Byron “The close of a career in New York” 1905

Ben Bernanke announced a cut in QE by $10 billion a month this week, the financial press can’t stop talking about it and – what they call – “analyzing” it, and I still, after 8 years of Ben in the chair don’t know what puzzles me most: the quantity of attention paid to all things Bernanke, or the quality of it. I mean, I know why the press do it, but I have trouble understanding why they can’t constrain themselves.

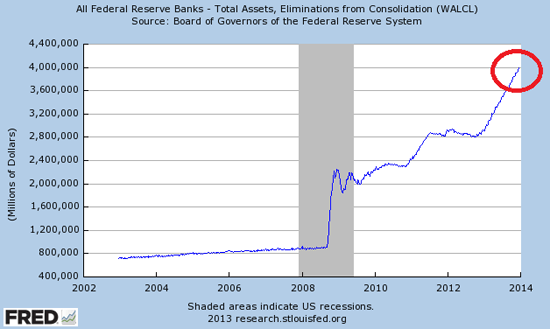

If a financial system is as dependent on public money injections as today’s one, there is a very real risk that this market has in fact stopped functioning, and that what we’re watching are zombified movements that can continue only thanks to those money injections, which are in their manipulative character, frankly, more reminiscent of what one would expect to see in communist nations than anything else.

That this market has stopped functioning is an option, however, that nobody seems to care about one bit. Everyone seems more than happy to take the money, run, and persist in labeling the system “capitalism”. Which I would think is a curious label for a system that depends to such an extent on government hand-outs (I know the central bank is supposed to be independent of the government, but hey …).

As the financial world stacks illusion upon illusion (that it is part of a capitalist system, that government hand-outs to banks benefit the people, that stock market records reflect anything at all about the real economy anymore), it sinks ever deeper into a warped fantasy world, and it doesn’t mind, because it knows it need not worry, it can take that money and run as long as the illusions last, and in the end it’s the people outside of the financial world that will forcibly coerced into paying the bills.

It looks like a good deal at first sight for the happy lucky few ones , and chances are they’re not going to wake up until the consequences become apparent and the societies they live in start to lose their social coherence and crumble into nasty stages of violent unrest. And even then they will in all likelihood manage to convince themselves that they of all people will be alright. After all, man is not only an easily fooled, but also a by nature optimistic animal with a great emphasis on the short-term view. Hope springs eternal.

It is that same attitude that, coincidentally, keeps the unlucky ones, who won’t be either happy or few, from comprehending today what is in store for them tomorrow. They look at the stock market records and tell themselves they too will be fine at some point in the future, because such is the overriding mantra: if the Dow is up, so is the economy. It would be good for them to contemplate the option that in today’s world, the exact opposite is true: that the higher the stock markets go, the worse off they are. Because it’s their money that pays for all of it.

A lot of people will claim when he leaves as Fed Chief February 1 2014 that Ben Bernanke’s been good for the financial markets. It’s, certainly at first glance, hard to argue with that. The S&P 500 went from 1280 to 1810 during his tenure, with a severe crisis in between.

But I would argue it’s more important that Bernanke’s also been as much of a scourge for the real US economy as his predecessor, Alan Greenspan. Who’s still revered by many as some kind of wizard, despite everything he did to attribute to the crisis that started just as he left. Is it possible to be good for the financial world and bad for the real economy? Yes it this, and these two gentlemen are living proof. And there’s no doubt Bernanke’s crown princess Janet Yellen will continue the “good” work.

Is it fair to blame Bernanke for what happened before he started as Fed chief on Feb 1 2006? Hell, yes. Bernanke became a member of the Fed Board of Governors in 2002, and thus had 4 years to stop the credit machine, the housing bubble and the derivatives mayhem, or get out and say he would have nothing to do with this mess. He did neither. He became no. 1.

Bernanke’s understanding of what happened on his watch from 2002 onwards is perhaps best summarized in a few choice quotes, courtesy of Michael Snyder:

• (July, 2005) “We’ve never had a decline in house prices on a nationwide basis. So, what I think what is more likely is that house prices will slow, maybe stabilize, might slow consumption spending a bit. I don’t think it’s gonna drive the economy too far from its full employment path, though.”

• (October 20, 2005) “House prices have risen by nearly 25% over the past two years. Although speculative activity has increased in some areas, at a national level these price increases largely reflect strong economic fundamentals.”

• (November 15, 2005) “With respect to their safety, derivatives, for the most part, are traded among very sophisticated financial institutions and individuals who have considerable incentive to understand them and to use them properly.”

• (February 15, 2006) “Housing markets are cooling a bit. Our expectation is that the decline in activity or the slowing in activity will be moderate, that house prices will probably continue to rise.”

• (October 4, 2006) “If current trends continue, the typical U.S. worker will be considerably more productive several decades from now. Thus, one might argue that letting future generations bear the burden of population aging is appropriate, as they will likely be richer than we are even taking that burden into account.”

• (February 15, 2007) “Despite the ongoing adjustments in the housing sector, overall economic prospects for households remain good. Household finances appear generally solid, and delinquency rates on most types of consumer loans and residential mortgages remain low.”

• (March 28, 2007) “At this juncture, however, the impact on the broader economy and financial markets of the problems in the subprime market seems likely to be contained. In particular, mortgages to prime borrowers and fixed-rate mortgages to all classes of borrowers continue to perform well, with low rates of delinquency.”

• (May 17, 2007) “All that said, given the fundamental factors in place that should support the demand for housing, we believe the effect of the troubles in the subprime sector on the broader housing market will likely be limited, and we do not expect significant spillovers from the subprime market to the rest of the economy or to the financial system. The vast majority of mortgages, including even subprime mortgages, continue to perform well. Past gains in house prices have left most homeowners with significant amounts of home equity, and growth in jobs and incomes should help keep the financial obligations of most households manageable.”

• (October 31, 2007) “It is not the responsibility of the Federal Reserve – nor would it be appropriate – to protect lenders and investors from the consequences of their financial decisions.”

• (January 10, 2008) “The Federal Reserve is not currently forecasting a recession.”

• (January 18, 2008) “[The U.S. economy] has a strong labor force, excellent productivity and technology, and a deep and liquid financial market that is in the process of repairing itself.”

• (June 10, 2008) “The risk that the economy has entered a substantial downturn appears to have diminished over the past month or so.”

• (July 2008, before House Financial Services Committee) “Fannie Mae and Freddie Mac are adequately capitalized.”

• (December 2010) “I wish I’d been omniscient and seen the crisis coming.”

Bernanke’s successor-to-be come February, Janet Yellen, like Ben is a long time stalwart of the Fed system. And while you may argue that she at least knows the system, it’s hard to see that as a positive given the examples set by Greenspan and Bernanke. Here’s the rundown: Janet Yellen was an economist with the Federal Reserve Board of Governors in 1977-78 and a member of the Federal Reserve System’s Board of Governors from 1994 to 1997. From June 14, 2004 until 2010, Yellen was the President and Chief Executive Officer of the Federal Reserve Bank of San Francisco. She was a voting member of the Federal Open Market Committee (FOMC) in 2009. In 2010, President Obama made her vice-chair of the Federal Reserve System and on October 9, 2013, he nominated Yellen to be Chair of the Federal Reserve Board of Governors. A few Yellen quotes:

• (June 1995) “To me the greatest asset of the Fed is the people. We have a tremendously dedicated staff. … They feel proud to work for the Fed, because this is such a competent, professional and well-respected organization. I feel proud of the organization, too; I wouldn’t have wanted to come back unless I felt that way.”

• (2005, speech in San Francisco) – Yellen argued against deflating the housing bubble because – “arguments against trying to deflate a bubble outweigh those in favor of it” and predicted that the housing bubble “could be large enough to feel like a good-sized bump in the road, but the economy would likely be able to absorb the shock”.

• (2010, Financial Crisis Inquiry Commission hearing) “For my own part, I did not see and did not appreciate what the risks were with securitization, the credit ratings agencies, the shadow banking system, the S.I.V.’s — I didn’t see any of that coming until it happened.”

Anyway, we’ll see more Yellen next year. Which is a shame for the American economy, and its people. Because as that last quote says, she saw nothing coming that contributed to this crisis, and carries that same blindness into the next one. For if that makes her the best choice for Fed chief, if America can’t produce any better candidate, that next crisis is guaranteed to happen.

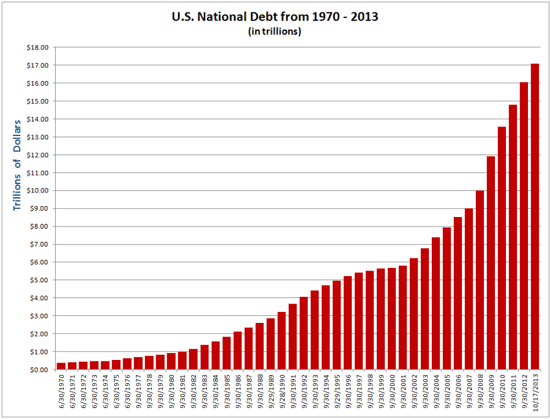

Let’s return to Bernanke. As I said, he’ll be hailed as a success by many, because the S&P 500 went from 1280 to 1810 during his tenure. However, he also took the target interest rate from 4.25% to 0.25%, and has kept it there. Such an artificial measure is not only far more something you’d expect from China than from the supposedly free market capitalist US, it also has an entire series of both perverting and perverted consequences. And down the line, interest rates will rise again regardless, leading to enormous potential damage for everyone who borrowed at cheap rates. Like the US government, whose debt doubled in the 8 years Bernanke was at the helm.

But let’s take a sidestep first, in this dance of the debt. And a sidestep from that sidestep: If Ben Bernanke is to be judged by history as having been successful, that would seem to mean that too much debt can be defeated with more debt. It’s not just, or all, on Bernanke’s shoulders, it’s a belief that’s still very widespread, but he does play a substantial role in it.

Sidestep 1: Employment growth is the responsibility of the Fed. In 1977, Congress amended The Federal Reserve Act, and stipulated the monetary policy objectives of the Federal Reserve as follows, thus defining the so-called dual mandate:

“The Board of Governors of the Federal Reserve System and the Federal Open Market Committee shall maintain long run growth of the monetary and credit aggregates commensurate with the economy’s long run potential to increase production, so as to promote effectively the goals of maximum employment, stable prices and moderate long-term interest rates.”

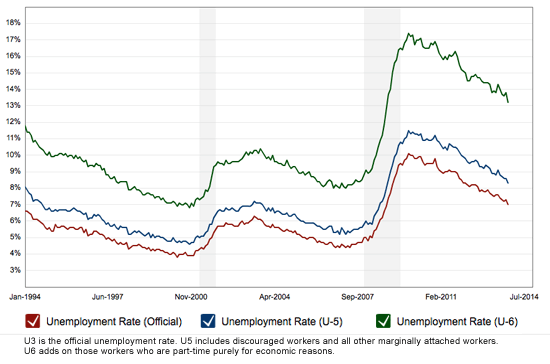

What has Ben Bernanke done to “promote effectively the goals of maximum employment”? Does a low interest rate lead to more jobs? For anyone wanting to argue it does, I have as many voices who would claim it does the opposite. Surely you don’t think QE 1,2,3,n promotes employment; we’ve already seen before that those $85 billion he’s been pumping into the banking system remain in that system, or at best end up in the stock markets. Moreover, in the past 5 years, we’ve seen so many questions raised about “official” U3 unemployment rates that it’s no longer acceptable to look only at U3. Here’s a comparison:

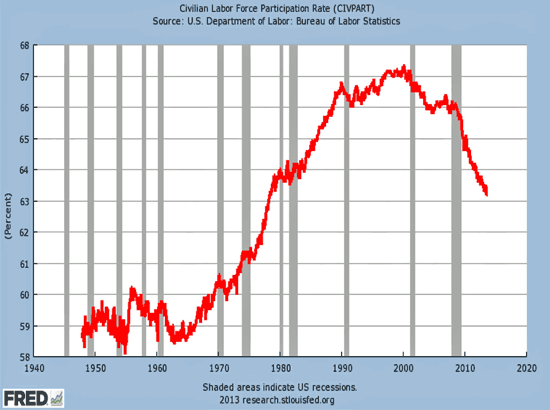

When Ben Bernanke mounted his throne, U3 was at 4.7%. Today it is 7%. But measuring standards seem to be far more subject to manipulation now then 8 years ago. Counting as employed those people who only have a part-time job when they want full-time work, or those who work for less than living wages – their number has gone up dramatically -, it simply perverts the stats. And on top of that, the number of those who are regarded as not participating, and therefore not counted towards U3, has risen dramatically:

“Promote effectively the goals of maximum employment”? It’s not really such a stretch to say US unemployment under Bernanke has doubled. U6 is at some 13%. Which means Ben has made a terrible failure of that part of his mandate.

Something else that has doubled under Bernanke is, ironically, federal debt.

Add the two together, a doubled unemployment rate and a doubled federal debt, and what do you get? Successful policies at the helm of the Fed? Hardly, I would think.

Let’s try and add up some things. We have $17 trillion in Federal debt.

Under Bernanke the Fed balance sheet rose from $800 billion to over $4 trillion. The Fed now holds $1.5 trillion in mortgage-related assets, $2.2 trillion in Treasuries, and $326 billion in other assets.

Other than that, we also have, according to the latest – Dec 9 – Federal Reserve Statistical Release, total household debt of $11.28 trillion.

Of course the mantra states that the Fed holds “assets”, and might even turn a profit on them, but if you want to go that way, then why not also claim the same for the country’s outstanding public debt – hey, it’s not impossible! – and while you’re at it, throw in household debt as a potential profit vehicle. The reality, as far as we can get a grip on it, is that the mortgage related assets would not have ended up at the Fed if they were all that solid, and Treasuries risk plummeting in value as soon as yields – re: interest rates – start going up.

What is perhaps hardest to stomach in all these numbers is that an increase in household debt is seen as positive (more mortgages, more borrowing, credit – debt – makes the world go round), and that household net worth keeps on rising. Broadly speaking, it plunged from $67 trillion in 2007 to $57 trillion in 2008, and now is all the way back up to $77 trillion. But how much of this is from grossly overvalued assets? If propping up the S&P no longer works, you better watch out, you better not cry, you better not pout.

All in all, 317 million Americans are potentially on the hook for a total of $17+$4+$11.28 trillion. That makes $32.28 trillion, or over $100,000 per capita, in a nation where close to 50 million, or 16% of people, live in poverty and/or on foodstamps. They ain’t going to be paying anything back anytime soon. And I graciously left out municipal and state government debt (Detroit, here we come), some $15 trillion, which could add another $47,000 or so per capita. Per family of three, that’s $440,000 in potential claims on their wealth/income/savings/pensions. With 16% living in poverty, twice as many so close to poverty they have a hard time even paying off their own debt, and 90 million not even counted as participating in the labor force, who’s going to pay?

This article addresses just one of the many issues discussed in Nicole Foss’ new video presentation, Facing the Future, co-presented with Laurence Boomert and available from the Automatic Earth Store. Get your copy now, be much better prepared for 2014, and support The Automatic Earth in the process!

Ben Bernanke never worked for the interests of the American people. He worked for nothing else than the interests of the banking industry. That has always been the Fed’s prerogative, ever since its inception in 1913, and even more so after Alan Greenspan took the stage. And while there may arguably have been a time in the past when those interests were – more – in line with each other, during the entire duration of Bernanke’s tenure they have been 180º opposites, for the simple reason that the debts hidden in the banks‘ vaults had grown to such heights that they needed immediate and large scale access to public money just to save themselves and their owners in the background from outright bankruptcy. People like Bernanke, Hank Paulson, Bob Rubin, Larry Summers and entire platoons of industry lobbyists went to Capitol Hill and secured that access for them.

On the same day Bernanke announced his $10 billion a month taper, the Bureau of Economic Analysis (BEA) reported that the US economy was growing at a 4.12% annualized rate in Q3. If that growth rate were real, all of QE should have been stopped immediately, and interest rates should be either raised or left entirely to the marketplace. Curiously, over 60% of the 4.12% annualized Q3 growth is attributed to gross private investment (inventories and fixed investment), which accounts for just 16.2% of GDP. Looks like a dud of a number.

I’ve written many times that Bernanke never worked for the interests of the American people, and never intended to. And while I see a lot of people lamenting what they call the “unintended consequences” of QE and ZIRP (zero interest rate policy), I’m not comfortable with leaving it there. These so-called unintended consequences have been obvious for years, and all the Fed has done is pile it on even more. What makes me uncomfortable in this is that I must presume, if the interests of the American people are really what drives Fed decisions, that Bernanke and his elves are as blind as they are stupid. And I don’t believe they are.

If, on the other hand, I look at this from the point of view that the Fed serves the interests of the banking industry, not the American people, it all makes a lot more sense. The Fed has played a decisive role in turning a financial crisis into a huge bonanza for the largest financial institutions. The big banks have gotten bigger, the industry is now more centralized, profits are back up, nobody of consequence is in jail, they can borrow for next to nothing, turn around, buy bonds or MBS, and sell it to the Fed at a profit, their reserves with the Fed have skyrocketed, which makes their wagers appear less risky, and they have undoubtedly dabbled deep into derivatives territory again.

And to top it all off, if anything goes wrong with all that the big banks are invested in, if interest rates go up, or stock markets plummet, or home prices plunge, they have become even more too-bigger-to-fail, and they will be rescued again at the cost of the American people. But an overwhelming majority of experts and analysts and pundits and journalists insist on trying to make me, and you, believe that these are all unintended consequences. Sorry, I don’t buy that. I don’t want to argue that there are no incompetent people at the Fed. But all of them all the time?

The Fed board also ventured some predictions, as noted by John Mauldin:

And what are they telling us about the future they have planned? It is going to turn out extremely well, they say. As a group they are forecasting economic Nirvana by at the end of 2016: a 3% GDP growth rate, 2% inflation, and a 5.5% unemployment rate. What would you expect the Fed funds rate to be in such a world? Might you assume that you would at least get some inflation premia? Think again. They are forecasting a median Fed funds rate for 2016 of 1.75%, which is a 0.25% negative risk-free return!

Unfortunately, in my view, Mauldin then continues with what increasingly feels like a desperate attempt not to say it out loud, that there are two possibilities here, and only two: either the Fed head honchos are blind and stupid, or their intentions are less than honest where fulfilling their Congressional mandate is concerned. I’m convinced that Mauldin has pondered the latter option, and I don’t know why he dares not speak it out loud.

The only thing I can think of is he’s an investor and investment advisor, and afraid of alienating people and losing out financially. I have no such hindrances, and I think that’s why it’s important that The Automatic Earth is here: to analyze the financial world from the outside, with no conflicts of interest that would keep us from saying what we think must be said. We don’t invest, not in anything at all, and that’s a very conscious choice, made for exactly that reason. Here is Mauldin’s “desperate attempt not to say it out loud”:

I have highlighted in the past how truly abysmal the models are that the Fed uses to forecast economic conditions. It is almost statistically impossible, as numerous researchers have documented, to do as badly as Federal Reserve economic forecasts have done, although the Office of Management and Budget and other congressional forecasters give them a run for their money. The latter have the partial excuse of being economists employed by politicians. The Fed has no such excuse. Their models are just plain bad.

I truly hope these people are right. I really do. But eight years without a recession in an environment where interest rates have been aggressively repressed for all that time? What distortions are we creating? What shocks await as we adjust? Will this test of a theory end without tears?

Of course you can play it down to a mere “test of a theory” by a group of people who simply don’t know any better. But if you say at the same time that it’s “almost statistically impossible” to do as bad as the Fed does, isn’t it time to at least consider the option that they don’t act in good faith? Isn’t that what you’re supposed to do when people are to trust your analyses? To consider all options? Or is it all just about maximizing profit, and less about the whole truth? Nothing personal against John Mauldin, mind you, I’m just using him as an example.

One last point. In just about everything I’ve read following Bernanke’s taper announcement, the expectation is that more tapering is to follow in 2014. Given the highly optimistic numbers and predictions I quoted before from the BEA and the Fed itself, that would seem reasonable. Then again, the numbers and predictions themselves look decidedly less reasonable.

In its annual list of 10 Outrageous Predictions (things that are unlikely and not part of the consensus view, but still possible), Saxo Bank takes a whole different view:

6. Quantitative easing goes all-in on mortgages

Quantitative easing (QE) in the US has pushed interest expenses down and sent risky assets to the moon, creating an artificial sense of improvement in the economy. Grave challenges remain, particularly for the housing market which is effectively on life support.

The FOMC will therefore go all-in on mortgages in 2014, transforming QE3 to a 100% mortgage bond purchase programme and – far from tapering – will increase the scope of the programme to more than $100 billion per month.

Does that look all that crazy or improbable to you? That if and when the US economy hits a snag – or two -, this will be used as an excuse to pour even more public funds, double or nothing, into the too-bigger-to-fail banks? To buy up all of their riskiest mortgages, so that when housing crumbles, the people will pay, not the banks? It wouldn’t surprise me for more than a fraction of a second, if that. But if and when it does, it will happen under Janet Yellen, not Ben Bernanke. His legacy stands. And I don’t think history books will look kindly upon him. I see him going down in history as either a dangerous fool or a devious tool.

Happy Solstice! May the light rise with you from here on in …

This article addresses just one of the many issues discussed in Nicole Foss’ new video presentation, Facing the Future, co-presented with Laurence Boomert and available from the Automatic Earth Store. Get your copy now, be much better prepared for 2014, and support The Automatic Earth in the process!

Home › Forums › The Ben Bernanke Balance Sheet