Ivan Shishkin Midday. Near Moscow 1869

Memorial on Old Arbat Street, Moscow, to children killed in Donetsk by US-backed Ukrainian forces BEFORE the Russian special operation began in February. pic.twitter.com/o4pczQ4YKl

— Dan Kovalik (@danielmkovalik) November 4, 2022

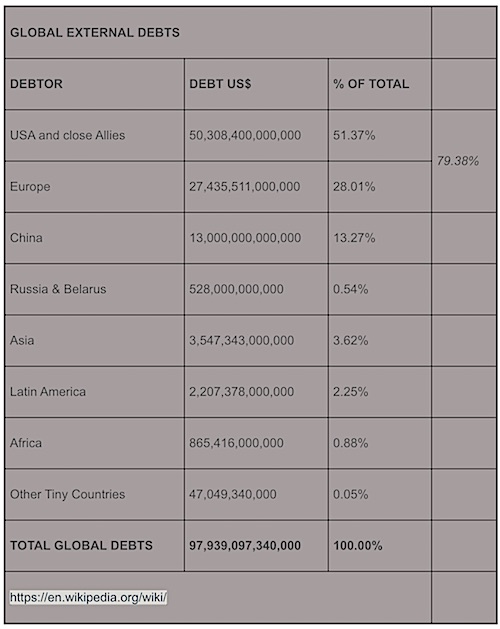

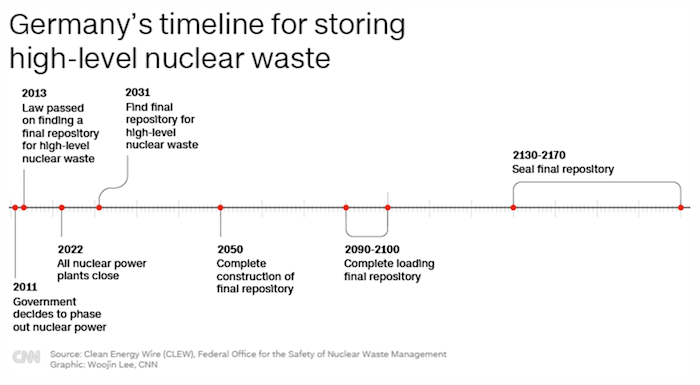

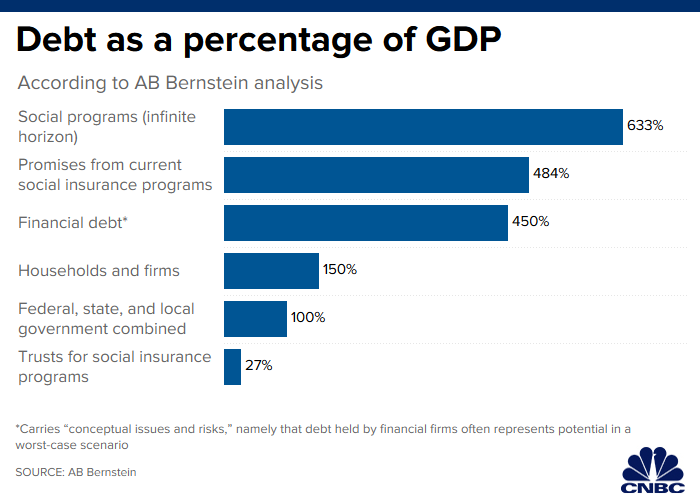

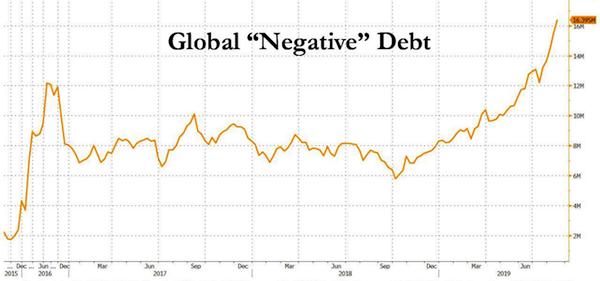

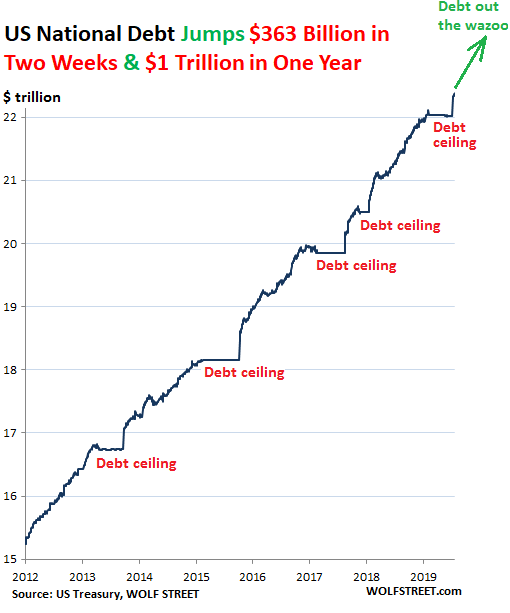

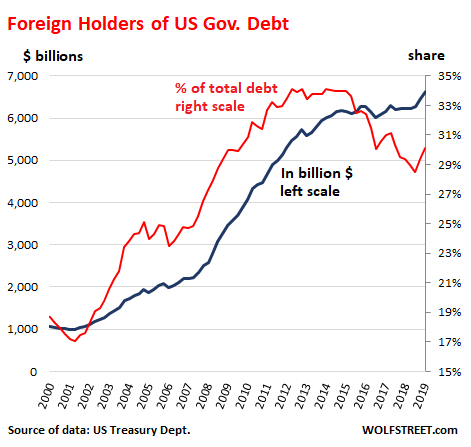

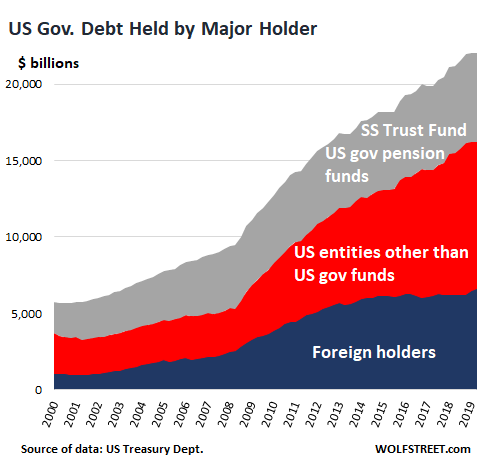

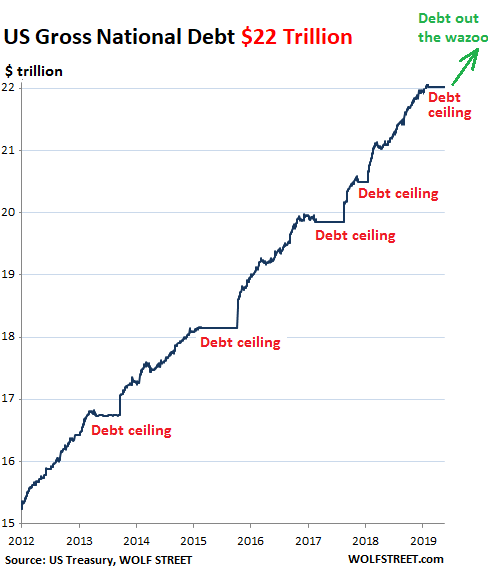

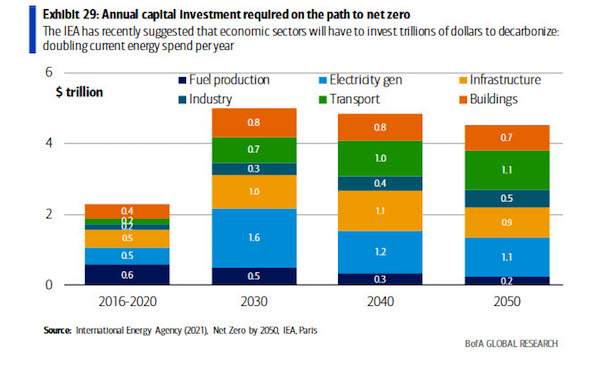

We’re deeper in debt than ever. And planning to spend trillions on net zero. It doesn’t add up.

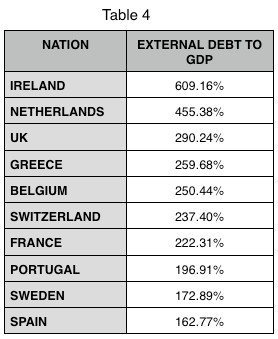

“Ireland’s external debt is 609% more than her GDP..”

• Love Letter to Ireland and to ALL the Debt-Enslaved Nations of the World (Chu)

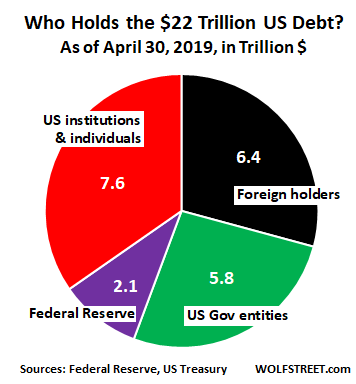

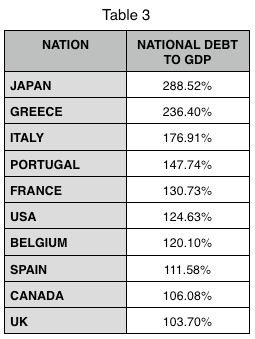

Sometime in October, 2022, the national debt of the United States will blow through $31 Trillion. That’s a lot of zeros! To give some context on how exponential is this growing number: It took the USA 205 years to surpass $1 Trillion in total national debt on October 22, 1981; but it will only take 41 years to exponentially add another 30 Trillion! Note to all the anal-retentive persons out there: Nothing survives exponential growth. Nothing. All 7 of the G7 nations (USA, Japan, Italy, France, Germany, UK, and Canada) are in the top 10 list of most indebted nations, as far total national debts are concerned. Three of the BRICS nations (China, India and Brazil) are in this top 10 list.

Table 3 shows the “national debt to GDP” ratios for the top 10 nations, in descending scale. One of the ways to understand what this “national debt to GDP” ratio means in layman terms is to use the “credit card to income” analogy. Let’s say that we have a credit card limit of $100,000 USD and our annual income is $50,000 USD. Because of hard times and all, we have maxed out our credit card and we owe $100,000 USD. Well, in our case then, the “credit card debt to income” ratio is 200%. Question: How long can we maintain our lifestyle if our “credit card debt to income” ratio is 200%? Answer: Not very long. All ten nations listed in Table 3 are spending more than they produce in terms of GDP each year.

Six of the G7 nations (Japan, Italy, France, USA, Canada, and UK) are spending more than they produce each year for quite a few years now. None of the BRICS nations are in the top ten of this list. Question: How long can nations like Japan, Greece, Italy, Portugal, etc. continue to incur national debts way beyond their annual national income? Answer: Not very long. All these 10 nations with a “national debt to GDP” ratio over 100% are spending money beyond their means. Japan and Greece are spending money way beyond their means.

Table 4 is a list of the “external debt to GDP” ratios for the top 10 nations, in descending scale. At the #1 spot, Ireland’s external debt is 609% more than her GDP. There is something that we should note about Ireland’s GDP. Apple, maker of the iPhones and all things that begin with an “i”, launders its European sales through its Irish headquarters. Why? To avoid paying taxes as Ireland has one of the most preferential business tax polices in the world. However, Apple’s “contribution” to Ireland’s GDP, which has been as high as 25%, generates ZERO income for the Irish nation. How’s that for a GDP accounting trick? Therefore, this ridiculous 609% is even a lot higher! Now, imagine if our credit card debt is more than 609% of our annual income! What happens when the credit card company demands that we pay off our credit card debt? That’s about to happen to Ireland, Netherlands, UK, etc.

“This is why we are experiencing the redivision of the world into warring blocs. This is why we are seeing the roll back of 30 years of Globalization and massive suppyline disruption.”

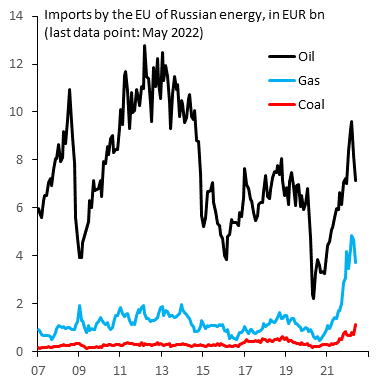

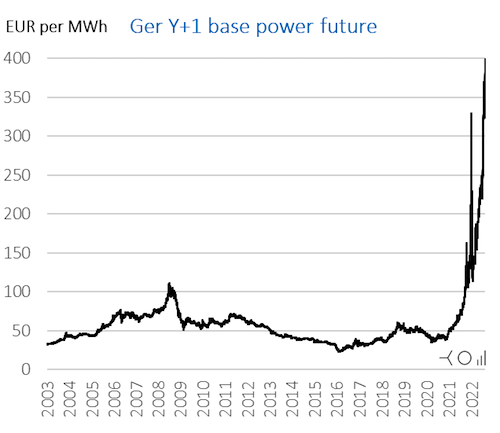

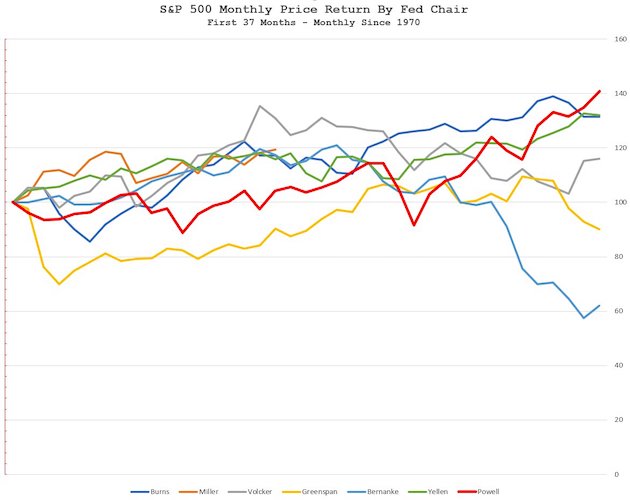

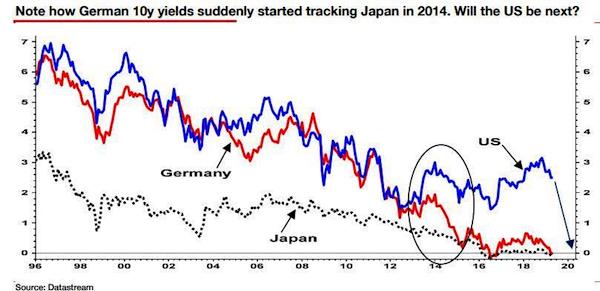

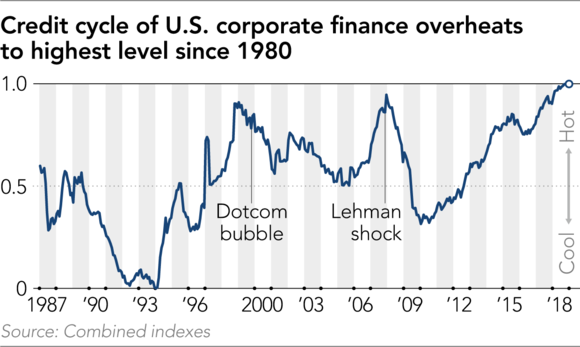

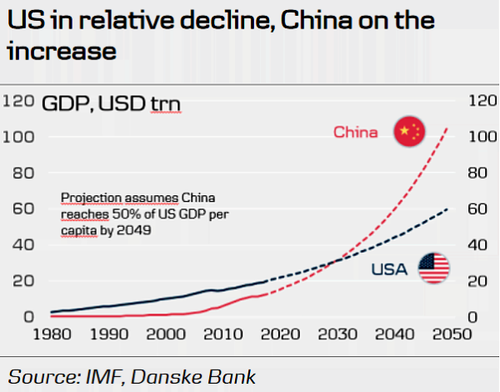

• The One Chart That Explains Everything (Mike Whitney)

It explains why Washington is so worried about China’s explosive growth. It explains why the US continues to hector China on the issues of Taiwan and the South China Sea. It explains why Washington sends congressional delegations to Taiwan in defiance of Beijing’s explicit requests. It explains why the Pentagon continues to send US warships through the Taiwan Strait and ship massive amounts of lethal weaponry to Taipei. It explains why Washington is creating anti-China coalitions in Asia that are aimed at encircling and provoking Beijing.

It explains why the Biden administration is stepping up its trade war on China, imposing onerous economic sanctions on its businesses, and banning critical high-tech semi-conductors that are “are essential not just… for virtually every aspect of modern society, from electronic products and transport to the design and production of all manner of goods.” It explains why China has been singled-out in the US National Security Strategy (NSS) as “the only competitor with both the intent and, increasingly, the capability to reshape the international order.” It explains why Washington now regards China as its biggest and most formidable strategic adversary that must be isolated, demonized and defeated.

The chart above explains everything, not just the hostile diplomatic jabs that are designed to discredit and humiliate China, but also the openly belligerent policies that are aimed at Russia as well. People need to understand this. They need to see what is really going on so they can put events in their proper geopolitical context. And what “context” is that? The context of a Third World War; a war that was thoroughly-planned, instigated and (now) prosecuted by Washington and Washington’s proxies. That’s what’s really going on. The increasingly violent conflagrations we see cropping-up in Ukraine and Asia are not the result of “Russian aggression” or “evil Putin”. No. They are the actualization of a sinister geopolitical strategy to quash China’s meteoric rise and preserve America’s dominant role in the world order. Can there be any doubt about that?

No. None. This is why we are experiencing the redivision of the world into warring blocs. This is why we are seeing the roll back of 30 years of Globalization and massive suppyline disruption. And this is why Europe has been thrust headlong into frigid darkness and forced deindustrialisation. All of these suicidal policies were concocted for one purpose and one purpose alone, to maintain America’s exalted spot in the global system. That is why all of humanity is presently embroiled in a Third World War; a war that is designed to prevent China from becoming the world’s biggest economy; a war that is designed to preserve US global primacy.

Sort of a shame that MissTrust couldn’t finish her ‘mission’.

• UK Was ‘Hours’ Away From Potential Total Meltdown – Bank Of England (RT)

U Britain narrowly avoided a financial crisis in September that could have seen some pension funds totally collapse, the governor of the Bank of England, Andrew Bailey, told Channel 4 on Thursday. Asked how close the UK came to a potential total economic meltdown after Liz Truss’ mini-budget was announced, Bailey said: “I think at the point when we intervened, I can tell you that the messages we were getting from the markets were that it was hours.” Truss’s so-called “mini-budget” included the biggest tax cuts since 1972, funded by a huge increase in borrowing, without an explanation as to how the government would pay it back. The measures caused the pound to hit an all-time low against the dollar and the price of UK government bonds – known as gilts – to collapse.

The Bank of England intervened by announcing an expansion of its emergency bond-buying to “restore orderly market conditions.” “It was becoming unstable and it was affecting pension funds, for instance, and how they were operating. So, we had to step in quickly and we had to step in quite decisively. This felt, and was, a very real threat to financial stability,” Bailey said. His interview came just hours after the regulator hiked the interest rate from 2.25% to 3% to try and curb soaring inflation. Bailey also warned that Britain was facing its longest recession since records began and warned of a “tough road ahead” for the UK and its households.

Let the bailouts begin…

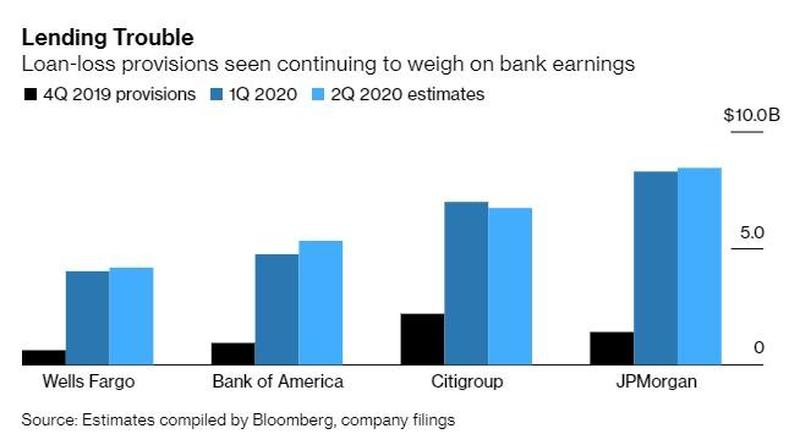

• Wells Fargo Braces For More Layoffs As Loan Volumes Collapse 90% YOY (ZH)

Among the growing list of many companies bracing for layoffs is now Wells Fargo, who has seen their U.S. loan volumes “collapse”. The fall off in loan volume has left some workers “idle”, according to a new CNBC report. This, in turn, has them worried about further job cuts. In the early weeks of Q4, the bank had about 18,000 loans in its pipeline, the report says. This is down an astonishing 90% from a year earlier when the pandemic housing boom was in full swing. The dropoff in loan volume is at least partly attributable to a slowing housing market as rates have risen. With the Fed raising rates again this week, it doesn’t look like the spigot on loans is going to be re-opening anytime soon.

Other housing loan companies, like Rocket Mortgage, are also expected to be downsizing as a result of the slowing activity in housing. Wells Fargo “has historically been the most reliant on mortgages” out of all major U.S. banks, CNBC notes. CFO Mike Santomassimo had already warned about the slowdown in mid-October, stating: “We expect it to remain challenging in the near term. It’s possible that we have a further decline in mortgage banking revenue in the Q4 when originations are seasonally slower.” The bank said this week: “The changes we’ve recently made are the result of the broader rate environment and consistent with the response of other lenders in the industry. We regularly review and adjust staffing levels to align with market conditions and the needs of our businesses.”

“..no country should be obliged to lower its living standards, bankrupt itself, and privatize its public domain in order to pay foreign debts. If a country can’t pay its debt, it’s a bad loan..”

• Michael Hudson on The Destiny of Civilization (Platypus)

They’re different kinds of debts, and canceling them requires different kinds of institutions. E.g., what’s most in the news these days is student loan debt and that it could be canceled by just an act of President Biden, which he won’t do, because he’s the person that sponsored the bankruptcy law. That law made it impossible to cancel student debts by bankruptcy laws. It could be done by a congressional law. The government has all sorts of regulatory agencies to handle corporate debt write-downs. Corporate write-downs in bankruptcy proceedings are a normal course, taking place almost continually, and we’re going to see that again. There are real estate debts. When the junk mortgage frauds peaked in 2008, President Obama ran by promising to write-down the junk mortgage debts to the actual market value of the homes bought by the victims of bank fraud and to bring the mortgage payments in line with the current rent.

As soon as he was elected, Obama invited the bankers to the White House and said, “don’t worry. I’m the only guy standing between you and the pitchforks. That was just to get elected. I’m on your side.” He proceeded to evict seven or eight million American families. Not only did Obama not write-down the debts, but he started quantitative easing that has given nine trillion dollars to support the real estate market, the stock market, and the bond market, so that the banks and the wealthy rentier 10% of the American economy would not lose any money. The result was that American home ownership rates have fallen from 69% and plunged into the 50s. America is being turned from a middle-class home ownership economy into a landlord economy.

We’re regressing back towards the 19th century, including its legacy of feudalism. That’s what we’re moving toward, as official government policy. We still have a strong government, but the role of the government is now to enforce the debts, not to write them down, and the most serious debts in the news are actually international debts. And of course, international debts cannot be settled by one nation. What is the vehicle to cancel the debts of global South countries like Argentina, that is now in yet another crisis with the International Monetary Fund (IMF). The Argentinian crisis, Sri Lanka — all this will characterize the Global South by this fall as a result of rising energy prices for oil and gas, rising food prices, and capital flight to the U.S. as it raises its interest rate.

If countries have to pay more for food and energy, how can they afford to pay their foreign debts? It’s necessary to have a new international organization to sponsor this. That’s what both President Putin and President Xi have said: we’re going to create a BRICS bank as an alternative to the World Bank and the IMF and this will have to accompany a new world court. We are going to provide a different philosophy of operations for this bank: the principle is that no country should be obliged to lower its living standards, bankrupt itself, and privatize its public domain in order to pay foreign debts. If a country can’t pay its debt, it’s a bad loan, and just as individuals and corporations are allowed to declare bankruptcy, countries should be able to declare bankruptcy.

“..EUropeans would just appear to be aggressive, manipulative, and conceited… and not superior to anyone else..”

• How Bright Are EUropeans ? (Vilches)

Dr. Josep Borrell is the EU´s topmost senior diplomat as High Representative for Foreign Affairs and Security Policy. Recently joined by another un-elected official namely the EU Commission President Ursula von den Leyen both now roughly insist that EUrope´s problems stem from its addictiveness to excellent and cheap Russian energy and resources, to China´s humongous export markets and high productivity dependency, and to the military ´security´ that the US today supposedly renders to them. So, accordingly their solution for EUrope would be to (a) get itself up in arms yet again and (b) to double-down on the ‘battle of narratives´ which should be interpreted to be just some more effective EU propaganda. So from this perspective rather than being bright EUropeans would just appear to be aggressive, manipulative, and conceited… and not superior to anyone else. So why be so proud about it all ?.

Objectively searching into the EUropean political soul it´s easy to find EUrope´s self-EUthanization vis-á-vis its sheer lack of any ´affectio societatis´. This makes EUrope an un-viable business associate to and for anyone, even amongst themselves in view of the current widespread infighting. But JB´s ´brightness´ does not stop there, now proclaiming that “the world needs Europe” and that EUrope is a “garden” and the rest a mere ”jungle” ready to encroach upon it… So at this rate it would be wise to copernically acknowledge that EUrope is not any “global super-power” and that God Almighty has not appointed the un-elected European Commission as the rule-maker for the rest of the world to follow. Furthermore, the “international community”(sic) is not headquartered at Davos or Brussels and 85% of planet Earth does not even wake up in the West every morning. Making that clear would focus EU politics better than complaining about “too many abstentions” in the UN votes regarding this conflict which EU officials fail to understand and accept.

“Ukraine, Batman and complex identities”…

• Key Takes From Vladimir Putin’s Latest Speech (RT)

Russian President Vladimir Putin honored National Unity Day by meeting with historians and dignitaries – including leaders of religious communities – and discussing the role of history in protecting national sovereignty, identity, and culture. Here are some key points from his speech and the subsequent discussion. “Russia’s clash with the neo-Nazi regime that arose in Ukraine was inevitable, and had our country not undertaken the actions it did in February, nothing would have changed, only our position would have been far worse,” Putin said. “Our so-called friends brought the situation in Ukraine to the stage where it was a mortal threat to Russia.” Putin compared the situation with what happened in 1941, when the USSR had ample warning about the upcoming Nazi invasion but did not take steps to defend itself, suggesting that this was one of the reasons millions of Soviet citizens died before victory over Nazism was achieved.

Western countries meddled in Ukraine’s internal affairs after the fall of the Soviet Union and “managed to instill such pseudo-values into the minds of millions of people, which led to the fact that anti-Russia was created on this territory, sowing hatred, violating the minds of people, depriving them of true history,” Putin said. Ukraine has been turned into a grave danger for Russia, but also something suicidal for the Ukrainians themselves, he explained. “It is Ukraine, the Ukrainian people, that is the first and main victim of the deliberate sublimation of hatred towards the Russians and Russia. In Russia, everything is exactly the opposite – you know this very well: we have always treated the Ukrainian people with respect and warmth. It remains so, despite today’s tragic confrontation.”

Speaking further about the current conflict in Ukraine, Putin drew parallels with the Russian Revolution over a hundred years ago. “In fact, the confrontation is going on within one people – just like it was after the upheavals of 1917.” Back then, “foreign powers warmed their hands on the tragedy of our people. They did not care about either the Whites or the Reds, they pursued their own interests, weakened and tore historical Russia to pieces.” The West is doing the same in Ukraine today, Putin said, sacrificing the Ukrainian people to achieve their geopolitical goals, which he described as “weakening, disintegrating and destroying Russia.” Russians need to know the full past of their country, the president argued, without repeating the “mistakes of the Soviet period,” where academia worked to fit ideological patterns.

“Something similar is happening now in some countries in the West, where much is determined by the current radical-liberal establishment. To please it, key historical events are presented in a completely distorted, inverted form, and the truth is canceled,” Putin said. “When someone wishes to deprive the state of sovereignty and turn its citizens into vassals, they begin by twisting the country’s history, in order to deprive people of their roots, doom them to unconsciousness,” the Russian president explained, condemning this as a “deliberately perverted attitude to history.” Pointing to Ukraine as an example of this, Putin said that “there have been similar attempts against Russia, and they do not stop, but we firmly and in time put up a solid barrier against them. “

While Russia is absolutely a part of European civilization, there is no denying that many major colonial empires in the West are now “medium-sized or small countries,” Putin said, comparing the population of Portugal with its former colony Brazil, the UK with India, and how China’s Guangdong province alone has 1.5 times the population of Germany. “European capitals were [once] the center of the universe – but this is already in the past,” the Russian president said. Putin also opted to broach a slightly less political issue. During the question-and-answer session, he noted that academic work won’t be enough without teaming up with popular culture and merchandising. Russian children “know of Batman but not of our own heroes,” Putin said, noting that historical education starts from an early age. “There should be cartoons, films, children’s literature… All of these things are needed. That’s why we’re here today, to nudge this process forward.”

Thorough.

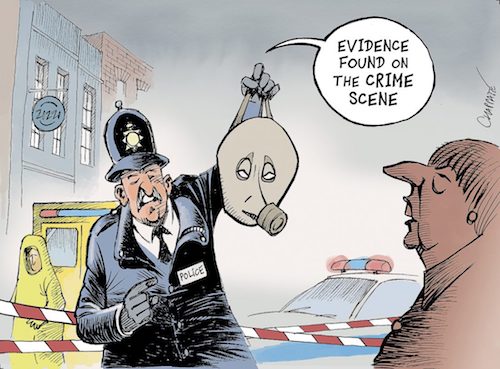

• British Spies Constructing Secret Terror Army In Ukraine (GZ)

Documents obtained by The Grayzone reveal plans by a cell of British military-intelligence figures to organize and train a covert Ukrainian “partisan” army with explicit instructions to attack Russian targets in Crimea. On October 28th, a Ukrainian drone attack damaged the Russian Black Sea fleet’s flagship vessel in the Crimean port of Sevastopol. Moscow immediately blamed Britain for assisting and orchestrating the strike, as well as blowing up the Nord Stream pipelines – the worst acts of industrial sabotage in recent memory. The British Ministry of Defense issued a blustery denial in response, branding the accusations “false claims of an epic scale.” Whoever was behind those specific attacks, suspicions of a British hidden hand in the destruction are not unfounded.

The Grayzone has obtained leaked documents detailing British military-intelligence operatives inking an agreement with the Security Service of Ukraine’s Odessa branch, to create and train a secret Ukrainian partisan terror army. Their plans called for the secret army to conduct sabotage and reconnaissance operations targeting Crimea on behalf of the Ukrainian Security Service (SSU) – precisely the kind of attacks witnessed in past weeks. As The Grazyone previously reported, the same coterie of military-intelligence operatives was responsible for drawing up plans to blow up Crimea’s Kerch Bridge. That goal was fulfilled on October 8th in the form of a suicide truck bomb attack, temporarily disabling the sole connecting point between mainland Russia and Crimea, and triggering a major escalation in Moscow’s attacks on Ukrainian infrastructure.

These blueprints were produced by a military veteran named Hugh Ward, at the request of Chris Donnelly, a British military-intelligence operative best known for hatching the covert, Foreign Office-funded Integrity Initiative information warfare program. The plans were circulated throughout Donnelly’s private transnational network of military officials, lawmakers and intelligence officials. Such high-level connections underline that he is far from a passive observer in this conflict. He has used his position and contacts to secure the resources necessary to train up the secret saboteur battalion in order to attack Russian targets in Crimea. This wrecking strategy is certain to escalate the war, and undercut any momentum toward negotiation.

“US Treasury Secretary Janet Yellen said in May that seizing the assets was “not something legally permissible in the United States.”

• EU Exploring Ways To Use Frozen Russian Assets (RT)

The European Union is trying to determine whether it’s feasible to use the assets of the Russian Central Bank that have been frozen by member states to finance Ukraine, Bloomberg reported on Thursday. The discussions are at an early stage and legal experts have been asked to look into possible options, the outlet wrote, citing people familiar with the matter. Some $300 billion belonging to the Russian Central Bank were frozen by the EU, the US, and their allies as part of anti-Russia sanctions. Any EU action would deal with assets held in Europe, Bloomberg says, adding that the issue has also been raised with the US.

Last month, European Commission President Ursula von der Leyen said that the EU wanted to confiscate Russian assets in order to use them for the reconstruction of Ukraine but admitted that establishing a legal base for such a move was tricky. US Treasury Secretary Janet Yellen said in May that seizing the assets was “not something legally permissible in the United States.” Russia strongly criticized the freezing of the funds, with Russian Foreign Minister Sergey Lavrov accusing the West of essentially committing theft.

“The Atlantic magazine, a house organ of the people in America who know better than you do about… really… everything..”

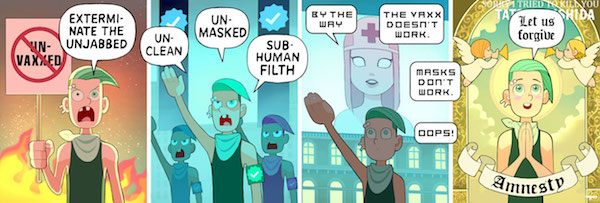

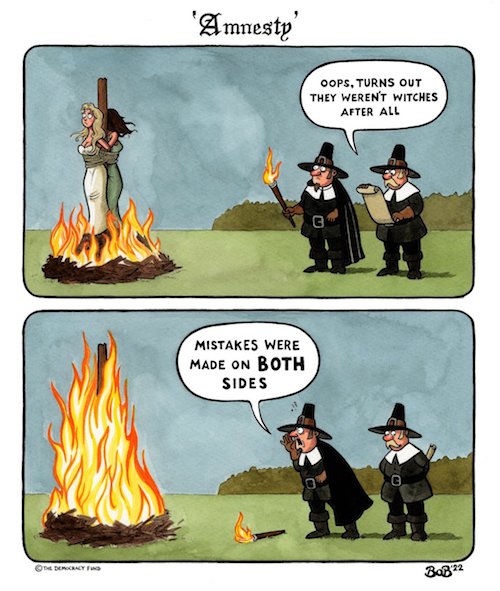

• Emily Oster’s Plea Bargain (Kunstler)

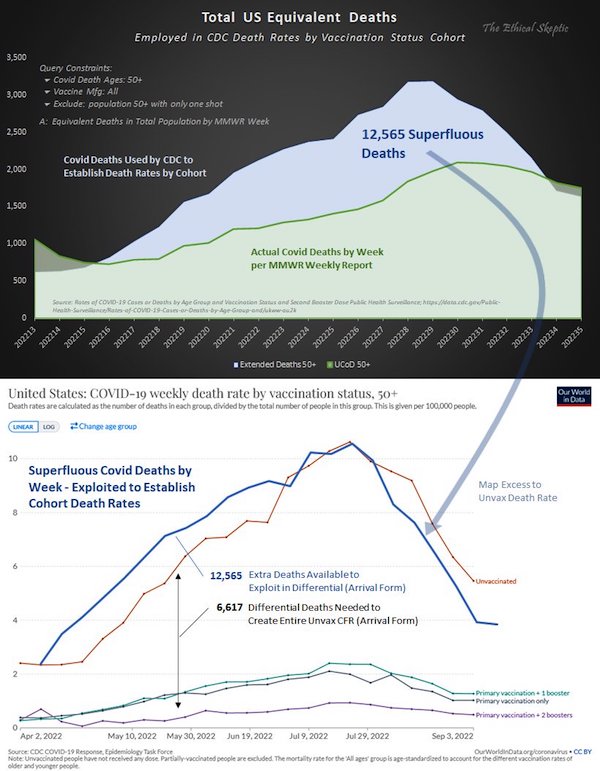

By now, everybody and his uncle has seen Emily Oster’s plea for “pandemic amnesty” in The Atlantic magazine, a house organ of the people in America who know better than you do about… really… everything. Emily’s wazoo is so stuffed with gold-plated credentials (BA, PhD, Harvard; economics prof at Brown U) it’s a wonder that she could sit down long enough to peck out her lame argument that “we need to forgive one another for what we did and said when we were in the dark about COVID.” Emily wasn’t “in the dark.” She had access to the same information as the Americans who recognized that everything the public health authorities, the medical establishment, and many elected officials shoveled out about Covid and its putative remedies and preventatives was untrue, with a patina of bad faith and malice — especially when it was used to persecute their political adversaries.

These dissenters turned out to be “right for the wrong reasons,” she declared, the main reason being that they were not aligned in good-think with the Woke-Jacobinism of her fellow “progressives” at Brown U, and academics all across the land, who were righteously busy destroying the intellectual life of the nation, making it impossible for the thinking class to think. Let’s face it: every society actually needs a thinking class, a cohort able to frame important issues-of-the-moment that require argument in the public arena to align our collective thoughts and deeds with reality. America used to have a pretty good thinking class, with a pretty good free press and many other platforms for opinion — all animated by respect for the first amendment to the Constitution.

The thinking class destroyed that by vigorously promoting a new censorship regime in every American institution, shutting down free speech and, more crucially, the necessary debate for aligning our politics with reality. Hence, America’s thinking class became the torchbearers of unreality, in step with the Party of Chaos which held the levers of power. This included the powers of life and death in the matter of Covid-19. These were the people who militated against effective early treatment protocols (to cynically preserve the drug companies’ emergency use authorization (EUA) and thus their liability shields); the people who enforced the deadly remdesivir-and-ventilator combo in hospital treatment; the people who rolled out the harmful and ineffective “vaccines”; who fired and vilified doctors who disagreed with all that; and who engineered a long list of abusive policies that destroyed businesses, livelihoods, households, reputations, and futures.

Normally October numbers rise for Christmas…

• What Employment? (Denninger)

Vomited up the Bureau of Lies and Scams did…. “Total nonfarm payroll employment increased by 261,000 in October, and the unemployment rate rose to 3.7 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred in health care, professional and technical services, and manufacturing.” Yeah-yeah. I pay near-zero attention to the headline, ever, and this was no exception to my rule in that regard. The market did the hanky-panky on the release but as I write this is up strongly, close to +50 handles on the Spoos. Why? Someone bothered to actually read the internals? I’m impressed, because the internals of the household survey, unadjusted, said +141k and out of that 111 of it came out of the “not in labor force” figures, so in fact its really about +30 net-net on the population itself.

In other words statistically zero. October is usually a very decent hiring month as, which we all know, there’s this thing called “Christmas” coming and the start of the hiring for it is usually reflected here. Prior to the pandemic in 2019 October was +589k on the same unadjusted household number, and 425k of that came from bench-sitters, so economic reasons were enough to get close to half a million off their butts. This time it was only good for 100k and the total impulse was basically all of that. Thus the market reaction: Pavlov’s Dog took this as “The Fed will slow down or reverse course.” Which, incidentally, means they probably won’t because, as I’ve pointed out, that Pavlovian response is exactly what The Fed needs to break before it can take its foot off the rate-increase gas and not only did the market exhibit the exact opposite when the announcement came out it confirmed it this morning.

“The FBI and its parent agency, the Justice Department, have become political institutions.”

• FBI Is ‘Rotted At Its Core,’ Republican Lawmakers Say (RT)

America is no longer a country where citizens are afforded equal justice under the law, as guaranteed by their Constitution, because the nation’s top law enforcement agency has been corrupted by politicized leadership and a “woke, leftist agenda” being imposed from the top, Republican lawmakers have claimed. The allegations were contained in a 1,050-page report released on Friday by Republican members of the House Judiciary Committee. The report, which was based on information gathered from 14 FBI whistleblowers who came forward to expose a pattern of misconduct, argued that the agency was “rotted at its core.” “Quite simply, the problem — the rot within the FBI — festers in and proceeds from Washington,” the report said. “The FBI and its parent agency, the Justice Department, have become political institutions.”

The report detailed such abuses as a secret partnership in which the FBI receives private information on conservative users from Facebook, without seeking their consent or going though the legal processes that would normally be required to tap such data. Whistleblowers also alleged that the FBI “looked the other way” on dozens of attacks against anti-abortion groups, even as the agency sent heavily armed teams of officers to arrest pro-life activists at their homes for alleged violations of selectively enforced crimes. Parents who spoke out at school board meetings over controversial policies were targeted by investigators as alleged terrorists.

At the same time, former FBI official Timothy Thibault “shut down” a probe into the overseas business dealings of President Joe Biden’s son, Hunter Biden, and attempted to keep the case from being reopened, the report said. Thibault openly displayed his political bias in social media posts that included his official title. “America’s not America if you have a Justice Department that treats people differently under the law,” Representative Jim Jordan, the ranking member of the House Judiciary Committee, told Fox News on Friday. “It’s supposed to be equal treatment under the law. That’s not happening, and we know it’s not happening because 14 brave FBI agents came to us as whistleblowers and told us what exactly is going on here.”

The report also accused the FBI of inflating statistics on domestic extremism to help fuel a narrative promoted by President Joe Biden’s administration. FBI employees who have conservative views are being purged from the agency, it claims. Republicans argued that the FBI was plagued by a “systemic culture of unaccountability,” as well as “rampant corruption, manipulation and abuse.” The agency’s shift toward “political meddling” has allegedly pulled resources away from legitimate law enforcement duties. For instance, one whistleblower claimed that he was told after the January 2021 US Capitol riot that child sex-abuse cases were “no longer an FBI priority and should be referred to local law enforcement agencies.”

CNN has more employees than viewers.

• Can Licht Make the Cuts? (Byers)

When Chris Licht became chairman and chief executive of CNN, back in May, his boss David Zaslav asked him to conduct a six-month review of the 4,500-person global news business. During the early months of that review, Licht would repeatedly tell members of his staff that the broad cost-cutting effort that was taking place across Warner Bros. Discovery would not result in layoffs at CNN. The parent company had more than $50 billion in debt, of course, and Zaz had promised to identify at least $3 billion in cost-cutting synergies across his new media empire, but Licht repeatedly assured staff that CNN would be spared: “As it relates to CNN, there are no layoffs per se,” Licht said at one staff-wide event in June. “A lay off is a downsizing, where you are given a target, and that is not happening at CNN.”

During the course of the review, however, Zaslav and his C.F.O. Gunnar Wiedenfelds asked Licht to engage in a hypothetical financial engineering exercise, sources with direct knowledge of the matter told me. If he were to cut costs at the company, how would he manage to achieve savings? Over time, the target number that Zaz and Gunnar were asking for became larger, and the exercise became less hypothetical. Then, last month, staring down the barrel of a recession and another disappointing earnings report, Zaz and Gunnar gave Licht a direct order: he needed to cut $100 million from CNN’s budget. Zaz’s team might argue that such an edict is financially responsible amid the current economic environment, but it is nevertheless significant. The figure, which CNN representatives declined to comment on, likely translates to almost 10 percent of CNN’s overall budget, sources familiar with the financials told me.

I guess I simply don’t understand where this satanic cult came from. It seems to have appeared from nowhere.

• Florida Bans Puberty Blockers, Transgender Surgery For Minors (SAC)

Breaking Friday, Florida’s Board of Medicine and state Board of Osteopathic Medicine voted to ban puberty blockers and sex-reassignment surgery for minors in the state. “The chief point of agreement among all of the experts — and I must emphasize this — is that there is a pressing need for additional, high-quality clinical research,” said the board of medicine’s chair, Dr. David A. Diamond, a radiation oncologist. More than 70 percent of children with gender dysphoria “typically outgrow” it, City Journal reported earlier this year.

National Review reports: “The board of medicine voted 6-3, with five others not present, on Friday to forbid doctors from prescribing puberty blockers and hormones or performing surgeries until a patient is 18. Exceptions will be made for children who are already receiving the treatment. The Florida Board of Osteopathic Medicine also voted to ban the use of puberty blockers and sex-reassignment surgery in new patients who are minors but allowed an exception for children enrolled in clinical studies. Florida is also one of at least nine states that prohibits Medicaid coverage of gender-transition services.”

Canada is lost.

• Vaccine-Doubting Doctor Ordered To Pay $1m In Legal Costs (NP)

When a host of doctors, academics and journalists criticized her COVID vaccine-doubting, anti-lockdown views, Dr. Kulvinder Kaur Gill struck back, filing a $12-million libel suit against them. A judge this week ordered the pediatrician in Brampton, west of Toronto, to pay the defendants as much as $1.1 million in legal costs after her lawsuit was struck down earlier this year as a potential curb on important public debate. Part of the costs were assigned to a fellow plaintiff, Dr. Ashvinder Kaur Lambda, who sued only two of the 23 defendants, but Gill is on the hook for the bulk of the hefty award.

Justice Elizabeth Stewart said the cost sum was appropriate, noting that the damages sought by the two physicians in their suit was “a considerable sum by any calculation and of understandably great concern” to the people they sued. “Although the individual … plaintiffs are not substantial corporations or institutions, they are educated persons who were represented by counsel throughout,” she added. Meanwhile, the doctor faces more legal trouble at Ontario’s College of Physicians and Surgeons. After cautioning Gill last year over some of her COVID statements, the regulator ordered her earlier this month to appear on similar charges before a discipline tribunal, a sort of trial where a guilty verdict could lead to revocation of her licence.

Asian leopard cat. Its markings look like a python.

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.