Salvator Rosa Lucrezia as poetry c.1641

What strikes me more than anything today is the amount of negativity everywhere I look, the antagonism and self-righteousness, which culminate in handing Big Tech the power to determine our own personal liberty. Not a Constitution, or even a law, not a judge or a court, but large corporations.

The problem with that is you’re not going to get it back. Be very careful what you wish for.

Glenn Greenwald, like Julian Assange, has warned against the increasing power of Big Tech for a long time.

Greenwald Tucker

“A tiny handful of tech oligarchs are more powerful than any nation-state. They determine what we can hear, what we can speak, what is true and what is false, with zero accountability and zero transparency.”

Glenn Greenwald nails it. pic.twitter.com/zbCX18Cm7h

— Sarah Abdallah (@sahouraxo) January 9, 2021

India and ivermectin.

• An Unlikely Nation Is Kicking This Pandemic. Guess Which. Then Why. (TS)

Ten months into its battle with the SARS-CoV-2 virus, India is on track to become an unexpected warrior in the fight against this global pandemic. Although the densely populated nation has four times the population of the U.S., India has less than half the U.S. COVID deaths. And India isn’t just beating the poorly performing U.S. In all, 98 nations have higher death rates than India. It may be tempting to attribute this startling news to imperfect data from a developing country. But doctors in India, Indian press reports, and even the Wall Street Journal have taken note of a sea change in COVID there. “In September, India was reporting almost 100,000 COVID-19 cases a day, with many predicting it would soon pass the U.S. in overall cases,” the WSJ wrote on Dec. 30. “Instead, its infections dropped and are now at one-fourth that level.”

Dr. Anil K. Chaurasia, a physician in Lucknow, in the state of Uttar Pradesh, watched this trend unfold. Starting about mid-September, “a clear decline in COVID cases and fatalities in India was noticeable,” he told me in a text message. The “steep decline in cases and fatalities is still continuing.” Like a lot of western reporting, the WSJ article held fast to an accepted COVID theme. The Indian miracle was due to masks, it asserted, since they are worn by 88 to 95 percent of a population “bombarded” with public-service reminders. The article cited German research that showed masks work. Fair enough. However, many factors are likely at play in India, including its painful yet supported national shutdown and individual state efforts at contact tracing and testing. But a pivotal role in any illness is surely the availability of treatments to resolve illness before crisis.

Late last March, as the U.S. argued over the merits of Trump-endorsed hydroxychloroquine and studies failed in late-stage patients, India decided to recommend the drug in its national guidelines. HCQ “should be used as early in the disease course as possible…and should be avoided in patients with severe disease,” the directives wisely state. As a precaution, authorities suggested an EKG to monitor for a rare heart arrhythmia that several COVID studies have since shown to be minimal. But a crucial turn for India may have come in August when the Indian state of Uttar Pradesh recommended use of another drug: Ivermectin, which is coming on fast as a leading COVID treatment — without the baggage of at-turns effective but vilified hydroxychloroquine.

This was no small move. Were it a country, U.P.’s more than 230 million citizens would rank it fifth worldwide. As India’s largest state, its embrace of ivermectin may have changed the treatment landscape across India. “This authentication of ivermectin revived the faith of people,” Dr. Chaurasia told me, “and net result was a massive inclination to take these drugs” — both ivermectin and hydroxychloroquine. By the end of 2020, Uttar Pradesh — which distributed free ivermectin for home care — had the second-lowest fatality rate in India at 0.26 per 100,000 residents in December. Only the state of Bihar, with 128 million residents, was lower, and it, too, recommends ivermectin.

But Uttar Pradesh did more than treat 300,000 mild cases at home through 2020; it also opted to use ivermectin to prevent infection. It seems a young health officer’s COVID response teams had taken the drug and remained well – something prophylaxis studies support. U.P. then had contacts of COVID patients take it, with similar success. “Recognizing the sense of urgency,” Amit Mohan Prasad, a U.P. health official, wrote in a Dec. 30 article, “we decided to go ahead.”

Spare a thought for the doctors making these decisions.

• Covid-19 Forces Swedish Hospitals To Delay ‘Necessary Surgery’ (Local)

Hospitals across Sweden are now postponing urgent operations to make room for coronavirus patients, a survey by Sweden’s state broadcaster SR has found. Every one of the country’s 21 regional healthcare authorities reported being in a “strained” or “very strained” situation, with the regions of Jönköping and Uppsala telling SR that they were having to postpone urgent operations on cancer or heart patients. “It may actually be cancer surgery that has to wait for a bit right now,” Uppsala’s health and medical care director, Mikael Köhler, told the broadcaster. “We need to do everything we can to prevent harm that could have been avoided, and, in the long run, deaths. We really shouldn’t end up in that kind of situation, but we are starting to get close to it.”

Jönköping, like Uppsala, said that it was delaying urgent cancer surgery and heart operations, with the region’s medical director Mats Bojestig telling SR that it plans to trigger the crisis clause agreed with unions which will allow it to increase health personnel’s working hours. “This feels absolutely necessary if we’re going to be able to carry out more operations than before, because otherwise we think local residents are going to harmed,” he said. Uppsala has already triggered the crisis clause. In Skåne, urgent operations have had to be moved between hospitals, delaying procedures.

We should have had this discussion at least 9 months ago. Choose between various rapid tests, and get it going.

• Rapid Covid Testing Across England Will Help Identify Symptomless Carriers (G.)

Rapid testing to find symptomless carriers of Covid-19 is to be launched in England this week. The aim of the programme is to identify some of the tens of thousands of infected people who are unwittingly spreading the virus across the country. The dramatic escalation of the programme – which uses detectors known as lateral flow devices – comes as Covid death rates have continued to soar and hospitals have reported alarming numbers of patients needing intensive care. On Saturday it was revealed a further 1,035 Covid deaths had occurred in the UK, bringing the nation’s total to 80,868. In addition, the daily number of those testing positive increased by 59,937.

Under the new, expanded testing scheme, local authorities will be encouraged to identify more positive cases of Covid and ensure those who are infected isolate. The use of lateral flow devices, which can confirm if a person is infected in under 30 minutes, will allow quick detection of infected individuals at test centres. Lateral-flow devices are accurate at pinpointing infected individuals but have been criticised for generating large numbers of false negatives. Nevertheless, many experts have welcomed the expansion of the testing programme, which 131 local authorities have already agreed to implement. Professor Adam Finn, of Bristol University, described the expanded programme as a vitally important measure. “Added to the measures already in place, this provides an important new tool to help to reduce the rapid rise in cases that is paralysing in our country,” he added.

Professor Lawrence Young of Warwick Medical School agreed. “This is good news. Testing individuals during the current lockdown will help to restrict the spread of infection as long as we ensure folk who test positive appropriately isolate and their contacts are traced and also isolate.” Other scientists were more cautious. “Here, In Liverpool, a trial using lateral flow tests had a good uptake: 25% of the population were tested and 900 cases identified,” said Tom Wingfield, of the Liverpool School of Tropical Medicine. “However, an interim report later showed this testing missed 60% of cases and provided no clear evidence the strategy led to a reduction of cases.

“The real power in the Assange case is Lady Emma Arbuthnot, forced out of a visible role because of very compromising, direct ties she and her husband Lord Arbuthnot maintain with British intelligence and military..”

• Assange Saga – Real Journalism Is Criminally Insane (Escobar)

The invaluable Craig Murray, from inside Westminster Magistrates Court No. 1 in London, meticulously presented the full contours of the insanity this Wednesday. Read it in conjunction with the positively terrifying judgment delivered on Monday in the United States government case against Julian Assange. The defining issue, for all those who practice real journalism all across the world, is that the judgment affirms, conclusively, that any journalist can be prosecuted under the US Espionage Act. Since a 1961 amendment, the Espionage Act carries universal jurisdiction. The great John Pilger memorably describes “judge” Vanessa Baraitser as “that Gothic woman”. She is in fact an obscure public servant, not a jurist. Her judgment walks and talks like it was written by a mediocre rookie hack. Or, better yet, entirely lifted from the US Department of Justice indictment.

Julian Assange was – at the last minute – discharged on theoretically humanitarian grounds. So the case had, in effect, ended. Not really. Two days later, he was sent back to Belmarsh, a squalid maximum security prison rife with Covid-19. So the case is ongoing. WikiLeaks editor Kristinn Hrafnnson correctly noted, “It is unjust and unfair and illogical when you consider her ruling of two days ago about Julian’s health in large part because he is in Belmarsh prison (…) To send him back there doesn’t make any sense.” It does when one considers the real role of Baraitser – at a loss to juggle between the imperatives of the imperial agenda and the necessity of saving the face of British justice.

Baraitser is a mere, lowly foot soldier punching way above her weight. The real power in the Assange case is Lady Emma Arbuthnot, forced out of a visible role because of very compromising, direct ties she and her husband Lord Arbuthnot maintain with British intelligence and military, first revealed by – who else – WikiLeaks. It was Arbuthnot who picked up obscure Baraitser – who dutifully follows her road map. In court, as Murray has detailed in a series of searing reports, Baraitser essentially covers her incompetence with glaring vindictiveness. Baraitser discharged Julian Assange, according to her own reasoning, because she was not convinced the appalling American gulag would prevent him from committing suicide.

But the key issue is that before reaching this conclusion, she agreed and reinforced virtually every point of the US indictment. So at this point, on Monday, the “Gothic woman” was performing a contortion to save the US from the profound global embarrassment of prosecuting a de facto journalist and publisher for revealing imperial war crimes, not United States government secrets. Two days later, the full picture became crystal clear. There was nothing “humanitarian” about that judgment. Political dissent was equaled with mental illness. Julian Assange was branded as criminally insane. Once again, practicing journalism was criminalized.

“..exploding the myths that maintained US hegemony, both at home and abroad.”

• The American Empire Has Fallen, Though Washington May Not Know It Yet (Malic)

[..] here’s Ishan Tharoor, a columnist for the notoriously pro-establishment Washington Post, declaring on Thursday that for “many abroad,” the vision of the US as a shining city on a hill with global moral influence and authority “has already died a thousand deaths.” For some of these people, Tharoor argued, this narrative was “always an illusion to obscure the Washington-engineered coups and client military regimes.” Indeed. Democrats and their neocon allies have spent the past four years blaming Trump’s ‘America First’ policy, lamenting that he was acting unilaterally, antagonizing “allies” and creating a “leadership vacuum” in the world. Those are the talking points of the incoming administration as well.

Except they’ve clearly forgotten the events of January 2020, when Trump ordered the drone assassination of Iranian General Qassem Soleimani. There were no protests from US “allies” – or should we say vassals? Instead, they fell in line with amazing alacrity. Trump actually embraced the American Empire, he simply dispensed with the polite fictions it had used to dress up as something else over the years. Ironically, it was the mobilization of the entire US political establishment to get rid of Trump – starting with ‘Russiagate’ and the impeachment circus over the phone call to Ukraine, with nationwide riots about “racial justice” and the politically weaponized coronavirus lockdowns along the way – that did the lion’s share of exploding the myths that maintained US hegemony, both at home and abroad.

Remember the ‘Deep State’ that was supposedly a Trumpian conspiracy theory? Yet its existence was confirmed in the impeachment hearings, a former CIA director openly praised it, and the eventual revelations of a FBI plot to frame General Flynn removed any vestiges of doubt. The mainstream media’s war on Trump, later joined by social media platforms – censorship of the legitimate and accurate Hunter Biden laptop story just before the election being just the most egregious example – also played out for the world to see. In the end, they banned Trump from every social media platform while he was still in office, even as he said he would leave peacefully.

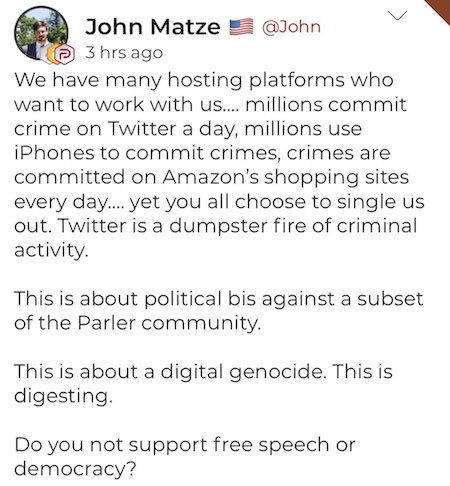

Parler was at no. 1 in the AppStore.

• Parler Kicked Off Amazon Servers And Apple Store (JTN)

Parler’s chief executive said Saturday night that the social media app was suspended from Apple’s store and will be thrown off Amazon’s servers in a standoff over censoring content. CEO John Matze said Parler would not bend to Apple’s demands for increased surveillance and moderation of content and was exploring “many options.” He said the decision by Amazon could result in a weeklong interruption of it service. “Sunday (tomorrow) at midnight Amazon will be shutting off all of our servers in an attempt to completely remove free speech off the internet. There is the possibility Parler will be unavailable on the internet for up to a week as we rebuild from scratch,” he said.

“This was a coordinated attack by the tech giants to kill competition in the marketplace. We were too successful too fast. You can expect the war on competition and free speech to continue, but don’t count us out,” Matze added. The dual announcements came a day after Google kicked Parler out of its App Store. “Apple will be banning Parler until we give up free speech, institute broad and invasive policies like Twitter and Facebook and we become a surveillance platform by pursuing guilt of those who use Parler before innocence,” Matze said in a statement posted on the platform. “They claim it is due to violence on the platform. The community disagrees as we hit number 1 on their store today.”

Matze accused Apple of a double standard by allowing Twitter to have its users post offensive content while shutting down Parler. ”The same day ‘Hang Mike Pence,’ a disgusting violent suggestion, was trending nationally on Twitter. Displaying the horrible double standard Apple and their big tech pack apply to the community,” he said. “Apple, a software monopoly, provides no alternatives to installing apps on your phone other then their store. We do not own our phones, Apple simply rents them to us.

“The shocking rampage on Wednesday was the culmination of years of political and ideological polarization fueled by social media platforms, primarily Facebook.”

• Elon Musk Blames Facebook and Mark Zuckerberg For Capitol Riot (Ob.)

In times of social crises in America, big tech billionaires are often amongst the first to speak up—though how they do so varies. Tesla and SpaceX CEO Elon Musk, unlike many of his peers, didn’t directly speak about the riot that erupted in Washington, D.C. on Wednesday afternoon. But the second-richest man in the world did make it clear that he was watching the news and indeed had a strong opinion about the surreal events that transpired at the U.S. Capitol. Late Wednesday night, after police had cleared protestors from the Capital ground to allow Congress to resume vote counting and certifying election results, Musk tweeted a meme showing bricks lining up like dominoes.

The smallest front brick was labeled “a website to rate women on campus”—a reference to the early version of Facebook—and the largest tile in the back was superimposed with a tweet by The New York Times Magazine correspondent Mark Leibovich that read: “The Capitol seems to be under the control of a man in a viking hat.” His message was clear: The shocking rampage on Wednesday was the culmination of years of political and ideological polarization fueled by social media platforms, primarily Facebook. “This is called the domino effect,” Musk tweeted alongside the meme. It’s not the first time the Tesla CEO openly expressed his dislike for Facebook. In February, he called Facebook “lame” in a tweet and urged people to delete their accounts. Three months later, he tweeted “Facebook sucks” after the company’s artificial intelligence lead criticized his lack of knowledge about A.I.

“Tesla’s stock price jumped 8% that day alone, adding $60 billion to its market capitalization – equivalent to “1 GM, 2 Hersheys, 3 Etsys, 4 Dominos, 10 Vornados..”

• Big Short’s Michael Burry: Tesla Will Collapse Like The Housing Bubble (BI)

Michael Burry, the investor whose billion-dollar bet against the US housing market was immortalized in Michael Lewis’ book “The Big Short,” predicted that Tesla stock would suffer a similar downfall. “Well, my last Big Short got bigger and bigger and BIGGER too,” Burry tweeted on Thursday. Tesla’s stock price jumped 8% that day alone, adding $60 billion to its market capitalization – equivalent to “1 GM, 2 Hersheys, 3 Etsys, 4 Dominos, 10 Vornados,” he continued. “Enjoy it while it lasts,” the Scion Asset Management founder and boss added. Burry disclosed in December that he was shorting Tesla, and he called for CEO Elon Musk to capitalize on his electric-vehicle company’s “current ridiculous price” by issuing shares.

“Sell that #TeslaSouffle,” he added. Tesla stock skyrocketed about 740% in 2020 and has climbed 16% already this year, granting the automaker a bigger market cap than Facebook and making Musk the richest man in the world. [..] Burry was almost universally dismissed when he predicted that the housing bubble would burst and began snapping up credit-default swaps on subprime-mortgage bonds in May 2005. He weathered immense pressure from investors to return their money. A wave of mortgage defaults eventually tanked the housing market in 2007, and Burry personally raked in $100 million and made $750 million in profits for his investors.

Tears and fears.

• Bee-Killing Pesticide Banned By EU Can Be Used In England (G.)

A pesticide believed to kill bees has been authorised for use in England despite an EU-wide ban two years ago and an explicit government pledge to keep the restrictions. Following lobbying from the National Farmers’ Union (NFU) and British Sugar, a product containing the neonicotinoid thiamethoxam was sanctioned for emergency use on sugar beet seeds this year because of the threat posed by a virus. Conservationists have described the decision as regressive and called for safeguards to prevent the pollution of rivers with rainwater containing the chemical at a time when British insects are in serious decline.

The decision by 11 countries to allow emergency use of the product comes amid a growing awareness of the harmful role played by refined sugar in the development of long-term health problems. Matt Shardlow, the chief executive of the invertebrate conservation group Buglife, said it was an “environmentally regressive” decision that would destroy wildflowers and add to an “onslaught” on insects. “In addition, no action is proposed to prevent the pollution of rivers with insecticides applied to sugar beet,” he said. “Nothing has changed scientifically since the decision to ban neonics from use on sugar beet in 2018. They are still going to harm the environment.”

Michael Sly, the chairman of the NFU sugar board, said he was relieved the application had been granted and that the sector was working to find long-term solutions to virus yellows disease. “Any treatment will be used in a limited and controlled way on sugar beet, a non-flowering crop, and only when the scientific threshold has been independently judged to have been met,” he said. “Virus yellows disease is having an unprecedented impact on Britain’s sugar beet crop, with some growers experiencing yield losses of up to 80%, and this authorisation is desperately needed to fight this disease. It will be crucial in ensuring that Britain’s sugar beet growers continue to have viable farm businesses.”

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site.

Click at the top of the sidebars for Paypal and Patreon donations. Thank you for your support.

“Some people have no idea what they’re doing, and a lot of them are really good at it.”

– George Carlin

Support the Automatic Earth in 2021. Click at the top of the sidebars to donate with Paypal and Patreon.