Spain Has A Long Way To Go Down

Home › Forums › The Automatic Earth Forum › Spain Has A Long Way To Go Down

- This topic is empty.

-

AuthorPosts

-

March 11, 2013 at 3:15 am #7083

Gravity

ParticipantGravedad es un algoritmo recursivo.

March 11, 2013 at 7:36 am #7085TheTrivium4TW

ParticipantViscount St. Albans post=6773 wrote: Why is the stock market making all-time highs?

My short positions are hemorrhaging. I’m going to bleed-out if this keeps up.

How can everything be so bad if the market is so good? Is Stoneleigh going to update things sometime? At some point, the disconnect is so blazing hot, your brain gets third degree burns just for thinking in the gutter.

I look around and I see cars accelerating, and I hear jets soaring overhead, and I smell burgers and steaks sizzling at the cafes. I pinch my skin and I learn two things: I’m getting fat and no, I’m not dreaming.

I’ve started watching Jim Cramer again.

Dear Viscount, the market is going up because that is the direction that will inflict the most pain on everyone outside the inner party.

Completely wipin gout the shorts usually precedes wiping out the longs when the bubble collapses.

One fundamental reason why stocks might do better than some would otherwise expect is because ObamaCare was written to eliminate corporate healthcare and pass it off on to the citizen. All that corporate money spent of healthcare now will be pure gravy for the corporations in the future.

March 11, 2013 at 7:43 am #7086TheTrivium4TW

Participantpipefit post=6779 wrote: Viscount asked, “How can everything be so bad if the market is so good?”

Because we’re in a hyperinflationary depression. Bought any groceries lately, or anything else for that matter. Notice how the packages are smaller and the prices are higher? This is the logical outcome of unrestrained money creation by those in charge.

For the fiscal year ending 9/30/2012, the federal govt. ran a GAAP budget deficit of $6.9 trillion. That’s about 40% of GDP. Money creation in the extreme.

Why should China call us out now? We’re suppressing the price of gold, enabling them to get in cheap. When the time is right for them, they will dump the dollar, don’t ask me when.

The second chart of credit and monetary aggregates belies your hyperinflationary thesis…

https://market-ticker.org/akcs-www?post=218297

Reported monetary and credit aggregates are **barely** above the 2007 high and there is probably a few trillion “mark to myth” fraud propping the number as high as it is.

Prices are going up because trillions are being directed the mega banks so they can gamble on food stuffs. This is nothing new, Andrew Jackson had to deal with the criminal banker cartel doing the very same thing in his day…

“Gentlemen! I too have been a close observer of the doings of the Bank of the United States. I have had men watching you for a long time, and am convinced that you have used the funds of the bank to speculate in the breadstuffs of the country. When you won, you divided the profits amongst you, and when you lost, you charged it to the bank [updated to tax payers now]. You tell me that if I take the deposits from the bank and annul its charter I shall ruin ten thousand families. That may be true, gentlemen, but that is your sin! Should I let you go on, you will ruin fifty thousand families, and that would be my sin! You are a den of vipers and thieves. I have determined to rout you out, and by the Eternal, (bringing his fist down on the table) I will rout you out!”

~From the original minutes of the Philadelphia committee of citizens sent to meet with President Jackson (February 1834), according to Andrew Jackson and the Bank of the United States (1928) by Stan V. Henkels – online PDFIt wasn’t hyperinflation back then and it isn’t now. Hyperinflation will only occur if it benefits the criminal money defining/government loaning class and not one iota before.

March 11, 2013 at 8:15 am #7088TheTrivium4TW

Participantpipefit post=6784 wrote: It is a lot easier for the fed to just print $85 billion a month, and for Congress to deficit spend $7 trillion a year.

pipefit, this logic is where you jump the track, IMHO.

How to be a Crook

https://www.youtube.com/watch?v=2oHbwdNcHbc

It isn’t about “ease,” it is about the people that control the Fed maximizing the profits for themselves and those interests they control.

The corporat emandate is simple – maximize profits. While they don’t teach you this truth in business school, this is equivalent to maximizing debt throughout the rest of society.

Since debt is the banker product, its widget if you will, that means every corporation in the world’s mandate could properly be stated thusly, “maximize banker widgets.”

The Matrix just glitched for those who are paying attention.

So the question, when properly stated, is… what course of action will maximize the real wealth of the interests that control the Fed.

The government does not control the Fed. The Fed is privately controlled by the interests that defined money, created the Fed in the first place and now lend trillions to governments.

https://www.youtube.com/watch?v=ol3mEe8TH7w

Napoleon figured out WHO was in control when governments servilely had to plead with bankers for access to money:

“When a government is dependent upon bankers for money, they and not the leaders of the government control the situation, since the hand that gives is above the hand that takes. Money has no motherland; financiers are without patriotism and without decency; their sole object is gain.”

― Napoleon BonaparteSo. “Money,” as Napoleon called them, have trillions in debt instruments and trillions more in cash. “Money” controls the actions of the Fed and will direct monetary policy.

“If all the bank loans were paid, no one could have a bank deposit, and there would not be a dollar of coin or currency in circulation. This is a staggering thought. We are completely dependent on the commercial Banks. Someone has to borrow every dollar we have in circulation, cash or credit. If the Banks create ample synthetic money we are prosperous; if not, we starve. We are absolutely without a permanent money system. When one gets a complete grasp of the picture, the tragic absurdity of our hopeless position is almost incredible, but there it is. It is the most important subject intelligent persons can investigate and reflect upon. It is so important that our present civilization may collapse unless it becomes widely understood and the defects remedied very soon.”

– Robert Hemphill

Credit Manager of Federal Reserve Bank, Atlanta, Ga.

In the foreword to a book by Irving Fisher, entitled 100% Money (1935)Your thesis is that “Money” will hyperinflate their trillions in wealth away because it is “easy” and “Money” wants to please government workers with paychecks.

I have news for you, “Money” has no motherland and no affinity towards government workers. Their sole object is gain for themselves AND HYPERINFLATING THEIR WEALTH AWAY IS CONTRARY TO THEIR PSYCHOLOGICAL MAKEUP.

So, what will they do?

When their current “looting phase” [steal trillions in the asset “face” of money while offloading trillions in the liability face of money to sucker tax payers], they will restrict credit.

As Hemphill made clear, this will cause America to “starve,” forcing many into bankruptcy.

This will accomplish the following for the money definers/creator class:

1. Their debt paper will be turned into actual real assets. They get the house, the farm, the business, etc… based on money they created from nothing and then lent it into society.

2. Their non TBTF&Jail competition is wiped out enshrining themselves as monopoly power.

3. The prices within society collapse and their trillions in looted cash will then buy up 3 or 4 10 times more physical goods while Americans are eliminated from demand side competition as they starve.

4. The “government,” or, more accurately, wolf bankster operatives dressed up in government sheep outfits, will usher America into receivership for the benefit of the Debt Money Tyrants – the people who defined money as debt and then let it do what it always does, which is covertly and systematically asset strip society and transfer the wealth of society to the financial fraud “Money” class. Why do you think the police state has been financed by the Fed? Why do you think Congress declared America a battle field? Why do you think DHS has orders to buy 2 billion bullets, at least 450 million of which are hollow point and not used for practice because they are expensive? Why do you think DHS has ordered “no hesitation” shooting targets of children, pregnant women, grandma and grandpa types?Oh, you probably don’t believe the last one, do you. Truthfully, you shouldn’t believe anything anyone says, you should gather the data yourself and identify contradictions and fallacies and then remove them – hence my nick name here on these forums.

https://www.infowars.com/company-behind-shooting-targets-of-children-received-2-million-from-dhs/

How about re-education camps in America – they even use the Soviet authoritarian dictatorship term and throw it in your face.

https://www.infowars.com/leaked-u-s-army-document-outlines-plan-for-re-education-camps-in-america/

5. Sets the stage for the Biggest Finance Capital cabal of money definers and nation state money creators to seize possession of the physical world and then hyperinflate to “balance their books” and proclaim that “capitalism failed, you need to be ruled byu the private international banking cartel [that destroyed your country, but the average person won’t figure it out].”

“It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning. The one aim of these financiers is world control by the creation of inextinguishable debt.”

~Henry FordI apologize about the length of this post, but the topic is of extreme importance and all the data presented is relevant and important to making the argument.

March 11, 2013 at 9:01 am #7089TheTrivium4TW

ParticipantBeppe has a good understanding of Debt Money Tyranny.

https://www.youtube.com/watch?v=eyCpidT53nY&feature=player_embedded#t=177s

This Is Why Central Planners Are So Scared of Italy’s Beppe Grillo

https://www.zerohedge.com/news/2013-03-10/why-central-planners-are-so-scared-italys-beppe-grillo

Beppe’s critical tone towards Debt Money Tyranny puts him at risk – if he has a sudden heart attack or if some three named assassin takes him out, well, what’s new?

“The bank, Mr. van Buren, is trying to kill me. I will kill it.”

~President Andrew Jackson (survived assassination attempt when two guns misfired in his belly. Davey Crocket then beat down the would be assassin)March 11, 2013 at 9:23 am #7090jal

Participant@ TheTrivium4TW

Re.:

Napoleon Bonaparte

Robert Hemphill

Henry Ford

and many moreI have not verified the quotes. However, I have seen them, and others, on the blogs. ( I accept the fact that they knew “the score”.)

What is there that is different this time?

When these powerful men were passing on their wisdom to other educated men, their efforts proved to be sterile.

The bankers won.Why should the fact that the web is making it possible for the average person to be aware of present and past stealing make any difference?

March 11, 2013 at 11:33 am #7091davefairtex

ParticipantTrivium –

Yes great video. Gives me a new appreciation for Mr. Grillo. Ilargi had good things to say about him a few weeks ago, but there’s nothing like a video that really brings the lesson home. If a picture = 1000 words, a video = a whole book.

Especially one from 1998. I was completely asleep back then.

March 12, 2013 at 5:38 pm #7106pipefit

ParticipantDAve & The Tri-If you look around, you will always be able to justify just about any statement with a chart or three. The bottom line is that we are six years into this credit bust and CPI inflation is running at about 9%/yr if you used the same methodology as was used in the 1970’s, per John Williams of shadowstats. You can argue that they measured it incorrectly back then, but that isn’t the point. Our current rate of CPI inflation is approaching the rates of the 1970’s. It is called stagflation.

Sentiment surveys don’t mean much to me. If 60% of those approaching mid-career say they have no faith in social security, yet aren’t saving much, they assume some combination of corporate pension, social secutiry, and other sources will finance their retirement.

Unlike some of the dogmatic voices around, I have an open mind and therefore I realize this could go either way. It hasn’t been determined yet. As long as they keep up the pretense of representative democracy, a hyperinflation outcome is assured. They have the legal right to print whatever quantity of federal reserve notes as is required to meet any all obligations, and they will.

Should there be some sort of military takeover, the odds tilt toward deflation. I don’t think it matters all that much. There are over 300 million people here, and enough productive assets to support about half that at the present standard of living. Presumably there will be some combination of population loss and standard of living reduction to reach a lower equilibrium. In fact this process is already well under way, with the big drop in gasoline usage, big drop in new home construction, etc.

March 12, 2013 at 7:36 pm #7109davefairtex

Participant@pipefit –

“If you look around, you will always be able to justify just about any statement with a chart or three.”

If everyone involved in the discussion is being intellectually honest, that’s not true. There is fact, and then there’s lies. Given a particular chart, either the data is accurate, or not. If the data behind the chart is accurate, and the data is presented with every attempt to properly represent the truth in context, and the people are operating in good faith, then the discussion can be an honest one

That is the kind of discussion we’re having, right?

So I believe there is an important question to answer underlying your whole hyperinflation mindset. That is, why the heck have food prices gone nuts since about mid 2005?

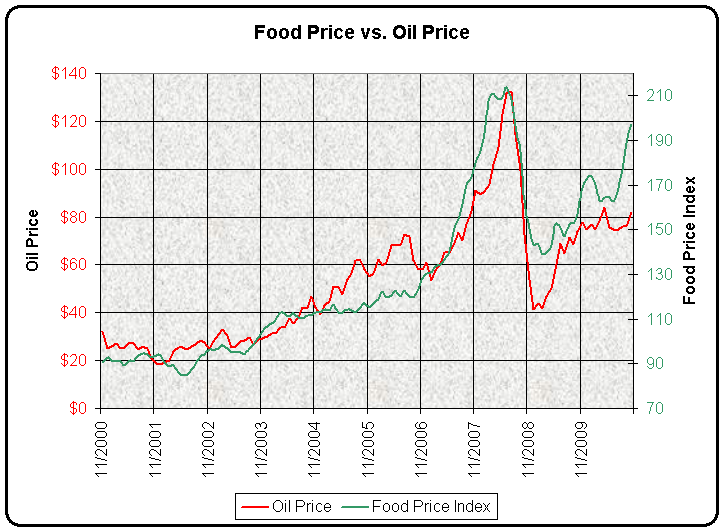

I happen to have a chart on this (naturally) and indeed it shows that food has gone up perhaps 230% since 2000, and perhaps more shockingly, about 60% over the two years of 2007-2008. While 60% isn’t hyperinflationary, its definitely disturbing. But then what happened after? If we eliminate the 2009-2010 period, food isn’t much more expensive now than in 2008. That 30% per year move hasn’t continued.

How does John Williams explain this? Its all monetary? Hyperinflation? GAAP deficits? Fed money printing? None of it washes. Our GAAP deficit hasn’t changed since 2008 – if anything, its gone up. Money printing hadn’t happened in 2008 yet. So what then?

My explanation: its oil – at least 80% anyway.

Of course it could be speculation to some degree as well. But since the marginal barrel of oil is now about $60-$80 per barrel, and since there’s no decline in demand, the oil price has to rise accordingly. And where oil goes, food follows, since food production is energy intensive.

So. Did food prices rise primarily because of GAAP deficits and Fed money printing? My gut says no. GAAP deficits do not seem to be causal. The chart would look quite different – there would be a continued steady upside pressure. My conclusion: its all about oil, with perhaps some leveraged speculation to throw in a bit of added oomph on both the upside and the downside.

But these are my charts. Please feel free to bring out your 3 charts. I will assume you too are being intellectually honest, and are not trying to deliberately deceive me. And you can challenge my charts, tell me why I’m wrong, and we can work to get at the truth.

That is why we’re here, right?

March 12, 2013 at 8:51 pm #7110gurusid

ParticipantHi Dave,

Ahh, food and ‘oil’:

The thing that stunned me was the closeness of the correlation. For you math geeks, the correlation coefficient of the two data sets is 0.93!

The next thing that’s fascinating is that changes in the Food Price Index appear to lead changes in the price of oil by a few months. Since food prices don’t drive oil prices as far as I know, this implies that they are both responding to the same underlying situation, but that food prices are a more sensitive indicator.

The last thing that I noticed is the behaviour of food and oil prices in the last six months. The sharp rise in food prices is being noticed in the media now, but the graph hints that the story is just beginning.

The key could be here: “Since food prices don’t drive oil prices as far as I know” actually with the rise of bio-fuels in the form of corn ethanol, there is an even greater link perhaps – oil price goes up, food price goes up so does the ‘bio’fuel price leading to higher fuel price (not ‘oil’ price) – but I’ll bet any correlation is down to speculators hedging their bets. It might be that oil inventories have longer lead times than food inventories and so betting on prices feeds through quicker – who knows? Definitely ‘some’ sort of correlation. :woohoo:

Wait until there’s real scarcity, then we’ll see some ‘price shocks:

Energy used to produce food:

…or oil! :sick:

Though in the search for ‘truth’ I prefer perhaps the ‘original’ (?) version:

A chapter called “Conversations with North American Indians” contained comments made by Alanis Obomsawin who was described as “an Abenaki from the Odanak reserve, seventy odd miles northeast of Montreal.” (The book uses the spelling Obomosawin.) Obomsawin employed a version of the saying while speaking with the chapter author Ted Poole. [AOTP]:

Canada, the most affluent of countries, operates on a depletion economy which leaves destruction in its wake. Your people are driven by a terrible sense of deficiency. When the last tree is cut, the last fish is caught, and the last river is polluted; when to breathe the air is sickening, you will realize, too late, that wealth is not in bank accounts and that you can’t eat money.

In later years Obomsawin became famous as an award-winning documentary filmmaker based in Canada.

:whistle:

L,

Sid.March 12, 2013 at 11:56 pm #7114davefairtex

Participant@gurusid –

I’ve been outcharted! My charts cannot yet do two y-axis settings, sadly, so I have to reduce myself to scaling things by hand.

However! I happen to have data, specifically the five timeseries components that together make up the FPO Food Price Index: meat, dairy, cereal, oil, and sugar.

So it turns out that neither meat nor sugar correlate well with oil. So I eliminated them from the chart. What remains of course are dairy, cereal, and oils.

I totally see what you mean about some of these things leading rather than following oil. I didn’t see that before – your chart made that more visible. I think I need to go off and write some code!

So that leading behavior I can’t explain. These days sometimes I see some commodities move almost in lock step intraday – I think some big hedge funds put on trades and/or have computers that encourage this sort of correlation but that’s just a guess on my part.

I’m sure droughts cause things to become uncorrelated. [I looked at some charts offline]. Yeah, looking at wheat & corn, they definitely split directions in later 2012, and for whatever reason corn is much more weakly correlated with crude than wheat.

It could be gambling by the big banks, hedge funds, and commodity index funds causing things to move largely in lock step. If people want a “commodity fund” they get all of them, which would cause them to move in unison to some degree.

Bottom line, I don’t think the primary thing moving “stuff” prices around at retail is the GAAP deficit, or any sort of monetary policy decision-making at the Fed.

But perhaps someone can show me a chart that shows otherwise.

March 13, 2013 at 3:37 pm #7117alan2102

Participantpipefit post=6785 wrote: Alan-IMHO, we are very close to entering the ‘hyper’ part of this inflationary trend. One indicator that I gave you already was that the 2012 fed. budget deficit, using GAAP accounting, was 40% of GDP.

Another indicator is the oil:ng ratio….All good points. And maybe you are right that we are CLOSE TO ENTERING the hyper part. (I’ll bet that you are right.) But we are NOT THERE YET, was my point. So why call it what it isn’t?

I am going by the dictionary definition of inflation — universally accepted, though rejected by TAE — of higher prices, and (hence) of hyperinflation as much higher prices, typically 10% rises per month, or more. By that definition, we are certainly not in a hyperinflationary state.

March 13, 2013 at 4:16 pm #7118alan2102

Participantpipefit post=6818 wrote: we are six years into this credit bust and CPI inflation is running at about 9%/yr if you used the same methodology as was used in the 1970’s…. Our current rate of CPI inflation is approaching the rates of the 1970’s. It is called stagflation.

YES. Stagflation, which includes inflation. The inflationary mega-trend has not skipped a beat, for decades. Actually, it did skip one beat, in 2008, but it was brief, and it picked itself up and continued on as though nothing had happened. Remarkable, but true.

Unlike some of the dogmatic voices around, I have an open mind and therefore I realize this could go either way.

Ditto. The inflationary way is the most likely, but nothing is certain.

It hasn’t been determined yet. As long as they keep up the pretense of representative democracy, a hyperinflation outcome is assured. They have the legal right to print whatever quantity of federal reserve notes as is required to meet any all obligations, and they will.

Should there be some sort of military takeover, the odds tilt toward deflation.That IS the sad truth, is it not? Deflation. to some extent, is probably what SHOULD happen, but not at all necessarily what WILL happen. More likely to go the other way, since that will be far more politically expedient and palatable. Very very sad that it would take some sort of fascist putsch to do what actually needs to be done.

I don’t think it matters all that much. There are over 300 million people here, and enough productive assets to support about half that at the present standard of living. Presumably there will be some combination of population loss and standard of living reduction to reach a lower equilibrium. In fact this process is already well under way, with the big drop in gasoline usage, big drop in new home construction, etc.

On this I disagree. The present standard of living could easily be supported on a much lower resource footprint. The current system is so massively wasteful that wringing out even a substantial fraction of the waste would allow a reasonably comfortable transition. However, this would be (like deflation) politically near-impossible. The waste is “necessary” to keep the whole insane system going.

March 13, 2013 at 4:41 pm #7119alan2102

Participantdavefairtex post=6821 wrote:

I happen to have a chart on this (naturally) and indeed it shows that food has gone up perhaps 230% since 2000, and perhaps more shockingly, about 60% over the two years of 2007-2008. While 60% isn’t hyperinflationary, its definitely disturbing. But then what happened after? If we eliminate the 2009-2010 period, food isn’t much more expensive now than in 2008. That 30% per year move hasn’t continued.

How does John Williams explain this? Its all monetary? Hyperinflation? GAAP deficits? Fed money printing? None of it washes. Our GAAP deficit hasn’t changed since 2008 – if anything, its gone up. Money printing hadn’t happened in 2008 yet. So what then?

My explanation: its oil – at least 80% anyway.Good hypothesis.

However, looking at the charts, I have a question. Would it not be true that food prices would tend to LAG oil prices by a year or two? That is, it would take that long for fuel to be reflected in food prices. Increased fuel utilization for a given year’s crop would not be fully priced-in for many months, perhaps a year or longer. This would be especially true of the more energy-intensive secondary feedstocks such as beef, where grain has to be grown first, then converted to meat on the hoof, then butchered, etc. — the whole process taking at least 1.5 years. Anyway, as I look at the charts, I see no lag, and in many places I see the opposite: food is leading rather than trailing. This observation is not consistent with the thesis. I’m not saying that higher energy prices do not impact food prices; of course they do. Just saying that that may not be as big a factor as was suggested.

Further: higher energy prices are themselves part of the inflationary mega-trend, which is not exclusively about currency creation. Here again, I am going by the standard dictionary definition of inflation: increased prices. Higher energy prices will redound broadly, spurring inflation throughout the economy since everything depends more or less on energy, from raw materials to finished goods and everything in between. When you combine this with the Fed’s open-spigot policies (likely to be reflected in higher prices sooner or later) it is quite easy to see inflation from here to whenever (eternity? no, that’s too long 😉 ).

March 13, 2013 at 5:30 pm #7120gurusid

ParticipantHi alan,

alan: I am going by the dictionary definition of inflation — universally accepted, though rejected by TAE — of higher prices

No they don’t ‘reject’ it:

Alan’s dictionary ref:

http://www.bing.com/Dictionary in·fla·tion [ in fláysh’n ] — higher prices: an increase in the supply of currency or credit relative to the availability of goods and services, resulting in higher prices and a decrease in the purchasing power of money. Synonyms: price rises, increase, price increases, rise.Also I suspect that your view is incommensurate with that of the TAE:

Further:

Also:

Inflation is an increase in the supply of money relative to goods and services. Deflation is a decrease in supply of money relative to goods and services. ‘Stagflation’, is ‘Inflation’ (money supply increase) without any concomitant growth in GDP, and a relatively high unemployment rate. It resulted when banks increased the money supply to counter the recession bought on by the 1970s oil crisis. Most neo-classical economists cannot explain what happened because their theories do not work – read Steven Keen’s “Debunking Economics” to see why.

As Stoneleigh says:IMHO price ‘inflation’/‘deflation’ is a non-sense term used by the media to obfuscate and dumb down the reality of what is actually happening (and I have been guilty of thinking this way myself before I clearly understood what the concepts meant). It’s a version of Orwellian double speak, and more ominously of ‘double think’ “the act of simultaneously accepting two mutually contradictory beliefs as correct”:

‘Prices’ go up and they go down, dependant upon what people will ‘pay’ or what the seller thinks they will pay. They do not inflate or deflate, they are results not causes.

Don’t get me wrong, I am learning about all this stuff too, but it is important to hammer out the key concepts clearly and concisely. Other wise its double think and speak time… :dry:

L,

Sid.March 13, 2013 at 7:09 pm #7121alan2102

Participantgurusid post=6832 wrote:

Hi alan,alan: I am going by the dictionary definition of inflation — universally accepted, though rejected by TAE — of higher prices

No they don’t ‘reject’ it:

Alan’s dictionary ref:

http://www.bing.com/Dictionary in·fla·tion [ in fláysh’n ] — higher prices: an increase in the supply of currency or credit relative to the availability of goods and services, resulting in higher prices and a decrease in the purchasing power of money. Synonyms: price rises, increase, price increases, rise.Right. Synonyms: PRICE RISES. PRICE INCREASES. Those phrases, in common parlance, are SYNONYMOUS with inflation.

TAE does not accept this. TAE wishes to go with a definition which includes factors thought to be causal. TAE suggests that their definition is “traditional”. That may be true. I said in the thread where we discussed this: THEY MAY BE RIGHT. Their definition may be superior in every way. And YOU MAY BE RIGHT that the non-TAE definition is an evil Orwellian conspiracy to capture our brains and turn them into mush. And yet, TAE’s definition is TAE’s definition — it is not the commonly, universally accepted definition of today, found in all dictionaries and reference works. ALL dictionaries and reference works. They ALL define inflation as a general rise in prices of goods and services. EVERY ONE OF THEM. Google for it and see for yourself. Sometimes causal factors are alluded to, such as increases in currency supply or increases in demand for goods, but the bottom line, the sine qua non, ALWAYS, IN EVERY CASE, is price increases. That is now what the word means, in common parlance. Sorry about that. I did not make it so. It IS so.

Further: Although I did not get into it much on that other thread, I actually find TAE’s causal analysis to be limited and inadequate. Inflation is said to be an increase in the supply of money relative to goods and services — but that is only one of several critical factors that can drive prices. Here they are, succinctly, compliments of about.com:

https://economics.about.com/cs/money/a/inflation_terms.htm

inflation is caused by a combination of four factors. Those

factors are:

The supply of money goes up.

The supply of goods goes down.

Demand for money goes down.

Demand for goods goes up.You’ll note that TAE’s definition is limited to only the first one listed: money supply (or, credit), and perhaps the third (demand for money). What about the rest?

In any given situation multiple factors are involved and it is not possible to say in advance what their relative weightings will be; i.e. it is not possible to build a SINGLE definition of “inflation” that includes a causal explanation that will be correct in every case.

The phrases “demand-pull inflation” and “cost-push inflation” introduce causal theory, and do so with more granularity and nuance than does the TAE view. I suggest you read the about.com link.

It is this nuance, this complexity and malleability (depending on circumstances that change), that makes it impossible to try to retain a single, narrow theory of causation in the word. No doubt causation has been dropped-off in contemporary usage for that reason. If one wants to discuss causation, they can to do so using modifying phrases like “cost-push” or some other.

Anyway…

I already talked myself hoarse on this subject so I will now shut up about it. Except to say that I will continue to use the word in the commonly-accepted contemporary way, and I will point out that I am doing so as I do so (just for clarity, in this context). For my purposes, inflation means higher prices, regardless of cause. Period.

If you want to use the word in a different way, fine. Do it. Just indicate what you are doing as you are doing it.

March 13, 2013 at 7:19 pm #7122davefairtex

Participantalan –

gurusid already beat you to it with that observation, and you’re both right, oil (at least in the case of 2007-2008) isn’t leading the charge. Oil & food are clearly correlated, but its not oil out in front.

Can the move of both oil & food be traced to the GAAP deficit? The original thesis was that GAAP deficits were alleged to be massive money creation leading to hyperinflation – 7 trillion per year. I claimed that GAAP deficits do not cause price increases, because no actual money is created by such a deficit – and actual money creation chasing actual goods & services is required to create monetary inflation.

Yet something drove huge price increases in the 2006-2008 timeframe. And those price increases which have been filtering through the economy over the past 3 years make people think Fed money printing is doing it, makes some people think about stagflation and hyperinflation and so on. But I don’t think thats the case. I think its something else.

I wouldn’t mind figuring out what it is. Expectation of peak oil? Its all conjecture.

March 13, 2013 at 9:35 pm #7123pipefit

ParticipantDave said, “On this I disagree. The present standard of living could easily be supported on a much lower resource footprint. The current system is so massively wasteful that wringing out even a substantial fraction of the waste would allow a reasonably comfortable transition. However, this would be (like deflation) politically near-impossible. The waste is “necessary” to keep the whole insane system going.”

That is the irony. Strictly from an engineering standpoint, we could reduce our gasoline consumption by a huge percent, just by increasing the average number of people per rush hour car from the current 1.2 to 2.2 (or whatever the exact figure is). But using the free market (high gas prices) doesn’t seem to be working. Or even the somewhat socialist carpool lane strategy.

Also, there is a huge number of stakeholders that are dependent of high gasoline consumption: state govt. hwy workers, highway contractors, gas stations, oil companies, etc. So there will some short term pain associated with the drop to a lower level of gasoline consumption.

Getting back to Spain, I saw a worldbank url (https://data.worldbank.org/indicator/IS.ROD.SGAS.PC) that says petrol consumption in Spain dropped by 15% from 2008 to 2010. I’ll try to find a more up to date data series.

Normally, with gasoline consumption dropping in developed nations, the price should be tanking, pun intended. But with consumption increasing in less developed nations, and the world at post cheap oil, the price is plateauing at a high level.

March 13, 2013 at 9:55 pm #7124pipefit

Participant@stoneleigh–When I look at natural gas, I usually look first at this url, https://ir.eia.gov/ngs/ngs.html, the weekly natural gas storage table/graph.

The natural gas storage glut has been building for a decade, even with all sorts of drilling rig utilization reduction (in response to low prices). Winters have been mild, and if the global climate change mantra is even part right, will continue to be mild.

We are in depression (some say deflationary, some say inflationary). In either event, it is crushing ng industrial demand, and crude oil demand, for that matter. However, crude is easy and cheap to trasport, so the pricing structure is global. Gas is local, or at least confined to the nearest contiguous pipeline system.

Also, the housing slump hurts ng sales more than oil (and related products) sales. If houshold formation continues to be weak, this hurts ng sales growth more so than oil sales growth. e.g. an young adult living in their parents’ basement is using much less ng then when he was in an apartment, but he is burning just as much gasoline in his car he bought with the 1% auto loans they are handing out like candy.

I don’t know why there hasn’t been more fuel switching from oil to ng. Seems like a no brainer, but it isn’t happening on near the scale.

Keep watching the oil:ng ratio. It drops near 10:1 or below, I’ll be ditching my ‘hyperinflation outlook’ and join the TAE deflation club.

March 14, 2013 at 1:54 am #7125Nassim

ParticipantWhy not just say “price inflation” so that everyone is happy. 🙂

March 14, 2013 at 6:14 am #7126gurusid

ParticipantHi Folks,

Forgive me but this is critical:

Alan: Right. Synonyms: PRICE RISES. PRICE INCREASES. Those phrases, in common parlance, are SYNONYMOUS with inflation.

And that is the problem, because most synonyms are context dependant and the context has changed so that this ‘synonym’ is no longer (if it ever was) valid.

Nassim: Why not just say “price inflation” so that everyone is happy.

Because it is incorrect.

Why? Because it’s a category error . Price is a measure of value. It’s not the measurement that inflates but the thing being measured. In this case it is the relative value of the currency, which can be valued relatively to many things. When you ‘inflate’ a balloon, its not the ruler that gets bigger, but the balloon that gets bigger regarding the measure of the ruler. Price is a measure of many things, from expectation and to some extent demand, but also of affordability and notions of value. By conflating inflation and price, one distorts the very notions of value. Its not the ‘value’ that is increasing, but means to acquire that value that is inflating. That can happen if there is more of the means available, or if that means itself loses relative value so that you need more of it. Whether that means is money, goats or pink elephants, does not matter, it is the means that inflates or deflates, not the price which is a measure of relative value. At the moment the means (money, debt/credit) is disappearing. Wages unlike the previous inflationary eras are falling not rising, except for the very rich elite such as CEOs and bankers: the ‘FED’ and for that matter all the other ‘banks’ are not handing out free cash to people in the street. However, the prices of many ‘goods’ are being bet upon by the stock market system that is assigning arbitrary(1) prices and hence arbitrary value irrespective of what the true value is worth. As TAE have said, these stocks (and derivatives and financial products) have yet to be ‘marked to market’ to discover their true ‘price’ or value. What the ‘measure’ of their true worth is. Thus currently we have a situation in which price has become divorced from the money supply; it’s a bit like an authoritarian government ‘fixing’ the state price of bread, regardless of what is affordable or what the bread is actually worth, only here its called the ‘free’ market, and instead of party officials fixing the price, we have stock brokers and computerised algorithms. These are price rises driven by speculation on value (virtual digital value at that) NOT inflation of the money supply. The irony here as regards ‘energy’ prices such as oil is that they would go through the roof, as their value has been held down as regards their true worth, say when compared to the equivalent in human labour energy. As regards ‘price inflation’ – good luck with trying to measure anything with an inflatable ruler… 🙁The boys and girls in the Bubble? Damn right:

“”Reality” is what we take to be true. What we take to be true is what we believe. What we believe is based upon our perceptions. What we perceive depends upon what we look for. What we look for depends upon what we think. What we think depends upon what we perceive. What we perceive determines what we believe. What we believe determines what we take to be true. What we take to be true is our reality.”

(2)

2 This is attributed by many to a David Bohm lecture at Berkely, 1977, however in Gary Zukav’s “The Dancing Wu Li Masters”, (1980, p.310) he writes this phrase without reference to Bohm with the opening word “Reality” in inverted commas, and this gives me reason to think he is the originator – perhaps inspired by Bohm..

March 14, 2013 at 7:46 am #7127alan2102

Participantgurusid post=6838 wrote: By conflating inflation and price, one distorts the very notions of value.

Who is conflating anything? I am simply referring to higher prices as “inflation”, same as every other dictionary and reference work in the world. You can still have whatever causal theory about those higher prices that you please; I’m not taking that away from you. You just cannot call your causal theory “inflation” and still communicate effectively with the rest of the world, without cumbersome preliminary explanations.

Its not the ‘value’ that is increasing, but means to acquire that value that is inflating.

True. Who said otherwise?

It is a truism in investing, and in economic life, that price is not value, and pricing is not valuation. Everyone either knows this, or should know it.

But the point is (from my earlier post) that higher prices have several possible causes, and increased money supply is just one.

Trying to build a theory of cause into the word “inflation” is a non-starter; see discussion at comment #6833.

currently we have a situation in which price has become divorced from the money supply; it’s a bit like an authoritarian government ‘fixing’ the state price of bread, regardless of what is affordable or what the bread is actually worth, only here its called the ‘free’ market, and instead of party officials fixing the price, we have stock brokers and computerised algorithms. These are price rises driven by speculation on value (virtual digital value at that) NOT inflation of the money supply. The irony here as regards ‘energy’ prices such oil is that they would go through the roof as their value has been held down as regards their true worth, say when compared to the equivalent in human labour energy.

So, prices are being driven UP artificially, but are also being held DOWN artificially. Maybe you could explain in more detail.

March 14, 2013 at 5:41 pm #7129gurusid

ParticipantHi Alan,

So, prices are being driven UP artificially, but are also being held DOWN artificially. Maybe you could explain in more detail.

I just did. Its down to a distorted value system which assigns an arbitrary monetary value to everything, even when a ‘price’ cannot be put on it to start with. How can you put a monetary value fresh clean water to drink? How can you put a monetary value fresh clean air to breath? How can you put a monetary value on good soil and fertile seeds that provide food? How can you put a monetary value on an energy source that gives you the equivalent of one to seven years of constant human toil (twelve if you give them a break now and again)?

It is the ‘wetiko psychosis:

The wétiko psychosis, and the problems it creates, have inspired many resistance movements and efforts at reform or revolution. Unfortunately, most of these efforts have failed because they have never diagnosed the wétiko as an insane person whose disease is extremely contagious.

Jack D. Forbes (Derrick Jenson quoting Jack D Forbes on the ‘insanity’ of it all)

If your value system is corrupted or worse your value system is not based in reality at all, then it is quite easy to assign arbitrary* notions of value to anything, including court judgements on the very sanctity of life.

Dictionary ref: arbitrary. adj. 1 based on or derived from uniformed opinion or random choice; capricious. 2 despotic. (Concise Oxford, 9th Ed. 1995)

On conflating the measure with the thing being measured, well it kind of goes to eleven…

https://www.youtube.com/watch?v=EbVKWCpNFhY

😆

L,

Sid.March 14, 2013 at 6:33 pm #7130alan2102

ParticipantTheTrivium4TW post=6800 wrote:

Your thesis is that “Money” will hyperinflate their trillions in wealth away because it is “easy” and “Money” wants to please government workers with paychecks.

I have news for you, “Money” has no motherland and no affinity towards government workers. Their sole object is gain for themselves AND HYPERINFLATING THEIR WEALTH AWAY IS CONTRARY TO THEIR PSYCHOLOGICAL MAKEUP.This argument comes up in different forms from time to time in discussions of inflation vs. deflation. The argument is: they (TPTB, the Money Power) will not let inflation happen because it would let the debtors off the hook; it would inflate-away THEIR wealth. Not a bad point, superficially — depending on who “they” really are, and in what form their wealth is stored (dollars?). But it goes without saying that they have clear plans to preserve their wealth, no matter what. And they will probably be successful.

I recently read an interesting point about this. Here it is:

https://www.tfmetalsreport.com/comment/264618#comment-264618

Questions about nickels…

Submitted by Katie Rose on January 28, 2013 – 12:30pm.

[…snip…]

A brilliant friend of mine is convinced that we are headed for

hyper-inflation. He has spent many months studying what

happens in countries when the currency rapidly deflates while

real goods and services rapidly inflate.

He told me the first things that disappear are the coins.

People begin to hoard them, thinking the metal/s they are made

of has/have some value. In the case of the USA, the only coin

that has any intrinsic value due to metal content is the lowly

nickel.

Next, he claims, TPTB get the legislature to pass emergency

legislation concerning bank loans and interest rates. He told

me most people think that they will be able to pay off their

home loans with debased money. Not so!

He told me that within 48 hours of hyper-inflation beginning,

legislation is passed tying/increasing loan payments of any

kind to the rapidly decreasing monetary value. If the dollar’s

value goes down 2% in a day, the house payment increases by

2%. He told me that folks have a 24-48 hour window to pay off

their loans, then the legislation is passed and they are truly

screwed. He told me this has always happened. It’s as if the

legislation is already written, just waiting in the wings for

the event to begin. Then the legislature moves with lightning

speed to accommodate their Masters.Interesting idea! Makes perfect sense. The moment I read it, I had one of those forehead-slapping “OF COURSE!” moments, like “yes, of course that is true… how could it be otherwise?”. The ravages of hyperinflation will be for the little people, not the elites, who will have multiple layers of protection. Their puppet politicians will immediately pass legislation (probably already written and ready to rubber-stamp) indexing interest on loans to the prevailing rate of inflation — “fixed rates” be damned. Hey, this is a National Emergency! We’re under attack by Financial Terrorists! You’re either With Us or you’re Against Us!

“Dateline 13 January 2014…. the U.S. senate, in emergency weekend sessions, passes the Financial Terrorism National Defense Act (FTNDA), calling for immediate…….”

Can you seriously imagine it being otherwise?

That is EXACTLY what will happen.

…………………………

PS: I left in the paragraph about nickels just because it remains an interesting quasi-investment or wealth-preservation opportunity. U.S. nickels, composed of 75% copper and 25% nickel, are currently worth more than a nickel, and can be bought at any bank in unlimited quantities; 50-roll boxes cost $100. Several proposals to debase the nickel have come and gone over the last few years; one of these years they WILL do it — i.e. replace most of the copper and nickel with (worthless) zinc. It already costs the mint nearly a dime to make each nickel, all costs included. So the clock is ticking on this idea. When hyperinflation kicks in, nickels will preserve and gain purchasing power. The gains could be great. The classic story about this is a guy, at the peak of the Weimar hyperinflation, who bought an entire city block in downtown Berlin for 10 ounces of gold. I’m not sure how true that story is, but it might as well be. It illustrates the general phenomenon of dramatically increased purchasing power of tangible commodities in a hyperinflation. Anyway, I’ll bet that nickels eventually have the purchasing power of a 2013 buck. Those boxes that you tucked away back in 2013 could come in mighty handy. 🙂

March 14, 2013 at 11:53 pm #7131pipefit

ParticipantAlan said, “When hyperinflation kicks in, nickels will preserve and gain purchasing power.”

What is even more incredible is that a nickel also protects the holder against deflation!!! It cannot, by legal tender law, go below five cents worth of purchasing power, even if the contained metal were to go near zero in price. e.g. a deflationary depression unfolds, and the price of copper and nickel go to 1/20 of their present value. Your roll of nickels can now buy enough metal build a car, lol!!!

March 15, 2013 at 8:46 am #7133davefairtex

Participantalan, pipefit –

Nicely done guys. Since a nickel is always worth 5 cents, the government by law has put a floor on its value. And if hyperinflation hits, the metal in a nickel will appreciate in value! That’s a trade that only has upside to it!

However, there is an aspect of practicality here. In the physical PM community, silver is considered to be a bit too weighty to be a convenient wealth savings vehicle. Nickel is 100 times worse!

1 pound of silver: $421

1 pound of nickels: $4.53

1 ton of silver: $842,459

1 ton of nickels: $9,060Can you imagine saving $9000 in nickels? At 5 grams each, you get 90 nickels per pound, and 181,200 nickels per ton.

An $18,000 car could be bought with two tons of nickels! 331 pounds to pay your $1500 rent!

But if you ignore the logistics and storage aspect, its a no-lose trade. And there aren’t many of those around.

Coinflation says the nickel is worth about 101% of face value right now. The real deal is pre 1982 pennies, which are 232% of face.

March 15, 2013 at 6:38 pm #7137gurusid

ParticipantHi Dave,

Your reply summed up nicely the whole conundrum. Practically speaking, i.e. in the real world it doesn’t work; but in the fantasy worlds inside the deluded minds of many people on the planet today, and especially the ‘financial world’ it does.

if you ignore the logistics and storage aspect, its a no-lose trade

When humanities little bubble bursts and they find themselves in the Real world – what’s left of it – they will find out how much they truly have ‘lost’. That time is fast approaching… :ohmy:

L,

Sid.March 24, 2013 at 9:48 pm #7221alan2102

Participantdavefairtex post=6845 wrote:

Can you imagine saving $9000 in nickels? At 5 grams each, you get 90 nickels per pound, and 181,200 nickels per ton.Yes, I can easily imagine that. It is not as big a deal as you think.

Actually, nickels are much more compact for wealth storage than most other things — wheat, butter, whiskey, ammunition, etc. (Though ammo might come close these days.) If you have any money, you have to put it somewhere, and paper cash is obviously a terrible bet, as is anything in the electronic system. But where? Bolts of linen? Condoms? Canisters of propane? More compact is generally better.

You understand, surely, that we are talking about hedge against a very different kind of world — a post-dollar world, or a devalued-dollar world, or an extended-bank-holiday world, etc., etc. The appropriate comparison is not nickels vs. visa cards or hundred dollar bills, but nickels vs. other hard goods, or nickels vs. dollars of newly decimated purchasing power.

Plus, of course, the rock-solid protection underneath (as someone pointed out up thread) of nickels never being worth less than 5 cents. In other words, you are protected no matter WHAT happens!

Some very smart people have picked up on this idea. Millionaire investor and fund manager Kyle Bass bought 20 million nickels — $1 million worth:

https://www.cnbc.com/id/44788851

Kyle Bass’s Nickel CollectionSmart man! He knows what is coming. He also has large gold bars in his desk drawers, it is said.

Nickels remain a steal at only 5 cents each, or $100 per box at the bank — about 3″ x 4″ x 10″. $1000 almost fits into a cubic foot of storage space. Not that big of a deal, unless you are living in a studio apartment. Much better than most other hard goods.

March 24, 2013 at 10:24 pm #7222alan2102

Participantdavefairtex post=6845 wrote:

Coinflation says the nickel is worth about 101% of face value right now.Yes, and that will change. It has been near 200% in recent years, and it will re-visit that level and much higher in coming years. Nickels will sooner or later be worth a quarter, eventually perhaps even a buck, in 2013 terms. Nickels remain a steal at only 5 cents each. The mint is letting them go at far below cost.

The real deal is pre 1982 pennies, which are 232% of face.

True, they are a good deal too. Only problem is somewhat more bulk. But not too bad, if you have a good source. And now you DO have a good source:

https://portlandmint.com

https://portlandmint.com/shop/product.php?productid=2&cat=2&page=1

68lbs of Copper Pennies

$100 face value

$170.00 + $16 shipping……….. ha! Free money! They’re selling pennies for LESS than melt value! Better deal even than nickels, for the time being, though as I say there is somewhat more bulk.

I still like nickels because of the compactness, and the neat “factory” boxes in which they come from the bank. The 50-roll boxes are a convenient unit for storage, measure and (eventually) exchange.

March 25, 2013 at 4:24 pm #7230alan2102

Participantdavefairtex post=6845 wrote: In the physical PM community, silver is considered to be a bit too weighty to be a convenient wealth savings vehicle.

Is that so? I had not noticed.

But here is my question for you, Dave: where should people put their money? What practical suggestion do yo have? I trust that it is nothing in the electronic system. I also trust that it is nothing in paper form. Given the current obvious systemic risks, such vehicles are highly problematic. But, regardless, what do you suggest?

This is a serious question. Most people have at least some savings, however modest. What should they do with them?

-

AuthorPosts

- You must be logged in to reply to this topic.

Sorry, the comment form is closed at this time.