Why Liquidity is No Longer Enough

Home › Forums › The Automatic Earth Forum › Why Liquidity is No Longer Enough

- This topic is empty.

-

AuthorPosts

-

March 6, 2012 at 4:14 pm #8598

ashvin

ParticipantJohn Vachon Woolworth May 1940 "Woolworth Company, Indianapolis, Indiana" Since Lehman's failure in 2008, the name of the

[See the full post at: Why Liquidity is No Longer Enough]March 6, 2012 at 11:42 pm #1396Greenpa

Participant“They are afraid that, even after the Greek deal is done and losses are absorbed, all of the debt floating around in the Eurozone will still be just as unsustainable as it was before; “

Yup, I’m sure that’s part of it. I’m wondering though if some of those same players are not thinking “this is a mess; but maybe my best bet to save my own ass is to see to it that the credit default swaps are actually triggered; maybe I’ll collect more from JP Golem than I’ll ever get from Greece- before it all goes entirely to hell…”

What’s your guess, Ash- how many are thinking that way? And oh, what a big FAT mess that would make.

March 7, 2012 at 12:42 am #1399ashvin

ParticipantGreenpa,

I’d say they’d be willing to be screwed on the CDS if they thought the PSI actually had a chance of making Greece’s public debts sustainable, and that the EFSF/ESM could actually contain the crisis for the rest of the periphery. But it’s plain as day that’s not going to happen, and so some of the holdouts figure “what the hell”, might as well try to recover some of the inevitable losses through litigation and CDS while there’s still any money left to recover.

March 7, 2012 at 2:00 am #1400el gallinazo

MemberThe article was really interesting. It goes to show you how little most of the economic journalists really know what’s going down and how it works. Unfortunately, I found it a little confusing also, and I did go over the original Sober Look article. (Nothing worse than a sober look 🙂 It appears from the article that the ECB does not credit the banksters directly but through the national central banks? Actually, it might be useful if you could give a step by step chart of how the credit and collateral moves and why the new net amount must inevitably wind up in the ECB excess reserves. Why it must start its fateful voyage on the ECB (now bloated) balance sheet it clear.

Regarding Greenpa’s comment:

CDS’s are, of course, a zero sum game until the house of cards defaults start going down, i.e. the writers unable to pony up the dough and welching on their bets. The whole area is totally secretive since they are OTC and the last thing the writers wish is for other banks to know how vulnerable they are, as was AIG in 2008. However, it does seem that the Too Big to Jail banks wrote a lot more CDS’s than they bought, and a lot were purchased by hedge funds actually trying to hedge. Might have to revert back to beer to wash down the popcorn when this deal goes down.

March 7, 2012 at 3:20 am #1401YesMaybe

MemberI, too, am not at all clear about this:

The mistake people often make is assuming that if banks were to lend these new eurit’sos out, the euros would leave the Deposit Facility. But any euro “created” by the ECB (via net new lending) has to end up in some bank’s excess reserves (like the game of musical chairs). It may not be the same bank that took out the loan from the ECB, but it is still a bank within the Euro-system. So one way or another (whether banks, lend to each other, to clients, or buy securities) some bank in the Euro-system will end up with the excess reserves (net new euros never leave the system).

Could someone who’s in the know about this topic clear this up for us (as in whether claim made here is true or not and how the thingamabob works)?

March 7, 2012 at 3:31 am #1402ashvin

Participantel gallinazo post=1000 wrote: Actually, it might be useful if you could give a step by step chart of how the credit and collateral moves and why the new net amount must inevitably wind up in the ECB excess reserves. Why it must start its fateful voyage on the ECB (now bloated) balance sheet it clear.

Here is a better explanation of the process – https://soberlook.com/2012/01/deposit-facility-is-indicator-of-net.html

The logic goes like this:

Bank A borrows some cash from the ECB and posts some junk as collateral. The loan + junk is listed as an asset for the ECB, while the cash credited to the bank’s excess reserve account is listed as the liability. Bank A then transfers most of that credited cash to the ECB’s deposit facility, simply because it pays a slightly higher rate than holding it as excess reserves (although it has to keep some minimum amount as ER). If Bank A decides to use the money to make a loan to a bank, corporation or individual within the Eurozone, instead of keeping it on deposit with the ECB, the money will almost always end up being deposited in the excess reserve account of another bank within the EZ (assuming whoever ends up with the money doesn’t keep it in cash). Bank B will usually end up transferring to the ECB’s deposit facility for the same reason as the original bank.

All of that being said, I don’t think the banks are actually lending out much of the money they borrow from the ECB. Some of LTRO1 was used for sub 3-year bonds of peripheral nations (perhaps longer if its an Italian bank lending to Italy), but probably not as much will be used from LTRO2. Mostly, they use it to pay off their own maturing bonds and keep it on deposit.

March 7, 2012 at 4:01 am #1404YesMaybe

MemberThanks, Ash.

But if they were to actually lend more money, wouldn’t a portion of the funds turn from “excess reserves” to “required reserves”? Like, say you inject $100, and the reserve ratio is 0.1. Then if the banks extend loans for $500, only $50 would end up in the deposit facility, right? Of course, I know that doesn’t happen immediately, but if it were to happen eventually then the use of the deposit facility should drop?

March 7, 2012 at 12:45 pm #1409ashvin

ParticipantYesMaybe,

The ECB’s deposit facility is separate from the banks’ reserve accounts. Basically, each bank within the EZ has an option of storing their unused cash (credits) in their reserve account or in the DF.

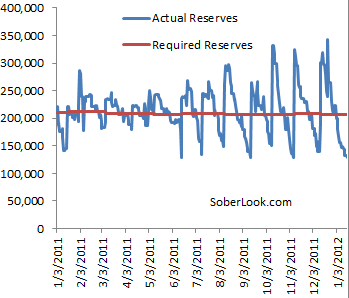

The Deposit Facility is an indicator of net borrowings from the ECB

Banks generally keep the minimum amount necessary in the reserve account. They just want to make sure that the daily balances average out to a number that is above the minimum reserve requirement over a specific time period. This makes the reserve amount “cyclical”

March 7, 2012 at 2:21 pm #1411

March 7, 2012 at 2:21 pm #1411Golden Oxen

ParticipantUnderstanding Hieroglyphics is a breeze compared to this!

March 7, 2012 at 2:31 pm #1412ashvin

ParticipantZH and Peter Tchir raise another way in which cheap LTRO liquidity makes solvency problems worse. The ECB’s requirement of variation margins on posted collateral creates the conditions for a “death spiral” in underlying asset markets if the collateral declines in value. Peripheral banks that receive margin calls from the ECB will generally have to sell assets (sovereign bonds) or pledge any remaining unencumbered assets, which makes it harder for peripheral governments to finance their deficits as well as the banks themselves, since it subordinates their unsecured creditors even further.

https://www.zerohedge.com/news/ltro-scratching-surface

Zerohedge pointed out a spike in additional collateral being posted at the ECB. According to some documents, the ECB is required to impose variation margins on its financing operations. This means that the collateral posted is not a one-time deal. If the collateral a bank has posted declines in value, the banks would have to post additional collateral. This is a big deal. Somehow the world seems to have an image that banks can borrow 3 year money at 1%, pledge an asset against it, and let the carry take effect with no other consequences. That is far from the truth if variation margins are being used.

Having to post variation changes the product a lot. Buying longer dated bonds becomes very risky. They remain volatile and although banks could hold them in non mark to market books to avoid that volatility hitting their P&L, it wouldn’t save them from posting variation margin if the holdings decline in value. That helps explain why the curves are so steep, and really will limit the ability of banks to hold down longer term yields if we get another round of weakness, the death spiral risk is too scary.

Portuguese banks should be of particular concern – again. The 2 year Portuguese bonds have jumped from a price in the low 80’s to the low 90’s. If banks bought these bonds as LTRO the potential for death spirals is on. As the bonds start declining in value, the banks would have to post collateral. Since the Portuguese banks are surviving almost exclusively on central bank money, their only choice would be to pledge some unpledged assets (if they have any), or sell the bonds and try and repay some of the LTRO. Selling bonds would put additional pressure on a then weak market. So the banks will pledge more assets. This does nothing to stop the slide in the underlying bonds, but would subordinate senior unsecured debt holders further. Senior unsecured debtholders will run for the hills again. They will see assets being taken out of the general pool – where they have a claim – and get shifted to the ECB, where ECB has the first rights.

March 7, 2012 at 2:40 pm #1413Greenpa

ParticipantClean cup! Clean cup! Move down! Move down!

🙂

-

AuthorPosts

- You must be logged in to reply to this topic.

Sorry, the comment form is closed at this time.