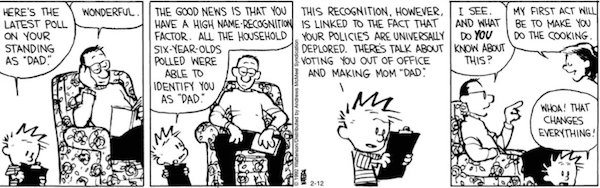

Piet Mondriaan Mill 1905

Biden 100k

https://twitter.com/i/status/1660240874851168259

Conyers

In 2016, Rep. John Conyers (D) warned against arming the "Ukrainian neo-Nazi militia, the Azov Battalion," as he believed these "white supremacists and antisemitic" extremists would eventually use their weapons against their own people, similar to the Mujahideen in Afghanistan. pic.twitter.com/9E8gVPIU8j

— KanekoaTheGreat (@KanekoaTheGreat) May 21, 2023

Nobody is safe

"NOBODY IS SAFE!" #COVID19 pic.twitter.com/GeRfWm8jce

— Matt Orfalea (@0rf) May 20, 2023

CoronaThrax

Is CoronaThrax being launched for September 11, 2023. Greenlight now in Hiroshima at G-7? RFK Jr. has been watching. pic.twitter.com/WZJoIX2eo2

— George Webb – Investigative Journalist (@RealGeorgeWebb1) May 21, 2023

The sudden rush into the 50-year old F-16s shows us just how badly Ukraine is losing.

• Ukraine Claims It’ll ‘Win War’ After Getting F-16s (RT)

F-16 fighter jets could become a game changer in the ongoing conflict between Moscow and Kiev, a spokesman for the Ukrainian Air Force Command, Yury Ignat, claimed in remarks to Ukraine’s Espreso TV broadcaster on Saturday. “When [we] have F-16, we will win this war,” Ignat said, adding that Kiev has repeatedly told its Western backers that the air defense systems it has already obtained from the West are insufficient to protect all of Ukraine’s territory against Russian air strikes. “The territory of the country and the length of the state border are big and the frontline … is over 2,500 kilometers [long],” the Air Force spokesman said, counting Ukraine’s border with Belarus, its Black Sea shores, and the border with Moldova’s breakaway region of Transnistria as parts of the “frontline.”

It would be impossible to cover such an expanse with air defense systems, Ignat maintained. He also said that the US-made F-16 fighter jets would become “a part of the air defenses” and would be used in areas not covered by the ground-based systems. The Air Force spokesman also admitted that the Soviet-made jets that Ukraine has been using until now cannot effectively counter Russian unmanned aerial vehicles (UAVs) and cruise missiles. He said that Kiev also plans to use the US-made jets in offensive operations and that the aircraft would significantly increase the effectiveness of anti-radar HARM missiles and JDAM precision-guided munitions, which Western nations have already handed over to Ukraine. Ukraine would also use the F-16s to strike the command centers and logistical networks of Russian forces, Ignat said, adding that such attacks would allow Kiev to “quickly” seize territories that it considers “occupied” by Russia.

His words came just days after Washington said it would support a joint program to train Ukrainian pilots on modern jets such as F-16s and would allow allies to transfer the US-made aircraft to Kiev. On Saturday, US national security adviser Jake Sullivan told journalists that President Joe Biden had “informed his G7 counterparts” that Washington would let its Western allies supply advanced jets to Ukraine. Moscow blasted the decision as a “movement up the escalation ladder” that is “fraught with colossal risks” for the West itself. Russian Foreign Ministry spokeswoman Maria Zakharova also accused the US of “waging a hybrid war against the entire region” and of using Ukrainian territory to achieve its own goals.

“..when US planes will take off from NATO airfields, piloted by foreign ‘volunteers’..”

• US Approval Of Crimea Strikes Proves Lack Of Interest In Peace – Envoy (TASS)

Washington’s approval of Ukraine’s strike on Crimea with Western weapons indicates that the US has no interest in peace, Russian Ambassador to Washington Anatoly Antonov said Sunday. “Washington has totally bent G7 members to its will in regards to the conflict in Ukraine. Moreover, it has seriously tightened its approaches on two important issues. I am referring to the handover of F-16 planes to the Kiev regime, as well as unconditional approval of strikes on Crimea with American and other Western weapons. Such steps once again make it clear that the US has never been interested in peace,” he said. The envoy added that Russia will view strikes on Crimea “as an attack on any other region of the Russian Federation,” and called on the US to consider potential response measures from Russia.

Antonov also pointed out that Ukraine lack infrastructure to use F-16 planes, as well as the required number of pilots and maintenance crews. According to Antonov, all this raises concerns about NATO’s future involvement in the conflict “when US planes will take off from NATO airfields, piloted by foreign ‘volunteers’,” he said. Earlier, US President Joe Biden told his Ukrainian counterpart Vladimir Zelensky on the sidelines of the G7 summit in Hiroshima that the US and its allies will start training Ukrainian pilots in use of F-16 fighter. Previously, US National Security Advisor Jake Sullivan said that the US and its allies will discuss which states exactly will send F-16 planes to Ukraine. He also noted that F-16s are not on the list of priority shipments for preparation of Kiev’s counteroffensive.

“..the end of democracy in the United States” and the “end of Ukraine..”

• Trump’s Victory Would Be ‘The End Of Ukraine’ – Hillary Clinton (RT)

If ex-US President Donald Trump is re-elected in 2024, it would be the downfall of both Ukraine and democracy in America, former Democratic presidential candidate Hillary Clinton warned on Saturday. Speaking to the Financial Times, Clinton, who served as secretary of state under Barack Obama and lost to Trump in the 2016 election, said she does not believe that her former rival will be successful this time. However, she claimed that if Trump does win in 2024, it will be “the end of democracy in the United States” and the “end of Ukraine,” as he will withdraw the country from NATO. Clinton went on to say that Russian President Vladimir Putin believed Trump would do so had he won the 2020 election. “Trump was the gift that kept giving to people like [Chinese leader Xi Jinping] and Putin,” she said, accusing him of being “enamored of authoritarians” and “inept in any kind of strategic approach to China.” She added that Trump was “clearly going to do whatever Putin wanted on NATO.”

Clinton also said she once believed that China was preparing to “make [a] move against Taiwan” within a few years, but the Ukraine conflict discouraged Beijing from attempting to reclaim the island, which it regards as part of its sovereign territory. She went on to address widespread concerns that the current president, Joe Biden, 80, who confirmed that he would run again in late April, is too old for the job. While acknowledging that age is “an issue,” she urged voters to compare him to the man he is running against. Trump, who announced last November that he would run again in 2024, has been critical of Biden’s approach to the Ukraine conflict. In January, he claimed that the president “is systematically, but perhaps unknowingly, pushing us into what could soon be World War III.” Trump has described himself as the “only candidate” capable of stopping the US from sliding into a global conflict, promising he would settle the conflict in Ukraine “very quickly” if elected.

And why not? Anything goes.

• Zelensky Compares Artyomovsk To Hiroshima (RT)

The devastation left by the months-long battle for the Donbass city of Artyomovsk is reminiscent of the destruction resulting from the US nuclear bombing of Hiroshima, Ukrainian President Vladimir Zelensky told journalists on Sunday while attending the G7 summit hosted by the Japanese city. “The photos of Hiroshima remind me of Bakhmut,” said Zelensky, using the Ukrainian name of the city. He laid wreaths at the memorial to the victims of the atomic bombing in Hiroshima during his visit. “Absolute total destruction. There is nothing, there are no people,” he said, adding that “all the buildings are destroyed” in the city captured by Russia over the weekend. The Russian Defense Ministry confirmed seizing Artyomovsk late on Saturday.

On Sunday, Russian President Vladimir Putin congratulated Wagner fighters and the servicemen of the regular Russian Army for successfully taking the city. Kiev continues to deny losing control of it. Zelensky himself sent mixed signals about the situation on the ground. Early on Sunday, he said the city “is only in our hearts” when asked if Ukraine still controls Artyomovsk. Later, he denied the city was “occupied by Russia.” Russian businessman Evgeny Prigozhin, the founder of the Wagner Group private military company, told journalists on Sunday that “no Ukrainian fighters had been left” in Artyomovsk. The US nuclear bombing of Hiroshima killed between 70,000 and 80,000 civilians, or around 30% of the city’s population at that time, according to various estimates. Another 70,000 people were injured. The blast also killed an estimated 20,000 Japanese military personnel.

The ‘Little Boy’ bomb that exploded about 580 meters above the city right over the Shima Surgical Clinic destroyed everything within a some 1.6-kilometer radius from the center of the blast. It also caused a massive blaze that engulfed 11 square kilometers. According to Japanese officials, almost 70% of the city’s buildings were destroyed. The salt-mining city of Artyomovsk had been the scene of intense fighting for some eight months as Russian forces gradually pushed Ukrainian troops out. The city, which spreads over some 41.6 square kilometers, was largely destroyed in the process. In 2017, the total population of Artyomovsk amounted to just over 71,000 people. Most residents were evacuated before the battle began or earlier in the fighting. However, according to the International Committee of the Red Cross, some 10,000 people were still living in the city in late March. Kiev also stated that the battle for Artyomovsk claimed the lives of some 4,000 civilians. Russia did not comment on these estimates.

Zakharova has the real link between the two..

• Destruction Of Both Hiroshima, Artyomovsk Led By White House – Zakharova (TASS)

Russian Foreign Ministry Spokeswoman Maria Zakharova pointed out that both Artyomovsk (Bakhmut) and Japan’s Hiroshima were destroyed by the official Washington, commenting on Ukrainian President Vladimir Zelensky’s comparison of the aftermath of the nuclear bombing of Hiroshima to hostilities in Artyomovsk. She pointed out that the Ukrainian president “compared Hiroshima, destroyed by an American nuclear bomb to Artyomovsk” on the sidelines of the G7 summit in Japan. “Well done, because the White House orchestrated both things,” Zakharova said on her Telegram channel Sunday.

A very lenghty timeline of a very lenghty battle.

• How Russia Forced Ukrainians To Retreat From Artyomovsk (RT)

Nine months of battles for a symbolic site in Kiev’s attempt to regain control of the region have ended with another triumph for Moscow’s forces Screenshot from social media video= The battle for Artyomovsk (called Bakhmut by the Ukrainians) began in August 2022, and gradually turned into the epicenter of fighting between Russia and Ukraine. While other parts of the front remained relatively stable, both sides actively brought forces to this small city. For Kiev, which in May 2022 suffered a defeat at Azovstal that helped undermine its image, Artyomovsk became the new Mariupol. Ukrainian propaganda labeled it ‘the Bakhmut Fortress’, and attempted to give an air of heroism to those fighting there.

Despite the fact that the city has no strategic importance for advancing westward, Russian troops accepted the challenge posed by Ukrainian propaganda. So what did Moscow gain from the nine-month-long ‘Bakhmut meat grinder’? In the nineteenth century, Artyomovsk was a provincial town in the Russian Empire and the administrative center of the developing Donbass region. As other cities grew, however, its role became less prominent. By the beginning of the Russian offensive in February 2022, the city had a population of about 70,000. It was home to several industrial facilities including a sparkling wine factory where battles took place in early 2023. According to the Ukrainian authorities, by that time 60% of the city had already been destroyed.

The importance of the city grew tremendously after the start of Russia’s military operation in February 2022. Initially, when Russian troops broke the first line of fortifications in the area of Popasnaya, Zolotoye, and the Lisichansk-Severodonetsk agglomeration, Artyomovsk was an important transport hub. It kept the Ukrainian front line connected with the rest of the country. After the Russians managed to break this line of defense and completely removed Kiev’s forces from the territory of the Lugansk People’s Republic (LPR), Artyomovsk went from being a transport hub to becoming Ukraine’s second line of defense around the Bakhmutka River. This strip ran from Ukrainian positions opposite Gorlovka – since 2014 controlled by the Donetsk People’s Republic (DPR) – in the south up to Seversk in the north, running straight into the Seversky Donets, the main river in Donbass.

At this week's G7 summit in Japan, Zelenksy's trivialised Russia's capture of Bakhmut. But last year, when begging for weapons from Congress in Washington, he told a different story:

"The fight for Bakhmut will change the trajectory for the war of our independence and freedom." pic.twitter.com/mNgLMAptHK— Mark Alan Pearce (@PearceAlan1962) May 21, 2023

Zelensky knows where Lula stands. Peace. Negotiations.

• Lula Says Zelensky Didn’t Show Up To Scheduled Meeting (RT)

Brazilian President Luiz Inacio Lula da Silva has said that his Ukrainian counterpart, Vladimir Zelensky, had failed to show up for a scheduled bilateral meeting during the G7 summit in Hiroshima, Japan. “I had an interview, a bilateral one with [Zelensky] here in this room at 3:15 pm. We waited and received the information that he was late,” the president, who is commonly referred to as just Lula, said on Monday, as cited by Reuters. He added that Zelensky “did not show up” because “clearly he had appointments and he couldn’t come.” AFP cited Lula as saying that he was “upset” that the meeting fell through. A face-to-face meeting with the Ukrainian leader was absent from the itinerary published by Lula’s office ahead of his trip to Japan.

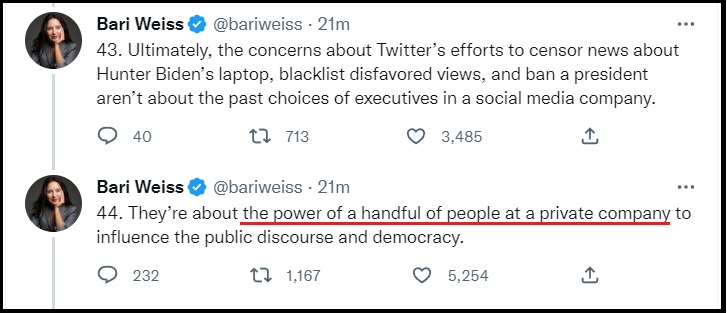

However, Bloomberg cited unnamed Brazilian officials as saying on Saturday that the Brazilian delegation felt pressured to arrange a meeting between Lula and Zelensky, whose travel plans are not usually publicly announced in advance. Zelensky later told reporters that “everyone has their schedules, so we couldn’t meet with the Brazilian president.” The two leaders previously spoke over the phone in March. Lula has condemned Russia’s military operation in Ukraine, but refused to join Western sanctions imposed Moscow and declined to provide weapons to Kiev. He has stressed that the Russia-Ukraine conflict should be resolved through negotiations. “No solution will last if it is not based on dialogue. We need to work to create the space for negotiations,” Lula said on Sunday.

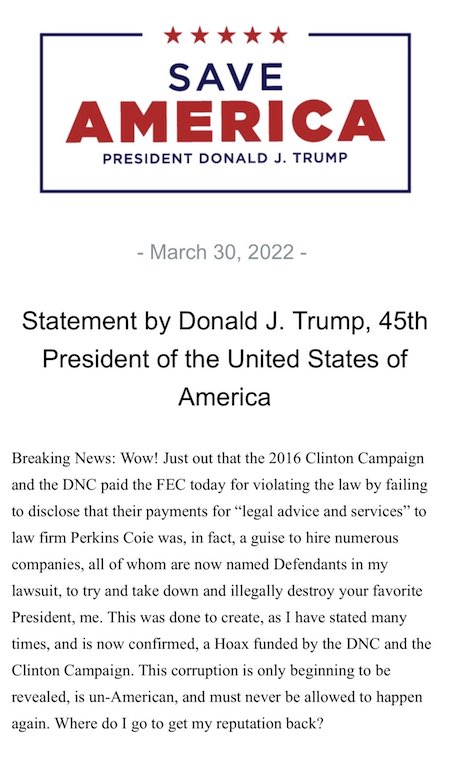

How much longer till she’s indicted?

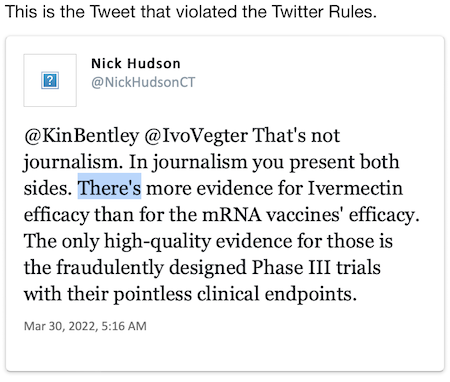

• Durham Report: Clinton, Not Trump, Colluded With Russians – Hanson (Fox)

The Durham report suggests there are more questions about Hillary Clinton’s overtures toward Russian entities than former President Donald Trump’s, Victor Davis Hanson claimed. Hanson, a historian and fellow at Stanford University’s Hoover Institution, told “Life, Liberty & Levin” that Durham’s findings showed that “far from being a Trump-Russian connection, there was a Hillary-Clinton–Russian connection.” Hanson analyzed the findings, saying they showed Clinton was using a Moscow-based “source,” Democrat-linked PR executive Charles Dolan Jr., to collect purported intelligence on Trump. Dolan, who served twice as former President Bill Clinton’s Virginia state campaign chairman, was “feeding” information to Igor Danchenko, a Russian national working at the Brookings Institution at a time the thinktank was being led by Nelson “Strobe” Talbott, Hanson said.

Talbott, who also served as Bill Clinton’s deputy secretary of State, had been made privy to “briefings and inquiries on the development of the dossier” by Steele, according to a Fox News analysis by law professor Jonathan Turley. “Strobe Talbott… was introduced to Christopher Steele through Fiona Hill of impeachment fame, and the basic story mark was that they were fabricating everything in this dossier, and Dolan was trying to pass on rumors to Danchenko, who was corroborating with Steele,” Hanson said. In a 2019 Politico op-ed, Talbott notably claimed in-part, “[W]e already know that the Kremlin helped put Trump into the White House and played him for a sucker.”

Hanson said the purported “pee tape” — which supposedly was to have shown prostitutes urinating on a Moscow hotel bed at the behest of Trump to spite the Obamas, who reportedly previously slept there — was “all made up.” “[A]nd worse yet, the FBI knew it was made up, and yet they continued to pay Danchenko in hopes that he might find some credibility because they were using this material to get a FISA warrant to spy on [then-Trump campaign aide] Carter Page, and yet they knew that it was false.” “Even in the case of Steele, they offered him $1 million, apparently, if he could just reify or substantiate just one point and he couldn’t. So the FBI was knee-deep in it, and Durham suggests that they didn’t want to investigate Hillary or monitor her communications,” he said.

The reason the feds didn’t probe Clinton as they had Trump, he surmised, was because they were certain she was soon to be elected president. “And they were terrified that anybody, I guess, who would concoct such a conspiracy might do the same to them if she was in the White House,” he said. “So it’s damning to the FBI. It’s damning to the Hillary Clinton campaign. It’s damning to the media, because it’s all out there and then nobody’s refuted it… it really shows that Hillary Clinton colluded with the Russian government through intermediaries, and the FBI knew about it and blamed Donald Trump, who was innocent of it.”

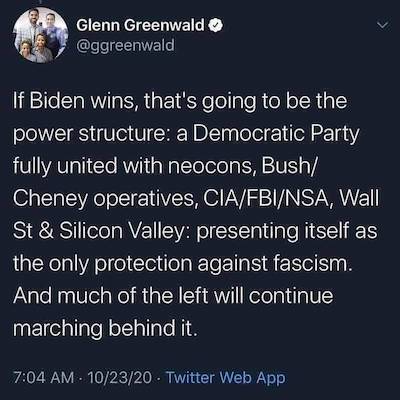

“..Russiagate’s aim from the jump was to delegitimize, destabilize, and destroy Donald Trump’s presidency..”

• The Durham Report Indicts the Deep State—and the Media (RCI)

Russiagate’s aim from the jump was to delegitimize, destabilize, and destroy Donald Trump’s presidency. Hatched by the Hillary Clinton campaign, this would be her revenge for losing to Trump—an attempt to make his victory a Pyrrhic one. This would be the deep state’s way to sabotage and subvert a commander in chief who threatened to upend its agenda, and that of the entire political establishment. Neither fidelity to the law and truth, nor any sense of shame, nor any fear of consequences could temper the zealous would-be vanquishers of the “bad orange man.” We know this because, as Durham’s report spells out, and as even casual observers have long been aware, the story of Trump-Russia collusion was a farce from the very beginning and in virtually every respect.

It was born of hearsay, ludicrous innuendo, and laughable inferences. Its sources were biased, unscrupulous, and shady. The investigators acted corruptly, lawlessly, and violated basic practices and time-honored norms in pursuing a probe of the highest stakes. They could not corroborate the key pillars on which they “built” their “case” and covered their eyes and ears in the face of exculpatory evidence at every turn. The lack of due diligence and carelessness is staggering—if you were to assume the FBI and Justice Department were operating in good faith. Despite the glaring deficiencies in their case and the blatant violation of the rights of innocent Americans, including among them true patriots, nothing would slow them down.

It did not have to be this way. Were American journalists at our nation’s most storied publications adversaries of the ruling class rather than its stenographers—had they even a modicum of skepticism, curiosity, or intellectual honesty, they could have stepped in to defend our republic. They could have exposed one of the greatest scandals in American history: that our national security and law enforcement apparatus effectively sought to halt the transfer of power to a president they feared and loathed by pursuing him as a traitor, based on crackpot conspiracy theories borne of his political opponent’s research. Consider Gen. Michael Flynn’s purported Logan Act violations; George Papadopoulos’ comments to an Australian diplomat; Carter Page’s supposed Russian ties; the contents of the Steele dossier; Sergei Millian’s significance; the secret Alfa Bank back channel to Russia. The list of shoddy stories pertaining to purported Russian collusion is virtually endless, and as the Durham Report shows—as did reporting from independent, contrarian journalists at the time—such stories would fall apart under the slightest scrutiny.

K. T. McFarland, a former Deputy National Security Advisor, says the FBI, Justice Department, and CIA will rig the 2024 U.S. presidential election, following their success in rigging 2016 and 2020, because they won't allow any candidate to win that would hold them accountable:… pic.twitter.com/30dSX700HQ

— KanekoaTheGreat (@KanekoaTheGreat) May 21, 2023

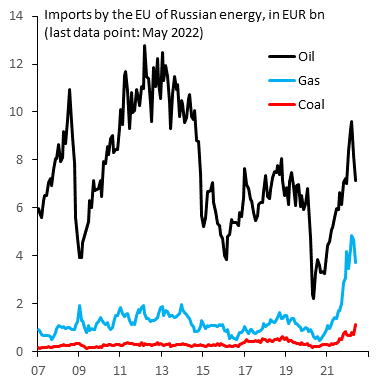

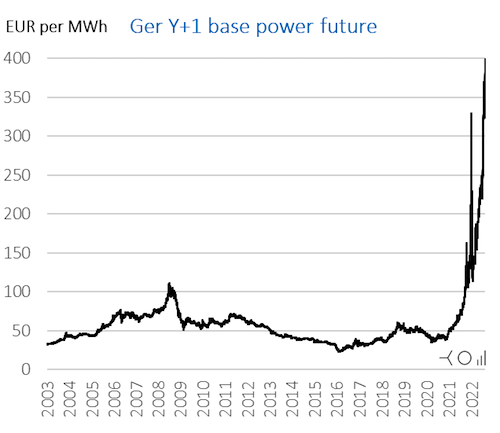

EU and G7 are 10 years late. Or is that 20? Africa, Latin America, Central Asia, they’ve lost it all. And they’re so full of hubris they never even noticed.

• EU ‘Offer’ To Global South Must Be Better Than China’s – Ursula (RT)

The EU needs to offer a real alternative to China’s economic projects for the countries of the Global South, European Commission President Ursula von der Leyen said on Saturday. The EU and likeminded nations must use the “window of opportunity” as “many countries of the Global South are looking for alternative funding options,” she said at the G7 summit in Japan’s Hiroshima. Von der Leyen claimed that China’s Belt and Road Initiative – a global infrastructure investment strategy unveiled ten years ago – has been losing its appeal because many countries had “bad experiences with China.” “They took Chinese loans and ended up in a debt crisis,” the EU official stated, adding that the European bloc and the G7 must fill the void.

“We want to put a better offer on the table. If we are in a race, we are in a race to the top,” von der Leyen said. She added that the EU is rolling out 90 “flagship projects” on different continents as part of its Global Gateway investment scheme. Von der Leyen’s words came as G7 countries adopted a joint statement that accused Beijing of “economic coercion” and technology theft. China, in turn, has repeatedly accused G7 members of abusing trade regulations in order to impose their will on others. Beijing has also denied claims that the Belt and Road project hurts other nations. “The so-called Chinese debt trap is a lie made up by the US and some other Western countries,” Chinese Foreign Ministry spokesman Wang Wenbin said last year.

“On the list are business partners who are connected to millions of dollars acquired from foreign interests in China, Ukraine and other countries…”

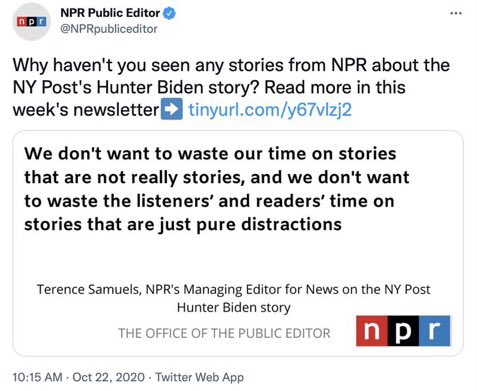

• Hunter Biden Faces Call for the Appearance of Key Business Associates (Turley)

There is a new and interesting development in Arkansas where attorneys for Lunden Alexis Roberts have prepared a list of witnesses for the upcoming proceedings involving Hunter Biden’s daughter, Navy. As previously discussed, Hunter Biden is seeking to reduce child support payments and has balked at Navy being able to use the Biden name. If successful, this could get a lot worse for Hunter in his allegedly efforts to conceal his past incomes. On the list are business partners at the center of the influence peddling scandal. (Thank you to the reader who sent this possibly prophetic intersection picture). On the list are business partners who are connected to millions of dollars acquired from foreign interests in China, Ukraine and other countries. Also on the list is New York City art gallery owner Georges Bergès who continues to sell his art.

Bergès has reportedly pushed back on congressional efforts to reveal details on these proceeds and buyers even though former government ethicists have raised concerns over the sales. The costs of these proceedings and high-priced legal team would seem to undermine claims of financial distress by Biden. However, by putting his financial worth at issue, Hunter has opened up a new front in battling over the disclosure of his past dealings. Some of his part associates are reportedly cooperating with House investigators in tracking foreign payments. Even the Washington Post has belatedly published an editorial admitting that this is all a serious concern over influence peddling. In an editorial titled “Millions flowed to Biden family members. Don’t pretend it doesn’t matter.”

It was a bittersweet moment for many of us who have been writing about these dealings for years as newspapers like the Post downplayed the scandal or the authenticity of the laptop. Media outlets like National Public Radio (NPR) declared NPR declared that it “not want to waste our time on stories that are not really stories, and we don’t want to waste the listeners’ and readers’ time on stories that are just pure distractions.” These disclosures have been forced into the public despite the best efforts of the Post and other media. Indeed, recently the Post’s Philip Bump derided the House investigation as a “fishing expedition . . . it’s nearly all innuendo, a big corkboard with lots of pictures but little interconnecting string.” His “witchhunt” attack was then repeated by others at the Post.

Despite these efforts, Hunter Biden appears to going his level best to force the issue in Arkansas. It is not clear if the court will call any of these witnesses. However, since Hunter has put his finances at issue, some disclosures will need to be made. As for Navy, she is still uncertain if the court will allow her to use the Biden name despite her father’s efforts to the contrary. While it does not appear that Hunter (who lives in a California mansion) is financially broke, his actions (and those of the President and First Lady) toward this little girl show a moral deficit and delinquency that is abundantly obvious.

MAGA?!

• White House Blasts GOP Over Debt Ceiling Talks (RT)

The White House has hit out at a Republican congressional leadership it says has become increasingly beholden to fringe ‘MAGA’ elements for obstructing talks designed to raise the US debt ceiling and avoid putting the country into default for the first time in its history. In a statement posted to the White House website on Saturday, a spokesperson for the administration of President Joe Biden described a deal offered by House Speaker Kevin McCarthy on Friday as a “big step back” and said that it contained a set of “extreme partisan demands.” “The President has over and over again put deficit reduction proposals on the table, from limits on spending to cuts to Big Pharma profits to closing loopholes for oil and gas,” the statement from White House Press Secretary Karine Jean-Pierre said.

“It is only a Republican leadership beholden to its MAGA wing – not the President or Democratic leadership – who are threatening to put our nation into default.” The proposal offered by McCarthy on Friday included significant cuts to domestic programs while increasing defense spending. It also imposed work requirements on some aid programs, while making it more difficult for states to waive work requirements for people in areas of high unemployment who rely on federal food assistance. The GOP deal also refuses Democratic requests to increase tax revenue to help pay for future budget deficits. “I’m not going to agree to a deal that protects wealthy tax cheats and crypto traders while putting food assistance at risk for nearly one million people,” Biden said on Sunday in comments delivered from Hiroshima, Japan, where he was attending the G7 summit.

Biden also accused Republicans of engaging in political theater in their handling of the negotiations to extend the debt ceiling. “I think there are some MAGA Republicans in the House who know the damage this would do to the economy, and because I am president, and the president’s responsible for everything, Biden would take the blame,” he said. Unless an accord is struck, the Treasury Department has indicated that the US could default on its $31.4 trillion debt as early as June 1. This would lead to a scenario where Washington is unable to borrow more money or pay all of its bills.

“The idea hinges on a phrase in the 14th Amendment that says the public debt “shall not be questioned,” which proponents of the idea argue means the president could unilaterally continue to issue debt..”

• Biden Thinks He Has Authority To Use 14th Amendment On Debt Ceiling (Hill)

President Biden on Sunday said he believes he has the authority to use the 14th Amendment to unilaterally address the debt ceiling, but he acknowledged potential legal challenges could still lead the nation to default if he went that route. “I’m looking at the 14th Amendment as to whether or not we have the authority — I think we have the authority,” Biden told reporters at a press conference in Hiroshima, Japan. “The question is, could it be done and invoked in time that it would not be appealed, and as a consequence past the date in question and still default on the debt. That is a question that I think is unresolved.”

Biden added that all four congressional leaders said in a recent White House meeting that they agreed the nation would not default, signaling that he hoped talk of the 14th Amendment would ultimately not be necessary. “So I’m assuming that we mean what we say and we’ll figure out a way to not have to default,” Biden said. Sunday’s remarks were Biden’s strongest to date on the 14th Amendment, which has been a point of debate among legal experts and administration officials as the U.S. gets closer to the risk of default. The Treasury Department has warned the U.S. could default as early as June 1 if no action is taken to raise the debt ceiling.

The idea hinges on a phrase in the 14th Amendment that says the public debt “shall not be questioned,” which proponents of the idea argue means the president could unilaterally continue to issue debt if Congress does not act. Biden earlier this month said he had been “considering” the 14th Amendment as a way to unilaterally work around the debt ceiling, but he acknowledged that it would not be a viable short-term solution. Treasury Secretary Janet Yellen previously warned that using the 14th Amendment could trigger a “constitutional crisis,” calling it “one of the not good options” if Congress failed to act.

“This is happening now because the USA today no longer manufactures and/or renders anywhere remotely near enough products or services..”

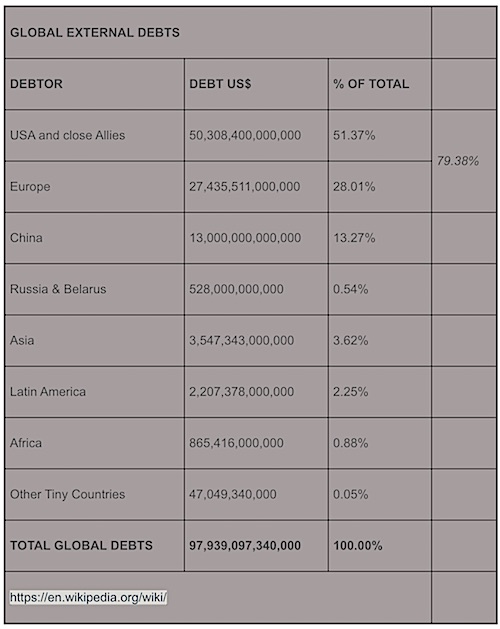

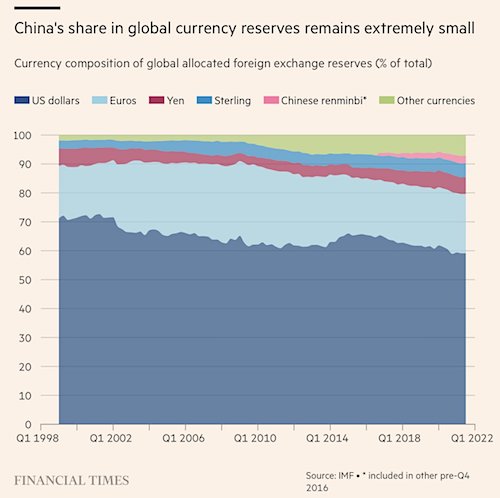

• DE-Dollarization Made Simple -Even For Millennials (Vilches)

Dollars are just failing I.O.U´s (more on that later) issued by the US which until today were still exchangeable for (1) goods and/or (2) services and/or (3) payment of debts the three of which could be either of US origin (that´s okay) or also from elsewhere (that´s NOT okay). In a nutshell, that´s what the current DE-dollarization process is all about, which translated means that US dollars will progressively be dumped onto the US economy´s front lawn as time goes by leading to an unstoppable hyperinflationary process. So, as we speak, many commercially and industrially, and technologically important economies (actually essential for the world and individual countries) have decided that transactions amongst themselves should be paid for in something different from US dollars as the USA is not involved in any part of such process.

Why would Argentina or Brazil export their grains to China payable in US dollars rather than Yuans while both need tons of Yuans to pay for Chinese imports? Accordingly, Saudis now allow China to pay for their oil in Yuans. So with growing impetus, many countries are now paying – and planning to pay in increasing quantities — for transactions amongst themselves with their own currencies and/or physical gold bullion which thru 6000 years of history has clearly proved that it has long-lasting intrinsic value in and of itself as accumulated labor duly acknowledged by third parties. So bullion´s role would be to compensate for the differences in the exchanging BRICS+ currencies used to settle import-export balances between non-US trading partners. BTW, the Central Bank of China does not waste any time reducing its exposure to US Treasuries now lowest since early 2010 and getting lower by the hour.

Since 2018 Russia holds practically 0 (zero) US Treasuries. This is happening now because the USA today no longer manufactures and/or renders anywhere remotely near enough products or services to cancel the humongous amount of IOU dollars already issued with total impunity. An “exorbitant privilege“ per former French President Valery Giscard d’Estaing´s brilliant definition many decades ago. The US deal is “you work hard as hell and we´ll just print” follow? You raise cattle till cows are fat and healthy enough to export us your beef – meaning years of investments and hard labor – and we´ll just copy-paste some more pretty Benjamins and hand them over to you in exchange, okay? Please be advised in case you didn´t notice that Walmart today does not carry “Made in USA” goods because everything now is most efficiently manufactured somewhere else.

Ruling center-right won the Greek elections yesterday. They can now continue to sell off the country.

• Greece’s Debt Is More Unsustainable Than Ever (Varoufakis)

Greece is deeper in the hole of insolvency today than it was in 2010, when the whole world of finance — the International Monetary Fund, the European Central Bank, and the European Commission — said we were bankrupt. Back then, our debt was something like €295 billion and our income €220 billion, whereas today the debt is €400 billion and our national income, in real terms, €192 billion. Most of our debt is owed to the troika and to foreign investors. So, our dependence on the kindness of strangers is greater than ever. Greece’s population today has, on average, 20 percent lower living standards than in 2010; if you look at the working class, the reduction of GDP per capita is 45 percent. As for private sector debt, around two million out of ten million Greeks have negative equity and nonperforming loans.

It’s a world record: it didn’t even happen in the US in 2008–09, during the subprime mortgages crisis. But how come I acknowledge that from the perspective of foreign investors, Greece is doing better than any other country? Well, government bonds are trading at 3.6 to 3.7 percent yields — a very nice spread over German ones at 2.2 to 2.3 percent. Everyone knows that the Greek state is bankrupt and the bonds are junk. So, why do they buy them? The European Central Bank (ECB) has announced that it will back Greek bonds. It’s a political decision to declare Greece solvent, just as it was a political decision to declare it insolvent in 2010. Christine Lagarde and her minions are making a nod and a wink to investors.

Why is the ECB standing behind bonds, when it didn’t in 2012 or 2015? Recent years saw a world first, a mechanism for extracting wealth from the bankrupt. The powers that be have instituted the so-called Hercules plan, taking bonds off the books of banks and selling them to vulture funds based in the Cayman Islands. They belong partly to foreign investors, partly to people who run the Greek banks, partly to the extended families of the political class. They can, for instance, buy a nonperforming loan of €100,000 but for just €3,000. They don’t expect to get the money back; but if they can sell the collateral for €50,000 they have extracted €47,000 in rent to the Caymans without paying a cent in tax. This can extract around €70 billion from a sub-€200-billion-a-year economy.

So, it may sound like a paradox that the financial press is hailing an economy whose public and private sectors are more bankrupt than ever. But seeing the gains foreign investors can draw from this situation, it is no paradox. Greece is a goose laying golden eggs: such profit rates don’t exist anywhere else. To boot, this Hercules scheme, passed by the Greek parliament, guarantees a minimum of €23 billion. The Greek state — and thus the ECB itself — stands behind the vultures’ interests, if they don’t manage to extract enough in dispossessions.

Anne Heche

https://twitter.com/i/status/1660121425846435840

Thai ducks

Farmers in Thailand use armies of thousands of ducks to eat their way through rice paddies after a harvest.

This method of farming is not only beneficial to the environment but can also increase crop yield

[read more: https://t.co/wcsjLisyaF]pic.twitter.com/dfLkPqVeya

— Massimo (@Rainmaker1973) May 21, 2023

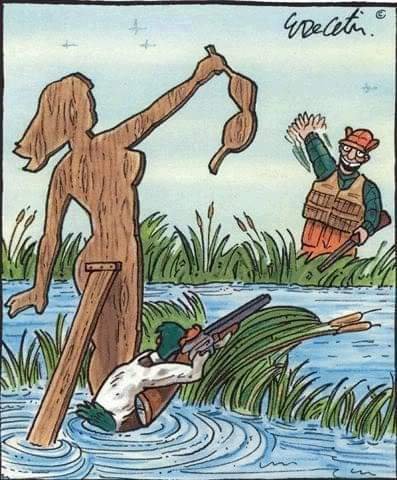

The revenge of the duck

How?

https://twitter.com/i/status/1660258993573359617

Ibex

Gravity causes bodies on Earth to fall towards the ground; however, the alpine ibex seem it doesn't care at all

Its herbivorous diet is lacking in calcium salt, so it typically climbs dams' steep walls to reach deposits of mineral salts from the stonespic.twitter.com/9OHpNOA1CU

— Massimo (@Rainmaker1973) May 21, 2023

Cheetah

https://twitter.com/i/status/1660009782349111296

Lunch

Lunch timeeee pic.twitter.com/bY9WYXRET5

— The Best (@Figensport) May 21, 2023

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.