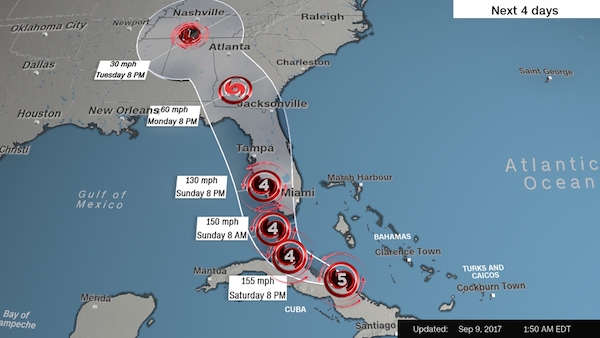

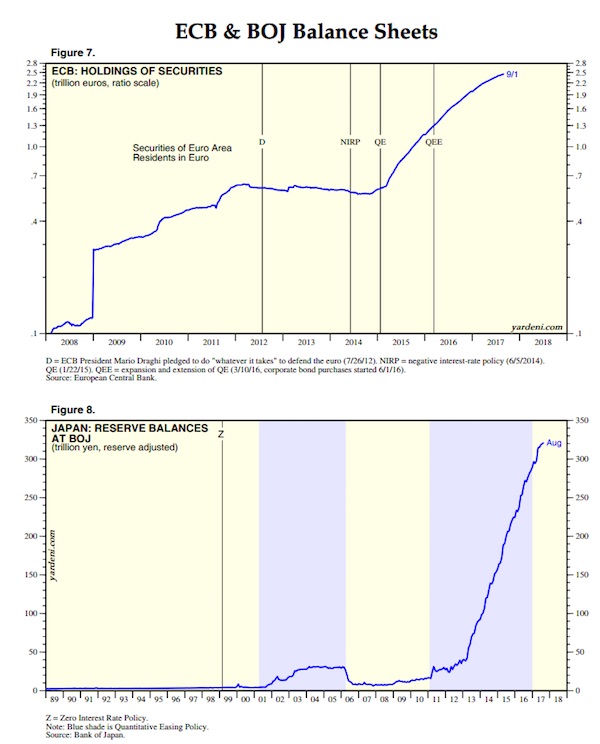

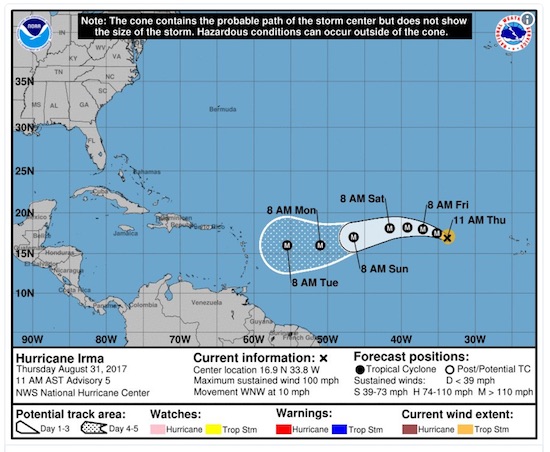

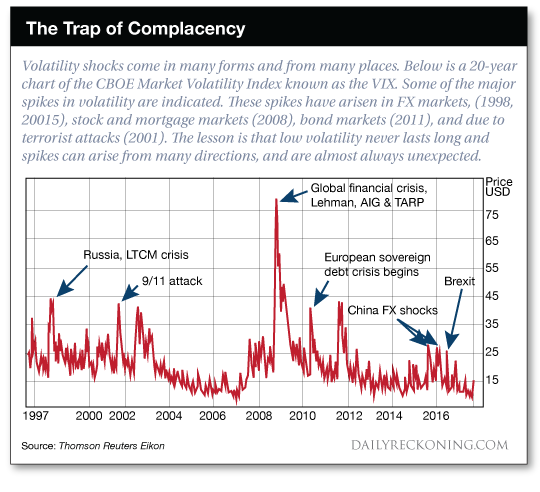

Irma projections took a slight deflection west

Irma took a light dip south towards Cuba last night. This may save Miami from a direct hit – but not Tampa. Irma’s the first Category 5 hurricane to make landfall in Cuba since 1924. 3 storms making landfall at the same time has never been recorded before.

• Hurricane Irma Becomes Category 5 Storm Again (CNN)

Hurricane Irma regained Category 5 status late Friday as the core of the storm made landfall in Cuba with maximum sustained winds of 160 mph, the US National Hurricane Center said. Irma made landfall on the Camaguey archipelago of Cuba, the center said late Friday night. The massive storm edged closer to US landfall in the Florida Keys after leaving a trail of devastation and death in much of the Caribbean as it advanced toward South Florida. Forecasters with the National Hurricane Center say the storm’s wind speeds will increase after Irma passes Cuba then slips into the extremely warm waters near the Keys. “Nowhere in the Florida Keys will be safe,” the National Weather Service tweeted.

There were worries the storm’s most powerful winds, on the northeastern side of the core, could pummel Miami, but it appears the city will avoid a direct hit, while still getting pounded by strong winds, storm surge and heavy rains. At least 24 people were killed this week when Irma pummeled northern Caribbean islands such as Barbuda and the Virgin Islands. In Puerto Rico, hundreds of thousands of people – nearly 70% of the US territory’s utility customers – were left without power, the governor’s office said. Irma slammed the Turks and Caicos, and southeastern Bahamas early before it was off to pound northern Cuba and the central Bahamas.

Irma is expected be near the Florida Keys and South Florida by early Sunday, and many residents there have moved inland or to shelters. Many counties are under evacuation orders. “If you have been ordered to evacuate, leave now. Not tonight, not in an hour, now,” Gov. Rick Scott said Friday night. Staying in homes could subject residents to storm surge as high as 12 feet, the governor added. Forecasters have advised that the storm’s potential path could change and residents should realize that most of Florida will feel its impact.

Read more …

How do you evacuate millions? The logistics are staggering.

• 5.6 Million People Told To Evacuate Florida Due To Irma (AP)

Florida has asked 5.6 million people to evacuate ahead of Hurricane Irma, or more than one-quarter of the state’s population, according to state emergency officials. Andrew Sussman, the state’s hurricane program manager, said Friday the total includes people throughout the southern half of the state as well as those living in inland Florida in substandard housing who were also told leave due to the dangerous storm that will slam the state this weekend. Florida is the nation’s third-largest state with nearly 21million people according to the U.S. Census. For days Gov. Rick Scott has been urging residents to evacuate, especially those who live in coastal areas that could be flooded due to the walls of water expected from Irma’s arrival. The National Hurricane Center is warning Floridians that even if the storm seems to moving away from the East Coast in the latest tracks, don’t get complacent.

“This is a storm that will kill you if you don’t get out of the way,” said National Hurricane Center meteorologist and spokesman Dennis Feltgen. Feltgen says the storm has a really wide eye, with hurricane-force winds that cover the entire Florida peninsula and potentially deadly storm surges on both coasts. “Everybody’s going to feel this one,” Feltgen said. As Florida deals with a catastrophic, dangerous hurricane, it may have a financial storm to deal with. The annual budget forecast released this week shows, despite an ongoing economic recovery, Florida is expected to bring in just enough money to meet its spending needs. That forecast shows the state will have a surplus of just $52 million during the fiscal year that starts in July 2018. The new estimate does not take into account the potential effects that will come from Hurricane Irma.

Read more …

Ironically, Irma has sucked up so much warm surface water, it is lowering water temperatures and thereby ‘hampering’ the next storm up, José. Who was still noted as ‘close to Category 5’ overnight.

• Hurricane Irma Thrives On Fateful Mix Of ‘Ideal’ Conditions (R.)

Hurricane Irma, a deadly, devastating force of nature, rapidly coalesced from a low-pressure blip west of Africa into one of the most powerful Atlantic storms on record, following an unhindered atmospheric path and fed by unusually warm seas. A combination of many factors, experts said on Friday, set the stage for Irma’s formation and helped the storm achieve its full thermodynamic potential, creating the monster tropical cyclone that wreaked havoc on the eastern Caribbean and may inflict widespread damage on Florida. “It got lucky,” said John Knaff, a meteorologist and physical scientist for the National Oceanic and Atmospheric Administration (NOAA). “This storm is in the Goldilocks environment for a major hurricane. It’s bad luck for whoever is in its path, but that’s what going on here.”

Brian Kahn, an atmospheric scientist and cloud specialist for NASA’s Jet Propulsion Laboratory, called the ocean conditions that spawned Irma “absolutely ideal.” Balmy water temperatures along Irma’s trajectory ran deep beneath the surface and slightly higher than normal, by as much as a degree Fahrenheit in places, providing ample fuel for the storm’s development, scientists said. Irma also encountered little if any interference in the form of wind shear – sudden changes in vertical wind velocity that can blunt a storm’s intensity – as it advanced at about 10 to 18 miles per hour, an ideal pace for hurricanes. Its fortuitous path of least resistance was essentially ordained by a well-placed atmospheric ridge of high pressure that steered the storm by happenstance through some of the Caribbean’s warmest waters as well as an area mostly devoid of wind shear.

The result was a gargantuan storm that rapidly grew to a Category 5, the top of the Saffir-Simpson scale of hurricane strength, with sustained winds of 185 miles per hour, the most forceful ever documented in the open Atlantic. It also ranks as one of just five Atlantic hurricanes known to have achieved such wind speeds during the past 82 years.

Read more …

“..of the 1 million or so mortgaged homeowners in the disaster area, more than 300,000 could become delinquent within two months..”

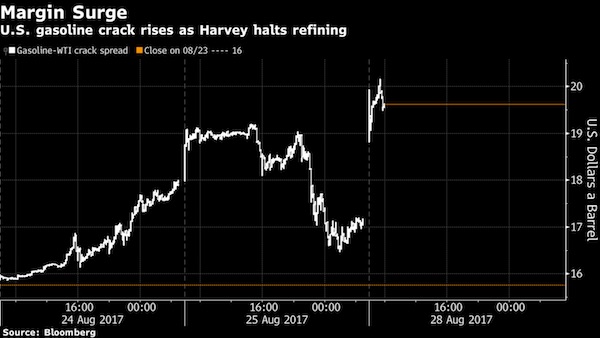

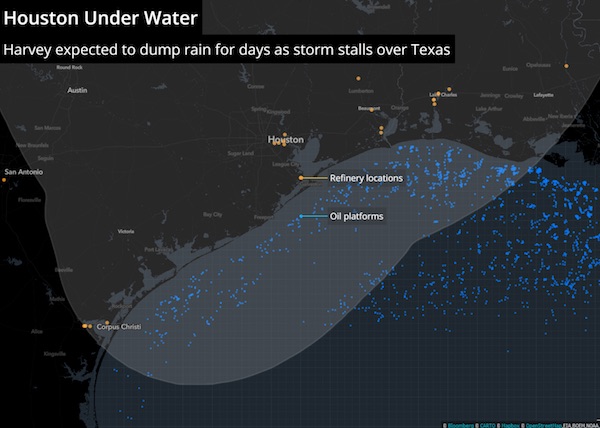

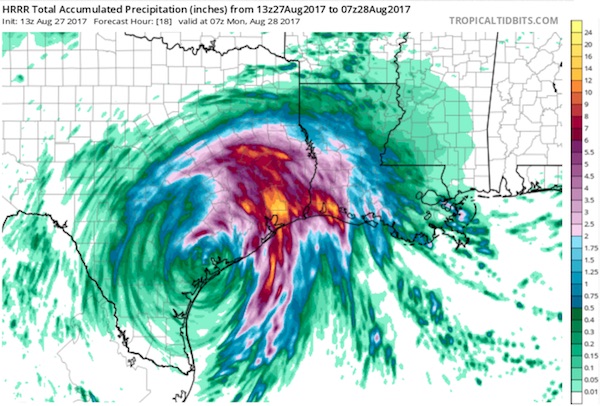

• Harvey Won’t Help Flagging Housing Market (DDMB)

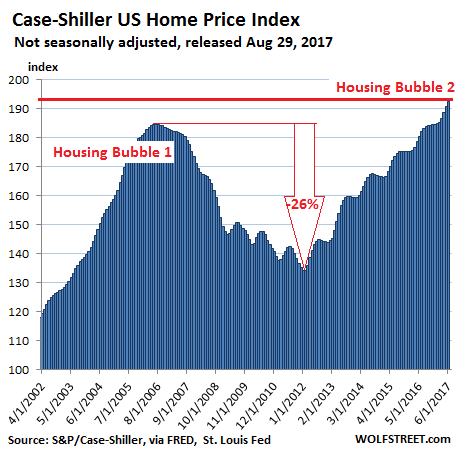

Something is up, or more likely down, with the U.S. housing market. And the reconstruction after Hurricane Harvey may not do much to help. Here’s the evidence: The latest take on home-builder sentiment showed that buyer traffic stubbornly remains in negative territory, despite some of the highest readings of the current cycle on builders’ expectations for sales gains in the next six months. In addition, recent mortgage rate declines have not led to an increase in applications to buy a home. Over the past few weeks, purchase activity has slumped to a six-month low, even though rates are at their lowest level since November. This defies a central tenet of the housing market that falling rates naturally lead to an uptick in sales. As for actual sales volumes, both new and existing July home sales missed forecasts by wide margins.

At an annualized rate of 571,000, new home sales dropped to a seven-month low, well off their long-term average pace of 727,000. The number of homes on the ground rose to 276,000 units, the highest since June 2009. At July’s pace, it would take 5.8 months to clear the inventory. The existing home sales report that followed was similarly weak, with closings sliding to the lowest since August 2016. Not only was the 5.44-million annualized pace 110,000 units below forecast, July’s figures reveal the all-important spring selling season was something of a bust, given July’s data captured contracts signed from April through June. Prices have been and remain the main impediment. The median new home sales price of $313,700 marked the highest July price on record and is up more than 6% over last year’s level.

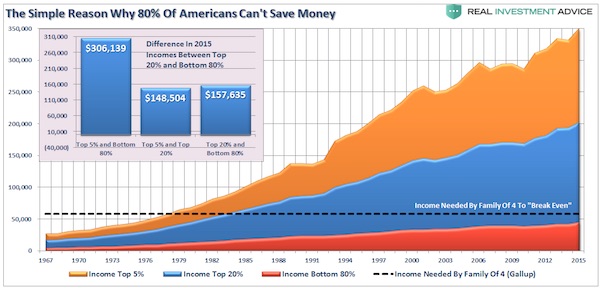

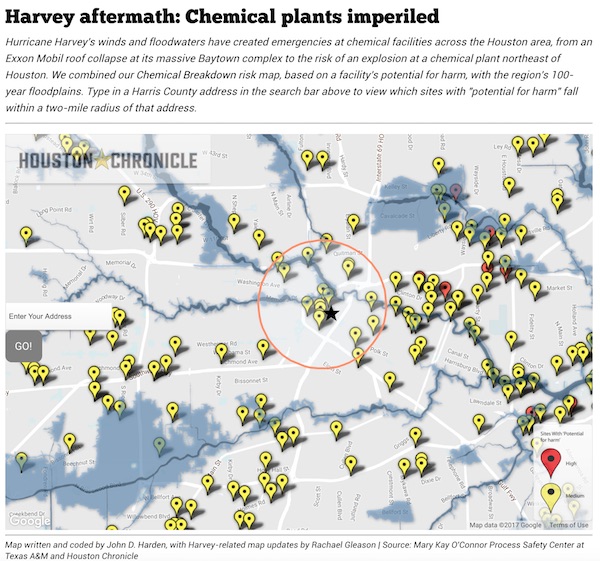

At an annual gain of 6.2%, the best that can be said of the median sales price for previously occupied homes is that it’s off the record pace it set in June. Corroborating the slowdown in sales, both the Federal Housing Finance Agency and S&P Case-Shiller home-price indexes have softened unexpectedly. [..] About 1.2 million homes in and around Houston were at moderate to high risk for flooding but aren’t in a designated flood zone that would have required insurance. Many will qualify for federal disaster relief. Still, the government program comes in the form of low-interest rate loans to help shoulder the burden of repair costs at a time when many households are already buried in debt with precious little in savings; as the third quarter got underway, the saving rate fell to 3.5%, a fresh low for the current cycle.

Although many have drawn comparisons to the aftermath of Hurricane Katrina, Harvey will affect more than twice as many mortgaged properties. According to Black Knight Financial Services, of the 1 million or so mortgaged homeowners in the disaster area, more than 300,000 could become delinquent within two months, and 160,000 are at risk of becoming seriously delinquent inside a four-month period. As per the Mortgage Bankers Association, homes in foreclosure nationwide totaled 502,437 in the second quarter, exemplifying the very real potential for Harvey to leave a huge scar on the housing market.

Read more …

“A week or so after Irma has gone away, the ill-feeling that heaps this country like a swamp fever will still be there, driving the new American madness into precincts yet unknown.”

• Swamp Fever (Jim Kunstler)

The destruction of Florida (and whatever else stands in the way up the line) will be as real as it gets. You’ve heard the old argument, I’m sure, that a natural disaster turns out to be a boon for the economy because so many people are employed fixing the damage. It’s not true, of course. Replacing things of value that have been destroyed with new things is just another version of the old Polish Blanket Gag: guy wants to make his blanket longer, so he cuts a foot off the top and sews it onto the bottom. The capital expended has to come from something and somewhere, and in this case it probably represents the much talked-about necessary infrastructure spending that is badly needed for bridges, roads, water and sewer systems, et cetera, in all the other parts of the USA that haven’t been hit by storms.

Instead, these places and the things in them will quietly inch closer to criticality without drawing much notice. The second major weather disaster this year may not be enough to induce holdouts to reconsider the issue of climate change, but it ought to provoke some questioning about the development pattern known as suburban sprawl, which even in its pristine form can be described as the greatest misallocation of resources in the history of the world. Surely there will be some debate as to whether Florida, or at least parts of it, gets rebuilt at all. The wilderness of strip malls, housing subdivisions, and condo clusters deployed along the seemingly endless six-lane highways that accumulated in the post-war orgy of development was an affront to human nature, if not to a deity, if one exists.

There are much better ways to build towns and we know how to do it. Ask the shnooks who paid a hundred bucks to walk down Disney’s Main Street the week before last. Apart from all that remains the personal tragedy that awaits, the losses of many lifetimes of work invested in things of value, of homes, of meaning, and of life itself. Many people who evacuated will return to… nothing, and perhaps many of them will not want to stay in such a fragile place. But the America they roam into in search of a place to re-settle is going to be a more fragile place, too. A week or so after Irma has gone away, the ill-feeling that heaps this country like a swamp fever will still be there, driving the new American madness into precincts yet unknown.

Read more …

Is it really capitalism that’s to blame? Do other systems not build where they should not? It seems a general human propensity to look at a desert or a swamp and declare ‘there’s nothing there’, so let’s build and exploit.

• Capitalism, the State and the Drowning of America (CP)

What we need to understand is how capitalism has managed to reproduce itself since the Great Depression, but in a way that has put enormous numbers of people and tremendous amounts of property in harm’s way along the stretch from Texas to New England. The production of risk began during the era of what is sometimes called regulated capitalism between the 1930s and the early 1970s. This form of capitalism with a “human face” involved state intervention to ensure a modicum of economic freedom but it also led the federal government to undertake sweeping efforts to control nature. The motives may well have seemed pure. But the efforts to control the natural world, though they worked in the near term, are beginning to seem inadequate to the new world we currently inhabit.

The U.S. Army Corps of Engineers built reservoirs to control floods in Houston just as it built other water-control structures during the same period in New Orleans and South Florida. These sweeping water-control exploits laid the groundwork for massive real estate development in the post–World War II era. All along the coast from Texas to New York and beyond developers plowed under wetlands to make way for more building and more impervious ground cover. But the development at the expense of marsh and water could never have happened on the scale it did without the help of the American state. Ruinous flooding of Houston in 1929 and 1935 compelled the Corps of Engineers to build the Addicks and Barker Dams. The dams combined with a massive network of channels—extending today to over 2,000 miles—to carry water off the land, and allowed Houston, which has famously eschewed zoning, to boom during the postwar era.

The same story unfolded in South Florida. A 1947 hurricane caused the worst coastal flooding in a generation and precipitated federal intervention in the form of the Central and Southern Florida Project. Again, the Corps of Engineers set to work transforming the land. Eventually a system of canals that if laid end to end would extend all the way from New York City to Las Vegas crisscrossed the southern part of the peninsula. Life for the more than five million people who live in between Orlando and Florida Bay would be unimaginable without this unparalleled exercise in the control of nature. It is not simply that developers bulldozed wetlands with reckless abandon in the postwar period. The American state paved the way for that development by underwriting private accumulation.

Concrete was the capitalist state’s favored medium. But as the floods mounted in the 1960s, it turned to non-structural approaches meant to keep the sea at bay. The most famous program along these lines was the National Flood Insurance Program (NFIP) established in 1968, a liberal reform that grew out of the Great Society. The idea was that the federal government would oversee a subsidized insurance program for homeowners and in return state and local municipalities would impose regulations to keep people and property out of harm’s way.

Read more …

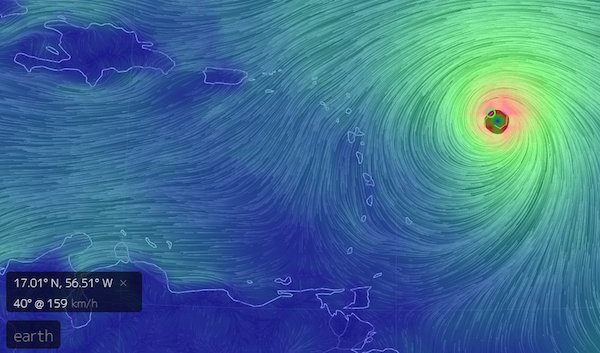

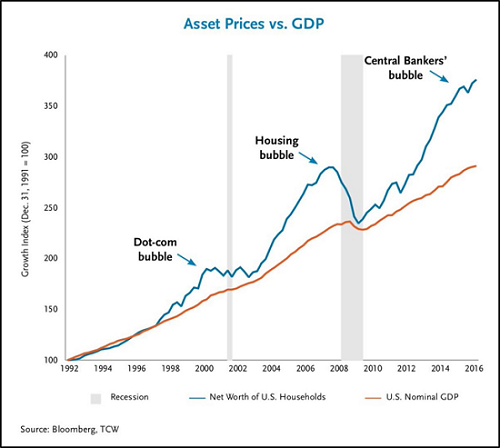

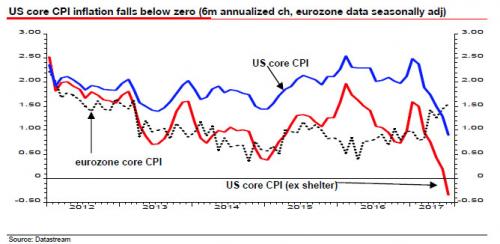

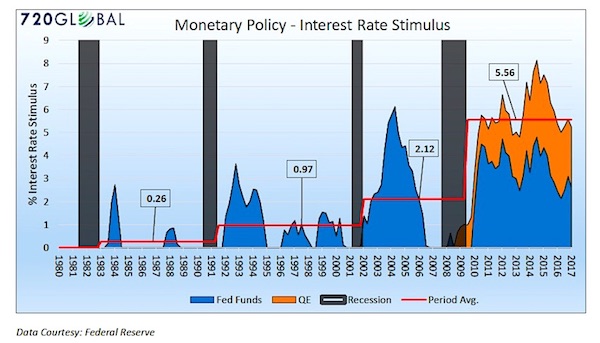

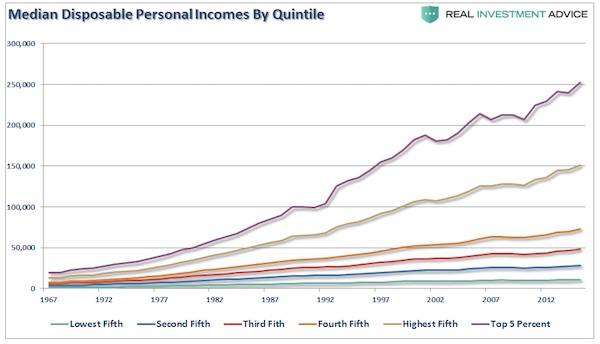

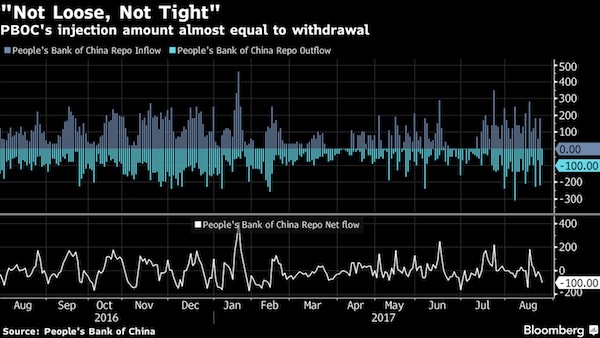

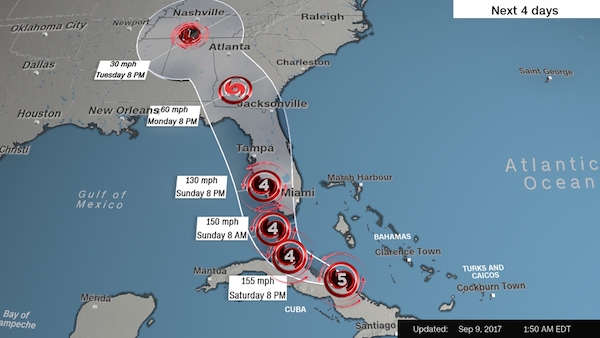

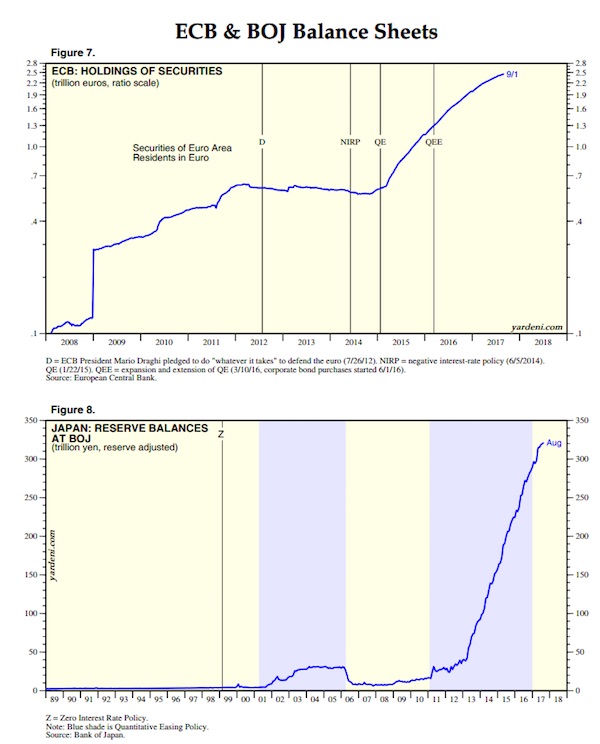

Central bankers lie when they say there is a recovery, but still keep buying assets by the trillions.

• The “Real” Vampire Squid (Roberts)

According to the Bank for International Settlements: “Policy tools that involve the active use of central bank balance sheets – both the assets and the liabilities – can help monetary authorities to navigate the policy challenges during times of financial stress and when interest rates are close to zero.“ But wait, this is what Draghi said next: “The economic expansion, which accelerated more than expected in the first half of 2017, continues to be solid and broad-based across countries and sectors.” So, what is it?

If you actually have “solid and broad-based” economic growth across countries and sectors, why are you still flooding the system with “emergency measures,” and keeping interest rates near zero? That’s a rhetorical question. The reality is that Central Banks are keenly aware of the underlying economic weakness that currently exists as evidenced by the inability to generate inflationary pressures. They also understand that if the financial markets falter, the immediate feedback loop into the global economic environment will be swift and immediate. This is why there continue to be direct purchases of equities by the ECB and the BOJ. Which is also the reason why, despite nuclear threats, hurricanes, geopolitical tensions and economic disconnects, the markets remain within a one-day striking distance of all-time highs.

Read more …

Maduro trying to stay ahead of the CIA.

• Venezuela’s Maduro Says Will Shun US Dollar In Favor Of Yuan, Others (R>)

Venezuelan President Nicolas Maduro said on Thursday his cash-strapped country would seek to “free” itself from the U.S. dollar next week, using the weakest of two official foreign exchange regimes and a basket of currencies. Maduro was refering to Venezuela’s “DICOM” official exchange rate in which the dollar buys 3,345 bolivars, according to the central bank. At the strongest official rate, one dollar buys just 10 bolivars, but on the black market the dollar fetches 20,193 bolivars, a spread versus the official rate that economists say has fostered corruption. A thousand dollars of local currency bought when Maduro came to power in 2013 would now be worth $1.20. “Venezuela is going to implement a new system of international payments and will create a basket of currencies to free us from the dollar,” Maduro said in an hours-long address to a new legislative superbody, without providing details of the new mechanism.

“If they pursue us with the dollar, we’ll use the Russian ruble, the yuan, yen, the Indian rupee, the euro,” Maduro said. The oil-rich nation is undergoing a major economic and social crisis, with millions suffering food and medicine shortages and what is believed to be the world’s highest inflation. Monthly inflation quickened to 34%, according to the opposition-controlled National Assembly. Critics say that instead of overhauling Venezuela’s failing currency controls or enacting reforms to shake the economy out of a fourth straight year of recession, Maduro has dug in and increased controls. On Thursday night, he increased the country’s minimum wage by 40%, taking it to just over $7 per month at the black market exchange rate. He also announced that around 50 “essential” products and services would have their prices frozen at new levels, auguring higher inflation and more shortages.

Read more …

Sorry, but this isn’t “a theory advanced in William R. Clark’s book Petrodollar Warfare”. This is general knowledge, has been for many years.

• What Happens To Nations That Try To Ditch The Dollar (TAM)

Venezuela sits on the world’s largest oil reserves but has been undergoing a major crisis, with millions of people going hungry inside the country which has been plagued with rampant, increasing inflation. In that context, the recently established economic blockade by the Trump administration only adds to the suffering of ordinary Venezuelans rather than helping their plight. A theory advanced in William R. Clark’s book Petrodollar Warfare essentially asserts that Washington-led interventions in the Middle East and beyond are fueled by the direct effect on the U.S. dollar that can result if oil-exporting countries opt to sell oil in alternative currencies. For example, in 2000, Iraq announced it would no longer use U.S. dollars to sell oil on the global market. It adopted the euro, instead. By February 2003, the Guardian reported that Iraq had netted a “handsome profit” after making this policy change. Despite this, the U.S. invaded not long after and immediately switched the sale of oil back to the U.S. dollar.

In Libya, Muammar Gaddafi was punished for a similar proposal to create a unified African currency backed by gold, which would be used to buy and sell African oil. Though it sounds like a ludicrous reason to overthrow a sovereign government and plunge the country into a humanitarian crisis, Hillary Clinton’s leaked emails confirmed this was the main reason Gaddafi was overthrown. The French were especially concerned by Gaddafi’s proposal and, unsurprisingly, became one of the war’s main contributors. (It was a French Rafaele jet that struck Gaddafi’s motorcade, ultimately leading to his death). Iran has been using alternative currencies like the yuan for some time now and shares a lucrative gas field with Qatar, which may ultimately be days away from doing the same. Both countries have been vilified on the international stage, particularly under the Trump administration.

Nuclear giants China and Russia have been slowly but surely abandoning the U.S. dollar, as well, and the U.S. establishment has a long history of painting these two countries as hostile adversaries. Now Venezuela may ultimately join the bandwagon, all the while cozying up to Russia, as well (unsurprisingly, Venezuela and Iran were identified in William R. Clark’s book as attracting particular geostrategic tensions with the United States). The CIA’s admission that it intends to interfere inside Venezuela to exact a change of government — combined with Trump’s recent threat of military intervention in Venezuela and Vice President Mike Pence’s warning that the U.S. will not “stand by” and watch Venezuela deteriorate — all start to make a lot more sense when viewed through this geopolitical lens.

Read more …

It’s still unclear what exactly Beijing is banning.

• Bitcoin Tumbles On Report China To Shutter Digital Currency Exchanges (R.)

Bitcoin fell sharply on Friday after a report from a Chinese news outlet said China was planning to shut down local crypto-currency exchanges, although analysts said this was just a temporary setback. Sources close to a cross regulators committee that oversees online finance activities told Chinese financial publication Caixin that authorities plan to shut key bitcoin exchanges in China. [..] two sources in direct contact with officials at three Chinese bitcoin exchanges – Beijing-based OKCoin, Shanghai-based BTC China, and Beijing-based Huobi – said the platforms told them that they have not heard anything from the Chinese government.

The news follows China’s move earlier this week to ban so-called “initial coin offerings,” or the practice of creating and selling digital currencies or tokens to investors in order to finance start-up projects. Greg Dwyer, business development manager at crypto-currency trading platform BitMEX, said there was confusion over whether China would close bitcoin exchanges following the ICO ban. [..] China’s Bitcoin exchanges said on Saturday they are still awaiting clarification from the authorities on a media report that they will be shut down.

Read more …

Nabiullina, the world’s smartest central banker, doesn’t seem to be seeing eye to eye with Putin on this.

• Russia Faces Internal Battle Over Bitcoin (Forbes)

A lot can happen in month. Russian institutions went from preparing the Moscow Stock Exchange for the legal trading in crypto-currencies like bitcoin and ether, the two most popular ones used in Russia, to coming a hair away from following in China’s footsteps and banning initial coin offerings (ICO), a crypto-currency funding mechanisms for new tech companies. “The use of crypto-currency as a surrogate for the ruble in trading in goods and services, in our opinion, has a risk of undermining the circulation of money,” central banker Elvira Nabiullina told Russian newswire Tass on Friday. “We will not allow the use of crypto-currency as a surrogate money,” she said without mentioning ICOs in particular. One can only speculate that those crowdfunding platforms are on her radar.

Nabiullina is arguably one of the most powerful women in Russia. She has Vladimir Putin’s ear on all things economic and financial. Putin defers to her on such matters. This summer, Putin met with Ethereum developer and CEO Vitalik Buterin to discuss developments in so-called blockchain technologies, the tech platforms that provide the backbone to digital money. Buterin later told a local newspaper in Tatarstan that he felt Putin was opening to these new technologies as a matter of Russian national tech strategy. “Many people at different levels of the Russian government are open to crypto-currencies. I think my meeting with Putin helped him see things clearer,” Buterin was quoted as saying in Tatarstan’s online daily Realnoe Vremya. This is the second time this week that the Russian Central Bank has come out against crypto-currencies.

“Crypto-currencies are issued by an unlimited circle of anonymous entities. Due to the anonymous nature of the issuance of crypto-currency, citizens and legal entities can be involved in illegal activities, including legalization (laundering) of proceeds from crime and financing of terrorism,” the Russian central bank said in a statement issued on September 4. “Given the high risks of circulation and use of crypto-currency, the Bank of Russia considers it premature to admit crypto-currencies, as well as any financial instruments nominated or associated with crypto-currencies, into circulation and used at organized trades such as clearing and settlement infrastructure within the territory of the Russian Federation.” Nabiullina likened the rapid expansion of crypto-currency to the gold rush. Others have referred to it as a bubble. “For a long time there was very little growth (in this technology), and now we see something like a gold rush,” she warned.

Read more …

Why Google and Facebook won’t be regulated anythime soon. They’re part of the CIA now.

• Artificial Intelligence Fuels New Global Arms Race (Wired)

For many Russian students, the academic year started last Friday with tips on planetary domination from President Vladimir Putin. “Artificial intelligence is the future, not only for Russia but for all humankind,” he said, via live video beamed to 16,000 selected schools. “Whoever becomes the leader in this sphere will become the ruler of the world.” Putin’s advice is the latest sign of an intensifying race among Russia, China, and the US to accumulate military power based on artificial intelligence. All three countries have proclaimed intelligent machines as vital to the future of their national security. Technologies such as software that can sift intelligence material or autonomous drones and ground vehicles are seen as ways to magnify the power of human soldiers.

“The US, Russia, and China are all in agreement that artificial intelligence will be the key technology underpinning national power in the future,” says Gregory C. Allen, a fellow at nonpartisan think tank the Center for a New American Security. He coauthored a recent report commissioned by the Office of the Director of National Intelligence that concluded artificial intelligence could shake up armed conflict as significantly as nuclear weapons did. In July, China’s State Council released a detailed strategy designed to make the country “the front-runner and global innovation center in AI” by 2030. It includes pledges to invest in R&D that will “through AI elevate national defense strength and assure and protect national security.” The US, widely recognized as home to the most advanced and vibrant AI development, doesn’t have a prescriptive roadmap like China’s.

But for several years the Pentagon has been developing a strategy known as the “Third Offset,” intended to give the US, through weapons powered by smart software, the same sort of advantage over potential adversaries that it once held in nuclear bombs and precision-guided weapons. In April, the Department of Defense established the Algorithmic Warfare Cross-Functional Team to improve use of AI technologies such as machine vision across the Pentagon. Russia lags behind China and the US in sophistication and use of automation and AI, but is expanding its own investments through a military modernization program begun in 2008. The government’s Military Industrial Committee has set a target of making 30 percent of military equipment robotic by 2025. “Russia is behind the curve—they are playing catchup,” says Samuel Bendett, a research analyst who studies the country’s military at the Center for Naval Analyses.

Algorithms good at searching holiday photos can be repurposed to scour spy satellite imagery, for example, while the control software needed for an autonomous minivan is much like that required for a driverless tank. Many recent advances in developing and deploying artificial intelligence emerged from research from companies such as Google. China’s AI strategy attempts to directly link commercial and defense developments in AI. For example, a national lab dedicated to making China more competitive in machine learning that opened in February is operated by Baidu, the country’s leading search engine.

Read more …

It’s not just about warfare either, it’s about tracking your own people.

• Data Swamped US Spy Agencies Put Hopes On Artificial Intelligence (AFP)

Swamped by too much raw intel data to sift through, US spy agencies are pinning their hopes on artificial intelligence to crunch billions of digital bits and understand events around the world. Dawn Meyerriecks, the Central Intelligence Agency’s deputy director for technology development, said this week the CIA currently has 137 different AI projects, many of them with developers in Silicon Valley. These range from trying to predict significant future events, by finding correlations in data shifts and other evidence, to having computers tag objects or individuals in video that can draw the attention of intelligence analysts. Officials of other key spy agencies at the Intelligence and National Security Summit in Washington this week, including military intelligence, also said they were seeking AI-based solutions for turning terabytes of digital data coming in daily into trustworthy intelligence that can be used for policy and battlefield action.

AI has widespread functions, from battlefield weapons to the potential to help quickly rebuild computer systems and programs brought down by hacking attacks, as one official described. But a major focus is finding useful patterns in valuable sources like social media. Combing social media for intelligence in itself is not new, said Joseph Gartin, head of the CIA’s Kent School, which teaches intelligence analysis. “What is new is the volume and velocity of collecting social media data,” he said. In that example, artificial intelligence-based computing can pick out key words and names but also find patterns in data and correlations to other events — and continually improve on that pattern finding.

AI can “expand the aperture” of an intelligence operation looking for small bits of information that can prove valuable, according to Chris Hurst, the chief operating officer of Stabilitas, which contracts with the US intelligence community on intel analysis. “Human behavior is data and AI is a data model,” he said at the Intelligence Summit. “Where there are patterns we think AI can do a better job.” The volume of data that can be collected increases exponentially with advances in satellite and signals intelligence collection technology. “If we were to attempt to manually exploit the commercial satellite imagery we expect to have over the next 20 years, we would need eight million imagery analysts,” Robert Cardillo, director of the National Geospatial-Intelligence Agency, said in a speech in June.

Read more …

The EU is full of people who have no say. Ultimately, only Merkel does, or rather, those who keep her in power. The Eurogroup is not accountable to anyone but her, because it doesn’t even officially exist.

• EU Brushes Off ‘Democratic Scandal’ Of Greek Bailout (EUO)

The European Commission has defended its role in the Greek bailout despite Pierre Moscovici, the EU finance commissioner, having called the Eurogroup “a democratic scandal.” The Eurogroup is a club of eurozone states’ finance ministers presided over by Dutch finance minister Jeroen Dijsselbloem but dominated in practice by his German counterpart, Wolfgang Schaeuble. It imposed its will on Greece when the country was teetering on the verge of economic collapse and a eurozone exit in 2015, in exchange for access to bailout funds from the European Commission, the ECB, and IMF. A Commission spokesperson on Tuesday (5 September) noted that the EU executive had “invested a lot of time and effort and resources to keep Greece in the eurozone.” But Pierre Moscovici, the EU finance commissioner, took a more critical line.

Over the weekend, he described the Eurogroup as a “democratic scandal”, given that its talks are held behind closed doors and without any public accountability. “Let’s face it, the Eurogroup as we know it is rather a pale imitation of a democratic body,” he said in his blog on Saturday (2 September). Moscovici said the governance behind the EU’s economic and monetary union had also lacked proper democratic oversight. “Sometimes in the past, when we look at Greece, it has been close to a democratic scandal,” he said. Moscovici’s admission is all the more striking given the recent publication of a book by Greece’s former finance minister, Yanis Varoufakis. Varoufakis, who steered Greek talks at the Eurogroup until his resignation in July 2015, provides a detailed account of the Commission’s double-standards during the initial rounds.

He said that Moscovici would agree in private to easing the austerity measures but, in the Eurogroup, the Commission’s representative would then reject everything in favour of harsh measures driven by Dijsselbloem and Schaeuble. In one private meeting in Dijsselbloem’s office, Varoufakis said that Moscovici had even capitulated to Dijsselbloem, despite having previously agreed to concessions that would render the Greek programme more flexible. Dijsselbloem refused to agree to the measures proposed by the Commission. Varoufakis said that Moscovici had responded to Dijsselbloem with “whatever the Eurogroup president says” in a voice that quavered with dejection. “During the Eurogroup meeting, whenever I looked at him [Moscovici] I imagined the horror Jacques Delors or any of the EU’s founding fathers would have felt had they observed the scene in Jeroen’s [Dijsselbloem’s] office,” writes Varoufakis.

[..] Most of the bailout funds have gone towards paying off international loans and proved beneficial to German and French banks that were massively exposed to Greek public debt in the lead up to the financial crisis. According to one study, Germany had also ended up with large profits, yielding interest savings on German bonds of more that €100 billion during the period of 2010 to 2015 from the Greek debt crisis.

Read more …