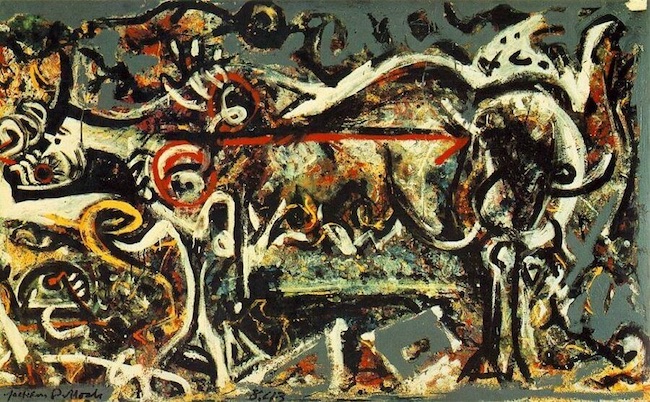

Jackson Pollock The She Wolf 1943

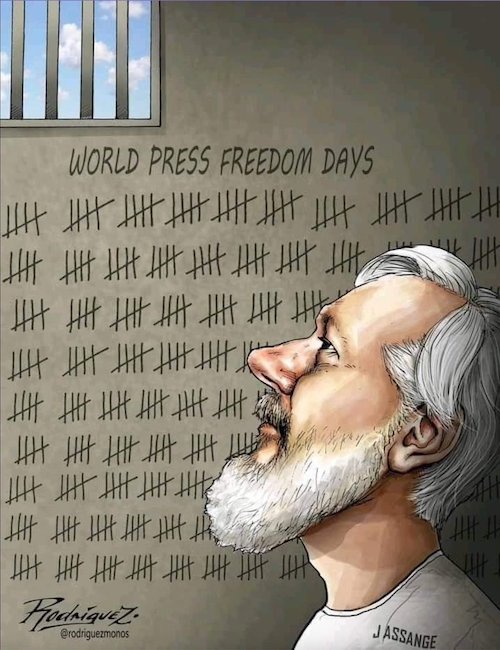

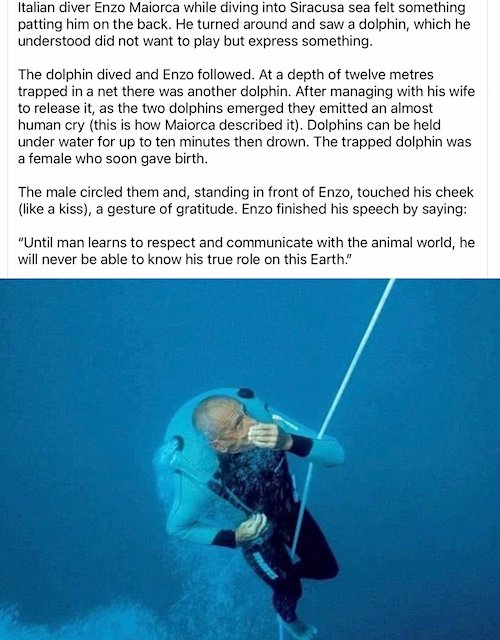

Make him smile

https://twitter.com/i/status/1726034829446119697

T�h�e� �b�a�s�i�c� �J�e�w�i�s�h� �a�p�p�r�o�a�c�h�

Zionism explained in 1:28m

Douche chills all over my body, I’m telling ya #Israel pic.twitter.com/HSISen3WsE

— Abier (@abierkhatib) November 18, 2023

Bladder

According to doctors, 9 out of 10 Urologists rightly advice that frequently emptying your bladder can save your life from risk of stones. pic.twitter.com/GxNNdk6Jjz

— Wow Videos (@ViralXfun) November 18, 2023

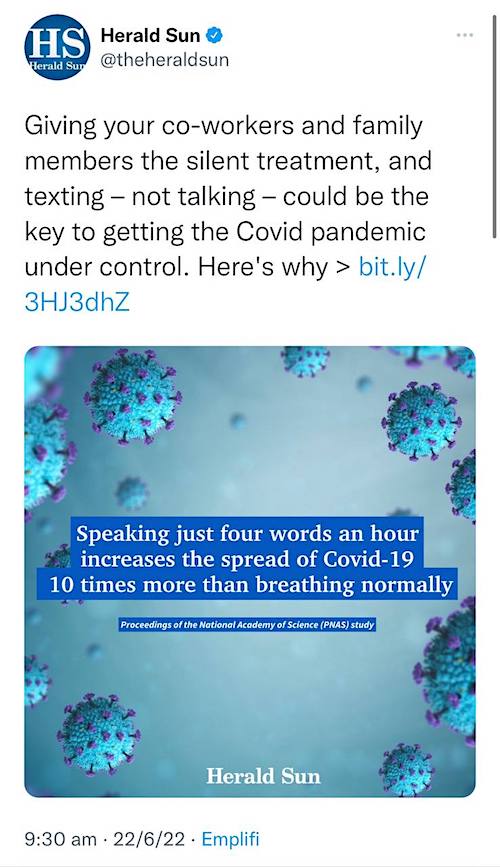

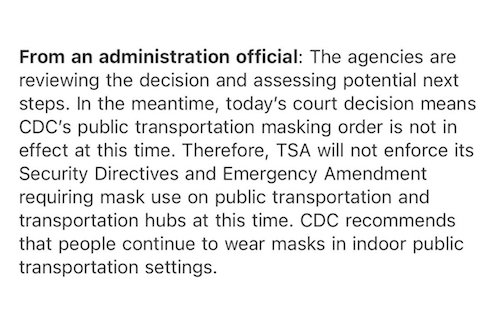

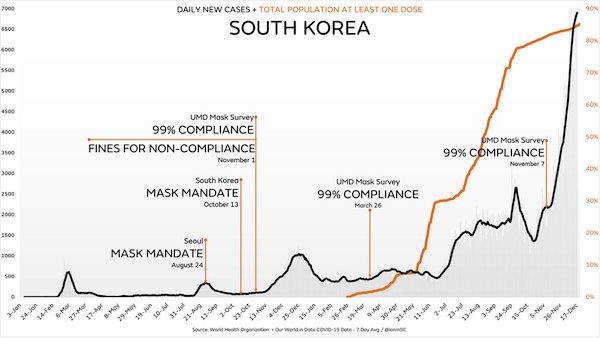

Lies

Twitter, before @elonmusk took over, stopped the Hunter Biden laptop story from being shared. The story was accurate.

YouTube suspended @RandPaul for saying true things about wearing masks.

What other true information is suppressed? pic.twitter.com/9suVyAE0Dc

— John Stossel (@JohnStossel) November 19, 2023

That’s over 1,857 nurses or junior doctors on 35k per year. ULEZ- Ultra Low Emission Zone

“Clearly the Western World is in the grip of Satan.”

• A World Without a Moral Conscience (Paul Craig Roberts)

Today is the 44th day of Israel’s slaughter of Palestinians and destruction of Infrastructure necessary for life. For 44 days the Great Moralists in Washington, London, Berlin, Paris and the rest of the Western World have cheered on, and sent weapons for, the Israeli Genocide of Palestine. The slaughter now extends from Gaza to the remnants of the West Bank. In the US even some Evangelical Christian churches approve of the slaughter and the erasure of Palestine. The citizens who protest the slaughter and erasure are arrested and blacklisted from jobs. For someone, such as myself, who once lived in a country where a moral conscience was respected, to experience the indifference of governments, churches, and media to 44 days of genocide is disheartening.

Clearly the Western World is in the grip of Satan. There is no longer right and wrong and justice, only official narratives. If you disagree with the official narratives you are suspect. The Western World has come to its end. It has no leaders. It has no ears to hear the few voices that still exist. Satan’s hold extends to the Muslim world, which talks but does not act. Words cannot defend Palestine. It is pointless to disapprove of something and to do nothing about it. Russia and China whose own existence is threatened by US/Israeli hegemony over the Middle East also offer nothing but words, words that don’t count because both are demonized and have no inclination to carry the fight to their enemy.

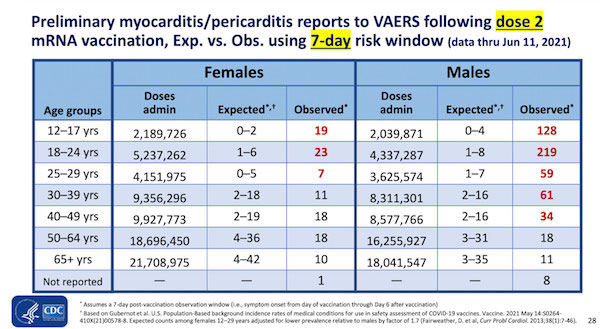

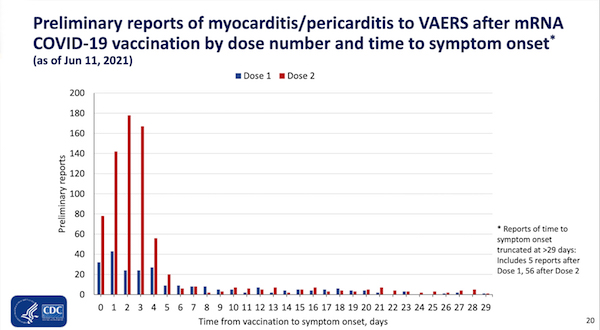

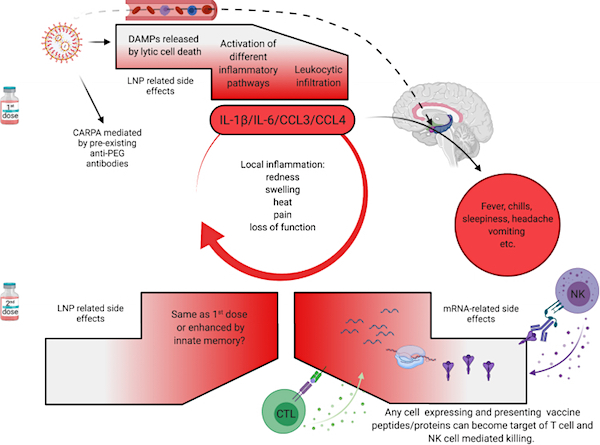

Russia and China invite conflict by their adeptness in avoiding it. How can murder remain on the books as a capital crime when mass murder is ignored? We experience so many instances of mass murder. Mass murder is not limited to Israel’s genocide of Palestinians and Big Pharma, Western governments and “medical authorities” murder of millions with a mandated “Covid vaccine.” Mass murder is happening all the time. We accept it as no worse than a rainy day. The moral conscience of the West has wilted away.

“There is no medicine, and the wounds of injured people are becoming infected, some with maggots..”

• Catastrophe Unfolding At Gaza’s Al-Shifa Hospital (Cradle)

Catastrophe is unfolding now at the Al-Shifa hospital in Gaza following its capture and occupation by the Israeli army, Dr. Muhammad Abu Salmiya warned on 16 November. Journalist Ali Abunimah of the Electronic Intifada summarized the doctor’s comments, which he made to Al-Jazeera Arabic regarding conditions in the hospital. Dr Abu Salmiya explained that there are about 7,000 people under total siege inside the Al-Shifa compound, including 650 injured people, 45 dialysis patients, and 36 premature babies. A few hours ago, one dialysis patient died, while four are at imminent risk of death because there is no power for dialysis machines. Three premature babies died in recent days, and two injured persons died in recent hours due to lack of treatment.

There is no water, fuel, or electricity. Israel broke the main water line into the hospital. There is no purified water to make the special formula for the babies, so they are using ordinary water, and some have become sick with diarrhea, infections, and fever. There is no food. Children are starving and distressed. There is no medicine, and the wounds of injured people are becoming infected, some with maggots. Hospital administrators tried to send a delegation to Israeli forces to ask for food, fuel, medicine, and safe evacuation of the sick and injured, but the Israelis refused to speak to them. The hospital is besieged from all sides by tanks and bulldozers. The bulldozers are destroying areas around the compound, but no one can see what they are doing.

Snipers or drones shoot at anyone who tries to move between hospital buildings. There are hundreds of soldiers in the hospital compound, searching all over and causing severe damage to hospital premises and equipment. In the 48 hours since Israeli forces entered the hospital and its grounds, not a single shot has been fired at them. Dr. Abu Salmiya closed by saying, “We hold the world responsible” for what he calls a genocide. “We are waiting for slow death.” At the same time, Dr. Ghassan Abu Sitta warned that conditions are dire at the Al-Ahli Baptist Hospital, also in northern Gaza. He wrote on the social media site X that doctors at the hospital can no longer provide surgeries.

The hospital is now effectively a first aid station, while hundreds of wounded are now at the hospital with no access to surgery and will now die from their wounds. On 17 October, Israel bombed the courtyard of the Al-Ahli Baptist hospital with a guided missile, killing 471 Palestinians sheltering there to escape Israel’s bombing elsewhere. The Israeli government denied bombing the hospital, claiming a failed Palestinian rocket had fallen onto the crowded hospital and exploded. However, this was proven false by independent analysts and the New York Times.

https://twitter.com/i/status/1726345295515058255

“How do you give a toy to a child who will not play, who searches the skies for what they know will come?”

• From Gaza With Rage (Dr. Mona El-Farra)

The repeating Israeli airstrikes on the Jabalia refugee camp in Gaza are beyond my own comprehension. For at least 10 of the last 40 days, missiles have rained down on the most densely populated refugee camp in all of Gaza. And it is not just the days; it is also the nights. The bombing is done in the dark, when the power is off and the only light is from the fires that burn. It is done when the internet is cut, when the journalists are shot dead, to hide their crimes, the burning of children. I have a long history and strong connection to the people in this camp. My friends, former coworkers, patients, and people I have known for decades through my work as a doctor at Gaza’s Al-Awda hospital are living in this camp. There are the children who grew up coming to the library I founded in Jabalia, who are now young men and women, who have their own children, their own families.

There are my beautiful neighbors and friends and patients, who are not my relatives but are my family. They are generation after generation of refugee families living in one of the most crowded places on earth. After the latest massacre, I cannot reach any of them. I see these same families in the video sent to me of my neighbors pulling children from the rubble. I see them in my memories as we lived and struggled under dual occupations, and Israeli bombings and apartheid. I hear what it sounds like in the aftermath when women and children, the overwhelming majority of those living in, injured, and killed in Jabalia, scream and mourn in anguish and wake up to do it again. I can taste the chemicals, the poisons that linger in the air for hours and days after these indiscriminate explosions.

I can smell the acrid odor of white phosphorus, used by Israel in Gaza and caked on the walls of burning buildings and bodies. I can feel the collective hunger: for food and for justice and for all of it to stop. But now I am in Cairo and it is so difficult and distressing to hear more terrible news each day, news of my loved ones killed by this criminal occupation, by these crimes of war bragged about by Israeli officials who say that there will be no buildings left in Gaza, that we will be a “city of tents.” I had always been home in Gaza during previous Israeli bombings that so often use U.S. planes and U.S. missiles, gifted and given as “aid.” Such “help” is the opposite of the aid I am buying now. The food, medicine, and more, even toys for children who have lost so, so much.

The Middle East Children’s Alliance is raising money so we can buy these supplies to deliver to children and families in Gaza as soon as we can. I am so very sad. But it is not only sadness that I feel. It is also rage. How do I feed a child that will not eat because of fear? How do you give a toy to a child who will not play, who searches the skies for what they know will come? I am enraged at Israel’s constant, ruthless bombardment, killing thousands of people from newborn babies to grandfathers. What is happening now in Gaza is genocide. Those who are not killed by Israeli bombs are dying slowly from the lack of medicine, food, and water.

Why waste ammo?

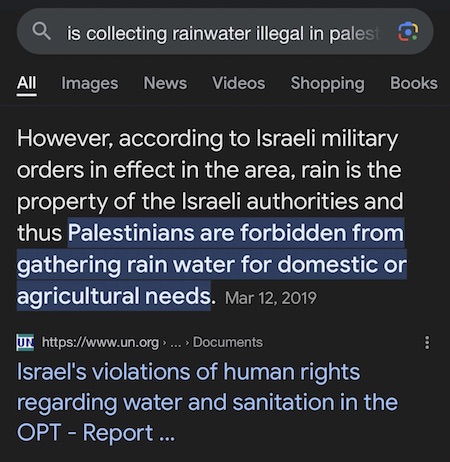

• Diseases Spread In Gaza Amid Water And Sewage Crisis, Cholera Feared (AlJ)

Sewage flows in the streets of Gaza as all key sanitation services have ceased operating, raising the alarming prospect of an enormous surge of gastrointestinal and infectious diseases among the local populations – including cholera. For Gaza’s 2.3 million residents, finding drinkable water has become close to impossible. At a school run by the United Nations relief agency for Palestinian refugees (UNRWA) in Khan Younis, 33-year-old Osama Saqr attempted to fill some bottles with water for his thirsty children. He took a sip and grimaced in disgust at the saltiness of the fluid, before letting out a long sigh. “It’s polluted and unsuitable, but my children always drink it, there’s no alternative,” he told Al Jazeera. Saqr’s one-year-old son has diarrhoea but he cannot find medicines in hospitals or pharmacies to treat him.

“Even if I find it, the problem remains, the water is polluted and salty water, not suitable for drinking,” he said. “I’m afraid that eventually, I’m going to lose one of my children to this poisoning.” The World Health Organization (WHO) has recorded more than 44,000 cases of diarrhoea and 70,000 acute respiratory infections, but real numbers may be significantly higher. On Friday, the UN agency said it was extremely concerned that rains and floods during the approaching winter season will make an already dire situation even worse. “We are hearing about several hundred people per toilet at the UNRWA centres and those have been overflowing, so people are doing open defecation,” Richard Brennan, regional emergency director for the Eastern Mediterranean region at WHO, told Al Jazeera. “They have to find a place to go to the bathroom in the grounds where they are staying. That’s a huge public health risk and also very humiliating.”

Brennan said overcrowding, lack of solid waste management, poor sanitation and open-air defecation were all contributing to the spread of diseases including diarrhoea, respiratory infections and skin infections, including scabies. UN agencies have warned that the collapse of water and sanitation services could even spark bouts of cholera if urgent humanitarian aid is not delivered. If nothing changes, “there will be more and more people falling sick and the risk of major outbreaks will increase dramatically,” Brennan said. Gaza’s essential water and sanitation infrastructure has either been destroyed by Israeli bombardment or has run out of fuel. In the southern governorates of Deir el-Balah, Khan Younis and Rafah, all 76 water wells have stopped functioning, as well as two main drinking water plants and 15 sewage pumping stations, according to the UNRWA.

WHO estimates that the average person in Gaza is currently consuming just 3 litres of water per day for drinking and sanitation. This compares with the minimum of 7.5 litres recommended by the agency in emergency situations. The halt of key services including water desalination plants, sewage treatment and hospitals has led to a 40 percent increase in diarrhoea for people taking shelter in UNRWA schools, the agency said. It estimated that about 70 percent of Gaza’s 2.3 million people – more than half of whom are children – no longer have access to clean water. On Wednesday, Israeli authorities allowed just over 23,000 litres (6,000 gallons) of fuel to be brought into the Strip via Egypt. But they restricted the use of this fuel to trucks transporting the little aid coming in. The UNRWA said it needed 160,000 litres (42,000 gallons) of fuel a day for basic humanitarian operations.

“.. In the name of rooting out an apparently non-existent Hamas network out of the hospital, the IDF created what Amnesty International has called “a graveyard of children.”

• Lies About Al-Shifa Hospital Recall Those Preceding the Iraq Invasion (Jones)

In the weeks before the Israel Defense Forces (IDF) raided the Al-Shifa hospital, the largest hospital in Gaza, the IDF “went to great lengths to depict the medical complex as a headquarters for Hamas, from where its attacks on Israel were planned,” according to The Guardian. The U.S. has claimed that it produced its own intelligence that verifies this claim. National security spokesperson John Kirby told reporters on Thursday that “We have information that confirms that Hamas is using that particular hospital for a command and control mode” and likely for storing weapons. According to Reuters, “[Kirby] said the United States had information that Hamas and the Palestinian Islamic Jihad were using some hospitals in the Gaza Strip, including Al Shifa, to conceal or support their military operations and to hold hostages.”

Despite Kirby’s claim that the information came from various intelligence methods, the U.S. has provided no evidence to verify that the hospital is being used by Hamas. In the name of rooting out an apparently non-existent Hamas network out of the hospital, the IDF created what Amnesty International has called “a graveyard of children.” The World Health Organization (WHO) said the U.N. assessment team that analyzed the hospital similarly concluded that the complex has become a “death zone.” The team found “a mass grave at the entrance of the hospital and was told more than 80 people were buried there.” Further, the WHO reported: “Lack of clean water, fuel, medicines, food and other essential aid over the last 6 weeks have caused Al-Shifa Hospital – once the largest, most advanced and best equipped referral hospital in Gaza – to essentially stop functioning as a medical facility…Al-Shifa Hospital can no longer admit patients, with the injured and sick now being directed to the seriously overwhelmed and barely functioning Indonesian Hospital.”

“The vast majority of patients are victims of war trauma, including many with complex fractures and amputations, head injuries, burns, chest and abdominal trauma, and 29 patients with serious spinal injuries who are unable to move without medical assistance. Many trauma patients have severely infected wounds due to lack of infection control measures in the hospital and unavailability of antibiotics.” The IDF recently released a video in which Lt. Colonel Jonathan Conricus “exposes the countless weapons IDF troops have uncovered in the Shifa Hospital’s MRI building.” The video shows Conricus walking a cameraman through the MRI room while pointing out what the IDF claims are Hamas weapons and equipment.

According to The Guardian, “The IDF accused Hamas…of hiding evidence that would confirm that the organization had used the hospital as a command and control center.” An IDF spokesperson said “Hamas has persistently worked to conceal infrastructure and cover up evidence.” Despite Hamas’ alleged attempts to cover up evidence, the guns and equipment spread across the MRI room in the IDF video are extremely visible and don’t appear hidden whatsoever. Conricus also cites the destruction of security cameras as evidence that Hamas is using the hospital to carry out military operations. While it would be in Hamas’s interest to prevent any recording of them using the hospital as a headquarters, it would also be in the IDF’s interest to destroy any footage of them planting the “evidence” offered in the video.

According to Julian Borger in The Guardian: “A BBC analysis found the footage of an IDF spokesperson showing the apparent discovery of a bag containing a gun behind an MRI scanning machine, had been taped hours before the arrival of the journalists to whom he was supposedly showing it.” “In a video shown later, the number of guns in the bag had doubled. The IDF claimed its video of what it found at the hospital was unedited, filmed in a single take, but the BBC analysis found it had been edited.”

“All this begs the question of why no state has yet invoked the Genocide Convention. This is especially remarkable as Palestine is one of the 149 states party to the Genocide Convention, and for this purpose would have standing before both the U.N. and the ICJ…”

• Activating the Genocide Convention (Craig Murray)

There are 149 states party to the Genocide Convention. Every one of them has the right to call out the genocide in progress in Gaza and report it to the United Nations. In the event that another state party disputes the claim of genocide — and Israel, the United States and the United Kingdom are all states party — then the International Court of Justice is required to adjudicate on “the responsibility of a State for genocide.” These are the relevant articles of the genocide convention:

“Article VIII

Any Contracting Party may call upon the competent organs of the United Nations to take such action under the Charter of the United Nations as they consider appropriate for the prevention and suppression of acts of genocide or any of the other acts enumerated in article III.

Article IX

Disputes between the Contracting Parties relating to the interpretation, application or fulfilment of the present Convention, including those relating to the responsibility of a State for genocide or for any of the other acts enumerated in article III, shall be submitted to the International Court of Justice at the request of any of the parties to the dispute.” Note that here “parties to the dispute” means the states disputing the facts of genocide, not the parties to the genocide/conflict. Any single state party is able to invoke the convention. There is no doubt that Israel’s actions amount to genocide. Numerous international law experts have said so and genocidal intent has been directly expressed by numerous Israeli ministers, generals and public officials.This is the definition of genocide in international law, from the Genocide Convention:

“Article II

In the present Convention, genocide means any of the following acts committed with intent to destroy, in whole or in part, a national, ethnical, racial or religious group, as such:

(a) Killing members of the group;

(b) Causing serious bodily or mental harm to members of the group;

(c) Deliberately inflicting on the group conditions of life calculated to bring about its physical destruction in whole or in part;

(d) Imposing measures intended to prevent births within the group;

(e) Forcibly transferring children of the group to another group”I can see no room to doubt whatsoever that Israel’s current campaign of bombing of civilians and of the deprivation of food, water and other necessities of life to Palestinians amounts to genocide under articles II a), b) and c). It is also worth considering Articles III and IV:

“Article III

The following acts shall be punishable:

(a) Genocide;

(b) Conspiracy to commit genocide;

(c) Direct and public incitement to commit genocide;

(d) Attempt to commit genocide;

(e) Complicity in genocide.

Article IV

Persons committing genocide or any of the other acts enumerated in article III shall be punished, whether they are constitutionally responsible rulers, public officials or private individuals.”There is, at the very least, a strong prima facie case that the actions of the United States and United Kingdom and others, in openly providing direct military support to be used in genocide, are complicit in genocide. The point of Article IV is that individuals are responsible, not just states. So Israel’s Prime Minster Benjamin Netanyahu, U.S. President Joe Biden and U.K. Prime Minister Rishi Sunak bear individual responsibility. So, indeed, do all those who have been calling for the destruction of the Palestinians. It is very definitely worth activating the Genocide Convention. A judgement of the International Court of Justice that Israel is guilty of genocide would have an extraordinary diplomatic effect and would cause domestic difficulties in the U.K. and even in the U.S. in continuing to subsidise and arm Israel.

Relationship of ICJ & ICC

The International Court of Justice is the most respected of international institutions; while the United States has repudiated its compulsory jurisdiction, the United Kingdom has not and the EU positively accepts it. If the International Court of Justice makes a determination of genocide, then the International Criminal Court does not have to determine that genocide has happened. This is important because unlike the august and independent ICJ, the ICC is very much a western government puppet institution which will wiggle out of action if it can. But a determination of the ICJ of genocide and of complicity in genocide would reduce the ICC’s task to determining which individuals bear the responsibility. That is a prospect which can indeed alter the calculations of politicians.

It is also the fact that a reference for genocide would force the Western media to address the issue and use the term, rather than just pump out propaganda about Hamas having fighting bases in hospitals. Furthermore a judgement from the ICJ would automatically trigger a reference to the United Nations General Assembly — crucially not to the Western-vetoed Security Council. All this begs the question of why no state has yet invoked the Genocide Convention. This is especially remarkable as Palestine is one of the 149 states party to the Genocide Convention, and for this purpose would have standing before both the U.N. and the ICJ.

“..the US essentially considers “money” and “blood” together as a “good investment.” “How very American. No comment..”

• ‘Blood’ And ‘Money’ – Medvedev Outlines Essence Of US Security (RT)

Former Russian President Dmitry Medvedev has said that US President Joe Biden’s latest opinion piece for the Washington Post once again highlighted the essence of Washington’s security doctrine, which is to provide for America’s interests at the expense of others. The US supposedly makes itself safer by pouring money into “its own military industry” and starting “wars on other continents,”Medvedev said Sunday in a poston X (formerly Twitter), calling it “the essence of the American security doctrine.” “That’s why our commitment to Ukraine today is an investment in our own security,” Biden said in his piece published on Saturday. Medvedev, who now serves as deputy chairman of the Russian Security Council, responded to this by saying that the US essentially considers “money” and “blood” together as a “good investment.” “How very American. No comment,” he added.

“Others, surely, don’t matter,” the former Russian leader said, commenting on the article in which Biden once again reaffirmed US support to Ukraine and Israel. The US leader also argued in the piece that Russia and the Gaza-based Hamas militants should not be allowed to have their way. “Out of great tragedy and upheaval, enormous progress can come,” Biden wrote. He claimed that the US is “the essential nation” with a “duty of leadership.” On the topic of Ukraine, the US president also admitted that the conflict “draws America in directly.” Washington has openly supported Kiev since armed hostilities with Moscow began in February 2022. The US has provided Ukraine with military equipment worth billions of dollars together with its allies in Europe and elsewhere.

Moscow has repeatedly argued that sending arms to Kiev would only prolong the military operation and extend human suffering. Russia also repeatedly accused the US and its allies of planning to make Kiev fight “to the last Ukrainian.” Ample Western military supplies, including heavy armor, such as tanks and infantry fighting vehicles, have so far not helped Ukraine to achieve any significant success in its closely-watched summer offensive, which has failed to bring about any meaningful changes to the frontlines over several months since the start of the operation in early June. Ukrainian forces have suffered heavy losses in both personnel and material, including the Western-supplied equipment, during the assault, however. In early November, the Pentagon warned it potentially had only $1 billion remaining for Ukraine military aid and would have to ration arms packages in the future.

“..Kiev must seize all territories lost to Russia, including the Crimean Peninsula, or risk disappearing from the world’s map..”

• Top Zelensky Aide Questions Ukraine’s ‘Survival’ (RT)

A senior aide to Ukrainian President Vladimir Zelensky claimed in an interview with Ukraine’s Channel 24 television station on Friday that Kiev must seize all territories lost to Russia, including the Crimean Peninsula, or risk disappearing from the world’s map. The aide, Mikhail Podoliak, opined that failure to push back Russian troops from the territory Kiev claims as its own could become a breaking point for the country. “Do we have an endgame in which we do not enter Crimea and which would clearly indicate that Ukraine has a historical perspective?” he asked. According to Podoliak, the same concerns apply to the four other regions – the Donetsk and Lugansk People’s Republics, as well as Kherson and Zaporozhye Regions – that overwhelmingly voted to join Russia last autumn.

“Do we have even a single chance to survive in historical terms for another ten to 15 years?” the official added. Podoliak also believes that Russia’s victory would be a significant setback for the West as it would “not be able to claim global leadership” while its “autocratic” rivals would have free reign to attack other territories. He also admitted that “the war is unpopular” in Ukraine but rejected any peace engagement with Russia, insisting that Moscow wants to “subjugate” Kiev. Russian officials have repeatedly said they have never closed the door to talks with their Ukrainian counterparts. Podoliak also attempted to justify unfulfilled predictions that Ukraine would seize Crimea during the past summer, noting that this assessment was based on an analysis of how many arms Kiev would receive from its Western backers and the impact of sanctions on Russia.

According to the official, however, many Western companies remained in the Russian market, allowing the country’s government to receive “high taxes” and use this money to fund its military campaign. Ukraine’s eventual takeover of Crimea was predicted twice this year by Ukrainian intelligence chief Kirill Budanov – first in the spring and later in the summer amid Kiev’s counteroffensive. Moscow has warned it would use “any weapon” in response to a potential Ukrainian attack on the peninsula. Russian Defense Minister Sergey Shoigu said last month that Kiev “is losing” while being unable to make any substantial progress on the battlefield. He also estimated Kiev’s losses at more than 90,000 service members since the start of the counteroffensive in early June.

“..these next 60 days are going to be critical in Ukraine, as far as I’m concerned..”

• Ukraine Regime Faces ‘Day of Reckoning’ Amid Dwindling Western Support (Sp.)

Ukrainian President Zelensky has drawn attention to reducing Western support as Washington’s attention is increasingly focused on the Middle East and the escalation of the Israeli-Palestinian conflict. A recent stopgap funding bill signed by the POTUS contains no provisions for further assistance to Ukraine. Zelensky’s words appears to be “both symbolic and real,” as Ukraine’s “hopes of victory, that were already dim, would falter in oblivion” if the constant flow of weapons and munitions to Kiev from the West were to cease, argued Jacques Sapir, a director at the School for Advanced Studies in the Social Sciences (EHESS) in Paris. According to him, supporting Ukraine has never been a “top priority” for the Western powers, no matter what declarations on the subject they made in the past.

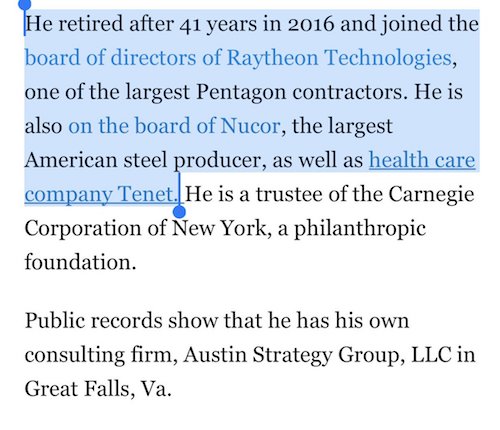

“Ukrainian leaders choose to believe words and not fact in spring 2022,” Sapir said. “But a shooting war is not waged by words but real hardware. This is now the day of reckoning for the Ukrainian leadership.” Meanwhile, Paul E. Vallely, a retired US Army major general and chairman of Stand Up America US Foundation, noted that several European powers have ramped up efforts to supply Ukraine with munitions even as the United States turns its attention towards Israel and the Gaza Strip crisis. He did point out, however, that one of Europe’s major players, Germany, has been “lagging in supporting Ukraine to a great degree,” even as Berlin recently promised to “double that support to $8.5 billion in 2024 and also deliver crucial air defense systems to Zelensky.”

“So what they say and what they do may be two different things,” Vallely mused. Having voiced his skepticism over the US’ and Europe’s ability to deliver on their most recent promises, Vallely also suggested that the situation on the battlefield may soon worsen for Kiev as “winter moves forward and Russian offensive operations move forward.” “Zelensky continues to say that they’re winning, and some of the Western press says Ukraine is winning, but in reality, they’re not. So these next 60 days are going to be critical in Ukraine, as far as I’m concerned,” he remarked.

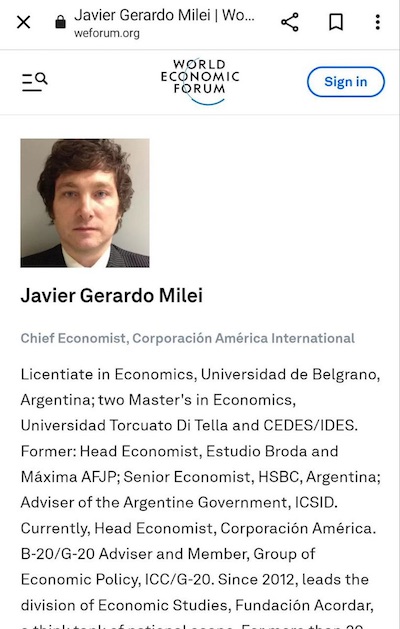

“Commenting on Milei’s victory, Elon Musk predicted that “Prosperity is ahead for Argentina.”

• Anti-Woke Central Bank Nemesis Javier Milei Argentina’s New President (ZH)

Javier Milei, the outsider libertarian candidate with radical solutions to Argentina’s economic crisis, has just won Sunday’s presidential runoff against Economy Minister Sergio Massa. In a surprise outcome, Massa conceded in a speech to supporters in Buenos Aires on Sunday even before the official results were released, saying he called Milei to congratulate him on his victory. Javier Milei, a 53-year-old far-right economist and former television pundit with no governing experience, claimed nearly 56 percent of the vote, with more than 80 percent of votes tallied. It was a stunning upset over Sergio Massa, the center-left economy minister who has struggled to resolve the country’s worst economic crisis in two decades. Voters in this nation of 46 million demanded a drastic change from a government that has sent the peso tumbling, inflation skyrocketing and more than 40 percent of the population into poverty.

The new President of Argentina…

pic.twitter.com/NKqJxKYW3a— Greg Price (@greg_price11) November 20, 2023

And with Milei, Argentina takes a leap into the unknown — with a leader promising to shatter the entire system, which the locals now correctly realize, is broken. Milei, who two months ago was interviewed by Tucker Carlson, has promised to fix Argentina’s perennial economic problems by making drastic budget cuts, replacing the battered peso with the US dollar and shutting down the central bank. He will take office on Dec. 10. Massa, from the ruling Peronist coalition, placed first in October’s first round, a remarkable comeback after losing a primary election two months previously. But the dire state of Argentina’s economy, plagued by 143% hyperinflation and a looming recession, posed a challenge too far to his presidential bid. “Argentines chose another path,” Massa said in a speech to supporters. Polls before the vote showed Milei with a slight edge over his rival. For those unfamiliar with Milei’s unique style, the following clip should be rather informative: Commenting on Milei’s victory, Elon Musk predicted that “Prosperity is ahead for Argentina.”

Ep. 24 Argentina’s next president could be Javier Milei. Who is he? We traveled to Buenos Aires to speak with him and find out. pic.twitter.com/4WwTZYoWHs

— Tucker Carlson (@TuckerCarlson) September 14, 2023

[..] Milei made a name for himself as a television pundit who insulted other guests, and has shown a tendency to fight with the news media. In presidential debates, he has cast doubt on the widely accepted tally of murders during the country’s Dirty War from 1976 to 1983. He has branded Argentine Pope Francis an “evil” leftist, called climate change a “socialist lie” and said he would hold a referendum to undo the three-year-old law that legalized abortion. Wielding chain saws on the campaign trail, the wild-haired Milei vowed to slash public spending in a country heavily dependent on government subsidies. He pledged to dollarize the economy, shut down the central bank and cut the number of government ministries from 18 to eight. His rallying campaign cry was a takedown of the country’s political “caste” — an Argentine version of Trump’s “drain the swamp.”

“The Bank of America, with no directive from the FBI, data-mined its customer base..”

• Rep. Jordan Subpoenas Bank of America Over Sharing Jan. 6 Info With FBI (ET)

House Judiciary Chairman Jim Jordan (R-Ohio) has subpoenaed Bank of America (BoA) for information over the company’s alleged sharing with the FBI of private customer data from around the time of the Jan. 6, 2021, events in Washington. The subpoena is part of the Select Subcommittee on the Weaponization of the Federal Government’s probe “into major banks sharing Americans’ private financial data with the [FBI] without legal process for transactions made in the Washington, DC, area around Jan. 6, 2021″—the day that supporters of President Donald Trump breached the U.S. Capitol as Congress was certifying the 2020 election, which the former president has called rigged and stolen. Politico first reported the Nov. 16 development.

The committee subpoenaed relevant documents from the bank, including internal communications about the decision to transfer the information to the FBI, any communications that the bank had with the agency, and any other information. The lawmakers gave Bank of America a June 8 deadline to comply. In a 78-page whistleblower report released by the House Judiciary Committee on May 19, whistleblowers allege that in the aftermath of the riot, Bank of America gave the FBI information about customers who made transactions in the Washington area on or near Jan. 6, 2021. Those who had used Bank of America accounts to purchase a firearm, regardless of when or where the transaction took place, were bumped to the top of that list.

George Hill, a retired FBI supervisory intelligence analyst, told the panel: “The Bank of America, with no directive from the FBI, data-mined its customer base. And they data-mined a date range of [Jan. 5, 2021, to Jan. 7, 2021] any BoA customer who used a BoA product [meaning a Bank of America credit or debit card]. “They compiled that list. And then, on top of that list, they put anyone who had purchased a firearm during any date. So it was a huge list.” No further action was taken with the information, according to testimony from the special agent in charge of the Boston field office, which received the information. Bank of America told the Judiciary Committee that its conduct was “within a legal process initiated by the United States Department of the Treasury.”

“My concern is the trend has just begun, it’s not ending. And my sense is, I can just do more constructive things with my life.”

• Lawmakers Slam ‘Political Performance Art’ in US Congress (Sp.)

“I don’t think being in Congress is the best way for me to make progress,” said retiring Rep. Earl Blumenauer (D-OR). “Life is short. I don’t want to be a part of this charade. And I won’t be.” In 2011, former Supreme Court Justice Anthony Kennedy mused on an increasing decline of civility and decorum in the US Congress, lamenting the lack of “rational, quiet, thoughtful, respectful discussion and debate” within the legislative body. “The verdict on freedom is still out in over half the world,” said Kennedy. “And the rest of the world is looking at us. They see the current dialogue and discourse and they are horrified by it.” Those were the days when iconoclasts like Anthony Weiner, Jim DeMint, and Alan Grayson made headlines, gleefully attacking opposing members of Congress from the floor of the US Capitol.

Since then it seems Congress has only become a more brutal and unforgiving place, with several retiring lawmakers recently telling US media that chronic legislative dysfunction contributed to their decision not to seek reelection in 2024. “You’re rewarding the wrong kind of behavior here,” said retiring Rep. Brian Higgins (D-NY), decrying the tendency towards theatrics at the expense of cooperation. “My concern is the trend has just begun, it’s not ending. And my sense is, I can just do more constructive things with my life.” “I’m just afraid that the performative nature of the House today, the people that – you know their names, they’re household names now – and the people that are making names for themselves are making spectacles of themselves.”

Rep. Ken Buck (R-CO), who also recently announced his retirement, agreed, saying, “unconstitutional impeachments and censures that don’t make any sense.” “The big driver was we can’t admit that Republicans lost an election in 2020, which is crazy.” So far, the number of lawmakers announcing their retirements is reportedly in line with previous years. But onlookers note that 2023 has seen an unusual number of experienced, highly valued members announce their exit. “It’s not the quantity of retirements. It’s the quality,” said former Rep. Steve Israel (D) of New York. “These are people who really understand how to get things done.” A recent study from the Center for Effective Lawmaking seems to buttress this perception. By 2021, the group found almost half of US House members have served for five years or less.

This compares to about a third of representatives who had served for that amount of time in 2003. In other words, US Congress is increasingly made up of newer, less experienced members. There may be some advantage to the trend. The average age of members of the US House of Representatives declined slightly after the last midterm election. That may suggest the perspective of younger Americans could get a hearing in a legislative body that many argue has become a stale gerontocracy. But conversely, the average age of those in the US Senate increased slightly. Time will tell whether that trend changes next year, and whether a growing exodus of lawmakers will play a part. Some analysts predict the number of legislators announcing their retirements will increase in early 2024 after they return from time spent with their families over the holiday season.

This comes literally just days after the EU decided to license the use of glyphosate for another 10 years. I kid you not.

• Monsanto Hit With $1.5 Billion Verdict in Latest Roundup Cancer Case (ZH)

In a landmark decision, a Missouri jury has ordered Bayer AG’s Monsanto unit to pay more than $1.5 billion in damages to three former users of its Roundup weedkiller. This ruling, one of Monsanto’s largest trial losses in the five-year litigation over the herbicide, raises new questions about the safety of the controversial product and the company’s future legal challenges. In a late Friday decision, jurors awarded James Draeger, Valorie Gunther, and Dan Anderson $61.1 million in actual damages and a staggering $500 million each in punitive damages. They claimed that years of using Roundup on their properties led to their non-Hodgkin’s lymphomas. This verdict is one of the largest against a US corporate defendant this year, eclipsing even a significant $1.78 billion verdict in a federal real estate case (which could balloon to more than $5 billion), Bloomberg reports.

Bayer officials said on Saturday that US judges have allowed what they see as mischaracterization of regulatory decisions on Roundup’s safety. Despite recent plaintiff victories, the company says it remains confident in overturning these verdicts, citing ongoing regulatory support for glyphosate, Roundup’s main ingredient. Bayer plans to phase out glyphosate in the US consumer market by year’s end. “Bayer also noted in the statement the US Environmental Protection Agency continues to find Roundup and its main ingredient, glyphosate, as safe and a federal appeals court recently backed a rejection of calls for Bayer to include safety warnings on the product’s distinctive white bottles. The company agreed to transition from the version of Roundup containing glyphosate to new active weed-killing ingredients in the US consumer market by the end of the year.” -Bloomberg

The punitive award in the Missouri case may be subject to reduction, as US Supreme Court rulings generally limit such awards to ten times the actual damages. However, Monsanto has previously seen substantial damage awards in similar cases, including a $2 billion verdict in California, later reduced to $87 million. Bayer, which acquired Monsanto in 2018, has allocated up to $16 billion for over 100,000 Roundup cases. The company’s legal challenges extend beyond Roundup, encompassing other Monsanto products like toxic PCBs. With more trials on the horizon in Arkansas and Delaware, Bayer’s legal landscape appears increasingly precarious.

Plaintiffs in most of the Roundup casess argue that Monsanto was aware of glyphosate’s potential carcinogenic properties and attempted to suppress this information. Internal documents have revealed efforts by Monsanto officials to influence scientific studies supporting glyphosate’s safety. “These are the kinds of verdicts Bayer can look forward to in future trials,” said Dallas-based attorney Jay Utley. “Monsanto has done wrong for so many years in selling Roundup that it’s a beautiful thing to have a jury recognize that wrongdoing and punish them for it.” The Missouri case, which brought together plaintiffs from across the US, illustrates the widespread usage and impact of Roundup. The varied backgrounds of the plaintiffs, from landscapers to homeowners, underscore the herbicide’s broad reach and the potential scale of its health effects.

Cat matrix

https://twitter.com/i/status/1726016075496579350

Salt mine

https://twitter.com/i/status/1726235269303865366

Arctic Fox

https://twitter.com/i/status/1726216825795494060

Pet the dog

Who needs a good laugh? pic.twitter.com/n2hUfLk0k6

— Constitutional Gator (@WeThePeople021) November 18, 2023

Socotra

Socotra is considered the jewel of biodiversity in the Arabian Sea.

37% of Socotra’s 825 plant species, 90% of its reptile species and 95% of its land snail species do not occur anywhere else on Earth.

Literally a different world.pic.twitter.com/DAm9TA2LiC

— Massimo (@Rainmaker1973) November 19, 2023

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.