 3.9% in the three months from April, according to a Bloomberg poll of economists, ending a projected six straight quarters of growth.

Japan’s economy grew less than economist estimated last quarter, revealing a lack of firm support from business investment and exports. A survey yesterday underlined concern about the impact of the higher levy. Expectations of people such as taxi drivers, supermarket managers and restaurant workers for the economy two to three months ahead fell in February by the most since March 2011, when the economy was struck by an unprecedented earthquake and tsunami, erasing all the improvement made after Abe took office in December 2012, a Cabinet Office survey showed yesterday. The government approved a 5.5 trillion yen extra budget in December to offset the impact of the higher sales levy.

Kuroda said exports have been weaker than the BOJ forecast when it began unprecedented easing in April, and cited developments in emerging markets. The central bank said in its statement that exports have leveled off recently.

China still seem far away to you?

• China’s shadow banking grinds to a halt (AEP)

A slew of shockingly weak data from China and Japan has led to a sharp sell-off in Asian stock markets and the biggest one-day crash in iron ore prices since the Lehman crisis, calling into question the strength of the global recovery. The Shanghai Composite index of stocks fell below the key level of 2,000 after investors reacted with shock to an 18% slump in Chinese exports in February and to signs that credit is wilting again. Iron ore fell 8.3%.

Fresh loans in China’s shadow banking system evaporated to almost nothing from $160bn in January, suggesting the clampdown on the $8 trillion sector is biting hard. “It seems that rising default risk has started to erode Chinese investors’ confidence,” said Wei Yao, from Societe Generale. “Together with continued regulatory tightening on banks’ off-balance-sheet activity, we are certain this slowing credit trend has further to go and will inflict real pain on the economy.”

Japan’s economy is losing steam as the monetary stimulus from “Abenomics” wears off and the country braces itself for a rise in the consumption tax from 5% to 8%. Economic growth slumped from 4% in early 2013 to 0.7% in the fourth quarter, while the country racked up a record trade deficit. The Economy Watchers Survey saw the steepest drop last month since the March 2011 tsunami and is now lower than when Abenomics began. Marcel Thieliant, from Capital Economics, said Japan faces a “sharp slowdown”.

The renewed jitters in China come after the authorities allowed solar company Chaori to default last week, the first ever failure in the country’s domestic bond market. The episode is a litmus test of President Xi Jinping’s new regime of market discipline, though the central bank has been careful to cushion the blow by engineering a fall in interbank interest rates. “Such adjustments are necessary for China in the long run, but are nothing if not risky in the short term,” said Ms Wei.

It is extremely hard to calibrate a soft landing of this kind, and the sheer scale of China’s credit boom now makes it a global headache. China accounts for half of all the $30 trillion increase in world debt over the past five years. Zhiwei Zhang, from Nomura, said the central bank will be forced to loosen monetary policy this year with repeated cuts in the reserve asset ratio to head off a deeper slowdown. Nomura said China’s $23bn trade deficit in February masks capital outflows, while data was in any case distorted by the Chinese New Year.

Even so, there are signs that deflationary forces are taking hold in China. Producer prices (PPI) fell by 2% in February from a year earlier. Haibin Zhu, from JP Morgan, said it is “disturbing” the PPI index has been negative since November, a sign that China is struggling to cope with excess manufacturing plant. China invested $5 trillion last year, as much as the US and Europe combined. There are already signs that the country is trying to export its over-capacity overseas by pushing down the yuan. If this amounts to a competitive devaluation policy, it risks sending a fresh deflationary impulse across the globe.

Iron, copper, name a metal.

• Iron Ore’s Bear Market Deepens on Demand Concern in China (Bloomberg)

Iron ore extended its decline into a bear market on concern that demand in China may slow as credit tightens in the largest buyer, exacerbating the impact of rising global supplies that are seen spurring a surplus. Ore with 62% content delivered to Tianjin fell 8.3% to $104.70 a dry ton, the lowest since October 2012 and the biggest drop in more than four years. The benchmark price lost 27% since Aug. 14, when it reached a five-month high of $142.80.

BHP Billiton and Rio Tinto predict lower prices this year after producers spent billions of dollars to expand output. Banks from Citigroup to Standard Chartered predict a surplus, and Goldman Sachs listed iron ore among its least-preferred commodities for 2014. Credit concerns in China may have helped to amplify volatility in prices, according to Jimmy Wilson, BHP’s head of iron ore. “You have this credit issue in China, you have reasonably high iron ore stocks, traders have a view that prices are going to go down, so they do everything they can to hold back,” Wilson said at a conference in Perth today. “That’s why these fluctuations tend to amplify.”

Stockpiles of ore at ports in China stand at 105 million tons, 21% higher this year, according to Shanghai Steelhome Information Technology Co. Anecdotal evidence suggests increases in stockpiles at ports, especially iron ore, are for trade-finance deals instead of production, HSBC Holdings Plc analysts Ma Xiaoping and Qu Hongbin said in a report.

“The default by Shanghai Chaori Solar, followed by weaker-than-expected Chinese trade data, has sparked a sharp decline in iron ore and copper,” Citigroup Inc. analyst Ivan Szpakowski said in a note today. “These concerns have combined with the fundamental weakness of physical markets for both commodities due to increasing supply and weakening demand from China.” The so-called opportunity cost of holding iron ore inventories for traders and mills in China is very high at present due to tight credit, Commonwealth Bank of Australia analyst Lachlan Shaw wrote in a report today.

“It is believed most of the inventory purchases are unhedged,” Evan Lucas, a market strategist at IG Ltd., said in a note received today, referring to holdings in China. “This means margin calls are coming thick and fast and losses are mounting. This could see inventory-dumping as losses become unsustainable.” “The fall in iron ore prices may reflect the beginning of a buyers’ strike in China,” wrote Shaw at Commonwealth Bank of Australia. The market is “biased to oversupply in the very near term, and may prompt a further drop in the iron ore price.”

Putin refuses to talk on Obama’s terms, and vice versa. The US insists that the “government” in Kiev is legit, Putin says the one in Crimea is. Who’s trying to make what point here?

• John Kerry Refuses To Talk To Vladimir Putin (BBC)

The US secretary of state has rejected a talks offer with Russian President Vladimir Putin until Moscow engages with US proposals on Ukraine’s crisis. John Kerry told his Russian counterpart Sergei Lavrov that Moscow’s military intervention in Crimea had made any negotiations extremely difficult. US officials say there will be little to talk about if the referendum on Crimea’s future goes ahead. The vote is to be held on Sunday – Ukraine and the West say it is illegal.

In other developments on Tuesday:

• At a news conference in Russia, ousted Ukrainian President Viktor Yanukovych describes the new Ukrainian authorities as a “gang of fascists” and says presidential elections set for 25 May are “illegal”

• Ukrainian PM Arseniy Yatsenyuk tells MPs in Kiev that Crimea’s authorities are an “organised gang” backed by Russia, and urges Moscow to settle the crisis diplomatically

• The parliament in Kiev asks the US and UK – as guarantors of the security pledges given to Ukraine in 1994 – to use all measures, including military, to stop Russia’s “aggression”

• Crimea’s lawmakers adopt an “independence declaration”. The document says the region will ask to join Russia if this is approved at the referendum

• Officials from several countries are meeting in London to discuss sanctions against Russian officialsRussia said on Monday it was drafting counter-proposals to a US plan for a negotiated solution to the crisis. Moscow has condemned Ukraine’s new Western-backed government as an unacceptable “fait accompli” – it says that Russian-leaning parts of the country have been turned into havens of lawlessness.

Moscow has officially denied that its troops are taking part in the blockades, describing the armed men with no insignia as Crimea’s “self-defence” forces. The government in Kiev – as well as the US and EU – accuse Russia of invading Ukraine, in violation of international law.

In a televised briefing with President Putin on Monday, Mr Lavrov said proposals made by Mr Kerry for a negotiated solution to the crisis are “not suitable” because they take “the situation created by the coup as a starting point”, referring to the overthrow of Ukraine’s pro-Russian President, Viktor Yanukovych.

Washington says that there has been no official response yet to a set of questions Mr Kerry gave Mr Lavrov at the weekend, asking in particular whether Moscow is prepared to meet officials from the new Ukrainian government. “The United States needs to see concrete evidence that Russia is prepared to engage on the diplomatic proposals we have made to facilitate direct dialogue between Ukraine and Russia and to use international mechanisms like a contact group to deescalate the conflict,” State Department spokeswoman Jen Psaki said in a recent written statement.

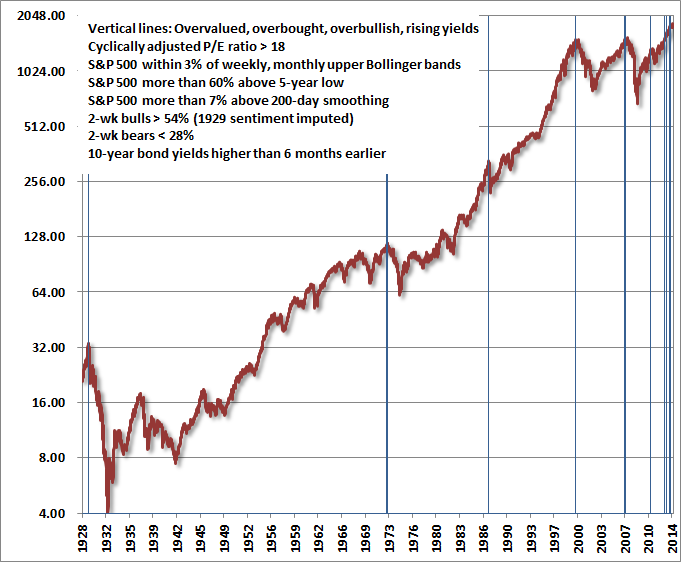

Hussman, as so often, makes great points: “we expect the S&P 500 to be at least 40% lower than present levels”. But then he goes off talking about them great investment opportunities…. I think not. Unless you want to bet against the while shebang.

• It Is Informed Optimism To Wait For The Rain (John Hussman)

We fully expect that from present valuations, U.S. stocks will produce zero or negative returns on every horizon shorter than 7 years. There is no antidote or alchemy that will allow a buy-and-hold approach to squeeze water from this stone. There is no painless monetary fix that will shift the allocation of capital toward productive investment and away from distortive speculation. Instead, one must wait for the rain. [..] To wait patiently in the expectation of fertile soil and rain is not an act of pessimism, but an act of optimism and informed experience. [..]

Based on valuation metrics that have demonstrated a near-90% correlation with subsequent 10-year S&P 500 total returns, not only historically but also in recent decades, we estimate that U.S. equities are more than 100% above the level that would be associated with historically normal future returns. We presently estimate 10-year nominal total returns for the S&P 500 averaging just 2.2% annually over the coming decade, with zero or negative nominal total returns on every horizon of less than 7 years. [..]

These are not welcome views, but they are evidence-based, and the associated metrics have dramatically higher historical correlation with actual subsequent returns than a variety of alternative approaches such as the “Fed Model” or various “equity risk premium” models. We implore investors (as well as FOMC officials) to examine and compare these historical relationships. It is not difficult – only uncomfortable.

[..] Objectively, there is no specific level at which investors can be told “no, stop, don’t” once the speculative bit is in their teeth. Historically, however, such periods have typically reached their extremes when a syndrome of overvalued, overbought, overbullish, rising-yield conditions emerges. By the time one observes extreme conditions simultaneously – rich valuations, overbought market conditions, lopsided bullish sentiment, and rising 10-year yields – equity markets have generally been at precarious and climactic highs. Prior to the current market cycle, these points singularly include 1929, 1972, 1987, 2000, and 2007 (slightly broader criteria also would include 1937). In the uncompleted half-cycle since 2009, however, we’ve seen these conditions at the 2011 market peak (followed by a near 20% decline that was truncated by investor enthusiasm about fresh quantitative easing), and several instances over the past year – specifically, February 2013, May 2013, December 2013, and today.

It is the series of extreme instances over the past year that give investors the hope and delusion that historically reckless market conditions will lead only to further gains and greater highs. This is a mistake born of complacency in the face of a nearly uninterrupted, Fed-enabled 5-year market advance, and is the same mistake that was made in 2000 and again in 2007. By the time the present market cycle is completed,we expect the S&P 500 to be at least 40% lower than present levels. Only the reliance on historically unreliable valuation metrics, and what Galbraith called the “extreme brevity of financial memory” makes that assertion seem the least bit controversial.

Investors and policy-makers that focus attention on some alternative valuation measure (usually because it seems pleasantly benign) would be well-advised to examine the data, and compare the historical relationship between competing measures and actual subsequent market returns. [..]

It’s instructive that the 2000-2002 decline wiped out the entire total return of the S&P 500 – in excess of Treasury bills – all the way back to May 1996, while the 2007-2009 decline wiped out the entire excess return of the S&P 500 all the way back to June 1995. Overconfidence and overvaluation always extract a terrible payback.

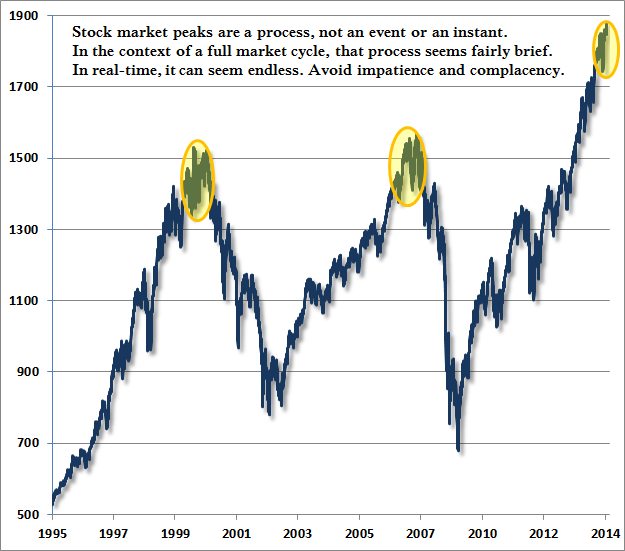

It may also be helpful to remember that market peaks are a process, not an event. In the presence of a broad range of reliable valuation metrics uniformly at more than twice their historical norms, coupled with the most severe overvalued, overbought, overbullish, rising-yield syndrome we define, it is instructive how shorter-term action has evolved near those points. Outside of today and 1929, the other two instances are, not surprisingly, 2000 and 2007. The chart below provides a more granular reminder that market peaks are often a broad process and can involve hard initial downturns and swift recoveries. The ultimate follow-through provides some insight regarding the full scale of our concerns.

A final note – in my view, it is incorrect to believe that the 2008-2009 market plunge and financial crisis were caused by the housing bubble. The housing bubble was merely the expression of a very specific underlying dynamic. The true cause of that episode can be found earlier, in Federal Reserve policies that suppressed short-term interest rates following the 2000-2002 recession, and provoked a multi-year speculative “reach for yield” into mortgage securities. Wall Street was quite happy to supply the desired “product” to investors who – observing that the housing market had never experienced major losses – misinvested trillions of dollars of savings, chasing mortgage securities and financing a speculative bubble.

I bet you Fifth Avenue is fine?!

• The Great U.S. Retail Apocalypse (Michael Snyder)

If the U.S. economy is getting better, then why are major retail chains closing thousands of stores? If we truly are in an “economic recovery”, then why do sales figures continue to go down for large retailers all over the country?

Without a doubt, the rise of Internet retailing giants such as Amazon.com have had a huge impact. Today, there are millions of Americans that actually prefer to shop online. But Internet shopping alone does not account for the great retail apocalypse that we are witnessing. In fact, some retail experts estimate that the Internet has accounted for only about 20% of the decline that we are seeing. Most of the rest of it can be accounted for by the slow, steady death of the middle class U.S. consumer. Median household income has declined for five years in a row, but all of our bills just keep going up. That means that the amount of disposable income that average Americans have continues to shrink, and that is really bad news for retailers.

And sadly, this is just the beginning. Retail experts are projecting that the pace of store closings will actually accelerate over the course of the next decade.

So as you read this list below, please take note that things will soon get even worse.

The following are 20 facts about the great U.S. retail apocalypse that will blow your mind…

#1 As you read this article, approximately a billion square feet of retail space is sitting vacant in the United States.

#2 Last week, Radio Shack announced that it was going to close more than a thousand stores.

#3 Last week, Staples announced that it was going to close 225 stores.

#4 Same-store sales at Office Depot have declined for 13 quarters in a row.

#5 J.C. Penney has been dying for years, and it recently announced plans to close 33 more stores.

#6 J.C. Penney lost 586 million dollars during the second quarter of 2013 alone.

#7 Sears has closed about 300 stores since 2010, and CNN is reporting that Sears is “expected to shutter another 500 Sears and Kmart locations soon”.

#8 Overall, sales numbers have declined at Sears for 27 quarters in a row.

#9 Target has announced that it is going to eliminate 475 jobs and not fill 700 positions that are currently empty.

#10 It is being projected that Aéropostale will close about 175 stores over the next couple of years.

#11 Macy’s has announced that it is going to be closing five stores and eliminating 2,500 jobs.

#12 The Children’s Place has announced that it will be closing down 125 of its “weakest” stores by 2016.

#13 Best Buy recently shut down about 50 stores up in Canada.

#14 Video rental giant Blockbuster has completely shut down all of their stores.

#15 It is being projected that sales at U.S. supermarkets will decline by 1.7% this year even as the overall population continues to grow.

#16 McDonald’s has reported that sales at established U.S. locations were down 3.3% in January.

#17 A home appliance chain known as “American TV” in the Midwest is going to be shutting down all 11 stores.

#18 Even Wal-Mart is struggling right now. Just check out what one very prominent Wal-Mart executive recently admitted…

David Cheesewright, CEO of Walmart International was speaking at the same presentation, and he pointed out that Walmart would try to protect its market share in the US – where the company had just issued an earnings warning. But most of the growth would have to come from its units outside the US. I mean, via these share buybacks?

Alas, outside the US too, economies were limping along at best, and consumers were struggling and the operating environment was tough. “We’re seeing economies under stress pretty much everywhere we operate,” Cheesewright admitted.

#19 In a recent CNBC article entitled “Time to close Wal-Mart stores? Analysts think so“, it was recommended that Wal-Mart should close approximately 100 “underperforming” supercenters in rural locations across America.

#20 Retail consultant Howard Davidowitz is projecting that up to half of all shopping malls in America may shut down within the next 15 to 20 years…

Within 15 to 20 years, retail consultant Howard Davidowitz expects as many as half of America’s shopping malls to fail. He predicts that only upscale shopping centers with anchors like Saks Fifth Avenue and Neiman Marcus will survive.

So is there any hope that things will turn around? Well, if the U.S. economy started producing large numbers of good paying middle class jobs there would definitely be cause for optimism. Unfortunately, that is just not happening.

On Friday, we were told that the U.S. economy added 175,000 jobs during the month of February. That sounds pretty good until you realize that it takes almost that many jobs each month just to keep up with population growth. And according to CNS News, the number of unemployed Americans actually grew faster than the number of employed Americans in February…

The number of unemployed individuals 16 years and over increased by 223,000 in February, according to the Bureau of Labor Statistics (BLS).

In February, there were 10,459,000 unemployed individuals age 16 and over, which was up 223,000 from January, when there were 10,236,000 unemployed individuals.

Meanwhile, the labor force participation rate continues to sit at a 35 year low, and a staggering 70% of all Americans not in the labor force are below the age of 55. That is outrageous. And things look particularly depressing when you look at the labor force participation rate for men by themselves.

In 1950, the labor force participation rate for men was sitting at about 87%. Today, it has dropped beneath 70% to a brand new all-time record low.

The truth is that there simply are not enough jobs for everyone anymore. The chart posted below shows how the%age of working age Americans that actually have a job has changed since the turn of the millennium. As you can see, the employment-population ratio declined precipitously during the last recession, and it has stayed below 59% since late 2009…

If we were going to have a “recovery”, we should have had one by now.

Since there are not enough jobs, what is happening is that more highly educated workers are taking the jobs that were once occupied by less educated workers and bumping them out of the labor force entirely. The following is an excerpt from a recent Bloomberg article…

Recent college graduates are ending up in more low-wage and part-time positions as it’s become harder to find education-level appropriate jobs, according to a January study by the Federal Reserve Bank of New York.

The share of Americans ages 22 to 27 with at least a bachelor’s degree in jobs that don’t require that level of education was 44% in 2012, up from 34% in 2001, the study found.

Due to the fact that there are not enough middle class jobs to go around, the middle class has been steadily shrinking. In 2008, 53% of all Americans considered themselves to be “middle class”. Today, only 44% of all Americans consider themselves to be “middle class”. That is a pretty significant shift in just six years, don’t you think?

What’s wrong with America? This is.

• US Hedge Fund Merges Financial Markets With Political System (NY Times)

At a Midtown Manhattan steakhouse last June, William A. Ackman, the activist hedge fund manager who had bet a billion dollars on the collapse of the nutritional supplement company Herbalife, offered his latest evidence to a handful of other hedge fund managers about why the company’s stock could soon plummet. Mr. Ackman told his dinner companions that Representative Linda T. Sánchez, Democrat of California, had sent a letter to the Federal Trade Commission the previous day calling for an investigation of the company.

The commission had not yet stamped the letter as received, nor had it been made public. But Mr. Ackman, who had personally lobbied Ms. Sánchez and stood to profit if the company’s stock dropped as a result of the call for an inquiry, already knew what it said, and read from a copy of it that he had on his cellphone. When Ms. Sánchez’s office ultimately issued a news release a month later, it was backdated as though it had been made public the day before Mr. Ackman’s dinner talk.

The letter was a small hint of Mr. Ackman’s extraordinary attempt to leverage the corridors of power — in Washington, state capitols and city halls — for his hedge fund’s profit after taking a $1 billion financial position called a short, a bet that will pay off only if Herbalife’s stock drops. Corporate money is forever finding new ways to influence government. But Mr. Ackman’s campaign to take this fight “to the end of the earth,” using every weapon in the arsenal that Washington offers in an attempt to bring ruin to one company, is a novel one, fusing the financial markets with the political system.

Others have criticized the business practices of Herbalife, a company that sells vitamins and other health supplements through independent distributors, many of whom are lower-income Latinos or African-Americans. But Mr. Ackman’s attack is unprecedented in its scale, and Herbalife officials strongly deny his accusations that the company is a pyramid scheme that stays afloat by constantly recruiting new distributors.

To pressure state and federal regulators to investigate Herbalife, an act that alone could cause its stock to dive, his team has helped organize protests, news conferences and letter-writing campaigns in California, Nevada, Connecticut, New York and Illinois, although several of the people who signed the letters to state and federal officials say they do not remember sending them, an investigation by The New York Times has found.

His team has also paid civil rights organizations at least $130,000 to join his effort by helping him collect the names of people who claimed they were victimized by Herbalife in order to send the leads to regulators, the investigation found. Mr. Ackman’s team also provided the money used by some of these individuals to travel to Washington to participate in a rally against Herbalife last month.

Herbalife has mobilized its own army of lobbyists to defend itself against Mr. Ackman’s charges. “These accusations are provably false,” said Herbalife’s chief financial officer, John G. DeSimone. “And they can all be traced back to the same source: hedge fund billionaire Bill Ackman, who is motivated by one thing — getting even richer by winning a billion-dollar bet he made against our company, by any means possible, no matter how unscrupulous.”.

What’s wrong with Britain? Where do I start? How much time do you have?

• Banking bonuses worldwide up 29% as City of London fares even better (Guardian)

The average bankers’ bonus globally was 29% higher than a year ago, with those in the City of London higher than in other parts of the world, according to a survey by a leading careers website. More than 2,660 financiers in the UK, US, Hong Kong, Singapore and Australia were asked about their bonuses by eFinancialCareers, and the 700 who responded from the UK were found to have higher payouts. In the UK nearly half (49%) of respondents reported higher bonuses, compared with 47% in the US and Hong Kong. Yet 41% said they were disappointed with the size of their bonuses.

“While the results of the survey may seem surprising, a deeper look finds that banks are dividing their bonus pool more ruthlessly, with a priority placed on rewarding top performers,” said James Bennett, global managing director of eFinancialCareers. “Banks argue that they need to pay large bonuses to keep their top talent. It would appear that a handful have been awarded handsome bonuses, while the majority did not necessarily see a huge increase,” he said. Although the size of bonuses increased, the degree of satisfaction among the recipients increased only one point to 39%, compared with 38% a year ago.

Yup. Great market. Recovering all the time.

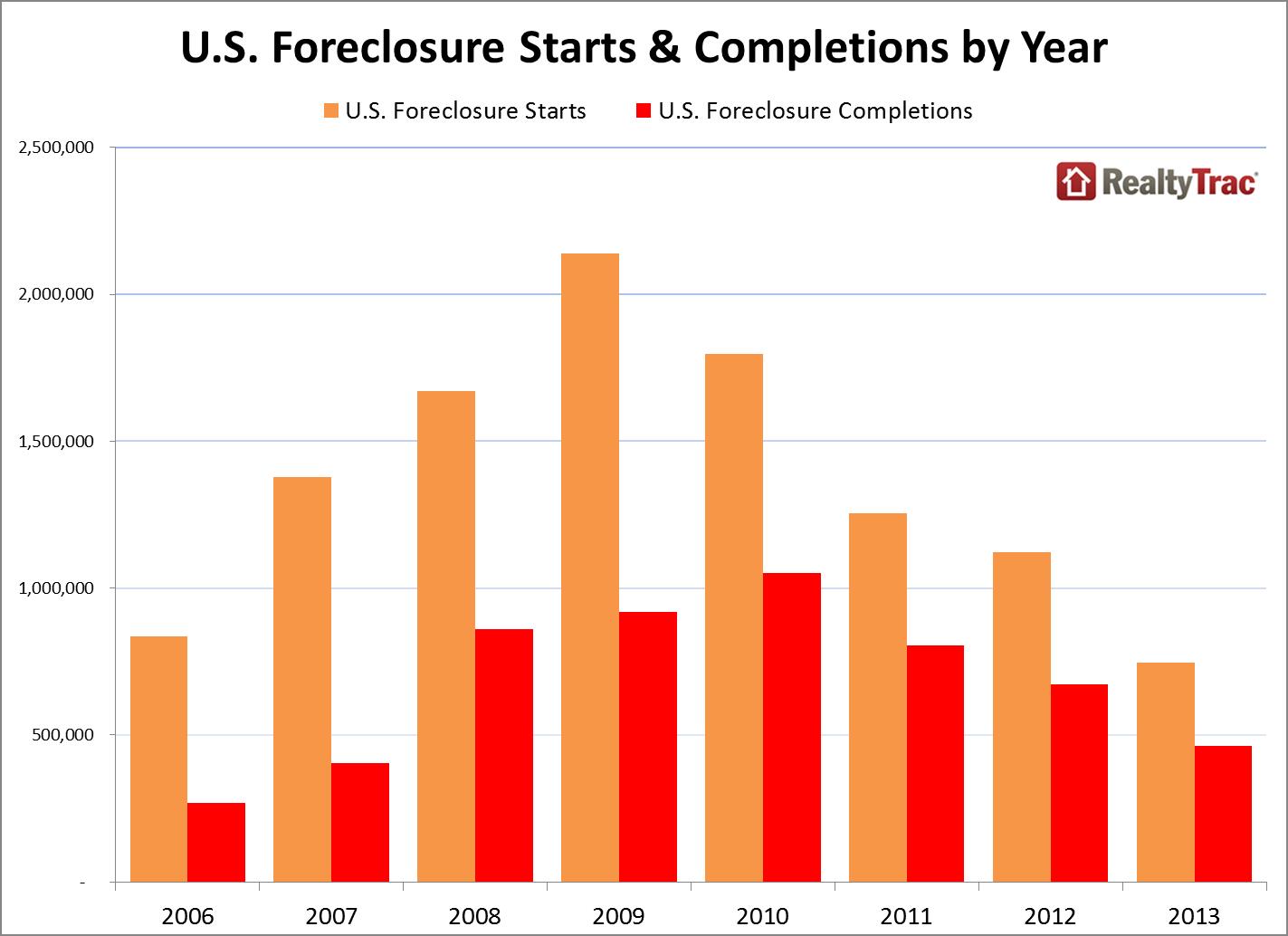

• A housing graveyard made up of 7,000,000 foreclosures (DrHousingBubble)

There is little bragging that goes on when a poor financial decision is made. You rarely hear about the person that invested a sizeable portion of their retirement account into AOL at the peak or going all in on Enron. The same applies to housing. We are seeing chatter reflect that of 2005, 2006, and 2007. Justifications are different but some people seem to feel they bought at the “perfect” time. Just for the sake of curiosity I ran the numbers of total foreclosures since the crisis began with the housing peak in 2006.

In total, 7 million Americans have been served with the bitter taste of foreclosure. On the flipside, since we know that roughly 30% of all purchases have gone to investors and Wall Street, we can say that probably over this same period 2,000,000 homes are now in the hands of some sort of investors (i.e., big money, small money, foreign money, and second homes). You also have to wonder how many of these people that lost their homes in foreclosure are itching to get back on the horse and buy again. Credit standards are fairly tough for getting a loan today even though rates are low. And those with the credit and income are battling it out in flippervilles where “all cash” is dominating the scene. There are likely some permanent structural changes that are a result of a stunning 7 million foreclosures.

The 7 million club

From reading the mainstream press all you hear are glorious signs of housing resurrection! Come one come all into the house of real estate where the almighty Fed will allow no harm to occur. Just sign and pray and the next thing you know you’ll be the next Donald Trump. The flipping, rehabbing, and housing shows are once again filling the space on a cable station near you. The perception of the Fed being this almighty protector of housing makes a bit of sense but where was the Fed in 2007? Last time I checked the Fed came into existence in 1913, over 100 years ago. Frankly, the Fed on their list of priorities has: to keep member banks afloat, keep financials steady, a deep attempt to protect the bond market, and more importantly keep interest rates low on our massive $17+ trillion national debt that will never be paid back. Housing is low on the list of priorities especially with many of the foreclosures now shifting to “stronger” hands.

You wouldn’t know it but since the peak in 2006 we have witnessed 7 million foreclosures:

Even in 2013 we had 1.4 million properties with notice of defaults, scheduled auctions, and full on REOs taken on. Early in the crisis these stories were common since they were a novelty to the press. Now however, many of these properties are shifting over to large investors pushing inventory up. A clear consequence of this is a large pool of potential buyers that are unable to buy. 7 million households now have a marred credit history. In many hot metro areas given the 2013 jump in prices to get the best rates you will need good credit. Contrary to nonsense being spouted you actually need a solid income to compete in any high priced metro area. Plus, we are assuming this foreclosed club is even interested in buying again. Many are opting to go the renting route.

The assumption is that the market is being driven up organically by regular households and that is not the case:

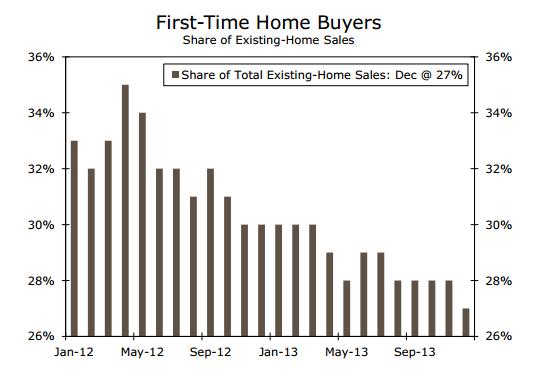

Source: Wells FargoThe number of first time buyers is pathetic because household formation is weak and many young Americans are living at home with mom and dad. Forget about buying, they are having a tough time paying higher rents to the new feudal landlords. You would expect with the rapid rise in prices that existing home sales are off the charts but they are not. For most people in the perpetual serf demographic, a mortgage is necessary to buy but look at requests for mortgages via applications:

We are back to levels last seen nearly 20 years ago! Only difference is that we have 50,000,000 more people today walking the streets of the U.S. of A. than we did back then. [..]

Pensions are a tapeworm. Yes, well, depends on one’s vantage point, doesn’t it. There’s people who would claim that Buffett, and the system he represents, is the tapeworm.

• Buffett’s Omaha Shows Pension Tapeworm Eating Funds (Bloomberg)

Like everyone else who dines at a restaurant in Omaha, Nebraska, Buffett is charged a 2.5% tax that’s used in part to defray $850 million in unfunded retirement expenses for city workers. The levy, in effect for more than three years, hasn’t closed the gap. So the mayor is trying to persuade employees to accept lower retirement payments. Omaha is a prime example of what Buffett, the 83-year-old chairman of Berkshire Hathaway, described this month as a tapeworm threatening government finances.

States and localities from California to New York are struggling with how to shore up pensions that are underfunded by at least $1 trillion, according to the Nelson A. Rockefeller Institute of Government in Albany, New York. “We are in a black hole and it’s going to take 45 years to get out of it,” said Omaha Mayor Jean Stothert, a Republican. “I’m not going to turn around and raise everybody’s taxes sky high and put it into the pension. The key is convincing unions this is something that must be done.”

Cities across the country are considering varied approaches to paying the bill. Philadelphia may sell a utility. Charleston, West Virginia, is weighing closing of fire stations, while Bloomington, Illinois, is considering new levies on concert tickets, bowling and trips to the zoo. When Buffett called attention to pension shortfalls in a March 1 annual report to shareholders of Omaha-based Berkshire, he wrote: “Citizens and public officials typically under-appreciated the gigantic financial tapeworm that was born when promises were made.” In a subsequent interview on CNBC, Buffett said Omaha pensions are in “terrible shape” even though the city has “a lot of resources” and is a “healthy community.”

Pension deficits emerged as the 18-month recession that ended in 2009 drove down stocks, trimming the value of investments used to pay benefits. Governments for years had also failed to put aside enough money. In Chicago, the third most populous U.S. city, a “massive and growing” pension-fund shortfall could lead to insolvency, Moody’s Investors Service said in a report this month as it cut the municipality to three levels above junk grade. Detroit’s pension deficit, estimated at more than $3 billion, gained public attention last year as the city filed the largest U.S. municipal bankruptcy.

The shortfalls are affecting the $3.7 trillion municipal-bond market, even as a rally pushed benchmark 10-year yields to the lowest since June. Investors demanded an average of about 0.9%age point of extra yield to own local-government bonds instead of state debt in the first two months of the year, Bank of America Merrill Lynch data show. The gap was more than double the level of March 2011. Elected officials said they’re being forced to make unpopular decisions.

Charleston, West Virginia, is considering the fire station plan to close a pension shortfall of about $250 million, said the city’s Republican mayor, Danny Jones. “It’s going to be tough,” said Jones, citing years of failure to set aside money to fund retiree benefits. “We’ll come up with the money — fees will have to go up, services will have to be cut — but we’ll just have to do it.”

What can I say? I love Jim. And I see he reads me.

• It’s Back To The Kardashians, Tattoos And Heroin (Jim Kunstler)

And so it’s back to the Kardashians for the US of ADD. As of Sunday The New York Times kicked Ukraine off its front page, a sure sign that the establishment (let’s revive that useful word) is sensitive to the growing ridicule over its claims of national interest in that floundering, bedraggled crypto-nation. The Kardashians sound enough like one of the central Asian ethnic groups battling over the Crimea lo these many centuries — Circassians, Meskhetian Turkmen, Tatars, Karachay-Cherkessians — so the sore-beset American public must be content that they’re getting the news-of-the-world. Perhaps one of those groups was once led by a Great Kanye.

Secretary of State John Kerry has shut his pie-hole, too, for the moment, as it becomes more obvious that Ukraine happens to be Russia’s headache (and neighbor). The playbook of great nations is going obsolete in this new era of great nations having, by necessity, to become smaller broken-up nations. It could easily happen in the USA too as our grandiose Deep State descends further into incompetence, irrelevance, buffoonery, and practical bankruptcy.

Theories abound about what drives this crisis and all the credible stories revolve around the question of natural gas. I go a little further, actually, and say that the specter of declining energy sources worldwide is behind this particular eruption of disorder in one sad corner of the globe and that we’re sure to see more symptoms of that same basic problem in one country after another from here on, moving from the political margins to the centers. The world is out of cheap oil and gas and, at the same time, out of capital to produce the non-cheap oil and gas. So what’s going on is a scramble between desperate producers and populations worried about shivering in the dark. The Ukraine is just a threadbare carpet-runner between them.

Contributing to our own country’s excessive vanity in the arena of nations is the mistaken belief that we have so much shale gas of our own that we barely know what to do with it. This is certainly the view, for instance, of Speaker of the House John Boehner, who complained last week about bureaucratic barriers to the building of new natural gas export terminals, with the idea that we could easily take over the European gas market from Russia.

Boehner is out of his mind. Does he not know that the early big American shale gas plays (Barnett in Texas, Haynesville in Louisiana, Fayettville in Arkansas) are already winding down after just ten years of production? That’s on top of the growing austerity in available capital for the so-far-unprofitable shale gas industry. That’s on top of the scarcity of capital for building new liquid natural gas terminals and ditto the fleet of specialized refrigerated tanker ships required to haul the stuff across the ocean. File under “not going to happen.”

Even the idea that we will have enough natural gas for our own needs in the USA beyond the short term ought to be viewed with skepticism. What happens, for instance, when we finally realize that it costs more to frack it out of the ground than people can pay for it? I’ll tell you exactly what will happen: the gas will remain underground bound up in its “tight rock,” possibly forever, and a lot of Americans will freeze to death.

The most amazing part of the current story is that US political leaders are so ignorant of the facts. They apparently look only to the public relations officers in the oil-and-gas industries and no further. Does Barack Obama still believe, as he said in 2011, that we have a hundred years of shale gas?” That was just something that a flack from the Chesapeake Corporation told to some White House aide over a bottle of Lalou Bize-Leroy Domaine d’Auvenay Les Bonnes-Mares Grand Cru. Government officials believe similar fairy tales about shale oil from the Bakken in North Dakota — a way overhyped resource play likely to pass its own peak at the end of this year.

If you travel around the upper Hudson Valley, north of Albany, where I live, you would see towns and landscapes every bit as desolate as a former Soviet republic. In fact, our towns look infinitely worse than the street-views of Ukraine’s population centers. Ours were built of glue and vinyl, with most of the work completed thirty years ago so that it’s all delaminating under a yellow-gray patina of auto emissions. Inside these miserable structures, American citizens with no prospects and no hope huddle around electric space heaters. They have no idea how they’re going to pay the bill for that come April. They already spent the money on tattoos and heroin.

Big thing in North America, non-item anywhere else.

• The end of restaurant tipping? (MarketWatch)

Is the no-tip movement at restaurants reaching, well, a tipping point? In recent years, such renowned restaurants as Thomas Keller’s Per Se in New York and French Laundry in Yountville, Calif., Alice Waters’ Chez Panisse in Berkeley, Calif., and Grant Achatz’s Alinea in Chicago have put no-tip policies in place. So did the recently closed Linkery restaurant in San Diego.

Perhaps the policies at these establishments shouldn’t come as a surprise, since restaurant patrons are increasingly saying they don’t like to play the tipping game. A solid majority of Americans — 75% — say they tip less than the customary 20% when dining out, according to a new survey by vouchercloud.net, which researches consumer spending habits. Additionally, the website reports that 46% of Americans say they are tipping less in general than they did five years ago.

Scott Rosenberg, owner of Sushi Yasuda, another no-tip restaurant in New York, believes that diners are simply tired of the meal-ending ritual of “grading” a server and then doing the math based on that judgment. “The meal should be there for you to enjoy without doing this calculus,” says Scott Rosenberg. To be clear, such restaurants are still paying their waiters — and the customers are still paying for the service as part of the overall bill. When Scott Rosenberg did away with tipping some months back, he raised menu prices by 15% to cover costs.

But there’s a reason beyond customer preference that restaurants are going no-tip. At a time when dining establishments have come under fire for issues relating to how tip money is split among employees — in many eateries, gratuities are shared with support staff or even managers — there’s some thought that a no-tip policy may be the quickest way to avoid headaches and potential legal complications. For example, at Starbucks SBUX +0.67% , the issue has become so thorny that baristas have sued to win back millions in tips that they allege were unfairly divvied; one case is currently making its way through the courts.

But tipping has its defenders. Without such a reliable system of accountability, high-level service could be compromised, says Edward P. Foy, Jr., owner of The Chateau on the Lake, an American-European upscale restaurant in Bolton Landing, N.Y. Even some servers point out that accountability can sometimes work to their advantage: With tips, there’s the potential to make more money than might be possible under a flat-wage system. “Getting rid of tipping would be horrible,” says Jenn Harris, a waitress in Solana Beach, Calif.

There’s also the issue that old habits are hard to break. While tipping is not necessarily standard in other parts of the world — most notably, some Asian and European countries — it’s long been part of the American dining system. “Even if you changed the server’s mentality toward how they are compensated, it is almost impossible to rewire the American customer who thinks they have to leave ‘something’ at the end of the meal,” says Carolyn Richmond, a New York-based attorney with Fox Rothschild who specializes in the hospitality industry.

That’s indeed what Scott Rosenberg of Sushi Yasuda discovered after establishing the restaurant’s no-tip policy. Patrons were still leaving money on the table, resulting in instances of waiters having to track them down outside the restaurant to return the cash. But Rosenberg says that customers have gotten more accustomed to the policy over time and are better appreciating the point.

Get corporations out of your water. Today.

• The water-energy-food nexus: where are we now? (Guardian)

Some of the biggest challenges the world is facing hinge on the growing scarcity and allocation of resources vital to sustaining life – water, energy and food. To make enough food to support a growing population we need more water and energy. Producing energy requires water to cool power plants and produce biofuels, while making water accessible and clean for human consumption demands energy. According to UN estimates, by 2030 we will need 30% more water, 45% more energy and 50% more food.

The 2012 US drought hit 80% of US farms and ranches, impacting food and livestock feed prices. Meanwhile, powerplants had to scale back or shut down because water temperatures had become too warm to be useful for cooling. Many companies are beginning to recognise the complexities of the water-energy-food relationship. Conservation International’s Business and Sustainability Council outlines the business case (pdf) for focusing on the nexus and shares case studies of businesses taking action, including Chevron, Coca-Cola, Shell and Veolia Water.

We’re not just fighting for these resources in the face of a changing climate and extreme weather events. New players are throwing their weight into the ring too. A report by the Ceres investor network found that fracking is depleting water supplies in America’s driest areas. It can take millions of gallons of fresh water to frack a single well and of the nearly 40,000 oil and gas wells drilled since 2011, 55% were in areas experiencing drought.

California’s Kern County, about 100 miles from Los Angeles, is one area whose water supply is feeling the consequences of the energy rush. Beth Hoffman explains that in 2012, Kern County farmers grew almost $1.5bn in grapes and nearly $1bn in almonds, a scale of agriculture that requires a lot of water. Groundwater sources are running low, and farmers are now also up against fracking which has become a top industry in the area.

The case for nexus thinking has been around for a while now, but is it really joined up enough yet? Do we have enough data points to catalyse action? How are organisations tackling interconnected resource challenges and what are the concrete examples of scenario planning, collaborations or programmes in place? Could the move towards valuing natural capital help accelerate nexus thinking and policy making?

Join a panel of experts online on Thursday 13 March, 1pm to 2.30pm GMT to explore where today’s thinking is around nexus challenges and opportunities

Good to see we reach main media now. Is there still hope?

• 10 innovative food projects reconnecting eaters and producers (Guardian)

For most of the past half century, many of us didn’t know – and didn’t care to know – how or where our food was produced. For many, food came from the grocery store or restaurant, not from the ground.

In the USA, The Food Network draws more viewers than any other cable news channel, but people are cooking less than ever. The time it takes the average American to prepare dinner is now less than half the length of a Hell’s Kitchen episode. Cooking has become a spectator sport, with people watching TV chefs battle it while they grow ever-distant from the farmers who produce their food. The loss of culinary skills and regular meal times mean 40% of American meals are solitary, and eating with friends and family has become the exception rather than the norm.

Globally, famers are aging. Their average age in sub-Saharan Africa and the USA is 56. Youth, in rich and poor countries alike, don’t consider agriculture a viable career. Those that choose it often feel forced into farming because they have no other options.

But now, the growth in farmers’ markets and increasing interest in local food and food transparency is not only bringing people closer to producers, but creating excitement around cooking skills and conviviality. Here are 10 projects connecting eaters and producers, encouraging youth to choose agriculture, bringing people together over food and restoring lost culinary traditions.

1. Developing Innovations in School and Community Cultivation – Uganda : Teaching pupils about indigenous crops, founders Edward Mukiibi and Roger Sserunjogi have partnered with Slow Food International to strengthen relationships between young people and food. As well as improving diets and agricultural techniques they’ve helped reignite a vibrant cooking culture and local food knowledge.

2. Know Your Farmer, Know Your Food (KYF2) – USA : KYF2 local markets provide opportunities for new farmers, diversified sales for experienced farmers and retail for small businesses, and allow consumers to learn about the origin of their food. Strengthening regional food systems, fostering healthy eating and empowering consumers are the United States Department of Agriculture’s goals.

3. Tackling the Agriculture-Nutrition Disconnect – India : Agriculture employs more than half of India’s workforce and yet pervasive undernutrition endures, especially among the young. With the long-term goal of building a nutrition knowledge and innovations network in India, this International Food Policy Research Institute programme, provides an information-sharing platform for nutrition, health, agriculture and education stakeholders.

4. Fresh! From Finland : This campaign encourages the use of local foods in schools, teaches children about food origins, and educates Finland and the world in appreciating Finnish food. Parents are urged to enjoy food with their children, with the aim of raising a new generation of eaters who think of food as a vehicle for connection and gathering.

5. The Center for Foods of the Americas – Latin America : Much like language, culinary tradition must be practiced to be retained. This team preserve Latin American cuisine, traveling through the 21 countries cataloguing ingredients, dishes and street food for future generations.

6. Manna From Our Roof – Italy : Federica Marra wants to bring young people closer to the food system and shorten the field-to-fork loop. Using urban roof gardens young people own the process, from growing methods and energy supplies to harvesting and taking the product to market.

7. The Prettiest Kitchen Gardens – Hungary : By encouraging Hungarians to grow food, not just flowers, this new initiative revives the forgotten popular kitchen garden traditions.

8. The Binational Center for the Development of Oaxacan Indigenous Communities – USA : Created by a group of Oaxacan mothers, who were worried about their children forgetting native recipes – and the consequential health problems they observed. They publish recipes, consult, run workshops and classes to preserve and stengthen indigenous food culture.

9. The European Council for Young Farmers – Europe : Giving a voice to young farmers and promoting a youthful and innovative agricultural sector is the Council’s aim. Through exchange programmes, training and protecting agricultural and cultural traditions, they work to support young farmers and strengthen rural areas.

10. USAID Kenya Dairy Sector Competitiveness Programme : With a focus on youth and women, this project encourages farmers to develop dairy skills and grow their income throughout the value chain. Transferring knowledge from older farmers, as they retire, to Kenya’s youth, is seen as critical.

These projects are especially important in the International Year of Family Farming. Farmers are more than just producers, they’re the stewards of indigenous foods and traditional cooking practices as well as entrepreneurs, who deserve to be recognised for their capacity to improve local economies and raise incomes in both developing and industrialised nations.

Curious. Are they really so mysterious?

• Mysterious new man-made gases pose threat to ozone layer (BBC)

Scientists have identified four new man-made gases that are contributing to the depletion of the ozone layer. Two of the gases are accumulating at a rate that is causing concern among researchers. Worries over the growing ozone hole have seen the production of chlorofluorocarbon (CFC) gases restricted since the mid 1980s. But the precise origin of these new, similar substances remains a mystery, say scientists.

Lying in the atmosphere, between 15 and 30km above the surface of the Earth, the ozone layer plays a critical role in blocking harmful UV rays, which cause cancers in humans and reproductive problems in animals. Scientists from the British Antarctic Survey were the first to discover a huge “hole” in the ozone over Antarctica in 1985. The evidence quickly pointed to CFC gases, which were invented in the 1920s, and were widely used in refrigeration and as aerosol propellants in products like hairsprays and deodorants.

Remarkably, global action was rapidly agreed to tackle CFCs and the Montreal Protocol to limit these substances came into being in 1987. A total global ban on production came into force in 2010. Now, researchers from the University of East Anglia have discovered evidence of four new gases that can destroy ozone and are getting into the atmosphere from as yet unidentified sources. Three of the gases are CFCs and one is a hydrochlorofluorocarbon (HCFC), which can also damage ozone.

“Our research has shown four gases that were not around in the atmosphere at all until the 1960s which suggests they are man-made,” said lead researcher Dr Johannes Laube. The scientists discovered the gases by analysing polar firn, perennial snow pack. Air extracted from this snow is a natural archive of what was in the atmosphere up to 100 years ago. The researchers also looked at modern air samples, collected at remote Cape Grim in Tasmania.

They estimate that about 74,000 tonnes of these gases have been released into the atmosphere. Two of the gases are accumulating at significant rates. “The identification of these four new gases is very worrying as they will contribute to the destruction of the ozone layer,” said Dr Laube.

“We don’t know where the new gases are being emitted from and this should be investigated. Possible sources include feedstock chemicals for insecticide production and solvents for cleaning electronic components.” “What’s more, the three CFCs are being destroyed very slowly in the atmosphere – so even if emissions were to stop immediately, they will still be around for many decades to come,” he added.

Other scientists acknowledged that while the current concentrations of these gases are small and they don’t present an immediate concern, work would have to be done to identify their origin. “This paper highlights that ozone depletion is not yet yesterday’s story,” said Prof Piers Forster, from the University of Leeds. “The concentrations found in this study are tiny. Nevertheless, this paper reminds us we need to be vigilant and continually monitor the atmosphere for even small amounts of these gases creeping up, either through accidental or unplanned emissions.

The four new gases have been identified as CFC-112, CFC112a, CFC-113a, HCFC-133a

• CFC-113a has been listed as an “agrochemical intermediate for the manufacture of pyrethroids”, a type of insecticide once widely used in agriculture

• CFC-113a and HCFC-133a are intermediaries in the production of widely used refrigerants

• CFC-112 and 112a may have been used in the production of solvents used to clean electrical components

Oh, Sweet Jesus, can we please have one inkling of truth on this, just the once?

• 3 Years On: Contaminated Fukushima Water May Be Dumped Into Pacific (RT)

Contaminated water at the battered Fukushima plant has taken precedence over everything else. As the larger cleanup effort continues and storage space for the water is rapidly running out, scientists suggest dumping it into the Pacific Ocean. The plant’s chief, Akira Ono, has testified to the seriousness of the situation during a Monday visit by international media, saying that “the most pressing issue for us is the contaminated water, rather than decommissioning. Unless we resolve the problem, fear of the community continues and the evacuees cannot return home,” the AP cited him as saying.

The massive amount used to cool the melted cores of three reactors has been wreaking havoc with onsite radiation, which also began to seep into the ground a while back, with TEPCO having tried different techniques for stalling or containing it. But it has repeatedly been finding its way into the Pacific as well.

Four hundred and thirty-six tons of contaminated water is stored in 1,200 tanks suspended above ground all over the site. TEPCO has made progress with water treatment units to filter out strontium and cesium from the water and make it safer for storage. They say the remaining tritium is much safer to dump into the ocean later.

A plan to build an underground frozen wall around the four damaged reactors has been in the works for a while, but experts insist this this measure, worth billions in government funding, is as temporary as othersothers have been. Although similar routes have been taken at American sites in the past, something of the sort on this scale has never been attempted.

On Monday, TEPCO was setting the wall up for a test run at another location at the site. The final version will be a 2km thick wall around all four damaged reactors. The test run starts in four days, while the final version isn’t due until next year. That deadline is not set by TEPCO; it’s when the plant will eventually run out of storage capacity, whether it’s ready or not.

The former chairman of the US Nuclear Regulatory Commission, who now heads a group of external decommissioning advisers, Dale Klein, believes “storing the massive amounts of water in tanks is not sustainable… it’s not science that needs to be developed, but it’s public policy.” Klein is known to be a vocal opponent of the frozen wall approach.

This is also important because extensive leakage and increasing amounts of radioactivity put cleanup workers in increasing danger. The 5 milisievert exposure benchmark that, when crossed, qualifies the worker for compensation on health grounds, has fallen from 2,900 claims in 2011 to just 98 in June of 2013; however, it was four times that by October. Keeping the place continually manned is not easy because some workers have had it so bad they can’t risk ever working at the plant again.

In the midst of this is the cleanup operation, seeking to develop new robotic technology to expedite the process and removing melted fuel from the damaged reactors by 2020 – itself a multi-billion dollar venture whose deadline is too optimistic, some experts say.

This article addresses just one of the many issues discussed in Nicole Foss’ new video presentation, Facing the Future, co-presented with Laurence Boomert and available from the Automatic Earth Store. Get your copy now, be much better prepared for 2014, and support The Automatic Earth in the process!

Home › Forums › Debt Rattle Mar 11 2014: If You Don’t Need It, DON’T BUY IT