Russell Lee Bike rack in Idaho Falls, Idaho Aug 1942

The narrative continues: “The U.S economic underlying momentum is really very good,” Williams said.

• Low Inflation No Bar To Rate Rise, Fed Officials Say (Reuters)

The Federal Reserve is still on track for a potential mid-year interest-rate increase, a top Fed official said on Friday, citing strong U.S. economic momentum and a falling unemployment rate. “There is no need to rush to raise rates; at the same time we want to make sure that we appropriately act in a way that we don’t get behind the curve,” San Francisco Federal Reserve Bank President John Williams told reporters at the bank’s headquarters. “If the forecast evolves the way I expect, six months from now or whatever – middle of this year – I think we’ll have a better position to understand either well we need to wait longer, or maybe it’s we could act now.”

Fed officials are grappling with when to gradually wean the U.S. economy from more than six years of near-zero interest rates, now that unemployment has fallen and economic growth looks solidly above its long-term trend. But inflation has been undershooting the Fed’s 2% target, and some gauges suggest the inflation outlook is falling. That has prompted a few Fed officials to argue the Fed should defer any rate hikes until next year. “At some point you just have to give in to the data,” and respond to too-low inflation with stimulus, not tightening, Minneapolis Fed President Narayana Kocherlakota said on Friday. St. Louis Fed President James Bullard took the opposite view in a separate appearance in Chicago, saying while inflation is low, it is not low enough to justify keeping borrowing costs at zero.

Williams, who unlike Bullard and Kocherlakota votes this year on Fed policy and whose views are seen as centrist, acknowledged that dropping inflation expectations are a “negative signal,” but only about global growth prospects. Low yields on U.S. Treasuries, often tied to expectations for slowing future domestic growth, are “not about the U.S. economy and the Federal Reserve” but mostly reflect weakness in Europe and elsewhere, he said. “I don’t agree that it is sending a negative signal about the U.S. economy,” he said, forecasting GDP growth of 2.5% to 3% this year. While he does not expect inflation to be back up to 2% by the time the Fed raises rates, the inflation-subduing effects of falling oil prices should subside in six to 12 months, and it should begin to turn up as labor market slack declines further. “The U.S economic underlying momentum is really very good,” Williams said.

Regulators should stay out and let markets discover prices.

• Swiss Turmoil Hints at Future Lehman Moments (Bloomberg)

For three years, the Swiss National Bank successfully sat on its currency, selling the franc whenever it threatened to appreciate too much for the comfort of Swiss exporters. Yesterday, it tore up that policy, inciting the equivalent of a riot in the currency market and trashing retail brokerages from New York to New Zealand. While victims of the turmoil ponder whether Swiss policy makers are irresponsible or just incompetent, the scale of the damage is a timely reminder that contagion is always unpredictable, that markets always overshoot, and that traders, when they smell profit, can outgun central banks. Currency analysts all seem to assume that the Swiss central bank, after abandoning its €1.20 euro, expected its currency to settle at about €1.10 or even €1.15. Instead, the franc is trading at parity with the euro – a stunning blow for exporters. If the central bank thought that simultaneously cutting its deposit rate to -0.75% would deter franc purchasers – SNB President Thomas Jordan called negative rates “a very strong instrument” – it was badly mistaken.

Jordan also said markets “tend to strongly overreact” to surprises, and that the situation would “correct itself over time.” Maybe. But as of today, abandoning the cap rather than, say, adjusting the level seems to have been a wild miscalculation. And it contains a lesson for both U.S. and European policy makers. By the third quarter of this year, the Federal Reserve’s 0.25% interest rate is expected to at least double, according to economists surveyed by Bloomberg News. The Fed already has an idea of what the market impact will be: The so-called taper tantrum in May 2013, when then Fed Chairman Ben Bernanke first suggested the U.S. bond-purchase program would be scaled back, saw the yield on the 10-year Treasury jump half a percentage point in four weeks to end the month at 2.13%.

There’s a risk, though, that this time, having flagged the prospect of a change so far in advance, policy makers will be complacent about the probable market reaction. That’s what happened in 2008 when Lehman Brothers went bust. Treasury officials convinced themselves that the financial crisis had been rumbling on long enough for participants to have shielded themselves against the collapse of a big firm; instead, their earlier decision to contribute $29 billion to JPMorgan’s rescue of Bear Stearns had created a false sense of security about how far the government would go to support the financial system.

“You have to believe a lot of what went on yesterday and somewhat today has been short covering. There is still a whole bunch of reckoning to still go on.”

• Here’s Why Losses Triggered by Franc-Cap Removal Were So Painful (Bloomberg)

It’s easy to see why the Swiss National Bank’s surprise decision to abandon the cap on the franc versus the euro wreaked havoc on currency markets. You just have to look at data from the U.S.’s largest derivatives exchange. Speculators using futures to wager the franc would weaken versus the dollar had more than $3 billion worth of such bets as of Jan. 13, according to Bloomberg calculations based on Commodity Futures Trading Commission data. The SNB’s decision two days later to drop the cap sparked a rush for the exit as the franc surged 21% versus the greenback. “This move was so large that it would have gone through anybody’s reasonable stop level,” Robert Sinche, a strategist at Amherst Pierpont Securities LLC in Stamford, Connecticut, said by phone. “You have to believe a lot of what went on yesterday and somewhat today has been short covering. There is still a whole bunch of reckoning to still go on.”

Short covering is when traders try to buy back a security whose price is climbing after they sold it short, wagering the price would fall. Non-commercial accounts held a net short position on the franc versus the dollar of 26,444 contracts just before the SNB decision, the most since May 2013, according to CFTC data based on transactions on the CME exchange. With a contract valued at 125,000 Swiss francs ($122,537) on Jan. 13, the value of the position was $3.24 billion. The Swiss currency climbed more than 15% on Jan. 15 against all of the more-than 150 currencies tracked by Bloomberg. Dealers in London at banks including Deutsche Bank, UBS and Goldman Sachs battled to process orders after the SNB made its announcement in Zurich scrapping the three-year-old cap designed to stem the Swiss franc’s appreciation against the euro.

And Draghi’s.

• The Swiss Just Made Japan’s Job Harder (Bloomberg)

Haruhiko Kuroda’s monetary “bazooka” just got outgunned by the Swiss. Since April 2013, Japan’s central banker has been pumping trillions of dollars into the economy in an attempt to generate 2% inflation. But in a mature, aging economy like Japan’s, the effort is 95% about confidence. In order to “drastically convert the deflationary mindset,” as Kuroda puts it, the Bank of Japan must transform sentiment among households and businesses. Kuroda’s massive bond purchases mean little if the Japanese don’t trust that better days lay ahead. The Swiss National Bank’s move to abandon the franc’s cap against the euro may have blown a hole in Kuroda’s strategy.

By reneging on a promise made time and time again that he wouldn’t ditch the policy, SNB President Thomas Jordan “has undermined the credibility of central banks,” says Simon Grose-Hodge of LGT. Now, at central banks around the globe, he adds, “the unthinkable is entirely possible. You can’t rule anything out.” Even if the BOJ issues another blast of quantitative-easing after its two-day policy meeting next week, the question is how effective the move would be. Kuroda’s Oct. 31 shock-and-awe stimulus announcement worked for a time by bolstering perceptions that steady inflation was within reach. But this time, with even Economy Minister Akira Amari admitting “it will probably be difficult” for the BOJ to succeed, markets are likely to be more skeptical of the bank’s staying power.

Even aside from the Swiss decision, Kuroda has had trouble with signaling – what bankers call “open-mouth operations.” Understanding how minutely markets scrutinize their every word and deed, officials in Washington and Frankfurt have learned to use that obsessive attention to their advantage. In an April 2013 study, Federal Reserve Bank of San Francisco economists Michael Bauer and Glenn Rudebusch found “signaling effects are larger in magnitude and statistical significance” than investors appreciate. Former Fed Chairman Ben Bernanke’s skillful use of verbal winks, nods and innuendo to lead expectations helps explain why QE worked better in the U.S. than Japan.

This is just bizarre. Investors should always be left guessing, by default.

• SNB Officials Eating Words Risk Lasting Investor Aches (Bloomberg)

Switzerland’s central bank officials have just eaten their words, risking lingering indigestion in financial markets. Just three days after Swiss National Bank (SNBN) Vice President Jean-Pierre Danthine called the franc cap a “pillar” of monetary policy, the SNB yesterday dropped the minimum exchange rate of 1.20 per euro. The shock abandonment of the SNB’s primary policy of the past three years may now leave investors warier of taking officials’ words at face value, according to economists including Karsten Junius, chief economist at Bank J. Safra Sarasin. By scrapping one tool, the franc cap, SNB President Thomas Jordan risks blunting the effects of another. “The SNB’s credibility has suffered a bit,” said Junius, a former economist at the International Monetary Fund.

“Statements will get read in the future with a bit more caution. Verbal interventions will hardly work any more.” The central bank’s regular pledge to defend the franc cap with “utmost determination” had become part of the institution’s brand, not least because of the success of that policy in protecting the country’s domestic economy. “They’ve lost part of their credibility, I think, ”Han De Jong, chief economist at ABN Amro told Angie Lau on Bloomberg TV. “Whatever they will say, markets will not trust them very much.” George Buckley at Deutsche also argues the SNB’s words are hard to reconcile with the SNB’s new policy stance. “Their commentary now means nothing,” he said. “This is not utmost determination, is it?”

Bank of England Governor Mark Carney has suffered similar criticism. He was labeled an “unreliable boyfriend” by one U.K. lawmaker last year for giving conflicting messages on the possible timing of interest-rate increases in the U.K. SNB President Jordan yesterday defended his surprise move, saying that a tool like the cap would always need to be abandoned unexpectedly. Anatoli Annenkov at SocGen agrees. “It’s something we aren’t used to anymore because most central banks are talking about warning markets, improving communication, not surprising anymore,” Annenkov said by phone from London. “But in such circumstances, there’s basically no other way to do this. Markets would have speculated, positioned themselves beforehand.”

“The transaction allows FXCM, the largest U.S. retail foreign-exchange broker, to “continue normal operations ..” But why would anyone want that?

• FXCM, Brokerage Hit by Swiss Shock, Gets $300 Million From Leucadia (Bloomberg)

Leucadia gave FXCM a $300 million cash infusion, extending a lifeline to the currency brokerage hobbled by the Swiss central bank’s decision to let the franc trade freely against the euro. Leucadia, which owns New York-based investment bank Jefferies Group, extended FXCM a two-year, $300 million senior secured term loan with an initial coupon of 10%, according to a statement Friday. The transaction allows FXCM, the largest U.S. retail foreign-exchange broker, to “continue normal operations,” according to the statement. Shares of New York-based FXCM had tumbled as much as 92% to 98 cents Friday morning before they were halted. After the Leucadia deal was released, FXCM’s stock rebounded to $4.44 as of 5:40 p.m. New York time. That’s still down from the prior day’s closing price of $12.63.

Leucadia Chief Executive Officer Richard Handler has prior experience saving imperiled financial firms. Before Leucadia purchased the business, he ran Jefferies when the company was part of a group that bailed out Knight Capital Group Inc., which teetered on the brink of collapse after bombarding markets with errant trades in August 2012. FXCM had warned Thursday that client losses due to the Swiss National Bank’s action threatened the broker’s compliance with capital rules. The company, which handled $1.4 trillion of trades for individuals last quarter, said it was owed $225 million by clients.

Cloud cuckoo.

• FXCM Lobbied Against Leverage Limit Before Trades Went Bad (Bloomberg)

FXCM, the brokerage facing a shortfall of nearly a quarter-billion dollars after highly-leveraged investors made losing bets on the Swiss franc, pushed back against U.S. regulatory efforts that likely would have left it less vulnerable. In 2010, the Commodity Futures Trading Commission sought to force individual investors trading currencies to give their broker 10 cents in capital to back every $1 in positions. The regulator failed to accomplish that amid pressure from New York -based FXCM and other brokers, meaning only 2 cents must be pledged. The agency’s proposal would “have a devastating impact on the retail forex industry,” Drew Niv, FXCM’s chief executive officer, wrote in a March 2010 letter to the CFTC that was signed by eight other executives at currency dealers.

The industry relies on “electronic systems” to liquidate customer trades and protect against “currency fluctuations in the market,” they said in the letter, which is posted on the CFTC’s website. FXCM’s retail clients suffered big losses Thursday after the Swiss National Bank let the franc float freely against the euro. The franc surged as much as 41%. FXCM warned that client losses threatened the broker’s compliance with capital rules. The largest U.S. retail foreign-exchange broker, which handled $1.4 trillion of trades for individuals last quarter, said it was owed $225 million by clients. The CFTC, the main U.S derivatives regulator, is reviewing the situation at FXCM, Steve Adamske, a CFTC spokesman, said earlier.

The National Futures Association is in touch with the firm and CFTC, according to Karen Wuertz, an NFA spokeswoman. Leucadia, owner of Jefferies, said in a statement Friday that it will provide $300 million in cash to FXCM to enable the brokerage to meet regulatory capital requirements and continue normal operations. Shares of New York-based FXCM had tumbled as much as 92% Friday morning before they were halted, pending an announcement. Leucadia shares climbed 0.9% to $21.84 as of 12:24 p.m. in New York, when trading was halted. The client losses are shining a spotlight on U.S. regulators’ oversight of retail currency trading and whether they stopped short of necessary curbs to protect customers. In contrast to other markets, investors buying stock with borrowed money must put up at least 50% of the purchase price under Federal Reserve rules.

“Suddenly, many of these companies are essentially locked out of the capital markets. They have to live within their means or go under.”

• Money Dries Up for Oil & Gas, Layoffs Spread, Write-Offs Start (WolfStreet)

Larger drillers outspent their cash flows from production by 112% and smaller to midsize drillers by a breathtaking 157%, Barclays estimated. But no problem. Wall Street was eager to supply the remaining juice, and the piles of debt on these companies’ balance sheets ballooned. Oil-field services companies, suppliers, steel companies, accommodation providers… they all benefited. Now the music has stopped. Suddenly, many of these companies are essentially locked out of the capital markets. They have to live within their means or go under. California Resources, for example. This oil-and-gas production company operating exclusively in oil-state California, was spun off from Occidental Petroleum November 2014 to inflate Oxy’s share price. As part of the financial engineering that went into the spinoff, California Resources was loaded up with debt to pay Oxy $6 billion. Shares started trading on December 1.

Bank of America explained at the time that the company was undervalued and rated it a buy with a $14-a-share outlook. Those hapless souls who believed the Wall Street hype and bought these misbegotten shares have watched them drop to $4.33 by today, losing 57% of their investment in seven weeks. Its junk bonds – 6% notes due 2024 – were trading at 79 cents on the dollar today, down another 3 points from last week, according to S&P Capital IQ LCD. Others weren’t so lucky. Samson Resources is barely hanging on. It was acquired for $7.2 billion in 2011 by a group of private-equity firms led by KKR. They loaded it up with $3.6 billion in new debt and saddled it with “management fees.” Since its acquisition, it lost over $3 billion, the Wall Street Journal reported. This is the inevitable result of fracking for natural gas whose price has been below the cost of production for years – though the industry has vigorously denied this at every twist and turn to attract the new money it needed to fill the holes.

Having burned through most of its available credit, Samson is getting rid of workers and selling off a chunk of its oil-and-gas fields. According to S&P Capital IQ LCD, its junk bonds – 9.75% notes due 2020 – traded at 26.5 cents on the dollar today, down about 10 points this week alone. Halcón Resources, which cut its 2015 budget by 55% to 60% just to survive somehow, saw its shares plunge 10% today to $1.20, down 85% since June, and down 25% since January 12 when I wrote about it last. Its junk bonds slid six points this week to 72 cents on the dollar. Hercules Offshore, when I last wrote about it on October 15, was trading for $1.47 a share, down 81% since July. This rock-bottom price might have induced some folks to jump in and follow the Wall-Street hype-advice to “buy the most hated stocks.” Today, it’s trading for $0.82 a share, down another 44%. In mid-October, its 8.75% notes due 2022 traded at 66 cent on the dollar. Yesterday they traded at 45.

“The oil rig count has fallen by 209 since Dec. 5, the steepest six-week decline since Baker Hughes began tracking the data in July 1987.”

• Steepest Oil-Rig Drop Shows Shale Losing Fight to OPEC (Bloomberg)

U.S. drillers have taken a record number of oil rigs out of service in the past six weeks as OPEC sustains its production, sending prices below $50 a barrel. The oil rig count has fallen by 209 since Dec. 5, the steepest six-week decline since Baker Hughes began tracking the data in July 1987. The count was down 55 this week to 1,366. Horizontal rigs used in U.S. shale formations that account for virtually all of the nation’s oil production growth fell by 48, the biggest single-week drop. Analysts including HSBC say the decline shows that OPEC is winning its fight for market share and slowing the growth that’s propelled U.S. production to the highest in at least three decades. OPEC’s decision not to curb its output amid increasing supplies from the U.S. and other countries has driven global oil prices down 58% since June.

“OPEC’s strategy is working, and it will be obvious in U.S. production by midyear when growth from shale plays will come to a halt,” James Williams, president of energy consulting company WTRG in London, Arkansas, said by telephone Friday. “You can imagine the impact on any industry from a 50% impact on sales.” “Prices are being forced toward levels that would force outright shut-ins in high-cost areas, mainly in Canada and the U.S.,” Societe Generale SA (GLE) analysts including Mark Keenan, its head of commodities research for Asia in Singapore, said in a research note Jan. 14. The slump in oil rigs has yet to stop the unprecedented growth in U.S. oil production, which added 60,000 barrels a day in the week ended Jan. 9 to 9.19 million, Energy Information Administration data show. That’s the most in weekly data since at least 1983.

“We’ve been saying for a year now to clients,” he added, “the risks are certainly rising and have been rising.”

• Jim Chanos: Days Of Drilling For Cheap Oil Are Over (CNBC)

Jim Chanos, head of the world’s largest short-selling hedge fund, told CNBC on Friday he’s been short major oil companies for a couple years because the North American shale explosion has been “uneconomic for drillers.” “The fracking and shale revolution was propelling us to be the largest oil producer in a way that I thought was uneconomic and still is uneconomic for the drillers. But it was going to be enough supply to really disrupt the markets,” he said. Big oil companies like Exxon Mobil and Royal Dutch Shell are finding their business models challenged, he added, “because the days of finding cheap oil is over.” The founder of Kynikos Associates, with $3 billion in assets under management, has been betting against the economic situation in China for some time now. “We came across China because of our work in the mining sector in 2009.”

Chanos has also been short Caterpillar—saying the company is finding two out of its three business streams severely challenged: mining and now energy. Last year, he said mining was the sole troublemaker, but now with oil prices falling the heavy equipment marker is coming under even more pressure. He first disclosed his short position in Caterpillar at the CNBC and Institutional Investor Delivering Alpha conference in July 2013. Last month, Chanos told CNBC that 2014 was a better year for short sellers than 2013. But he said Friday that calling Kynikos the biggest short seller is damning with faint praise. “It’s sort of like being called the toughest guy in France. It’s been tough for five years.” “We’ve been saying for a year now to clients,” he added, “the risks are certainly rising and have been rising.”

“We tend to have a short memory and we tend to forget that the price of oil breached the $50 a barrel level only a decade ago.”

• Welcome to ‘Normal’ Crude Oil Price, Trading at 100-Year Average (Bloomberg)

The theory goes that commodity prices move in “supercycles” or bursts of phenomenal surges, followed by longer, less-exciting periods. As such, a barrel of oil at $50 is, well, normal. Many people think the oil price has crashed, but it has just gone back to its long-term historical trend, according to Ruchir Sharma at Morgan Stanley. That makes a barrel of oil at around $50 just about right based on a 100-year inflation-adjusted average, said Sharma. “The price of oil is returning to normal in its long-term 100-year history,” Sharma said in an interview from New York. “We tend to have a short memory and we tend to forget that the price of oil breached the $50 a barrel level only a decade ago.” Brent crude oil futures, which trade in London and are used as a benchmark to set prices for more than half of the world’s oil, reached a record of $139.83 a barrel on June 30, 2008, according to data compiled by Bloomberg. By Jan. 13, the price had plunged 67% to $46.59.

“At times like these, it’s good to step back and look at the bigger picture, look at what it has done through a long history,” he said. The supercycle surge in oil prices was kicked off by China’s emergence as an industrialized economy and net oil importer in the middle of the 1990s. In 1995 it imported 343,000 barrels a day, according to BP data. In 2013, it bought 5.7 million barrels a day. The nation is now the world’s biggest energy consumer and the second-biggest oil user. “China’s oil imports took off around 2003 and it emerged as a big factor in the market,” Thina Saltvedt at Nordea Bank said in a Jan. 13 phone interview. There’s a long time lag in oil between investments and new supply and it can take 10 years, sometimes 15 years, to balance the market and match it with demand, said Saltvedt. China is structurally changing its economy from big, energy-intensive industry to less so. India or perhaps Africa will start to take over the role China has played, said Saltvedt.

“.. no “concrete proposal” has yet been made. The Governing Council will meet on Jan. 22 in Frankfurt to set monetary policy.”

• ECB Weighing QE Through National Central Banks (Bloomberg)

ECB President Mario Draghi briefed German Chancellor Angela Merkel and Finance Minister Wolfgang Schaeuble on quantitative-easing plans under which national central banks would buy bonds issued by their own country, Spiegel magazine reported. The plan, which tries to avoid a transfer of risk between member states, envisages purchases in line with the ECB’s capital key with a limit of 20% to 25% of each country’s debt, Spiegel said in an article published yesterday, without saying where it got the information. Greece would be excluded from the program because its bonds don’t fulfill the necessary quality criteria, the magazine said. Klaas Knot, governor of the Dutch central bank, told Spiegel that no “concrete proposal” has yet been made. The Governing Council will meet on Jan. 22 in Frankfurt to set monetary policy.

Officials presented various forms of quantitative easing to the council at a Jan. 7 meeting, and Draghi signaled in an interview with Die Zeit that the ECB is ready to take a decision as early as next week. Officials have courted the German public in a flurry of interviews, arguing that more stimulus is needed to fend off deflation in the 19-nation currency region. Knot said in the Spiegel interview that he sees no sign households are postponing spending, which Draghi has pointed to as one indicator of deflation. Knot also signaled a preference for measures that limit risk-sharing. “If each central bank was only buying debt of its own country, the danger of an unwanted redistribution of financial risk would be lower,” he said. “We have to avoid that decisions are taken through the back door of the ECB balance sheet that have to continue to be reserved for elected politicians in euro-area countries.”

Elections January 25.

• Eurozone Ponders Yet Another Greek Bailout (Reuters)

Eurozone officials discussed on Thursday extending Greece’s bailout program by up to six months more to allow time for talks with any new government in Athens on closing the current bailout and on what should replace it. The current bailout, which has already been extended by two months, runs out at the end of February. Athens had hoped to replace it with an Enhanced Conditions Credit Line from the eurozone bailout fund that it would never have to use. “There will have to be an extension beyond February. It will be inevitable,” one eurozone official with knowledge of thetalks said. “It could be six months more.” The extension would have to be requested by the new Greek government that emerges after elections on Jan. 25. But with Greek borrowing costs skyrocketing on uncertainty about policy after the elections, Athens looks set to need further euro zone support and a credit line for insurance purposes only may not be enough, euro zone officials said.

Also, without another program, under which Greece gets cheap euro zone loans or access to a credit line in exchange for reforms, the European Central Bank said it could not provide liquidity to the Greek banking sector. No decisions were taken and the issue is likely to be further discussed at the next meeting of euro zone finance ministers on Jan. 26, a day after the Greek vote. “The ECCL is for a country which has in principle market access, and the ECCL is an insurance policy to calm any remaining doubts in the market,” a second eurozone official said. “With some goodwill you could say that towards the end of last year, this could apply to Greece. Now with the uncertainty, stress on the financial system, Greek long-term yield going beyond 10% – all that makes it much less obvious Greece qualifies for an ECCL,” the official said.

In case this was not clear.

• Forex Leverage: How It Works, Why It’s Dangerous (CNBC)

[..] many retail traders found their trading accounts completely wiped out, being on the wrong side of a trade that couldn’t be liquidated fast enough to preserve their capital. Trading in currency markets at the retail level, with these types of brokerages, centers on the use of one of the biggest double-edged swords in financial markets: leverage. In other words, borrowed funds that are used to amplify potential returns but can also exacerbate the potential losses of trading positions. In the world of retail foreign exchange trading, use of leverage is key. Here’s how it works: Let’s say you want to take a $10,000 position in terms of Swiss francs. Under current regulatory guidelines in the U.S., you are mandated to keep at least $200 in your account in order to support that position. That’s because there’s a mandated minimum margin requirement of 2% for retail forex markets.

In other words, you can only have a position that’s 50 times greater than the equity in your margin account. If the value of your position grows because of market movements, there is no issue. But if your position loses value to a point where you no longer meet minimum margin requirements, your broker will liquidate assets to help assure that you don’t lose more money than you put into the account. The reason why some retail foreign exchange brokerages have gone bankrupt, and others are in severe distress, has to do with how those margin accounts were maintained during the SNB’s shock move. Certain accounts with losing positions weren’t able to be liquidated quickly enough before they went into deficit. That left some brokers responsible for the debit balances in client margin accounts. If those debit balances were high enough, that could cripple the capital position of these retail brokerages. At that point, a handful of things can happen.

For one, the broker can request the client to add enough funds to bring their account back into good standing. Or, the broker is left holding the bag on client losses, perhaps with only legal recourse to try to recover those losses. According to Forex.com, which is a retail foreign exchange broker and is owned by publicly traded Gain Capital, the company does “reserve the right to hold clients responsible for large debit balances and in special circumstances.” Its website also encourages clients to manage use of leverage carefully, since use of more leverage increases risk. Bottom line, the pain of the SNB’s removal of its currency peg hit numerous parts of the market, and will lead to outsized financial losses for the big guys and the little guys. On a relative basis, retail traders may feel more pain than their bigger counterparts. The recent market action serves as a potent reminder of just how dangerous leverage can be when price action moves swiftly, and without warning.

Sounds like an interesting book.

• The End Of Banking, And How To Fix It (Reuters)

“The End of Banking” is an important book about finance. Jonathan McMillan, the nom de plume taken by an investment banker and a macroeconomist, provides a holistic and compelling explanation of the crisis of 2008. The authors predict a repeat, barring a revolution in finance. McMillan, as the co-authors can be called, defines banking as the private sector creation of money from extending credit. Loans create deposits – private money. The monetary liabilities are distinct from the physical or electronic money which comes out of central banks. The book’s central argument is that private money creation is impossible to control in the digital age. Until computers became widespread in the 1970s, banks could keep track of borrowers. But with electronic systems, transactions became more complex as lenders repackaged loans. Financial assets were spread across myriad interlocking chains of balance sheets, both of traditional banks and so-called shadow banks, which have grown into a $35 trillion monster in the United States and European Union.

The illustration of how balance sheets multiply and money grows in “The End of Banking” is illuminating. The focus is on how computing permitted massive regulatory arbitrage. “Over the last 40 years, IT has turned the stick [of capital requirements] into a toothpick.” Financial watchdogs are alert to shadow banking’s risks, but their efforts to bring non-regulated firms into a defined perimeter are akin to using a net to gather water. Thanks to electronic bookkeeping, firms can shift balance sheets out of the authorities’ purview at the tap of a button. Whether to prevent runs on banks or to firm up the financial stability of quasi-banks, weak governments have steadily extended guarantees to bigger portions of the private sector. McMillan has a solution. It starts with an accounting distinction.

Bank assets would be classified either as real, in other words claims on physical or distinct immaterial objects; or as financial, assets which appear as liabilities on the balance sheet of some other institution. Next, regulators would ensure that financial assets were 100%-backed by common equity. And lastly, in a combined regulatory and accounting change, the value of a company’s real assets would have to be greater or equal to the value of the total of its liabilities. This final fix is where the book goes beyond previous proposals to mend finance through concepts such as narrow- or limited-purpose banking. The implication of McMillan’s recommendation is that many derivatives, for which a counterparty’s losses could be infinite, would be banned. What’s more, the intended application to financial and non-financial companies alike would include shadow banking, addressing the so-called “boundary problem” of regulation that other approaches to improve the system fail to solve.

“.. the private sector in Asia-Pacific now owes 1.5 times the region’s combined annual output ..”

• Asia’s Big Demons: Debt, Deflation, Demographics (Reuters)

Asia is battling not one but three demons. The unholy trinity of debt, deflation and demographics threatens to sap the region’s growth potential. Fending off the challenge requires central banks to cut borrowing costs. But they are reluctant to do so when U.S. interest rates are poised to rise. That could turn out to be a huge error. Consider the debt overhang. Taken together, the private sector in Asia-Pacific now owes 1.5 times the region’s combined annual output, according to the Bank for International Settlements. As a big chunk of the borrowing is in the opaque shadow banking system, particularly in China, the debt could be even larger. Either way, servicing the loans requires incomes to increase quickly. Yet, real GDP growth is slowing almost everywhere in the region. The threat of slowly rising consumer prices slipping into outright deflation is making things worse. Producer prices are sliding across Asia-Pacific.

Falling energy costs provide a convenient excuse for margin-starved employers to skimp on pay hikes, just as they did in the late 1980s. That makes the situation harder for borrowers in Malaysia, Korea, Thailand and Singapore, all of which have high household leverage. Persistent lowflation will leave borrowers with higher debt burdens than they expected. Demographics aren’t helping. Japan, China, South Korea, Singapore and Thailand are ageing rapidly. Relatively young countries like Indonesia, Vietnam and the Philippines drag down the average age. Even so, the region will have more middle-aged people than youngsters by 2020. This will present Asian nations with the same problem that has plagued advanced nations: a savings glut. As those looking to invest for retirement outnumber those borrowing to buy new homes and start new businesses, market interest rates could fall.

“It is the first attack by Islamic State itself against Saudi Arabia and is a clear message after Saudi Arabia entered the international coalition against it ..”

• The Great Wall of Saudi Arabia? (Christian Science Monitor)

Saudi Arabia has been constructing a 600-mile East-West barrier on its Northern Border with Iraq since September. The main function of the barrier will be keeping out ISIS militants, who have stated that among their goals is an eventual takeover of the Muslim holy cities of Mecca and Medina, both of which lie deep inside Saudi territory, according to United Press International. This past week, a commander and two guards on the Saudi-Iraq border were killed during an attack by Islamic State militants, the first direct ground assault by the group on the border. “It is the first attack by Islamic State itself against Saudi Arabia and is a clear message after Saudi Arabia entered the international coalition against it,” Mustafa Alani, an Iraqi security analyst with close ties to Saudi Arabia’s interior ministry, told Reuters.

The Saudi “Great Wall” as it’s being dubbed by some media outlets, will be a fence and ditch barrier that features soft sand embankments that is designed to slow down infiltrators on foot and are too step to drive a tired-vehicle up, according to the Telegraph of London. It will have 40 watchtowers and seven command and control centers complete with radar that can detect aircraft and vehicles as far away as 22 miles as well as day and night camera installations. The barrier system will have five layers of fencing, complete with razor wire and underground motion sensors that trigger a silent alarm. The 600-mile structure will be patrolled by border guards and 240 rapid response vehicles. The Saudis sent 30,000 soldiers to patrol the border in July 2014 after ISIS forces swept into western Iraq and Iraqi guards on the Saudi border fled.

“While Poroshenko was pretending his heart bled for French cartoonists, the civilians targeted for extermination by his government were bleeding literally: dozens, including children, have been killed in renewed shelling of Donetsk by Kiev’s military that weekend. ”

• Why Should Charlie Hebdo Deaths Mean More Than Those In East Ukraine? RT)

Though US pundits have been the loudest in calling for another war on terror, American officials were nowhere to be seen on the Sunday march. Only the US Ambassador attended the event, while President Obama, Vice President Biden, or even top diplomat John Kerry was conspicuously absent. The highest-ranking US official in Paris was Attorney General Eric Holder, who had announced his resignation in September 2014. The leaders that did attend weren’t above using the march for their own political purposes. Israeli Prime Minister Benjamin Netanyahu came to the march, even though the French government asked him not to. Turkey’s Prime Minister Ahmet Davutoglu also attended, but as soon as he returned, President Recep Erdogan publicly declared the massacre a French false-flag operation, for which the mayor of the Turkish capital Ankara, Melih Gokcek, blamed the Israeli Mossad.

Perhaps the most hypocritical of all was the Kiev junta, whose leader, Petro Poroshenko, hastened to Paris to claim he too was a victim of terrorism , even as his forces restarted the terror shelling of civilians in dissenting Donetsk. Poroshenko paraded before the cameras, dutifully made accusations of yet another Russian invasion, again accused Russia of being behind the downing of flight MH17, and begged for money from the West to bail out his bankrupt government, and fund another military expedition against the civilians of Donetsk and Lugansk. While Poroshenko was pretending his heart bled for French cartoonists, the civilians targeted for extermination by his government were bleeding literally: dozens, including children, have been killed in renewed shelling of Donetsk by Kiev’s military that weekend.

Among them was a boy of eight named Vanya, who lost his legs, a hand and an eye to Kiev’s humanitarian bombs. When critics of the junta’s campaign of artillery terrorism posted news of this on Twitter with the hashtag #IamVanya, Russophobic trolls quickly responded with displays of hatred. Hypocrisy is the order of the day in the West. Frenchmen and other NATO-sphere subjects are supposed to simultaneously champion free speech and crack down on offensive speech; profess love of Islam and endless tolerance, while their governments sponsor Islamic terrorists in places like Libya, Syria, Iraq or the Balkans; and protest the murder of innocents while backing Kiev’s regime doing precisely that, in the name of – you guessed it – fighting terrorism.

Of course, NATO’s puppets in Kiev have the perfectly rational explanation why it’s different when they kill: their victims are “subhumans”, as US-backed PM Arseny Yatsenyuk once put it. The same man, during his visit to Germany just a day after the Charlie Hebdo massacre, claimed that Russia had invaded Ukraine and Germany in WW2. His German hosts, normally sensitive to pro-Nazi rhetoric, chose to remain silent.

“NATO’s eastward expansion has destroyed the European security architecture as it was defined in the Helsinki Final Act in 1975. ”

• Gorbachev: ‘I Am Truly and Deeply Concerned’ (Spiegel)

SPIEGEL: Michael Sergeyevich, few contributed more to ending the Cold War than you. Now it is returning as a result of the Ukraine crisis. How painful is that?

Gorbachev: It gives one a feeling of déjà-vu. Perhaps that would even make a good headline for this interview: Everything appears to be repeating itself. There was a time for building a Wall and a time for tearing it down. I’m not the only person to thank for the fact that this wall no longer exists. (Former Chancellor) Willy Brandt’s Ostpolitik was important, as were the protests in Eastern Europe. Now, new walls are being built and the situation is threatening to escalate. I do, in fact, see all the signs of a new Cold War. Things could blow up at any time if we don’t act. The loss of trust is disastrous. Moscow no longer believes the West and the West doesn’t believe Moscow. That’s terrible.SPIEGEL: Do you think it is possible there could be another major war in Europe?

Gorbachev: Such a scenario shouldn’t even be considered. Such a war today would inevitably lead to a nuclear war. But the statements from both sides and the propaganda lead me to fear the worst. If one side loses its nerves in this inflamed atmosphere, then we won’t survive the coming years.SPIEGEL: Aren’t you overstating things a bit?

Gorbachev: I don’t say such things lightly. I am a man with a conscience. But that’s the way things are. I am truly and deeply concerned.SPIEGEL: The new Russian military doctrine labels NATO’s eastern expansion and the “reinforcement of NATO’s offensive capabilities” as one of the primary threats facing Russia. Do you agree?

Gorbachev: NATO’s eastward expansion has destroyed the European security architecture as it was defined in the Helsinki Final Act in 1975. The eastern expansion was a 180-degree reversal, a departure from the decision of the Paris Charter in 1990 taken together by all the European states to put the Cold War behind us for good. Russian proposals, like the one by former President Dmitri Medvedev that we should sit down together to work on a new security architecture, were arrogantly ignored by the West. We are now seeing the results.

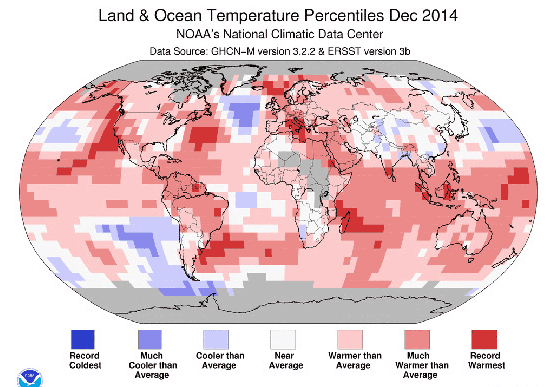

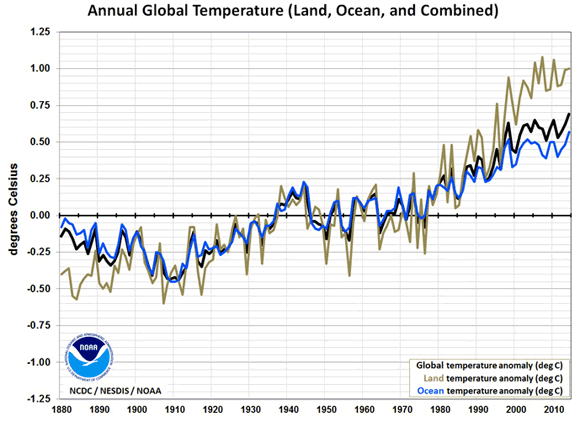

“The 10 warmest years on record have all occurred since 1997 ..”

• 2014 Was Hottest Year on Record (NY Times)

Last year was the hottest in earth’s recorded history, scientists reported on Friday, underscoring scientific warnings about the risks of runaway emissions and undermining claims by climate-change contrarians that global warming had somehow stopped. Extreme heat blanketed Alaska and much of the western United States last year. Several European countries set temperature records. And the ocean surface was unusually warm virtually everywhere except around Antarctica, the scientists said, providing the energy that fueled damaging Pacific storms. In the annals of climatology, 2014 now surpasses 2010 as the warmest year in a global temperature record that stretches back to 1880.

The 10 warmest years on record have all occurred since 1997, a reflection of the relentless planetary warming that scientists say is a consequence of human emissions and poses profound long-term risks to civilization and to the natural world. Of the large inhabited land areas, only the eastern half of the United States recorded below-average temperatures in 2014, a sort of mirror image of the unusual heat in the West. Some experts think the stuck-in-place weather pattern that produced those extremes in the United States is itself an indirect consequence of the release of greenhouse gases, though that is not proven. Several scientists said the most remarkable thing about the 2014 record was that it occurred in a year that did not feature El Niño, a large-scale weather pattern in which the ocean dumps an enormous amount of heat into the atmosphere.

Longstanding claims by climate-change skeptics that global warming has stopped, seized on by politicians in Washington to justify inaction on emissions, depend on a particular starting year: 1998, when an unusually powerful El Niño produced the hottest year of the 20th century. With the continued heating of the atmosphere and the surface of the ocean, 1998 is now being surpassed every four or five years, with 2014 being the first time that has happened in a year featuring no real El Niño pattern. Gavin A. Schmidt, head of NASA’s Goddard Institute for Space Studies, said the next time a strong El Niño occurs, it is likely to blow away all temperature records.

Home › Forums › Debt Rattle January 17 2015