G. G. Bain “New York: Aviator Clifford B. Harmon seated in aeroplane” July 1910

The climate debate has gone completely off track over the past few years, and at least 50% of the blame for that lies with the well meaning people who want climate change to be our (as in: all 7 billion of us) number one if not only priority. But as well-meaning as they may be, they’ve fallen for one of the oldest tricks in the book. They’ve been tripped and blind-sided by straw men.

Most of you have at one time in your lives, in high school, college, university or even workplace, been involved in discussion techniques and role playing. The most basic variety is when your neighbor argues one side of an issue, and you – by default – argue the complete opposite, whether you agree with what you argue or not. It’s an exercise. This is what the climate debate seems to have become, an exercise. And given the fact that in this case there are real issues at stake, I would argue it’s an exercise in futility.

There’s a bunch of people who react to every argument made that emissions resulting from human activity cause climate volatility, by saying that’s not true. Whatever the argument, they argue the opposite. The reaction to their blunt opposition is a neverending stream of reports and studies that seek to prove it IS true. And the reply is always: no it’s not. A proven model, as Monty Python showed years ago:

This approach does not strike me as either terribly smart nor as particularly useful. The climate side keeps arguing its points, the other side just keeps saying no. Maybe it’s time for something a little cleverer. Because this isn’t going anywhere. The Guardian had two pieces over the weekend that show just what’s wrong here.

Climate change deniers have grasped that markets can’t fix the climate (Guardian)

The refusal to accept global warming is driven by corporate interests and the fear of what it will cost to try to stop it

Part of the answer is in the influence of some of the most powerful corporate interests in the world: the oil, gas and mining companies that have strained every nerve to head off the threat of effective action to halt the growth of carbon emissions, buying legislators, government ministers, scientists and thinktanks in the process. In the US, hundreds of millions of dollars of corporate and billionaires’ cash (including from the oil and gas brothers Koch) has been used to rubbish climate change science. That is also happening on a smaller scale elsewhere, including Britain.

But climate change denial is also about ideology. Many deniers have come to the conclusion that climate change is some kind of leftwing conspiracy – because the scale of the international public intervention necessary to cut carbon emissions in the time demanded by the science simply cannot be accommodated within the market-first, private enterprise framework they revere. As Joseph Bast, the president of the conservative US Heartland Institute told the writer and campaigner Naomi Klein: for the left, climate change is “the perfect thing”, a justification for doing everything it “wanted to do anyway”.

There’s nothing here that hasn’t been said a thousand times before. It’s like the only thing the writer can think of is to repeat the same things over and over. Thinking or hoping that at some point in time the so loathed contrarians or “deniers” will see the light. While the deniers only seek to gain time by obfuscating the discussion. And succeeding wonderfully in their goal, not in the least because the other side is not handling the situation that well. One side seeks to prove their claim once and for all, the other just needs one small crack in “beyond all reasonable doubt” to live another day.

Of course there are those who actually believe that “Earth and its ecosystems – created by God’s intelligent design and infinite power and sustained by His faithful providence – are robust, resilient, self-regulating, and self-correcting, admirably suited for human flourishing, and displaying His glory.” But that’s a purely religious argument, while most who are worried about the climate don’t do so on religious grounds. So that’s always a lopsided discussion, and one that should probably be avoided.

A potentially more fruitful discussion is the one with those who deny climate change claims – more or less – purely for financial reasons. One point the author of the article above makes is valid: that of “the fear of what it will cost to try to stop it”. There are lots of people who understand the – short term – threat to their wealth from attempts to halt – long time – climate change damage. And they find that important, enough so to approach any claims that it needs to be done with doubt and then some.

Perhaps that’s where the focus should be: in economics. Because our economic system is a main culprit in this whole issue. We can wonder whether it‘s human stupidity that makes the economic system flourish, or the other way around, but there’s no doubt that the incessant quest for profit is a protagonist in driving emissions higher. And that would suggest that a case for limiting emissions might need to be made at the economics and financial level.

Nicholas Stern wrote in 2006 that climate change is “the greatest market failure the world has ever seen”, so it’s not like this is something entirely new. Why this is not a much more prevalent topic in climate discussions I don’t know, but I suspect it has something to do with the fact that not many people in the climate camp feel at ease in economics, and – arguably for that same reason – tend to dismiss it as far less relevant than climate itself. An attitude that might not go far, and even be counter productive, if economic arguments can be made to convince people of the need to reduce emissions, let alone if a direct link is established between economics and climate.

A nice quote comes from an article on UK nuclear power plants in yesterday’s Observer: “If operators paid for their own insurance indemnities, their case for economic production of nuclear electricity collapses.” The article states that the costs of any accidents in the lifecycle of a nuclear plant will be paid by the taxpayer, because that’s how we’ve set up our economic systems.

Obviously, these things may be hard to calculate, since the timeframes they take place in are often so long they tend to be discounted. And besides, if the (cost of) externalities of all industrial activities were moved away from the public and towards the industries, how much activity would still take place? And while you may be inclined to think that that would be a good thing, and you might well be right, the implications for our societies would be earth shatteringly large, and certainly not something you can simply gloss over.

That is to say, if we were to slow down the rate of emissions to a level where we might still halt some of the worst consequences of increasing climate volatility, we would dramatically alter our societies and economies. It seems only fair for the “climate people” to do the math and explain this to people. This should probably have been done a long time ago.

You don’t save your planet by changing a lightbulb, installing solar power on your roof, or having BP paint their gas stations green. The very least you would need to do, as in you and everyone else in your societies, is shrink your energy use by 90% or more. No more driving, no more central heating, very sparse use of electricity, no long haul transport of goods, a far more localized world, and one in which people would need to provide for themselves dramatically more, certainly when it comes to basic necessities. Not hell on earth, but certainly very different.

This would need to be done globally, with a much fairer distribution of available resources than we have now. If one large country refuses to cooperate with such a plan, it’s basically impossible to implement. It would mean bankrupting most of the world’s richest corporations and even nations, no trifle matter. It’s plain to see that, and why, there would be a lot of resistance to this. There is also no global body that has the power to even start discussing such a plan.

We might want to wonder if the human mind is capable of not only imagining, but actually implementing, this (as we might want to wonder if the human mind is capable of long term planning in general). And while wondering that, it seems indispensable that the real picture gets out there of what halting the changes in the climate would mean in practical terms: a completely different world. If those who feel climate is the number one issue today would start explaining that different world, instead of staying trapped in a regurgitating and bottomless argument exercise with those who are going to keep saying “no” regardless of what is said, that would at least greatly improve the level of conversation.

It won’t be an easy thing to do, because many people who are nowhere near deniers or contrarians will still say they’ll pick the long term risk of ongoing emissions above that of short term scorched earth economics. But at least it’ll be less of an insult to intelligence.

That our economic system is busy blowing itself up as we speak, and that the carbon sources we have extracted and exploited to raise emission levels have passed their peaks, should be inserted into the story as well somewhere. So people can get the biggest possible picture, and not just a narrow view through either the lens of just economics or just climate, or energy. Because that does not work, and deniers et al are only partly to blame for that.

Guess who comes knocking for help?

• Primary Dealers Seek US Treasury’s Help in Regaining Grip on Debt (Bloomberg)

The Masters of the Universe immortalized by Tom Wolfe in his 1987 novel “The Bonfire of the Vanities” are feeling like mere mortals. The Wall Street banks known as primary dealers because they get to trade with the Federal Reserve and raise the money that the U.S. government needs to operate are concerned they are being marginalized because of advances in technology. So worried are they that the group wants the Treasury Department to curb the increasingly popular practice by investors of buying bonds directly from the government without their involvement.

In many ways, the request underscores the changing nature of the business, where greater access to information has leveled the playing field between banks and investors, and turned telephones into little more than paperweights. A record 49% of Treasury trading was done electronically in 2013 and the amount of debt sold directly to investors at auction rose to 17.7% of issuance from 2.5% in 2008. The number of primary dealers has shrunk to 22 from the peak of 46 in 1988.

“The Treasury needed the dealer community for its information, for its distribution,” said E. Craig Coats Jr., who was the co-head of the government bond trading desk at Salomon Brothers in the 1980s, when the partnership was Wall Street’s biggest bond trading firm. “Today there’s so many different sources of liquidity and information and distribution that the dealers become less important to the Treasury.”

Primary dealers, which include JPMorgan, Goldman Sachs, Bank of America and Citigroup are seeing their roles diminished just as the Fed begins to unwind the extraordinary monetary stimulus measures put in place after the 2008 financial crisis. That includes bond purchases that swelled the assets on the central bank’s balance sheet to a record $4.15 trillion from less than $1 trillion. At the same time, government borrowing has more than doubled the amount of tradable U.S. government debt to $11.8 trillion. That combination has dealers concerned there’s an increased chance of disorder in markets if demand for Treasuries declines. Forecasters predict higher yields, which would reduce the value of existing bonds.

“This is an oligopoly that’s breaking down and the oligopolists are concerned,” said Robert Eisenbeis, a former director of research at the Fed Bank of Atlanta and vice chairman and chief monetary economist for money-management firm Cumberland Advisors in Sarasota, Florida.

“A set of four headwinds” …

• Global Economy Collapses Despite 4th “Warmest” January On Record (Zero Hedge)

The last 3 weeks have seen the macro fundamentals of the G-10 major economies collapse at the fastest pace in almost 4 years and almost the biggest slump since Lehman. Despite a plethora of data showing that 'weather' is not to blame, US strategists, 'economists', and asset-gatherers are sticking to the meme that this is all because of the cold on the east coast of the US (and that means wondrous pent-up demand to come). However, as the New York Times reports, for the earth, it was the 4th warmest January on record.

G-10 macro data is collapsing…

Must be the weather in the US, right?

For people throughout the Eastern United States who spent January slipping, sliding and shivering, here is a counter-intuitive fact: For the earth as a whole, it was the fourth-warmest January on record.

But this might be another surprise: Despite all the weather drama, it was not a January for the record books.

By the time analysts averaged the heat in the West and the cold in the East, the national temperature for the month fell only one-tenth of a degree below the 20th-century average for January. January 2011 was colder.

No state set a monthly record for January cold. Alabama, also walloped by the ice storms, came closest, with the fourth-coldest January on its record books.

The United States covers only 2% of the surface of the globe, so what happens in this country does not have much influence on overall global temperatures.

Brazil, much of southern Africa, most of Europe, large parts of China and most of Australia were unseasonably warm in January, the National Oceanic and Atmospheric Administration reported Thursday. That continues a pattern of unusual global warming that is believed to be a consequence of human-caused emissions of greenhouse gases.

Even in the United States, more than a third of the country is in drought of varying intensity. Mountain snowpack in many parts of the West is only half of normal, portending a parched summer and a likelihood of severe wildfires.

…

But the cold weather in the East is being balanced, in a sense, by the bizarrely warm temperatures in the West. And that trend, too, is likely to continue.

The outlook over the next month is for continued above-normal temperatures in the West, the Southwest and parts of Alaska, as well as a continuation of the California drought, despite recent rains that have eased the situation slightly.

Can we finally put to bed the "weather" meme and perhaps, just perhaps, recognize that the global economy is slowing as the animal spirits exuberance of global central bank liquidity pump-priming has simply run its course and faces the reality of a debt-saturated, growth-stifled reality.

As the following publicly available paper notes, the years of 2.0% 'trend' growth for the US are over...

The United States achieved a 2.0% average annual growth rate of real GDP per capita between 1891 and 2007. This paper predicts that growth in the 25 to 40 years after 2007 will be much slower, particularly for the great majority of the population. Future growth will be 1.3% per annum for labor productivity in the total economy, 0.9% for output per capita, 0.4% for real income per capita of the bottom 99% of the income distribution, and 0.2% for the real disposable income of that group.

The primary cause of this growth slowdown is a set of four headwinds, all of them widely recognized and uncontroversial. Demographic shifts will reduce hours worked per capita, due not just to the retirement of the baby boom generation but also as a result of an exit from the labor force both of youth and prime-age adults. Educational attainment, a central driver of growth over the past century, stagnates at a plateau as the U.S. sinks lower in the world league tables of high school and college completion rates. Inequality continues to increase, resulting in real income growth for the bottom 99% of the income distribution that is fully half a point per year below the average growth of all incomes. A projected long-term increase in the ratio of debt to GDP at all levels of government will inevitably lead to more rapid growth in tax revenues and/or slower growth in transfer payments at some point within the next several decades.

There is no need to forecast any slowdown in the pace of future innovation for this gloomy forecast to come true, because that slowdown already occurred four decades ago. In the eight decades before 1972 labor productivity grew at an average rate 0.8% per year faster than in the four decades since 1972. While no forecast of a future slowdown of innovation is needed, skepticism is offered here, particularly about the techno-optimists who currently believe that we are at a point of inflection leading to faster technological change. The paper offers several historical examples showing that the future of technology can be forecast 50 or even 100 years in advance and assesses widely discussed innovations anticipated to occur over the next few decades, including medical research, small robots, 3-D printing, big data, driverless vehicles, and oil-gas fracking.

Ukraine can ask for a lot, and under sweet terms. No chance no troika would drop them now.

• Ukraine Seeks $35 Billion as Yanukovych Warrant Is Issued (Bloomberg)

Ukraine’s interim government said the country needs $35 billion of financial assistance to avoid default as it issued an arrest warrant for fleeing ex-President Viktor Yanukovych for his role in last week’s violence. Lawmakers in Kiev are working on a coalition government after ousting Yanukovych from the presidency, while the U.S. and the European Union have pledged aid for a new cabinet. Yanukovych and others were placed on a wanted list for their role in violence that killed at least 82 people last week. Ukrainian assets gained.

“The situation in the financial sphere in general is difficult but controllable,” acting Finance Minister Yuriy Kolobov said today on the government body’s website. The ministry and the central bank are working around the clock to shore up the financial system, he said.

With protesters in control of the capital, Yanukovych’s opponents face a contentious period after the release from prison of former Prime Minister Yulia Tymoshenko, who vowed to return to the fractured political scene before a presidential election May 25. While a new government needs to be established before Ukraine can receive aid, the first payments may arrive next week, Elmar Brok, the head of the European Parliament’s foreign affairs committee, told reporters in Kiev today.

Ukrainian assets have benefited from the momentum for financial aid, with the yield on the government’s dollar bond maturing in 2023 falling 84 basis points, or 0.84%, to 9.36 percent, the lowest since Jan. 28. The UX Index of stocks soared 9%, the most since 2012. Kolobov proposed calling an international conference of donors with the European Union, the U.S and other countries, according to the statement. The $35 billion financing package is needed for this year and next, the ministry estimated.

Mykola Tomenko, a member of Tymoshenko’s Batkivshchyna party, said she was a candidate for the premiership, along with party leader Arseniy Yatsenyuk and billionaire ex-Economy Minister Petro Poroshenko. Tymoshenko, who was imprisoned more than two years ago for abuse of power, later ruled out the role for herself, as did Vitali Klitschko, who heads the UDAR party.

Parliament Speaker Oleksandr Turchynov, handed presidential powers as the government is being formed, warned late yesterday that the economy was in a “pre-default situation.” Ukraine’s economy “is spinning out of control,” he said on the parliament’s website. “The new government’s task is to stop the country’s slide, to stabilize the currency rate, to ensure timely salary and pension payments, to win back investors’ trust, and to create new jobs,” he said. “Another priority is to return to the European integration path.”

The Yanukovych administration in 2012 started negotiations for a $15 billion International Monetary Fund bailout, the country’s third since 2008. Talks stalled as the government rejected demands by the Washington-based lender to cut household heating subsidies. The fund’s most recent mission left Kiev in October, when the two sides said discussions were continuing.

Ukraine needs to renew the program immediately after its Treasury was “robbed,” Yatsenyuk, the head of Tymoshenko’s party, said at a parliamentary committee meeting today. The new government will be ready for “unpopular, but necessary reforms, according to Yatsenyuk, who also called for a change of leadership at the central bank.

Not sure this story is over yet, though.

• A country on the verge of default

A new era opened in Ukraine on Sunday after a day of dramatic twists and turns that saw parliament vote to oust a defiant president and call early elections, and opposition icon Yulia Tymoshenko walk free. The whereabouts of Viktor Yanukovych remained a mystery, after authorities claimed they had prevented the embattled leader from escaping the country and said he may be hiding out in the east, which is broadly pro-Russian and where concerns remain over the potential for unrest.

And while life creaked back to normal in central Kiev for anti-Yanukovych protesters occupying the capital’s Independence Square – where curious onlookers paid their respects to those who died under police fire this week – the focus abroad shifted to rebuilding a battered country on the verge of default. At a G20 gathering in Sydney, the United States and International Monetary Fund offered to assist Ukraine in rebuilding its economy following a three-month protest movement that dramatically escalated this week with the deaths of nearly 100 people in clashes between demonstrators and security forces.

US Treasury Secretary Jacob Lew emphasised that the United States, working with other countries including Russia, “stands ready to assist Ukraine as it implements reforms to restore economic stability and seeks to return to a path of democracy and growth”.

Fears that Ukraine’s debt-laden economy is facing default have sparked panic on markets, with bond yields rising sharply and the hryvnia currency losing a tenth of its value in the span of a few weeks. A new interim government could be announced Sunday in Ukraine, where residents were still reeling from the dizzying changes unleashed over the past week as a mainly peaceful protest movement turned deadly. The spiralling crisis prompted Yanukovych to sign a Western-brokered peace deal Friday with the opposition, which then took over parliament and ushered in huge political changes – including a vote to free Tymoshenko, the fiery 53-year-old hero of the 2004 pro-democracy Orange Revolution.

Yanukovych’s arch-nemesis, Tymoshenko was sentenced to seven years in jail for “abuse of power” after his election in 2010. Shortly after the parliament vote Saturday, she was freed from hospital in the eastern city of Kharkiv where she had been treated under guard, and headed straight to Kiev and Independence Square where she was greeted by an emotional, 50,000-strong crowd.

Hailing the end of a “dictatorship”, she said in a tearful voice late in the evening: “You are heroes, you are the best of Ukraine. “I did not recognise Kiev, the burnt cars, the barricades, the flowers, but it’s another Ukraine, the Ukraine of free men,” she said, sitting in a wheelchair suffering from chronic back problems, her face drawn after two-and-a-half years in jail.

Her appearance on the square would have been unthinkable just a few days ago, much like the fate of Yanukovych himself. On Saturday, police, parliamentary allies and members of his Regions Party deserted the president one by one. The army issued a statement saying it “will in no way become involved in the political conflict” and the police force declared itself in support of “the people” and “rapid change”.

Security forces all but abandoned government and presidential buildings and anyone was free to enter unchallenged. Even Yanukovych’s ostentatious mansion near the capital became a free-for-all, city residents gawping in awe and anger at the luxury of a sprawling estate that featured a private zoo and a replica galleon floating on an artificial waterway. [..]

Western countries cautiously welcomed the rapid-fire changes taking place in Ukraine – which has been in crisis since November, when Yanukovych ditched a key European Union trade pact in favour of closer ties with Russia. The EU, whose envoys from France, Poland and Germany negotiated the peace deal with Yanukovych, said a “lasting solution to the political crisis” needed to be found. “This must include constitutional reform, the formation of a new inclusive government, and the creation of the conditions for democratic elections,” said EU foreign policy chief Catherine Ashton.

Ukraine is broadly divided between the Russian-speaking east and a nationalist Ukrainian speaking west. The protracted protests have morphed into a wider geopolitical confrontation between Russia, which wants to keep reins on its historic fiefdom, and the European Union and United States, which want to bring the nation of 46 million people into the West’s fold. Polish Prime Minister Donald Tusk, who has played an active role in efforts to end the crisis, said Saturday that there were forces threatening the territorial integrity of Ukraine, without specifying what they were.

Of all useless declarations …

• G-20 Vows to Increase Global Economy by $2 Trillion (Reuters)

The world’s top economies have embraced a goal of generating more than $2 trillion in additional gross domestic output over five years while creating tens of millions of new jobs, signaling optimism that the worst of crisis-era austerity was behind them. The final communiqué on Sunday from the two-day meeting of Group of 20 finance ministers and central bankers in Sydney said they would take concrete actions to increase investment and employment, among other overhauls. The group accounts for about 85% of the global economy. “We will develop ambitious but realistic policies with the aim to lift our collective G.D.P. by more than 2% above the trajectory implied by current policies over the coming 5 years,” the communiqué read.

Joe Hockey, the Australian treasurer and host for the meeting, described the plan as a new day for cooperation in the G-20. “We are putting a number to it for the first time — putting a real number to what we are trying to achieve,” Mr. Hockey told a news conference. “We want to add over $2 trillion more in economic activity and tens of millions of new jobs.” The deal was also something of a feather in the cap of Mr. Hockey, who spearheaded the push for growth in the face of some skepticism, notably from Germany. “What growth rates can be achieved is a result of a very complicated process,” Wolfgang Schäuble, Germany’s finance minister, said after the meeting. “The results of this process cannot be guaranteed by politicians.”

Australia is president of the G-20 this year, following Russia in 2013 and ahead of Turkey next year. The growth plan borrows wholesale from an International Monetary Fund paper prepared for the Sydney meeting, which estimated that structural overhauls would raise world economic output about 0.5% per year over the next five years, increasing global output $2.25 trillion. The I.M.F. has forecast global growth of 3.75% for this year and 4% in 2015.

Prices still rose, but confidence did not.

• Reports of Tight Credit Hit China Property Stocks (WSJ)

Despite an increase in China’s housing prices, stocks of Chinese real estate firms fell on Monday. Analysts said investors took profit on reports that Chinese banks were curbing loans to both property developers and home buyers, and ignored January property prices.

Prices in January, compared with a year earlier, were up in 69 of the 70 cities surveyed by the government, but property developer stocks plummeted from local Chinese media reports stating that both mid-sized and the four major mainland banks –Bank of Communications Co. Ltd, Agricultural Bank of China Limited, Industrial and Commercial Bank of China, and China Construction Bank Corporation — have canceled interest-rate incentives for first-time buyers and have stopped lending to property developers. Second-tier banks have also reportedly suspended their mortgage-loan business.

“We’re mostly focused on news from local news media that big banks are stepping back on loans in the sector,” Shenyin Wanguo Securities analyst Qian Qimin says. However, “liquidity is ample and the market has already fallen a lot–valuations are quite low–so the losses in property shouldn’t bring down the market too much,” he adds. Shares of property developers such as Poly Real Estate Group, the largest state-owned real estate group, have fallen as much as 45% from a year earlier.

Great and incredible piece by the Guardian that speaks for itself.

• Scandal of Europe’s 11 million empty homes (Guardian)

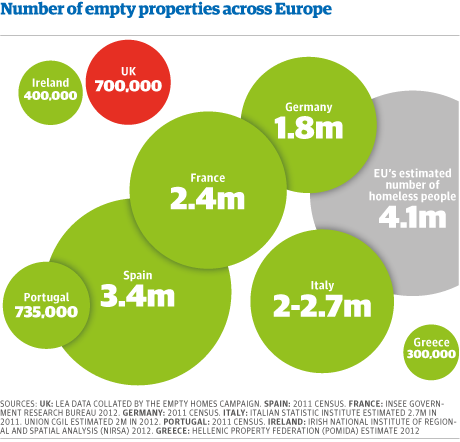

More than 11 million homes lie empty across Europe – enough to house all of the continent’s homeless twice over – according to figures collated by the Guardian from across the EU. In Spain more than 3.4 million homes lie vacant, in excess of 2 million homes are empty in each of France and Italy, 1.8 million in Germany and more than 700,000 in the UK. There are also a large numbers of vacant homes in Ireland, Greece, Portugal and several other countries, according to information collated by the Guardian.

Many of the homes are in vast holiday resorts built in the feverish housing boom in the run up to the 2007-08 financial crisis – and have never been occupied. On top of the 11 million empty homes – many of which were bought as investments by people who never intended to live in them – hundreds of thousands of half-built homes have been bulldozed in an attempt to shore up the prices of existing properties.

Housing campaigners said the “incredible number” of homes lying empty while millions of poor people were crying out for shelter was a “shocking waste”. “It’s incredible. It’s a massive number,” said David Ireland, chief executive of the Empty Homes charity, which campaigns for vacant homes to be made available for those who need housing. “It will be shocking to ordinary people. “Homes are built for people to live in, if they’re not being lived in then something has gone seriously wrong with the housing market.”

Ireland said policymakers urgently needed to tackle the issue of wealthy buyers using houses as “investment vehicles” – not homes. He said Europe’s 11 million empty homes might not be in the right places “but there is enough [vacant housing] to meet the problem of homelessness”. There are 4.1 million homeless across Europe, according to the European Union.

Freek Spinnewijn, director of FEANTSA, an umbrella organisation of homelessness bodies across Europe, said it was a scandal that so many homes have been allowed to lie empty. “You would only need half of them to end homelessness,” he said. “Governments should do as much as possible to put empty homes on the market. The problem of homelessness is getting worse across the whole of the European Union. The best way to resolve it is to put empty homes on the market.”

Gavin Smart, director of policy at the UK Chartered Institute of Housing, said many of the empty homes were likely to have fallen into disrepair or be in deprived regions lacking jobs, but others could be easily brought back to the market. He said a growing problem was rich investors “buying to leave” and hoping to profit from rising property prices. The prices of prime London property – defined as homes that cost more than £1,000 per sq ft – are now 27% above their 2007 peak, according to estate agent Savills.

Most of Europe’s empty homes are in Spain, which saw the biggest construction boom in the mid-2000s fed largely by Britons and Germans buying homes in the sun. The latest Spanish census, published last year, indicated that more than 3.4 million homes – 14% of all properties – were vacant. The number of empty homes has risen by more than 10% in the past decade.

The Spanish government estimates that an additional 500,000 part-built homes have been abandoned by construction companies across the country. During the housing boom, which saw prices rise by 44% between 2004-08, Spanish builders knocked up new homes at a rate of more than 800,000 a year.

More than 18% of homes in Galicia, on the north-west Spanish coast, and La Rioja, near Pamplona, are vacant. Many of the empty Spanish properties were repossessed by banks after owners defaulted on mortgages. María José Aldanas of Spanish housing and homelessness association Provivienda said: “Spain is suffering from high numbers of repossessions and evictions, so we have reached a point where we have too many people without a home and many homes without people.”

Some city councils in Catalonia have threatened banks with fines of up to €100,000 if homes they repossess remain empty for more than two years. The city council of Terrassa, to the north of Barcelona, has reportedly written to banks holding more than 5,000 homes demanding they take “all possible actions to find tenants” or hand the homes over to the council to use for social housing.

In France, the latest official figures from INSEE, the government research bureau, show that 2.4 million homes were empty in 2012, up from 2 million in 2009. Italy will release figures for the number of empty properties in the country’s census, published this summer. A survey by the Italian statistics institute estimated there were 2.7 million in 2011, and a 2012 report by the Cgil union estimated 2 million unfinished houses

In the UK more than 700,000 homes are empty, according to local authority data collated by the Empty Homes campaign. Campbell Robb, chief executive of Shelter, the UK’s biggest homelessness charity, said “homes shouldn’t stand empty” and the government needed to come up with “bigger, bolder ideas” to tackle the lack of available, affordable homes. In Portugal there are 735,000 vacant properties – a 35% increase since 2001 – according to the 2011 census. An estimated 300,000 lie empty in Greece and 400,000 in Ireland.

The Irish government has begun demolishing 40 housing estates built during the boom but still empty. It is working out how to deal with a further 1,300 unfinished developments, and Deutsche Bank has warned that it will take 43 years to fill the oversupply of empty homes in Ireland at the current low population growth rate.

Renting out someone else’s home? Isn’t that what the banks are supposed to be doing?

• Spain’s Empty Homes Spawn Black Housing Market (Guardian)

The hundreds of thousands of empty homes across Madrid has spawned a black market for cheap housing in which groups illegally break into, and then let, repossessed properties. Almost all the cases involving the properties, most of which now belong to Spanish banks, are identical, said Vicente Pérez, from a residents group, the Federación Regional de Asociaciones de Vecinos de Madrid: “Somebody goes and kicks in the door. Once he’s in, the others come – and they sell the place.”

While prices vary greatly, it generally costs from €1,000 (£830) to €2,000 to “buy” a repossessed property, El País reports. Those who cannot afford the fee can instead choose to rent for a few hundred euros a month. The price often includes electricity, gas and water, and sometimes even heating. The homes are guaranteed until a judicial process issues an eviction order, said Pérez. That process that could take up to two years. Exact figures on how many people are taking part in such arrangements were hard to come by, he said. “People are scared and they don’t want to talk.”

Nearly 15,000 households in Madrid were served eviction notices in 2012, according to official figures from the courts. Coupled with sky-high unemployment rates, this has led to “infinitely long” waiting times for subsidised housing, said Pérez. It has left families, immigrants and others desperate for affordable housing in the capital region. “A few shameless people are taking advantage of the needs of the most poor to make a business out of it,” he said. The “landlords” of this black market range from people just looking to make some extra money to groups with criminal connections. “Some of them are mafia,” said Pérez. “I wouldn’t call them the Italian mafia, but they are highly organised groups.”

Spain’s Guardia Civil police force was forced to acknowledge the problem last month when it responded to neighbours’ complaints about an illegally occupied flat. Police arrived at the building as a prospective tenant was being shown around the foreclosed flat. Two siblings, aged 33 and 28, were arrested for breaking and entering foreclosed properties and illegally renting them out. They targeted immigrants, who were charged €400 a month for flats in the south of the city.

Manuel San Pastor, a lawyer for the group Plataforma de Afectados por la Hipoteca, said the root of the problem was Spain’s “hundreds of thousands of empty properties”. His group provides support to Spaniards facing eviction, be it by negotiating with the banks or backing movements to occupy empty houses.

Just 10 years ago Spain was in the throes of a construction boom, with developers building hundreds of thousands of homes a year. The bubble burst in 2007, leaving its relics scattered across the country, including more than 300,000 empty homes in Madrid. Last year, in an effort to convey the staggering size of Spain’s construction bubble, a group of civil engineers and an architect created Nación Rotonda (Roundabout Nation).

Their website uses satellite imagery to show aerial pictures of dozens of Spanish neighbourhoods, before and after the boom. Where forests and farmland stood 10 years ago, now there are half-built homes, elaborate roundabouts and roads leading nowhere. “It’s mind-blowing,” said Rafael Trapiello, co-founder of Nación Rotonda. “These were developments that were thrown together with little consideration of social needs, just big expectations of making money.”

The aim of their project is not to editorialise the changes, but rather to inform Spaniards of the dramatic changes to the landscape in the past 15 years. Particularly powerful, he said, were the rows and rows of empty houses across Spain. “What we’ve ended up with are ghost towns,” said Trapiello. “There’s not much to compare it to across Europe. It’s pretty shocking to see.”

Repossessions are not just still rising, they’re accelerating.

• Ireland’s bailout may be over but its housing crisis is far from finished (Guardian)

Ireland may have left the international bailout programme but its problems are far from over, with the number of empty properties left over from the crash likely to almost double in 2014, according to rating agencies and campaigners for distressed mortgage holders. There are now 14,000 empty houses and flats scattered across the Irish Republic, including 700 so-called “ghost estates”.

Most of the abandoned properties now belong to the state company, the National Assets Management Agency (Nama), and 4,000 are earmarked to be handed over for public housing. But projections suggest repossessions will accelerate this year and David Hall, founder of the homeowners’ campaign group the Irish Mortgage Holders Organisation, said this meant the rate of empty properties would have increased to more than 26,000 by the end of 2014.

Almost a fifth of mortgage holders are in arrears in Ireland – the majority more than three months behind their payments. In its latest analysis of the Irish property market at the start of 2014, the ratings agency Fitch said one in five houses where mortgages had been in arrears for three months or more was likely to be repossessed.

Hall described the thousands of empty properties as a “disgraceful vision”, given that levels of homelessness are on the rise in Ireland again. He said: “The existence of the ‘ghost estates’ and the empty flats, houses, apartment complexes proves that the state put the banks ahead of the interests of its citizens.”

He said social housebuilding was still at a low point in the state, yet there were more than 90,000 people on housing waiting lists across Ireland. Commenting on Nama’s plan to hand over 4,000 of the empty properties to local authorities, Hall pointed out that in County Kildare alone there were 5,000 people on the waiting list.

“This measure to hand over these properties does nothing to solve the huge numbers of people living in private rented accommodation, including B&Bs,” he said. “It suits the banks to have a dearth in supply of homes, because in places like Dublin property prices are artificially on the rise again. Demand is high but supply is limited. Banks are basically using a financial Ouija board to try to conjure up a magical property price hike across the country. The banks are still being allowed to dictate what happens to these properties,” he said. Fitch’s projections would mean more families left homeless and ultimately more taxpayers’ money being used to pay for their rents in the private sector, he said. [..]

Those who work with Ireland’s growing number of homeless people say that with rents increasing in areas such as Greater Dublin by 11% this year, far more of those empty properties should be placed in public ownership. Bob Jordan, of the housing charity Threshold, said: “We would argue that all of those properties – not just the 4,000 they say are going to hand over to local authorities – should be put into public ownership. The authorities need to bring these on stream now because the homeless crisis is already upon us.”

Makes sense.

• Volcanic eruptions ‘contributed to global warming pause’ (Independent)

The impact of volcanic eruptions on global warming could provide a new explanation for the so-called “pause” used by sceptics to deny climate change is happening, scientists have said. According to a study in the US, models for predicting the rate at which temperatures around the world would rise from 1998 onwards did not take into consideration the measurable impact volcanoes can have. Rather than contributing to global warming, eruptions release particles into the air that reflect sunlight – causing temperatures to drop.

Experts from the Lawrence Livermore National Laboratory in California said this phenomenon was not taken into account when predictions were made – offering an explanation for why the world seemed to stop heating up. “We show that climate model simulations without the effects of early 21st century volcanic eruptions overestimate the tropospheric warming observed since 1998,” wrote Dr Benjamin Santer in the journal Nature Geoscience. “To reduce these uncertainties, better observations of eruption-specific properties of volcanic aerosols are needed, as well as improved representation of these eruption-specific properties in climate model simulations.”

Powerful volcanic eruptions send small sulphur droplets, or aerosols, high into the atmosphere where they act as a mirror to reflect the sun’s rays and prevent them warming the ground. In 1991, the second largest volcanic eruption of the 20th century occurred when Mount Pinatubo in the Philippines exploded with enormous force, killing almost 1,000 people and causing widespread damage. Millions of tonnes of ash and gas were blasted into the atmosphere from the mountain, reaching an altitude of 21 miles.

Over the next two years, average temperatures across the whole of the Earth fell by up to 0.5C. The research showed that Mount Pinatubo and the earlier major eruption of El Chichon in Mexico in 1982 “had important impacts on decadal changes in warming rates”. In addition, 17 “small” eruptions occurred after 1999 which had a cumulative effect increasing the reflective effect of aerosols in the upper atmosphere by up to 7% per year from 2000 to 2009.

Scientists have provided a number of explanations in recent years as to why the apparent global warming “pause” came about, including natural climate variability to failures in accurate surface temperature measurement. British climate expert Professor Piers Forster, from the University of Leeds, said: “Volcanoes give us only a temporary respite from the relentless warming pressure of continued increases in CO2.”

Recent volcanic eruptions

Tungurahua – February 3 2014

Tungurahua – 1 Feb 2014

Mount Sinabung – 5 January 2014

Mount Etna – 9 January 2014

Chaparrastique – 29 December 2013

Mount Etna – November 17 2013

Puyehue – 5th June 2011

Eyjafjallajökull – 21 March 2010Tungurahua – February 3 2014

Tungurahua – 1 Feb 2014

Mount Sinabung – 5 January 2014

Mount Etna – 9 January 2014

Chaparrastique – 29 December 2013

Mount Etna – November 17 2013

Puyehue – 5th June 2011

Eyjafjallajökull – 21 March 2010

• Climate change deniers have grasped that markets can’t fix the climate (Guardian)

The refusal to accept global warming is driven by corporate interests and the fear of what it will cost to try to stop it

It’s an unmistakable taste of things to come. The floods that have deluged Britain may be small beer on a global scale. Compared with the cyclone that killed thousands in the Philippines last autumn, the deadly inundations in Brazil or the destruction of agricultural land and hunger in Africa, the south of England has got off lightly.

But the message has started to get through. This is exactly the kind of disaster predicted to become ever more frequent and extreme as greenhouse gas-driven climate change heats up the planet at a potentially catastrophic rate. And it’s exposed the David Cameron who wanted to “get rid of all the green crap” and who slashed flood defence spending by £100m a year as weak and reckless to his own supporters.

Of course there have been plenty of floods in the past, and it’s impossible to identify any particular weather event as directly caused by global warming. But as the Met Office’s chief scientist Julia Slingo put it, “all the evidence suggests that climate change has a role to play in it”. With 4% more moisture over the oceans than in the 1970s and sea levels rising, how could it be otherwise?

If it weren’t for the misery for the people at the sharp end, you might even imagine there was some divine justice in the fact that the areas hit hardest, from the Somerset Levels to the Thames valley are all Tory heartlands. It’s the same with the shale gas fracking plans the government is so keen on: the fossil fuel drilling and mining so long kept away from the affluent is now turning up on their Sussex doorstep.

How do the locals feel that their government cut flood defences for the areas now swimming in water in the name of austerity, while one in four environment agency staff is being axed and the environment secretary, Owen Paterson, slashed his department’s budget for adaptation to global warming by 40%?

Not too impressed, to judge by the polling. But then, paradoxically, Paterson is in fact a climate change denier in what was supposed to be “the greenest government ever”, a man who refused to accept a briefing from the chief scientific adviser at the energy and climate change department, reckons there are benefits to global warming and thinks “we should just accept that the climate has been changing for centuries”. Of course he’s not alone among Conservatives in being what one of his cabinet colleagues called “climate stupid”. The basic physics may be unanswerable, 97% of climate scientists agree that carbon emissions are dangerously heating up the planet, the IPCC warn it’s 95% likely that most of the temperature rise since 1950 is due to greenhouse gases and deforestation, the risk of a global temperature rise tipping above 1.5–2C be catastrophic for humanity.

But the climate flat-earthers are having none of it. As a result, what should be a pressing debate about how to head off global calamity has been reframed in the media as a discussion about whether industrial-driven climate change is in fact taking place at all – as if it were a matter of opinion rather than science.

The impact of this phoney controversy during an economic crisis has been dramatic: in the US, the proportion of the population accepting burning fossil fuels drives climate change dropped from 71% to 44% between 2007 and 2011. In Britain, the numbers who believe the climate isn’t changing at all rose from 4% to 19% between 2005 and 2013 (though the floods seem to be correcting that).

The problem is at its worst in the Anglo-Saxon world – which has also historically made the largest contribution to pumping carbon into the atmosphere. Take Australia, which is afflicted by longer and hotter heatwaves, drought and bushfires. Nevertheless, its rightwing prime minister Tony Abbott dismisses any link with climate change, which he described as crap, and has pledged to repeal a carbon tax on the country’s 300 biggest polluters. The move was hailed by his political soulmate, the Canadian prime minister and tar sands champion Stephen Harper, as an important message to the world. And in the US, climate change denial now has the Republican party in its grip.

What lies behind the political right’s growing refusal to accept the overwhelming scientific consensus? There’s certainly a strong tendency, especially in the US, for conservative white men to refuse to accept climate change is caused by human beings. But there shouldn’t be any inherent reason why people who believe in social hierarchies, individualism and inequality should care less about the threat of floods, drought, starvation and mass migrations than anyone else. After all, rightwing people have children too.

Part of the answer is in the influence of some of the most powerful corporate interests in the world: the oil, gas and mining companies that have strained every nerve to head off the threat of effective action to halt the growth of carbon emissions, buying legislators, government ministers, scientists and thinktanks in the process. In the US, hundreds of millions of dollars of corporate and billionaires’ cash (including from the oil and gas brothers Koch) has been used to rubbish climate change science. That is also happening on a smaller scale elsewhere, including Britain.

But climate change denial is also about ideology. Many deniers have come to the conclusion that climate change is some kind of leftwing conspiracy – because the scale of the international public intervention necessary to cut carbon emissions in the time demanded by the science simply cannot be accommodated within the market-first, private enterprise framework they revere. As Joseph Bast, the president of the conservative US Heartland Institute told the writer and campaigner Naomi Klein: for the left, climate change is “the perfect thing”, a justification for doing everything it “wanted to do anyway”.

When it comes to the incompatibility of effective action of averting climate disaster with their own neoliberal ideology, the deniers are absolutely right. In the words of Nicholas Stern’s 2006 report, climate change is “the greatest market failure the world has ever seen”.

The intervention, regulation, taxation, social ownership, redistribution and global co-operation needed to slash carbon emissions and build a sustainable economy for the future is clearly incompatible with a broken economic model based on untrammelled self-interest and the corporate free-for-all that created the crisis in the first place. Given the scale of the threat, the choice for the rest of us could not be more obvious.

• Nazis, shoddy science, and the climate contrarian credibility gap (Guardian)

Because the pool of climate experts who dispute that humans are the primary cause of global warming is so small, representing just 2 to 4% of climate scientists, climate contrarians often reference the same few contrarian scientists. Two such examples are Roy Spencer and John Christy of the University of Alabama at Huntsville (UAH), both of whom have testified before US Congress several times, and are often interviewed and quoted in the conservative media.

And because that pool of contrarian climate experts is so small, their credibility often seems indestructible. For example, Richard Lindzen has been wrong on essentially every position he’s taken on major climate science issues over the past quarter century, and yet the conservative media continue to treat him as a foremost climate expert. Therefore, it’s important to remind ourselves what these few climate scientist contrarians really believe, and whether their arguments have any scientific validity.

Yesterday, Roy Spencer took to his blog, writing a post entitled “Time to push back against the global warming Nazis”. The ensuing Godwinian rant was apparently triggered by somebody calling contrarians like Spencer “deniers.” Personally I tend to avoid use of the term, simply because it inevitably causes the ensuing discussion to degenerate into an argument about whether “denier” refers to Holocaust denial. Obviously that misinterpretation of the term is exactly what “pushed [Spencer’s] button,” as he put it.

However, this misinterpretation has no basis in reality. The term “denier” merely refers to “a person who denies” something, and originated some 600 years ago, long before the Holocaust occurred. Moreover, as the National Center for Science Education and Peter Gleick at Forbes have documented, many climate contrarians (including the aforementioned Richard Lindzen) prefer to be called “deniers.”

“I actually like ‘denier.’ That’s closer than skeptic,” says MIT’s Richard Lindzen, one of the most prominent deniers. Steve Milloy, the operator of the climate change denial website JunkScience.com, told Popular Science, “Me, I just stick with denier … I’m happy to be a denier.” Minnesotans for Global Warming and other major denier groups go so far as to sing, “I’m a Denier!”.

Spencer is also on the advisory board of the Cornwall Alliance, a group with ‘An Evangelical Declaration on Global Warming’ claiming that “Earth and its ecosystems – created by God’s intelligent design and infinite power and sustained by His faithful providence – are robust, resilient, self-regulating, and self-correcting, admirably suited for human flourishing, and displaying His glory.” The declaration also has a section on “What We Deny,” and Spencer recently wrote in The Christian Post,

…we deny “that most [current climate change] is human-caused, and that it is a threat to future generations that must be addressed by the global community.”

Thus it’s rather hypocritical of Spencer to complain about the use of a word meaning “a person who denies” when he has expressly admitted to denying these climate positions. In his blog post, Spencer also wrote of those he calls “global warming Nazis,”

“Like the Nazis, they advocate the supreme authority of the state (fascism), which in turn supports their scientific research to support their cause (in the 1930s, it was superiority of the white race).”

Aside from being incredibly offensive, these comments are extremely hypocritical coming from Roy Spencer, who previously described his job as a UAH climate scientist as follows.

“I view my job a little like a legislator, supported by the taxpayer, to protect the interests of the taxpayer and to minimize the role of government.”

The day before Spencer’s blog post, John Christy along with another UAH colleague Richard McNider, published an opinion piece in the Wall Street Journal. Their piece was in response to comments by US Secretary of State John Kerry, who said,

“We should not allow a tiny minority of shoddy scientists and science and extreme ideologues to compete with scientific fact,”

Christy and McNider believe it’s climate contrarians like themselves who ’embrace the facts.’ To support this claim, they tried to argue that mainstream climate scientists are in denial about the accuracy of climate models.

“We might forgive these modelers if their forecasts had not been so consistently and spectacularly wrong. From the beginning of climate modeling in the 1980s, these forecasts have, on average, always overstated the degree to which the Earth is warming compared with what we see in the real climate.”

[..] In their opinion piece, Christy and McNider present a graph that’s supposed to prove their argument that climate models have overestimated global warming. However, rather than compare models and observations of global surface temperature, which are of the greatest importance for those of us living on the Earth’s surface, they instead show temperature data from higher up in the atmosphere, the temperature of the mid-troposphere (TMT).

The figure in the Wall Street Journal piece suffers from several problems. First, it improperly averages the data (also known as “baselining”) in a way that results in shifting the observational data downwards with respect to the model data, visually exaggerating the discrepancy. Second, it doesn’t show any error bars or uncertainty ranges, and the error bars on the TMT data are large. Third, it simply averages together two satellite TMT data sets (presumably from UAH and Remote Sensing Systems), ignoring the fact that there is a large difference in the estimated warming trends from these two data sets, and that other TMT data sets that Christy and McNider excluded show even greater TMT warming, more in line with model projections.

The other problem is that Christy and McNider assume that the observational data are perfect, and thus that any discrepancy must mean the models are wrong. However, a U.S. Climate Change Science Program report co-authored by Christy concluded that the difference between satellite estimates and model projections of atmospheric warming is probably mostly due to errors in the observations.

“This difference between models and observations may arise from errors that are common to all models, from errors in the observational data sets, or from a combination of these factors. The second explanation is favored, but the issue is still open.”

For more details, see Climate Science Watch. Christy and McNider’s ‘skepticism’ now only seems to apply to the models and not to the observations, despite their long history of needing to make large adjustments to correct for cool biases in their own observational data. As climate scientist Andrew Dessler said,

“As far as the data go, I don’t really trust the satellite data. While satellites clearly have some advantages over the surface thermometer record, such as better sampling, measuring temperature from a satellite is actually an incredibly difficult problem. That’s why, every few years, another big problem in the UAH temperature calculation is discovered.”

Spencer, Christy, and McNider offer perfect examples of what John Kerry was criticizing – shoddy, biased science being treated on equal footing with solid mainstream science. In reality, there should be an immense credibility gap between the climate contrarians who have been consistently wrong and who deny the inconvenient data, and the mainstream climate scientists whose positions are supported by the full body of scientific evidence.

When a fringe 2% to 4% minority – who consistently produce shoddy analysis and compare those with whom they disagree to Nazis – are given equal credibility by the media and policymakers as the 97% of scientific experts, we have a problem.

• UK Nuclear Leaks Bill Will Be Paid By Taxpayer (Observer)

The private consortium that will manage the decommissioning of Britain’s ageing Magnox nuclear reactors will not be held financially liable if they suffer a major radioactive incident – even if it costs billions of pounds to clear up, it has emerged.

The government will indemnify the private contractors, which means the taxpayer will be left to foot the bill for any leak, a similar arrangement to how things stand now. Critics complain that granting the multimillion-pound contract to a private consortium while freeing it of liability for a nuclear incident is such a poor deal for the taxpayer that it will render its new management unaccountable. The government has rejected this claim.

Confirmation of the indemnity was made at the start of this month, when the Department for Energy and Climate Change (DECC) slipped out a departmental minute relating to the Magnox reactors. Built in the 1960s, originally to produce plutonium to make nuclear weapons, the reactors include those at Sizewell, Hinkley and Dungeness.

They are now at the end of their lives and the government is preparing to fully decommission them, something that has never been done with such a reactor anywhere in the world. The minute reveals that private companies would refuse to bid for the decommissioning contract if they had to face paying out billions of pounds over a radioactive incident.

The minute explains that the firms “are not prepared to accept liability” and states that “because of the nature of nuclear activities, the maximum figure for the potential liability is impossible to accurately quantify”. The minute, which was published before the parliamentary break, giving MPs only a week to debate its implications, says that there is only a “low probability” of a claim against the public purse.

Labour MP Paul Flynn, who is deeply critical of the use of the indemnity, attacked the way it had been presented to parliament for using “chicanery, subterfuge and secrecy”. He accused the government of denying parliament a detailed debate on the costs of nuclear, which has become a major political issue given the coalition’s enthusiasm for building a new generation of reactors designed to help the UK secure its own energy supplies. “There have been major nuclear accidents about every decade since Three Mile Island,” Flynn said. “More are very likely from technical failure, terrorism, human error or natural disaster. If risk is minimal, nuclear sites could be insured commercially.”

The energy minister, Michael Fallon, insisted that there was “a very strong case” for the indemnity, which he said was “a prerequisite to awarding the contract and securing the benefits of the competition”. However, Flynn accused the government of taking a huge gamble. “The cost of the Fukushima cleanup and damages ranges from $250bn [£150bn] to $500bn and rising,” he said. “Nuclear installations are uninsurable in normal commercial terms. Only gullible governments can bear the enormous risk.

If operators paid for their own insurance indemnities, their case for economic production of nuclear electricity collapses.”

Well, as useless declarations go …

• UK Coalition To Unveil Radical Plans To Cut Child Poverty (Observer)

Radical plans to cut water, food and fuel bills for low-income families are being considered by the coalition as part of the government’s new child poverty strategy. The draft measures, seen by the Observer, indicate that the government is anxious to be seen to do more to improve the living standards of the worst off. They would also give the coalition ammunition to fight back against Labour, which has pledged to freeze energy prices, while helping it to deflect toxic claims made by Britain’s most senior Catholic, Cardinal Vincent Nichols, last week that the government has taken away the safety net for those who need it most.

Details of the draft strategy, which is expected to be unveiled within days by the work and pensions secretary, Iain Duncan Smith, and the Liberal Democrat education minister, David Laws, before being put out for consultation, include:

• Reducing the typical energy bill by around £50 and extending the warm home discount, currently worth £135 a year and available only to older claimants.

• Reducing water costs by capping bills for low-income families who are on a water meter and have three or more children.

• Reducing food costs through healthy start vouchers for young children and an extension of free school meals.

Other measures include the expansion of free school transport, building more affordable houses, promoting credit unions and introducing a cap on payday lending. [..]

“Ending child poverty is one of the most important promises made by this government, but the biggest increase in child poverty in a generation threatens to be one its most damaging legacies,” [Imran Hussain, head of policy at the Child Poverty Action Group] said. “A credible national child poverty strategy must face facts and accept that, after years of child poverty falling, government policies are now creating, not reducing, child poverty.”

We’re very good at this, ain’t we?

• More than 90% of lemur species threatened with extinction (Science Recorder)

Bristol Zoo Gardens reports that more than 90% of lemur species are threatened with extinction, giving them the dubious distinction of being the most threatened mammal group on Earth. Rising rates of poaching and the loss of funding for environmental programs by most international donors as a result of the political crisis in Madagascar is making lemur conservation even more difficult than it normally is.

An article, published in the journal Science, notes that there is still hope for lemurs despite the multitude of difficult problems facing these animals. The article discusses the significance of implementing a new emergency three year International Union for Conservation of Nature (IUCN) lemur action plan which details a way forward for preventing the extinction of Madagascar’s 101 lemur species.

“Fact is that if we don’t act now, we risk losing a species of lemur for the first time since our records began,” says primatologist Dr. Christoph Schwitzer, head of research at Bristol Zoo Gardens and vice-chair for Madagascar of the IUCN SSC Primate Specialist Group. “Lemurs have important ecological and economic roles and are essential to maintaining Madagascar’s unique forests, through seed dispersal and attracting income through ecotourism. Their loss would likely trigger extinction cascades. The importance of the action plan cannot be overstated.”

Fruits, anyone?

• California Braces for Drought Without End in Sight (NBC)

As California and other western states face what some scientists fear could be a prolonged drought amplified by global warming, water experts say there’s simply no way to predict how long the dry spell will last. The best thing to do, they said, is to prepare for the worst and hope for rain. It wouldn’t be the first time California soil went parched for a long stretch. Tree growth rings in the region show evidence of prolonged periods of aridity in the past.

“To know that we are going into another pattern like that, that we could expect this drought to persist for 10 to 15 years is really, really, really hard to say,” Brian Fuchs, a climatologist with the National Drought Mitigation Center in Lincoln, Neb., told NBC News. “There is really nothing in our forecasting models that are being looked at that would suggest that we would even have the ability to do that.” And even if a new mega-drought is here, he added, no one knows if the impacts would be as devastating as the droughts “700 years ago that moved entire societies out of regions,” Fuchs said. “Are we able to offset some of that impact because of the developed water systems and technology? That’s even a tough question to ask.”

But variations of the question are nevertheless being asked across the state where, at last count, 10 communities have less than 60 days of water, forest fires flare up almost daily, water deliveries to 750,000 acres of farmland and 25 million people have been halted, cattle are starving on wilted rangelands, and homeowners are drilling thousands of wells to suck water from aquifers they only hope won’t go dry.

“It is hard to know how bad this drought is going to get … but the climate is changing. We know that droughts are becoming more frequent and more intense, so we need to begin thinking about the possibility of longer, more intense droughts in the future,” Heather Cooley, co-director of the water program at the Pacific Institute, an Oakland-based environmental think tank, told NBC News.

The impact to the state’s $45 billion agriculture industry has already been severe. An estimated 500,000 acres of farmland sits unplanted due to water shortages, a number that could nearly double if the drought extends into 2015, according to Doug Parker, the director of the California Institute of Water Resources housed at the University of California’s Division of Agriculture and Natural Resources in Oakland. Fallowed fields translate to high rates of unemployed farmworkers who fall back on social services such as food assistance programs.

“In the long term, it could change some of the cropping patterns in California, especially for the animal industry,” Parker told NBC News, explaining that the economics of raising and tending livestock hinges on locally-grown feed. “Without water to grow it, you really end up just having to sell off animals.” Much of the state’s beef cattle, for example, roam unirrigated rangelands that are parched.

This article addresses just one of the many issues discussed in Nicole Foss’ new video presentation, Facing the Future, co-presented with Laurence Boomert and available from the Automatic Earth Store. Get your copy now, be much better prepared for 2014, and support The Automatic Earth in the process!

Home › Forums › Debt Rattle Feb 24 2014: What Drives The Climate Debate Off Track