Claude Monet Ships in harbor 1873

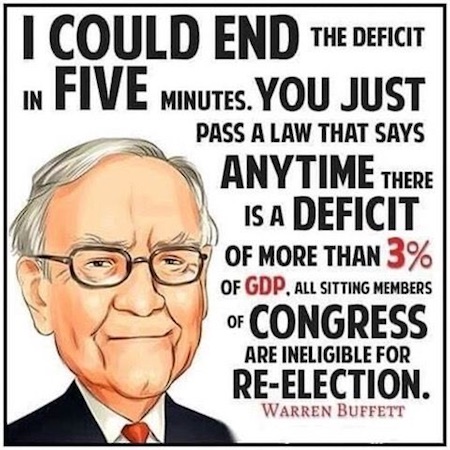

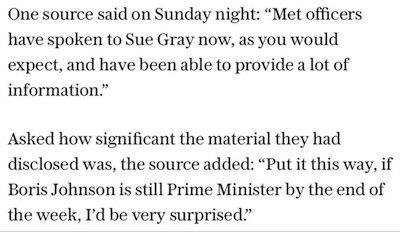

RFK

No wonder the Democrat party is scared to death of him…. pic.twitter.com/qOpuj7DGLp

— A Man Of Memes (@RickyDoggin) August 7, 2023

The average income in our country is $5,000 less than the basic cost of living. I'm going to change that. Over the course of the next few weeks, I'll be releasing an economic plan that focuses on ending the corrupt merger of state and corporate power to make sure Americans can… pic.twitter.com/jzBKfeKTbB

— Robert F. Kennedy Jr (@RobertKennedyJr) August 8, 2023

Ramaswamy

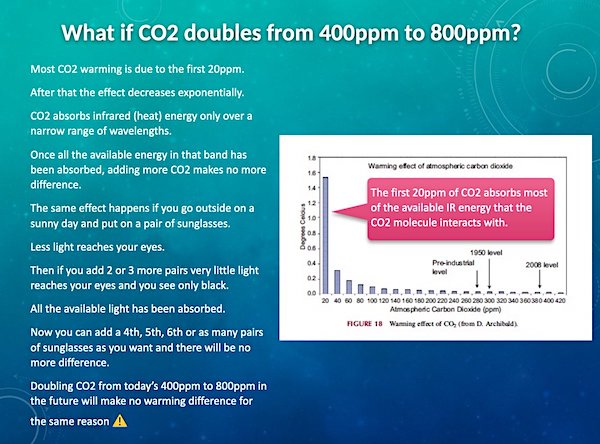

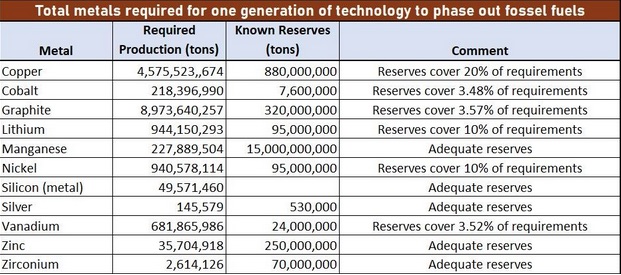

Fact: the climate disaster death rate has *declined* by 98% over the last century, even as carbon emissions have risen. The average person is 50X less likely to die of a climate-related cause than in 1920. Why? Fossil fuels. An inconvenient truth for the climate cult. pic.twitter.com/nJJRDmwIlF

— Vivek Ramaswamy (@VivekGRamaswamy) August 7, 2023

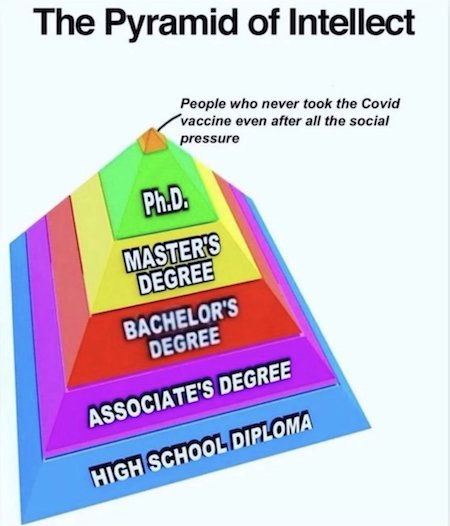

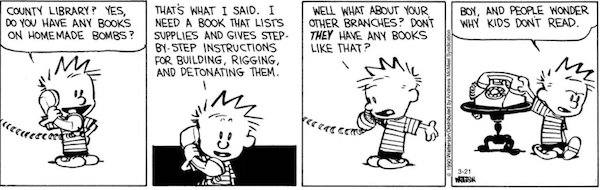

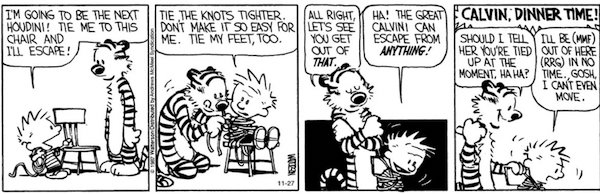

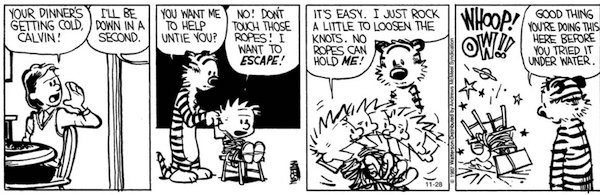

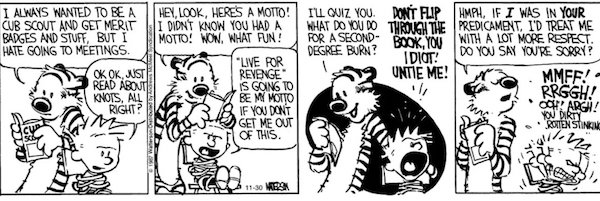

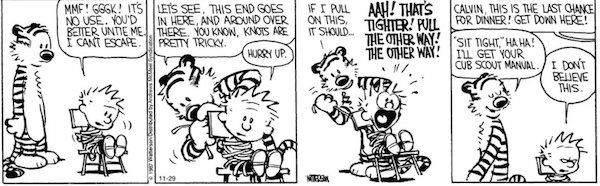

Satire

https://twitter.com/i/status/1688611582639546368

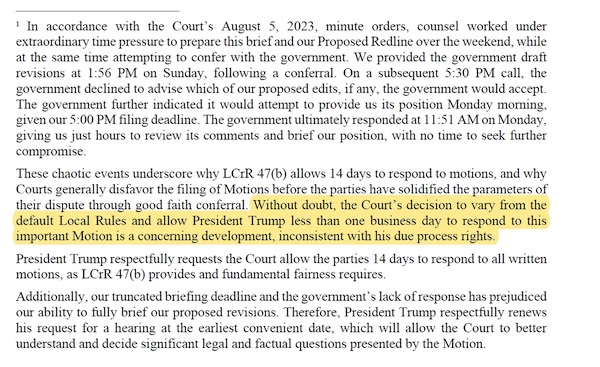

Ritter Aug 6

The idea is to drown Trump in litigation. And then at some point, make up something that puts him in jail. No more campaigning.

“This indictment is a naked threat and act of intimidation by the Democratic Party against any and all of their political opponents’”

• The Great Unravelling: ‘For All That Is Ours, We Must Fight’ (Alastair Crooke)

“[The DoJ indictment] “is ‘a declaration of war’ against American voters. It is not about Trump per se. It’s about criminalising dissent and punishing the millions who voted for him. [This week the Justice Department] took the unprecedented step of indicting former President Donald Trump — Biden’s chief rival in the upcoming 2024 election — for repeatedly expressing his opinion that the last election was stolen, rigged, and unfair”. It’s an opinion millions of Americans share, and to which they are unquestionably entitled thanks to the First Amendment. And that includes Trump, who has said repeatedly (and recently) that the 2020 election was stolen. He will probably keep saying it until his dying day, and he has every right to do so. The idea that our Justice Department can indict someone, especially the sitting president’s main political rival, over speech that’s protected by the First Amendment is simply insane … Simply put, this indictment is nothing more than a declaration of war against American voters and their constitutional right to free speech.

“Consider what is alleged and what isn’t: The charges against Trump do not include ‘incitement to violence’ on Jan. 6, 2021. Critically, The indictment simply presupposes that there was no election fraud. It then characterizes Trump’s contrary assertions from November 14, 2020 through January 20, 2021 as “false” – as though this were self-evident. “Trump’s claims were false and that he knew they were false”. On this basis, the indictment claims that 6th Jan was a ‘conspiracy’ – based in deceit – to prevent Electors’ votes from being appropriately counted”. Tom Fitton, president of the Conservative legal and election watchdog group, Judicial Watch, believes: “This indictment is a naked threat and act of intimidation by the Democratic Party against any and all of their political opponents’”.

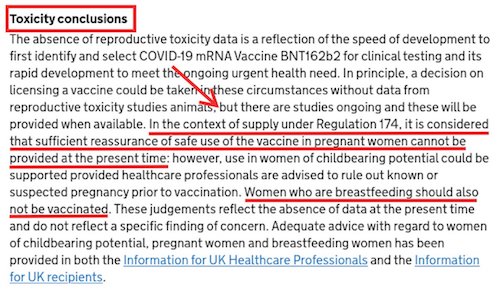

And The Federalist warns: “If the prosecution of Trump succeeds, it means the First Amendment is a dead letter in America. It means you’re not allowed to have opinions that contradict the Justice Department’s official narrative”. For the sake of clarity, what is being expressed here is that this indictment is part and parcel of the ongoing western ‘culture war’ – just as scientists were cancelled, dismissed from their professions and ostracised for expressing a view about mRNA science; just as views on human biology are subject now to official negation; just as ‘misgendering’ has become a potential criminal offence (hate speech), so ideological and institutional capture is being extended to the political sphere. This is the issue, amongst others, that is set to unravel America – and, in unravelling the U.S., will unravel Europe too.

SCOTUS wants to remain neutral. But with, what is it, 10 indictments and 42 charges(?!) vs Trump, that neutrality is long gone. Better act while Trump is still a free man.

• Trump Demands Supreme Court ‘Intercede’ In Legal Battles (ZH)

Former President Donald J. Trump has called on the Supreme Court to step in and ‘intercede’ in his various legal battles.” “My political opponent has hit me with a barrage of weak lawsuits, including D.A., A.G., and others, which require massive amounts of my time & money to adjudicate,” Trump said in a Friday post to Truth Social. “I am leading in all Polls, including against Crooked Joe, but this is not a level playing field,” he continued “It is Election Interference, & the Supreme Court must intercede. MAGA!” The former president is currently President Joe Biden’s #1 political opponent, and has been charged by Biden’s DOJ with conspiracy to defraud the United States, conspiracy to obstruct an official proceeding, obstruction of and attempting to obstruct an official proceeding and conspiracy against rights.

He was arraigned on Thursday in a Washington DC courtroom, where he entered a ‘not guilty’ plea on the four charges above. The indictment is the third filed against the former president in the past few months – as opposed to the entire time he’s been out of office. Trump is already facing charges linked to porn-star payoffs and keeping classified documents at his Mar-a-Lago property in Florida, in a locked safe, as opposed to a garage where his crackhead son doing business with the Chinese and the Ukrainians had full access to them. Trump has pleaded not guilty to all charges and maintained that he is being prosecuted for political purposes because of position as the front-runner for the GOP nomination for president in 2024.

All three of Trump’s criminal cases remain in early stages. Although the disputes could eventually end up at the Supreme Court, such an appeal would not take place until further down the road. In his hush money case, Trump has begun the appeal process over a ruling that denied Trump’s attempt to move the case to federal court. That dispute is now in the hands of the 2nd U.S. Circuit Court of Appeals. -The Hill Meanwhile, President Biden – who lied about his level of knowledge and involvement in Hunter Biden’s business dealings – says his DOJ is apolitical and makes its own decisions.

No.

• Can Trump Get an “Impartial Jury” in DC? (Dershowitz)

What should happen… when it is virtually impossible for the defendant to get an impartial jury in that state or district? The prosecution of Donald Trump for the events around January 6, 2021 would seem to call for a change of venue. The District of Columbia is the most extreme Democratic district in the country. Approximately 95% of the potential jurors register and vote Democrat. Whereas approximately 5% voted for Trump. Furthermore, the anger against Trump is understandable in light of the fact that the events of January 6th directly involved many citizens of the district. Moreover, the judge randomly selected to preside over this case has a long history of bias against Trump and his supporters, and her law firm has a long history of conflicts and corruption.

It is imperative, therefore, that in a case where the incumbent president has urged his Attorney General to pursue his political opponent aggressively, that all efforts must be made to ensure fairness. Prosecutors must lean over backwards to persuade the public that partisan considerations played absolutely no role in the decision to indict. Agreeing to a change of venue and judge would go a long way toward seeing that justice is done. Change of venue motions are only rarely granted, as are motions to recuse a selected judge. But this is a case where justice demands that these motions be granted, both in the interests of the defendants and in the interests of justice. The government should not oppose such motions, though they generally do if it gives them a tactical advantage.

It is likely therefore that these defense requests will be denied by the trial judge. If an unfair trial results in a conviction, the impact will already be felt, even if it is reversed on appeal after the election, as the prosecution likely anticipates. If the prosecution case is strong, it should have no fear of a jury and judge outside of DC. As the Supreme Court has repeatedly said: the job of a prosecutor is not merely to maximize the chances of winning, but to assure that he wins fairly and justly. In order to achieve that goal, the prosecutors in this case should not oppose defense motions for a change of venue and judge. Nor should it oppose an appeal if the trial judge denies these well-founded defense motions.

In all likelihood, prosecutors will vigorously fight all efforts by the defense to assure an impartial jury and judge, because they want every advantage that will help them secure a victory. They will point to defense efforts to secure advantages for their client and argue that the adversary system of justice requires them to do the same. But that is not the law. The Supreme Court clearly delineated a different role for prosecutors who represent the government: “The United States Attorney is the representative not of an ordinary party to a controversy, but of a sovereignty whose obligation to govern impartially is as compelling as its obligation to govern at all, and whose interest, therefore, in a criminal prosecution is not that it shall win a case, but that justice shall be done.” The prosecutors in the January 6th case should study this opinion before they deny Trump an impartial jury.

Yeah, he can get a Pyrrhic victory in Florida.

• DOJ Slapped By Judge In Trump Documents Case (ZH)

The judge overseeing former President Trump’s classified documents case, Florida District Judge Aileen Cannon, rebuked federal prosecutors on Monday while striking down two of their filings. DOJ special counsel Jack Smith has been directed by the court to unseal two filings and to provide a comprehensive legal rationale for a Washington, D.C. grand jury’s involvement in the investigation. Specifically, Cannon, a Trump appointee, has ordered Smith to explain “the legal propriety” of using a DC Grand Jury in a Florida matter. “The Special Counsel states in conclusory terms that the supplement should be sealed from public view ‘to comport with grand jury secrecy,’ but the motion for leave and the supplement plainly fail to satisfy the burden of establishing a sufficient legal or factual basis to warrant sealing the motion and supplement,” the order reads.

“Among other topics as raised in the Motion, the response shall address the legal propriety of using an out-of-district grand jury proceeding to continue to investigate and/or to seek post-indictment hearings on matters pertinent to the instant indicted matter in this district,” the order adds. Canon was responding to the special counsel’s motion for a “Garcia” hearing, where Smith’s team addressed a potential conflict of interest posed by Stanley Woodward representing defendant Walt Nauta and individuals who could be called to testify in the classified documents case, the Daily Caller reports.

“Trump and Nauta are scheduled to be arraigned Aug. 10 for the classified documents case. Smith issued a superseding indictment July 27 with additional charges for Trump and new charges for Mar-a-Lago employee Carlos De Oliveira who allegedly moved boxes around Trump’s Florida estate. Smith indicted Trump Tuesday for allegedly contesting the 2020 presidential election results and for his alleged role in the Jan. 6, 2021 Capitol riot. The former president pleaded not guilty at an arraignment in Washington, D.C. Thursday and accused Smith of “persecution” for his latest charges.” -Daily Caller. Separately, a grand jury in Washington DC indicted Trump last week on four counts over alleged efforts to overturn the 2020 election.

A gag order on a campaignig presidential candidate. What’s next? That’s right: jailtime.

• Trump Pushes Back On Proposed Gag Order (RT)

Lawyers for former US President Donald Trump have challenged a protective order requested by prosecutors on his election interference case, insisting that only “genuinely sensitive” material should be kept from the public eye. Trump’s legal team responded to the proposed order in a court filing on Monday night, saying that any attempt to prohibit the defense from publicly discussing material obtained from the government, including “exculpatory documents,” would violate Trump’s constitutional rights. “In a trial about First Amendment rights, the government seeks to restrict First Amendment rights,” the attorneys said.

“Worse, it does so against its administration’s primary political opponent, during an election season in which the administration, prominent party members, and media allies have campaigned on the indictment and proliferated its false allegations.” The filing went on to accuse special counsel Jack Smith, who is leading the election interference case against Trump, of seeking to use the court as a “censor” to impose “content-based regulations” on the former commander in chief, instead calling for a “more measured approach.”The defense lawyers suggested an amended protective order that would “shield only genuinely sensitive materials,” rather than “all documents produced by the government, regardless of sensitivity,” as proposed by the prosecution.

Though the attorneys noted they had reached a deal with prosecutors on a “small number” of revisions to the order, they said the government would be unlikely to agree to their full proposal, citing communications with Smith’s team. That leaves the matter to Judge Tanya Chutkan, who will decide on the order sometime before the next hearing scheduled on August 28. Trump was indicted last week on multiple criminal charges linked to alleged interference in the 2020 election, to which he has pleaded not guilty. The ex-president has slammed the case as politically motivated, claiming he was unfairly targeted to remove him as a contender in the 2024 presidential race.

“How can my corrupt political opponent put me on trial(s) during a campaign that I am winning (by a lot!),” Trump said in an all-caps social media post on Monday, apparently referring to President Joe Biden. He added that the legal proceedings are “forcing me to spend time and money away from the ‘campaign trial’ in order to fight bogus accusations.” In addition to the latest case, Trump also faces two other criminal lawsuits launched earlier this year, including dozens of felony charges related to his alleged mishandling of classified documents after leaving office, as well as another linked to alleged hush-money payments made to porn actress Stormy Daniels during his 2016 campaign. He has pleaded not guilty in those cases as well, insisting the charges are part of a “witch hunt” against him.

Yes, they love him in Georgia, too.

• Trump May Face Racketeering Charges in Fulton County Election Case (Sp.)

To date, former US President Donald Trump has faced down three indictments tied to dealings that took place while in his official capacity as commander-in-chief. The trio of cases are currently linked to hush money payments, the mishandling of classified documents and alleged election interference efforts. A looming fourth indictment against former US President Donald Trump may see Fulton County District Attorney Fani Willis invoke Georgia’s RICO Act and hit Trump with racketeering charges over his alleged efforts to interfere in the state’s 2020 election results. The state-level act echos much of the federal Racketeer Influenced and Corrupt Organizations Act of 1970, which has largely been used to take down organized crime entities involving mob connections and cartel groups.

Legal scholars noted Willis may utilize the state’s RICO Act as she has a proven success rate in such cases, and because it would allow her to connect various instances in which Trump associates across the US attempted to keep the one-time president in office. Additionally, officials pointed out that Willis early on in her investigation retained John Floyd, who is known as a leading expert on racketeering offenses. “It [invoking Georgia’s RICO Act] gives prosecutors lots of choices as far as venue goes, and it leads to very long complicated trials that wear down defense attorneys,” said Andrew Fleischman, a defense lawyer in Atlanta, to a US media.

The impending grand jury proceedings, scheduled to convene within the next two weeks, will decide whether criminal charges are warranted against Trump and his GOP allies. Already facing federal charges, the election interference case in Georgia proves the second such investigation into the Trump case over the 2020 presidential election. To date, Trump’s legal battles span multiple states, including New York and Florida, where he pleaded not guilty to all charges.

“The Russians are now fighting with weapons they didn’t have 18 months ago because they didn’t exist 18 months ago.

And that to me is the most impressive thing..”

• Ukraine’s Counteroffensive May ‘Run Its Course in the Next Few Weeks’ (Sp.)

Kremlin spokesman Dmitry Peskov earlier said that Kiev’s counteroffensive, which was launched on June 4, has been unsuccessful on all fronts as Russia continues its special military operation in Ukraine. The next few weeks will see the Ukrainian counteroffensive “run its course”, former International Monetary Fund (IMF) economist and Bank of America strategist David Woo has told the Russian media. Woo said that he was “really impressed” with the fact that that “the Russian military technology has literally been going through a revolution every three months” and “the Russians are constantly learning from their mistakes.” “The Russians are now fighting with weapons they didn’t have 18 months ago because they didn’t exist 18 months ago.

And that to me is the most impressive thing, […] whereas the West is still walking around in the same circle, Russia’s getting better and better, and this war is gonna [sic] be won by technology in the end,” the former IMF economist argued. He suggested that even though “the Ukrainians are good fighters,” Russia will eventually “crush them”. According to Woo, “if Russia crushes Ukraine, that will be the end of American hegemony, as we know.” Ukraine’s much-hyped counteroffensive kicked off on June 4 after months of delays over a lack of military supplies from Western donors. Russian President Vladimir Putin underscored last month that Ukraine’s counteroffensive, which he said claimed the lives of “tens of thousands” of Ukrainian servicemen, had yielded no results.

“Neither the colossal resources that were pumped into the Kiev regime, nor the supply of Western weapons, tanks, artillery, armored vehicles and missiles helped. The delivery of thousands of foreign mercenaries and advisers who were most actively used in attempts to break through the front of our army did not help either,” Putin told a Russian Security Council meeting at the time. Kremlin spokesman Dmitry Peskov, for his part, said that “the Kiev regime has no successes” and “is in a very difficult situation.” “The special military operation continues. It is obvious that the counteroffensive is not working out the way it was intended in Kiev,” Peskov told reporters. He was echoed by the Russian Defense Ministry, which in turn, said that Ukrainian troops kept trying, but were failing to advance as they continue to suffer heavy losses in men and materiel. A number of Western media outlets also pointed to the unimpressive results of Kiev’s counteroffensive, admitting that its progress was “slower than desired.”

‘No Compromise’ = ‘No Ukraine’.

• ‘No Compromise’ With Moscow, Kiev Vows (RT)

The government in Kiev has not given up on its “peace formula” and rejects all compromise positions, Ukrainian President Vladimir Zelensky’s adviser Mikhail Podoliak announced on Monday. His comments came after the Wall Street Journal suggested Ukraine had softened its stance during the peace conference in Saudi Arabia. “The only basic ‘foundation for negotiations’ is President Zelensky’s Peace Formula,” Podoliak tweeted. “There can be no compromise positions such as ‘immediate ceasefires’ and ‘negotiations here and now’ that give Russia time to stay in the occupied territories. Only the withdrawal of Russian troops to the 1991 border.”

Ukraine accuses Russia of “occupying” not just Donetsk, Lugansk, Zaporozhye and Kherson – four regions that chose to join Moscow last year – but also Crimea, which voted overwhelmingly to rejoin Russia after the 2014 US-backed coup in Kiev. “Any scenario of a ceasefire and freezing of the war in Ukraine in the current disposition will mean only one thing – Russia’s actual victory and [President Vladimir] Putin’s personal triumph,” Podoliak added several hours later. “This would be a great defeat for the Western world and the end of the current global security order.”

He also claimed that Moscow would use a “Minsk 3” to rearm and prepare for the “next round” of war, which would return “bigger, bloodier, and better prepared” as soon as “political leaders in key Western countries change.” Minsk 1 and Minsk 2 were ceasefires mediated by Paris and Berlin in 2014 and 2015, after Kiev failed to crush the rebellion in Donetsk and Lugansk by force. The German and French leaders involved in the talks admitted last year that they were buying time so NATO could arm Ukraine for a war against Russia. Podoliak did not specify what prompted his tweets. However, a Wall Street Journal article about the weekend’s talks in Jeddah – which suggested Ukraine had given up on its hardline position – circulated widely on Russian-language social media on Monday.

The talks, to which Russia was not invited, did not appear to accomplish anything. However, the Journal quoted “a senior European official” and two diplomats to report that Ukraine “didn’t push again for its peace plan to be accepted” and “didn’t press the point” about the demand for Russian withdrawal. Moscow has rejected Zelensky’s “peace formula,” a set of ten demands amounting to Russia’s unconditional surrender, as “a useless ultimatum” that only serves to prolong the hostilities. “There can be no negotiation process in the current disposition. The status quo must be changed on the battlefield. This means… more weapons, missiles and aircraft,” Podoliak demanded on Monday afternoon. The US and its allies have already supplied Ukraine with over $100 billion worth of weapons, ammunition and equipment, arguing that Russia “must lose” while insisting they are not actually involved in the conflict.

Hard to believe, but probably true. It’s what you get when all you see is propaganda.

• The West Really Believes Russia Is On The Verge Of ‘Collapse’ (Andrey Sushentsov)

The ongoing Western narrative that Russia is constantly on the verge of imminent collapse stems from the persistent perception that the state is vulnerable to internal combustion because of its perceived fragility, vast territory and critical imbalances. The current crisis serves as a serious stress test for Russia. However, in reality, it has already revealed the country’s remarkable adaptability. Moscow’s current strategic foreign-policy objectives have remained unchanged since they were formulated in November-December 2021. Originally intended to be solved through diplomatic channels, they encompass not only Ukraine but also Russia’s broader relations with the US and the West. An agreement could have been reached through negotiations but, unfortunately, the West did not take this route. As a result, Russia has resorted to military means to achieve its vital interests.

Russia’s plans revolve primarily around ensuring the demilitarization of Ukraine and preventing any formal alliance between Kiev and Washington, as well as countering potential military links with the NATO military bloc. Moscow’s determination to get what it wants remains unwavering, and it is prepared to use all available means. If negotiations resume in the future, it is likely that the issues that figured prominently in the November-December 2021 diplomatic contacts will be revisited. Unfortunately, the dominant narrative in Western countries often focuses on Russia’s supposed imminent collapse, ignoring its will to overcome the crisis. This narrative appears to be fueled by Western politicians’ belief in the country’s perceived weaknesses, which encourages the Western establishment not to seek an end to the conflict.

Based on long-term observations of the situation on the ground, especially after the infamous ‘Prigozhin revolt,’ one can conclude that there are still no clear signs of an impending crisis in Russia. On the contrary, the current state of the country has exceeded expectations in many areas – economic, social, demographic and military, given Russia’s ability to stand up to NATO’s formidable military machine. The current crisis situation serves as a serious stress test, assessing Moscow’s ability to make informed decisions, demonstrate social resilience, use resources effectively, adapt its economic model, sustain its political system, manage information strategies and overcome foreign-policy challenges. Undoubtedly, Russia is under enormous pressure and, like any nation state, is subject to factors that reveal both strengths and weaknesses.

“Businesses that can’t sell anything stop being businesses..”

What news is suppressed? That the USA is worse than dead broke. That the people were poisoned, apparently on-purpose. That the spectral “Joe Biden” sold out our country. That the war we started in Ukraine, on purpose, for no good reason, is about to be lost, and with it our standing around world. That there actually is such a criminal organism as the Blob at large in our government, responsible for the astounding abnormality immersing us. But never mind all that… for now, just go see Barbie. Have a clam roll, a dip in the ocean, another margarita…. September will be here soon enough.

Eventually, the official perversion of money — especially of borrowing an awesome lot of it with no intention of ever repaying — leads to the unhappy circumstance of money disappearing until nobody has any money. And by such, the broke-ness of the government transmogrifies to a whole land full of broke people. Many banks go broke as well. Even the high-fliers who hoarded things that purport to represent money go broke. Then, nobody has the means to buy anything. Businesses that can’t sell anything stop being businesses. After a while, no activity is meaningful except grubbing in the soil to grow some food, or stealing it from those who grubbed and grew it. By then, you can barely even call it a society.

By September, we’ll have some idea where all that is heading. The bond market is wobbling because the government can’t stop increasing its spending. America issues more and more bonds to borrow ever more money, but to the world’s bond-buyers (a.k.a. lenders), what used to be considered virtually risk-free now looks like a bad bet. So, the enticement to buy, which is called the interest rate, has to go up. But as it goes up, the cash value of existing bonds goes down (who wants the older bonds when the newer ones pay more?)

The holders of bonds are mainly big institutions: banks, pension funds, insurance companies, sovereign wealth funds (other countries). They put their large holdings into bonds because in normal times they are safe and dependable investments. But these are abnormal times. When the value of their bonds goes down a lot, the value of their reserves goes down. And when those reserves get reduced too much in relation to the institutions’ liabilities (what they owe), the institutions go bankrupt. When that happens, the people who are vested in those institutions lose their money, too, and end up having to sell stocks and other property to meet their obligations. This ends up looking like what we call “a crash.” It will get Normies’ attention.

On their way to becoming the no. 1 party.

• The EU Is A ‘Failed Project’ – Right-wing “Alternative For Germany” Party (RT)

The European Union’s migration, climate, and monetary policies have “completely failed,” according to a policy document adopted by the right-wing Alternative for Germany (AfD) party on Sunday. However, the party aims to change the EU from within rather than withdraw from the bloc. AfD delegates adopted the document at a party conference in the eastern city of Magdeburg on Sunday. The paper describes the EU as a “failed project,” and calls for the bloc to be reformed as a “federation of European nations,” with significant sovereignty ceded back to its member states. “The EU and the globalist elites that support it have strayed from the original idea of the founding fathers of a European community adopted many years ago,” the document states, citing the 2007 Lisbon Treaty – which gave the EU the power to act as a single legal entity and made EU law supersede national law – as the moment when the bloc became “an EU super state.”

Among a lengthy list of reforms, the AfD is proposing that the EU strengthen its external borders, lessen its military reliance on the US by following a policy of “strategic autonomy,” and protect the “diversity of cultures and traditions of the peoples of Europe” from immigration. While a draft version of the document released in June called for the “orderly dissolution of the EU,” this language is absent from the final version. The party also chose 35 candidates to contest next year’s European Parliament elections at the Magdeburg conference. The list is led by Maximilian Krah, who has been an MEP since 2019. The AfD currently holds nine seats in the parliament, and is the third-largest German party in the EU legislature.

At home, the AfD is currently polling at a record high of 21%, according to Politico. This figure puts the party ahead of Chancellor Olaf Scholz’s Social Democrats (SPD) and behind only former chancellor Angela Merkel’s Christian Democratic Union (CDU). However, Germany’s mainstream parties have repeatedly ruled out entering into coalition with AfD, and a government-funded watchdog group recently called for the party to be banned for its “racist and nationalist” positions. The latest polling figures suggest a doubling in the AfD’s support since 2021, when it garnered 10.3% of votes in the parliamentary elections. This surge in popularity comes as Germany’s economy reels in the wake of Berlin’s decision to impose sanctions on Russia, which was formerly the country’s leading energy supplier. At a rally last year, AfD co-leader Tino Chrupalla accused Scholz’s government of waging an “economic war” on the German people by cutting the country off from Russian energy imports.

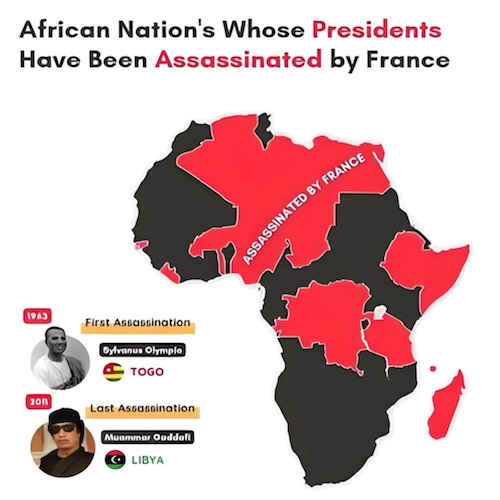

“This is conclusive evidence that the Ukrainian state is covering up and encouraging this bloody business,” Zakharova stated..”

• Ukraine Leader in Black Market of Human Organ Trafficking – Zakharova (Sp.)

Rampant corruption and lawlessness in Ukraine have effectively turned the country into a veritable paradise for organ traffickers eager to take advantage of cheap and abundant supply of human tissue. While reports about organs being illegally removed from the bodies of the deceased in Ukraine started emerging as early as in the late 1990s amid the decline of the Ukrainian economy , the illicit organ harvesting and trade in the country started becoming more widespread during the 2000s, noted Russian Foreign Ministry spokeswoman Maria Zakharova. In her op-ed in one of the Russian newspapers, Zakharova pointed out that the 2014 coup in Kiev and the armed conflict in Donbass that followed further exacerbated the problem, with OSCE confirming the discovery of the bodies with removed internal organs in mass graves located in the conflict zone.

Things have taken a turn for the worse since the escalation of the Ukrainian conflict in February 2022, while the laws passed by Ukrainian legislators in recent years greatly simplify the work of black market transplant specialists. For example, Zakharova points out, the Law No. 5831 passed by the Ukrainian parliament on December 16, 2021, effectively waives the requirement for a written consent of a living donor or their relatives for organ donation. “There is no need to authenticate signatures, either. In effect, even the removal of organs from children is permitted. The procedure for removing organs from the deceased who did not consent to donation while living has been significantly simplified,” Zakharova surmised.

She added that, under the Ukrainian legislation, the person responsible for the burial of a deceased, such as a head doctor at a hospital or a military unit’s commander, could grant permission for the removal of tissues from the corpse. Furthermore, private clinics in the country have also been granted the right to perform transplantation, while the Law No. 5610 adopted by Ukraine’s parliament on April 14, 2022, made transplantation exempt from VAT. Posthumous organ donations and the sale of human organs abroad have also been legalized in Ukraine. Massive casualties taken by Ukraine’s Armed Forces amid the escalation of the Ukrainian conflict resulted in a steady supply of fresh corpses that could be harvested for organs, leading to the emergence of hearts, livers, kidneys and other body parts of slain Ukrainian soldiers on the darknet marketplaces, Zakharova noted citing media reports.

One black market dealer reportedly claimed that a heart could be procured quickly for €25,000 while kidneys may be obtained for €12,000. The delivery, limited to the EU countries, would be made in a medical box within 48 to 60 hours, either to a predetermined location or directly to the recipient. Zakharova also claimed that people related to the infamous Kosovo Liberation Army – a militant group whose members faced allegations of illegal organ harvesting in the past – may own this illicit organ marketplace or at least have dealings with it. Aside from Ukrainian soldiers, the children of Ukraine also risk falling prey to illicit organ traffickers. For example, in June 2023 a member of a certain charity was detained on the border between Ukraine and Slovakia.

According to Zakharova, the detainee was involved in the trafficking of Ukrainian children abroad, with some of these children trafficked for the purpose of organ transplantation. Despite the severity of the accusations against him, the suspect was released on a 1 million hryvnias (about $27,000) bail and promptly disappeared. “This is conclusive evidence that the Ukrainian state is covering up and encouraging this bloody business,” Zakharova stated, adding that people close to Ukrainian President Volodymyr Zelensky may be involved in this sordid trade.

Sickos.

• UK’s NHS Raises Age For Government-Funded Transgender Treatments To Seven (ZH)

Children covered by the services will be offered psychological support and therapy to focus on issues that may have led to feelings concerning their gender, however health experts warn that the new rule could still put children with mental health struggles on a “pathway to medical transition.” The concerns are amplified by the potential consequences of labeling a child’s difficulties as gender-related, potentially pushing them towards a predetermined path of treatment. The decision to implement these changes stems from the NHS’ decision to shutter the Tavistock transgender clinic. Dr. Hilary Cass’ review deemed the clinic as unsafe, raising concerns that young individuals were being rapidly pushed into a medical framework without adequate consideration of alternative factors such as autism and mental health.

“The clinic is being replaced by a set of regional centres that will be led by medical doctors, rather than therapists, and consider the impact of other conditions such as autism and mental health issues. The move came amid growing concern about the impact of gender ideology on children, including in schools where some were being socially transitioned without their parents’ consent. NHS England said that a new service was needed because there was “scarce and inconclusive evidence to support clinical decision-making” at the Tavistock clinic.” -Telegraph

The shift in approach reflects the growing unease around the impact of gender ideology on children. Reports of children undergoing social transitions without parental consent in schools have fueled concerns over the potential consequences of premature interventions. While the move toward evidence-based decision-making is welcomed by many, questions linger about the potential long-term effects of early intervention. Critics argue that more research is needed to fully understand the ramifications of puberty blockers, especially for young patients whose bodies and minds are still developing.

Under the new plans, “Children under seven years of age may not be expected to have sufficiently developed their intellectual understanding of, and comprehension of, sex and gender to be able to understand the reasons for, and potential consequences of, a referral to a specialist gender incongruence service.”” But, according to the UK, by the age of seven, children will “be more established within school, and education professionals and school nurses will be able to contribute to a general observational view as to the appropriateness of a referral.” Right. Previously, children as young as three were being treated by Tavistock, with an average of three children under the age of seven having been referred each month.

“..scared at times for my safety and, overwhelmingly, for my family’s safety.”

For saying a woman is a woman. Why not try to ban her work outright?

• Museum Bans JK Rowling From Harry Potter Exhibit (RT)

The Museum of Pop Culture in Seattle has removed any references to Harry Potter author JK Rowling from an exhibition celebrating the fictional wizard, due to her “super hateful and divisive” comments about the transgender community. “There’s a certain cold, heartless, joy-sucking entity in the world of Harry Potter and, this time, it is not actually a Dementor,” the exhibit’s project manager Chris Moore, who is transgender, wrote in a blog explaining the decision to axe Rowling from the museum. Moore added: “This certain person is a bit too vocal with her super hateful and divisive views to be ignored.” The blog post also explained that the series creator’s absence is a short-term measure to “reduce her impact” while the museum determines its “long-term practices.”

According to the Daily Mail newspaper, the Harry Potter exhibit remains on display but without any mention whatsoever about the creator of the series, which has sold over 500 million books globally since 1997. JK Rowling was inducted into the museum’s hall of fame in 2018. In a statement, the museum said that it is “proud to support our employees and unequivocally stands with the nonbinary and transgender communities.” Rowling initially courted controversy in 2019 when she issued a message on social media in support of a British woman who’d lost her job after she herself tweeted that a woman could not change her biological sex. “I absolutely knew that if I spoke out, many people who love my books would be deeply unhappy with me,” the author said in a podcast interview earlier this year. She added that the backlash against her views has led to her being “scared at times for my safety and, overwhelmingly, for my family’s safety.”

Rowling was absent last year at events to celebrate the 25th anniversary of the release of the first Harry Potter book – with each of the film series’ three stars having expressed their opposition to her statements about transgender people. Daniel Radcliffe, the actor who played Harry Potter in the eight movies that have taken in more than $7.7 billion at the box office globally, said that he was “hurt” by Rowling’s comments. Rupert Grint, who played Ron Weasley, also said, “Trans women are women, trans men are men,” while Emma Watson announced a donation to a transgender charity in the wake of Rowling’s comments. Rowling is one of the world’s most successful authors. In 2008, nine years after the release of the first Harry Potter book, she was named by Forbes magazine as the world’s highest-paid author.

koi

platinum butterfly koi

pic.twitter.com/aXPhJjmE4V— Science girl (@gunsnrosesgirl3) August 6, 2023

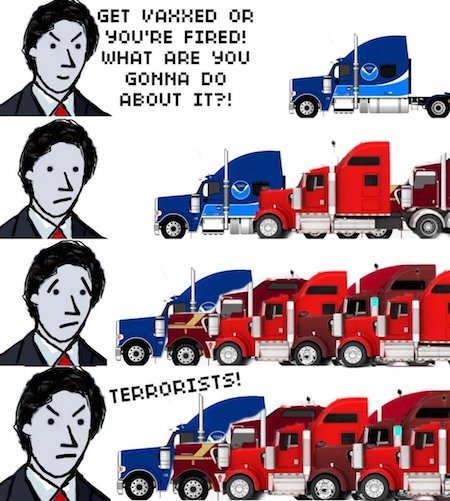

Eat bugs

“It's not about global warming. It's not about sustainable development. It's about enslaving humanity. They want to wipe out small and medium sized producers, centralise food control in the hands of mega corporations in bed with the mega governments.”

— James Melville (@JamesMelville) August 7, 2023

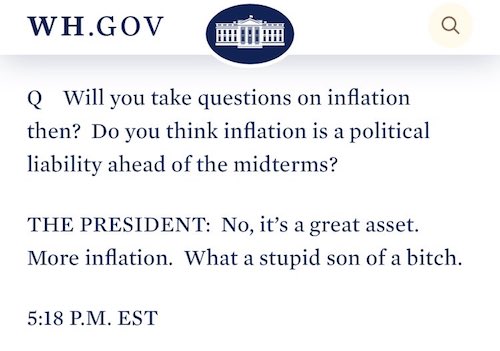

Hey Joe

Hey Joe! pic.twitter.com/C8obcCgJU3

— MAGA War Room (@MAGAIncWarRoom) August 6, 2023

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.