Jan van Eyck Crucifixion and Last Judgement 1430

It’s so easy to confuse me…

Peltz Musk

Activist investor Nelson Peltz on @elonmusk: “Can I tell you something? Elon is friend of mine. I think the world of him. This guy has no ego. That may be hard for you to believe, but having spent the amount of time i have with Elon, he’s willing to listen to anybody; His ideas… pic.twitter.com/dfvedDWXnW

— Sawyer Merritt (@SawyerMerritt) April 4, 2024

Galloway Escobar

What a huge pleasure to be back with George on MOATS.

A very serious discussion.

George is the Prime Minister of us all. pic.twitter.com/Fjh8yFvyN3

— Pepe Escobar (@RealPepeEscobar) April 4, 2024

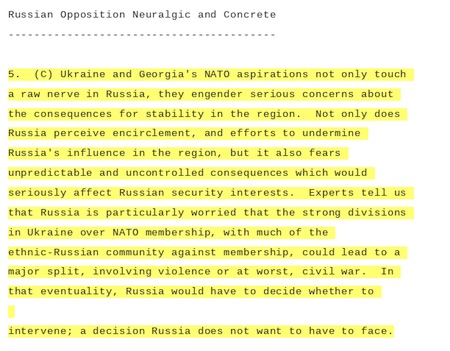

WikiLeaks Ukraine Cable from 2008 written by CIA director William J. Burns, then US ambassador to Moscow

Macgregor

Col. Douglas Macgregor: Netanyahu must escalate to survive. If he drags the US into this we’ll end up fighting Russia directly. Most of the US political class is bought and paid for by the Israeli lobby. Hatred has taken over Israel. Iranians don’t want a war. This is the end of… pic.twitter.com/ECoQnrCtkB

— 🅰pocalypsis 🅰pocalypseos 🇷🇺 🇨🇳 🅉 (@apocalypseos) April 4, 2024

CNN

This is my all-time favorite 30-second ad from CNN. Be sure to watch the ENTIRE 30 seconds to see why I like it. There is a surprise ending. pic.twitter.com/ajLJDFUs8K

— Steve Kirsch (@stkirsch) April 3, 2024

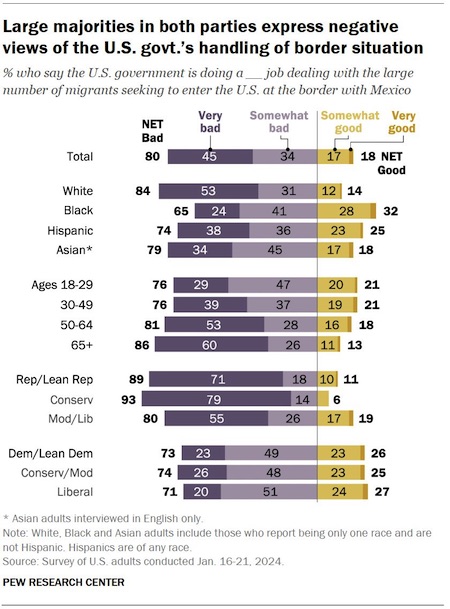

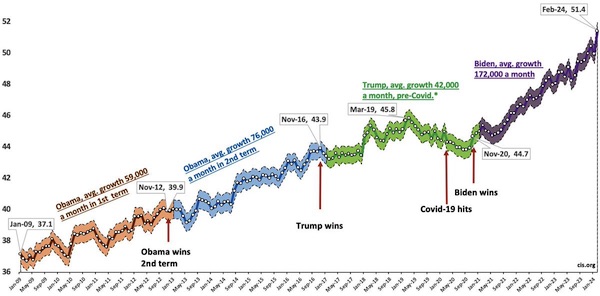

Foreign-born population growth:

Barack Obama: 68,000 per month

Donald Trump: 42,000 per month

Joe Biden: 172,000 per month

Trump UN

https://twitter.com/i/status/1700360281698791655

Obama

As they try to throw Trump in jail, flashback to 2005 when a known Chicago gangster helped Obama buy his first house.

A Senator for only a few months, who according to his own words, was broke and saddled with student debt at the time, Obama was able to buy a 2 million dollar… pic.twitter.com/WwoOcupSlY

— MAZE (@mazemoore) April 3, 2024

Elon Musk: “Bet you didn’t know that this administration is flying hundreds of thousands of illegals into America using your tax dollars …”

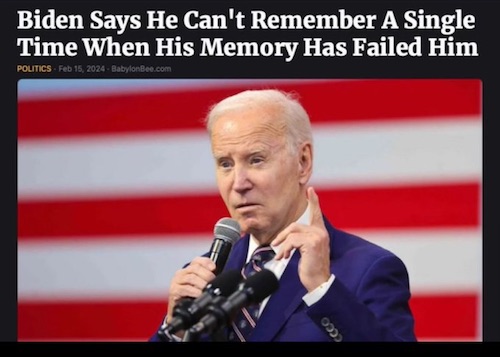

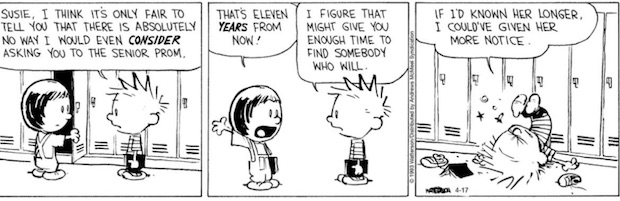

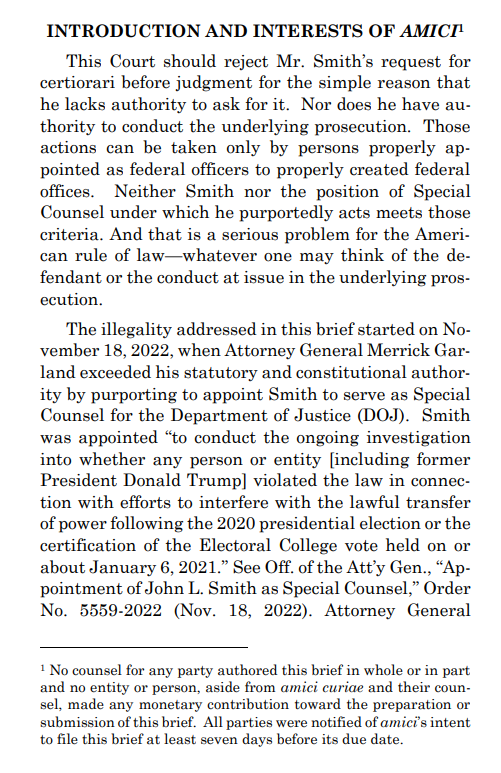

A judge who confuses the case beforee him with a parallel case? Seems a very strange mistake.

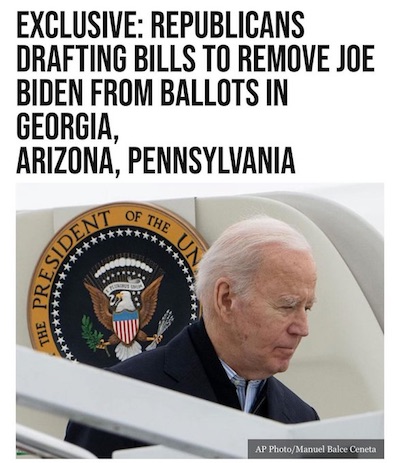

• New York Judge Calls Trump Jan. 6 Case ‘Federal Insurrection Matter’ (ET)

On April 3, New York Supreme Court Justice Juan Merchan denied a defense motion to adjourn the upcoming trial scheduled for April 15, and in his order, referred to former President Donald Trump’s case before the Supreme Court as the “Federal Insurrection Matter.” “Defendant fully briefed the issue of presidential immunity in his motion to dismiss the matter of United States v. Trump, US Dist Ct, DDC 23 CR 25, (TSC) (hereinafter “Federal Insurrection Matter”) on October 5, 2023,” Justice Merchan wrote. Justice Merchan is presiding over one of four criminal cases against President Trump. This one is a state case, where Manhattan District Attorney Alvin Bragg has charged President Trump with 34 counts of falsifying business records, alleging a scheme to influence the 2016 elections. The other case in question charges President Trump with four counts of obstruction and conspiracy for his acts on Jan. 6, 2021, but it does not allege insurrection in the indictment.

Special counsel Jack Smith is prosecuting the case in the U.S. District Court for the District of Columbia, and trial proceedings have been stayed as President Trump pursues an appeal on grounds of presidential immunity. Counsel for President Trump in the Manhattan case brought the federal case up recently in requesting that the trial be delayed, arguing that the presidential immunity they raised in state court will soon be under review by the U.S. Supreme Court. On April 25, the Supreme Court will hear oral arguments on “whether and if so to what extent does a former President enjoy presidential immunity from criminal prosecution for conduct alleged to involve official acts during his tenure in office.” The presidential immunity defense is one President Trump has raised in several of his cases, and attorneys in other cases have requested additional hearings and delays in anticipation of a Supreme Court decision. It is unclear why Justice Merchan would use the “insurrection” as shorthand for the federal case.

The only appearance of the word “insurrection” is in a quote in response to an attorney saying there would be “riots everywhere” if President Trump remained in office. In response, one of the unnamed co-conspirators tells him, “Well, [Deputy White House Counsel], that’s why there’s an Insurrection Act.” Separately, critics of President Trump have colloquially referred to the events of Jan. 6, 2021, as an “insurrection,” resulting in a wave of almost 100 state-level lawsuits to disqualify him from the ballot over the past half year. Earlier this year, the Supreme Court heard another case involving President Trump and ruled that states have no authority to disqualify a federal candidate in elections. However, it would be unlikely that the judge confused the two cases, as President Trump did not argue presidential immunity in the ballot disqualification case, and the Supreme Court issued a ruling ending the challenges on March 4. Defense attorneys in the Manhattan case are also renewing requests that the judge step down, arguing that he has shown partisan interest.

Last August, Justice Merchan rejected an initial motion for recusal. He stated that his small-dollar donations to President Trump’s political opponents and his daughter’s employment at a marketing firm, which has received millions from those campaigning against President Trump, would not affect his ability to try the case impartially. However, Justice Merchan recently broadened a gag order to prevent President Trump from discussing the judge’s family members. The move follows President Trump’s renewed grievances about the judge’s daughter helping to campaign for politicians such as Vice President Kamala Harris and Rep. Adam Schiff (D-Calif.). Defense attorneys made another request that the judge recuse himself on April 1, arguing that the judge’s family has commercial interests that “are benefitted by developments in this case that harm President Trump’s penal interests.”

I was wondering if, like Fani and her boytoy, the judges in various Trump cases have also had 8-hour sessions at the White House. How would we ever find out?

• Judge Denies Trump First Amendment Challenge to Georgia Election Charges (ET)

Fulton County Superior Court Judge Scott McAfee has denied former President Donald Trump’s motion to dismiss charges under the First Amendment, noting that the way the challenge was brought limited the arguments that could be made. “Without foreclosing the ability to raise similar as-applied challenges at the appropriate time after the establishment of a factual record, the Defendants’ motions based on First Amendment grounds are denied,” the judge wrote in an April 4 order. President Trump is being charged along with 14 others of violating Georgia’s Racketeer Influenced and Corrupt Organizations (RICO) Act for their actions in challenging the 2020 election results. He had brought a First Amendment as-applied challenge, arguing that everything he said listed in the indictment was protected by the First Amendment.

The defense also touched on making a First Amendment facial challenge, arguing that the charges were overly broad and the statutes may be unconstitutional. But when such a challenge is made before trial, the only record of facts that can be used is the indictment itself. The allegations must be accepted as fact at this stage. Much of President Trump’s speech is cited as part of the RICO charge, in which legal acts and truthful speech can be listed in order to show that an “operation” was in place, prosecutors explained. The First Amendment does not protect speech “integral to criminal conduct, fraud, or speech presenting an imminent threat that the government can prevent,” the judge wrote. Political speech is protected, as is communication to government officials, but protection “does not extend to allegedly fraudulent petitions,” the judge wrote. In the indictment, prosecutors allege all included speech was tied to criminal conduct and the furtherance of a conspiracy.

Defense attorney Steve Sadow argued that President Trump’s speech could not be prosecuted for falsity, and argued that courts have recognized that even false speech must be protected, as free debate cannot be free from error. However, the judge found that prosecutors did not bring charges because the speech was “false” but because President Trump allegedly “knowingly” and “willfully” acted in a way that “impacted matters of governmental concern.” As for proving out that intent, that was a matter for trial, he added. “The allegations that the Defendants’ speech or conduct was carried out with criminal intent are something only a jury can resolve,” the order reads.

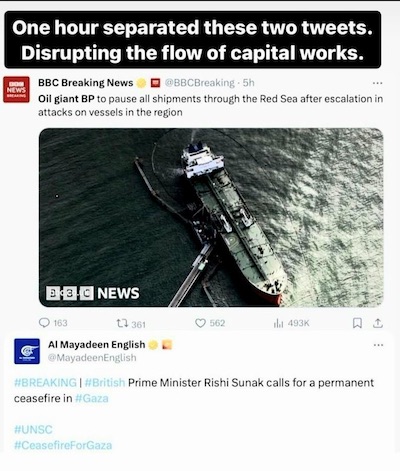

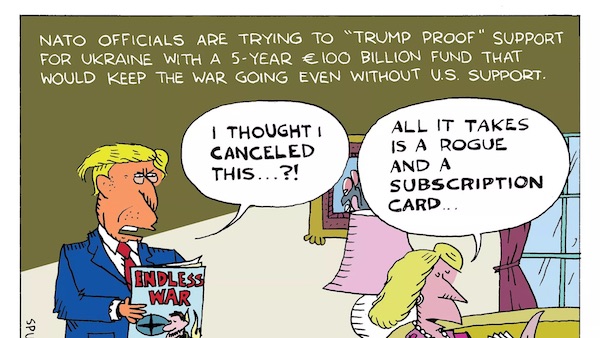

“The US has used the group to funnel tens of billions of dollars in weapons and other equipment to Ukraine. But NATO may bring the group under its control should Ukraine lose US support..”

• The Trump-Proofing Checklist (Manley)

Mainstream media has dubbed a new proposal a way to “Trump-proof” aid for Ukraine. Some foreign ministers, however, have made it clear that any funding that moves NATO closer to war will not be supported. NATO foreign ministers met Wednesday to discuss a proposal by NATO chief Jens Stoltenberg for a €100 billion ($108 billion) five-year fund for Ukraine. The move comes as Europe fears the return of a Donald Trump presidency. The former US president has said he will not aid Ukraine in their conflict with Russia if he is elected, according to Hungarian Prime Minister Viktor Orban. “What is obvious is that we need new and more money for Ukraine. And we need it over many years. And the whole idea of now discussing a framework, commitments and an institutionalized framework, for the support is to ensure more predictability and more confidence that the money will come every month, every year for the long haul,” said Stoltenberg before the meeting.

The Ukraine Defense Contact Group was first created in the early weeks of the conflict by US Defense Secretary Lloyd Austin and then-Joint Chiefs Chair General Mark Milley. The US has used the group to funnel tens of billions of dollars in weapons and other equipment to Ukraine. But NATO may bring the group under its control should Ukraine lose US support. “We need to shift the dynamics of our support,” Stoltenberg said. “We must ensure reliable and predictable security assistance to Ukraine for the long haul… less on short-term offers and more on multi-year pledges.” But foreign ministers have reportedly warned that putting together such a fund would not be easy. Hungarian Foreign Minister Peter Szijjarto “firmly stated Hungary will not back any [NATO] proposals that might draw the alliance closer to war or shift it from a defensive to an offensive coalition,” government spokesman Zoltan Kovacs said on X.

Spanish Foreign Minister Jose Manuel Albares said he and others warned against duplicating efforts between bilateral, European Union and NATO aid. In early March, former President Donald Trump met with Hungarian Prime Minister Viktor Orban. According to Orban, Trump will “not give a penny into the Ukraine-Russia war and therefore the war will end” as its “obvious that Ukraine on its own cannot stand on its feet.” Stoltenberg concluded at the end of the summit that NATO will make its final decision in July. A consensus between its 32 members will be required before they can move forward with such a decision. As NATO marks its 75th anniversary this week, Russia has accused the military alliance of returning to a Cold War mindset. Late last year, US legislators passed a law requiring congressional approval should any US president attempt to pull the country out of NATO.

Note that he doesn’t say when.

• Ukraine ‘Will Become a Member of NATO’ – Blinken (RT)

US Secretary of State Antony Blinken has capped a meeting of NATO diplomats by doubling down on an issue that helped trigger the Russia-Ukraine conflict: allowing Kiev to join the Western military alliance. “Ukraine will become a member of NATO,” Blinken told reporters on Thursday in Brussels. “Our purpose at the summit is to help build a bridge to that membership and to create a clear pathway for Ukraine moving forward.” Blinken made his comments as NATO foreign ministers completed a two-day meeting to rally more international support for Kiev. He spoke at a press briefing alongside Ukrainian Foreign Minister Dmitry Kuleba, who argued that Ukraine “deserves to be a member of NATO.” The Ukrainian diplomat added, “This should happen sooner rather than later.”

Russian President Vladimir Putin has warned for the better part of two decades that NATO’s eastward expansion undermines Russian national security and that moving the bloc’s forces into Ukraine would cross a “red line.” NATO-Russia relations have deteriorated so much amid the current Ukraine crisis that the alliance is now in “direct confrontation” with Moscow, Kremlin spokesman Dmitry Peskov said on Thursday. The determination of NATO members to back Ukraine remains “rock solid,” Blinken said at Thursday’s press briefing. “We will do everything we can; allies will do everything that they can to ensure that Ukraine has what it needs to continue to deal with Russia’s ongoing aggression.” The top US diplomat also urged Congress to approve $60 billion in additional aid to Ukraine. The proposal has been stalled by rising opposition from Republican lawmakers since last fall. The administration of US President Joe Biden has already burned through $113 billion in previously approved Ukraine funding.

US Representative Marjorie Taylor Greene said in an interview on Wednesday that the latest aid bill is likely headed for passage when Congress goes back into session next week. The Georgia Republican argued that Washington’s escalating “proxy war” in Ukraine is making Americans less safe and pushing the world closer to World War III. Reacting to Blinken’s statement on Thursday, Greene reminded her 3.2 million followers on X (formerly Twitter) that under the NATO charter, an attack on one member is considered an attack on all. “Making Ukraine a member of NATO means that the US will be going to war against Russia, as mandated by Article 5,” she wrote.

Blinken says that Ukraine will be joining NATO. Under Article 5, this means that an attack on Ukraine will be considered an attack on the United States. If you want World War 3, vote Biden in November. pic.twitter.com/kv0fyv5zdf

— David Sacks (@DavidSacks) April 4, 2024

“We could exit this tragedy by reaching out to Russia to negotiate a new inclusive European security architecture devoted to reducing security competition instead of imposing hegemony..”

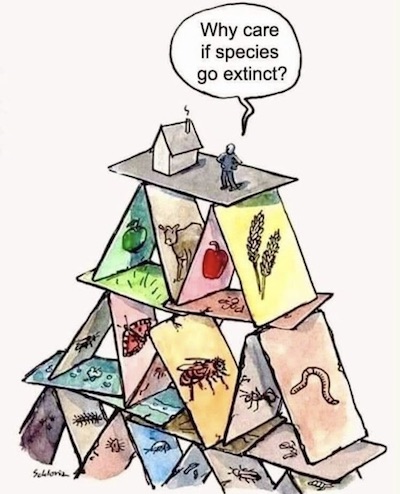

• NATO Exists To Respond To The Conflicts Caused By Its Own Existence (Sp.)

Exactly 75 years ago, the North Atlantic Treaty Organization was founded by the US, Canada, and several Western European nations, with the main aim of deterring and confronting the USSR, their former Second World War ally. After the Soviet Union’s collapse in December 1991, the conditions for a new inclusive security architecture in Europe and beyond emerged, according to Glenn Diesen, professor of international relations at the University of South-Eastern Norway. “After the Cold War, we developed the format for a new inclusive security system,” Diesen told Sputnik. “The Charter of Paris for a New Europe in 1990 and the establishment of the Organization for Security and Cooperation in Europe (OSCE) in 1994 were both based on the [1975] Helsinki Accords, and embraced the principles of sovereign equality, indivisible security, and ending the dividing lines in Europe.”

The Helsinki Accords, signed during the Cold War by the US, Soviet Union, and several European countries, led to greater cooperation between Eastern and Western Europe. Even though the agreements weren’t binding, they significantly contributed to the détente between the East and West. Instead of building on that momentum, the US saw the end of the Cold War as the beginning of its unipolar moment, according to the professor: in 1992, George H.W. Bush proudly declared that the US had “won” the Cold War during his State of the Union address. “The US also developed a security strategy based on hegemony, which required expanding NATO and thus cancelling the pan-European security architecture,” Diesen said. “NATO therefore transitioned from a status quo power to a revisionist power. NATO required a new purpose, which became ‘out-of-area’ military interventionism and expansionism.”

The next 30 years saw a string of NATO overseas military campaigns, neither of which has seen a comprehensive resolution, resulting in the creation of hotbeds of instability instead. “During the 1990s, NATO turned from a conceptually defensive organization into an openly aggressive organization when it entered the Yugoslav wars and waged a massive bombing campaign there,” Gilbert Doctorow, an international relations and Russian affairs analyst, told Sputnik. “More generally, the United States was at this time preparing NATO to move out of its core geography in Europe and to assist US plans for global domination in the Middle East in the succession of regime change operations and open invasions that the United States planned and led.” Doctorow highlighted that these “out-of-region NATO operations were one disaster after another, ending in the withdrawal from Afghanistan after participation in a 20-year-long war directed by Washington.”

Meanwhile, the alliance’s seven waves of post-Cold War eastward expansion accelerated tensions in Europe, according to the Norwegian academic. “Reviving the bloc approach to security and competing over where to draw the new dividing lines has been the primary source of conflicts in Europe for the past three decades and eventually resulted in the Ukraine war,” Diesen said. The academic pointed out that “by going along with NATO expansionism, the Europeans allowed their continent to be re-divided and remilitarized, which has predictably doomed Europe to greater irrelevance.” He projected that Europe “will undergo systemic economic decline and become painfully subordinated to the US.” “We could exit this tragedy by reaching out to Russia to negotiate a new inclusive European security architecture devoted to reducing security competition instead of imposing hegemony,” the professor emphasized.

NATO exists to respond to the conflicts caused by its own existence,” Diesen explained. “The problem now is that NATO is returning to great power conflicts with the same disastrous approach to security, based on hegemony rather than mitigating security competition.” Despite the Western mainstream media claims that the North Atlantic Alliance is united like never before amid the Ukrainian conflict, it is in fact not true, according to the professor. “There are great tensions within NATO that simmers below the surface, and I do not think the hatred of Russia is enough to ensure unity after the war is over,” he said.

Tucker Ukr

Tucker Carlson: Ukraine cannot win

“The population of Ukraine has been decimated. Hundreds of thousands of Ukrainians have died, and the country itself is a mess. It's been wrecked, as countries are in war,” he said during an introductory monologue on his show.

“Russia is a… pic.twitter.com/YCbT77jmCC

— Zlatti71 (@djuric_zlatko) April 4, 2024

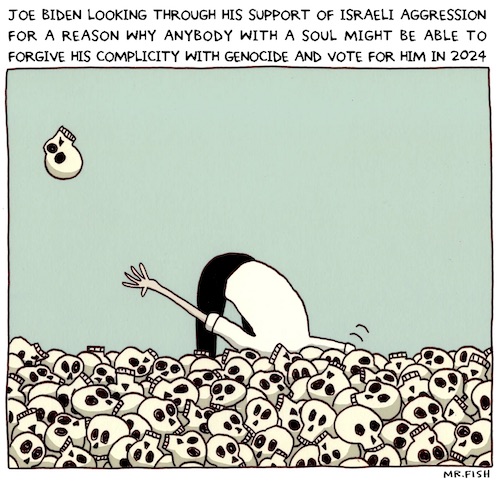

“..classic tail-wags-the-dog situation..”

• Enlargement Made NATO Hostage to Agenda Pushed by Eastern Europe (Sp.)

The decades-long NATO expansion to all of Central and Eastern Europe has turned the United States into a hostage of the agenda pursued by Eastern European allies in a classic case of “tail-wags-the-dog,” James Carden, former adviser to the US-Russia Bilateral Presidential Commission at the Department of State, told Sputnik. The United States together with 31 other NATO members is celebrating the alliance’s 75th anniversary this week. “NATO expansion has turned what once arguably (pre-March 1953) could have been called a defensive alliance into a (post-1992) classic tail-wags-the-dog situation,” Carden said. That has resulted in the former Soviet and Warsaw Pact states “pushing their parochial agenda on the United States,” he said. “Not a good state of affairs but here we are,” Carden concluded.

Even at the height of the Cold War, and a quarter century before the peaceful disintegration of the Soviet Union, NATO’s tendencies to over-extend itself to the east and become a tool for the continued US domination and micro-management of Europe had been noted by the great, visionary French statesman President Charles de Gaulle, Carden pointed out. “Over-extension is the core issue, identified early on by no less a statesman than de Gaulle, who intuitively understood that the opening of the European Economic Community (ECC) to the United Kingdom (UK) would introduce an American Trojan horse into the most sensitive issues of European economic affairs,” he said.

For years, Moscow has objected to NATO’s continued expansion and military buildup near Russian borders. Ukraine’s plans to join the bloc were among the reasons why Russia launched its special military operation in February 2022, President Vladimir Putin said. In response to the latest NATO enlargement, Russia will station its troops and strike systems near the borders of Finland and Sweden, Putin said in a March interview with Rossiya Segodnya Director General Dmitry Kiselev for the Rossiya 1 broadcaster and RIA Novosti.

“NATO continues to fulfill its purpose, which currently, however, in no way contributes to security, predictability and stability on the continent, but on the contrary is a destabilizing factor..”

• Russia and NATO Already In ‘Direct Confrontation’ – Kremlin (RT)

The current state of relations between Russia and NATO can be described as a “direct confrontation,” Kremlin spokesman Dmitry Peskov has said. He claimed that the US-led military bloc has been a destabilizing force in Europe rather than ensuring the continent’s security. He made his comment on Thursday, as the bloc marked 75 years since the signing of its founding document, the North Atlantic Treaty. Since the start of the Ukraine conflict, NATO has provided Kiev with billions worth of military aid and weaponry, as well as sharing intelligence and helping to train Ukrainian troops. “The bloc itself is already involved in the Ukraine conflict. NATO continues to move towards our borders, expanding its military infrastructure towards our borders… In fact, our relations have now descended to the level of direct confrontation,” Peskov said at a press-briefing.

He stated that the organization had been created as an “instrument of confrontation” in Europe, and is fulfilling its purpose to the detriment of the entire continent. “NATO continues to fulfill its purpose, which currently, however, in no way contributes to security, predictability and stability on the continent, but on the contrary is a destabilizing factor,” Peskov explained. Multiple Western leaders have warned that Russia may attack NATO once the Ukraine conflict is over. Moscow has repeatedly dismissed those claims. Russian President Vladimir Putin said last month that talk of a potential Russian attack on NATO countries is simply propaganda by their governments aimed at scaring their own population to “beat the money out of them.”

Moscow has for years voiced concerns about NATO’s expansion toward its borders, viewing the US-led military bloc’s policies as an existential threat. However, it has also warned that NATO’s more pronounced involvement in the Ukraine conflict, in particular, the possibility of a troop deployment to the front lines, would be seen as an intervention. This, according to an earlier statement by Putin, would take the conflict “one step shy of a full-scale World War III.”

“Now they want to turn voluntary military assistance to Ukraine within NATO into mandatory military assistance..”

• Lavrov Says Obvious That Ukraine Involved in Terrorist Attack in Crocus (Sp.)

It is obvious that Ukraine was involved in the terrorist attack in the Crocus City Hall concert venue on March 22, Russian Foreign Minister Sergey Lavrov said on Thursday. “This terrorist attack, as you know, is now being actively investigated by the Investigative Committee and the Prosecutor General’s Office, other competent authorities. It is already obvious … that there was a Ukrainian trace, especially since Ukraine’s involvement in many other terrorist attacks on Russian territory is no longer in doubt,” Lavrov said at the round table with ambassadors of over 70 countries dedicated to the Ukrainian crisis. On March 22, several armed men broke into Crocus City Hall and started shooting at people. They also started a fire in one of the auditoriums, which was full of people ahead of a concert. The attack left 695 casualties, including 144 dead, according to the latest data from the Russian Emergencies Ministry.

The four main suspects in the case — all of them citizens of Tajikistan — tried to flee the scene in a car but were detained and charged with terrorism. Russian authorities believe their plan was to flee to Ukraine, where the masterminds of the attack had arranged a safe haven for them. An investigation is underway. Providing aid to Ukraine is planned to be made obligatory for NATO members, Lavrov added. “Now they want to turn voluntary military assistance to Ukraine within NATO into mandatory military assistance. To force all NATO members through strict discipline to sign up for the mandatory provision of funding and weapons to the Kiev regime,” Lavrov said at the round table with ambassadors of over 70 countries dedicated to the Ukrainian crisis.

A hard habit for them to break:

“Russia is not a pariah,” Blinken stated, and “the idea has never been to exclude [it]..”

• ‘Stop Lying,’ Russia Tells US (RT)

The US mantra that Russia must change its behavior to improve relations with the West disregards the fact that Washington has for years willfully ignored Moscow’s core interests, Russian Ambassador Anatoly Antonov has said. Moscow’s envoy was responding to comments by US Secretary of State Antony Blinken who told French broadcaster LCI on Tuesday that he did not rule out a possible meeting between President Joe Biden and his Russian counterpart, Vladimir Putin, despite the current standoff over Ukraine.“Russia is not a pariah,” Blinken stated, and “the idea has never been to exclude [it],” while insisting that Moscow is responsible for the current rift with the West. “If policy changes, we don’t rule anything out. The problem is that we don’t have any proof, for the moment, that policy is changing.” It was not Moscow that “moved its war machine to NATO’s borders” and spearheaded unprecedented economic and personal sanctions, Antonov added.

“Everything that is happening now is the exclusive choice of the West, which has trampled on the basics of diplomacy, the principle of indivisibility of security and has been abusing the trust of the Russian Federation for many years,” the envoy claimed. For relations to improve, Western countries “should abandon illusions about the possibility of inflicting a strategic defeat” on Russia and learn to respect other nations’ interests, the ambassador stated, adding that Moscow does not accept “attempts at dictatorship” and the US desire to impose its values on others. President Putin said in December that Moscow is open to improving relations with the US, but that this process depends on fundamental changes in Washington’s policies and a desire to seek compromise. Russia has for years voiced concern about NATO’s expansion toward its borders, viewing the US-led military bloc’s policies as an existential threat. Putin, however, has repeatedly said Moscow has no plans to attack NATO.

“..the Center for Countering Disinformation (CCD), stated on Tuesday that Moscow “does not have resources” for a major push forward..”

• Kiev’s Backers Fear Frontline Breach – Media (RT)

There are growing concerns both in Ukraine and among its Western backers that an expected Russian offensive this summer could break through the country’s defenses, Western media have reported. Kiev has been complaining for months that a shortage of weapons from the West has put it at a massive disadvantage on the battlefield against Moscow. President Vladimir Zelensky told the Washington Post last week that his forces may have to retreat further to reduce the length of the front line and the amount of munitions and men needed to hold it. “If [the line] breaks, the Russians could go to the big cities,” he warned. Bloomberg reported on Wednesday that the ratio of artillery shells fired by Russia compared to Ukraine has increased from 3:1 to 7:1 since the beginning of the year.

Sources told the outlet that concerned foreign donors intend to improve the ratio to 7:3, as Western-donated weapon systems are supposedly superior to Russia’s. An even gloomier prediction came from Ukrainian military officials, who spoke to Politico on condition of anonymity, and warned that the front line may collapse. Russia’s advantage in weapons and manpower means that it will likely be able to “penetrate the front line and to crash it in some parts,” one of the officers said on Wednesday. “There’s nothing that can help Ukraine now because there are no serious technologies able to compensate Ukraine for the large mass of troops Russia is likely to hurl at us,” a top military leader said. The warning came from officers who served under Valery Zaluzhny, who was the commander of the Ukrainian Armed Forces until Zelensky replaced him in early February.

Prior to that, the pair had clashed publicly over whether the hostilities with Russia had reached a stalemate, which was the general’s assessment. The officers cautioned against underestimating Russia’s ability to adapt and counter new military capabilities provided by the West to Ukraine. They “are always studying. They don’t give us a second chance. And they’re successful in this,” one of them said. Even now, Russian forces are laying the groundwork for engaging F-16 fighter jets, which Kiev is expected to eventually deploy, the report said. Domestically, the Ukrainian government has been downplaying the risks that a Russian offensive would pose. Its information warfare service, the Center for Countering Disinformation (CCD), stated on Tuesday that Moscow “does not have resources” for a major push forward.

“..You simply do not buy the debt of your enemy. Central banks are buying gold because the USD is political..”

• Why Are Central Banks Buying Gold? (Martin Armstrong)

Investors’ curiosity has peaked as central banks are increasing their gold purchases. We are not going back to a Bretton Woods type situation and that is not the issue. You must understand that gold is neutral. Central banks are buying gold because the Neocons have weaponized the dollar. Russia was removed from the SWIFT system, and private citizens’ assets were confiscated. When Russian assets were removed from SWIFT, a threat to the world was issued to say, “Hey, if you don’t do what we tell you to do, we will take you out of SWIFT.” This is not the end of the dollar. Money continues to pour into US equities, particularly the Dow. Why? When the drum of war is beating, major institutions rush to move their money into a safe haven, which happens to be the US at this point in time.

The big money is not purchasing start-up equities on the Nasdaq, for example, as they will not take that risk. Our computer model indicates the Dow will continue rising into 2032 as it remains one of the last safe havens. The West has become extremely aggressive in its geopolitics. You simply do not buy the debt of your enemy. Central banks are buying gold because the USD is political. There is a stark difference between short-term and long-term bonds. The central banks have zero control over the short-term and that is how this whole QE fiasco began as central banks began purchasing long-term debt in an attempt to reduce long-term interest. Why would you buy long-term when war, the primary driver of inflation, is looming? This is a serious situation that the neocons who have weaponized the dollar simply do not understand.

GOP picking one Trojan horse after the other…

• “Is He Blackmailed?” MTG Questions Speaker Johnson (ZH)

Marjorie Taylor Greene (R-GA) suggested that House Speaker Mike Johnson is being “blackmailed” because of his “complete departure” from Republican concerns, saying the Louisiana Republican “has completely changed his character.” “Mike Johnson has completely changed his character in a matter of about five months after he has become speaker of the House,” Greene told Tucker Carlson in a recent episode of Tucker Carlson Uncensored Carlson pointed to Johnson’s meeting with Ukraine’s President, Volodymyr Zelensky – after which Johnson said that the second congressional recess ends, “his number one priority at a moment when the U.S. is being invaded” is to ” send that $60 billion to Ukraine, possibly as a loan.” According to Carlson, Johnson won’t come on his show to explain, while Zelensky also refused to discuss his position:

They’re not grateful now. So we sent a message to the speaker of the House and asked him to come on and explain why, when the majority of the Republicans he represents both the voters and members of Congress, opposes why he would join with Democrats to do the one thing that Americans don’t think we should do, which is send another $60 billion to pay the pensions of Ukrainian bureaucrats and fund a doomed war. Why are you for that? And of course, he hasn’t responded. We also sent multiple requests to Zelensky himself for an interview to explain his position. Of course, he ignored that as well. Greene echoed Tucker’s concerns, saying “It’s outrageous.” When you saw Zelenskyy right there on that interview talking about, oh, we’re going to lose territory. Oh, we really need this money. This $60 billion should have been approved yesterday.

Let me tell you, we are losing our country to the illegal invasion that’s happening every single day at our southern border. And I am so pissed off about it because the American people are pissed off about it. And while our so-called Republican speaker of the House is only working with Chuck Schumer and Hakeem Jeffries and Ukraine First Mitch McConnell and the white House and Jake Sullivan, who he talks to on the phone all the time. We are angry and people have had it. Greene said this “needs to end,” but Johnson “has has made a complete departure of who he is, and what he stands for and to the point where people are literally asking, is he blackmailed?” When Carlson asked her to expound, Greene said that she has “no idea” if that’s the case, but asks: “What radically changes a man. I mean, if we break down the the second part of basically an omnibus, let’s let’s break that down.”

Greene cited Johnson’s funding of “full term abortion clinics” despite being pro-life, doing “nothing for the southern border” – particularly on the heels of Laken Riley’s murder at the hands of an illegal, which followed “a video that was running on loop on social media, where illegal aliens had rushed our border, ran over Texas National Guard.” “He did nothing to secure the border. It’s the number one issue in the world. He completely changed who he was. Funded the FBI, gave them a brand new building, fully funded the Department of Justice that is persecuting everyone on the right and actually targeting our presidential candidate, for for election this year. Literally trying to put him in jail the rest of his life. We don’t know who Mike Johnson is anymore. So there’s no, I can’t comprehend it,” Greene continued.

Ep. 88 Is Speaker of the House Mike Johnson being blackmailed to do the bidding of the left? It certainly seems that way. His colleague, Marjorie Taylor Greene, explains pic.twitter.com/r60v1XQusY

— Tucker Carlson (@TuckerCarlson) April 3, 2024

“To militarize as much as it needs to,” he wrote, “Europe needs its citizens to bear higher taxes or a smaller welfare state.”

• Europe’s Identity Crisis (Patrick Lawrence)

It is many years now since the French, bless them, revolted as Disneyland Paris arose near the previously uninvaded village of Marne-la–Vallée–Chessy. Soon enough came the Disney Hôtel New York, the Disney Hôtel Santa Fe, the Disney Hôtel Cheyenne, the Disney Newport Club, the Disney Sequoia Lodge, Disney Village, Parc Disneyland, Parc Walt Disney Studios. Let us not omit Star Wars Hypersonic Mountain among these monuments to the Americanization of Europe. Blocking imports of American “culture,” and we need the quotation marks, is among the world’s more quixotic undertakings, given the failure rate. But losing the battle against the infantilization of European sensibilities seems the least of the Continent’s worries at this point. The irrational Russophobia, the proxy war in Ukraine, the disruption of the Continent’s natural place as Eurasia’s western flank, the conjured-from-nothing “threat” of Russian expansionism, support of Israel’s siege of Gaza: These are U.S. imports, too, and Europe finds itself in crisis in consequence of them.

Who are we, Europeans now ask in one or another way. What have we made of ourselves? Are we always to be America’s obedient underlings, taking all orders and refusing none? What has become of us in the 21st century? European social democracy in its various forms has been vulnerable to the attacks of market fundamentalists and neoconservative ideologues for many years. Now the apostles of “savage capitalism,” as its Latin American casualties call it, and their warmongering siblings begin, this time in the name of Cold War II, what appears to be their final assault. Europe has vacillated between two contradictory impulses — asserting its sovereignty and succumbing to an undignified dependence on American power — since the mid–Cold War years. Charles De Gaulle was the last European leader to stand with conviction for the Continent’s independence and autonomy.

But Gaullism is no more than a faint and far-off light around Europe today. I reluctantly conclude that, in the moment of truth now upon it, the Continent will make the unwise choice, a self-condemnation that could endure for decades to come. A long-evident divide between Europeans and those who purport to lead them now widens. The former defend what remains of the socially advanced state erected across the Continent during the first postwar decades. The latter are poised to tear it down to import a version of America’s military-industrial complex precisely as The Walt Disney Company brought Sleeping Beauty’s Castle to the French capital’s outskirts. “Europe’s leaders have woken up to hard power” is the headline atop a commentary Janan Ganesh, a Financial Times columnist, published on this topic last week. “To militarize as much as it needs to,” he wrote, “Europe needs its citizens to bear higher taxes or a smaller welfare state.”

This is bitterly succinct. Europe’s leaders and the media that serve them are in the process of normalizing the “need” to turn Europe into a warrior state in the American image — suffused with animus and paranoia, beset with “threats,” never at ease as the social fabric deteriorates.

Taking it all to 2030.

• The European Union’s Fires Where Freedom Burns (Hugo Dionísio)

It is in Brussels that we find the symbolic center to which we must be loyal. The “Ukrainian project”, for the idolaters of european central power — and their followers — which is based on the bodies that make up the European Union, has a founding dimension, having become the ultimate symbol of the regime; a regime that no longer asserts itself by what it is, but by what it defends as the ultimate symbol of Russian antagonism: support for the Kiev regime. The more rigid, uncompromising and demanding you are in your support for Kiev, the more anti-Russian you became. And that’s the ultimate proof of loyalty. Is that a reason to say that this EU is no longer the same. Or is it, now, what it should be from the very start?

Presented as a peace project, but which ended up financing the war, even the most absent-minded passer-by in Brussels won’t miss the regime’s ultimate symbol. Since February 25, 2022, Brussels has been a city bathed in blue and yellow. From billboards to public works fences, everything seems to denounce the single truth to which we must be loyal. Zelensky’s Ukraine is indeed a member state of the EU! The legitimacy that it lacks in formal law, it has in the manifestation of symbolic paraphernalia and in the persecutory frenzy with which the European institutions embrace its protection. By dispensing with the usual access procedures, which only aim to give some formal legitimacy to a whole phenomenon (Ukraine on the “fast track” to the EU) that is observable in fact, Ukraine benefits from a whole altar that is the ultimate symbol of this idolatrous fundamentalism and this de facto adoption.

Nothing is more overwhelming than a trip to the central square of “Luxembourg”, where the European Parliament is located, under the watchful eye of a vigilant European Commission and a European Council commanded by far more distant powers. Yellow and blue are so intensely prominent here that we seem to be both in the sky and close to the sun. They say they are the colors of the EU… Their presence has never been as strong as it is today. Ukraine and the EU are also intertwined in color. Zelensky’s image stands out from this sea of colors, flooded with messages like “stand with Ukraine” or billboards saying “the brave people of Ukraine, represented by their president (…)”. As if to prove that what is outside, emanates from within, the Ukrainian state, without other democratic backing than that generated by the immense propaganda that floods our senses, even has its space in the very hemicycle of the European Parliament.

In addition to all the simultaneous translation booths for each of the languages that make up the European project, the “Ukrainian project” also has its own. Even if it has no MEP’s. Even the 50 billion euros recently approved by the European Council for the remaining 4 years of the Multiannual Financial Framework (which normally runs until one year after the nominal period, which is 21-27), taken from the respective financial cake, seems to reproduce, more or less, what a country with 35 to 40 million inhabitants and a per capita income below the European average would receive. In other words, not even the funds are lacking for the development of the goals of the 2030 strategy. Now, tell me Ukraine isn’t a member state?

“Histrionic Personality Disorder (HPD)”

“– Incurable Unless She Takes The Prime Ministry From Justin Trudeau..”

Freeland is of Ukrainian origin.

• Canada’s Deputy PM Chrystia Freeland Diagnosed With Progressive HPD (Helmer)

In two public performances of less than two minutes apiece, Chrystia Freeland, Canada’s Deputy Prime Minister, Finance Minister, and leader of Canada’s war against Russia, has demonstrated bizarre facial and upper torso symptoms. Political analysts and psychiatrists have been asked if they believe Freeland is suffering from a clinical pathology or drug abuse. Cocaine use has been ruled out. According to a medical psychiatrist, “the display [of symptoms] is remarkable. And just as remarkable, they disappear when [Freeland] takes the tribune from the prime minister and starts to make a speech herself. The control of torso, eyes, and speech she shows then is not consistent with chronic cocaine use.” The source, who specializes in treating drug addiction, says that Freeland’s display of symptoms does not reveal the twitches, tics, or other involuntary muscular movements usually seen with cocaine users. “What can I make of the relentless movements,” the source commented.

“[They] are more or less non-stop and they serve to draw attention away from everybody but herself. In her speech, there was no restlessness. It was fluent and clear. But she was the centre of attention then. It seems to me that with all her restless movements taking so many different forms she could still be the centre of attention…In some ways she was like the child who must always have attention.” Another expert source believes Freeland’s symptoms have been diagnosed clinically in the US as Histrionic Personality Disorder (HPD). This has been reported in a research paper published in January of this year: “a chronic and enduring condition marked by a consistent pattern of attention-seeking behaviours and an exaggerated display of emotions. Typically emerging in late adolescence or early adulthood, individuals with HPD are often characterized as narcissistic, self-indulgent, and flirtatious. Individuals with HPD may feel undervalued when not in the spotlight, leading to a persistent need for validation…People presenting with HPD typically demonstrate rapidly shifting and shallow emotions that others may perceive as insincere…

Women are four times more likely to be diagnosed with histrionic personality disorder than men.” Canadian political analysts report that Freeland’s condition has long been recognized among male voters; less so among female voters. The analysts also note that as Prime Minister Justin Trudeau loses general voter approval, and also the support of his Liberal Party constituency, Freeland’s ambition to replace him before the national election next year, is becoming more obvious. Her HPD symptoms, the sources say, become extreme when she appears in public with Trudeau, revealing her impatience to replace him. In this personal contest of wills and of political power in Canada, the national and provincial polls are showing that the looming defeat of Freeland’s side in the war against Russia, the partition of the Ukraine, and the loss of more than C$4 billion in Canadian military donations to Kiev, are making no (repeat no) difference to the election outcome in Ottawa.

Freeland’s career to promote herself and the neo-Nazi ambitions of the Ukrainian community in Canada – the largest Ukrainian diaspora outside the country identifying as anti-Russian – has been documented in this archive. Her grandfather, Mikhail Chomiak’s career as a profiteer and propagandist of the ethnic cleansing of the Ukraine and murder of Russians, Jews and Poles, was documented from January 2017; Freeland and her supporters have dismissed this record, including US Army intelligence and Polish police files, as Kremlin propaganda. The recording of Freeland’s facial and torso displays have not been noted in Canadian politics before. Layman observers have suspected the display to be symptomatic of drug use, particularly of cocaine. The standard lists of symptoms of cocaine use include restlessness, agitation, irritability, tremors, involuntary muscular spasms, and volatile behaviour, such as temper tantrums. Sources who have worked with Freeland in the past note that her screaming fits were commonplace.

Canada’s Deputy PM Chrystia Freeland appears completely out of it as she displays erratic body movements and bizarre facial expressions during a press conference. pic.twitter.com/4EZDX7Hkyo

— Mats Nilsson (@mazzenilsson) March 29, 2024

VdB

https://twitter.com/i/status/1775594138378854503

Aaron Russo

I had no idea pic.twitter.com/uOBFPs5hbR

— TaraBull (@TaraBull808) April 3, 2024

Bachmann

"It is a complete dictatorial power grab."

Former U.S. congresswoman, Michele Bachmann: Through the WHO Pandemic Agreement, Bill Gates is attempting "the greatest grab of power in 5000 years of recorded human history".

"Once the deed is done next May, if in fact it does get… pic.twitter.com/2hRU5FPj3X

— Wide Awake Media (@wideawake_media) April 3, 2024

Worm

Australonuphis or beach worm, you don't see it, but it sees you pic.twitter.com/dROcYACdgr

— Nature is Amazing ☘️ (@AMAZlNGNATURE) April 4, 2024

Max

This is Max. He has been preparing his whole life for this moment. 13/10 pic.twitter.com/YslVYl8ner

— WeRateDogs (@dog_rates) April 3, 2024

Kitten

kitten said: let me call my mum pic.twitter.com/tjaDUKdplp

— Why you should have a cat (@ShouldHaveCat) April 3, 2024

Bath

https://twitter.com/i/status/1775918366290493661

Baby

https://twitter.com/i/status/1775628060366090723

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.