Ben Shahn “Scene in Jackson Square, New Orleans” 1935

With test results all over the place, we need to recognize that having all the world’s top minds on viruses focused on the same issue, does not guarantee a thing. Other than confusion.

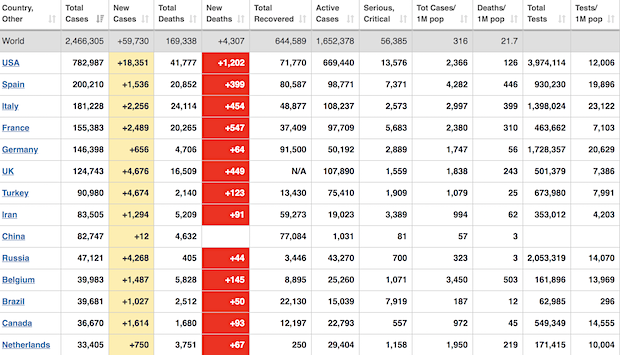

• US records 1,433 #coronavirus deaths in past 24 hours:.

• Cases 2,498,480 (+ 79,296 from yesterday’s 2,419,184)

• Deaths 171,333 (+ 5,559 from yesterday’s 165,774)

From Worldometer yesterday evening -before their day’s close-

From Worldometer – NOTE: among Active Cases, Serious or Critical fell to 3%

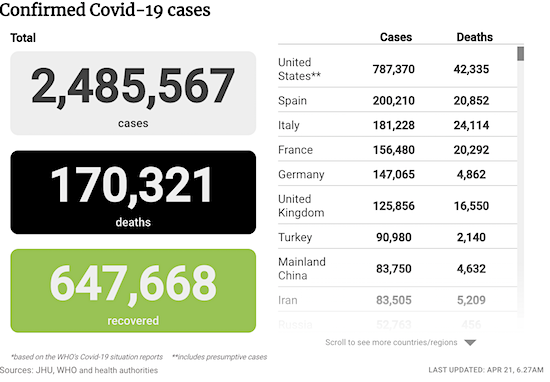

From SCMP:

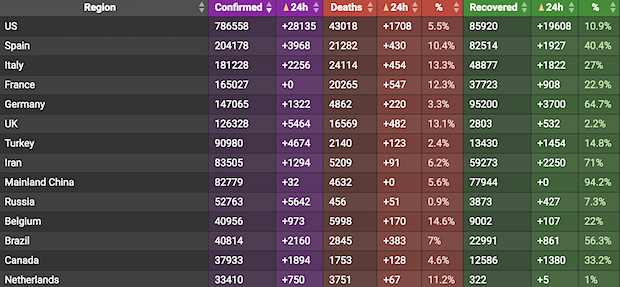

From COVID19Info.live: Note: Turkey is coming on very strong.

Virustime and human time are different things.

• Coronavirus’s Ability To Mutate Has Been Vastly Underestimated (SCMP)

A new study by one of China’s top scientists has found the ability of the new coronavirus to mutate has been vastly underestimated and different strains may account for different impacts of the disease in various parts of the world. Professor Li Lanjuan and her colleagues from Zhejiang University found within a small pool of patients many mutations not previously reported. These mutations included changes so rare that scientists had never considered they might occur. They also confirmed for the first time with laboratory evidence that certain mutations could create strains deadlier than others. “Sars-CoV-2 has acquired mutations capable of substantially changing its pathogenicity,” Li and her collaborators wrote in a non-peer reviewed paper released on preprint service medRxiv.org on Sunday.

Li’s study provided the first hard evidence that mutation could affect how severely the virus caused disease or damage in its host. Li took an unusual approach to investigate the virus mutation. She analysed the viral strains isolated from 11 randomly chosen Covid-19 patients from Hangzhou in the eastern province of Zhejiang, and then tested how efficiently they could infect and kill cells. The deadliest mutations in the Zhejiang patients had also been found in most patients across Europe, while the milder strains were the predominant varieties found in parts of the United States, such as Washington state, according to their paper. A separate study had found that New York strains had been imported from Europe. The death rate in New York was similar to that in many European countries, if not worse.

But the weaker mutation did not mean a lower risk for everybody, according to Li’s study. In Zhejiang, two patients in their 30s and 50s who contracted the weaker strain became severely ill. Although both survived in the end, the elder patient needed treatment in an intensive care unit. This finding could shed light on differences in regional mortality. The pandemic’s infection and death rates vary from one country to another, and many explanations have been proposed. Genetic scientists had noticed that the dominant strains in different geographic regions were inherently different. Some researchers suspected the varying mortality rates could, in part, be caused by mutations but they had no direct proof.

The issue was further complicated because survival rates depended on many factors, such as age, underlying health conditions or even blood type. In hospitals, Covid-19 has been treated as one disease and patients have received the same treatment regardless of the strain they have. Li and her colleagues suggested that defining mutations in a region might determine actions to fight the virus. “Drug and vaccine development, while urgent, need to take the impact of these accumulating mutations … into account to avoid potential pitfalls,” they said.

Confusion reigns supreme.

• WHO Warns That Few Have Developed Antibodies To COVID19 (G.)

Only a tiny proportion of the global population – maybe as few as 2% or 3% – appear to have antibodies in the blood showing they have been infected with Covid-19, according to the World Health Organization, a finding that bodes ill for hopes that herd immunity will ease the exit from lockdown. “Easing restrictions is not the end of the epidemic in any country,” said WHO director-general Dr Tedros Adhanom Ghebreyesus at a media briefing in Geneva on Monday. “So-called lockdowns can help to take the heat out of a country’s epidemic.” But serological testing to find out how large a proportion of the population have had the infection and developed antibodies to it – which it is hoped will mean they have some level of immunity – suggests that the numbers are low.

“Early data suggests that a relatively small percentage of the populations may have been infected,” Tedros said. “Not more than 2%-3%.” Dr Maria Van Kerkhove, an American infectious diseases expert who is the WHO’s technical lead on Covid-19, said they had thought the number of people infected would be higher, but she stressed it was still too early to be sure. “Initially, we see a lower proportion of people with antibodies than we were expecting,” she said. “A lower number of people are infected.” On Friday, a study carried out in Santa Clara, California by Stanford University and released as a “pre-print” without peer review, found that 50 to 85 times more people had been infected with the virus than official figures showed.

Santa Clara county had 1,094 confirmed cases of Covid-19 at the time the study was carried out, but antibody tests suggest that between 48,000 and 81,000 people had been infected by early April, most of whom did not develop symptoms. But even those high figures mean that within the whole population of the county, only 3% have been infected and have antibodies to the virus. A study in the Netherlands of 7,000 blood donors also found that just 3% had antibodies. Van Kerkhove said they needed to look carefully at the way the studies were being carried out. “A number of studies we are aware of in pre-print have suggested that small proportions of the population [have antibodies],” she said. These were “in single digits, up to 14% in Germany and France”. “It is really important to understand how the studies were done.”

Are the antibody tests valuable?

• LA Infections 40 Times Greater Than Known Cases In Antibody Tests (R.)

Some 4.1% of adults tested positive for coronavirus antibodies in a study of Los Angeles County residents, health officials said on Monday, suggesting the rate of infection may be 40 times higher than the number of confirmed cases. The serology tests, conducted by University of Southern California researchers on 863 people indicate the death rate from the pandemic could be lower than previously thought but also that the respiratory illness may be being spread more widely by people who show no symptoms. “We haven’t known the true extent of COVID-19 infections in our community because we have only tested people with symptoms and the availability of tests has been limited,” Neeraj Sood, a professor of public policy at USC and lead researcher on the study.

“The estimates also suggest that we might have to recalibrate disease prediction models and rethink public health strategies,” Sood said. At least 17 additional fatalities were recorded in Los Angeles County on Monday, bringing the total to 600, with more than 12,300 positive cases, according to a Reuters tally. The county is home to roughly 8 million people. The Los Angeles County results were announced as antibody tests come under increasing scrutiny over a high number of false positives reported in the kits. A similar study conducted in Santa Clara County last week by a Stanford University researcher has been criticized over its methodology and sample size.

New York Governor Andrew Cuomo on Sunday said health officials there would begin conducting statewide antibody testing of 3,000 people on Monday. The antibody tests, using decades-old ELISA technology, do not always pick up early-stage infections but show whether a person had the virus in the past, even if the person was asymptomatic. In comparison, the so called RT-PCR-technology swab tests used at drive-through stations and clinics across the country determine whether a person has the virus at that moment by looking for it in nose or throat secretions.

40%? 80%? Anybody’s guess.

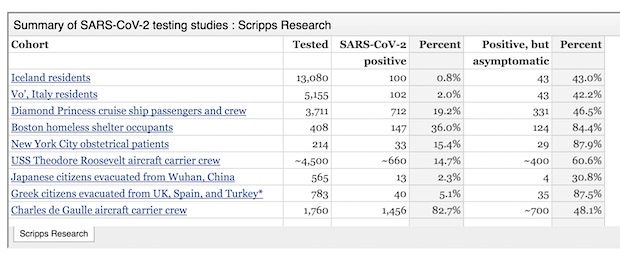

• Getting A Handle On Asymptomatic SARS-CoV-2 Infection (Scripps)

Since human-to-human transmission of the SARS-CoV-2 virus was first confirmed in January 2020, the early identification and testing of individuals with symptoms of COVID-19 has been the primary focus of public health measures in virtually all locales affected by the pandemic. But over the last two months [1], it has become increasingly clear that a sizable proportion of individuals infected with SARS-CoV-2 do not, in fact, have any symptoms of COVID-19. This new knowledge has significant implications for the targeting and scale of our testing efforts. For reasons that are not yet known, SARS-CoV-2 infection in certain individuals appears to cause no detectable illness.

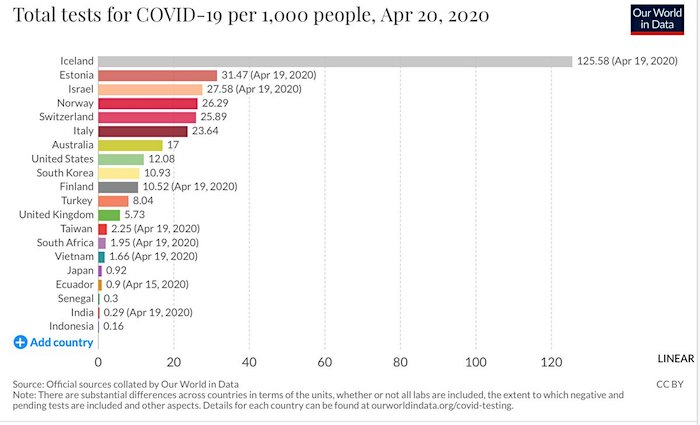

Presumably, though, because these individuals shed enough virus particles to trigger positive results in PCR testing, they may be capable of transmitting SARS-CoV-2 to others, an uncertain number of whom will develop COVID-19. Such cryptic transmission might explain the rapid spread of SARS-CoV-2 around the globe—and the grave challenge involved in containing the virus. In the studies that we have summarized in the table, the range of infection rates is wide: from 0.76% for residents of Iceland to 36% for residents of a Boston homeless shelter. It is striking, however, that the proportion of individuals who test positive for SARS-CoV-2, but who have no symptoms of COVID-19, remains consistently high: from approximately 31% to 88%, with a mean of 56%.

Because of various limitations in the summarized studies, this likely overstates the overall population mean, which some observers have suggested is around 40%. It should be noted that the summarized studies are essentially convenience samples. They do not purport to depict anything more than the circumscribed populations from which data were collected. Large, well-designed studies with representative samples are desperately needed to accurately assess the prevalence of those who are infected with SARS-CoV-2, yet are asymptomatic for COVID-19—and to determine their impact on the pandemic.

So, blood vessel linings and testicles.

• Coronavirus Attacks Blood Vessel Linings All Over The Body (SCMP)

The coronavirus attacks the lining of blood vessels all over the body, which can ultimately lead to multiple organ failure, according to a new study published in The Lancet. “This virus does not only attack the lungs, it attacks the vessels everywhere,” said Frank Ruschitzka, an author of the paper from University Hospital Zurich. He said the researchers had found that the deadly virus caused more than pneumonia. “It enters the endothelium [layer of cells], which is the defence line of the blood vessels. So it brings your own defence down and causes problems in microcirculation,” said Ruschitzka, referring to circulation in the smallest of blood vessels. It then reduces the blood flow to different parts of the body and eventually stops blood circulation, according to Ruschitzka, chairman of the heart centre and cardiology department at the university hospital in Switzerland.

“From what we do see clinically, patients have problems in all organs – in the heart, kidney, intestine, everywhere,” he said. That also explained why smokers and people with pre-existing conditions who had a weakened endothelial function, or unhealthy blood vessels, were more vulnerable to the novel virus, he said. Those underlying conditions included hypertension, or high blood pressure, diabetes, obesity and established cardiovascular disease. The study, published on Friday, found viral elements within endothelial cells, which line the inside of blood vessels, and inflammatory cells in Covid-19 patients. While the results were based on analysis of three cases, Ruschitzka said autopsies on other Covid-19 patients had also found their blood vessel linings were “full of virus” and the function of vessels was impaired in all of their organs.

Moral hazard squared.

• Through No Fault of Their Own (Ben Hunt)

“I think we all agree with you that more money for Main Street is needed. But maybe not in spite of the money to all of these companies and whatever that make up the economy, as well. More money is needed everywhere, perhaps. Why does anybody deserve to get wiped out from a crisis created like this? It’s like a natural disaster! Why does anyone deserve to be wiped out? Wouldn’t that be immoral itself?”

“Mr. Clarida also dismissed a question about whether the central bank had created a “moral hazard” that encouraged risky investor behavior when the Fed moved quickly to backstop swaths of credit markets. “This is entirely an exogenous event,” said Mr. Clarida, noting how the virus—not private-sector behavior—had forced widespread business closures and revenue losses.”I, for one, am delighted to learn of the “Through No Fault of Their Own” exemption to stock market risk. What a relief to learn that there’s no need for the plebes to hog all of the money, that so long as investment losses are from an “exogenous event” as opposed to “private sector behavior” – whatever the hell that means – the Fed will provide unlimited amounts of money – their words, not mine – to make the rich investors whole. Could this possibly be a bad idea … some form of moral hazard … for the federal government to insure the rich investors against capital market losses by buying TRILLIONS of dollars in financial assets and providing TRILLIONS of dollars in interest-free loans liquidity facilities? You know, provided that these losses weren’t their fault. LOL.

These are exactly the same people who paid off Goldman Sachs 100 cents on the dollar with their AIG losses in 2009. You think they give a flying fuck what you think about moral hazard or precedent or optics or fairness or decency? You think these oligarchs and their CNBC/fintwit Renfields care about ANYTHING other than getting their MONEY back? Why, it would be immoral NOT to pay off the rich investors on their market losses. I mean, sure, let’s hope that Congress gets its act together and throws a bone to the poors, but c’mon, man. First things first. Besides, you wanna know the REAL moral hazard here? Wanna know what sort of immoral behavior your sociopath “leaders” are worried about encouraging?

“Claiming the relief package will encourage people to stay out of the workforce, Graham told reporters that the bill “pays you more not to work than if you were working,” noting that it would provide the equivalent of $24.07 an hour in South Carolina versus the state minimum wage of $7.25 an hour. “If the federal government accidentally incentivizes layoffs, we risk life-threatening shortages in sectors where doctors, nurses, and pharmacists are trying to care for the sick, and where growers and grocers, truckers and cooks are trying to get food to families’ tables.”‘

I am not making this up. It’s the old Welfare Queen argument, all dolled-up for the age of COVID-19. Can’t make unemployment too attractive, you know … all those good-for-nothing poors will laze at home eating bonbons and sucking on the gummint teat instead of getting off their ass and doing an honest day’s work.

Meanwhile, back at the ranch, the Big 4 airlines will be accessing tens of billions of dollars in cash grants and easy 10-year loans, all explicitly designed to support entrenched management and equity shareholders. But hey, fret not, concerned citizen! Management will be prevented from making more stock buybacks until Sept. 30, 2021. That’s a whole eighteen months of no stock buybacks, so don’t tell me that Wall Street doesn’t understand shared sacrifice. And yikes! Management will also have to get by on their current salaries for the next three years, as hard as it may be to imagine the privation and human misery that will entail.

#DickB: "Fannie and Freddie have a 0.25% reserve against their portfolios which now have forbearance on 4.9% of their loans. The math is not looking good here." @Black_KnightInc @TheSamKhater @FHFA @FannieMae @FreddieMac

— R. Christopher Whalen (@rcwhalen) April 21, 2020

The middle ground between a job and a life as expressed in “..setting the “value of a statistical life” at $11.5 million..”

• US Economic Shutdown Too Tight For ‘Optimal’ Outcome: Minneapolis Fed (R.)

Current U.S. economic restrictions may be twice as tough as needed to balance the risks of the coronavirus pandemic against the economic needs of workers, according to research here released on Monday by the Minneapolis Federal Reserve. Titled “Health versus Wealth,” the paper was explicit in its topic and its methodology, setting the “value of a statistical life” at $11.5 million, in line with other federal agencies like the Department of Transportation. It used that figure to analyze the trade-offs between keeping more workers idled and easing social distancing. The current restrictions, the research concluded, are shifting benefits from younger workers, who would be better off with looser rules, to older individuals for whom protection from the coronavirus is more vital.

A middle ground, with more modest restrictions left in place until the end of July, produces the “optimal” outcome, it said. “The shutdown in place is around twice as extensive as it should be,” wrote the research team, which included Minneapolis Fed monetary adviser Jonathan Heathcote and Kansas City Fed senior economist Andrew Glover. The team noted that ending the shutdown at Easter, as President Donald Trump initially hoped to do, “would have implied an additional 172,000 deaths,” more than four times the 40,000 who have died so far.As it stands, the group estimates that 418,000 people in the United States would die over the next 18 months or so if economic restrictions are largely lifted by July 1. The Trump administration has relied on estimates of around 60,000 deaths through early August.

30 years of American climate change denial is summarised in the first five seconds of this video pic.twitter.com/1s83VfdpQa

— Ketan Joshi (@KetanJ0) April 20, 2020

Oil is almost down to $1/barrel. Since many are not familiar with oil markets, its important to note why this is happening.

The May contract expires tomorrow. If you have a May contract at expiration, you must take physical delivery of 1,000 barrels of oil at Cushing in Oklahoma

— (((Alex Gilbert))) (@gilbeaq) April 20, 2020

• Oil’s Big Crash Is More Rational Than It Looks (R.)

Oil prices have gone through the floor, literally. The price of a barrel of West Texas Intermediate crude oil went negative for the first time in history on Monday as traders panicked that storage for black gold coming from the vast U.S. fields had filled to the brim. Normally, that sort of crash in one-month U.S. crude futures would be indicative of something funny going on in the market rather than something deeply disturbing. In this case, both things can be true. The immediate cause of the mayhem was the normally innocuous news that the so-called “front-month” contract for May is expiring on Tuesday. Usually, investors who want to continue to invest in oil would simply sell their soon-to-expire paper to buyers that want it right now, and then buy the June contract, with a minimal price difference between the two.

Yet with the June contract still trading at $20 a barrel, that spread is now at an unprecedented level. Plummeting demand and a lack of restraint from U.S. drillers mean that at the current rate, storage capacity in Oklahoma will be full in a few weeks, traders told Reuters. Buyers are so wary of taking delivery of crude amid what they see as a global oil glut and a storage crunch that they will only do so at murderously low prices. The optimist’s view, if such a thing is possible, is that other oil benchmarks are less bombed out, and dislocations like this could also suggest short-term investors are struggling with their trades. The similar contract for Brent crude, which reflects oil prices in Europe, fell “only” 9% to $25 a barrel on Monday.

Recent cuts led by Saudi Arabia and Russia in theory offer a coordinated reduction that will remove 10 million barrels of oil from the market daily in May and June. Critically, though, these cuts don’t start until next month. A large chunk of the promised cuts may not even materialise, and pressure on Texas regulators to limit production hasn’t transpired, suggesting there’s no regional relief in sight either. The basic problem remains that the hit to daily global oil demand from Covid-19 could be as high as 30 million barrels. If so, storage will be busted through, and prices will need to fall low enough for the market to balance. While Monday’s epic crash may represent an overshoot, it is based in reality.

Let’s bailout shale.

• US Energy Industry Steps Up Lobbying For Fed’s Emergency Aid (R.)

The U.S. energy industry has asked the Federal Reserve to change the terms of a $600 billion lending facility so that oil and gas companies can use the funds to repay their ballooning debts, according to a letter seen by Reuters. The effort comes at a time of intensifying pain for the sector as U.S. crude oil futures traded in negative territory on Monday for the first time in history on worries of massive oversupply. So far, the energy industry has largely missed out on federal support to businesses hurt by the novel coronavirus economic disruption, but it is hoping it can benefit from the Fed’s Main Street Lending Program due to launch in coming weeks. The Fed has been deluged with roughly 2,000 letters seeking changes to the rules of the program, under which the Fed will purchase 95% of eligible bank loans to small- and medium-sized businesses.

The terms of that and other federal assistance schemes are under growing scrutiny amid worries that insufficient conditions are being placed on borrowers and banks may dish out funds to companies without the greatest need for the cash. The Independent Petroleum Association of America (IPAA) asked the Fed to reconsider a provision that bars eligible borrowers from using the cash to repay other loan balances and requires borrowers to promise to repay the Fed before other debt of equal or lower priority, according to an April 15 letter seen by Reuters. “Oil and natural gas producers are not looking for a government handout; they are seeking a bridge to help survive this economic disruption,” the IPAA, which represents thousands of independent oil and natural gas producers, wrote in the letter, which has not been previously reported.

How about renters though?

• Mortgage Payments Paused Or Reduced For 3 Million US Households (R.)

Some 3 million U.S. households have won at least a measure of relief on mortgage payments as efforts to squelch the coronavirus pandemic throw millions out of work and stretch household balance sheets, a survey from the Mortgage Bankers Association showed on Monday. About 5.95% of mortgage loans were in forbearance during the survey week of April 6-12, up from 3.74% a week earlier and from just 0.25% the week of March 2, the industry lobbying group said on Monday. That increase helps builds the case for a rescue for the mortgage services industry, suggested Mike Fratantoni, MBA’s senior vice president and chief economist.

“To ensure market stability during these challenging times for consumers and the entire industry, servicers need access to interim financing so that they can continue to play this critical role,” Fratantoni said. Congress did not include any such relief in its recent $2.3 trillion stimulus package, though some top Democrats have called for it and Dallas Fed President Robert Kaplan has said he is open-minded about potentially coming to the sector’s aid. The survey covered 38.3 million loans serviced by independent mortgage companies and banks, representing about 77% of the first mortgage-servicing industry.

Cheap air travel is a huge bubble, so yeah, bailout.

• US Treasury Releases $2.9 Billion In Airline Support (R.)

The U.S. Treasury Department said on Monday it had disbursed $2.9 billion in initial payroll assistance to 54 smaller passenger carrier and two major passenger airlines, while it finalized grant agreements with six major airlines. The Treasury is initially giving major airlines 50% of funds awarded and releasing the rest in a series of payments. In total, Treasury is awarding U.S. passenger airlines $25 billion in funds earmarked for payroll costs. Major airlines must repay 30% of the funds in low-interest loans and grant Treasury warrants equal to 10% of the loan amount, while airlines receiving $100 million or less do not need to repay any funds or issue warrants to the government.

Treasury said on Monday it had finalized grant agreements with Allegiant Air, American Airlines Group Inc, Delta Air Lines Inc, Southwest Airlines Co, Spirit Airlines Inc, and United Airlines Holdings Inc. Air carriers have been devastated by the coronavirus pandemic and seen U.S. travel demand fall by 95%. Southwest said it would receive half of the $3.2 billion payroll award immediately and the remainder in installments during May, June and July. Separately, Treasury said Alaska Airlines, Frontier Airlines, Hawaiian Airlines, JetBlue Airways Corp and SkyWest Airlines had also indicated that they planned to participate. The 12 major airlines represent nearly 95% of U.S. airline capacity.

The entire US economic system is ideal for smothering small business.

• Banks Warn New Small-Business Funding Could Evaporate In 2 Days (Pol.)

Lawmakers are nearing a deal to restart an emergency small-business loan program that exhausted its funding last week — but it may buy only a few days before the program screeches to a halt once again. Lenders are warning their customers they might not be able to secure loans even if Congress provides an additional $300 billion as soon as this week. Banking industry representatives say the program has a burn rate of $50 billion per day and needs closer to $1 trillion to meet demand, with hundreds of thousands of applications pending. “This is going to go within, at most, 72 hours,” said Consumer Bankers Association President Richard Hunt, who represents large banks. “But the odds are more like 48 hours.”

The legislation also likely won’t tackle controversial elements of the program’s structure, chiefly an exemption that allowed large companies such as Shake Shack and Ruth’s Hospitality Group to obtain tens of millions of dollars in loans, as well as rules that encouraged banks to favor their existing customers. The hurried rescue effort had only just begun to operate as intended when funding lapsed Thursday, after banks at first muddled through with a lack of guidance from the Trump administration and an overloaded Small Business Administration system needed to approve loans. Lenders handed out nearly 1.7 million loans from April 3 until the initial allocation of $350 billion for the program was exhausted.

Now, with controversy swirling around big companies taking advantage of the first rounds of loans, small businesses may be in for another shock with funding set to run dry again shortly after it’s made available to the program, which was set up to avert massive layoffs amid the coronavirus pandemic. The loans have proved enticing to businesses because they can be forgiven if borrowers maintain their payroll.

The level of craziness is not always easy to comprehend.

• NHS Staff Not Allowed To Tweet About ‘Political Issues’ – Like PPE (Ind.)

An NHS trust has been accused of “gagging” its staff by asking them not to tweet about “political issues” such as “PPE, testing and exit strategies”. Workers at the Norfolk and Suffolk mental health trust were issued guidance on “Covid-19 suggested subjects for tweets” as part of a staff newsletter. Acceptable tweets included praising staff for their hard work, volunteering to move departments, working over the weekend and keeping people safe. The Norfolk and Suffolk Foundation Trust faced backlash over their definition of a “political issue” after an extract from the newsletter was posted to Twitter by the Campaign to Save Mental Health Services in Norfolk and Suffolk. A spokesperson for The Norfolk and Suffolk Foundation Trust told us:

“In response to requests for guidance from our staff who are new to social media we produced guidelines to help support them. Our staff are keen to reassure the public and celebrate the work of their colleagues during the Covid-19 pandemic and these suggestions were intended to support them to do that. We actively encourage our staff to use social media within the remit of our social media policy. It was never the intention to deter staff from giving their own views on these issues.” According to government figures, 27 NHS staff members have died nationwide while fighting Covid-19. Why some NHS workers have not had proper access to personal protective equipment (PPE) and testing have been some of the key questions levelled at the government over its handling of the coronavirus crisis. The least we can expect NHS frontline staff to do is talk about it.

This must be a glbal issue. If you live near a zoo, check them out.

• New Zealanders Donate $230,000 To Help Zoo Feed Animals (G.)

New Zealanders have donated hundreds of thousands of dollars to feed hungry zoo animals in the midst of lockdown as the prime minister announced coronavirus lockdown restrictions would continue for at least three more weeks. Orana Wildlife Park on the outskirts of Christchurch is home to 400 wild and domestic animals, including chimps, meerkats, rhinos and giraffes. The zoo has been shut to the public during the lockdown, with keepers, deemed essential workers, working split shifts to stay safe. Unable to earn any income from visitors, which usually accounts for 95% of its revenue, the zoo is now struggling to pay its weekly NZ$70,000 (US$42,000) food bills, and has appealed to the general public for help. The gorillas alone eat NZ$800 (US$485) worth of vegetables every week.

In just four days more than 4,000 Kiwis have donated more than NZ$230,000. The wildlife park is the country’s only open-range zoo and is home to over 70 species of endangered animals from New Zealand and around the world. According to the givealittle appeal, the government’s wage subsidy only covers 40% of the park’s operating costs. “These costs are impossible to put on hold and include enormous food bills, huge electricity bills to keep our animals warm in the cooler weather and essential veterinary costs,” the appeal reads. “Our important New Zealand native conservation work continues, such as Kiwi chicks have recently hatched and must have access to heated brooder units in these crucial early stages.”

“..those capers were just old-fashioned scams. Joe Biden for President is Emperor’s-New-Clothes caliber deceit..”

Check out the Trump campaign video. At least make him work for it please.

Everybody knows he’s dimmer than a night-lite, and everybody’s pretending it’s okay. There’s no analog in history for any faction putting up such an empty vessel for high office. Granted, the Democratic Party has trafficked in unreality for years, from Crossfire Hurricane through UkraineGate – with side-trips like trannies in women’s sports – but those capers were just old-fashioned scams. Joe Biden for President is Emperor’s-New-Clothes caliber deceit, requiring a rank-and-file so marinated in falsehood they couldn’t tell you the difference between a red light and a green light. So, you have to ask: what is their game? In the weeks that led up to the blossoming of Covid 19, the game was apparently to bump off Bernie Sanders to satisfy the party’s corporate sponsors, who were not so eager to back someone that promised to confiscate their wealth.

Ironically, Covid 19 only fortified Bernie’s case that the nation’s obscenely crooked health care system demands drastic reform. Now, you could easily construct a scenario in which ol’ Bernie would have glided to victory in November on the basis of that, combined with unemployment figures that make the Great Depression look like a job fair. Picking Joe Biden as the instrument to block Bernie seemed especially dumb just weeks after the Democrats’ impeachment gambit blew up in their faces by shining a fiercely revealing light on Joe and Hunter’s adventures in international grift. One can easily discern Mr. Biden’s motive for remaining in the race after that because sheltering in candidacy seemed to inoculate him from any criminal investigation. But, did the whole party want to go all-in on that?

When you’re so oblivious & outta touch that even Trump lampoons you for it. pic.twitter.com/xU4yxDbGQ7

— Jimmy Dore (@jimmy_dore) April 21, 2020

We would like to run the Automatic Earth on people’s kind donations. Since their revenue has collapsed, ads no longer pay for all you read, and your support is now an integral part of the process.

Thanks everyone for your wonderful donations to date.

Smackdown of Bill Maher by Rep. Dan Crenshaw pic.twitter.com/0yTDfKNSrk

— James Hirsen (@thejimjams) April 21, 2020

https://twitter.com/aubrey75092/status/1252421403078299648

Support the Automatic Earth. It’s good for your mental health.