Howard Hollem Assembly and Repairs Department Naval Air Base, Corpus Christi 1942

I am definitely not in my normal morning rhythm today (hence only 7 articles in today’s aggregator). Part of that may be due to meeting up with some friends in Athens yesterday, but that’s certainly not the whole story. Athens is still mainly deserted, by the way, which is kind of nice and refreshing, but also very obviously hurtful to many people’s incomes.

But what really bumped me off my rhythm is reading the stories, and reactions to them, about AG Barr asking US Attorney for the Southern District of New York Geffrey Berman to resign, and the latter refusing to comply. Reading through all the related articles had one notion, one fear, creep up on me: that the US is at a serious risk of becoming ungovernable. And I mean: serious.

Whoever wins on November 4, Trump or Biden(?!), may well be unacceptable and unaccepted by half the country. And what happens then? Are we going to have a civil war? I’ll get back to that soon. It’s not like this is the first time it ever occurred to me, but it has gained a lot of weight -and risk- lately.

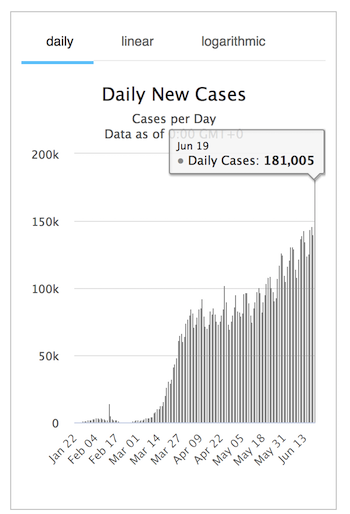

I thought maybe I had erred yesterday when my count of new cases was so much higher than Worldometer. Instead, they are even higher.

Worldometer reports new cases for June 19 (midnight to midnight GMT+0) at + 181,005.

My count 6AM EDT to 6AM EDT based on Worldometer numbers is 184,233. Have we entered a new phase?

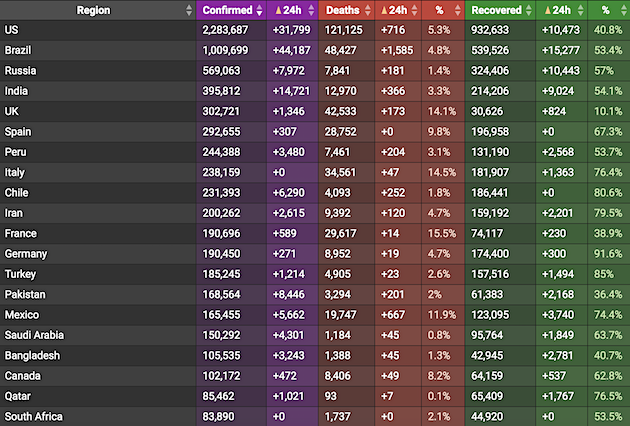

New cases past 24 hours in:

• US + 30,810

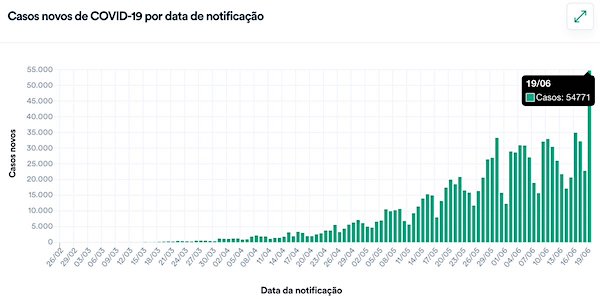

• Brazil + 54,771

• Russia + 7,790

• India + 14,721

• Pakistan +8,466

• Mexico + 5,662

Brazil was scary:

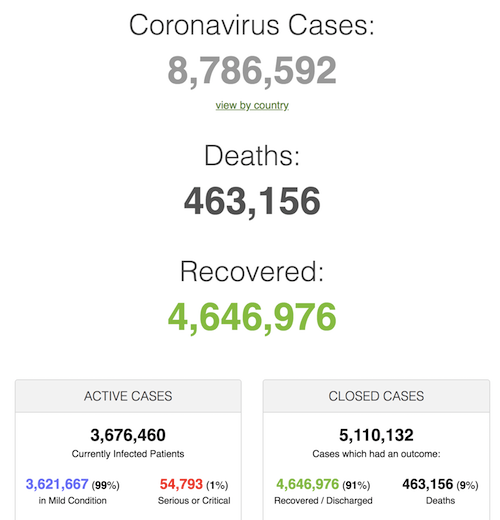

• Cases 8,786,592 (+ 184,233 from yesterday’s 8,602,359)

• Deaths 463,156 (+ 6,354 from yesterday’s 456,802)

From Worldometer yesterday evening -before their day’s close-:

I forgot to take a screen shot last night.

From Worldometer:

From COVID19Info.live:

2/n

I am not saying 1) here is the authority of Hayek, or 2) Hayek was a "true" libertarian.

I am just fed up with sociopaths with reduced brain functions citing Hayek to justify their crackpot theories about the pandemic.

Period.— Nassim Nicholas Taleb (@nntaleb) June 20, 2020

4/n This is similar to aversion to plane crashes. A tiny risk of crash, orders of magnitude smaller than death from COVID, causes enough people to avoid flying in the 737 max to make it unprofitable. Governments follow.

— Nassim Nicholas Taleb (@nntaleb) June 20, 2020

The pandemic in the US is very far from over. Forget about that trip to Europe.

• Several US States See Coronavirus Infection Spikes (R.)

Troubling spikes in coronavirus infection rates were reported on Friday in several U.S. states, mainly in the South and West, a day before President Donald Trump was due to preside over an Oklahoma campaign rally that will be America’s largest indoor gathering in months. Wall Street jitters over a resurgence in COVID-19 cases as states moved to reopen long-stifled commerce and ease social-distancing measures helped drive down major U.S. stock indexes, reversing earlier gains. Experts say expanded diagnostic testing accounts for some, but not all, of the growth in cases – numbering at least 2.23 million nationwide on Friday – and that the mounting volume of infections was elevating hospitalizations in some places.

“Clearly the cases are rising rapidly. It’s not just a matter of testing more,” said Dr. Murtaza Akhter, an emergency room physician at Arizona hospitals, noting the lag time between a positive test and severe illness or death. “The real concern is what is coming up for us in the next week or two.” He said the latest wave of cases has put Arizona’s major hospitals at or near capacity, and placed the Southwestern state on track to surpass New York at its peak on a per-capita basis. More than 119,000 Americans have perished from COVID-19 to date, according to Reuters’ running tally. Particularly alarming has been the upward trends several states are reporting in the percentage of positive tests among individuals who are screened, a metric experts refer to as the positivity rate.

The World Health Organization considers positivity rates above 5% to be especially concerning, and widely watched data from Johns Hopkins University shows 16 states with average rates over the past week exceeding that level and climbing.

Still don’t really understand how they missed this for so long.

• Mainland China Reports 27 New Coronavirus Cases, Including 22 In Beijing (R.)

Mainland China reported 27 new coronavirus cases as of the end of June 19, 22 of which were reported in the capital Beijing, China’s National Health Commission said on Saturday. This compared with 32 confirmed cases a day earlier, 25 of which were in Beijing, where local authorities are working to contain a new outbreak at a food wholesale market. Another seven asymptomatic COVID-19 patients, those who are infected with the coronavirus but show no symptoms, were also reported as of June 19 compared with five a day earlier. China does not count these patients as confirmed cases.

Berman is a Republican who contributed to the Trump campaign. And, like Bolton, the DNC and MSM’s best new friend.

• US Attorney Berman Refuses To ‘Step Down’ After Barr Asks For Resignation (ZH)

Geffrey Berman is refusing to step down as US Attorney for the Southern District of New York after Attorney General William Barr asked him to resign, according to Bloomberg. “I learned in a press release from the Attorney General tonight that I was ‘stepping down’ as United States Attorney,” said Berman, adding “I have not resigned, and have no intention of resigning, my position, to which I was appointed by the judges of the United States District Court for the Southern District of New York. “I will step down when a presidentially appointed nominee is confirmed by the Senate… …Until then, our investigations will move forward without delay or interruption.” Reacting to the news, Senate Democratic leader Chuck Schumer (D-NY) said “This late Friday night dismissal reeks of potential corruption of the legal process.”

[..] A Republican who contributed to Trump’s campaign, Berman was considered a highly qualified pick to succeed Preet Bharara, the previous occupant of his Berman’s soon-to-be-former office, which also features heavily in the TV show “Billions” (it’s the position held by the show’s antagonist, a corrupt federal prosecutor). AG Barr didn’t offer much in the way of an explanation, and Berman hasn’t said much either. Then again, we’re only just finding out about this, and it’s 10pmET on a holiday Friday. But even more surprising than the news of Berman’s sudden departure is the news of who will take his place. Following a brief interlude, SEC Chairman Jay Clayton will become the next US Attorney for the Southern District of New York.

For those who aren’t familiar, Clayton is the same man who almost allowed Hertz and its creditors to sell hundreds of millions of dollars of stock to unsuspecting Robinhood day traders trying to flip their stimulus checks for quick cash with nary a word from the SEC. But even more extraordinary than his handling of the Hertz situation is Clayton’s decision to allow Tesla CEO Elon Musk walk away from a dispute with the SEC in which the CEO flagrantly and blithely violated basic securities regulations involving disclosures of material information to the public (remember “funding secured?” and the tedious legal melodrama that ensued in which Musk, in full blown tantrum mode, was repeatedly appeased by government regulators seemingly robbed of all willingness to hold him accountable).

How many countries are doing similar studies? Could be revealing.

• Coronavirus Was Already In Italy By December, Waste Water Study Finds (BBC)

Italian scientists say sewage water from two cities contained coronavirus traces in December, long before the country’s first confirmed cases. The National Institute of Health (ISS) said water from Milan and Turin showed genetic virus traces on 18 December. It adds to evidence from other countries that the virus may have been circulating much earlier than thought. Chinese officials confirmed the first cases at the end of December. Italy’s first case was in mid-February. In May French scientists said tests on samples showed a patient treated for suspected pneumonia near Paris on 27 December actually had the coronavirus.

Meanwhile in Spain a study found virus traces in waste water collected in mid-January in Barcelona, some 40 days before the first local case was discovered. In their study, ISS scientists examined 40 sewage samples collected from wastewater treatment plants in northern Italy between last October and February. Samples from October and November came back negative, showing that the virus had not yet arrived, ISS water quality expert Giuseppina La Rosa said. Waste water from Bologna began showing traces of the virus in January. The findings could help scientists understand how the virus began spreading in Italy, Ms La Rosa said. However she said the research did not “automatically imply that the main transmission chains that led to the development of the epidemic in our country originated from these very first cases”.

Go Tyler!

Gee, Barry Ritholtz has no clothes on.

• Trump Admin To Name Most Recipients Of Bailout Loans (ZH)

When the government said it would give out thousands of dollars in bailout loans grants under the Paycheck Protection Program, every eligible business – which was most small and medium businesses (that had no access to capital markets) with up to 500 employees, signed up. And why not: it was free money from a government that had launched helicopter money, and was seeking to ram the newly created money into the economy. There was no downside – the grants would be forgiven if used to pay wages or rent, and – at least according to widespread speculation – the loans would remain a secret. Which is why it was so surprising when it emerged that some “asset managers” such as Ritholtz Asset Management, led by Josh Brown and Barry Ritholtz, had also accepted bailout grants to stay in business. In retrospect, Ritholtz is the author of Bailout Nation so it probably should not have been a surprise.

What should have been a surprise is that an asset manager – i.e., a professional collecting generous fees to predict the future and entrusted with billions in capital not only failed to do that, but himself needed a bailout. It just goes to show how important it is to pick very calm and patient clients. Of course, we can’t blame them: like most other recipients, Ritholtz probably expected that his name would never see the light of day, even though technically he used taxpayer money to prop up his company. And since it is taxpayer money, everyone has a right to know how it would be used. Only in the case of just over half a trillion dollars in PPP grants that wasn’t the case, because for nearly 3 months after the PPP program was launched, Treasury Secretary Steven Mnuchin persisted in keeping the names of all recipients secret, much to the growing anger of those who effectively funded the loans.

That all changed late on Friday, when Bloomberg reported that the Trump administration said it would disclose details about companies that received loans of $150,000 or more from a coronavirus relief program for small businesses, following a backlash against its earlier refusal to release data about which firms got billions of dollars in government aid. Eleven news organizations had sued to make details about PPP loan recipients public. Which is bad news for all those “financial advisors” like Ritholtz who will soon be revealed as getting paid to “predict” the future, yet not having the sense to even budget for a short-term crisis, let along have hedges in place for a downside scenario. As for the rest, it’s unclear how willing most small businesses would have been had they known that the very act of requesting a bailout would open them up to eventual public shaming.

It has become useless to discuss the Fed at the same time you discuss markets. The former killed the latter.

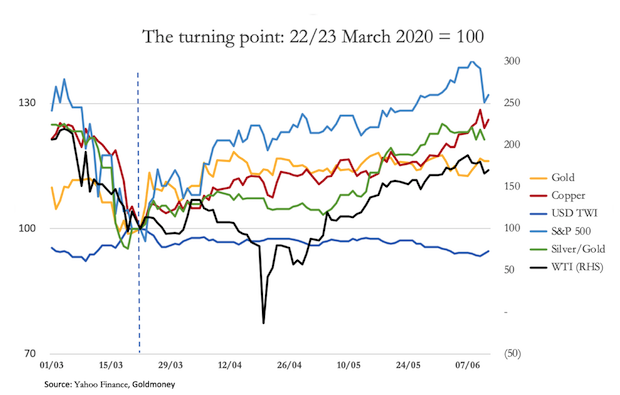

• The Crisis Goes Up A Gear (Macleod)

The early morning of Monday, 23 March was a significant time, marking the top of the dollar’s trade-weighted index. At the same time, gold, silver and copper prices, having fallen in the weeks before turned sharply higher. And while oil initially followed, it was a month before it resumed its uptrend — delayed by the delivery hiatus in the futures markets which briefly drove the price negative. The S&P 500 rallied the following day, ending a near 30% decline before recovering all of it, and then some. Something had changed. Either markets decided that economic growth, both in the US and the rest of the world was going to continue following lockdowns, and growing demand for key commodities was going to be resumed. Or, as the decline in the dollar’s TWI indicated, the purchasing power of the dollar was going to decline, and commodity prices were reflecting an accelerating downtrend for the dollar’s purchasing power.

The performance of the S&P 500 since 23 March, being unhinged from any business conditions, gives us a clue: the flood of money emanating from the Fed is fuelling stock prices. It is also fuelling prices of all other financial assets. The turnaround in silver is a more subtle story, shown in the chart as the reciprocal of the more usual gold/silver ratio. Silver had been ignored, classed solely as an industrial metal. Gold was seen by the financial community as the only metallic hedge against uncertainty in the financial system. That changed on 23 March when the gold/silver ratio peaked at 125 on the previous business day. It is now beginning to outperform gold with the gold/silver ratio currently down to 98. We might look back and pinpoint this time as marking the beginning of a return to some moneyness in silver.

The weeks before had seen the Fed ease monetary policy. On 3 March, the Fed cut its funds rate from 1,5% to 1%. In the accompanying announcement the Fed said that the fundamentals of the economy remained strong, but the coronavirus posed evolving risks to the economy. On 15 March, the Fed cut its funds rate again, this time to zero, but the statement now said the coronavirus had harmed communities and disrupted economic activity in many countries, including the US. On a twelve-month basis, overall price inflation and price increases for other than food and energy were running at below 2%. The Fed announced renewed quantitative easing of at least $500bn of Treasury purchases and $200bn of mortgage-backed securities “in the coming months”. It was “prepared to use its full range of tools to support the flow of credit to households and businesses and thereby promote its maximum employment and price stability goals.”

How many people know the history behind the Democratic Party?

• House GOP Leader: Democratic Party Should Change Its Name (JTN)

House GOP leader Kevin McCarthy suggested Thursday that the Democratic Party change its name, considering its ties to the Confederacy and segregation laws. The comments by McCarthy, the chamber’s top Republican, follow House Speaker Nancy Pelosi saying she wants to remove Confederate-era statues from the Capitol, most of which honor registered Democrats. Pelosi, a California Democrat, on Thursday announced the removal of four portraits of former House speakers – three Democrats and one a Whig who later registered as a Democratic. “The speaker has the power to do that,” McCarthy said when asked about the portrait removal.

“If the speaker is concerned about that, should she also start talking about changing the name of her party and actually changing the nominee?” The California Republican also said that Pelosi should be “really concerned about the history of her party and what her party has done so shouldn’t they change the name if they’re going to be different?” McCarthy went further and said the Democrats should consider changing Joe Biden as their 2020 presidential nominee, given his remarks at the funeral of Sen. Robert Byrd (D-W.V.), a former member of the KKK who later denounced the group. Biden referred to Byrd as a “mentor” and “dear friend” at his funeral when he was vice president. McCarthy called on Pelosi to apply the “same standards” for the portrait removals to the name of her party and its 2020 nominee. “Shouldn’t they change the nominee if they want to be different?” McCarthy asked.

We try to run the Automatic Earth on donations. Since their revenue has collapsed, ads no longer pay for all you read, and your support is now an integral part of the interaction.

Thank you.

Kayleigh McEnany smokes Jim Acosta:

"You have to let me answer your question, Jim. This isn't a cable news segment. This is the White House podium." pic.twitter.com/z2chinIqKM

— August Takala (@AugustTakala) June 19, 2020

1️⃣CNN talking about fake news is an oxymoron.

2️⃣ @Acosta has zero self awareness or ability to self examine.

3️⃣@Acosta doesn’t understand anything satirical – even tho his ENTIRE JOB working for @CNN is just that, a joke.

4️⃣@Acosta is rude.

5️⃣@Acosta is disrespectful. pic.twitter.com/ojdlRu8A2o

— Jali_Cat{⭐️} (@Jali_Cat) June 19, 2020

.@PressSec TORCHES @Acosta after he repeatedly asks questions because he can’t comprehend a meme.

CNN regularly twists the facts and puts misleading headlines on their network.

That was the point of the meme.. pic.twitter.com/IAjtkL2XDS

— Benny (@bennyjohnson) June 19, 2020

.@RichardGrenell just nuked @CNN pic.twitter.com/w1KSz5Pgz2

— Benny (@bennyjohnson) June 20, 2020

Word is Biden is close to picking Rice.

UNHINGED: Susan Rice says Trump's supporters belong in "the trash heap of history" pic.twitter.com/08VirKdghR

— Steve Guest (@SteveGuest) June 19, 2020

Steve Keen

Bankers will have us believe that they are God’s gift to humanity… @ProfSteveKeen take on the matter? “Bullshit. You're the Sorcerer's Apprentice.” @edwardnh & @ProfSteveKeenhttps://t.co/0QEvhlgwbE pic.twitter.com/bDgvdMGtBC

— Real Vision (@RealVision) June 19, 2020

The textbooks are wrong — As are some notable Nobel Prize winners…

Have doubts? Even the central banks of the world have admitted it. @ProfSteveKeen & @edwardnhhttps://t.co/0QEvhlgwbE pic.twitter.com/34sLdAtX1n

— Real Vision (@RealVision) June 19, 2020

Bob Dylan released his new album, Rough and Rowdy Ways, yesterday. This is where the title comes from.

And these are some of the lyrics of the song Mother of Muses:

4 famous US generals – plus Georgi Zhukov, who led the Soviet Red Army’s assault on Nazi Germany

I love listening to Duck Step music pic.twitter.com/Tlj9IpE9U5

— Life on Earth (@planetpng) June 18, 2020

Support the Automatic Earth in virustime.

Home › Forums › Debt Rattle June 20 2020