Edward Hopper Sunday 1926

The perfect recipe for strangling an economy: “..as a result of this increased market power, the big superstar companies have been raising their prices and cutting their wages. This has lifted profits and boosted the stock market, but it has also held down real wages, diverted more of the nation’s income to business owners, and increased inequality. It has also held back productivity, since raising prices restricts economic output.”

• America’s Superstar Companies Are a Drag on Growth (BBG)

Here’s a story about the U.S. economy that more people are telling these days. Since the 1980s, antitrust enforcement has gotten weaker. As a result, a few big companies have managed to capture a much bigger share of the market in various industries. Technology may have helped too, by letting big companies spread their geographic reach, and by creating network effects that keep customers locked in to platforms like Facebook. Anyway, as a result of this increased market power, the big superstar companies have been raising their prices and cutting their wages. This has lifted profits and boosted the stock market, but it has also held down real wages, diverted more of the nation’s income to business owners, and increased inequality. It has also held back productivity, since raising prices restricts economic output.

Like all big, sweeping theses about the economy, this story can’t be proven or disproven with a single research paper, or even a dozen papers. But like detectives, economists can probe various pieces and see how each one checks out. In the past few years, researchers have found that industrial concentration – measured by the market share of the four biggest companies in an industry – has indeed been increasing in most parts of the U.S. economy. They’ve documented a correlation between industrial concentration and a decline in labor’s share of national income. They’ve confirmed that profits have risen substantially. They’ve documented a slackening in the enforcement of antitrust law. And they’ve found some evidence that after mergers, prices go up while productivity doesn’t improve.

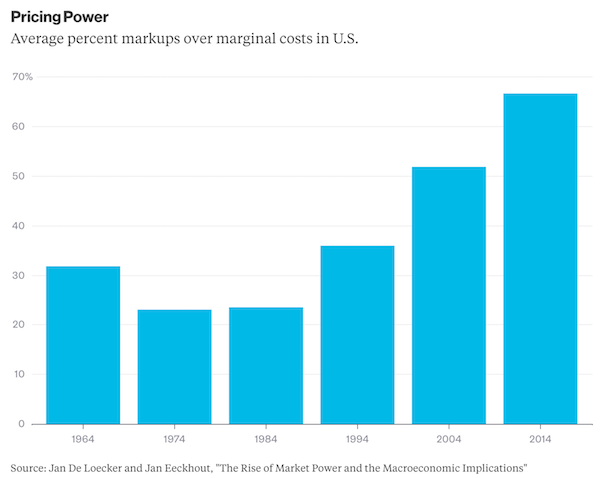

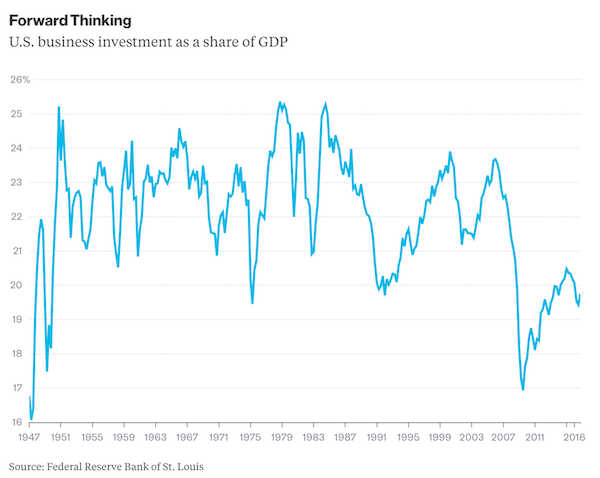

Now, a series of new papers provides even more support for key aspects of the story. The first, a paper by economists Jan de Loecker and Jan Eeckhout, has caused quite a stir in the economics press and on the blogs. De Loecker and Eeckhout find that markups – the amount that companies charge over and above their costs – have been on the rise since about 1980. Back then, according to the authors’ estimates, the average company charged a price that was about 18% above costs – now, the number is 67%.

The authors then use some very simple econ models to link a rise in markups to declines in labor’s share of national income, low-skilled workers’ wages, reduced labor force participation and a slowdown in the broader economy. It all fits with basic economic theory – less competition leads to increased market power, leading in turn to all sorts of bad economic outcomes. The second paper, by German Gutierrez and Thomas Philippon, looks at declining levels of business investment. Basic theory suggests that when top companies get more market power, they invest less in their businesses as they restrict output and raise prices. Market power could therefore be one big reason for the decline in U.S. business investment:

But these ‘superstar’ companies can do what they want; they have the power, both politically and economically.

• Forget Wall Street – Silicon Valley Is The New Political Power In DC (G.)

Funding thinktanks is just one of the ways that America’s most powerful industries exert their influence over policymakers. Much of the work takes place a quarter of a mile from the White House, in a lesser-known political power base: Washington’s K Street corridor, the epicenter of the lobbying industry. In addition to thinktanks, K Street is packed with slick corporate representatives, hired guns, and advocacy groups. The lobbyists spend their days swarming over members of Congress to ensure their private interests are reflected in legislation and regulation. While the big banks and pharma giants have flexed their economic muscle in the country’s capital for decades, there’s one relative newcomer that has leapfrogged them all: Silicon Valley. Over the last 10 years, America’s five largest tech firms have flooded Washington with lobbying money to the point where they now outspend Wall Street two to one.

Google, Facebook, Microsoft, Apple and Amazon spent $49m on Washington lobbying last year, and there is a well-oiled revolving door of Silicon Valley executives to and from senior government positions. Tech companies weren’t always so cozy with Capitol Hill. During its 1990s heyday, Microsoft accumulated enormous wealth and market share. Despite being one of the world’s largest companies, the PC software pioneer mostly kept away from Washington, spending just $2m on lobbying in 1997. However, the company’s size and anticompetitive business practices attracted the scrutiny of regulators in Clinton’s administration, whipped up by the lobbying of disgruntled competitors including Sun Microsystems, IBM and a company called Novell. The following year, the Department of Justice sued Microsoft, accusing it of using a Windows operating system monopoly to push its Internet Explorer browser to the disadvantage of rivals.

US ‘superstar’ companies’ power has not yet fully pervaded Europe. A matter of time?!.

• Google To Be Hit With Record EU Fine Over Claims Of Phone Software Abuse (T.)

Google faces a multibillion-euro fine by the European Commission for using its Android smartphone software to stifle competition. The record-breaking penalty could be imposed as soon as this month, according to industry and legal sources in Brussels. Other insiders said the commission may wait until later in the year before sanctioning Google. Brussels has accused the world’s second-biggest company of breaking anti-trust laws by forcing mobile phone manufacturers to pre-load Google apps on their devices. The fine will escalate the company’s regulatory woes in Europe, where the commission has waged a long-running campaign to try to ensure competition flourishes in the digital economy. In June, the competition commissioner Margrethe Vestager fined Google €2.4bn (£2.2bn) for doctoring search results to favour its price-comparison shopping service.

Vestager also ordered the company to change how it presents search results. It has until the end of the month to comply with the demand, or face daily fines of 5% of its global turnover. Sources expect the Android fine to be substantially higher than the shopping penalty. The software is a central pillar of the $650bn (£502bn) empire of Alphabet, Google’s owner. It powers an estimated 80% of smartphones. About half of all internet traffic is through phones. Last year Vestager, 49, accused Google of using Android as a tool to “protect and expand its dominant position in internet search”. The company allows handset makers to use the software without paying a fee, but they must pre-install Google’s Chrome browser, search bar and other apps. This stipulation “harms consumers” and prevents digital rivals “from competing on their own merits”, according to Vestager.

In addition to fining Google, she is expected to demand a fundamental overhaul of its relationship with smartphone makers, such as Samsung. That could undermine the big profits Google earns through Android. It monetises the software platform by analysing the mountains of data generated by its apps and selling targeted adverts to clients. [..] the company has strenuously denied breaking competition laws. Last year it said giving away Android “keeps manufacturers’ costs low, while giving consumers unprecedented control of their mobile devices”.

The pressure on Xi will rise a lot. And US should sit down with Putin. Urgently.

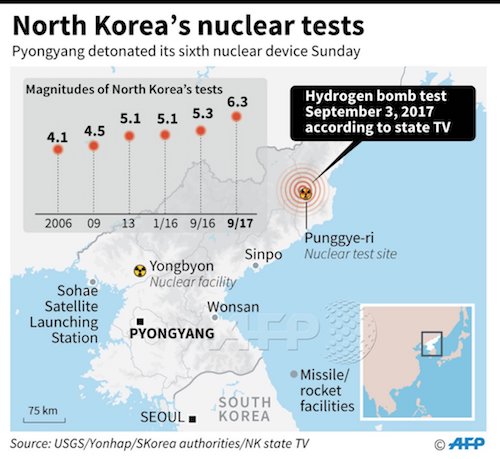

• North Korea Quake Seems Related To Nuclear Test (BBG)

North Korea said it successfully tested a hydrogen bomb with “unprecedentedly big power” on Sunday that can be loaded onto an intercontinental ballistic missile, in its first nuclear test under U.S. President Donald Trump’s watch. The test, ordered by Kim Jong Un, was a “perfect success” and confirmed the precision and technology of the hydrogen bomb, according to the Korean Central News Agency. Kim’s regime has defied Trump’s warnings as it seeks the capability to strike America with an atomic weapon. “The creditability of the operation of the nuclear warhead is fully guaranteed,” KCNA said. South Korea’s weather agency said it detected a magnitude 5.7 earthquake around 12:29 p.m. local time near the Punggye-ri nuclear test site in northeast North Korea. Energy from Sunday’s explosion was about six times stronger in force than the nuclear test conducted by Pyongyang last September, the weather agency said.

“All options are on the table,” Japanese Foreign Minister Taro Kono said on public broadcaster NHK. Prime Minister Shinzo Abe said a North Korea nuclear test would be “absolutely unacceptable and we must protest it strongly.” Pyongyang’s actions are set to further increase tensions in Northeast Asia, where concerns have grown this year that a war of words between Trump and Kim could set off a military conflict. It was the sixth nuclear test by Pyongyang since 2006 and the first since the U.S. and South Korea elected new leaders. Trump had no immediate response to the nuclear test, though he sent a tweet thanking relief workers after Hurricane Harvey devastated states in the southern U.S. He has repeatedly lashed out at North Korea since taking office, warning last month of “fire and fury” if Kim’s regime continues to threaten the U.S.

“Chinese market regulators have begun cracking down on ICOs as “illegal fundraising vehicles” in disguise..“

• Bitcoin Tumbles To Pre Korea-Missile-Launch Level After Topping $5000 (ZH)

Shortly after topping $5,000 (according to several exchanges), Bitcoin began to tumble dramatically – now down almost $500 – erasing all the post-North-Korea missile anxiety gains.

Ethereum has crashed even more.

Meanwhile, one of the world’s largest bitcoin exchange, Shanghai-based BTC China, announced it had suspended ICOCoin deposits as well as trading and withdrawals, starting 6pm on Sunday, while Caixin reports that authorities shut down a blockchain conference over the weekend on concerns unregulated Initial Coin Offerings were being used to raise funds illegally, adding that Chinese market regulators have begun cracking down on ICOs as “illegal fundraising vehicles” in disguise, and in taking a page out of the SEC playbook, will soon issue official rules on ICOs. As CoinTelegraph adds, the self-regulatory group National Internet Finance Association of China warned its members about the dangers in participating in initial coin offerings (ICO).

The group claimed that ICOs could be using misleading information as part of fundraising campaigns. In a statement in late August 2017, the online finance organization further warned its member companies to exercise extreme caution when dealing with the new fundraising mechanism. Part of the statement reads: “China Internet Finance Association members should take the initiative to strengthen self-discipline, to resist illegal financial behavior.” [..] an official for Russia’s national legislature said that new laws regulating the exchange of cryptocurrencies will be complete by the end of the fall. Anatoly Aksakov, who leads the State Duma’s financial markets committee, told Russian media this week that next steps involve the formation of a dedicated working group to address the issue.

Sounds overcooked. But yes, US sanctions are not helping. Still, physical delivery in gold is not what anyone wants, far too clumsy for real trade. And who trusts paper gold? Even better: no-one trusts the yuan.

• China Sees New World Order With Oil Benchmark Backed By Gold (ANR)

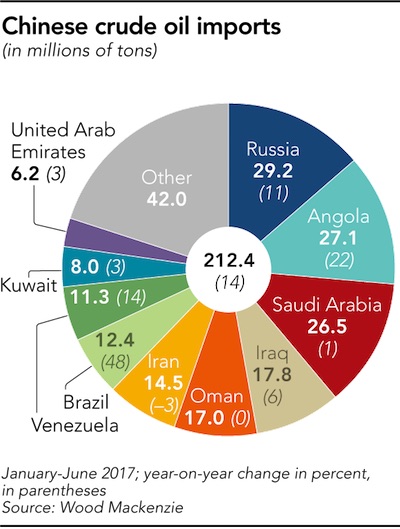

China is expected shortly to launch a crude oil futures contract priced in yuan and convertible into gold in what analysts say could be a game-changer for the industry. The contract could become the most important Asia-based crude oil benchmark, given that China is the world’s biggest oil importer. Crude oil is usually priced in relation to Brent or West Texas Intermediate futures, both denominated in U.S. dollars. China’s move will allow exporters such as Russia and Iran to circumvent U.S. sanctions by trading in yuan. To further entice trade, China says the yuan will be fully convertible into gold on exchanges in Shanghai and Hong Kong. “The rules of the global oil game may begin to change enormously,” said Luke Gromen, founder of U.S.-based macroeconomic research company FFTT.

The Shanghai International Energy Exchange has started to train potential users and is carrying out systems tests following substantial preparations in June and July. This will be China’s first commodities futures contract open to foreign companies such as investment funds, trading houses and petroleum companies. Most of China’s crude imports, which averaged around 7.6 million barrels a day in 2016, are bought on long-term contracts between China’s major oil companies and foreign national oil companies. Deals also take place between Chinese majors and independent Chinese refiners, and between foreign oil majors and global trading companies. Alan Bannister, Asia director of S&P Global Platts, an energy information provider, said that the active involvement of Chinese independent refiners over the last few years “has created a more diverse marketplace of participants domestically in China, creating an environment in which a crude futures contract is more likely to succeed.”

China has long wanted to reduce the dominance of the U.S. dollar in the commodities markets. Yuan-denominated gold futures have been traded on the Shanghai Gold Exchange since April 2016, and the exchange is planning to launch the product in Budapest later this year. Yuan-denominated gold contracts were also launched in Hong Kong in July – after two unsuccessful earlier attempts – as China seeks to internationalize its currency. The contracts have been moderately successful. The existence of yuan-backed oil and gold futures means that users will have the option of being paid in physical gold, said Alasdair Macleod, head of research at Goldmoney, a gold-based financial services company based in Toronto. “It is a mechanism which is likely to appeal to oil producers that prefer to avoid using dollars, and are not ready to accept that being paid in yuan for oil sales to China is a good idea either,” Macleod said.

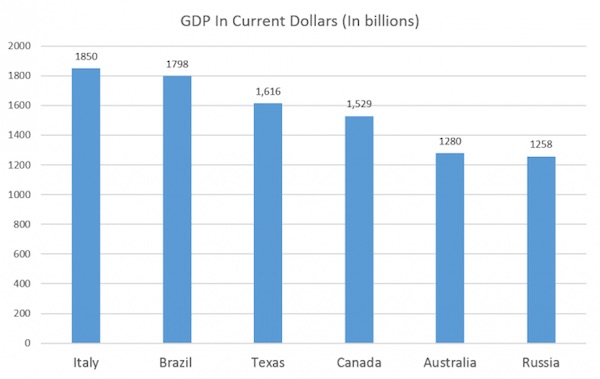

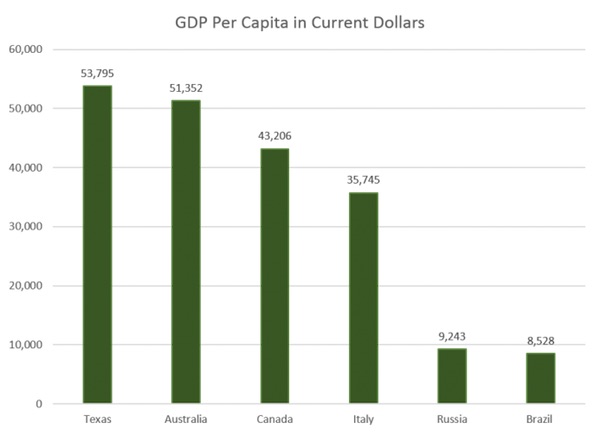

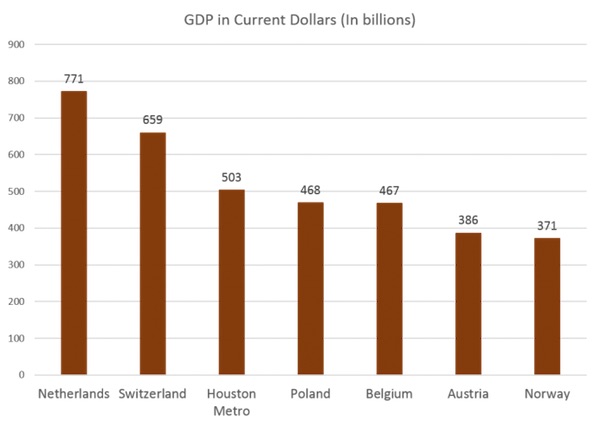

The size of both Texas and Houston Metro GDP is quite something.

• Why Houston Doesn’t Need Federal Flood Relief (Mises)

In his article today, Christopher Westley noted that Texas’s economy — when measured by GDP — is larger than Canada’s. In other words: If Texas were an independent country, it would be the world’s 10th largest economy (totaling $1.6 trillion), and its citizens would be more than capable of addressing natural disasters of the magnitude of a major flood. Texas’s economy is also larger than those of Russia and Australia. By why stop our analysis at the state of Texas? Indeed, if we look at the GDP of the Houston metropolitan area, we find it comes in at $503 billion. This total is similar to the GDPs of Poland, Belgium, and Austria. It’s significantly larger than the GDPs of Norway and Denmark. Nor is Texas’s GDP largely driven by federal spending — so we can’t say that Texas’s economy depends on federal spending to stay afloat.

When we look at federal spending in Texas compared to the federal taxes paid by Texans, we find it’s nearly a one-for-one relationship. So, if the Federal government stopped spending in Texas — but allowed Texans to keep their money, Texas would be fine. [..] Of course, we’ll be told that federal disaster relief programs are all about “sharing” and “cooperation” and “kindness.” In reality, it’s all just about forcing one group of people to hand over money to another group of people. There is no doubt that Texas and Houston now face significant challenges in rebuilding after the flood. But, when we demand that other regions and states pay for the rebuilding of Texas, we’re acting as if those other states and communities don’t have problems of their own. Needs related to poverty, infrastructure, and education in, say, Michigan did not magically disappear because Texas experienced a flood.

The only reason it now seems right to take money from people in Michigan, and hand it over to Houstonians, is because Houston’s problems are in the headlines, and Michigans mundane daily problems are not. The central planners have decided that Houstonians deserve Michigan’s money. But the rationale for this decision is purely political, and thus arbitrary. This isn’t to say real sharing and kindness are a bad thing. It’s excellent that private charities have already been hard at work helping with the cleanup in Houston. If one wants to insist that governments be involved, there’s nothing stopping other states from handing over funds to Texas directly. The federal government need not be involved at all.

Which is why the possibility of a second hurricane hitting the US this year is intriguing.

• Harvey Could Bankrupt The Federal Flood-Insurance Program (ZH)

Hurricane Harvey may solve the auto industry’s inventory problem. But right now, it’s about to create a giant headache for the federal government. Based on the latest estimates from Irvine, California-based CoreLogic, insured flood losses for homes in the affected areas of Texas and Louisiana could total between $6.5 billion to $9.5 billion. Since private insurers typically don’t provide personal flood insurance, all but $500 million of that will fall to the Federal Emergency Management Agency’s National Flood Insurance Program, or NFIP. According to the Street, if insured damages reach the high end of this range, it would totally deplete the $7.5 billion of cash and available credit available to the 49-year-old government program, which provides about 98% of residential flood insurance. The program is already about $25 billion in debt to the US Treasury Department and would need Congressional authorization for additional funding.

To be sure, final totals could be much, much higher given the severity of the the “1-in-1000-year” flood. The potential funding shortfall could create problems if Congress doesn’t act quickly this month to shore up the financially-troubled flood-insurance program. As we’ve reported, Congress already has a full agenda in September – a month where lawmakers must pass a funding bill to keep the government open, and another to raise the debt limit and stave off a technical default on US debt. Initially, President Trump said he would force a government shutdown if Congress didn’t approve funding for his border wall in its next budget. However, it appears that he has backed away from this, as the Washington Post reported today that the administration has quietly notified Congress that the $1.6 billion in wall funding would not need to be included in the September continuing resolution.

Furthermore, Congress must explicitly pass legislation to keep the NFIP intact. Without it, the entire program will lapse. To be sure, there are some signs that Republicans are taking steps to ensure that emergency disaster-relief funding is approved as quickly as possible. According to a report in the Wall Street Journal, some Republican lawmakers are raising the possibility that funding for the cleanup effort could be attached to the debt-ceiling bill, giving both measures a strong chance of passing. But it didn’t say if funding for the flood-insurance program would be included. Thanks, in part, to the hurricane, and the perceived political consequences of failing to aid the disaster victims (though Texas has proven to be a reliably red state), Goldman has cut its odds of a government shutdown to 15%.

“..even as Saudi Arabia sees prices of the end products of its industry spiking, by and large it is not capturing that windfall for itself..”

• Harvey Makes Landfall in Saudi Arabia (BBG)

Hurricane Harvey has devastated the Gulf Coast, and its impact is now spreading out to the rest of the U.S., chiefly at gas pumps. But America’s resurgent role in the global energy trade means the ripples extend far beyond its own shores. One place they are lapping onto is Saudi Arabia.In theory, the de-facto leader of efforts by OPEC, Russia and other members of the so-called Vienna Group stands to gain from disruption at the nerve center of the shale boom that has helped to suppress oil prices. In practice, things are a bit more complicated.

The shale boom has moved a lot of U.S. oil production inland and contributed to a glut of barrels building up in storage. So Harvey’s biggest impact on the region’s energy industry has been the closure of ports, refineries and pipelines – and keeping many drivers off highways that have turned into lakes and streams.The net result is depressed demand for crude oil due to absent refiners and panic buying of refined products such as gasoline for the same reason. So even as Saudi Arabia sees prices of the end products of its industry spiking, by and large it is not capturing that windfall for itself:

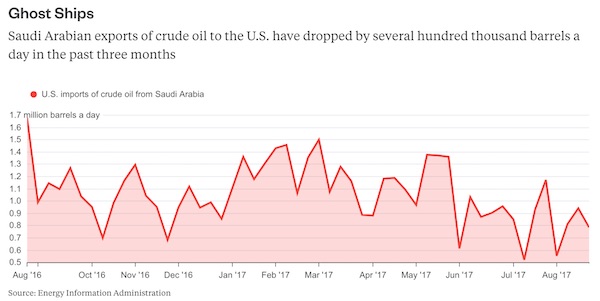

The disruption should cause U.S. inventories of refined products to fall as they are used to cover shortages and stocks of crude oil and products to drop elsewhere as, for example, European refiners run flat-out to send fuel to the U.S. to capture higher prices. This ultimately helps Saudi Arabia.Again, though, there’s a complicating factor.Saudi Arabia has explicitly targeted the U.S. in its strategy to drain the glut; shipments of its oil to America have dropped noticeably this summer:

Will we ever stop poisoning ourselves? No high hopes here.

• Pesticides Linked To Birth Abnormalities In Major New Study (Ind.)

High exposure to pesticides as a result of living near farmers’ fields appears to increase the risk of giving birth to a baby with “abnormalities” by about 9%, according to new research. Researchers from the University of California, Santa Barbara, compared 500,000 birth records for people born in the San Joaquin Valley between 1997 and 2011 and levels of pesticides used in the area. The average use of pesticides over that period was about 975kg for each 2.6sq km area per year. But, for pregnant women in areas where 4,000kg of pesticides was used, the chance of giving birth prematurely rose by about 8% and the chance of having a birth abnormality by about 9%. Writing in the journal Nature Communications, the researchers compared this to the 5 to 10% increase adverse birth outcomes that can result from air pollution or extreme heat events.

“Concerns about the effects of harmful environmental exposure on birth outcomes have existed for decades,” they wrote. “Great advances have been made in understanding the effects of smoking and air pollution, among others, yet research on the effects of pesticides has remained inconclusive. “While environmental contaminants generally share the ethical and legal problems of evaluating the health consequences of exposure in a controlled setting and the difficulties associated with rare outcomes, pesticides present an additional challenge. “Unlike smoking, which is observable, or even air pollution, for which there exists a robust network of monitors, publicly available pesticide use data are lacking for most of the world.”

Addicted farmers: “More than half of British farmers say they are concerned that a ban could cost them more than £10,000 every year.”

• France Votes Against The Use Of Pesticide Glyphosate (FarmingUK)

The French government has voted against the renewal of an EU Commission license for the pesticide glyphosate. The decision by the French government comes as evidence emerges of the risk of birth defects caused by exposure to pesticides. Monsanto is the major supplier of products containing glyphosate, with ‘Roundup’ being the best-known product. The product is widely used by farmers, gardeners and local authorities to control weeds. In 2015 the World Health Organisation’s (WHO) classified glyphosate as a probable carcinogen. But in March, the EU’s chemicals agency said glyphosate should not be classed as a carcinogen. And a survey has shown that a ban on glyphosate in the UK could force one in five wheat farms into ‘serious financial difficulty’. More than half of British farmers say they are concerned that a ban could cost them more than £10,000 every year.

Speaking at Cereals 2017, NFU Vice President Guy Smith said: “This year looks like being a watershed year for classical chemistry for arable farms with these three decisions on the horizon from Europe. “A poor decision on endocrine disruptor definition could see an end to the availability of around 26 active ingredients; the European Commission is proposing a ban on the use of neonicotinoids on all outdoor crops; and a decision on the reauthorisation of glyphosate is due by the end of the year. “The NFU will continue to make the case for evidence-based decisions to be made in all three of these areas, and we will continue to work with our members to help them make the case to politicians and other decision makers about the importance of these products and to demonstrate the damage that bad decisions will have on farming and our food supply.”