Mathew Brady Three captured Confederate soldiers, Gettysburg, PA 1863

Xi and Li are moving ‘wealth’ from the housing casino to the stocks roulette.

• US Dot-Com Bubble Was Nothing Compared to Today’s China Prices (Bloomberg)

The world-beating surge in Chinese technology stocks is making the heady days of the dot-com bubble look almost tame by comparison. The industry is leading gains in China’s $6.9 trillion stock market, sending valuations to an average 220 times reported profits, the most expensive level among global peers. When the Nasdaq Composite Index peaked in March 2000, technology companies in the U.S. had a mean price-to-earnings ratio of 156. Like the rise of the Internet two decades ago, China’s technology shares are being fueled by a compelling story: the ruling Communist Party is promoting the industry to wean Asia’s biggest economy from its reliance on heavy manufacturing and property development. In an echo of the late 1990s, Chinese stocks are also gaining support from lower interest rates, a boom in initial public offerings and an influx of money from novice investors.

The good news is the technology sector makes up a smaller portion of China’s equity market than it did in the U.S. 15 years ago, limiting the potential fallout from a selloff. The bad news is that any reversal in the industry will saddle individual investors with losses and risk putting an end to the Shanghai Composite Index’s rally to a seven-year high. “Chinese technology stocks do resemble the dot-com bubble,” Vincent Chan, the Hong Kong-based head of China research at Credit Suisse Group AG, Switzerland’s second-biggest bank, said in an interview on April 2. “Given stocks fell 50 to 70% when that bubble burst in 2000, these small-cap Chinese shares may face big corrections when this one deflates.”

China’s government is boosting spending on science and technology as a faltering industrial sector drags down economic growth to the weakest pace in 25 years. In March, Premier Li Keqiang outlined an “Internet Plus” plan to link web companies with manufacturers. Authorities also plan to give foreign investors access to Shenzhen’s stock market, the hub for technology firms, through an exchange link with Hong Kong. Among global technology companies with a market value of at least $1 billion, all 50 of the top performers this year are from China. The sector has the highest valuations among 10 industry groups on mainland exchanges after the CSI 300 Technology Index climbed 69% in 2015, more than three times faster than the broader measure.

“..this is just temporarily overvalued paper masquerading as something durable”

• The Coming $10 Trillion Loss in Paper Wealth (John Hussman)

Financial assets now represent over 82% of the net worth of both households and U.S. non-financial corporations (Data: Federal Reserve Z.1 Flow of Funds). Except for periods where total net worth had itself retreated (for example, 2008-2010), the concentration of private net worth on financial assets, rather than real assets or productive capital, has reached the highest extreme in history in recent years. In our view, this is just temporarily overvalued paper masquerading as something durable. The previous extreme – again, outside of periods where net worth itself had retreated – was not surprisingly in Q1 of 2000. We are rather helpless observers to this, as we were prior to the last financial crisis, and as we were prior to the technology collapse – despite the same conviction each time that the imbalances and elevated valuations would end badly.

There a strong correlation between private net worth and U.S. market capitalization. Examining the data, we find that the change in private net worth per dollar of change in U.S. market cap is actually about 1.5. That means that stocks have not only a direct impact on total private net worth, but an indirect effect, as many privately held assets such as corporate debt and junk bonds are also correlated with stock price fluctuations. At about $23 trillion in U.S. non-financial equity market capitalization, and over $100 trillion in total U.S. private net worth, a standard, run-of-the mill bear market decline in stocks on the order of 30% would likely be associated with total paper losses in the private sector on the order of $10 trillion.

Meanwhile, much has been made about “cash on the sidelines” held by corporations, where the sum of currency, bank deposits and foreign deposits of U.S. nonfinancial corporations has surged by $700 billion since 2008. What’s typically left out of this observation is that the debt of those same corporations has surged by $1.5 trillion over the same period. As my friend Albert Edwards and his colleagues have demonstrated, much of this debt issuance has been used to finance stock repurchases instead of expanding investments in productive capital. While this process may feel right in an environment of low interest rates and a belief in permanently rising stock prices, it has made corporate balance sheets much more vulnerable to debt refinancing risk down the road, particularly if earnings fall short or credit spreads rise as they have in prior cycles.

“They’ve found, courtesy of Draghi, a new source of financing that is plenty cheap.”

• The Great American Invasion Into Europe’s Debt Market Has Begun (Bloomberg)

Just when debt-addicted American companies were starting to worry that Federal Reserve Chair Janet Yellen was going to take their proverbial punch bowl away, along came Mario Draghi. The ECB president has made borrowing so cheap in the region that foreign corporations are selling record amounts of debt. Forget the deeper, bigger U.S. corporate-bond market. Borrowing in euros is all the rage these days because it’s about 2 percentage points less expensive to do so. About 65% of the record €60 billion of investment-grade bonds sold in March came from overseas companies, according to a March 27 Bank of America report. And a lot of those sellers are based in the U.S.

“The appeal of Europe is likely to continue throughout 2015,” Fitch Ratings analysts Michael Larsson and Monica Insoll wrote in an April 1 report. They predict non-European issuers will sell twice as much euro-denominated debt this year than they did in 2014. The trend comes down to basic math. Yields on investment-grade bonds in Europe have fallen to 0.99%, compared with 2.9% on those in the U.S., according to Bank of America Merrill Lynch index data. Debt is so cheap in Europe that U.S. companies are saving money even if they buy currency hedges that have gotten expensive as the dollar’s soared versus the euro, according to Fitch.

And it’s not just top-rated companies. Speculative-grade borrowers including Huntsman and IMS Health have also headed to Europe to raise cash, according to Fitch. “Riskier credits also achieve a larger discount than stronger names, and this is likely to boost the U.S. high-yield footprint in Europe,” the Fitch analysts wrote. Stimulus-driven “search for yield is pushing European investors into embracing a wider range of credits.” Yields of 4.3% on euro-denominated high-yield bonds are about 2.2 percentage points lower than those on dollar-denominated notes, Bank of America Merrill Lynch data show. So even if the Fed does hike interest rates this year, it may not matter too much to U.S. corporate borrowers. They’ve found, courtesy of Draghi, a new source of financing that is plenty cheap.

“Are we asking the permission of the Europeans for our central bank policies? I’m not sure, but the market’s saying [we are].”

• Fed Needs Europe’s Permission To Raise Rates (CNBC)

The market is sending signals that the Federal Reserve may not make much headway raising interest rates during the next two years—even if central bankers are intent on doing so, Jonathan Golub, chief U.S. market strategist at RBC, said on Tuesday. The Fed will not be able to raise its federal funds rate above 1.5% by the end of 2017, Golub said. If it tries to do so, the dollar will start to rise, putting pressure on the economy and causing the central bank to retreat. “I would love to see the Fed be able to move toward 2%, but with free money in Europe, it’s very hard for them to get tighter,” he told CNBC’s “Squawk Box.” “Are we asking the permission of the Europeans for our central bank policies? I’m not sure, but the market’s saying [we are].”

The Fed faces the challenge of raising rates at a time when European central bankers are suppressing rates by purchasing large amounts of bonds. That monetary policy disparity is expected to send investors flocking to U.S. bonds for higher yields, which would drive up the value of the dollar. The greenback has already run up too far, too fast, Golub said, and while he believes the United States remains strong compared with other economies, no country can weather a 20% move in its currency in eight months without experiencing disruptions. That said, Golub views the lower-for-longer rate policy as bullish for stocks. With investors looking for returns outside the bond market, he sees U.S. equities, excluding the energy sector, returning 12 to 14% in 2015.

“If you look at the average year that you don’t have a recession, the market’s up 18%,” he said. “As long as recessionary risk is away, there’s no reason you won’t get double-digit price returns on the market. People are way too bearish.” Mark Grant, managing director at Southwest Securities, said it would be a “huge mistake” for the Fed to raise interest rates, noting that $5 trillion of bonds around the world have negative interest rates and more than 20 central banks have lowered rates in the last six months. The dollar has been “ravaged” by the European Central Bank’s stimulus program, he added. “For us to raise interest rates in this kind of environment would just be really the wrong, wrong thing,” he said. While the U.S. unemployment rate stands at 5.5% and companies are beginning to raise wages, Europe is essentially exporting deflation, Grant said. Lower oil prices are adding to the deflationary pressures, he said.

“..it’s a real snubbing..”

• US Failure to Stop China Bank Unmasks Fight Over World Finance (Bloomberg)

The Obama administration’s vain attempt to prevent allies from joining China’s Asian Infrastructure Investment Bank is feeding a growing perception that U.S. influence in Asia is declining and America is losing its 70-year grip on global economic institutions. “This past month may be remembered as the moment the United States lost its role as the underwriter of the global economic system,” former Treasury Secretary Larry Summers wrote in an April 5 column in which he also blamed Congress for domestic politicking that has rendered the U.S. “increasingly dysfunctional.” The administration’s campaign against China’s new investment bank stands in contrast to its push for greater regional leadership to battle Islamic extremists, remedy climate change and address other global issues.

And while administration officials argue that domestic economic realities limit America’s ability to police the world, they’re trying to resist the reality of China’s growing economic clout, said a U.S. official who requested anonymity to speak frankly. The U.S. “knows only too well that China is rising and that it wants to reshape the global order, and it is trying to prevent this from happening.” said Tom Miller at Gavekal Dragonomics. That’s leaving the U.S. increasingly isolated. Although the administration has refused to join the $100 billion AIIB and urged others to follow suit, allies such as Australia, the U.K., South Korea, Germany and France are among the more than 40 countries that have joined the new bank, which will fund infrastructure in Asia and be fully established by year’s end.

The U.K. decided that “seeking to ensure that governance is robust from the inside is the best way forward” with the AIIB, British Foreign Secretary Philip Hammond told reporters in Washington March 27. The U.S. has argued that the new bank would lack the lending standards of the World Bank. Despite its chilly relations with China, Japan hasn’t ruled out joining, and Japanese Finance Minister Taro Aso said on Tuesday in Tokyo that he’ll meet his Chinese counterpart, Lou Jiwei, in Beijing in June. “The most damaging part of this at the moment is the reaction of the allies; it’s a real snubbing,” said Mathew Burrows, a former U.S. intelligence analyst who’s now director of the Strategic Foresight Initiative at the Atlantic Council. “I think we fumbled badly, but I’m not convinced that there was any way to get the Chinese to back down on this institution.”

Well, not for the people, that is. But what if that was never the intention?

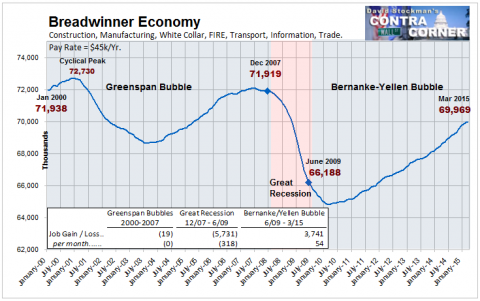

• 15 Years Of Stimulus – Nothing To Show (David Stockman)

At some point 15 years ought to count for something. After all, it does amount to one-seventh of a century. And during that span we have encompassed several business cycles, two financial crises/meltdowns and nearly a non-stop blitz of “extraordinary” policy interventions. To wit, a $700 billion TARP, an $800 billion fiscal stimulus, upwards of $4.0 trillion of money printing and 165 months out of 180 months in which interests rates were being cut or held at rock bottom levels.

You’d think with all that help from Washington that American capitalism would be booming with prosperity. No it’s not. On the measures which count when it comes to sustainable growth and real wealth creation, the trends are slipping backwards—– not leaping higher.

So here’s the tally after another “Jobs Friday”. The number of breadwinner jobs in the US economy is still 2 million below where it was when Bill Clinton still had his hands on matters in the Oval Office. Since then we have had two Presidents boasting about how many millions of jobs the have created and three Fed chairman taking bows for deftly guiding the US economy toward the nirvana of “full employment”.

Say what?

When you look under the hood its actually worse. These “breadwinner jobs” are important because its the only sector of the payroll employment report where jobs generate enough annual wage income—about $50k—- to actually support a family without public assistance.

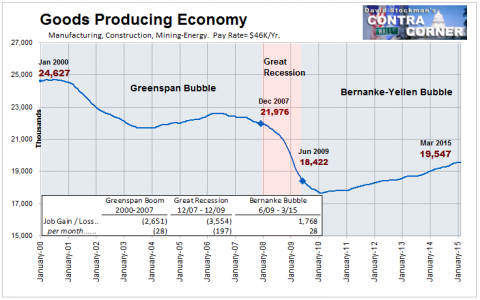

Moreover, within the 70 million breadwinner jobs category, the highest paying jobs which add the most to national productivity and growth——goods production—-have slipped backwards even more dramatically. As shown below, there were actually 21% fewer jobs in manufacturing, construction and mining/energy production reported last Friday than existed in early 2000.

“..the problem of the zero lower bound if adverse growth shocks materialize..” Huh?

• IMF Sees Low Potential Economic Growth Around World (Reuters)

The world’s growth potential took a big hit after the 2007-2009 financial crisis and is likely to lag for years, implying that interest rates should likely stay low for quite a while, the International Monetary Fund said in a study on Tuesday. Potential growth, which gauges how fast economies can grow over time without hitting inflationary speed bumps, already was slowing in richer economies before the financial crisis due to aging populations and a drop in technological innovation. But declines in private investment and employment growth cut annual potential growth in these countries to 1.3% between 2008 and 2014, half a percentage point lower than before the crisis, according to the IMF study.

The study, part of the Fund’s twice-yearly World Economic Outlook, could frame the discussions over how to boost growth when the world’s economic policymakers gather in Washington next week for the IMF and World Bank’s spring meetings. Over the next five years, advanced economies’ annual growth potential should increase to 1.6%, still below pre-crisis growth rates, making it more difficult to cut high public and private debt, the IMF said. With interest rates low, “monetary policy in advanced economies may again be confronted with the problem of the zero lower bound if adverse growth shocks materialize,” the IMF said.

It also said weak demand in the euro zone and Japan could prompt even lower potential growth than forecast. The study comes ahead of the Fund’s global economic forecasts next week. In emerging markets, potential annual growth fell to 6.5% from 2008 to 2014, about 2 percentage points lower than before the crisis, and is expected to fall further to 5.2% over the next five years as populations age, structural constraints curb capital growth, and productivity slows. A projected drop in growth potential for China, the world’s second largest economy, could be even deeper as it transitions away from an investment-led economy to a consumption-based one, the IMF said.

Student debt and subprime auto. What a swell recovery this is.

• Consumer Credit in U.S. Increases on Jump in Non-Revolving Debt (Bloomberg)

Consumer borrowing in the U.S. increased in February as the value of non-revolving debt climbed by the most since July 2011. The $15.5 billion advance in household credit followed a $10.8 billion gain in January that was smaller than initially reported, Federal Reserve figures showed Tuesday in Washington. A surge in non-revolving loans such as those for automobile purchases and education more than offset the biggest drop in revolving credit since November 2010. Consumers burned by mounting debt during the recession will need to see economic improvement in the way of wage gains and job growth to feel more comfortable boosting their borrowing. While households have been willing to take out loans for education and vehicles, they’ve remained reluctant to break out the plastic for other spending.

The median forecast in a Bloomberg survey of economists called for a $12.5 billion February gain. Estimates of the 31 economists ranged from increases of $5.5 billion to $16 billion. The report doesn’t track debt secured by real estate, such as mortgages and home equity lines of credit. Revolving debt, which includes credit-card spending, decreased by $3.7 billion in February after a $1 billion decline the month before, the figures showed. Non-revolving credit, such as that for college tuition and the purchase of vehicles and mobile homes, increased by $19.2 billion after January’s $11.8 billion gain. Lending to consumers by the federal government, mainly for student loans, rose by $6.4 billion before adjusting for seasonal variations after surging $27.9 billion in January.

“Or we could blame the voters who punish at the ballot box any party that tells them anything other than good news..”

• Scathing Assessment: “The UK Economy Is A Ticking Time Bomb” (Simon Black)

Despite being an otherwise staid, traditional news service, the professional banking division of the Financial Times recently released an utterly scathing assessment of the British economy. It was entitled, “The UK economy is a ticking time bomb,” and the editor didn’t pull any punches in completely shattering the conventional fantasy that ‘all is well’, and that advanced economies can simply print and indebt their way to prosperity.

“What is the problem? Quite simply, the key numbers are terrible. According to the OECD, after five years of ‘austerity’ the UK’s budget deficit is 5.3%, down from 11.2% in 2009. “In other words, it has gone from being close to meltdown to a situation that is merely dreadful. “Since the government is spending more than it earns, it is hardly surprising that it is borrowing more, and that the debt-to-GDP has risen from 68.95% in 2009 to 93.30% in 2013, again according to OECD figures.

“As the UK is currently growing it should really be running a budget surplus, providing it with the means to run deficit financing during the next downturn. “This is one of the tenets of the Keynesian philosophy that underpins a lot of left-of-centre economic thinking. “Unfortunately Europe’s political parties of all persuasions have bastardised Keynes’ ideas – running deficits in both good and bad times – so as to render them almost meaningless.

“To make matters worse the UK, again similar to most advanced economies, is an ageing society with pension, welfare and healthcare systems that are wrongly structured and financially unsustainable.” “We can blame the politicians for failing to be honest with the electorate about the challenges ahead. “Or we could blame the voters who punish at the ballot box any party that tells them anything other than good news and wants to hear that taxes can be cut, spending raised and the budget balanced all at the same time.”

“The banking sector maintains a substantial capital buffer and the banking sector is able to counter serious shocks even if crisis phenomena deepen.”

• Russia Rules Out Joining The QE Gang (CNBC)

The Russian central bank has ruled out joining its global counterparts with a massive bond-buying despite the country sliding into a recession this year. Speaking at a banking conference in Moscow, Russian Central Bank Chair Elvira Nabiullina said that a QE package wouldn’t be applicable for the country and would increase inflation and heighten capital outflows, according to the Dow Jones news agency. The country is due to post negative GDP growth of around 4% in the coming year. Russia has been hit hard by the dramatic fall in oil prices and international economic sanctions following its intervention last year in Ukraine. The Russian ruble has experienced a major selloff due to the economic concerns and was one of the worst-performing currencies of 2014 despite emergency measures by the country’s central bank.

The bank has produced several rate cuts this year and has also performed market interventions by selling its U.S. dollar reserves in the hope of boosting the price of the ruble against the greenback. Nabiullina said Tuesday that she expected a rapid decline in inflation for Russia, if there are no unforeseen shocks, after a weak ruble caused consumer price growth to soar to around 16% in recent months. She also said that the banking sector was strong enough to weather financial difficulties, according to Reuters, and said the bank was ready to continue cutting interest rates as inflation rates fell. “On the whole, we judge the situation in the banking sector as stable,” she said, according to the news agency. “The banking sector maintains a substantial capital buffer and the banking sector is able to counter serious shocks even if crisis phenomena deepen.”

The ruble has actually appreciated this year against the greenback and was higher for the session after Nabiullina’s remarks, close to a 2105 high. Higher oil prices have been seen as the main driver for Russian assets, which have staged a small rebound in recent weeks. Russia’s five-year credit default swaps – the price it costs to insure its debt over a 5-year period – have fallen to multi-month lows in recent sessions and Sberbank – one of its biggest lenders – has recently posted better-than-expected results.

“..there appears to be no restriction on the banks using these bonds to tap credit from their own central banks..”

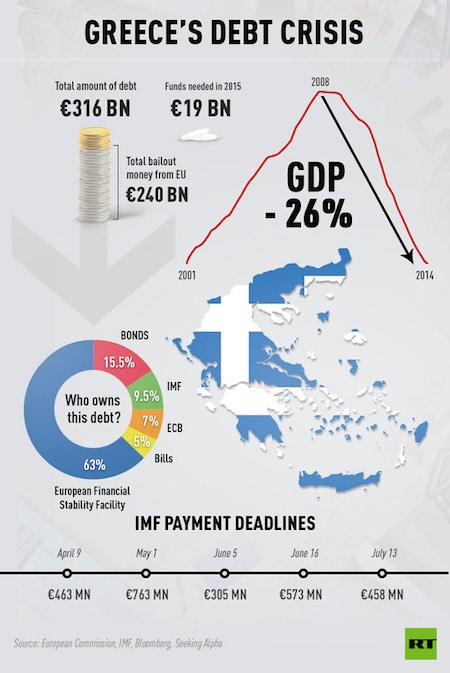

• As Greece Battles a Debt Crisis, Its Banks Issue More Short-Term Debt (NY Times)

A strange thing is happening as Greece struggles to avert bankruptcy: Its troubled banks are loading up on more debt. These short-term bonds, which have been issued by the country’s largest banks and carry the guarantee of the Greek government, are not being sold to foreign investors. They are being issued to the only entity that would dare buy them: themselves. In the last four months, some of Greece’s largest banks, including Piraeus, Alpha and Eurobank — have self-issued more than €13 billion euros’ worth of these government-guaranteed bonds. Wounded by vanishing deposits and bad loans, Greek bank bonds are about as toxic an investment as can be found. The banks are on life support via an emergency lending program overseen by the ECB, via which they have access to short-term loans from their own central bank.

But to secure this credit line, about €71 billion (more than half the deposits outstanding in Greece), these banks need to provide collateral to the Greek central bank. As was the case in Cyprus during its banking crisis, when a financial system implodes, finding acceptable collateral to swap for desperately needed loans can be difficult. The solution has been for the banks to manufacture and issue billions of euros of short-term bonds, which — because they carry the guarantee of the Greek government — can be used as collateral to secure much-needed cash from the ECB. As long as the bank’s problem is access to short-term funds and not solvency, such machinations can work. In the last year or so, Greek banks have issued more than €50 billion worth of these securities at artificially high interest rates (the higher the rate, the more valuable the collateral becomes in securing loans).

But the strategy has been controversial, and it was criticized by none other than Yanis Varoufakis, the Greek finance minister, who a year ago described the practice as a “hidden bailout from European taxpayers.” Mr. Varoufakis, then a relatively unknown economist, argued that the loans were a potent risk for Greece, which would have to assume responsibility for them if the banks failed. The practice has also been flagged by two German economists as a questionable way for troubled eurozone economies to extract funding from the central bank. Uncomfortable with the amounts of bonds being issued, the ECB said that, as of March, it would no longer accept such paper. But there appears to be no restriction on the banks using these bonds to tap credit from their own central banks, and they have done so. The most recent case occurred Tuesday, when Piraeus, Greece’s largest bank, issued a €4.5 billion note at 6%, which matures in July.

The Germans will pay the price for using words like that. At least their opposition gets it: ‘It’s disgraceful’.

• German Economy Minister Calls Greek War Reparations Request ‘Stupid’ (Guardian)

Germany’s economy minister has branded Greece’s demand for €278.7bn in WWII reparations as “stupid”, but the German opposition said Berlin should repay a forced loan dating from the Nazi occupation. The Greek deputy finance minister, Dimitris Mardas, made the demand on Monday, seizing on an emotional issue in a country where many blame Germany, their biggest creditor, for the tough austerity measures and record high unemployment that accompanied two international bailouts totalling €240bn. Sigmar Gabriel, Germany’s minister for economic affairs and vice chancellor, said Greece ultimately had an interest in squeezing a bit of leeway out of its eurozone partners to help Athens overcome its debt crisis.

“And this leeway has absolutely nothing to do with world war two or reparation payments,” said Gabriel, who leads the Social Democrats (SPD), the junior partner in the ruling coalition with chancellor Angela Merkel’s conservatives. Berlin is keen to draw a line under the reparations issue and officials have previously argued Germany has honoured its obligations, including a 115-million deutschmark payment made to Greece in 1960. A spokeswoman for the finance ministry said on Tuesday that the government’s position was unchanged. Eckhardt Rehberg, a budget expert for the conservatives, accused Athens of deliberately mixing the debt crisis and reform requirements imposed by Greece’s international creditors with the issue of reparations and compensation.

“For me the figure of €278.7bn of supposed war debts is neither comprehensible nor sound,” he told Reuters. “The issue of reparations has, for us, been dealt with both from a political and a legal perspective.” But Greece’s demand for Germany to repay a forced wartime loan amounting to €10.3bn found support from the German opposition, with members of the Greens and the far-left Linke party saying Berlin should pay. Manuel Sarrazin, a European policy expert for the Greens, and Annette Groth, a member of the leftist Linke party and chairman of a German-Greek parliamentary group, told Reuters that Berlin should repay a so-called occupation loan that Nazi Germany forced the Bank of Greece to make in 1942.

Berlin and Athens should “jointly and amicably” take any other claims to the International Court of Justice, Sarrazin said. Groth went further, saying: “If you look at Greece’s debt and the ECB’s bond purchases every month, it puts the figure of €278.7bn into perspective.” She said the German government should, at the very least, talk to Athens about how it came up with that figure. “The German government’s categorical Nein certainly cannot be allowed to stand. That’s disgraceful, 70 years after the end of the war,” Groth said.

Not what he says. He’s talking about if Greece is thrown out.

• Greek Defense Minister: We Cannot Keep ISIS Out If EU Keeps Bullying Us (KTG)

For a second time within a couple of weeks, Greek Defense Minister and leader of coalition government junior partner Independent Greeks, Panos Kammenos, warned that if the European Union keeps undermining the coalition government and the country exits or is forced to exit the Euro, “waves of migrants: will stream from Turkey to Europe and among them there would be ISIS “radicals.” Speaking to THE TIMES, Kammenos said:

“The gross meddling into [Greek] domestic affairs isn’t just unheard for European standards, it’s unethical and it’s dangerous. If Greece goes, then a lot more than financial stability and the euro is at stake.” “If Greece is expelled or forced out of the eurozone, waves of immigrants without papers, including radical elements, will stream from Turkey and head towards the heart of the West,” Kammenos told The Times.

German government coalition partners, European Parliament President Martin Schulz and “European anonymous sources” have repeatedly and even blatantly expressed the wish that Prime Minister Alexis Tsipras gets rid of nationalist Kammenos and make a coalition with austerity-friendly To Potami and/or even PASOK. Panos Kammenos described these statements and efforts as “bullying” committed by Brussels and Berlin in order to force Greece into “a full and complete economic surrender.” “Europe must realize that maintaining Greece stable, the West front against the Islamic State (ISIS) is safe. But if expelled or forced out of the eurozone, waves of immigrants without papers, including radical elements will stream from Turkey, heading towards the heart of the West. If these waves of immigrants increase, then the threat of incoming extremist elements will grow not for Greece but for the whole of the West.“

“Wait, does Russia have the money for this? Yes and No.”

• What You Need To Know About Putin’s Meeting With Tsipras (RT)

Greek Prime Minister Alexis Tsipras will meet Russian President Vladimir Putin on Wednesday. Greece could ask Moscow to bankroll a bailout, Gazprom could agree to a gas discount, or the two sides could talk about how to sidestep EU sanctions. The new 40-year-old leader of one of the world’s most indebted countries with meet with Putin on Wednesday, just one day before the country is due to repay €463.1 million to the IMF. The Greek Prime Minister arrives in Moscow on Tuesday. Is Russia going to bail out Greece? Rumors have been abuzz that Athens and Moscow are plotting a secret bailout ever since the idea was first floated by Russian Finance Minister Anton Siluanov days after the Syriza party won the elections in January. Russian daily Kommersant reported that Moscow is ready to offer indirect financial help, citing an unnamed government source.

“We are ready to consider the issue of allowing Greece a gas discount: under the contract, the gas price is linked to the oil price that has gone significantly lower in recent months,” as Kommersant cites a Russian government source. “We are also ready to discuss the possibility of allowing Greece new loans. But in turn we are interested here in reciprocal moves, in particular in terms of Russia getting certain assets from Greece,” the source added, without specifying the sort of assets he was talking about. Greek Finance Minister Yanis Varoufakis has said that his country “will never ask for financial assistance from Moscow,” in an interview with Zeit online in early February. Wait, does Russia have the money for this? Yes and No.

Government officials have hinted that Russia’s help, if provided, would be indirect. Most economists around the world are more positive about the Russian economy, but everybody agrees it will contract this year between 4 and 3%. Most recently S&P improved its economic outlook for Russia, saying it’ll return to growth in 2016 and add 1.9%. In the first quarter of 2015, the economy expanded 0.4%, and the Russian ruble, which lost nearly 50% in 2014, is now the best performing currency of the year. Though Russia ‘s economy isn’t as strong as it was two years ago, and growth is near zero, it still has a lot saved up for a rainy day – $356 billion in currency reserves as of April and over $150 billion split between the country’s oil reserve funds, the National Reserve Fund and National Welfare Fund. If the Russian economy goes nose first into a recession, these funds are expected to keep the financial situation stable for 2-3 years.

14.6% YoY.

• Greek Cash Crunch Results In Significant Reduction Of Imports (Kathimerini)

Imports posted a decline for a second consecutive month in February, sliding 14.6% compared to the same month in 2014. When fuel products are excluded, the yearly decline amounts to 6.7%, according to data released on Tuesday by the Hellenic Statistical Authority (ELSTAT). The reason for the drop does not point to any increase in the economy’s self-sufficiency. Rather, as exporters announced on Tuesday, it is mainly due to the lack of liquidity available to Greek enterprises and the pressure on them from foreign suppliers. A key component in this drop is the remarkable decrease in fuel product imports, which is connected to the decline in production activity and the return to economic contraction after a year of relative growth in 2014. There was also a fall in ship imports.

ELSTAT announced that the total value of imports in February amounted to €3.44 billion, against €4.04 billion in February 2014. Imports had contracted by 16% year-on-year in January, reaching €2.14 billion against €3.74 billion a year earlier. Therefore, in the first couple of months of the year there was a total contraction of 15.3% in revenues, or 11% excluding fuel products. Notably, the biggest drop concerned imports from third countries and not from the European Union. Third-country imports declined 31.2%, while imports from within the EU fell by just 6.7%. This suggests that EU imports could constitute a safety cushion for Greece.

“Draghi may have signed a mutually assisted suicide pact with finanzkapital in the eurozone.”

• Draghi’s Doom Loop(s): More Than Just Rentiers’ Euthanasia (Parenteau)

The recently adopted QE approach by the ECB, in concert with the negative deposit policy rate (NDPR) introduced last summer, has set off a number of nested disequilibrium dynamics that may unwittingly introduce a material increase in systemic risk for the eurozone, and perhaps beyond. Lord Keynes anticipated what he termed ”euthanasia of the rentiers”, as he expected active monetary policy would be successful in reducing long-term interest rates, and the share of the population living off of bond coupons would eventually just wither away. By way of contrast, if the following assessment is correct, Draghi may have signed a mutually assisted suicide pact with finanzkapital in the eurozone.

The logistics of implementing QE (including questions about adequate bond supply for the ECB to purchase, as well as the related market “liquidity” concerns), or whether or not QE represents what Lord Turner refers to as “open monetary financing”, are not the real problem, or at least not the most compelling ones. Rather, the implementation of QE with a large and increasing share of the bond market displaying negative yields to maturity (NYTM) presents a number of serious challenges to financial stability in the eurozone. To cut to the chase, the ECB’s QE and NDRP measures may be setting investors up for a discontinuous price event, much like what was experienced in the equity market meltdown back in October 1987.

Even if a disruptive yield spike is avoided, or even contained and reversed by ECB heroics, pursuing QE under NYTM market conditions may lead to a significant dampening down of bank and insurance company profitability. In the extreme, the solvency of key eurozone financial institutions could once again come under question. This could further complicate the ECB’s chances of achieving their 2% inflation goal, as it may dampen the bank lending channel as a key transmission mechanism for unconventional monetary policy. The entire set up, in other words, begins to take on many of the characteristics of Andrew Haldane’s Doom Loops. In this case, however, the ECB may unintentionally be setting off nested Doom Loops that will feed on each other, and thereby magnify systemic risks quicker than investors and policy makers might otherwise imagine possible.

It gets crazier by the day.

• Got A Million? Auckland Homes Are For You (NZ Herald)

One in four houses sold by Auckland’s biggest real estate agency last month fetched more than $1 million. According to Barfoot & Thompson, which released the record-breaking sales figures yesterday, 420 of the 1597 houses sold cost buyers seven figures. At the same time, sales prices increased almost 4% since February, taking the average price of a residence in Auckland to an all-time high of $776,729. The cost is 9% higher than the median for March last year and $17,000 higher than the previous record average price set in December. It indicates the city’s housing market is showing no signs of letting up, as first-home buyers scramble to get on the property ladder.

Barfoot & Thompson managing director Peter Thompson said March was always the most active month for property sales, but last month set a string of new highs. In one fortnight alone, the company sold more than 400 properties each week, the highest two weeks’ trading in its 92-year history. Only March 2003 had bigger sales, when 476 residences sold in seven days. Last week, agents sold a two-bedroom house in Sussex St in Grey Lynn for $1.5 million – 39% above its council valuation. “Buyers remain convinced that with a stable economy, low interest rates and restricted housing availability, buying at current prices is manageable,” said Mr Thompson.

Makes your phone work.

• The Worst Place On Earth: A Dystopian Lake In China (BBC)

From where I’m standing, the city-sized Baogang Steel and Rare Earth complex dominates the horizon, its endless cooling towers and chimneys reaching up into grey, washed-out sky. Between it and me, stretching into the distance, lies an artificial lake filled with a black, barely-liquid, toxic sludge. Dozens of pipes line the shore, churning out a torrent of thick, black, chemical waste from the refineries that surround the lake. The smell of sulphur and the roar of the pipes invades my senses. It feels like hell on Earth. Welcome to Baotou, the largest industrial city in Inner Mongolia. I’m here with a group of architects and designers called the Unknown Fields Division, and this is the final stop on a three-week-long journey up the global supply chain, tracing back the route consumer goods take from China to our shops and homes, via container ships and factories.

You may not have heard of Baotou, but the mines and factories here help to keep our modern lives ticking. It is one of the world’s biggest suppliers of “rare earth” minerals. These elements can be found in everything from magnets in wind turbines and electric car motors, to the electronic guts of smartphones and flatscreen TVs. In 2009 China produced 95% of the world’s supply of these elements, and it’s estimated that the Bayan Obo mines just north of Baotou contain 70% of the world’s reserves. But, as we would discover, at what cost? Rare earth minerals have played a key role in the transformation and explosive growth of China’s world-beating economy over the last few decades. It’s clear from visiting Baotou that it’s had a huge, transformative impact on the city too. As the centre of this 21st Century gold-rush, Baotou feels very much like a frontier town.

In 1950, before rare earth mining started in earnest, the city had a population of 97,000. Today, the population is more than two-and-a-half million. There is only one reason for this huge influx of people – minerals. As a result Baotou often feels stuck somewhere between a brave new world of opportunity presented by the global capitalism that depends on it, and the fading memories of Communism that still line its Soviet era boulevards. Billboards for expensive American brands stand next to revolution-era propaganda murals, as the disinterested faces of Western supermodels gaze down on statues of Chairman Mao. At night, multicoloured lights, glass-dyed by rare earth elements, line the larger roads, turning the city into a scene from the movie Tron, while the smaller side streets are filled with drunk, vomiting refinery workers that spill from bars and barbecue joints.

Even before getting to the toxic lake, the environmental impact the rare earth industry has had on the city is painfully clear. At times it’s impossible to tell where the vast structure of the Baogang refineries complex ends and the city begins. Massive pipes erupt from the ground and run along roadways and sidewalks, arching into the air to cross roads like bridges. The streets here are wide, built to accommodate the constant stream of huge diesel-belching coal trucks that dwarf all other traffic.