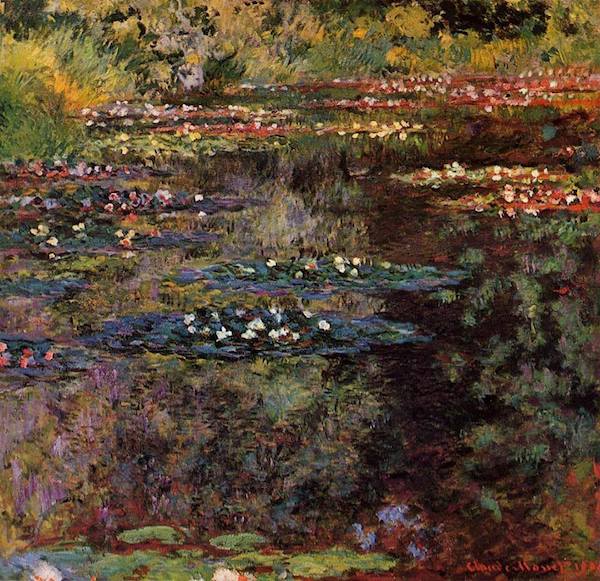

Odilon Redon Street in Samois 1888

https://twitter.com/sxdoc/status/1915472634252583045

Judges

https://twitter.com/DOGEDDS/status/1915751361955668308

Gingrich

Former House Speaker @NewtGingrich has the solution to stop rogue judges.

The Senate GOP needs to move immediately to get this done!pic.twitter.com/Sucn0c22GO

— Kyle Becker (@kylenabecker) April 24, 2025

Oz

Satan

WHAT???

Researchers in the UK already tested a geo-engineering program where they released sulfur dioxide into the atmosphere back in 2023.

The project is called satan (stratospheric aerosol transport and nucleation).

No, I'm not making this up.

This is evil.

— PeterSweden (@PeterSweden7) April 25, 2025

Lavrov

https://twitter.com/DD_Geopolitics/status/1915571315966435445

Harvard

https://twitter.com/VigilantFox/status/1915579807011660139

BS

This is bullshit…https://t.co/yt7neyaywM

— Dave Collum (@DavidBCollum) April 24, 2025

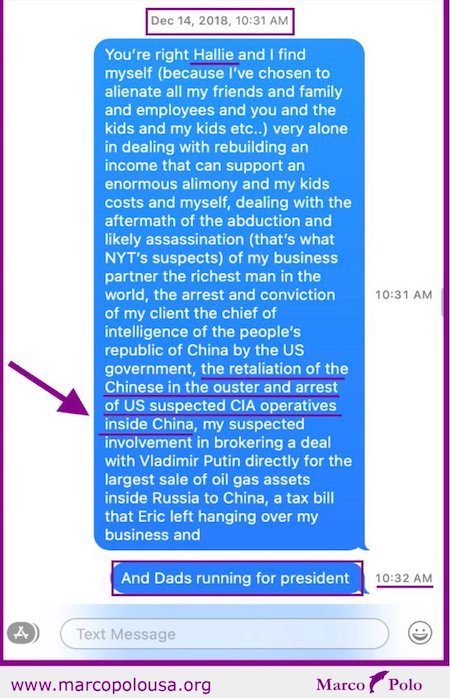

USAID and the CIA helped orchestrate Trump’s impeachment

The evidence keeps coming out. American taxpayers paid for the impeachment of Donald Trump with laundered USAID money

Jesse Watters “You have this new piece on Substack that the USAID and the CIA helped orchestrate Trump's impeachment?”

Michael Shellenberger “It's a crazy story… pic.twitter.com/gyVfawoIL8

— Wall Street Apes (@WallStreetApes) April 25, 2025

‘sundance’ explains that the Ukraine constitution was changed right after Russia invaded, so Zelensky can now say all sorts of things are unconstitutional.

• President Trump Delivers Remarks on Ukraine/Russia Conflict (CTH)

President Trump hosted Norwegian Prime Minister Jonas Gahr Støre in the Oval Office and took questions from reporters on Thursday. The majority of the question from both the U.S. and Norwegian media encompass the current effort to negotiate a ceasefire in Ukraine. One of the ceasefire ‘sticking points’ per se’, is that immediately following the breakout of the conflict the government of President Zelenskyy changed many of their constitutional rules to include the legal elimination of opposition parties in the country, removal of religion or faith-based social influence that runs counter to the Ukrainian Nazi mindset, the cessation of elections in Ukraine, and other “emergency measures” intended to assist the stability of Zelenskyy’s government as they entered a war footing.

The results of the legal changes and constitutional framework, which included non-recognition of any lost territory, is now being leveraged by Zelenskyy in negotiations for a ceasefire. President Zelenskyy is now saying the ceasefire terms proposed, which include accepting regional losses of geography to Russia, are not constitutionally possible and he has no power to agree to them. In essence, Zelenskyy’s emergency government changed the constitutional power of the President, cemented a new constitutional status during war, and now says those previous changes make it impossible to accept proposed terms. This self-fulfilling creation, intentionally done with forethought for exactly this kind of current scenario, is the baseline for frustration toward the Ukraine position. President Trump notes this Ukraine position is frustrating, while thousands die weekly in the process.

“..if one country in Europe is forced to give up parts of its own legal territory… no country in Europe or elsewhere can feel safe, NATO or no NATO.”

• Trump’s Peace Plan Triggers ‘Concern’ Among Allies – CNN (RT)

Officials in Western Europe and Asia have claimed US President Donald Trump’s reported framework to end the Ukraine conflict could set a precedent for territorial conquest, CNN reported on Thursday, citing anonymous sources. The framework, which has not been officially confirmed by the White House, reportedly includes US recognition of Crimea as Russian territory and acknowledgement of Moscow’s control over large parts of four former Ukrainian regions that have joined Russia. US Vice President J.D. Vance has also stated that the administration is considering the option to “freeze the territorial lines at some level close to where they are today.” CNN cited several unnamed diplomats who criticized the proposed settlement, claiming it would “reward” Russian President Vladimir Putin and send a “dangerous message” to other leaders, including China’s Xi Jinping.

“This is about the fundamental principles of international law,” one Eastern European diplomat told CNN, claiming that “if one country in Europe is forced to give up parts of its own legal territory… no country in Europe or elsewhere can feel safe, NATO or no NATO.” Moscow has repeatedly denied having any intention to strike NATO or EU countries, or claim their territories, accusing Western officials of “fearmongering” in order to justify further militarization. Nevertheless, many Eastern European governments, such as Poland and the Baltic states, have cited the supposed threat of a Russian attack as justification for increasing defense budgets and deploying additional forces. The CNN report comes as US special envoy Steve Witkoff is expected to meet with Russian officials in Moscow for another round of talks in the coming days. Trump has warned that Washington could abandon its diplomatic efforts altogether if no significant progress is made in the peace effort soon.

Trump has publicly expressed frustration with Ukraine’s Vladimir Zelensky, whom he has accused of obstructing peace efforts by refusing to even consider any territorial concessions. At the same time, the US president has suggested that he has found Russia easier to negotiate with than Ukraine. Moscow has welcomed the Trump administration’s attempts to settle the conflict. Russian Foreign Minister Sergey Lavrov stated this week that Moscow and Washington are “moving in the right direction” with regard to reaching a peace deal. Russian officials have repeatedly said that Moscow remains open to a negotiated solution, but have emphasized that any peace agreement must reflect the territorial realities on the ground and address the root causes of the conflict.

Realism helps.

• Crimea Will Stay With Russia – Trump (RT)

The Crimean Peninsula will remain a part of Russia under a final settlement of the Ukraine conflict, US President Donald Trump has said in an interview with Time Magazine published on Friday. Crimea officially joined the Russian Federation in 2014 after a referendum that followed a Western-backed coup in Kiev. Ukraine and its backers have dismissed the results of the referendum as illegitimate, and Kiev has continued to claim sovereignty over the peninsula, vowing to take it back by any means necessary. In an interview to mark his first 100 days in office, Trump said Crimea “went to the Russians” long ago and suggested that “everyone understands” that Ukraine will not be able to get it back. “Crimea will stay with Russia” under a final settlement of the Ukraine conflict, Trump went on to say, adding that even Ukraine’s Vladimir Zelensky understands this.

“It’s been with them for a long time,” the US president stated, noting that Russia had its submarines there “long before any period that we’re talking about” and that the majority of Crimeans speak Russian. Trump also stressed that the peninsula was “given” to Russia by former US President Barack Obama, claiming that the whole conflict is “Obama’s war,” which “should have never happened.” Since returning to office in January, Trump has been pressuring both Moscow and Kiev to settle the conflict. During last year’s election campaign, he said he would end the hostilities “within 24 hours” of entering the White House. He told Time, however, that he said this “figuratively” as an “exaggeration.” Recently, Trump has signaled that he has grown frustrated with the lack of progress on reaching a resolution of the Ukraine conflict. He has expressed dissatisfaction with Zelensky, saying he has found Russia much easier to negotiate with than the Ukrainian leader.

In a Truth Social post this week, the US president criticized Zelensky for refusing to even consider any territorial concessions. Russia has expressed its appreciation for Trump’s peace efforts and has repeatedly indicated that it is open to negotiations. However, Russian officials have stressed that a final peace deal must respect the territorial realities on the ground and address the root causes of the conflict, such as Ukraine’s NATO aspirations. In his interview with Time, Trump acknowledged that Ukraine would likely never be able to join NATO. He cited Kiev’s ambitions to enter the US-led bloc as the issue that “caused the war to start.” “If that weren’t brought up, there would have been a much better chance that [the conflict] wouldn’t have started,” he said.

“the constitution of Ukraine says that all the temporarily occupied territories… belong to Ukraine.”

• Zelensky Contradicts Trump On Deal With Russia (RT)

President Donald Trump has claimed that “most of the major points” in an agreement to end the Ukraine conflict have been resolved, even as Vladimir Zelensky once again publicly rejected a reported key clause in the proposed US peace framework. Russian President Vladimir Putin held lengthy talks with US special envoy Steve Witkoff on Friday, described by Kremlin aide Yury Ushakov as “constructive and very useful.” Trump also expressed satisfaction with the negotiations, praising a “good day in talks and meetings with Russia and Ukraine.” “They are very close to a deal, and the two sides should now meet, at very high levels, to ‘finish it off.’ Most of the major points are agreed to,” Trump wrote in a post on Truth Social late Friday, adding that “SUCCESS seems to be in the future!”

The agreement proposed by Washington reportedly includes US recognition of Russian sovereignty over Crimea, a “freezing” of the conflict along the current front line, and acknowledgment of Moscow’s control over large parts of the four former Ukrainian regions that voted to join Russia. “Crimea will stay with Russia” under a final settlement of the Ukraine conflict, Trump said in an interview with Time Magazine published on Friday. However, in direct contradiction to Trump, Zelensky reiterated on Friday that Kiev will not even discuss formally recognizing Crimea as Russian territory. “Our position is unchanged: only the Ukrainian people have the right to decide which territories are Ukrainian,” Zelensky told reporters in Kiev, arguing that “the constitution of Ukraine says that all the temporarily occupied territories… belong to Ukraine.”

Zelensky went on to claim that his “vision” of a resolution includes more “sanctions, economic and diplomatic pressure” on Moscow – even as Washington’s peace framework reportedly includes a phased removal of restrictions imposed on Russia. Trump has previously blamed Zelensky’s public statements for harming the negotiation process and warned that he risks losing the entire country if he continues to stall talks with Moscow. The US-proposed deal would also reportedly prevent Ukraine from joining NATO, an ambition enshrined in Ukraine’s constitution. Kiev’s intention to join the US-led bloc likely “caused the war to start,” Trump acknowledged in his interview with Time.

The Kremlin has consistently said it remains open to diplomacy and has expressed gratitude for Trump’s peace efforts. Ushakov confirmed that Friday’s talks touched on the possibility of resuming direct bilateral negotiations between Moscow and Kiev, but offered no details. No direct talks between the two sides have taken place since Ukraine pulled out of the Istanbul negotiations in 2022. According to Putin, Zelensky – who has banned himself from engaging in talks with Moscow – is actively sabotaging any peace process, as it would require lifting martial law, which currently allows him to remain in power. Moscow maintains that without martial law, Zelensky would be compelled under the Ukrainian constitution to either hold elections or transfer presidential authority to the current speaker of Ukraine’s parliament.

“..Zelensky insisted that any future peace arrangement with Moscow must be backed by sustained US military, financial and political support.”

• Zelensky Demands ‘At Least’ Israel-style Support From US (RT)

Kiev expects Washington to provide long-term security assistance modeled on the US relationship with Israel, Vladimir Zelensky has claimed, after Ukraine’s European backers reportedly rejected several significant points of President Donald Trump’s proposed peace plan. Washington presented its draft deal to end hostilities between Kiev and Moscow during talks in Paris last week. At a follow-up meeting in London on Wednesday – which was downgraded at the last minute after Zelensky publicly rejected key US suggestions – Ukrainian officials and their NATO European counterparts reportedly tabled a counterproposal. Speaking to journalists on Friday, Zelensky insisted that any future peace arrangement with Moscow must be backed by sustained US military, financial and political support.

“Discussions in London have focused on security guarantees from the United States. We hope them to be at least as robust as those provided to Israel. Additionally, we anticipate support from our European partners and are actively developing the infrastructure necessary for these guarantees,” Zelensky said. Deliberations about an “Israeli model” of support for Ukraine first emerged during the presidency of Joe Biden, when Western officials began to acknowledge that Kiev was unlikely to be granted NATO membership. In lieu of collective security guarantees, they sought ways to at least ensure a long-term, uninterrupted flow of Western arms. Zelensky’s comments come amid increasing friction with Washington, as Trump pushes Kiev to accept what media outlets have described as his “final offer” to end the conflict.

Reports indicate that Washington’s framework includes freezing the conflict along current front lines and recognizing Crimea as Russian territory – a condition Zelensky has firmly rejected. Trump stated that “Crimea will stay with Russia” in an interview with Time Magazine on Friday. He argued that Kiev would never have enough weapons or manpower to retake the peninsula, which “was handed over to Russia without a shot being fired.” Crimea officially joined the Russian Federation in 2014 after a referendum held following a Western-backed coup in Kiev. “Our position is unchanged,” Zelensky reiterated on Friday, despite acknowledging Kiev’s dependence on continued American support.

Trump and other senior US officials have warned that if progress is not made soon, Washington may reconsider its role as a mediator and shift its focus to other global priorities. According to reports, Ukrainian officials are already bracing for the possibility of reduced American support should negotiations collapse. Moscow has consistently expressed willingness to engage in negotiations, conveying its gratitude for Trump’s peace initiatives. However, the Russian leadership has repeatedly stressed that it seeks a lasting solution to the crisis, saying a temporary halt in the hostilities would simply allow Ukraine’s Western backers to rearm its military. Any peace deal must acknowledge the territorial reality and address the root causes of the conflict, including Ukraine’s NATO aspirations, Russia has insisted.

“..due to the Vatican’s arrangements for the various delegations, Zelensky will be seated “very, very far away” from Trump during the funeral ceremony.”

And Meloni doesn’t need it either. The security operation in Rome today is on her. Her plate is full.

• Ukraine ‘Pressuring’ Italy For Sideline Summit At Pope’s Funeral (RT)

Kiev is reportedly “pressuring” Rome to organize a mini-summit on the Ukraine conflict on the sidelines of Pope Francis’ funeral this week. Around 140 delegations are expected at the Vatican on Saturday morning to pay their final respects to the late pontiff, who passed away on Monday. Ukraine’s Vladimir Zelensky will be in attendance, as will US President Donald Trump. Diplomatic sources cited by La Repubblica on Friday said Trump may hold a few informal bilateral meetings in Rome, potentially including with Zelensky. Meanwhile, Kiev is advocating for a broader multilateral gathering involving European NATO members to be held in Italy, putting the Ukrainian delegation in front of the USA, Italy, France, Great Britain and probably also Germany.

However, Prime Minister Giorgia Meloni’s government is hesitant to facilitate such a gathering, fearing that the country’s reputation as a host could suffer from its likely failure, the outlet noted. Sources described the situation as “fluid.” This month, American officials outlined a potential framework for a truce that they believe Moscow could accept. However, Ukraine reportedly rejected key aspects of it, and in collaboration with European backers, proposed an alternative plan this week. Trump has accused Zelensky of undermining the peace process with public remarks that directly contradicted the ideas his administration reportedly included in its proposal.

A Trump-Zelensky meeting at the White House in late February ended in a diplomatic spat when the Ukrainian leader openly questioned Washington’s approach to mediating the conflict. Vice President J.D. Vance, who was present at the scene, admonished Zelensky for what he perceived as ingratitude and disrespect. La Repubblica noted that, due to the Vatican’s arrangements for the various delegations, Zelensky will be seated “very, very far away” from Trump during the funeral ceremony.

Zelensky simply denies ever receiving half of the money. That should be about the amount that vanished?! “Hey, not our fault”

• Elon Musk Mocks Zelensky For Claiming Every US Taxpayer Dollar Is Accounted For (ZH)

Ukrainian President Volodymyr Zelensky has hilariously declared that every single dollar of U.S. taxpayer money sent to Ukraine since Russia’s 2022 invasion has been meticulously tracked and accounted for, dismissing concerns about corruption or misuse. The claim, one of his most audacious yet, came during an interview with Daily Wire co-founder and conservative podcaster Ben Shapiro. Shapiro, known for his interventionist views regarding foreign affairs, pressed Zelensky on the issue of transparency, zeroing in on the nearly $200 billion in U.S. aid allocated to Ukraine’s defense. “There’s lot’s a questions about where the money is going pensions, to war profiteering, to corruption,” Shapiro noted, before asking: “What kind of transparency can you provide to the American people to guarantee that there taxpayer dollars are being used in the best possible way to fight Russia and defend Ukraine, and to ensure, if the United States wants, would an audit be possible by the United States for where those dollars are going?”

“As for the audit, the United States has the understand there’s United States inspectors working, there’s inspectors of European countries, because we’ve also allocated their money and grateful to them,” Zelensky replied. “That is why we told them at once we’re ready to have any inspections from the very beginning of the way, inspectors coming from the United States, Europe, and our own inspectors.” “We have complete reporting and accounting, absolutely transparent within the ministry of defense,” the Ukrainian president added. “There’s access to all the figures starting from the very first year of the war.” Zelensky then claimed that Russian “fake news” aimed at undermining U.S. aid to Ukraine was a primary reason for maintaining a comprehensive accounting of all American taxpayer funds provided to his government for the war.

“There’s nothing to hide, we’re absolutely open,” Zelensky told Shapiro. “There’s all the reports available.” Zelensky’s comments prompted Sen. Mike Lee (R-UT), an opponent of additional U.S. aid to Ukraine, to ask his nearly 600,000 followers on X if they believed the Ukrainian president’s claims. “Funniest thing I’ve read all day,” billionaire Elon Musk tweeted in response, with a pair of laughing emojis.

https://twitter.com/elonmusk/status/1915562708264771665?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1915562708264771665%7Ctwgr%5E65156ec4eccd8c9b49e6ec040010947d6d39dff2%7Ctwcon%5Es1_c10&ref_url=https%3A%2F%2Fwww.zerohedge.com%2Fpolitical%2Ffunniest-thing-ive-read-all-day-elon-musk-mocks-zelensky-claiming-every-us-taxpayer

Not only does Zelensky maintain that Ukraine’s handling is U.S. aid is corruption-free, but he’s suggested in an interview with podcaster Lex Fridman that corruption was an issue in the West. Kyiv Independent reports: “Ukraine has received less than half of the $177 billion in U.S. aid allocated to support Kyiv throughout the full-scale war, according to Zelensky. He suggested that this shortfall could be tied to issues of corruption or lobbying by U.S. companies. “If we had $177 billion and if we get the half, where is the second half? If you find the second half, you will find corruption,” he said. While Ukrainian President Volodymyr Zelenskyy firmly denies corruption allegations, Nigerian President Muhammadu Buhari claims the Russia-Ukraine conflict is fueling an influx of arms and fighters into the Lake Chad region, strengthening terrorist groups.

Of note, in 2015, The Guardian ranked Ukraine “the most corrupt nation in Europe.” VOA reported in November 2022: “Buhari called for more vigilance and cooperation among the commission’s six member nations against the increased proliferation of weapons into the Lake Chad basin. He said weapons meant for the Ukraine war and to combat terrorism in the Sahel are being diverted to West Africa and ending up in the hands of terrorist groups. Zelensky’s comments about U.S. aide comes as President Donald Trump is intensifying efforts to broker peace between Russia and Ukraine, with recent London talks pushing a ceasefire that would freeze frontlines and cede Crimea to Russia. Zelenskyy resists the plan, calling it unconstitutional, but Trump remains optimistic. On Thursday evening, Russian Foreign Minister Sergey Lavrov told CBS News that the Kremlin is “ready to reach a deal” with the U.S. regarding Ukraine, but cautioned that some of the terms need to be “fine tuned.” “The President of the United States believes, and I think rightly so, that we are moving in the right direction,” Lavrov told the news outlet.

“U.S. Treasury Secretary Scott Bessent warned a US-China trade deal could take 2 to 3 years to finalize..”

• Who Blinks First? China May Exempt Tariffs On US Ethane & Other Goods (ZH)

Those sources continued down Beijing’s laundry list of potential tariffs to be removed, including waiving the tariff for plane leases… Boeing has caught a sigh of relief. “It’s another step toward a de-escalation of the trade war,” said Kok Hoong Wong of Maybank Securities, adding that a trade deal might not be imminent, but certainly, “it would appear the worst may truly be over.” Bloomberg Economics analysts Chang Shu and Eric Zhu commented on the BBG headline: “Exempting critical, hard-to-replace U.S. products from tariffs would be a pragmatic approach that could ease tensions with the U.S. and serve the interests of Chinese industry. Anything that helps lower the temperature in the trade war is also beneficial from the perspective of avoiding broader clashes with the U.S.”

In a separate report, Reuters stated that instead of merely considering exemptions, Beijing has already “exempted” certain U.S. imports from the 125% tariff, citing businesses that were notified by authorities about the change. “As a quid-pro-quo move, it could provide a potential way to de-escalate tensions,” said Alfredo Montufar-Helu, a senior adviser to the Conference Board’s China Center. Montufar-Helu warned: “It’s clear that neither the U.S. nor China want to be the first in reaching out for a deal.”

Earlier in the week, U.S. Treasury Secretary Scott Bessent warned a US-China trade deal could take 2 to 3 years to finalize. Bessent emphasized at a closed-door investor meeting on Tuesday: “No one thinks the current status quo is sustainable, at 145% and 125%, so I would posit that over the very near future, there will be a de-escalation. We have an embargo now on both sides.” Both sides may want a deal to avoid further tariff fallout in their respective economies, but neither wants to appear desperate on the global stage. China is grappling with shuttered factories and possible ethane supply woes that threaten to roil its core manufacturing economy, while in the U.S., containerized volumes through the Port of Los Angeles are poised for a steep decline in the coming week.

Shapiro knows better.

• How Not to Fight a Trade War (Ben Shapiro)

This week, the stock market yo-yoed wildly, taking investors on a roller coaster of stunning lows and sudden highs. Rarely has investment been so gut-churning. And the reason for the turbulence is obvious: the Trump administration’s continuing mixed signals over its trade war. When that trade war was first announced on April 2 (“Liberation Day”) the Dow Jones Industrial Average immediately plummeted nearly 4%; the day after, 5.5%. After President Donald Trump put a hold on the vast majority of tariffs the following week, it recovered nearly 8%. The following day, as markets realized that Trump would retain massive tariffs on China and highly elevated tariffs on many of our allies, it dropped again 2.5%. The Dow Jones Industrial Average remained volatile but close to even for a few days. And then to open this week, it dropped almost 2.5% again, thanks to Trump’s apparent threats to fire Federal Reserve Chairman Jerome Powell.

And then, on Tuesday, it rose again, 2.7%—this time based on Treasury Secretary Scott Bessent’s leaked statements implying that the United States would come to a trade agreement with China (a sentiment seconded by Trump), as well as Trump’s statements that he would not be firing Powell. What is the purpose of recapping this potted history? To understand a simple lesson: Volatility in policy results in market volatility. Market volatility results in lack of investor confidence. And lack of investor confidence results in economic disaster. Typically, stock prices and bond yields work in inverse, since people flee to safety from stocks to bonds, driving down yields. Yet even as the Dow Jones is off approximately 13% from its high just after Trump’s inauguration, bond yields have been climbing as well—meaning that investors are showing lack of confidence in investing in American assets.

Now, taking on China is an admirable goal. And trade is certainly a chief weapon the United States could use in containing Chinese aggression across the world. But to wage a successful trade war on China would require certain preliminary steps: negotiation of strong and stable trade relationships with allies to box in China rather than a declaration of trade war on everyone; time to reshore critical national security industries and resources and to solidify non-Chinese supply chains; a military buildup capable of deterring Chinese action against Taiwan, which—based on the destruction or capture of semiconductor giant TSMC—could plunge the entire world into a depression and easily leave China itself at a technological advantage over the West.

The Trump administration did not do this preliminary groundwork. And so, the White House has been forced to punch holes in its own tariff regime, from exempting Apple products and semiconductors to unilaterally abandoning tariffs on erstwhile allies to deploying Bessent to pledge to lower tariffs on China itself. Impulsive decision-making can be an asset in foreign policy; it’s often smart to keep our enemies on their toes, unsure of what comes next. But in economic policy, impulsivity and unpredictability lead to chaos. And it’s far easier for the markets to lose trust in policymakers than to regain it. China must be contained, and Trump has been singularly transformative in forcing the world to face up to that fact. But if he wishes to truly defeat China in the economic sphere, it’s time for solid, understandable, and methodical policy that achieves the goals Trump has correctly set forth.

Pepe’s still in China, in body and in mind. But even he does see a few problems.

• China, Hong Kong and The Art of Blinking (Pepe Escobar)

So, predictably, Captain Chaos did blink first. As much as he – and his sprawling media circus – could not possibly admit it. It all started with “tariff exemptions” – from smartphones and computers to auto parts – on products imported from China. Then it veered towards carefully manicured leaks implying tariffs “could” be reduced to a range between 50% and 65%. And finally a terse admission that if there’s no deal, a “tariff number” will be unilaterally set. China’s Ministry of Commerce was unforgiving: “Trying to trade away others’ interests for temporary gains is like bargaining with a tiger for its skin – it will only backfire”. And it got fiercer. The Ministry was adamant that any Trump 2.0 claims of any progress on bilateral negotiations have “no factual basis” – de facto depicting the US President as a purveyor of fake news.

Tigers, tigers burning bright: the image does not recall poetry superstar William Blake, but Mao’s legendary depiction of the US Empire as a “paper tiger” – a flashback that struck me over and over again last week in Shanghai. If the US Empire was a paper tiger already in the 1960s, the Chinese argue, imagine now. And the pain will increase, not only for the paper tiger: any dodgy deals made by foreign – vassal – pussycat governments at the expense of Chinese interests simply will be not be tolerated by Beijing. Last week in Shanghai I was reminded over and over again – by academics and business people – that the weaponized Trump Tariff Tizzy (TTT) goes way beyond China: it is a desperate offense ordered by the US ruling classes against a peer competitor that scares the hell out of them.

The best Chinese analytical minds know exactly what’s going on in Washington. Take for instance this essay originally published by the influential Cultural Horizon magazine breaking down the “triangular power structure” of Trump 2.0. We have all-power Trump forming a “super-establishment”; Silicon Valley money politics, represented by Elon Musk; and the new right-wing elite represented by VP J.D. Vance. End result: a “governance system that is almost parallel to the federal government.” European chihuahuas – caught in the crossfire of Trump 2.0 – are simply incapable of such synthetic and precise conceptualization.

Paper tiger meets fiery dragon What a deep dive in Shanghai has revealed is that China has been handed over a rare earth-like opportunity by Trump 2.0 to consolidate its strategic initiative solidifying the role of leader of the Global South/Global Majority, at the same time carefully managing the risk of a New Cold War. Call it a Sun Tzu move that may paralyze the Empire in its tracks. Professor Zhang Weiwei, with whom I had the pleasure to share a seminar in Shanghai on the Russia-China strategic partnership, would agree. China is on the move across the spectrum. Chinese Premier Li Qiang sent a letter to Japanese Prime Minister Shigeru Ishibe urging a joint drive, right now, to counteract the tariff dementia.

President Xi’s top message in his Southeast Asia tour last week was to stand up against “unilateral bullying”. Xi deftly moved between Malaysia – current rotating chair of ASEAN, always avoiding taking sides – and Vietnam – with its “bamboo diplomacy” always hedging between US and China. Xi told Malaysia’s Prime Minister Anwar Ibrahim, directly: “We must safeguard the bright prospects of our Asian family”. Translation: let’s create an exclusive sphere of influence close to the ‘community of shared destiny’ but that does not include outside powers such as the US. In parallel, there has been a strong debate – from Shanghai to Hong Kong – that transcends the role of China as the world’s factory: what matters now is how to redirect some of China’s astonishing manufacturing capacity towards the domestic market.

Of course there are problems – such as the lack of purchasing power among scores of Chinese domestic consumers, even as the bulk of national China income is directed to fixed-asset investments. A great deal of China’s rural elderly population survives on a monthly pension of roughly $30 a month, and the hourly rate for the gig economy has stagnated at around $4. Meanwhile, in several high-tech fronts, China just built the fastest high-speed train on the planet: 400km/h, soon to run between Beijing and Shanghai. China is already receiving orders for the C919 commercial wide-bodied airliner. And China has come up with the world’s first thorium-powered nuclear reactor. Translation: unlimited cheap and clean energy is at hand.

Wonder where they would send them.

• Netherlands To Create Trial Detention Areas For Troublesome Asylum Seekers (RMX)

Dutch Asylum Minister Marjolein Faber, of the Party for Freedom (PVV), is initiating trial detention areas for disruptive asylum seekers in the Ter Apel registration center, as well as restrictions on where they can go, De Telegraaf reports. A trial “process availability location” (PBL) will be created in Ter Apel to detain “disadvantaged” asylum seekers who misbehave on public transport or shoplift. They must report there twice a day, may only stay in and around the asylum seekers’ center, and will be banned from entering residential and village areas. Faber adds that anyone who does not comply with the rules can be locked up.

“The behavior of a group of disruptive and criminal asylum seekers who abuse the hospitality offered in the Netherlands and cause nuisance and damage is, in whatever form, absolutely unacceptable,” said Faber. The PVV minister is taking action after the majority in the Dutch House of Representatives agreed that repeatedly disruptive asylum seekers need to be dealt with more quickly and severely. Her suggestion for the PBLs comes after her predecessor, Eric van der Burg (VVD), tried to do the same but had to stop it after a court ruling

Faber claims this will help get those migrants with behavioral problems — and little chance of being granted asylum — out of the Netherlands faster. The PBLs will help keep an eye on them and record their behavior as (and if) it deteriorates, she says. The new PBL in Ter Apel is specifically designed for lighter forms of nuisance and recidivism, such as shoplifting. Although not strict enough in cases demanding even tighter security, they are sufficient to justify restricting freedom. “It is unacceptable that asylum seekers who come to our country for safety, intimidate residents, and cause insecurity. These troublemakers deserve the toughest possible approach. I will not tolerate any nuisance. Not now. Not ever,” she posted on X.

“Golden Dome.”

• Trump Might Be About to Make Reagan’s Dream Come True (Green)

Acting on President Donald Trump’s promise of a “Golden Dome” against nuclear attack, the Republican Congress just placed a yuge down payment on fulfilling President Ronald Reagan’s dream of strategic missile defense. Congressional Republicans on Thursday announced a supplementary defense spending package, including $27 billion for Trump’s Golden Dome. In addition to funds for 14 new anti-missile warships, the bill includes money for the Army’s Terminal High Altitude Area Defense (THAAD) anti-missile systems, and “Elon Musk’s SpaceX and partners are expected to play a key role in missile tracking infrastructure.” When Reagan announced his Strategic Defense Initiative (SDI) in 1983, it started with some pretty crazy-sounding proposals that were nearly impossible then and aren’t much more likely now. Things like a network of orbital laser platforms and particle beam weapons, plus “smart rocks” and even “brilliant pebbles.”

That last one caught my imagination as a teen and never let go. But here’s the thing: If you throw enough time, money, and engineering talent at a problem, Americans will eventually find solutions. SDI — now known as Ballistic Missile Defense (BMD) — has come a long way since 1983. In addition to the Navy’s AEGIS systems that can shoot down anything from airplanes to satellites, we have a couple of Army land-based systems, and more on the way. Plus, some entertainingly fancy radars and satellites to detect threats and tie together the different defensive layers. One thing that hasn’t changed since 1983 is just how expensive it is. While we do have effective BMD systems, we have too few. We can (probably) defend against a small-scale nuclear attack from a rogue nation like North Korea, but that’s about it. Reagan’s dream of protecting our cities from nuclear destruction remains a dream — for now.

Reagan White House Photographs, 1/20/1981

“At least 70 or 80% of the resources applied should be going toward a system that will not evidence itself during the Trump administration,” Mark Montgomery, senior director of FDD’s Center on Cyber and Technology Innovation, cautioned. So, before you get too excited, experts say that deploying a nationwide BMD network will be an “intergenerational” project. Congress’s new budget priorities, however, are a big step in the right direction. It isn’t often appreciated, but for years, we’ve had mobile missile defense platforms that are quite good — the Navy’s guided-missile ships. The Navy took a keen interest in negating airborne threats on Dec. 7, 1941, and that interest grew only more keen after the Japanese developed kamikaze tactics. An anti-ship missile is basically an unmanned kamikaze.

So a lot of what a modern warship does is already missile defense, and a nuclear warhead is basically a very fast, very small missile. It’s more difficult to hit, sure, but the concept — one the Navy has worked on longer than I’ve been alive — is no different. The Navy’s SM-3 Standard Missile (they have got to come up with cooler names) has been in service since 2014 and can shoot down incoming nuclear warheads or even enemy satellites. Depending on the model and its capability, a single SM-3 costs between $10 million and $28 million, so we’ve only produced about 400 for us and our allies. But if you think an SM-3 is expensive, try losing a city. Reagan’s critics never seemed to understand any of this, or pretended not to for political advantage. I don’t have to imagine leaving this country open to a nuclear attack just to win a few votes because I witnessed it.

Let me finish with an anecdote that highlights how good even our limited number of BMD systems are. After retiring from the Air Force, my father-in-law spent almost 20 years working for a small BMD contractor. He had a list of clearances as long as your arm, so one of his jobs was coordinating between the disparate elements required to make BMD work, usually out of Pearl-Hickam in Hawaii. There wasn’t a room he wasn’t cleared to enter. A decade or so ago, I sketched out a scenario for him where China used long-range, hypersonic missiles across the Pacific in a theater-wide sneak attack against our naval and air bases. “I’d like to see them try,” he said with his undiminished fighter-pilot confidence. It’s nice knowing that our men and women in uniform at vital installations around the world enjoy some BMD protection. It will be nicer still when every city in America does. That won’t come soon, and it certainly won’t come cheap, but Reagan would have loved it.

” This isn’t just an interview—it’s a reckoning.”

• You Won’t Believe Who Trump Granted an Interview (Margolis)

President Trump made a huge announcement Thursday, and I’m still trying to wrap my head around it. “Later today I will be meeting with, of all people, Jeffrey Goldberg, the Editor of The Atlantic, and the person responsible for many fictional stories about me, including the made-up HOAX on “Suckers and Losers” and, SignalGate, something he was somewhat more ‘successful’ with,” Trump announced in a post on Truth Social. Jeffrey Goldberg, the notorious editor of The Atlantic who’s made a career out of publishing anonymous hit pieces against Donald Trump, is finally going to have to look President Trump in the eye. And boy, is this going to be interesting.

Trump, displaying his characteristic boldness, announced he’ll be sitting down with Goldberg and his cadre of liberal scribes, including Michael Scherer and Ashley Parker— neither of whom could be mistaken for MAGA supporters. It’s like walking into the lion’s den, except these lions have a history of making up stories out of thin air. According to Trump, the story being written will be titled “The Most Consequential President of this Century.” Let’s not forget Jeffrey Goldberg’s hall-of-shame reporting, starting with the infamously debunked cemetery smear against President Trump—a story denied by 25 witnesses, including Trump critic John Bolton. The most recent, of course, is the “Signalgate” kerfuffle, which was another flimsy hit piece the media eagerly seized on in a failed attempt to oust Defense Secretary Pete Hegseth.

Goldberg’s reporting style is all too familiar by now: a revolving door of anonymous sources and conveniently unverifiable claims that crumble under scrutiny, but are repeated ad nauseam by the liberal media as fact. But here’s what makes this deliciously ironic: Trump is doing this interview from a position of absolute strength. He’s already secured his place in history with a second term, while Goldberg and his mainstream media cohorts are no doubt still nursing their wounds from years of failed attempts to take him down. What’s Goldberg going to do when he can’t hide behind anonymous sources? When he has to actually face the man he’s spent years attacking through the safety of his keyboard? This isn’t just an interview—it’s a reckoning.

The liberal media elite have spent years constructing their anti-Trump narrative from the comfort of their coastal bubbles. Now, one of their chief architects will have to defend his “journalism” face-to-face with his favorite target. For conservatives who’ve watched the mainstream media’s relentless assault on truth, this meeting represents something larger than just another interview. It’s a moment of accountability, where one of the most egregious practitioners of fake news has to confront reality in real-time.

As Trump himself put it, he’s doing this “out of curiosity, and as a competition with myself.” The real question isn’t whether The Atlantic can write a fair story—we all know the answer to that. The real show will be watching Goldberg squirm when he has to defend his “reporting” to the very person he’s spent years maligning with fake stories. Get your popcorn ready, patriots. This is going to be wild.

“..America witnessed a 600% increase in sex trafficking, while over 10.5 million people entered illegally. A quarter-million Americans have died from fentanyl flooding across our open borders. The brutal Tren de Aragua gang now plots assassinations on U.S. soil.”

• We Need to Reclaim Our Country’s Soul From the Radical Left (Margolis)

In a stunning display of misplaced priorities, Democratic lawmakers recently traveled to El Salvador—not to address the border crisis devastating American communities, but to advocate for MS-13 gang member Kilmar Abrego Garcia. This disturbing development perfectly encapsulates how far the Democratic Party has strayed from protecting American interests. The same Democrats who rushed to El Salvador to defend a gang member remained conspicuously silent when Laken Riley, a 22-year-old nursing student, was brutally murdered by an illegal alien on her college campus. They offered no words of comfort when 18-year-old Jocelyn Nungaray was found dead in a San Diego canyon, raped and murdered by two illegal immigrants. And where were their impassioned speeches about “due process” when Rachel Morin, a mother of five, was murdered on a hiking trail by an illegal alien with a violent criminal history?

Border Czar Tom Homan and former Trump advisor Stephen Miller have both exposed the dangerous hypocrisy of these actions. While Sen. Chris Van Hollen (D-Md.) claims he’s merely defending “due process,” the facts tell a different story. Garcia’s own wife has accused him of domestic abuse, and he’s been accused of MS-13 gang affiliation. And then there are his connections to human trafficking. “The Democrat Party has become the party of terrorists and illegal aliens,” Miller declared during a recent Fox News appearance. “Who does it fight for? Who does it move heaven and earth to protect? Illegal alien gang members and foreign terrorists.” The statistics are damning: Under the Biden administration, America witnessed a 600% increase in sex trafficking, while over 10.5 million people entered illegally. A quarter-million Americans have died from fentanyl flooding across our open borders. The brutal Tren de Aragua gang now plots assassinations on U.S. soil.

“Where were you when thousands of American parents buried their children?” Homan demanded of the Democrats during a recent appearance on Sean Hannity’s show. “They got separated from their children forever ’cause they were killed by illegal aliens. That’s preventable crime.” The graves of Laken Riley, Jocelyn Nungaray, and Rachel Morin stand as stark testimonies to this preventable tragedy.Even more shocking, Van Hollen spent taxpayer money to meet with Garcia while ignoring murders committed by illegal aliens in his own state—released despite ICE detainers. During Biden’s presidency, Van Hollen never once visited the border to witness the catastrophe firsthand or spoke with the family of Rachel Morin, one of his actual constituents.

The American people face a critical choice. We can either stand with those working to secure our borders and protect our communities or watch as radical Democrats continue dismantling our national security to protect criminals and terrorists. We need your help to expose the radical left for their indifference to the safety and security of this country and its citizens.

Some people…

• Berlin Labor Minister Says Tesla Cars Are ‘Nazi Cars’ (RMX)

Berlin Senator Cansel Kiziltepe, of the Social Democratic Party (SPD), decided to attack Elon Musk on X, comparing his Tesla cars to “Nazi cars,” creating a massive backlash in the neighboring state of Brandenburg, home to Europe’s only Tesla car factory. The post is particularly odd, given her role as state minister for labor. “Who wants to drive a Nazi car? Manufacturers of electric cars are experiencing a sales boom – apart from Tesla,” according to Welt. Brandenburg’s Minister of Economic Affairs Daniel Keller (also SPD) called on her to retract the statement.

“Such a Nazi comparison hurts the people who work there and is completely inappropriate for a labor senator,” Keller told the dpa news agency. “I expect the labor senator to retract her historically unacceptable comparison and return objectively to the major economic and labor market policy challenges that Berlin and Brandenburg should tackle together.” Keller continued, saying, “Everyone can have their own personal opinion about Elon Musk. But it’s important to me that we don’t forget the people behind the Tesla factory in Grünheide. 11,000 people from 150 nations work here – more than half of the employees live in Berlin.”

Senator Kiziltepe still has a more diplomatic statement posted regarding the electric car company: “Tesla is currently experiencing a sales slump because customers attribute the right-wing extremist positions of its shareholder Elon Musk, who holds around 13% of the company,” she wrote. “I explicitly stand by my assessment of Elon Musk. Of course, this does not mean that I hold Musk’s employees or customers responsible for his political positions,” she added. But not everyone felt this was enough, especially given her comment was seen by most as potentially endangering jobs. “Denigrating the Tesla as a Nazi car shows what you’re really like. Full of hate and division. Simply disgraceful. Better to eliminate all jobs in Germany. You’d like that, wouldn’t you? After all, we’re paying you,” reads one reply.

“Are you still a senator, or have you already resigned to avert further damage to your office and democracy after your unspeakable trivialization of the Nazis? If not, you should do so immediately” another commenter posted.“Yeah, everyone knows by now that you hate Elon Musk. What are the reasons for your hatred? As a civil servant, don’t you have better things to do than vent your hatred online? another X user asked. Tesla has become the largest employer in Brandenburg in Grünheide, with some 11,500 people working there. The jobs at its Gigafactory, which opened just three years ago, are permanent with good salaries. The automaker’s net profits took a hit last quarter; the drop in sales is attributed to both a model change as well as controversies surrounding Musk’s politics.

“Brandenburg and Berlin benefit from this in terms of employment and value creation,” AfD deputy leader Stephan Brandner told the “Rheinische Post” newspaper. The Berlin-Brandenburg Business Association (UVB) also called out the comparison for insulting Tesla employees and scaring away new investment, not to mention hurting Kiziltepe’s own re-election. Managing Director Alexander Schirp stated that such defamation was unworthy of a member of the Berlin Senate. “This doesn’t increase the manufacturer’s chances of investing in the capital. Statements of this magnitude do not bode well for the election campaign,” the UVB MD said.

“..the transatlantic partnership has been built over so many decades that we will not get carried away by the statement of tariffs..”

• German Finance Minister Says Trust Not Yet Broken With US (CNBC)

The trust between Europe and the U.S. is not yet broken despite President Donald Trump’s aggressive tariff policies, Joerg Kukies, acting German finance minister, told CNBC Thursday. “For trust to be broken, a lot more would have to happen because the transatlantic partnership has been built over so many decades that we will not get carried away by the statement of tariffs,” he told CNBC’s Carolin Roth on the sidelines of the IMF World Bank Spring Meetings. Kukies added that during a previous visit to Washington, soon after the 25% tariffs on all cars imported to the U.S. was announced, there did appear to be interest in coming to an agreement. Europe and the U.S. have different interests and both parties need to understand one another’s viewpoints, he said. “But this is not the first time ever that the United States and Europe are negotiating over tariffs, so I don’t think we’re anywhere near a crisis moment.”

Kukies struck a positive tone when referring to talks, saying “everything is going in negotiation mode” with the bloc “optimistic” that it can resolve the differences. A zero-for-zero tariff agreement would be his preferred outcome, Kukies stated. This aligns with what European Commission President Ursula von der Leyen has advocated for. However, Trump has already rejected a proposal from the European Union for a deal which would see zero percent duties on industrial goods imported from the U.S. as well as on imports from the EU. Germany is currently subject to 10% tariffs — the temporarily reduced rate announced by Trump after the initially imposed 20% duties. The country’s struggling economy is heavily reliant on trade, as the U.S. serves as its most important trading partner. Tariff turmoil led by Trump is therefore expected to hit Germany especially hard.

Earlier on Thursday, the German government revised its forecast for the country’s economic growth lower, saying it was now expecting stagnation in 2025. This compares to January’s estimate of 0.3% growth. Acting economy minister Robert Habeck in a press conference cited U.S. President Donald Trump’s trade policies and their impact on the German economy as the main reason for the downward revision. The IMF in its latest World Economic Outlook, which was published earlier this week, also cut its expectations for the German economy with the body now projecting a 0.2% contraction.

Germany’s economy has been struggling for some time, contracting in both 2023 and 2024 on an annual basis. The country has however avoided a technical recession, which is characterized by two consecutive quarters of contraction. The latest GDP data is slated to be released next week. There could however also be some positives on the horizon after a major fiscal package, which could lead to a major investment boost, was enshrined in Germany’s constitution earlier this year. It included changes to the long-standing debt brake rule that are set to enable higher defense spending, as well as a 500 billion euro ($569 billion) infrastructure investment fund. Germany’s debt brake limits how much debt the government can take on and dictates the size of the federal government’s structural budget deficit

“In order for a system to be stabIe, it requires negative feedback, also known as consequences.” —Barrie Drain

• Where Things Stand (James Howard Kunstler)

“Fighting fascism,” for the American Jacobins who lead the Democratic Party, means opposing any attempt to flush the corruption out of the entrenched bureaucracy, just as their pet phrase “our democracy” actually refers to the matrix of grift and despotic activism that drives their political operating system. That is exactly how and why the USAID was so crucial to spread captured taxpayer spoils as NGO salaries for the gender studies grads to play “activist,” so as to inflict their special brand of sadistic power madness over the land — to keep the game going. Now, USAID is scattered to the winds and all they have left is their installed base of federal judges and the horde of lawfare lawyers who feed them bogus cases to halt the remaining work of Mr. Trump’s executive branch clean-up operation.

Remember: Robespierre, leader of the Jacobins in the French Revolution, was a lawyer. Their version of defending “our democracy” in 1793 was the Reign of Terror that sent at least 17,000 political opponents to the guillotine. Rep. Jamie Raskin (D-MD) is the Democrats’ Robespierre. He is promising his own reign of terror when his party recaptures Congress in the 2026 “midterm” election. Norm Eisen is his chief lawyer and legal strategist. His sole aim is to recapture power in order to restore the Democrats’ sadistic regime of thought-control and the money-flows that feed it. That’s where things stand for the moment. You can sense how this tension is tending toward something that looks like civil war.

In the House, Rep. Darrel Issa (R-CA) has introduced the No Rogue Rulings Act of 2025 (HR 1526, passed on April 9) to complement Sen. Grassley’s bill. The Constitution is somewhat vague about the composition of a federal judiciary below the Supreme Court, and essentially leaves the matter to Congress to set parameters for the power of federal judges. Congress can also alter or abolish districts, such as the DC federal district from which so much partisan Democratic Party lawfare has emanated under political activist Judges James Boasberg, Amy Berman Jackson, Tanya Chutkan, and Beryl Howell (all of them involved in the sadistic prosecutions of J-6 defendants).The bills from each house next must go through a reconciliation process that boils them down to a single piece of legislation that can be sent to Mr. Trump for the presidential signature. The House passage is likely assured.

The hang-up is that under Senate rules, the Democrats could mount a filibuster that would require 60 votes to break. The Republicans only control the chamber by a 53 to 47 majority, and no Democrats have signaled any intention to vote in favor of such a bill. In any case, the entire process would take months and might not succeed at all. A much simpler remedy would be for the Supreme Court (SCOTUS) to rule in any of a number of cases now on their docket that the lawfare antics of the federal judges amount to interference with an independent executive branch — in short, that the judiciary can’t usurp the executive powers of the President, which include the conduct of foreign policy, the ability to manage personnel in executive agencies, and certain issues around the spending of taxpayer dollars.

A different sort of remedy would be the application by the DOJ of federal statute 18 USC 371, Conspiracy to Defraud the United States against Norm Eisen and his colleagues-in-lawfare for attempting to maliciously bury the executive branch in litigation for the purpose of nullifying the executive powers of the president. Beyond all that is the abyss: a nullified election, a paralyzed chief executive, and a constitutional crisis that has the potential to lead to civil violence. The Democrats seem willing to go there, perhaps even avid for it. The Jacobins of 1793 were mad for blood, too, and they spilled a whole lot of it. By the summer of 1794, the blood was finally spouting out of their own necks. . . and then the Jacobin reign of terror came to a sudden and complete end. Heed their example.

But they’re not done yet. Got to have that giant NATO base.

• Cancelation of Romania’s Presidential Election Overturned (RT)

An appeals court in Romania has suspended the Constitutional Court’s decision to annul the results of the first round of last year’s presidential election, which was won unexpectedly by independent candidate Calin Georgescu, local media outlets reported on Thursday. Georgescu, a vocal NATO critic and opponent of arming Ukraine, made the headlines in November 2024 after securing 23% of the vote in the first round of the election. The Constitutional Court later invalidated the results, citing “irregularities” in his campaign and intelligence reports alleging Russian interference – which Moscow has denied. On Thursday, Judge Alexandru Vasile of the Ploiesti Court of Appeal overturned the annulment, according to HotNews. The prosecutor’s office attached to the Ploiesti court has filed an appeal.

George Simion, the leader of the Alliance for the Union of Romanians party, welcomed the decision as a “return to democracy” and constitutional order in a post on X. He added, however, that the Central Electoral Bureau – which barred Georgescu from running in May – “ignores it and continues its activity.” In February, Georgescu was indicted on six criminal charges, including allegedly plotting “anti-constitutional acts” and “promoting fascist, racist, or xenophobic ideologies.” He has denied all the charges, insisting the criminal case against him is part of a campaign orchestrated by the Romanian “deep state.”

The politician, who is under a 60-day travel ban as part of judicial oversight, will remain under court supervision for another 60 days, according to media reports. The preliminary findings of an investigation into the ‘irregularities’ found they were likely caused by a consulting firm associated with the pro-Western National Liberal Party running a campaign on behalf of an opponent of Georgescu, which backfired.

Romania

https://twitter.com/daily_romania/status/1915657419264246123

“Our success depends on his ability to shock you.”

Time has a whole edition on Trump. This is just one of their stories. A look from “the other side”.

• Exclusive: Inside Trump’s First 100 Days (Time)

President Donald Trump emerges through a pair of handsome wooden doors on the third floor of the White House. On his way down the wide, carpeted staircase, he passes portraits of his predecessors. Nixon is opposite the landing outside the residence. Two flights down, he has swapped the placement of Clinton and Lincoln, moving a massive painting of the latter into the main entrance hall of the mansion. “Lincoln is Lincoln, in all fairness,” he explains. “And I gave Clinton a good space.” But it’s the portrait around the corner that Trump wants to show off. It’s a giant painting of a photograph—that photograph, the famous image of Trump, his fist raised, blood trickling down his face, after the attempt on his life last July at a rally in Butler, Pa. It hangs across the foyer from a portrait of Obama, in tacit competition. When they bring tours in, everyone wants to look at this one, Trump says, gesturing to the painting of himself, in technicolor defiance. “100 to 1, they prefer that,” he says. “It’s incredible.”

Making his way out to the Rose Garden, he walks up the inclined colonnade toward the Oval Office, describing the other alterations to the decor, both inside and out. His imprint on his workspace is apparent. The molding and mantels have gold accents now, and he has filled the walls with portraits of other presidents in gilded frames. He has hung an early copy of the Declaration of Independence behind a set of blue curtains. The box with a red button that allows Trump to summon Diet Cokes is back in its place on the Resolute desk, behind which stands a new battalion of flags, including one for the U.S. Space Force, the military branch he established. A map of the “Gulf of America,” as Trump has rechristened the Gulf of Mexico, was propped on a stand nearby.

If Trump is making cosmetic changes to the White House, his effect on the presidency goes much deeper. The first 100 days of his second term have been among the most destabilizing in American history, a blitz of power grabs, strategic shifts, and direct attacks that have left opponents, global counterparts, and even many supporters stunned. Trump has launched a battery of orders and memoranda that have hobbled entire government agencies and departments. He has threatened to take Greenland by force, seize control of the Panama Canal, and annex Canada. Weaponizing his control of the Justice Department, he has ordered investigations of political enemies. He has gutted much of the civil service, removing more than a hundred thousand federal workers. He has gone to war with institutions across American life: universities, media outlets, law firms, museums.

He pardoned or gave a commutation to every single defendant charged in connection with the Jan. 6 attacks, including those convicted of violent acts and seditious conspiracy. Seeking to remake the global economy, he triggered a trade war by unleashing a sweeping array of tariffs that sent markets plummeting. Embarking on his promised program of mass deportation, he has mobilized agencies across government, from the IRS to the Postal Service, as part of the effort to find, detain, and expel immigrants. He has shipped some of them to foreign countries without due process, citing a wartime provision from the 18th century. His Administration has snatched foreign students off the streets and stripped their visas for engaging in speech he dislikes. He has threatened to send Americans to a notorious prison in El Salvador. Says one senior Administration official: “Our success depends on his ability to shock you.”

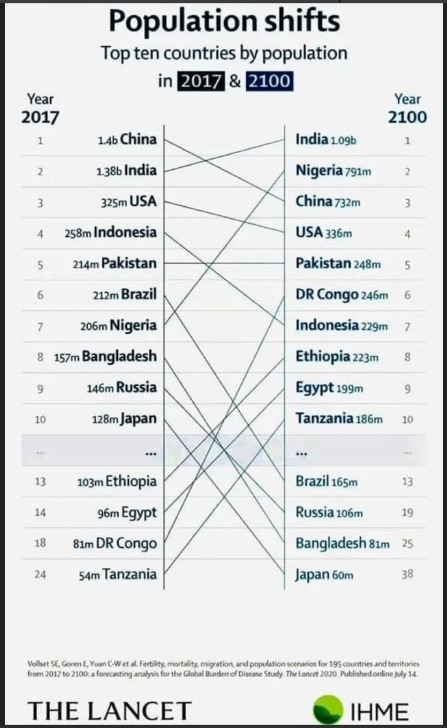

2032

Think ahead! https://t.co/nYabeOjvBY

— Elon Musk (@elonmusk) April 25, 2025

Sun

"Most Skin Cancers Are Caused By Wearing Sunglasses."

Dr Jack Kruse"We're The Only Stupid Idiot Animals On The Planet That Have Bought The Bull Sh*t…That Blocking The Sun Is Smart."

"You Don't Ever Want To Block The Sun…EVER."

"Your Eyes Were Created To Absorb Light."… pic.twitter.com/KyRNE5CUBX

— Valerie Anne Smith (@ValerieAnne1970) April 25, 2025

Miniatures

https://twitter.com/Rainmaker1973/status/1915721903483875524

Laundry

Robots folding hotel laundry

pic.twitter.com/jxDK4MW89Y— Science girl (@gunsnrosesgirl3) April 25, 2025

Willy

This is 1940's tech. A Willy's Jeep from WWII could be unpacked from a create and reassembled in around 4 minutes.pic.twitter.com/LrR5KojlI2

— Military Arms (@MAC_Arms) April 24, 2025

https://twitter.com/nicksortor/status/1915771350137897215

Rowe

Mike Rowe: “We’ve got $1.7 trillion in student debt on the books and we’ve got 7.6 million open jobs right now—most of which don’t require a 4-year degree.”

“And we’ve got 6.8 million able-bodied men who are not only out of the workforce, they’re not looking.”

“We took shop… pic.twitter.com/33eVay6muE

— Holden Culotta (@Holden_Culotta) April 24, 2025

Machine

The machine that started it all, hand built on a band saw using plywood. pic.twitter.com/mvVpQbUjkq

— Wintergatan (@wintergatan) April 25, 2025

Baby swan

https://twitter.com/Yoda4ever/status/1915407889482633272

Puffer

The male pufferfish tries to impress potential mates with his masterpiece.pic.twitter.com/Az8Qh81moh

— Wonder of Science (@wonderofscience) April 25, 2025

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.