Jack Delano “FOR US, BONDS : Chicago, Union Station” January 1943

The more I read about China, the more chaotic it seems to become, and the more I start to doubt the generally accepted notion that the Communist Party (+PBOC) is in control. If we accept that the politburo has little or no control of the shadow banking system, and that the latter is worth $5.86 trillion, or 69% of Chinese GDP, why would we still assume the politburo controls China’s economy and banking system?

There was another credit – interbank – squeeze over the weekend, and, as Zero Hedge said, the PBOC injected 255 billion yuan (some $40 billion, $1 is a little over 6 yuan) amid a lot of unease:

China Liquidity Fears Ease As PBOC Injects 255 Billion CNY – Most Since Feb 2013

Despite all the reform policy imperatives to constrict credit and normalize and liberalize policy and rates, the PBOC just provided the largest liquidity injection to its banking system in a year – 255 billion CNY. While this is not entirely unusual for a year-end, when Chinese banks have to confess their illiquidity sins and cover mismatches (and are always helped by the PBOC); this year, short-term money-market rates are triple that of last year and there is a very real chance of a very real default within the shadow banking system.

Credit default risks with Chinese companies are emerging because of rising borrowing costs and tight liquidity conditions, said the official China Securities Journal in a front page editorial. The government needs policy flexibility to prevent any systematic financial risks.

This problem – described as “contained” by one sell-side shop reminds us of the “it could never happen here” mentality in the 2008 US shadow banking system. Critically, when the PBOC suggests it may let some banks go (to prove its mettle and resolve to fight out of control credit creation); investors will sell first and think later about which are safe and which are not. A ‘default’ – which looks increasingly likely – may just be the test of just how ‘planned’ and ‘controlled’ the Chinese banking system can really be…

On Tuesday, Zero Hedge reported the injection didn’t help much to quiet things down.

China’s Liquidity Injection Did Not Calm All Its Credit Markets

While last night’s almost unprecedented reverse repo liquidity injection into the Chinese banking system stopped the bleeding of short-dated money-market rates briefly, the likelihood remains that a shadow-banking system default will occur: As CASS’s Zhang noted:

*China Trusts And Shadow Banking To See Defaults In 2014: Zhang

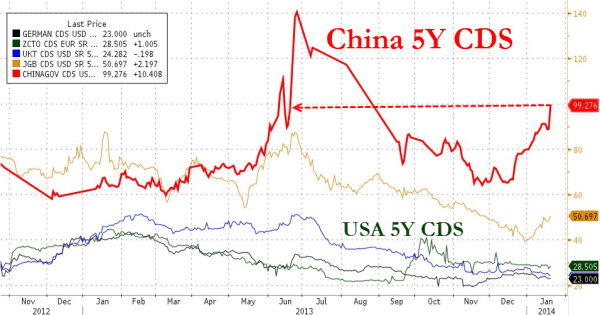

*China Shadow-banking Defaults Would Be Good Thing: Cass’s ZhangPerhaps that explains why China’s CDS spread remains at its highest since the summer credit crunch, barely budging on last night’s cash drop. At double the default risk of Japan, China appears far from out of the contagion fire.

The unease, from what I can see, seems due to two questions: who’s really in control, and which funds will be allowed to go broke, leaving investors out of pocket? Maybe a third question should be: how much of this will the Chinese people accept before unrest breaks out? If there’s a cascade of failing Wealth Management Products – and perhaps the trust companies that sold them -, what are those who put their savings in them going to say? Moreover, what will the effect be on the economy as a whole?

The numbers at times are nothing short of staggering. Here’s a choice selection I provided 2 weeks ago:

Perverse Incentives, China And You

- Bank lending dropped to 57% of direct and contingent liabilities as of June 30 from 79% at the end of 2010

- Premier Li Keqiang is cracking down on less-regulated shadow banking activities, estimated by JPMorgan Chase & Co. at $6 trillion in May last year

- Local government debt overdue at the end of June was 1.15 trillion yuan, or 10.56% of borrowings

- … growth in bank loans to local governments slowed to 19% to 10.1 trillion yuan from the end of 2010 to June 30, 2013, compared with a 67% jump in total debt

- Liabilities at non-financial companies may rise to more than 150% of gross domestic product in 2014, raising default risks, according to Haitong Securities Co. The ratio of 139% at the end of 2012 was already the highest among the world’s 10 biggest economies, according to the most recent data. That compares with 108% in France, 103% in Japan and 78% in the U.S

- Companies must repay a record 2.6 trillion yuan ($430 billion) of borrowings this year even after bond yields surged and economic growth slowed to the weakest in more than a decade. [..]

- China’s aggregate financing, the broadest measure of new credit, climbed 14% to 16.1 trillion yuan in the first 11 months of last year from the same period in 2012, central bank data showed. Total debt of publicly traded companies in China and Hong Kong has surged to the equivalent of $1.92 trillion from $607 billion at the end of 2007

The moment this could blow up is rapidly getting closer. Over the weekend, Gordon Chang wrote the following for Forbes. Note, as I said, I find it hard to believe that, as Chang contends, “Beijing technocrats dictate outcomes”. I’m starting to think perhaps the shadow banking system demands liquidity injections, both openly and hidden from view, under a threat of “or else”. Plus, the distinction between government and the shadow economy inevitably fades as politicians jockey for position to avoid being caught out by developments.

How’s next Friday for you?

Mega Default In China Scheduled For January 31

On Friday, Chinese state media reported that China Credit Trust Co. warnedinvestors that they may not be repaid when one of its wealth management products matures on January 31, the first day of the Year of the Horse.

The Industrial and Commercial Bank of China sold the China Credit Trust product to its customers in inland Shanxi province. This bank, the world’s largest by assets, on Thursday suggested it will not compensate investors, stating in a phone interview with Reuters that “a situation completely does not exist in which ICBC will assume the main responsibility.”

There should be no mystery why this investment, known as “2010 China Credit-Credit Equals Gold #1 Collective Trust Product,” is on the verge of default. China Credit Trust loaned the proceeds from sales of the 3.03 billion-yuan ($496.2 million) product to unlisted Shanxi Zhenfu Energy Group, a coal miner. The coal company probably is paying something like 12% for the money because Credit Equals Gold promised a 10% annual return to investors—more than three times current bank deposit rates—and China Credit Trust undoubtedly took a hefty cut of the interest.

Zhenfu was undoubtedly desperate for money. One of its vice chairmen was arrested in May 2012 for taking deposits without a banking license, undoubtedly trying to raise funds through unconventional channels. In any event, the company was permitted to borrow long after it should have been stopped—reports indicate that it had accumulated 5.9 billion yuan in obligations. Zhenfu, according to one Chinese newspaper account, has already been declared bankrupt with assets of less than 500 million yuan.

The Credit Equals Gold product is not the first troubled WMP, as these investments are known, to risk nonpayment, but Chinese officials have always managed to make investors whole. CITIC Trust did that in 2013 on a steel-loan product in Hubei province, and a mysterious third-party guarantee rescued a Hua Xia Bank WMP. An investment marketed by ICBC’s Suzhou branch was similarly repaid.

There has never been a default – other than one of timing – of a WMP, so the Credit Equals Gold product could be the first. If it is, it will edge out the WMP that invested in loans to Liansheng Resources Group, another Shanxi coal miner. Jilin Trust packaged Liansheng’s loans into a wealth management product sold by China Construction Bank , the country’s second-largest lender by assets, to its customers. Liansheng is in bankruptcy, and it looks like the WMP holders will not be repaid in full.

A WMP default, whether relating to Liansheng or Zhenfu, could devastate the Chinese banking system and the larger economy as well. In short, China’s growth since the end of 2008 has been dependent on ultra-loose credit first channeled through state banks, like ICBC and Construction Bank, and then through the WMPs, which permitted the state banks to avoid credit risk. Any disruption in the flow of cash from investors to dodgy borrowers through WMPs would rock China with sky-high interest rates or a precipitous plunge in credit, probably both. The result? The best outcome would be decades of misery, what we saw in Japan after its bubble burst in the early 1990s.

Most analysts don’t worry about a WMP default. Their argument is that the People’s Bank of China, the central bank, is encouraging a failure of the Zhenfu product to teach investors to appreciate risk and such lesson will improve the allocation of credit nationwide. Furthermore, they reason the central authorities would never allow a default to threaten the system. Observers make the logical argument that “to have a market meltdown, you have to have a market” and China does not have one. Instead, Beijing technocrats dictate outcomes.

That’s correct, but that is also why China is now heading to catastrophic failure. Because Chinese leaders have the power to prevent corrections, they do so. Because they do so, the underlying imbalances become larger. Because the underlying imbalances become larger, the inevitable corrections are severe. Downturns, which Beijing hates, are essential, allowing adjustments to be made while they are still relatively minor. The last year-on-year contraction in China’s gross domestic product, according to the official National Bureau of Statistics, occurred in 1976, the year Mao Zedong died.

Why will China’s next correction be historic in its severity? Because Chinese leaders will prevent adjustments until they no longer have the ability to do so. When they no longer have that ability, their system will simply fail. Then, there will be nothing they can do to prevent the freefall.

Even if Beijing makes sure there is no default on January 31, we should not feel relief. Just as Zhenfu followed Liansheng, there will be another WMP borrower on the edge of disaster after Zhenfu. And there are many Lianshengs and Zhenfus out there. There may have been 11 trillion yuan in WMPs at the end of last year.

And at the same time China’s money supply and credit are still expanding. Last year, the closely watched M2 increased by only 13.6%, down from 2012’s 13.8% growth. Optimists say China is getting its credit addiction under control, but that’s not correct. In fact, credit expanded by at least 20% last year as money poured into new channels not measured by traditional statistics. That appears to be in excess of credit expansion in 2012.

Even if credit expansion slowed last year, Silvercrest Asset Management’s Patrick Chovanec tells us why we should be concerned. As he wrote today, “Looking purely at the decline in the year-on-year rate of credit expansion is kind of like arguing that if I chase my shot of vodka with a pint of beer, I’m actually exercising moderation because the alcohol proof level of my drinks is falling.”

Michael Snyder has a few more numbers:

The $23 Trillion Credit Bubble In China Is Starting To Collapse

Since Lehman Brothers collapsed in 2008, the level of private domestic credit in China has risen from $9 trillion to an astounding $23 trillion. That is an increase of $14 trillion in just a little bit more than 5 years. Much of that “hot money” has flowed into stocks, bonds and real estate in the United States. So what do you think is going to happen when that bubble collapses?

The bubble of private debt that we have seen inflate in China since the Lehman crisis is unlike anything that the world has ever seen. Never before has so much private debt been accumulated in such a short period of time. All of this debt has helped fuel tremendous economic growth in China, but now a whole bunch of Chinese companies are realizing that they have gotten in way, way over their heads. In fact, it is being projected that Chinese companies will pay out the equivalent of approximately a trillion dollars in interest payments this year alone. That is more than twice the amount that the U.S. government will pay in interest in 2014.

Over the past several years, the U.S. Federal Reserve, the European Central Bank, the Bank of Japan and the Bank of England have all been criticized for creating too much money. But the truth is that what has been happening in China surpasses all of their efforts combined. As the Telegraph pointed out a while back, the Chinese have essentially “replicated the entire U.S. commercial banking system” in just five years…

Overall credit has jumped from $9 trillion to $23 trillion since the Lehman crisis. “They have replicated the entire U.S. commercial banking system in five years,” she said.

The ratio of credit to GDP has jumped by 75 percentage points to 200% of GDP, compared to roughly 40 points in the US over five years leading up to the subprime bubble, or in Japan before the Nikkei bubble burst in 1990. “This is beyond anything we have ever seen before in a large economy. We don’t know how this will play out. The next six months will be crucial,” she said.

Overall, M2 in China is up by about 1000% since 1999. That is absolutely insane. The truth is that what has been going on in the global financial system is completely and totally unsustainable, and it is inevitable that it is all going to come horribly crashing down at some point during the next few years. It is just a matter of time.

It’s interesting to ponder how a new report from the International Consortium of Investigative Journalists, People’s Republic of Offshore , will play out against all this. We’ve seen a few details last year reports by the New York Times and Bloomberg, who were promptly banned for it, but this is a different ball game altogether, and a pretty unbelievable story. Just about everybody who’s somebody in Beijing has accounts in offshore havens in the Caribbean. A total of up to $4 trillion has been smuggled out of China this way … Let’s see what the victims of upcoming WMP failures have to say about that. The Guardian has good coverage of the report:

China’s princelings storing riches in Caribbean offshore haven

More than a dozen family members of China’s top political and military leaders are making use of offshore companies based in the British Virgin Islands (BVI), leaked financial documents reveal. The brother-in-law of China’s current president, Xi Jinping, as well as the son and son-in-law of former premier Wen Jiabao are among the political relations making use of the offshore havens, financial records show.

The documents also disclose the central role of major Western banks and accountancy firms, including PricewaterhouseCoopers, Credit Suisse and UBS in the offshore world, acting as middlemen in the establishing of companies. The Hong Kong office of Credit Suisse, for example, established the BVI company Trend Gold Consultants for Wen Yunsong, the son of Wen Jiabao, during his father’s premiership — while PwC and UBS performed similar services for hundreds of other wealthy Chinese individuals.

The disclosure of China’s use of secretive financial structures is the latest revelation from “Offshore Secrets”, a two-year reporting effort led by the International Consortium of Investigative Journalists, ICIJ , which obtained more than 200 gigabytes of leaked financial data from two companies in the British Virgin Islands, and shared the information with the Guardian and other international news outlets.

In all, the ICIJ data reveals more than 21,000 clients from mainland China and Hong Kong have made use of offshore havens in the Caribbean, adding to mounting scrutiny of the wealth and power amassed by family members of the country’s inner circle.

As neither Chinese officials nor their families are required to issue public financial disclosures, citizens in the country and abroad have been left largely in the dark about the elite’s use of offshore structures which can facilitate the avoidance of tax, or moving of money overseas. Between $1 trillion and $4 trillion in untraced assets have left China since 2000, according to estimates.

China’s rapid economic growth is leading to a degree of internal tension within the nation, as the proceeds of the country’s newfound prosperity are not evenly divided: the country’s 100 richest men are collectively worth over $300 billion, while an estimated 300 million people in the country still live on less than $2 a day. The Chinese government has made efforts to crack down citizens’ movements aimed at promoting transparency or accountability among the country’s elite. [..]

One Chinese political family whose financial affairs have not escaped scrutiny — at least in the west — is that of the former premier, Wen Jiabao. In November, the New York Times reported that a consultancy firm operated by Wen’s daughter, who often goes by the name Lily Chang, had been paid $1.8 million by the US financial services giant JPMorgan.

The payment has become one of the targets of a probe by US authorities into the activities of JPMorgan in China, including an examination of the firm’s hiring practices, which are alleged to have included the deliberate targeting of relatives of influential officials.

However, the ICIJ files reveal the role of the BVI’s offshore secrecy in obscuring Chang’s links with her consulting firm, Fullmark Consultants. The company was set up in the BVI by Chang’s husband, Liu Chunhang, in 2004, and he remained as sole director and shareholder until 2006, when he took a job in China’s banking regulation agency.

[..] … in a recent letter dated December 27th apparently sent to a Hong Kong columnist amid public anti-corruption probes into other former officials, Wen Jiabao is reported to have denied any wrongdoing during his premiership, or in how his family obtained their reported wealth. “I have never been involved and would not get involved in one single deal of abusing my power for personal gain because no such gains whatsoever could shake my convictions,” he is reported to have written. [..]

The ICIJ records also detail a company connected to Deng Jiagui, the husband of the older sister of Xi Jinping, China’s president, who has cultivated a public image as an anti-corruption campaigner. According to the BVI records, Deng, a real-estate developer and investor, owns a 50% stake in the BVI-incorporated Excellence Effort Property Development. Ownership of the remainder of the company traces back to two Chinese property tycoons, who last year won a $2 billion real estate bid.

China’s political elite were not the only individuals taking advantage of the BVI’s offshore anonymity. At least 16 of China’s richest people, with a combined estimated net worth in excess of $45bn, were found to have connections with companies based in the jurisdiction. China has become a vital client for offshore jurisdictions. The ICIJ’s database of offshore owners and shareholders has six times as many addresses tied to China or Hong Kong [21,321] than it does to the USA [3,713].

The BVI’s courtship of China’s rich and powerful may prove an embarrassment for the United Kingdom. The BVI remains a British overseas territory, and while largely independent in practice, UK authorities retain a degree of responsibility and connection with the islands. [..]

The role of major Western financial institutions in establishing offshore structures has also attracted scrutiny, despite being a routine and entirely legal function for many of them.

The ICIJ records show both PricewaterhouseCoopers and UBS had extensive contacts with incorporation agents in the BVI and other territories in the region. In total, UBS helped incorporate more than 1,000 offshore institutions for clients from China, Hong Kong or Taiwan, while PwC had a role in establishing at least 400. [..]

The amassed wealth and alleged corruption among China’s political elite has been a topic of growing interest not only in the Western media, but also — to a limited extent — within China itself.

Spurred on by President Xi’s public statements around anti-corruption efforts, a Chinese academic and activist, Xu Zhiyong, inspired a “New Citizens’ Movement” in the country — an informal civil society group which among other goals aims to increase the financial transparency of the country’s elite and curbing corruption.

The movement, however, has faced strong opposition from Chinese authorities. Numerous participants in the New Citizens Movement have been arrested at public gatherings, while its founder Xu is in prison facing charged of “gathering a crowd to disrupt public order”, and faces up to five years in prison. Meanwhile, international journalists who have reported from within the country on the wealth of China’s political elite have faced immigration difficulties from the government, or trouble with authorities.

Trouble seems set to beset China from all directions. Western media have for years waxed orgasmic about the economic growth miracle, but they better find a new way to define what it turns out to be. It’s all been too much, too big, too fast. It may look nice to grow 7% in a year, but if you must grow that fast or implode, it gets a whole lot less attractive.

And now it looks inevitable that the working people, who’ve long dreamed of better lives, will start losing their investment money. While 300 million still live on $2 a day or less. That’s what you find in the dictionary under “powder keg”. Rest assured the Red Army is preparing. But for how long will they be willing to shoot their family, friends and neighbors? Remember asking that question about Russia, Romania, East Germany?

Are we about to witness the end of Communist Party rule in China?

This article addresses just one of the many issues discussed in Nicole Foss’ new video presentation, Facing the Future, co-presented with Laurence Boomert and available from the Automatic Earth Store. Get your copy now, be much better prepared for 2014, and support The Automatic Earth in the process!

Home › Forums › The End of Communist Party Rule in China?