Jack Delano for OWI Female Gas Attendant, Philadelphia, PA June 1943

Forests and trees. We live in a world built on such an overkill of 24/7 propaganda and misinformation that some of it easily slips by. At that point you need to rely on the little man inside to raise a warning sign. That’s about how I felt when I read yesterday about EU plans to deliver gas to Ukraine by reversing the flow through existing pipelines. That made me wonder things like: ‘How would that work in practice?’ and: ‘Which gas?’ While the little man simply said: ‘I don’t believe a word of this’.

And before you know it, you spend many hours trying to get a clearer picture. Here’s an idea of how that went for me. First, the Guardian on the initial report:

EU leaders draw up plans to send gas to Ukraine if Russia cuts off supply (Guardian)

EU leaders are rapidly drawing up plans to send some of their stocks of Russian gas back to Ukraine and other eastern European countries that need it, if Vladimir Putin reacts to western sanctions over the Crimea crisis by starving the continent of energy.

Gazprom provides Ukraine with around half its gas, and other countries in eastern and southern Europe, including Poland and Greece, reportedly have low stocks of gas. Although Gazprom said the threat to Kiev would not affect the supply to the rest of Europe, western leaders are steeling themselves for a possible battle with Moscow over energy supplies. [..]

“Either Ukraine makes good on its debt and pays for current supplies, or there is risk of returning to the situation of early 2009,” Gazprom CEO Alexei Miller said on Friday, adding that Ukraine now owed $1.89 billion in unpaid bills. [..] Although it is the largest producer of natural gas, the US does not currently export its supplies, and the construction of a handful of export terminals will not be completed until at least 2015. [..]

In Brussels on Thursday, European leaders engaged in detailed discussions about the feasibility of switching the flow of gas in eastern Europe’s pipelines. Storage reserves in Europe, particularly Germany and Hungary, which have ample supplies, could be used to pump gas back towards Ukraine. José Manuel Barroso, the president of European Commission, said energy security was an early priority for Ukraine, adding: “We are looking in the short term at the gas transmission network to ensure that reverse flows with the European Union are fully operational.”

A project to modernise Ukraine’s gas transmission infrastructure forms part of the EU’s $15 billion promised aid package to Kiev, with an initial loan possible in the near future.

A European Commission memorandum specifically states it will seek to enable “reverse flows” of gas to Ukraine, ensuring they can be “operationalised as soon as possible”. [..]

What I get from that: Europe is drawing up all sorts of plans before there is any real threat to its supplies. That gives me the idea that it’s overplaying the Ukraine threat card on purpose, but that’s just my little man inside. There’s also a lot more to that than either Ukraine or EU are saying, and that makes me suspicious. As does the line about “part” of the promised aid being set aside for “modernizing” Ukraine’s gas transmission infrastructure. What does that mean? That Shell and BP are going to come in to make sure that get control, and push aside Gazprom? What else could it be? Who else has the know how?

What is clear is that Ukraine has a horrible history of paying Gazprom for gas deliveries through the past 20 years. And Barroso et al are not urging Kiev to finally pay the bills, they intend to help them get gas without paying Russia for past delivery. But still, you could argue that these things are open to interpretation, though I think western coverage of delivery and payment has been very one-sided for a long time.

So let’s try another angle. My first question about reverse gas flows was: ‘How would that work in practice?’. Here’s what the article says about this:

… European officials and energy experts concede there are doubts over whether it would be technically possible to transfer sufficient gas through the continent, west to east, if Russia decided to restrict its supplies for a significant period of time. While short-term assistance through the summer months could help, western Europe would not have the capacity to supply neighbours in the east for an extended period of time.

Speaking on the condition of anonymity, one senior executive said reversing gas flows would be an extremely complex move. “This is not easy to do. Certainly the Gazprom export pipeline is built to move gas only in one direction, and it would involve a lot of time and money to reconfigure for imports ,” the executive said. “You would also have to get the agreement of dozens of commercial and other organisations. It is not going to happen.”

That’s pretty clear, though they have only the lone anonymous industry voice (you can’t exactly speak freely on this if you work for Big Oil of course, far too many conflicting interests). It seems obvious even to the layman that there are lots of pumps along the hundreds of miles of pipeline, and they’re all configured for one way flow. Logistically, this is a potential nightmare, and administratively too. There are plans these days to reverse flow in a Canadian pipeline from Montréal to Sarnia ON, and that’s hard enough. Doing that across multiple borders with dozens of interested parties and legal entities is quite another thing again.

Europe imported 155 billion cubic metres (bcm) of gas from Russia in 2013, about 30% of its overall gas demand, according to Wood Mackenzie, an Edinburgh-based energy consultancy. Ukraine is the key transit route for Russian gas to Europe, with around 50% piped through the country in 2013. [..]

In Washington, there is a growing appetite to retaliate against Russia with a long-term, strategic acceleration in energy exports. [..] Republicans, backed by gas producers such as ExxonMobil, have for years been pushing to dramatically increase gas production to enable export trade, and are using the crisis in Crimea to argue for swift action by the Obama administration.

I’ll get to the “retaliate against Russia with a long-term, strategic acceleration in energy exports” bit in a bit. First, the money quote from the article, one that puts on a very bleak light what madness al these ideas are based on:

US gas production is projected to rise 44% by 2040, according to the US Energy Information Administration, and producers have been pressing the Obama administration to expand exports of natural gas. [..]

A senior US official said the State Department was supportive of introducing substantial gas exports abroad as a move to counteract Russia’s influence. Carlos Pascual, a former American ambassador to Ukraine, who leads the State Department’s Bureau of Energy Resources, told the New York Times that opening global markets to US exports “sends a clear signal that the global gas market is changing, that there is the prospect of much greater supply coming from other parts of the world”.

The EIA is an organization of overpaid cheerleaders that haven’t had one prediction right in forever and a day. It’s perhaps because they have no track record to defend that they issue such double or nothing claims; it’s hardly interesting anymore. That claim that US gas production will be 44% more in 26 years than it is today is simply bonkers, and not supported by anything other than industry interests, loud as they may be.

The train of “thinking” behind it is what’s good to keep in mind: We’ve seen how Shell and BP and Exxon all see their production and reserves and investments fall. These are arguably the world’s most powerful corporations outside of Wall Street, and they’re on the brink of becoming irrelevant. That they, in their present predicament, would seek to go to “war without soldiers” with Gazprom and Putin, is no surprise, it’s desperation.

As we see also in an article by Nafeez Ahmed for the Guardian:

Ukraine Crisis Is About Great Power Oil, Gas Pipeline Rivalry (Guardian)

Just one month before Nuland’s speech at the National Press Club [in Dec 2013], Ukraine signed a $10 billion shale gas deal with US energy giant Chevron “that the ex-Soviet nation hopes could end its energy dependence on Russia by 2020.” The agreement would allow “Chevron to explore the Olesky deposit in western Ukraine that Kiev estimates can hold 2.98 trillion cubic meters of gas.” Similar deals had been struck already with Shell and ExxonMobil.

The move coincided with Ukraine’s efforts to “cement closer relations with the European Union at Russia’s expense”, through a prospective trade deal that would be a step closer to Ukraine’s ambitions to achieve EU integration. But Yanukovych’s decision to abandon the EU agreement in favour of Putin’s sudden offer of a 30% cheaper gas bill and a $15 billion aid package provoked the protests.

To be sure, the violent rioting was triggered by frustration with Yanukovych’s rejection of the EU deal, along with rocketing energy, food and other consumer bills, linked to Ukraine’s domestic gas woes and abject dependence on Russia. Police brutality to suppress what began as peaceful demonstrations was the last straw.

But while Russia’s imperial aggression is clearly a central factor, the US effort to rollback Russia’s sphere of influence in Ukraine by other means in pursuit of its own geopolitical and strategic interests raises awkward questions. As the pipeline map demonstrates, US oil and gas majors like Chevron and Exxon are increasingly encroaching on Gazprom’s regional monopoly, undermining Russia’s energy hegemony over Europe.

We’ve already seen that US agents have been heavily involved in regime change in Kiev. Now the picture emerges of the (for now let’s say potential) involvement of Big Oil behind the scenes. They want to break Gazprom’s power monopoly and replace it with their own.

For additional juicy tidbits, let’s take a look at this March 5 piece from Bloomberg.

Ukraine Plans to Cut Russian Gas Imports, Raise EU Supply (Bloomberg)

Ukraine, the subject of a struggle for influence between Russia and the West, plans to cut natural-gas imports from its eastern neighbor and fill the gap with supplies from Europe to reduce dependence on Gazprom. Ukraine will need to import about 30 billion cubic meters of gas this year, of which a third may come through Slovakian pipelines, Energy Minister Yuri Prodan said today in Kiev.

Prodan’s remarks follow a decision by Moscow-based Gazprom, which accounts for most of Ukraine’s gas imports, not to extend a price discount beyond April, citing unpaid debts for supply. Tensions between Russia and Europe and the U.S. have escalated since President Vladimir Putin sent troops into Crimea in a bid to regain influence over Ukraine following the overthrow of Kremlin-backed President Viktor Yanukovych last month.

Ukraine has reached a preliminary agreement with Slovakia to import 10 billion cubic meters of gas a year from various European Union countries through Slovakian pipelines, Prodan told reporters. It also has signed a deal with German utility RWE AG for 5 billion cubic meters a year, he said, without giving a start date for supply. RWE Chief Financial Officer Bernhard Guenther said this week that the Essen-based utility may be able to supply Ukraine in the event of a shortage.

The EU will help Ukraine diversify its imports and provide funding to upgrade its pipelines, the bloc’s regulatory arm said today in a statement. The European Commission also backs the use of “reverse-flow corridors” via Bulgaria, Romania and Croatia, whereby pipes that send gas west switch direction, or some fuel earmarked for those countries is sent directly to Ukraine.

Note the timeline: On March 5, Ukraine says it plans to cut gas imports form Russia. A bold enough statement to begin with if you still owe $2 billion worth of the stuff (I think I’ll go buy somewhere else now …), but that aside. I’m thinking it’s perhaps not the whole truth and nothing but the truth, because 8 days before, on February 25, Reuters reported this:

Ukraine’s Naftogaz Slashes Russian Gas Imports In February (Reuters Feb 25)

Ukraine’s state oil and gas company, Naftogaz, has slashed gas imports from Russia’s Gazprom to 28 million cubic meters per day as of February 24 from 147 million , two Russian industry sources told Reuters on Tuesday. They said Naftogaz had gradually reduced its imports from 147 million cubic meters as of February 1 , but did not offer a reason for the cuts. [..]

In December, Russia agreed to reduce the gas price for Kiev to $268.50 per 1,000 cubic meters, a cut of about one third from around $400 which Ukraine had paid since 2009. Under the deal, gas prices are revised quarterly.

Yanukovych was ousted on February 22. Two days later, Ukraine’s state oil and gas company announces it’s cut imports from Gazprom by over 80% (to be replaced with?!). What’s more, it started cutting on February 1, weeks before the Yanukovych ouster. We can probably only guess as to the reasons behind that, but it’s certainly a noteworthy event. Not least of all because the December deal with Russia that cut prices by a third was still valid and not up for revision by at least another month.

So where is the gas coming from for Ukraine today, and where will it come from in the future? Perhaps this from The Voice of Russia lifts part of the veil:

US tries to calm Europe as Russian gas shortage looming over Ukraine crisis

To be on the safe side, last week, the European Union made a decision to increase the volume of the gas purchased from Russia by 15%. In response, Josh Earnest, who is the US White House Special Assistant to the President and Principal Deputy Press Secretary, hurried to calm Europeans. He says that the American government has no information that would make it possible to conclude that Europe may face any lacks of natural gas in the foreseeable future. However, if such lacks do take place, the US would help Europe with its own liquefied gas, although it would be able to start deliveries of this gas to Europe not earlier than from the very end of 2015.

That is so funny you’d think April Fool’s Day is near. Not that the entire reverse flow story is not, but hey … The EU plans to buy 15% more gas from Russia, which they intend to use to – pretty openly – undermine Russian interests. Through some far-fetched reverse flow scheme it wants to take gas that has been pumped through Ukrainian pipelines, back to Ukraine, which can then continue to refuse to pay its past bills to Gazprom. And if Russia in turn would refuse to go along with such a scheme – and cut supplies – , they can all simply blame Putin.

And even then … :

EU Gas Flows To Ukraine Too Small To Cope With Russian Disruption (Reuters)

Directing natural gas from the European Union to Ukraine if Russia stops supplying its western neighbour would fail to keep up with demand for long as capacity between the EU and Ukraine is too small, analysts said on Thursday. Ukraine last year imported around 28 billion cubic metres (bcm) of natural gas from Russia [..]

One of the EU’s key plans to support Kiev in case of a supply cut by Russia is to use reverse flows to send gas to Ukraine, but at the moment the capacity to do so is limited. Ukraine began importing gas through reverse flows from Poland and Hungary in 2012 but analysts said the amounts so far have been equivalent to a mere 2 bcm a year. According to consulting group Wood Mackenzie, Poland has a reverse capacity of 1.5 bcm to Ukraine while Hungary is able to send 3.5 bcm. Romania has the potential for 1.8 bcm but there has been no firm agreement on its use, the consultancy said.

The real issue, however, might not be Ukraine but Europe itself. Wood Mackenzie estimated Europe would need more than 160 bcm of Russian gas in 2014. While Russia has enough gas and can reroute some flows from Ukraine to the Yamal Europe and Nord Stream pipelines, which supply Germany, the consultancy said these alternatives would still leave Europe needing more than 30 bcm of gas via Ukraine.

And we’re not done yet. There are more – and more grotesque – plans in the offing. US House Leader John Boehner apparently buys into the “US gas production is projected to rise 44% by 2040” number from the EIA (what does he know), and wrote in the WSJ this week that America should build LNG terminals: “The ability to turn the tables and put the Russian leader in check lies right beneath our feet, in the form of vast supplies of natural energy… ”

The Department of Energy has approved for terminals to export liquefied gas, 5 in Texas and Louisiana, and one in Maryland. A further 24 applications are pending and Boehner et al want Obama to speed up the process. It’s of little concern to them in their ignorance that building these terminals (and the LNG tankers required for transport) is very costly and takes years, on both the supply and the delivery side, and that LNG tankers are floating bombs and thus easy targets.

Much of the entire Ukraine story seems to be made up of a different sort of easy targets, those in the western media. We are good and they are bad. It’s almost cartoon like. And so are the “solutions” that sprout from the brains of politicians who are mostly singularly clueless when it comes to the intricacies of the energy industry, and shout out whatever some industry paid spin doctor will feed them.

The reverse flow of gas to the Ukraine is not going to happen (but we won’t know that till much later), because os technical issues, administrative and legal issues, and because Putin and Alexei Miller won’t volunteer for western leaders to make fools of them. Russia may not go to war of Crimea, but it will over control of the pipelines it has longstanding legal rights over. It’s perhaps the most pressing issue today, but that’s not how it’s presented.

Since the American and European political systems have been bought and paid for, we need to ask ourselves every step of the way where in words uttered and events ongoing we can see the footprints and fingerprints of the major shareholders of western financial and energy corporations, who would all kill their grandmas and sell their granddaughters just to pry away control over Russian and Asian oil and gas reserves and revenues from Putin’s cold dead fingers. It may all be presented as bringing freedom and democracy to Ukraine, but come on, who believes that anymore?

The only way the west can gain control over what it’s after, over Ukraine and the pipelines, and Russia and its oil and gas reserves, is to oust Putin. Are you willing to sacrifice your children over that? If not, keep paying attention. Follow the money. Of the most endangered of corporate species, Big Oil. At this point in time, they still have the clout to move governments into war. In 5 years time, that may be over.

• Global Debt Exceeds $100 Trillion as Governments Binge (Bloomberg)

The amount of debt globally has soared more than 40% to $100 trillion since the first signs of the financial crisis as governments borrowed to pull their economies out of recession and companies took advantage of record low interest rates, according to the Bank for International Settlements. The $30 trillion increase from $70 trillion between mid-2007 and mid-2013 compares with a $3.86 trillion decline in the value of equities to $53.8 trillion in the same period, according to data compiled by Bloomberg. The jump in debt as measured by the Basel, Switzerland-based BIS in its quarterly review is almost twice the U.S.’s gross domestic product.

Borrowing has soared as central banks suppress benchmark interest rates to spur growth after the U.S. subprime mortgage market collapsed and Lehman Brothers Holdings Inc.’s bankruptcy sent the world into its worst financial crisis since the Great Depression. Yields on all types of bonds, from governments to corporates and mortgages, average about 2%, down from more than 4.8% in 2007, according to the Bank of America Merrill Lynch Global Broad Market Index.

“Given the significant expansion in government spending in recent years, governments (including central, state and local governments) have been the largest debt issuers,” according to Branimir Gruic, an analyst, and Andreas Schrimpf, an economist at the BIS. The organization is owned by 60 central banks and hosts the Basel Committee on Banking Supervision, a group of regulators and central bankers that sets global capital standards.

Marketable U.S. government debt outstanding has surged to a record $12 trillion, up from $4.5 trillion at the end of 2007, according to U.S. Treasury data compiled by Bloomberg. Corporate bond sales globally jumped during the period, with issuance totaling more than $21 trillion, Bloomberg data show. Concerned that high debt loads would cause international investors to avoid their markets, many nations resorted to austerity measures of reduced spending and increased taxes, reining in their economies in the process as they tried to restore the fiscal order they abandoned to fight the worldwide recession.

Adjusting budgets to ignore interest payments, the International Monetary Fund said late last year that the so-called primary deficit in the Group of Seven countries reached an average 5.1% in 2010 when also smoothed to ignore large economic swings. The measure will fall to 1.2% this year, the IMF predicted. The unprecedented retrenchments between 2010 and 2013 amounted to 3.5% of U.S. gross domestic product and 3.3% of euro-area GDP, according to Julian Callow, chief international economist at Barclays Plc in London.

The riskiest to the most-creditworthy bonds have returned more than 31% since 2007, according to Bank of America Merrill Lynch index data. Treasury and agency debt handed investors gains of 27% in the period, while corporate bonds worldwide returned more than 40%, the indexes show.

• 96% of Chinese cities fail environmental probes (RT)

The vast majority of Chinese cities monitored for pollution fail to meet Beijing-set standards, China’s vice-minister of environmental protection says. China is mulling declaring “war” on the pollution resulting from the country’s rapid economic growth. 71 out of 74 cities monitored in China over 2013 did not meet state environmental standards with various degrees of problems, vice-minister of the Chinese Environmental Protection Ministry, Wu Xiaoqing, has announced.

Speaking on the sidelines of the annual parliament session in Beijing, Wu admitted that China was suffering the consequences of rapid industrialization. “When we were chasing GDP growth, we were also paying the price in pollution, and this price is heavy, in fact massive,” the Chinese official told reporters, Reuters quotes.

• US tries to calm Europe as Russian gas shortage looming over Ukraine crisis (Voice of Russia)

To be on the safe side, last week, the European Union made a decision to increase the volume of the gas purchased from Russia by 15%. In response, Josh Earnest, who is the US White House Special Assistant to the President and Principal Deputy Press Secretary, hurried to calm Europeans. He says that the American government has no information that would make it possible to conclude that Europe may face any lacks of natural gas in the foreseeable future. However, if such lacks do take place, the US would help Europe with its own liquefied gas, although it would be able to start deliveries of this gas to Europe not earlier than from the very end of 2015.

• Barroso proposes €11 billion to ‘stabilise’ Ukraine (EU Observer)

One billion euros of the new money is to come in the form of loans, paid from the EU budget, for Ukrainian macro-financial assistance. Another €1.4 billion will come as EU grants over the next seven years. The European Investment Bank is to contribute €3 billion over 2014 to 2016 and the European Bank for Reconstruction and Development is to add €5 billion.

In other measures, the commission will add a previous pledge of €610 million of macro-financial loans. It will also try to leverage €250 million of previously-earmarked Ukraine cash to raise over €3.5 billion in loans. Barroso noted the money will be conditional on reforms already set out by the International Monetary Fund (IMF), which include raising household gas prices. But in return, the IMF, the World Bank, EU member states, and other countries, such as Canada, Japan, South Korea, and the US are expected to top up the EU offer.

The EU’s €11 billion is almost equal to a $15 billion bailout offered by Russia before the Ukraine uprising broke out, but the top-ups could see it climb much higher. Meanwhile, Barroso said the macro-financial aid and some €600 million of the new grants can be paid out “very fast … within a matter of weeks.” He also proposed that EU countries should immediately apply lower trade tariffs on Ukrainian imports, as envisaged in a future free trade agreement. He urged the Union to also get ready to pump gas to Ukraine in “reverse flows” through Soviet-era pipelines to reduce its dependency on Russian imports.

• EU Gas Flows To Ukraine Too Small To Cope With Russian Disruption (Reuters)

Directing natural gas from the European Union to Ukraine if Russia stops supplying its western neighbour would fail to keep up with demand for long as capacity between the EU and Ukraine is too small, analysts said on Thursday. Ukraine last year imported around 28 billion cubic metres (bcm) of natural gas from Russia, which wants to maintain its influence over the former Soviet republic and fend off EU efforts to limit Moscow’s sway.

Disputes between Russia and Ukraine, which consumes more than 50 bcm of gas a year, have previously led to supply cuts for the EU, including in 2009 when hundreds of thousands of homes in southeast Europe went without heat in winter.

So far, Russia’s state-controlled Gazprom, which supplies around 30% of the EU’s gas needs and sends a third of that gas through Ukraine, has maintained supplies to Ukraine during a crisis in which Russian forces have effectively seized Ukraine’s Crimea region. But to prepare for a possible cut-off, the European Union has plans to send gas from its own storage facilities to Ukraine.

“The country (Ukraine) has sufficient gas storage to hold it through a few months, and could also turn to neighbours for additional gas supplies via reverse flows on pipelines that could bring up to 10 bcm (per year) of gas from Germany and Hungary through Poland and Slovakia,” political risk consultancy Eurasia Group said in a report this week.

Many other analysts say the available capacity to pump gas from the EU to Ukraine is well below 10 bcm, and Eurasia Group also warned that Ukraine would be likely to receive less. “If gas supplies to Europe are already compromised by an ongoing conflict, Ukraine may find its neighbours increasingly unwilling to provide this stopgap supply,” it added.

One of the EU’s key plans to support Kiev in case of a supply cut by Russia is to use reverse flows to send gas to Ukraine, but at the moment the capacity to do so is limited. Ukraine began importing gas through reverse flows from Poland and Hungary in 2012 but analysts said the amounts so far have been equivalent to a mere 2 bcm a year. According to consulting group Wood Mackenzie, Poland has a reverse capacity of 1.5 bcm to Ukraine while Hungary is able to send 3.5 bcm. Romania has the potential for 1.8 bcm but there has been no firm agreement on its use, the consultancy said.

TEXT

• Peru to ‘eliminate’ key environmental rule for oil and gas firms (Guardian)

The Peruvian government is planning a new law loosening the social and environmental checks on companies exploring for oil and gas, according to a controversial announcement by the Energy Minister. Current law states that companies must research and write “Environmental Impact Assessments” (EIAs) of proposed operations before submitting them to the government for approval and then beginning exploration.

However, Energy Minister Eleodoro Mayorga Alba announced this week that oil and gas companies planning to explore by conducting seismic tests will be exempt from the EIA process. Speaking at an event in Lima, he said that Energy Ministry and Environment Ministry personnel are currently working on the law and had reached several agreements:

[One] agreement is to eliminate environmental impact assessments for seismic operations. The [oil and gas] industry has its laws, the industry has principles, it has well-established practices, and the idea is to move away from procedures and permissions to action. The companies know what they have to do.

Mayorga’s comments were reported by Peruvian newspaper Gestion which stated that the new law, according to the minister, is intended to “accelerate investment in the oil and gas sector.” “I hope to be able to sign this law, together with the Environment Minister [Manuel] Pulgar-Vidal, and propose its enforcement in the next few days,” Gestion reported Mayorga, who was sworn in as minister on 25 February, saying. [..]

The potential impact of abolishing EIAs on indigenous peoples is particularly serious because so many of Peru’s oil and gas concessions currently at the exploration stage include indigenous territories. According to a report by Peru’s oil and gas licensing agency, Perupetro, as of November 2013 there were 50 oil and gas concessions in the exploration stage – 28 in the Amazon, two in the sierra. In addition, Perupetro is hoping to establish 26 new oil and gas concessions in the Amazon in 2014, and in recent months has been promoting them to potential investors in Peru, Colombia, Panama and the USA.

“A decision [to abolish EIAs for seismic testing] could run afoul of Peru’s obligations under international law,” says Marissa Vahlsing, a lawyer from NGO Earthrights International. “Those obligations require that the socio-environmental impacts of large scale projects in indigenous peoples’ territories be studied before the project begins, and this goes hand-in-hand with the requirement that indigenous peoples be “informed” about administrative measures that could affect their rights and territories. Abolishing EIAs essentially takes the “I” out of “FPIC” – free, prior and informed consent.”

• U.S. Wealth Hits a Record, Typical Savings Plan Is Still ‘Buy a House’ (Bloomberg)

U.S. household net worth climbed by $3 trillion to surpass $80 trillion in the latest data from the Federal Reserve. It’s a number so dumbfoundingly big that it almost invites Americans to celebrate just what a rich country we are. It shouldn’t.

The full balance sheet is a goldmine for data geeks. It’s worth drawing attention to the two biggest components of the $80 trillion: household real estate, with a value of $19.4 trillion, and $19.6 trillion of pension entitlements. That second part isn’t exactly what it sounds like to most folks, so let’s break it down further.

The $19.6 trillion pension total includes $4.9 trillion invested in 401(k) plans (which most Americans don’t think of as “pension entitlements”) plus $3.1 trillion in private pensions and $8.5 trillion in government pension entitlements. IRAs hold another $5.7 trillion worth of securities. (For those counting, the rest of that $19.4 trillion is in life insurance.)

So, basically of $80.7 trillion in household wealth, only $10.6 trillion, or about 13% is in 401(k)s and IRAs, the key instruments of middle class wealth accumulation. Decades of effort to get Americans to save, and incentives from both government and companies haven’t worked very well. The $4.9 trillion in accumulated savings in 401(k)s are much less than the pensions of government employees, who make up just 14% of U.S. workers.

Add up IRA and 401(k) plans, and the total is still a scant 25% more than government worker pensions alone (and some of those IRAs belong to government employees and retirees). Despite constant exhortations to save, the vast majority of middle-class and even upper middle-class workers don’t. Or at least they don’t in the instruments that they’ve been urged to use.

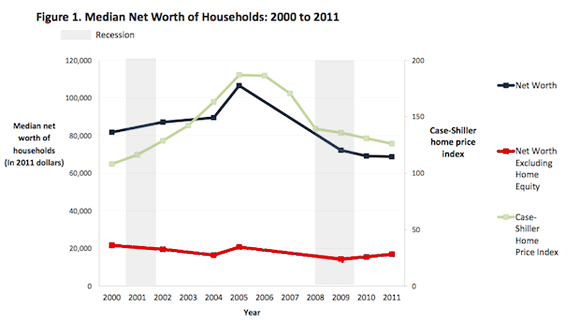

What do most American private-sector workers actually do? Consider the other big component of wealth, that $19.4 trillion in real estate. Except there’s an asterisk here: subtract $9.4 trillion in mortgages, and we’re left with $10 trillion in home equity. That’s about the same as the total in IRAs and 401(k), though that doesn’t quite tell the whole story, because the accumulation of home equity is heavily weighted toward folks in middle-age or older. The very nice chart below, from the Census Bureau’s economists, gives a very good idea of the median family’s overall financial pictures. It dates to 2011, but the overall situation hasn’t changed much.

That chart nicely reflects the gap between what policy makers wish would happen with middle-class savings, and what really does happen. In the ideal world, the upper middle-class would save lots of money, put it in retirement accounts filled mainly with index funds, and see their savings multiply as the overall economy grows.

In real life, (1) private-sector workers save fairly little, and (2) the main way of accumulating wealth is to buy a house. That house is a highly leveraged and potentially very profitable investment in the early years of your mortgage and as the mortgage is paid down becomes less leveraged and less profitable. This is especially if you believe that, in the long run, the value of housing in most places can’t outstrip salaries and inflation.

So the bottom line is that Americans are not accumulating wealth at anything like the rate we would hope, and not accumulating it in a way that lets them share in a stock market boom. And from a very appealing $80 trillion number we get to a fairly disheartening conclusion.

• George Soros blasts ‘parasite’ banks (Telegraph)

George Soros, the billionaire investor, believes the banking sector is a “parasite” holding back the economic recovery and an “incestuous” relationship with regulators means little has been done to resolve the issues behind the 2008 crisis. “The banking sector is acting as a parasite on the real economy,” Mr Soros said in his new book “The Tragedy of the European Union”. “The profitability of the finance industry has been excessive. For a while 35pc of all corporate profits in the United Kingdom and the United States came from the financial sector. That’s absurd.”

Mr Soros outlined how the problems that caused the Eurozone economic crisis remain largely unresolved.“Very little has been done to correct the excess leverage in the European banking system. The equity in the banks relative to their balance sheets is wafer thin, and that makes them very vulnerable. “The issue of “too big to fail” has not been solved at all.”

The proposed solution of a European banking union does not address the underlying problems, Mr Soros adds. “A real danger to the financial system is the incestuous relationship between national authorities and bank managements. France in particular is famous for its inspecteurs de finance, who end up running its major banks. Germany has its Landesbanken and Spain its caixas, which have unhealthy connections with provincial politicians.”

In his new book Mr Soros outlines, in a series of interviews with Dr. Gregor Peter Schmitz, how he believes the European Union is in danger of becoming a thing of the past unless its flawed structure is reformed. The German economy at the regions heart could also be its biggest weakness. “What was successful in Germany before the crisis will not be successful as a prescription for the rest of Europe in the years ahead.

“In German the word Schuld has a double meaning (both “blame” and “debt”). So it is natural (selbstverstandlich) to blame the debtor countries for their own misfortunes, “Germany’s tone, is sometimes self-righteous and even hypocritical…. In 2003 Germany was among the first countries to break the eurozone rules.”

The prospect of Germany leaving the eurozone is very real and it would have serious implications as the euro would depreciate sharply and deutsche mark would go through the roof, Germany would find out how painful it is to have an overvalued currency. Mr Soros, who famously “broke the Bank of England” by betting against the pound during the 1992 sterling crash, talks candidly about his most successful trade. “I have a clean conscience. The big events in which I participated would have occurred sooner or later, whether I speculated on them or not.”

• The Great U-Turn (Robert Reich)

Do you recall a time in America when the income of a single school teacher or baker or salesman or mechanic was enough to buy a home, have two cars, and raise a family? I remember. My father (who just celebrated his 100th birthday) earned enough for the rest of us to live comfortably. We weren’t rich but never felt poor, and our standard of living rose steadily through the 1950s and 1960s.

That used to be the norm. For three decades after World War II, America created the largest middle class the world had ever seen. During those years the earnings of the typical American worker doubled, just as the size of the American economy doubled. (Over the last thirty years, by contrast, the size of the economy doubled again but the earnings of the typical American went nowhere.)

In that earlier period, more than a third of all workers belonged to a trade union — giving average workers the bargaining power necessary to get a large and growing share of the large and growing economic pie. (Now, fewer than 7% of private-sector workers are unionized.) Then, CEO pay then averaged about 20 times the pay of their typical worker (now it’s over 200 times).

In those years, the richest 1% took home 9 to 10% of total income (today the top 1% gets more than 20%). Then, the tax rate on highest-income Americans never fell below 70%; under Dwight Eisenhower, a Republican, it was 91%. (Today the top tax rate is 39.6%.)

In those decades, tax revenues from the wealthy and the growing middle class were used to build the largest infrastructure project in our history, the Interstate Highway system. And to build the world’s largest and best system of free public education, and dramatically expand public higher education. (Since then, our infrastructure has been collapsing from deferred maintenance, our public schools have deteriorated, and higher education has become unaffordable to many.)

We didn’t stop there. We enacted the Civil Rights Act and Voting Rights Act to extend prosperity and participation to African-Americans; Medicare and Medicaid to provide health care to the poor and reduce poverty among America’s seniors; and the Environmental Protection Act to help save our planet.

And we made sure banking was boring. It was a virtuous cycle. As the economy grew, we prospered together. And that broad-based prosperity enabled us to invest in our future, creating more and better jobs and a higher standard of living.

Then came the great U-turn, and for the last thirty years we’ve been heading in the opposite direction. Why? Some blame globalization and the loss of America’s manufacturing core. Others point to new technologies that replaced routine jobs with automated machinery, software, and robotics. But if these were the culprits, they only raise a deeper question: Why didn’t we share the gains from globalization and technological advances more broadly? Why didn’t we invest them in superb schools, higher skills, a world-class infrastructure?

Others blame Ronald Reagan’s worship of the so-called “free market,” supply-side economics, and deregulation. But if these were responsible, why did we cling to these ideas for so long? Why are so many people still clinging to them? Some others believe Americans became greedier and more selfish. But if that’s the explanation, why did our national character change so dramatically?

Perhaps the real problem is we forgot what we once achieved together. The collective erasure of the memory of that prior system of broad-based prosperity is due partly to the failure of my generation to retain and pass on the values on which that system was based. It can also be understood as the greatest propaganda victory radical conservatism ever won.

We must restore our recollection. In seeking to repair what is broken, we don’t have to emulate another nation. We have only to emulate what we once had. That we once achieved broad-based prosperity means we can achieve it again — not exactly the same way, of course, but in a new way fit for the twenty-first century and for future generations of Americans. America’s great U-turn can be reversed. It is worth the fight.

• The Global Stock Market Is At An All-Time High (BI)

The MSCI World Index closed at an all-time-high Thursday, blowing past the pre-recession peak in October 2007 for the first time. This coincided with the S&P 500’s all-time-high, which came on the fifth anniversary of the U.S. bull market.

As American Enterprise Institute’s Mark Perry notes, the MSCI has spiked 17.5% in the past year.

“Bottom Line: The global stock market rally over the last five years to a record high yesterday for the MSCI world index has added back more than $36 trillion to world equity values since 2009, and demonstrates the incredible resiliency of economies and financial markets to recover and prosper, even following the worst financial crisis and global economic slowdown in at least a generation,” Perry concludes.

• EU leaders draw up plans to send gas to Ukraine if Russia cuts off supply (Guardian)

EU leaders are rapidly drawing up plans to send some of their stocks of Russian gas back to Ukraine and other eastern European countries that need it, if Vladimir Putin reacts to western sanctions over the Crimea crisis by starving the continent of energy. Russia’s largest gas producer, Gazprom, said on Friday that Kiev had missed a deadline to pay $440m for gas received in February and threatened to cut off the country’s supply if it did not make the payment. Gazprom provides Ukraine with around half its gas, and other countries in eastern and southern Europe, including Poland and Greece, reportedly have low stocks of gas.

Although Gazprom said the threat to Kiev would not affect the supply to the rest of Europe, western leaders are steeling themselves for a possible battle with Moscow over energy supplies. At least half of the Russian gas that is piped to Europe passes through Ukraine. Gazprom last cut off supplies to Ukraine in early 2009, leading to a slump in the supply of Russian gas to Europe. “Either Ukraine makes good on its debt and pays for current supplies, or there is risk of returning to the situation of early 2009,” Gazprom CEO Alexei Miller said on Friday, adding that Ukraine now owed $1.89 billion in unpaid bills.

The move to consider reversing Russian gas flows comes amid growing pressure in Washington to exploit the huge boom in US gas – extracted through fracking technologies – to begin global exports, providing a counter-weight to Moscow’s influence.

Although it is the largest producer of natural gas, the US does not currently export its supplies, and the construction of a handful of export terminals will not be completed until at least 2015. But Barack Obama’s administration considering moves to accelerate a drive to export its energy, weakening Putin’s leverage in the future.

In Brussels on Thursday, European leaders engaged in detailed discussions about the feasibility of switching the flow of gas in eastern Europe’s pipelines. Storage reserves in Europe, particularly Germany and Hungary, which have ample supplies, could be used to pump gas back towards Ukraine.

José Manuel Barroso, the president of European Commission, said energy security was an early priority for Ukraine, adding: “We are looking in the short term at the gas transmission network to ensure that reverse flows with the European Union are fully operational.”

A project to modernise Ukraine’s gas transmission infrastructure forms part of the EU’s $15 billion promised aid package to Kiev, with an initial loan possible in the near future. A European Commission memorandum specifically states it will seek to enable “reverse flows” of gas to Ukraine, ensuring they can be “operationalised as soon as possible”.

Such a move would likely occur first through Slovakia, and EU officials are pressing Slovakia and Ukraine to quickly sign an agreement that would enable gas to be piped in the opposite direction if the need emerges. Additional “reverse-flow corridors” could be introduced through Bulgaria and Romania, or Croatia and Hungary.

A senior German official briefed on Thursday’s meeting told the Guardian that Berlin was ready to help. “Our gas storage tanks are well filled after a mild winter and we stand ready to assist Ukraine in securing its energy supply including working on reserve flows.”

However, European officials and energy experts concede there are doubts over whether it would be technically possible to transfer sufficient gas through the continent, west to east, if Russia decided to restrict its supplies for a significant period of time. While short-term assistance through the summer months could help, western Europe would not have the capacity to supply neighbours in the east for an extended period of time.

Speaking on the condition of anonymity, one senior executive said reversing gas flows would be an extremely complex move. “This is not easy to do. Certainly the Gazprom export pipeline is built to move gas only in one direction, and it would involve a lot of time and money to reconfigure for imports,” the executive said. “You would also have to get the agreement of dozens of commercial and other organisations. It is not going to happen.”

Europe imported 155 billion cubic metres (bcm) of gas from Russia in 2013, about 30% of its overall gas demand, according to Wood Mackenzie, an Edinburgh-based energy consultancy. Ukraine is the key transit route for Russian gas to Europe, with around 50% piped through the country in 2013.

Gazprom insists exports remain stable, and is desperate to avoid a repeat of the Russia-Ukraine “gas wars” of 2006, 2008 and 2009.

In Washington, there is a growing appetite to retaliate against Russia with a long-term, strategic acceleration in energy exports. Exporting US gas obtained through fracking would be controversial among environmentalists, Democrats, and US industries reliant on cheap energy, the price of which would be expected to rise if supplies were being piped abroad.

Republicans, backed by gas producers such as ExxonMobil, have for years been pushing to dramatically increase gas production to enable export trade, and are using the crisis in Crimea to argue for swift action by the Obama administration.

US gas production is projected to rise 44% by 2040, according to the US Energy Information Administration, and producers have been pressing the Obama administration to expand exports of natural gas.

The Republican leader of the House, John Boehner, used an an op-ed in the Wall Street Journal on Friday to call on Obama to “dramatically expand production of American-made energy” and make US supplies of natural gas available to global markets.

The Department of Energy has approved six applications to export domestically approved applications for terminals to export liquefied gas; five are in Texas and Louisiana, and one in Maryland. A further 24 applications are pending and Boehner and other top Republicans are calling on the administration to expedite their approval. “The ability to turn the tables and put the Russian leader in check lies right beneath our feet, in the form of vast supplies of natural energy,” Boehner said.

The Obama administration appears receptive to moving to undercut Moscow’s hold over the energy sector. White House press secretary Jay Carney said this week that while the Department of Energy is approving terminal requests on a case-by-case basis, the US would look for ways to wean Ukraine from its “dependence on Russian gas”.

A senior US official said the State Department was supportive of introducing substantial gas exports abroad as a move to counteract Russia’s influence. Carlos Pascual, a former American ambassador to Ukraine, who leads the State Department’s Bureau of Energy Resources, told the New York Times that opening global markets to US exports “sends a clear signal that the global gas market is changing, that there is the prospect of much greater supply coming from other parts of the world”.

• EU Gas Flows To Ukraine Too Small To Cope With Russian Disruption (Reuters)

Directing natural gas from the European Union to Ukraine if Russia stops supplying its western neighbour would fail to keep up with demand for long as capacity between the EU and Ukraine is too small, analysts said on Thursday. Ukraine last year imported around 28 billion cubic metres (bcm) of natural gas from Russia, which wants to maintain its influence over the former Soviet republic and fend off EU efforts to limit Moscow’s sway.

Disputes between Russia and Ukraine, which consumes more than 50 bcm of gas a year, have previously led to supply cuts for the EU, including in 2009 when hundreds of thousands of homes in southeast Europe went without heat in winter.

So far, Russia’s state-controlled Gazprom, which supplies around 30% of the EU’s gas needs and sends a third of that gas through Ukraine, has maintained supplies to Ukraine during a crisis in which Russian forces have effectively seized Ukraine’s Crimea region. But to prepare for a possible cut-off, the European Union has plans to send gas from its own storage facilities to Ukraine.

“The country (Ukraine) has sufficient gas storage to hold it through a few months, and could also turn to neighbours for additional gas supplies via reverse flows on pipelines that could bring up to 10 bcm (per year) of gas from Germany and Hungary through Poland and Slovakia,” political risk consultancy Eurasia Group said in a report this week.

Many other analysts say the available capacity to pump gas from the EU to Ukraine is well below 10 bcm, and Eurasia Group also warned that Ukraine would be likely to receive less. “If gas supplies to Europe are already compromised by an ongoing conflict, Ukraine may find its neighbours increasingly unwilling to provide this stopgap supply,” it added.

One of the EU’s key plans to support Kiev in case of a supply cut by Russia is to use reverse flows to send gas to Ukraine, but at the moment the capacity to do so is limited. Ukraine began importing gas through reverse flows from Poland and Hungary in 2012 but analysts said the amounts so far have been equivalent to a mere 2 bcm a year. According to consulting group Wood Mackenzie, Poland has a reverse capacity of 1.5 bcm to Ukraine while Hungary is able to send 3.5 bcm. Romania has the potential for 1.8 bcm but there has been no firm agreement on its use, the consultancy said.

The biggest opportunity would be pumping gas through Slovakia, the EU gateway for Ukrainian supplies, which has more than 20 bcm of reverse capability. The problem is that such flows from Europe to Ukraine, which would largely send Russian imports into the EU back east, require contractual agreements between the governments of countries through which the gas passes.

While there have been talks, no deal has been finalised, although sources at the European Commission said it was working to get the reverse-flow arrangement finalised quickly. Despite these efforts, one source said it would take another six months for gas to flow from Slovakia to Ukraine, too late to address any imminent disruptions, and the link could initially carry only 6 bcm per year.

The real issue, however, might not be Ukraine but Europe itself. Wood Mackenzie estimated Europe would need more than 160 bcm of Russian gas in 2014. While Russia has enough gas and can reroute some flows from Ukraine to the Yamal Europe and Nord Stream pipelines, which supply Germany, the consultancy said these alternatives would still leave Europe needing more than 30 bcm of gas via Ukraine.

“Moscow does not shy away from sanctions against Ukraine, it has made this clear in the last few days,” German consultancy Ispex said. “The question is what will happen to the transit gas destined for western Europe should Moscow stop deliveries to Ukraine.”

• Ukraine Crisis Is About Great Power Oil, Gas Pipeline Rivalry (Guardian)

Russia’s armed intervention in the Crimea undoubtedly illustrates President Putin’s ruthless determination to get his way in Ukraine. But less attention has been paid to the role of the United States in interfering in Ukrainian politics and civil society. Both powers are motivated by the desire to ensure that a geostrategically pivotal country with respect to control of critical energy pipeline routes remains in their own sphere of influence.

Much has been made of the reported leak of the recording of an alleged private telephone conversation between US assistant secretary of state Victoria Nuland and US ambassador to Kiev Geoffrey Pyatt. While the focus has been on Nuland’s rude language, which has already elicited US apologies, the more important context of this language concerns the US role in liaising with Ukrainian opposition parties with a view, it seems, to manipulate the orientation of the Ukrainian government in accordance with US interests.

Rather than leaving the future of Ukrainian politics “up to the Ukrainian people” as claimed in official announcements, the conversation suggests active US government interference to favour certain opposition leaders:

Nuland: Good. I don’t think [opposition leader] Klitsch should go into the government. I don’t think it’s necessary, I don’t think it’s a good idea.

Pyatt: Yeah. I guess… in terms of him not going into the government, just let him stay out and do his political homework and stuff. I’m just thinking in terms of sort of the process moving ahead we want to keep the moderate democrats together. The problem is going to be Tyahnybok [Oleh Tyahnybok, the other opposition leader] and his guys and I’m sure that’s part of what [President Viktor] Yanukovych is calculating on all this.

Nuland: [Breaks in] I think Yats is the guy who’s got the economic experience, the governing experience. He’s the… what he needs is Klitsch and Tyahnybok on the outside. He needs to be talking to them four times a week, you know. I just think Klitsch going in… he’s going to be at that level working for Yatseniuk, it’s just not going to work.

[…]

Nuland: OK. He’s [Jeff Feltman, United Nations Under-Secretary-General for Political Affairs] now gotten both [UN official Robert] Serry and [UN Secretary General] Ban Ki-moon to agree that Serry could come in Monday or Tuesday. So that would be great, I think, to help glue this thing and to have the UN help glue it and, you know, Fuck the EU.

Pyatt: No, exactly. And I think we’ve got to do something to make it stick together because you can be pretty sure that if it does start to gain altitude, that the Russians will be working behind the scenes to try to torpedo it.

As BBC diplomatic correspondent Jonathan Marcus rightly observes, the alleged conversation:

“… suggests that the US has very clear ideas about what the outcome should be and is striving to achieve these goals… Washington clearly has its own game-plan…. [with] various officials attempting to marshal the Ukrainian opposition [and] efforts to get the UN to play an active role in bolstering a deal.”

But US efforts to turn the political tide in Ukraine away from Russian influence began much earlier. In 2004, the Bush administration had given $65 million to provide ‘democracy training’ to opposition leaders and political activists aligned with them, including paying to bring opposition leader Viktor Yushchenko to meet US leaders and help underwrite exit polls indicating he won disputed elections.

This programme has accelerated under Obama. In a speech at the National Press Club in Washington DC last December as Ukraine’s Maidan Square clashes escalated, Nuland confirmed that the US had invested in total “over $5 billion” to “ensure a secure and prosperous and democratic Ukraine” – she specifically congratulated the “Euromaidan” movement.

So it would be naive to assume that this magnitude of US support to organisations politically aligned with the Ukrainian opposition played no role in fostering the pro-Euro-Atlantic movement that has ultimately culminated in Russian-backed President Yanukovych’s departure.

Indeed, at her 2013 speech, Nuland added:

“Today, there are senior officials in the Ukrainian government, in the business community, as well as in the opposition, civil society, and religious community, who believe in this democratic and European future for their country. And they’ve been working hard to move their country and their president in the right direction.”

What direction might that be? A glimpse of an answer was provided over a decade ago by Professor R. Craig Nation, Director of Russian and Eurasian Studies at the US Army War College’s Strategic Studies Institute, in a NATO publication:

“Ukraine is increasingly perceived to be critically situated in the emerging battle to dominate energy transport corridors linking the oil and natural gas reserves of the Caspian basin to European markets… Considerable competition has already emerged over the construction of pipelines. Whether Ukraine will provide alternative routes helping to diversify access, as the West would prefer, or ‘find itself forced to play the role of a Russian subsidiary,’ remains to be seen.”

A more recent US State Department-sponsored report notes that “Ukraine’s strategic location between the main energy producers (Russia and the Caspian Sea area) and consumers in the Eurasian region, its large transit network, and its available underground gas storage capacities”, make the country “a potentially crucial player in European energy transit” – a position that will “grow as Western European demands for Russian and Caspian gas and oil continue to increase.”

Ukraine’s overwhelming dependence on Russian energy imports, however, has had “negative implications for US strategy in the region,” in particular the strategy of:

“… supporting multiple pipeline routes on the East–West axis as a way of helping promote a more pluralistic system in the region as an alternative to continued Russian hegemony.”

But Russia’s Gazprom, controlling almost a fifth of the world’s gas reserves, supplies more than half of Ukraine’s, and about 30% of Europe’s gas annually. Just one month before Nuland’s speech at the National Press Club, Ukraine signed a $10 billion shale gas deal with US energy giant Chevron “that the ex-Soviet nation hopes could end its energy dependence on Russia by 2020.” The agreement would allow “Chevron to explore the Olesky deposit in western Ukraine that Kiev estimates can hold 2.98 trillion cubic meters of gas.” Similar deals had been struck already with Shell and ExxonMobil.

The move coincided with Ukraine’s efforts to “cement closer relations with the European Union at Russia’s expense”, through a prospective trade deal that would be a step closer to Ukraine’s ambitions to achieve EU integration. But Yanukovych’s decision to abandon the EU agreement in favour of Putin’s sudden offer of a 30% cheaper gas bill and a $15 billion aid package provoked the protests.

To be sure, the violent rioting was triggered by frustration with Yanukovych’s rejection of the EU deal, along with rocketing energy, food and other consumer bills, linked to Ukraine’s domestic gas woes and abject dependence on Russia. Police brutality to suppress what began as peaceful demonstrations was the last straw.

But while Russia’s imperial aggression is clearly a central factor, the US effort to rollback Russia’s sphere of influence in Ukraine by other means in pursuit of its own geopolitical and strategic interests raises awkward questions. As the pipeline map demonstrates, US oil and gas majors like Chevron and Exxon are increasingly encroaching on Gazprom’s regional monopoly, undermining Russia’s energy hegemony over Europe.

Ukraine is caught hapless in the midst of this accelerating struggle to dominate Eurasia’s energy corridors in the last decades of the age of fossil fuels.

For those who are pondering whether we face the prospect of a New Cold War, a better question might be – did the Cold War ever really end?

• Boehner’s plan to save Ukraine: It’s full of gas (WaPo)

John Boehner thinks the United States can help Ukraine by approving more gas export terminals. Is he right?

“The ability to turn the tables and put the Russian leader in check lies right beneath our feet, in the form of vast supplies of natural energy,” Boehner says in an article in Friday’s Wall Street Journal.

If only it were that simple. No infrastructure limitations. No worries about the price signals that motivate private companies more concerned with profits than with politics. New exports of natural gas – whether from the United States, or Qatar or Australia – would increase competition and put Russia is a weaker bargaining position. Long gone is talk that used to take place among gas producers of forming a “GOPEC” – an organization of gas exporting countries. But Russia remains the world’s largest gas exporter, and one of the world’s lowest cost producers with easy access to the European market, and it will undoubtedly remain a key player.

“Can you imagine situations where U.S. gas could be a useful buffer? Yes. Is this the killer app? Absolutely not,” says Michael Levi, an energy expert at the Council on Foreign Relations. “And is this something the US can wield as a weapon? No. But it can be useful at the margins.”

• Why Crimea Is So Valuable To Russia (Guardian)

On Thursday, Crimean ministers held a vote in their regional parliament to join the Russian Federation and secede from Ukraine, and to organize a referendum on the issue for 16 March. The move comes as international tensions continue to mount over the presence of Russian troops in the peninsula, which reportedly now number 30,000.

Ukraine’s interim prime minister warned the Crimean parliament that “no one in the civilized world” would recognize its referendum, calling the vote “unconstitutional” and “illegitimate”. But the referendum has the support of the Russian parliament, with the speaker of the upper house saying that Russia would “unquestionably back” the referendum’s choice. The EU and US are mulling sanctions – so far targeting a small number of individuals with visa bans and asset freezes. This comes as a team of OSCE observers has been prevented for a second day from entering Crimea by unidentified armed men.

Why does Russia have a naval base in Crimea?

• Geographic limitations and ambitions: Russia’s capacity to reach the sea is limited by geography, so ports in the north and south seas, leading to larger waters, are crucial.

As the map below illustrates, Sevastopol is a strategically important base for Russia’s naval fleet, in addition to being Russia’s only warm water base. After the dissolution of the Soviet Union, a 1997 treaty with Ukraine allowed Russia to keep its Black Sea Fleet pretty much intact (with 15,000 personnel currently stationed) and lease the base at Sevastopol (extended to expire in 2042).

As Orlando Figes, author of Crimea: The Last Crusade, wrote last week: “Crimea was bound to be the focus of the Russian backlash against the Ukrainian revolution. … For more than 20 years, ever since the collapse of the Soviet Union, its rule by Kiev has been a major source of Russian resentment – inside and outside Crimea – and a major thorn in Ukraine’s relations with Russia.”

The Treaty of Friendship and Co-operation – by which Russia rents its naval base at Sevastopol from the Ukrainian government – is so far-reaching in the rights it gives the Russians to exercise their military powers that it is seen by many in Ukraine to undermine the country’s independence. In 2008 the Ukrainians said they would not renew the lease when it expired in 2017. But they buckled under the pressure of a gas-price hike and, in 2010, extended the Russian navy’s lease until 2042.

• Projecting power: Sevastopol has been an important hub to project Russia’s naval power on a global platform. The Black Sea Fleet has seen a flurry of activity since 2008: during the war with Georgia that year, the fleet staged blockades in the Black Sea. The Russian navy was actively engaged with Vietnam, Syria and Venezuela (and up until March 2011, Libya) “for logistics and repair services in their principal ports”. It has also been alleged that Sevastopol has served as the main source in supplying the Assad regime during Syria’s civil war and proved useful with Russia’s role in dismantling Syria’s chemical weapons last year. After Syria’s civil war forced Russia to stop using its naval base in the Syrian port of Tartus last year, Sevastopol became even more crucial.

A brief history of Crimea and Crimean Tatars

• Before Tsarist subsumption: For five hundred years – roughly the middle ages in Europe – Turkic and Tatar tribes traded rule of Crimea. The peninsula spent a few hundred years as a Muslim Khanate and then an Ottoman vassal state, until Russia annexed it in 1783, under Catherine the Great, who thought the region symbolized Russia’s links to antiquity. (She proceeded to parcel out land to aristocrats and build classical-style palaces and gardens.)

By 1900, the Crimean Tatars, once the majority, had been halved by wars and campaigns of Russification. Their population was halved again in 1917, and shortly after that, Stalin forcibly deported most of the remaining Tatars to central Asia. Unsurprisingly, Tatars have largely held fiercely anti-Russian sentiments for a very long time. Since the collapse of the Soviet Union, Tatars have been returning, and though they number upwards of 200,000, they’re still a minority.

• Crimean War: With its Black Sea fleet based in Sevastopol, Tsar Nicholas I knocked the Ottoman Empire out of the region – a hugely symbolic feat considering Russia’s tricky relationship with its Muslim population and its centuries in need of a fleet.

But Nicholas’ overconfidence in Crimea in part led to the Crimean war with Britain and France, whose leaders sought to stop Russia’s expanding borders and to slow its influence in the Middle East. The allies won the war, bestowing British culture with the Charge of the Light Brigade, Florence Nightingale and Timothy the Tortoise. The Russians lost, but Tolstoy’s Sevastopol Sketches made sure that the 11-month siege of Sevastopol stuck in the national memory. (Between Sevastopol in 1854 and Leningrad in the second world war, the notorious Russian “siege mentality” may begin to make sense.)

• Khrushchev to Yeltsin: Crimea was given to Ukraine by premier Nikita Khrushchev (himself born at the border with Ukraine) to mark the 300th anniversary of Ukraine’s inclusion in the Russian Empire, a “donation” many in Russia still see as illegitimate. Surprisingly, Boris Yeltsin, the first president of post-Soviet Russia, didn’t propose an acquisition of Crimea during negotiations to dissolve the Soviet Republics.

Peter the Great gets his own section

• Let’s build some boats: Peter the Great changed the course of history in countless ways, and was an extremely strange man and very serious about boats. (He supposedly said “A great leader who has an army has one hand, but he who has a navy has two.” As a child, he would order around the children of other noblemen as “regiments” pretending to prepare for war. As an adult, he built a small boat by hand and used it to sail across the Neva, the river that runs through St Petersburg.) After a long trip in his youth to western Europe, in particular Amsterdam, where he studied shipbuilding, he returned to Moscow obsessed with dragging Russia into modernity – and making it a rival of the nations he saw in Europe.

Peter saw Russia’s limited access to the ocean as one of its greatest weaknesses, and though it meant tens of thousands of dead serfs to build a city on a unforgiving swamp, he had St Petersburg built on the Gulf of Finland for this very reason: he would reach the sea at every opportunity. With his new northern capital giving access to the Baltic, Peter countered the power of his arch-rival, King Charles XII of Sweden. (To give you an idea of how deep-seated the contest over Ukraine is, Peter defeated Charles’ attempt to conquer Ukraine at the 1709 battle of Poltava.) To the south, Peter fought wars against the Tatars (who else) to gain access to the Black Sea, and built Russia’s first naval base in Taganrog in 1698.

• Ukraine Plans to Cut Russian Gas Imports, Raise EU Supply (Bloomberg)

Ukraine, the subject of a struggle for influence between Russia and the West, plans to cut natural-gas imports from its eastern neighbor and fill the gap with supplies from Europe to reduce dependence on Gazprom. Ukraine will need to import about 30 billion cubic meters of gas this year, of which a third may come through Slovakian pipelines, Energy Minister Yuri Prodan said today in Kiev.

Prodan’s remarks follow a decision by Moscow-based Gazprom, which accounts for most of Ukraine’s gas imports, not to extend a price discount beyond April, citing unpaid debts for supply. Tensions between Russia and Europe and the U.S. have escalated since President Vladimir Putin sent troops into Crimea in a bid to regain influence over Ukraine following the overthrow of Kremlin-backed President Viktor Yanukovych last month.

Ukraine has reached a preliminary agreement with Slovakia to import 10 billion cubic meters of gas a year from various European Union countries through Slovakian pipelines, Prodan told reporters. It also has signed a deal with German utility RWE AG for 5 billion cubic meters a year, he said, without giving a start date for supply. RWE Chief Financial Officer Bernhard Guenther said this week that the Essen-based utility may be able to supply Ukraine in the event of a shortage. Michael Murphy, a company spokesman, declined to comment further when contacted by phone today.

Prodan will travel to Brussels for energy talks with EU officials on March 19. “It hasn’t been possible to import gas via Slovakia in the past,” he said today. “Hopefully there will be companies with which we’ll try to agree” on supplies, in addition to imports from Slovakia and Germany, he said.

The EU will help Ukraine diversify its imports and provide funding to upgrade its pipelines, the bloc’s regulatory arm said today in a statement. The European Commission also backs the use of “reverse-flow corridors” via Bulgaria, Romania and Croatia, whereby pipes that send gas west switch direction, or some fuel earmarked for those countries is sent directly to Ukraine. Ukraine imported almost 28 billion cubic meters of gas last year, of which more than 90% came from Gazprom. Russia has said it’s considering lending $2 billion to $3 billion to its neighbor to pay off debts of about $2 billion to the state-controlled producer.

Securing more gas from elsewhere will depend on price, according to Energy Strategies Fund Co-Chairman Dmytro Marunich, who said “only a mad person” would get all its fuel from Gazprom if it can be bought more cheaply from Europe. Gazprom would oppose any Ukrainian move to increase imports from the EU by proposing discounts and using political pressure, he said. Ukraine received gas from Poland and Hungary in 2013. Russia last year agreed to cut the price it charges Ukraine by about a third to $268.50 for every 1,000 cubic meters.

• Global Riot Epidemic Due To Demise Of Cheap Fossil Fuels (Feb 28)

If anyone had hoped that the Arab Spring and Occupy protests a few years back were one-off episodes that would soon give way to more stability, they have another thing coming. The hope was that ongoing economic recovery would return to pre-crash levels of growth, alleviating the grievances fueling the fires of civil unrest, stoked by years of recession.

But this hasn’t happened. And it won’t. Instead the post-2008 crash era, including 2013 and early 2014, has seen a persistence and proliferation of civil unrest on a scale that has never been seen before in human history. This month alone has seen riots kick-off in Venezuela, Bosnia, Ukraine, Iceland, and Thailand.

This is not a coincidence. The riots are of course rooted in common, regressive economic forces playing out across every continent of the planet – but those forces themselves are symptomatic of a deeper, protracted process of global system failure as we transition from the old industrial era of dirty fossil fuels, towards something else.

Even before the Arab Spring erupted in Tunisia in December 2010, analysts at the New England Complex Systems Institute warned of the danger of civil unrest due to escalating food prices. If the Food & Agricultural Organisation (FAO) food price index rises above 210, they warned, it could trigger riots across large areas of the world. The pattern is clear. Food price spikes in 2008 coincided with the eruption of social unrest in Tunisia, Egypt, Yemen, Somalia, Cameroon, Mozambique, Sudan, Haiti, and India, among others.

In 2011, the price spikes preceded social unrest across the Middle East and North Africa – Egypt, Syria, Iraq, Oman, Saudi Arabia, Bahrain, Libya, Uganda, Mauritania, Algeria, and so on. Last year saw food prices reach their third highest year on record, corresponding to the latest outbreaks of street violence and protests in Argentina, Brazil, Bangladesh, China, Kyrgyzstan, Turkey and elsewhere. Since about a decade ago, the FAO food price index has more than doubled from 91.1 in 2000 to an average of 209.8 in 2013. As Prof Yaneer Bar-Yam, founding president of the Complex Systems Institute, told Vice magazine last week:

“Our analysis says that 210 on the FAO index is the boiling point and we have been hovering there for the past 18 months… In some of the cases the link is more explicit, in others, given that we are at the boiling point, anything will trigger unrest.”

But Bar-Yam’s analysis of the causes of the global food crisis don’t go deep enough – he focuses on the impact of farmland being used for biofuels, and excessive financial speculation on food commodities. But these factors barely scratch the surface. The recent cases illustrate not just an explicit link between civil unrest and an increasingly volatile global food system, but also the root of this problem in the increasing unsustainability of our chronic civilisational addiction to fossil fuels.

In Ukraine, previous food price shocks have impacted negatively on the country’s grain exports, contributing to intensifying urban poverty in particular. Accelerating levels of domestic inflation are underestimated in official statistics – Ukrainians spend on average as much as 75% on household bills, and more than half their incomes on necessities such as food and non-alcoholic drinks, and as75% on household bills. Similarly, for most of last year, Venezuela suffered from ongoing food shortages driven by policy mismanagement along with 17 year record-high inflation due mostly to rising food prices.

While dependence on increasingly expensive food imports plays a role here, at the heart of both countries is a deepening energy crisis. Ukraine is a net energy importer, having peaked in oil and gas production way back in 1976. Despite excitement about domestic shale potential, Ukraine’s oil production has declined by over 60% over the last twenty years driven by both geological challenges and dearth of investment.

Currently, about 80% of Ukraine’s oil, and 80% of its gas, is imported from Russia. But over half of Ukraine’s energy consumption is sustained by gas. Russian natural gas prices have nearly quadrupled since 2004. The rocketing energy prices underpin the inflation that is driving excruciating poverty rates for average Ukranians, exacerbating social, ethnic, political and class divisions.

The Ukrainian government’s recent decision to dramatically slash Russian gas imports will likely worsen this as alternative cheaper energy sources are in short supply. Hopes that domestic energy sources might save the day are slim – apart from the fact that shale cannot solve the prospect of expensive liquid fuels, nuclear will not help either. A leaked European Bank for Reconstruction and Development (EBRD) report reveals that proposals to loan €300 million to renovate Ukraine’s ageing infrastructure of 15 state-owned nuclear reactors will gradually double already debilitating electricity prices by 2020.

In Venezuela, the story is familiar. Previously, the Oil and Gas Journal reported the country’s oil reserves were 99.4 billion barrels. As of 2011, this was revised upwards to a mammoth 211 billion barrels of proven oil reserves, and more recently by the US Geological Survey to a whopping 513 billion barrels. The massive boost came from the discovery of reserves of extra heavy oil in the Orinoco belt.

The huge associated costs of production and refining this heavy oil compared to cheaper conventional oil, however, mean the new finds have contributed little to Venezuela’s escalating energy and economic challenges. Venezuela’s oil production peaked around 1999, and has declined by a quarter since then. Its gas production peaked around 2001, and has declined by about a third.

Simultaneously, as domestic oil consumption has steadily increased – in fact almost doubling since 1990 – this has eaten further into declining production, resulting in net oil exports plummeting by nearly half since 1996. As oil represents 95% of export earnings and about half of budget revenues, this decline has massively reduced the scope to sustain government social programmes, including critical subsidies.

Looming pandemic?These local conditions are being exacerbated by global structural realities. Record high global food prices impinge on these local conditions and push them over the edge. But the food price hikes, in turn, are symptomatic of a range of overlapping problems. Global agriculture’s excessive dependence on fossil fuel inputs means food prices are invariably linked to oil price spikes. Naturally, biofuels and food commodity speculation pushes prices up even further – elite financiers alone benefit from this while working people from middle to lower classes bear the brunt.