G.G. Bain ‘Casino Theater playing musical ‘The Little Whopper’, NY 1920

• The tally by Johns Hopkins University recorded 1,015 deaths in the past 24 hours, the lowest one-day figure in a month, with more than 1.17 million cases in the country as of 8:30 pm Monday (0030 GMT Tuesday), and a total 68,689 deaths

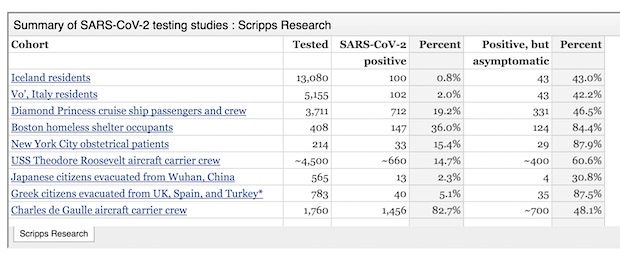

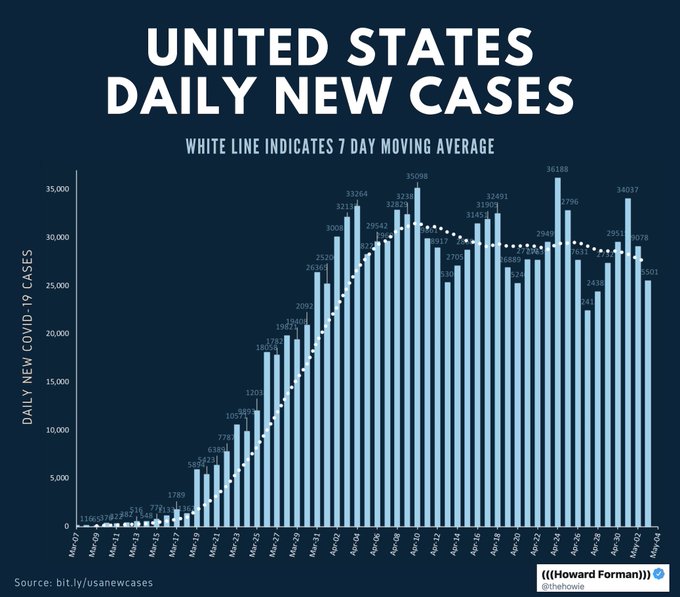

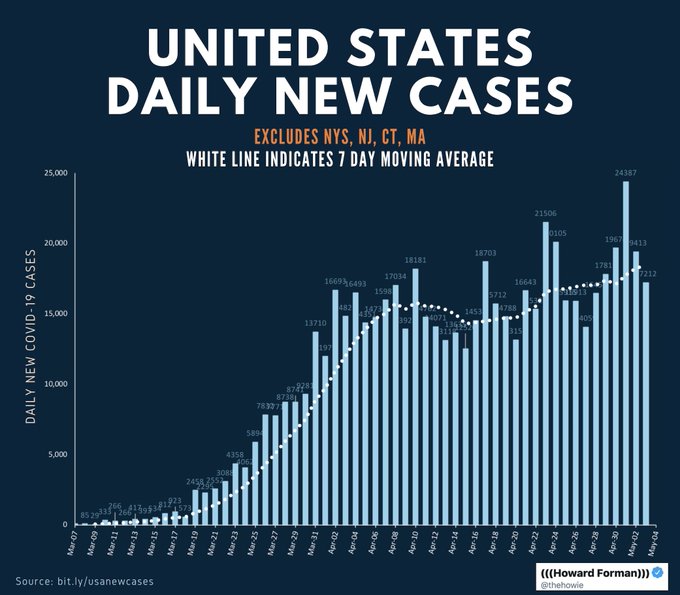

• US is improving only in NY,NY,CT and MA. Exclude those states and numbers are rising:

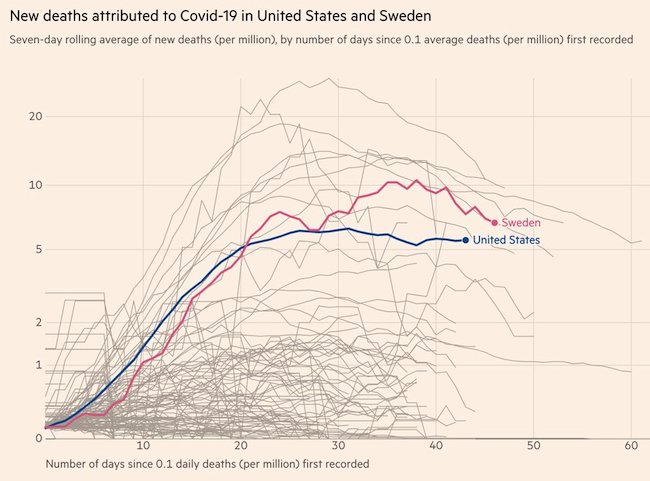

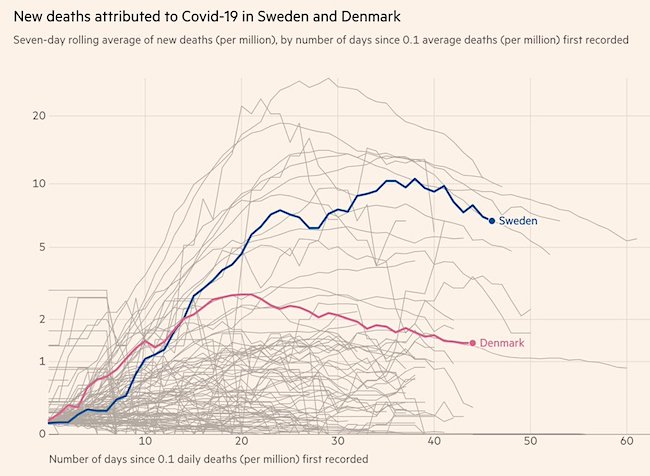

And while we’re at it, another success story: Sweden.

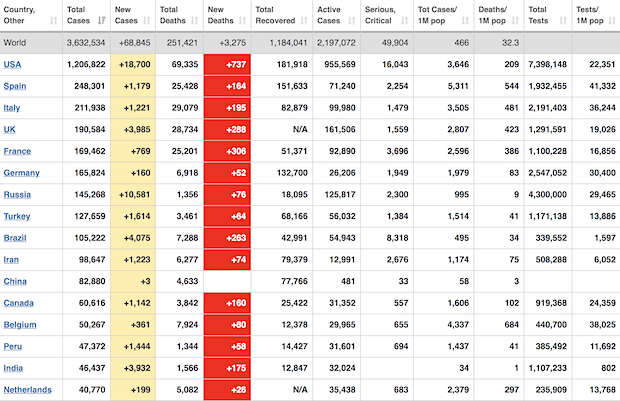

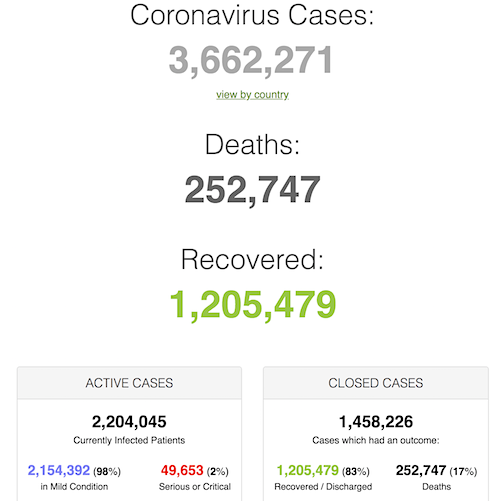

• Cases 3,662,271 (+ 79,382 from yesterday’s 3,582,889)

• Deaths 252,747 (+ 4,180 from yesterday’s 248,567)

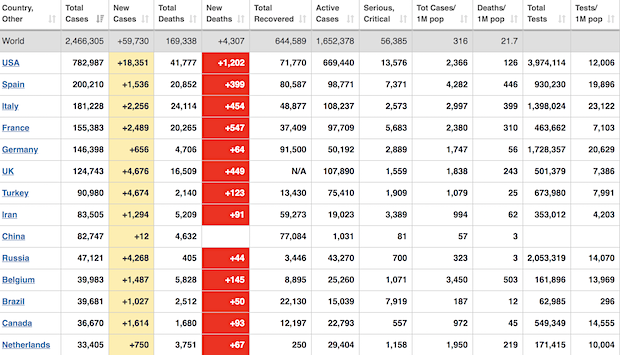

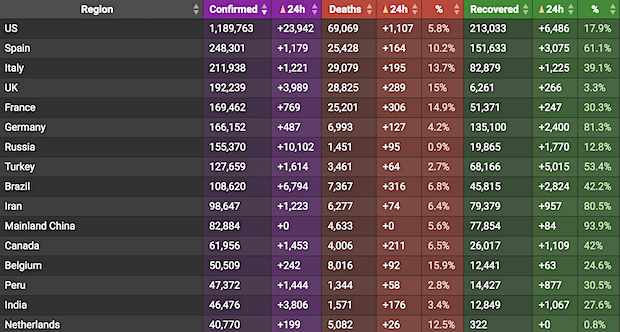

From Worldometer yesterday evening -before their day’s close-

From Worldometer

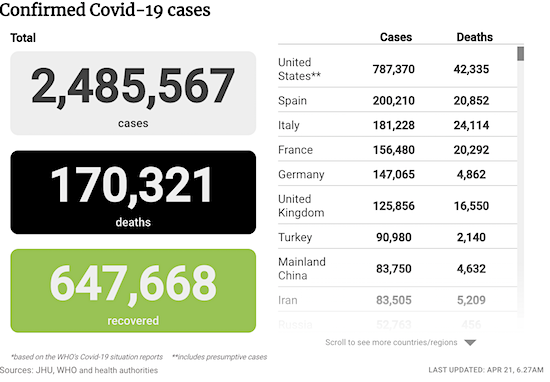

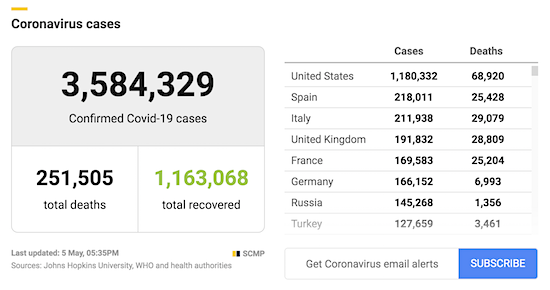

From SCMP:

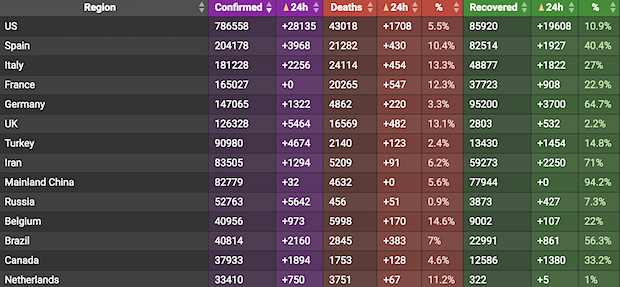

From COVID19Info.live:

I don’t want to quote CNN anymore than NYT or WaPo, but I was looking for these numbers, and CNN has them here. Note: they are from different sources, and the CDC one is only a draft “report”, of which the White House said it’s “not reflective of any of the modeling” done by the White House Coronavirus Task Force or “data that the task force has analyzed.”

Indicative of the level at which CNN “functions” are sentences like these: “Trump, who has consistently appeared to care most about his political prospects during three miserable months..”

• 30,000 New Cases, 3,000 New Deaths Daily Expected in US (CNN)

President Donald Trump now knows the price of the haunting bargain required to reopen the country — tens of thousands more lives in a pandemic that is getting worse not better. It’s one he now appears ready to pay, if not explain to the American people, at a moment of national trial that his administration has constantly underplayed. Depressing new death toll projections and infection data on Monday dashed the optimism stirred by more than half the country taking various steps to reopen an economy that is vital to Trump’s reelection hopes and has shed more than 30 million jobs. Stay-at-home orders slowed the virus and flattened the curve in hotspots like New York and California, but they have so far failed to halt its broader advance, leaving the nation stuck on a grim plateau of about 30,000 new cases a day for nearly a month.

New evidence of the likely terrible future toll of Covid-19 came on a day when Trump stayed out of sight — his wild briefings that hurt his political prospects now paused — meaning he could not be questioned on his enthusiasm for state openings in the light of new evidence. The White House also took new steps to limit testimony to the House from members of the President’s coronavirus task force, prompting Democratic Speaker Nancy Pelosi to warn on CNN that it was “afraid of the truth.” Trump, who has consistently appeared to care most about his political prospects during three miserable months, mounted another victory lap on Monday — boasting on Twitter that he was finally getting “great reviews” for his virus management.

A new model from the University of Washington, previously used by the White House suggested that 134,000 Americans could now die by August — in a revised toll prompted by the likely impact of state openings. The total was more than double the same organization’s estimate last month. A draft internal report by the US Centers for Disease Control and Prevention obtained by The New York Times buckled the White House narrative that the worst of the pandemic is passed and it’s time to get going again. It found that the daily death toll will reach about 3,000 by June 1, nearly double the current number.

More from the IHME.

• New Projection Puts US COVID19 Deaths At Nearly 135,000 By August (R.)

A new forecast projects nearly 135,000 deaths due to COVID-19 in the United States through the beginning of August mainly due to reopening measures under way, the Institute for Health Metrics and Evaluation (IHME) at the University of Washington said on Monday. The forecast U.S. death toll through early August totaled 134,475, a midrange between 95,092 and 242,890, the IHME said. The revised projection almost doubles the number of deaths foreseen in the United States since the last estimate in mid-April. The new projections reflect rising mobility and the easing of social distancing measures expected in 31 states by May 11, said the IHME, whose models are used by the White House.

The increasing contacts among people will promote transmission of the coronavirus, it said. “This new model is the basis for the sobering new estimate of U.S. deaths,” said IHME director Christopher Murray, referring to the reopening measures. The IHME said its new model assumes that public health orders that are currently in place will stay in place until infections are minimized. The IHME’s forecast increases the projected number of deaths in the U.S. by more than 62,000, with a rise of more than 8,700 deaths in New Jersey and more than 7,800 in New York state for the same period, up from estimates released last month.

Good thing the Lord of the Rings is finished.

• New Zealand PM: No Open Borders For ‘A Long Time’ (BBC)

New Zealand Prime Minister Jacinda Ardern says the country will not have open borders with the rest of the world for “a long time to come”. Ms Ardern was speaking after attending part of Australia’s cabinet meeting via video link. The meeting discussed a possible “trans-Tasman bubble”, where people could go between Australia and New Zealand freely, and without quarantine. But she said visitors from further afield were not possible any time soon. Both Australia and New Zealand have closed their borders to almost all foreigners as part of their Covid-19 response. Ms Ardern said New Zealand and Australia were discussing a “bubble of sorts between us, a safe zone of travel”.

She stressed there was “a lot of work to be done before we can progress…but it’s obviously been floated because of the benefits it would bring”. But, in response to a question about the country’s tourism sector, Ms Ardern said: “We will not have open borders for the rest of the world for a long time to come.” Tourism is one of New Zealand’s biggest industries, directly employing almost 10% of the country’s workforce, and contributing almost 6% of GDP. Most visitors are from Australia, followed by China, the US, and the UK. Ms Ardern said any “trans-Tasman bubble” was only possible because of “the world leading actions” of both countries.

UPDATE: In their COVID cabinet meeting today, Australia and New Zealand have agreed to stay at least 2,100km apart for the foreseeable future.

— The Shovel (@TheShovel) May 5, 2020

And few and far between after, from what I’ve seen.

• Just 273 Of 18.1 Million People Arriving In UK Prior To Lockdown Quarantined (G.)

Fewer than 300 people out of the 18.1 million who entered the UK in the three months prior to the coronavirus lockdown were formally quarantined, figures reveal. Passengers on three flights from Wuhan, in China, the source of the Covid-19 outbreak, and one flight from Tokyo, Japan, that was carrying passengers from the Diamond Princess cruise ship, were taken to government-supported isolation facilities between 1 January to 22 March. The figures, provided by the government to the Labour MP and member of the Home Affairs Select Committee, Stephen Doughty, show this totalled 273 people. Additional data provided to the committee shows that there were 18.1m arrivals at the UK border by air, land and sea in the same period.

Although that includes arrivals from all destinations, it is understood that Home Office estimates would still put the number of potentially infected individuals entering the UK from coronavirus-affected countries in that period in the tens of thousands. Doughty said: “The admission that just four flights from two locations, barely a few hundred individuals – out of literally millions of arrivals – were formally quarantined while the pandemic was already raging in a series of locations beggars belief. “On what scientific basis were a handful of flights from Wuhan and one from a Tokyo singled out for extreme attention? But not a single flight from Northern Italy, Spain or the US?

“The fact that many of these people then likely arrived and travelled onwards across the UK with little or no adherence to social distancing, and with no checks or protections at the border – barely a whiff of hand sanitiser – is deeply disturbing. Let alone the arrival of 3,000 fans from Madrid as the pandemic picked up speed.

But I thought the French strand didn’t come from China?!

• France’s First Known COVID19 Case ‘Was In December’ (BBC)

A patient diagnosed with pneumonia near Paris on 27 December actually had the coronavirus, his doctor has said. Dr Yves Cohen told French media a swab taken at the time was recently tested, and came back positive for Covid-19. The patient, who has since fully recovered, said he had no idea where he caught the virus as he had not been to any infected areas. This news means the virus may have arrived in France almost a month earlier than previously thought. Dr Cohen, head of emergency medicine at Avicenne and Jean-Verdier hospitals near Paris, said the patient was a 43-year-old man from Bobigny, north-east of Paris. He was exhibiting what later became to be known as the main symptoms of coronavirus, including a dry cough, a fever and trouble breathing.

He was admitted to hospital on 27 December, four days before the World Health Organization’s China country office was informed of cases of pneumonia of unknown cause being detected in the Chinese city of Wuhan. The French patient told French broadcaster BFMTV that he had not travelled before falling sick. Dr Cohen said two of the patient’s children had fallen ill but that the wife had not shown any symptoms. But Dr Cohen pointed out that the patient’s wife worked at a supermarket near Charles de Gaulle airport and could have come into contact with people who had recently arrived from China. The patient’s wife said that “often customers would come directly from the airport, still carrying their suitcases”.

The banks need more help, I’m sure.

• US Treasury Seeks To Borrow A Record $3 Trillion This Quarter (CNBC)

Massive stimulus to support the U.S. economy through the coronavirus crisis will cause the Treasury to borrow a record $3 trillion this quarter. The department on Monday announced the total, which is actually $2.999 trillion. “The increase in privately-held net marketable borrowing is primarily driven by the impact of the COVID-19 outbreak, including expenditures from new legislation to assist individuals and businesses, changes to tax receipts including the deferral of individual and business taxes from April – June until July, and an increase in the assumed end-of-June Treasury cash balance,” the department said in a statement. On top of that borrowing, the Treasury also said it anticipates another $677 billion in the third quarter. First-quarter borrowing totaled $477 billion.

The red ink comes thanks to multiple stimulus efforts Congress has passed to resuscitate an economy brought to a standstill amid social distancing efforts to halt the virus spread. Allocations thus far have totaled more than $2 trillion, and at last one more package is expected to help the more than 30 million Americans who have hit the unemployment line as well as thousands of other businesses that have seen their revenue streams evaporate. The Treasury Department also is backstopping several lending programs for the Federal Reserve, which is leveraging Treasury guarantees in programs aimed at providing another $2.2 trillion in funding to businesses and households.

They’ll laugh in her face.

• New York AG Asks Major Banks To Clarify Handling Of Small Business Loans (R.)

New York’s Attorney General said on Monday she has asked 11 major U.S. banks to clarify how they had issued loans tied to the U.S government’s $660 billion program to rescue small businesses from the impact of the coronavirus pandemic. Known as the Paycheck Protection Program, the plan was intended to help small firms weather the worst global economic crisis in decades but has been hobbled by missing paperwork, technology failure and a misdirection of funds to big corporations. Attorney General Letitia James said she is seeking information on the practices, marketing and procedures that banks undertook when they issued those loans.

Also of interest is whether some companies had used their lobbying power to influence the way banks had dispensed the loans, she said. “We are concerned that women and minority groups did not have equal access to loans,” James said in an interview, adding that she worried a disproportionate amount of money had flowed to big companies. A spokesman for James declined to name the 11 banks that had received a letter from the office, sent on April 29, but said they are “large” U.S. banks. The United States has been hardest hit by the coronavirus, which causes a respiratory disease, having seen 67,821 deaths in the country, higher than any other nation in the world.

“The beauty of springtime is sublime and, as Edmund Burke noted, that very beauty provokes our thoughts of pain and terror.”

• When the Birdies Sing Like the Fat Lady (Kunstler)

And so here we are at a fraught moment in the convergent crises of corona virus and the foundering economic system that it infected, with all its frightful pre-existing conditions. Of course, it isn’t capitalism, so-called, that is failing, but the perversions of capitalism, starting with the appendage of the troublesome term: ism. It isn’t a religion, or even a pseudo-religion like Zoroastrianism or communism. It’s simply the management system for surplus wealth. In a hyper-complex society, the management of wealth naturally grows hyper-complex, too, with lavish opportunities and temptations for chicanery, cheating, fraud, and swindling (the perversions of capital). It’s in the interest of the managers to cloak all that hyper-complex perversity in opaque language, to make it seem okay.

How many ordinary Americans have a clue what all the Municipal Liquidity Facilities, Primary Dealer Credit Facilities, Primary and Secondary Market Corporate Credit Facilities, Money Market Mutual Fund Liquidity Facilities, Main Street New Loan Facilities and Expanded Loan Facilities, Commercial Paper Funding Facilities, currency swap lines, the TALFs TARPs, PPPs, SPVs represent – besides the movement, by keystrokes, of “money” from one netherworld to another (both conveniently located on Wall Street), usually to the loss of non-elite citizens generally and to their offspring’s offspring’s offspring?

Real capital is grounded in the production of real things of real value, of course, and when it’s detached from all that, it’s no longer real capital. Money represents capital, and when the capital isn’t real, the money represents…nothing! And ceases to be real money. Just now, America is producing almost nothing except money, money in quantities that stupefy the imagination – trillions here, there, and everywhere. The trouble is that money is vanishing as fast as it’s being created. That’s because it’s based on promises to be paid back into existence that will never be kept, on top of prior promises to pay back money that were broken or are in the process of breaking. The net result is that money is actually disappearing faster than it can be created, even in vast quantities.

All this sounds like metaphysical bullshit, I suppose, but we are obviously watching money disappear. Your paycheck is gone. That activity you started – a brew-pub, a gym, an ad agency – no longer produces revenue. The HR department at the giant company you work for told you: don’t bother coming into the office tomorrow, or possibly ever again. Your bills are piling up. The numbers in your bank account run to zero. That sure smells like money disappearing. Wait until the pension checks and the SNAP cards mysteriously stop landing in the mailbox. There’s going to be a lot of trouble. Ordinary Americans are going to get super-pissed if money doesn’t disappear from the stock markets, too.

Every country develops its own app. And they’re all the best one, I’m sure.

• Apple, Google Ban Use Of Location Tracking In Contact Tracing Apps (R.)

Apple Inc and Alphabet Inc’s Google on Monday said they would ban the use of location tracking in apps that use a new contact tracing system the two are building to help slow the spread of the novel coronavirus. Apple and Google, whose operating systems power 99% of smart phones, said last month they would work together to create a system for notifying people who have been near others who have tested positive for COVID-19, the disease caused by the coronavirus. The companies plan to allow only public health authorities to use the technology. Both companies said privacy and preventing governments from using the system to compile data on citizens was a primary goal. The system uses Bluetooth signals from phones to detect encounters and does not use or store GPS location data.

But the developers of official coronavirus-related apps in several U.S. states told Reuters last month it was vital they be allowed to use GPS location data in conjunction with the new contact tracing system to track how outbreaks move and identify hotspots. The Apple-Google decision to not allow GPS data collection with their contact tracing system will require public health authorities that want to access GPS location to rely on what Apple and Google have described as unstable, battery-draining workarounds. Alternatives likely would miss some encounters because iPhones and Android devices turn off Bluetooth connections after some time for battery-saving and other reasons unless users remember to re-activate them. But some apps said they planned to stick to their own approaches.

Software company Twenty, which developed the state of Utah’s Healthy Together contact tracing app with both GPS and Bluetooth, said on Monday the app “operates effectively” without the new Apple-Google tool. “If their approach can be more effective than our current solution, we’ll eagerly incorporate their features into our existing application, provided it meets the specifications of current and prospective public health partners,” Twenty said. Canada’s Alberta province, which does not collect GPS data, said it has no plans to adopt the Apple-Google system for its ABTraceTogether app. Privacy experts have warned that any cache of location data related to health issues could make businesses and individuals vulnerable to being ostracized if the data is exposed. Apple and Google also said Monday they will allow only one app per country to use the contact system, to avoid fragmentation and encourage wider adoption. The companies said they would, however, support countries that opt for a state or regional approach, and that U.S. states will be allowed to use the system.

The Lancet should stand for quality. So sure, talk about why immunity passports won’t work. But what’s the use of discussing vaccination certificates when there’s no vaccine?

• Immunity Passports And Vaccination Certificates (Lancet)

Many governments are looking for paths out of restrictive physical distancing measures imposed to control the spread of severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2). With a potential vaccine against coronavirus disease 2019 (COVID-19) many months away,1 one proposal that some governments have suggested, including Chile, Germany, Italy, the UK, and the USA,2 is the use of immunity passports—ie, digital or physical documents that certify an individual has been infected and is purportedly immune to SARS-CoV-2. Individuals in possession of an immunity passport could be exempt from physical restrictions and could return to work, school, and daily life. However, immunity passports pose considerable scientific, practical, equitable, and legal challenges.

On April 24, 2020, WHO highlighted current knowledge and technical limitations, advising “[t]here is currently no evidence that people who have recovered from COVID-19 and have antibodies are protected from a second infection…[a]t this point in the pandemic, there is not enough evidence about the effectiveness of antibody-mediated immunity to guarantee the accuracy of an ‘immunity passport’”.3 In a follow-up tweet, WHO clarified that it is expected that infection with SARS-CoV-2 will result in some form of immunity.4 Caution is warranted about how population level serology studies and individual tests are used. It is not yet established whether the presence of detectable antibodies to SARS-CoV-2 confers immunity to further infection in humans and, if so, what amount of antibody is needed for protection or how long any such immunity lasts.3

Data from sufficiently representative serological studies will be important for understanding the proportion of a population that has been infected with SARS-CoV-2. These data might inform decisions to ease physical distancing restrictions at the community level, provided that they are used in combination with other public health approaches.5 The use of seroprevalence data to inform policy making will depend on the accuracy and reliability of tests, particularly the number of false-positive and false-negative results, and requires further validation.6

Not her decision, so easy talk. And the Tories will never go there.

• ‘Time Has Come’ For Universal Basic Income – Scottish PM Sturgeon (Ind.)

The “time has come” for universal basic income (UBI) in Scotland, Nicola Sturgeon has said. Speaking at the daily coronavirus briefing in Edinburgh, the first minister said there will be “constructive discussions” with the UK government on the matter. Under the scheme, residents would be given a universal payment from the government, with some benefits scrapped. The Scottish government has brought forward four pilots of a similar scheme in different council areas, but it is the UK government that has the ultimate power over creating a national scheme. When asked about the move at the briefing, the first minister said: “The experience of the virus and the economic consequences of that have actually made me much, much more strongly of the view that it is an idea that’s time has come.

The Scottish government would need more control over taxation and social security to make such a scheme a reality but the first minister said she hopes to “get into a constructive discussion” with the UK government about the scheme. She added she would like conversations to take place “hopefully reasonably quickly” after the coronavirus pandemic is over. The first minister added: “Watch this space.” Think tank Reform Scotland devised a detailed proposal for a UBI scheme. It would consist of an annual payment of £5,200 a year for adults and £2,600 for those under 16. Annually, the scheme would cost the Scottish government £20 billion, with measures found to raise £18.34 billion in revenue to support the scheme. When the think tank published its report in April, the first minister described it as “interesting and timely”, adding the coronavirus outbreak strengthened the case “immeasurably”.

Support the most bloated zombies! Or: look, if you want to support these guys, forget about supporting anyone else.

• US Mortgage Firms Push For Support As Borrowers Halt Payments (R.)

U.S. mortgage firms facing billions of dollars of missed home loan repayments are continuing to push for emergency government support as data published Monday showed a further rise in borrowers asking to halt payments. The number of people seeking to have mortgage payments paused or reduced rose to 7.5% as of April 26 from 7.0% a week earlier as the economic effects of the novel coronavirus outbreak stretched household finances, figures from the Mortgage Bankers Association (MBA) showed. The MBA estimates that 3.8 million homeowners are now in forbearance. The surge in delayed payments could leave mortgage service companies, which pool home loans and sell them to investors, with a liquidity shortfall of as much as $100 billion over the next nine months, according to the MBA.

That is because mortgage servicers still have to advance scheduled payments to investors even if borrowers fail to make their payments. Mortgage servicers want the Federal Reserve and Treasury to introduce an emergency liquidity facility to cover those payments but Treasury Secretary Steven Mnuchin said last week there were no current plans to offer such a lifeline. In an interview, the MBA’s Chief Executive Officer Bob Broeksmit said it was still discussing the issues with the Fed, Treasury and Federal Housing Finance Agency. “We don’t see it as the end of the matter,” he said. “We understand that the Fed and Treasury will continue to monitor the situation. We continue to advocate for the facility so we can prepare for the worst and hope for the best.”

“..3.5 billion people will be exposed to “near-unliveable” temperatures averaging 29 degrees through the year by 2070 [..] That heat compares with the narrow 11- to 15-degree range that has supported civilisation over the past six millennia

• Safe Climate Niche Closing Fast, With Billions At Risk (SMH)

As much as one-third of the world’s population will be exposed to Sahara Desert-like heat within half a century if greenhouse gas emissions continue to rise at the pace of recent years. Scientists from China, the US and Europe found that the narrow climate niche that has supported human society would shift more over the next 50 years than it had in the preceding 6000 years. As many as 3.5 billion people will be exposed to “near-unliveable” temperatures averaging 29 degrees through the year by 2070. Less than 1 per cent of the Earth’s surface now endures such heat. That heat compares with the narrow 11- to 15-degree range that has supported civilisation over the past six millennia, according to research published Tuesday in the journal Proceedings of the National Academy of Sciences.

“Absent climate mitigation or migration, a substantial part of humanity will be exposed to mean annual temperatures warmer than nearly anywhere today,” the paper said. Xu Chi, a researcher at China’s Nanjing University and one of the paper’s authors, said: “We were frankly blown away by our own initial results. As our findings were so striking, we took an extra year to carefully check all assumptions and computations.” “Clearly we will need a global approach to safeguard our children against the potentially enormous social tensions the projected change could invoke.” Among the most exposed nations will be India – where many people live in “already-hot places” – with as many as 1.2 billion people likely to be forced to move if population and warming trends continue. For Nigeria, the number exposed could be 485 million, according to a media release distributed along with the paper.

The scenario used projected the total populations in India and Nigeria to reach 2.2 billion and 600 million, respectively, by 2070, Dr Xu told the Herald and The Age. In Australia, areas of Western Australia and the Northern Territory home to about 200,000 people will be at risk. The research extended current population and greenhouse gas emissions trends into the future, and excluded impacts from the coronavirus pandemic on both. The researchers also considered possible rainfall changed. “The global pattern of population distribution seems less constrained by precipitation – while there is also an optimum around 1000 mm [of rainfall a year ] – so we focused on temperature,” Dr Xu said. “Changes of precipitation regime would definitely have impacts, but such impacts together those of temperature change would be more complex to foresee.”

“The UK is proud to be part of the Media Freedom Coalition championing press freedom around the world today.”

• Assange Extradition Hearing Delayed Until September (PR)

Hearings in the extradition of WikiLeaks founder, publisher, and editor Julian Assange will resume in September after being postponed from May 18 because of the coronavirus outbreak, which would have prevented lawyers from attending the hearing. Judge Vanessa Baraitser said it would not be possible for it to recommence this month because of strict restrictions on gatherings to curb the spread of COVID-19. Assange’s lawyers have said they have been unable to discuss the case with their client since the coronavirus outbreak. “There have always been great difficulties in getting access to Mr. Assange. But with the coronavirus outbreak, the preparation of this case cannot be possible,” his attorney Edward Fitzgerald told the court. Today, Judge Baraitser said the case would be moved to another Crown Court in September, once one with availability is secured.

The parties were unable to schedule the three week hearing for July or August. In addition, time was needed so that US prosecutors could attend the hearing. The Daily Mail reported the government lawyer, James Lewis, saying, ‘We think it is doubtful flights will have resumed earlier than then so we would rather have a September date because it gives more opportunity to have the American prosecutors actually in court.’ The parties agreed September 7 as the earliest date for the hearings to resume, although an exact date and an appropriate venue were yet to be decided. “It’s going to take some negotiation to find a Crown Court that is open in September, in the current climate, and willing and available to take this hearing,” Judge Baraitser said in Westminster Magistrates’ Court today. The judge will announce the new location, which might be outside London, and the start date for the remaining three weeks of the hearing in writing to the lawyers on Friday.

Assange was not able to attend Monday’s hearing via videolink because his lawyers said he was not well enough to appear. Kristinn Hrafnsson, WikiLeaks’ editor-in-chief, said in a video posted on social media on Monday that it was “completely unacceptable” that Assange has to spend another four months — and potentially longer — in prison. He described the hearing as a disgrace and denounced the tiny courtroom where only a few journalists could attend. He said this was not open justice and it needs to end. [..] Assange’s father John Shipton was delighted about the delay, saying it will allow family and supporters from Australia to attend. He’s also optimistic Assange might not be behind bars for the whole four months. He said, ‘I’m hoping there will be a very strong and firm bail application. It appears his lawyers held the power in today’s hearing and got the hearing dates they wanted, so it’s a good sign.’

"Remember now, a day after #WorldPressFreedomDay , Julian #Assange is the only journalist in Western Europe sitting in prison, and he is sitting in a UK prison. That has to end." – @khrafnsson Editor in Chief of @WikiLeaks #FreeAssange#AssangeCase#COVID19 #MayThe4th pic.twitter.com/SkXOXpsEaH

— Don't Extradite Assange (@DEAcampaign) May 4, 2020

The UK is proud to be part of the Media Freedom Coalition championing press freedom around the world today #WPFD2020. At this critical time, journalists & media professionals need our support and I call on governments to #DefendMediaFreedom https://t.co/SKP8h1PRQo

— Dominic Raab (@DominicRaab) May 3, 2020

We try to run the Automatic Earth on people’s kind donations. Since their revenue has collapsed, ads no longer pay for all you read, and your support is now an integral part of the process.

Thank you.

WATCH: Frontline health care workers in North Carolina stand-down protesters.

This is AMAZING. BRAVE. And SAD that as hard as they have worked to SAVE lives, they have to CONVINCE people to stay home to protect these protesters from spreading #COVID__19 pic.twitter.com/RuzaOpRF9L

— Peter Morley (@morethanmySLE) May 3, 2020

Doggo's Dream Comes True.. pic.twitter.com/LXRc4iXlrO

— Life on Earth (@planetpng) May 4, 2020

CNN in Greece

Support the Automatic Earth for your own good.