Pieter Bruegel the Elder Children’s games 1560

In England during weeks 36 to 39 in 2020, there were 571 COVID deaths.

In the same period in 2021, there were 3,026 COVID deaths.

2,281 (75%) of these deaths were fully vaccinated, i.e. >= 14 days post dose 2.

Rogan and Gupta

Joe Rogan explaining why lots of parents don’t want their kids vaccinated for COVID to CNN’s Dr. Gupta is priceless. Dr. Gupta’s brain totally froze in response. pic.twitter.com/U4F9ZUSWY4

— Robby Starbuck (@robbystarbuck) October 14, 2021

Joe Rogan asks Sanjay Gupta why CNN lied about Joe taking horse dewormer. Whole pod is worth a listen. pic.twitter.com/uvPLwfINd7

— rr (@remingtonreid) October 13, 2021

“You cannot interchange BioNTech’s Cominarty with Pfizer’s [shot] from a legal standpoint. They are legally distinct.”

What an odd game this has become.

• Pfizer’s COVID-19 Vaccine With Comirnaty Label Still Not Available in US (ET)

Officials in 19 states confirmed this week to The Epoch Times they have not received doses of Pfizer’s COVID-19 vaccine labeled Comirnaty. So did pharmacies in New York, California, and Missouri. A Pfizer spokesperson told The Epoch Times in an email that there are no doses of Comirnaty in the United States as of Oct. 12. “The FDA-approved Comirnaty and the EUA-authorized Pfizer-BioNTech COVID-19 vaccine have the same formulation and, according to the FDA labeling, can be used interchangeably to provide the COVID-19 vaccination series,” a Pfizer spokesman told The Epoch Times. However, lawyers representing clients challenging vaccine requirements, say the lack of availability means vaccine mandates based on the Food and Drug Administration (FDA) approval are unlawful.

“Under the emergency use authorization, everyone has an option to accept or refuse the product. And that means every person, military and civilian. So this is critical. All of the mandates, from the military to the civilian population, are violating federal law,” Mathew Staver, chairman of Liberty Counsel, a Christian legal group, told The Epoch Times. The situation would be different if Comirnaty was available, Staver said. “You cannot interchange BioNTech’s Cominarty with Pfizer’s [shot] from a legal standpoint. They are legally distinct.” Contact with state and federal officials and pharmacies revealed widespread confusion regarding the differences between the approved Pfizer-BioNTech vaccine and the version that received emergency use authorization (EUA) in December 2020 and continues to be administered under EUA now.

A number of officials were unaware of any differences and others insisted they were the same for all intents and purposes, including several officials with the Department of Health and Human Services (HHS), which handles distribution of COVID-19 vaccines. “It’s the same thing,” an HHS official told The Epoch Times. That’s a different message than that being sent to states, some of which have been told by federal officials not to expect doses of Comirnaty for a while. “The CDC anticipates that Comirnaty will begin to ship some time in November at the earliest,” a spokesman for the Arizona Department of Health told The Epoch Times in an email, referring to the Centers for Disease Control and Prevention. “The Maryland Department of Health has been told by the CDC that Comirnaty will not ship until the end of October/beginning of November,” a spokesman with the Maryland Department of Health told The Epoch Times in an email.

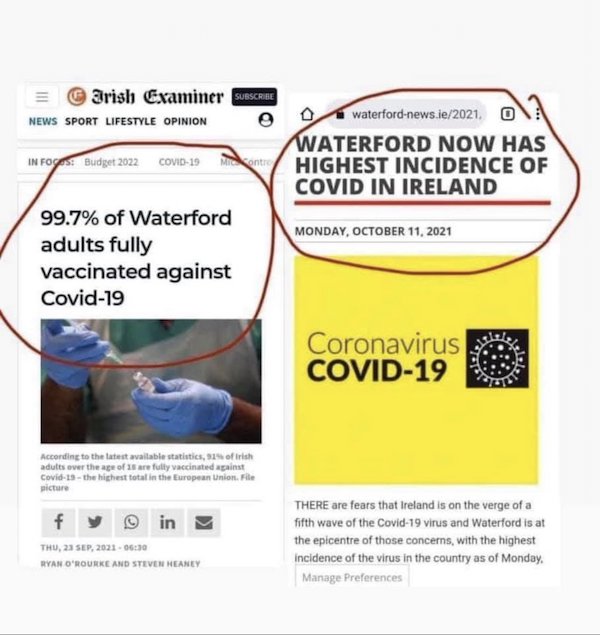

What a success story!

• Modelling: Covid Cases Could Peak At 5,300 A Week In Auckland Next Year (G.)

New Zealand is preparing to face up to 5,300 cases of Covid-19 a week in Auckland and the neighbouring region of Northland alone next year, even with a vaccination rate of 90%, according to modelling from the Ministry of Health. The minister of health, Andrew Little revealed the plan for how the health system could manage a surge in cases after the current vaccination drive, as the country recorded 71 new cases on Thursday. It includes upping intensive care (ICU) beds, preparing to relocate health staff to smaller regions if an outbreak emerges, giving nurses preemptive ICU training and preparing to support people recovering at home.

The number of people in ICU and high dependency units (HDU) is currently at roughly two-thirds of capacity and 16% of available ventilators are being utilised. The capacity ICU and HDU beds nationwide can be surged to 550 beds from its current capacity of 320-340 beds. Ministry of Health chief medical officer Andrew Connolly said the system is well prepared, but any system would be overwhelmed if the numbers became too great. Between 0.2 and 0.4% of Delta patients will require ICU care, while the others may need a “short, sharp burst” of hospital-level care, Connolly said. Providing vaccination levels are high, the vast number of cases would be able to recover at home in the future, with about 5% needing hospital care, Little said.

Mere days after it was recommended for Covid. Next week: vitamin D.

• Aspirin Not Recommended For Most Adults To Prevent Heart Attacks (Hill)

An influential U.S. panel of experts changed its recommendations for people who take low dosages of aspirin in order to prevent first heart attacks or strokes. The U.S. Preventative Services Task Force in a draft proposal released Tuesday recommended that adults ages 40 to 59 should only be taking low dosages of the blood thinner if their physician determines that they are at high risk for cardiovascular disease. Aspirin acts as an anticoagulant, which means it aids in preventing blood clots from forming, which is how heart attacks and strokes typically develop. Taking daily doses of aspirin was thought to lower the risk of these clots, and therefore lower the risk of heart disease and stokes.

In addition, the new guidance detailed in the draft recommends that people over the age of 60 not take aspirin to prevent first heart attacks or strokes. Previously, guidance had recommended a daily regimen of low-dose aspirin for people over the age of 50 who were at higher risk for heart attacks or strokes in the next decade, as long as they were not at a higher risk of bleeding. This move marks the first time that a U.S. health task force has recommended that adults in their 40s speak with their doctors about aspirin for heart health. This draft recommendation does not apply to people who have already suffered a heart attack or stroke. The task force still recommends that those people take aspirin preventatively.

“The latest evidence is clear: starting a daily aspirin regimen in people who are 60 or older to prevent a first heart attack or stroke is not recommended,” Tseng said in a statement. “However, this Task Force recommendation is not for people already taking aspirin for a previous heart attack or stroke; they should continue to do so unless told otherwise by their clinician.”

Ishmael is Karl Denninger’s alter ego.

Strikes and quitting jobs are the last peaceful means left before the guns and gasoline come out. If the right 10% of Americans quit, the ones who move people and freight around the country, clown world would disappear in a week. Even idiots in D.C. will understand when their grocery store shelves are bare. When planes and trains don’t move, they’ll get it. Those folks have the ability to end it the quickest, but what about everyone who doesn’t work in transportation? Same thing, strikes and walkouts work. Twenty percent of the workers at any job do 80% of the work. If you’re in the 20%, you leaving throws things into chaos. Oh, the company might not realize it for a while since many have a lot of vacation and sick leave to burn before slamming the door. Companies who pontificated how replaceable everyone is are going to find out the hard way they’re wrong.

Oops. When 80% of the money and productivity walk out the door they can’t import an H1B or hire a recent college grad. Training? Forget it. The company is stuck with a huge, gaping knowledge hole and the only one capable of training the replacement walked out the door! Don’t have one of those sexy jobs? You might be part of the 20% and not realize it. This could be as simple as being the only person who knows how to order supplies in a timely manner or does all the little things everyone takes for granted but no one knows exactly who does it. The secretary throws sand into the gears on her way out because a design engineer has to figure out how to order post-its. And God help you if the person who walks is in payroll. Whoever you are, you have the ability to bankrupt the company.

Who are your allies? What pool of people out there are most likely to act along with you (striked and quitting)? Some allies are obvious: folks in the “ain’t no way, no how, no body jabbing me,” crowd are natural allies. Their actions perfectly align. Jab mandate? Good-bye, and the door will not hit them on the way out. Some people got the first round of clot shots, but don’t believe in mandates. If they strike or walk, they’re allies. Some will, some won’t. If they are supportive, they aren’t enemies, which counts for something. Some want you to take the jab because they did. These are not allies. They range from idiots to true believers. Don’t engage with idiots. Don’t explain how to pour water out of a boot, they’ll never acknowledge the boot or water exist. Save your energy for the enemy: the true believer. There’s the pool of potential allies.

Looks pretty shallow: purebloods with ****-you money and maybe a few sympathizers. Remember the 20% rule and don’t lose hope. But wait purebloods, there is another group of natural allies: Those who got ****ed by the vax and survived (so far). People whose loved ones face expensive health problems are going to sit this one out. The parent who was “so proud” of their kid for getting the clot shot only to have him end up in the ICU with a heart attack? They are going to do whatever it takes to pay for the best treatments possible, including ****ing themselves up the ass to keep their insurance. These are not the allies. The working adults who got screwed by the vax are. Screwed. Hospitalizations, cancer, autoimmune disorders, permanent disabilities. Not sick for three days, screwed by life altering side effects. Why are they allies? ALLIES ACT. The act is “not working.”

Mixed messages at best.

• Southwest CEO Says No Employees Will Be Fired Over Vaccine Mandate (AmG)

During an interview with ABC News Tuesday, Gary Kelly, the CEO of Southwest Airlines, stated that no employees will be fired over the company’s vaccine mandate. However, the airline announced on October 4 that all 56,000 U.S. Southwest employees needed to get vaccinated against COVID-19 by November 24, or face termination. The CEO also told ABC’s George Stephanopoulos that there was “no evidence” that any type of demonstration against the mandate had contributed to the massive service disruptions over the holiday weekend. Over 2,000 Southwest flights were cancelled, leaving tens of thousands of passengers stranded. “There’s just no evidence of that,” Kelly said. “Our people are working very hard, they’re doing a great job, I’m very proud of them.”

He did acknowledge that the vaccine mandate is “very controversial,” and not something he wanted for his company. “This is a government mandate, it’s a presidential order, and we’re doing our best to comply with that according to the deadlines that have been set,” Kelly said. The CEO told employees last week that the airline had no choice but to comply with the regime’s vaccine mandate. “Southwest Airlines is a federal contractor and we have no viable choice but to comply with the U.S. government mandate for employees to be vaccinated, and — like other airlines — we’re taking steps to comply,” Kelly said. An executive order was issued last month requiring all federal employees to get vaccinated, but no executive order, or federal regulation has yet been issued for private companies.

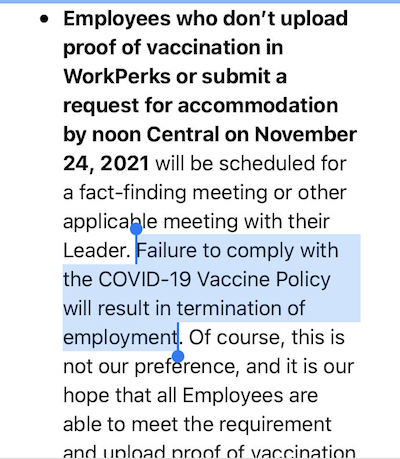

Joe Biden on September 9 unveiled his draconian plan to force all private businesses with more than 100 employees to make their workers get inoculated with the experimental COVID vaccines, or face weekly testing. A month later, no official guidance on the alleged mandate has been issued by the White House, the Occupational Safety and Health Administration (OSHA), or the Department of Labor. During his interview on ABC Tuesday, Kelly stated that Southwest would not be terminating any employees who refuse the injections. “We’re not going to fire any employees over this. We’re urging all of our employees to get vaccinated. If they can’t get vaccinated, we’re urging them to seek an accommodation, so we’ll do everything we can to support our people here,” he said. The guidance below went out to all Southwest employees on October 4:

“I do not believe the city has the authority to mandate that to anybody, let alone that information about your medical history.”

• Chicago Police Union Head Urges Cops To Defy Vaccine Mandate (AP)

The head of the Chicago police officers union has called on its members to defy the city’s requirement to report their COVID-19 vaccination status by Friday or be placed on unpaid leave. In the video posted online Tuesday and first reported by the Chicago Sun-Times, Fraternal Order of Police President John Catanzara vowed to take Mayor Lori Lightfoot’s administration to court if it tries to enforce the mandate, which requires city workers to report their vaccine status by the end of the work week. After Friday, unvaccinated workers who won’t submit to semiweekly coronavirus testing will be placed on unpaid leave.

Catanzara suggested that if the city does enforce its requirement and many union members refuse to comply with it, “It’s safe to say that the city of Chicago will have a police force at 50% or less for this weekend coming up.” In the video, Catanzara instructs officers to file for exemptions to receiving the vaccine but to not enter that information into the city’s vaccine portal. He said that although he has made clear his vaccine status, “I do not believe the city has the authority to mandate that to anybody, let alone that information about your medical history.”

During a news conference Wednesday, Lightfoot accused Catanzara of spreading false information and dismissed most of his statements as “untrue or patently false.” She said COVID-19 vaccines are proven to be effective and that getting vaccinated would protect city workers and their families. “What we’re focused on is making sure that we maximize the opportunity to create a very safe workplace,” Lightfoot said. “The data is very clear. It is unfortunate that the FOP leadership has chosen to put out a counter narrative. But the fact of the matter is, if you are not vaccinated, you are playing with your life, the life of your family, the life of your colleagues and members of the public.”

Hot potatoes.

• Vaccine Mandate Challenges Falter, Judges Shrug At Natural Immunity (JTN)

Legal challenges to COVID-19 vaccine mandates on the basis of natural immunity are faltering, even as more research shows the comparable durability of the protection that natural antibodies afford against infection. U.S. District Judge Paul Maloney denied a preliminary injunction Friday against Michigan State University’s mandate, citing an order last month that left in place the University of California’s mandate as litigation proceeds. The course of litigation seems to be substantiating a warning by University of Notre Dame Law Professor Gerard Bradley, a vocal critic of mandates, that judges would be “very wary” of lawsuits that are “very heavily dependent upon medical facts and statistics.”

Religious challenges are faring better. A federal judge Tuesday blocked New York Gov. Kathy Hochul from removing religious exemptions from a vaccine mandate for healthcare workers originally imposed by her predecessor, the disgraced Andrew Cuomo. Illinois Gov. J.B. Pritzker is also seeking to “clarify” a state law that bans discrimination by public or private institutions based on a person’s “conscientious refusal to receive” healthcare services. Pritzker’s spokesperson told ABC 7 the Health Care Right of Conscience Act is at risk of being “misinterpreted by fringe elements.” The Fraternal Order of Police said it’s considering invoking the law against Chicago Mayor Lori Lightfoot’s COVID vaccine mandate for city employees.

As noted by the New Civil Liberties Alliance (NCLA), which is representing MSU employee Jeanna Morris, Judge Maloney previously issued an injunction against a vaccine mandate that violated the religious beliefs of student athletes, who “had no immunity whatsoever.” The public interest law firm didn’t answer a query from Just the News on whether it plans to revisit its litigation strategy in the wake of these setbacks. Its first natural immunity challenge prompted George Mason University to issue a medical exemption to law professor Todd Zywicki, but the vaccine mandate remains in force. The latest study to verify the protective power of natural immunity was published this week in the Journal of the American Medical Association Internal Medicine.

In a study of more than 800,000 Swedish families, Scandinavian university researchers found that family members without “immunity” — prior infection or vaccination — had a 45-97% lower risk of COVID infection “as the number of immune family members increased.” “The results were similar for the outcome of COVID-19 infection that was severe enough to warrant a hospital stay,” they wrote. Notably, the researchers weren’t able to perform a sensitivity analysis in fully vaccinated individuals because too few participated in the study. Vaccination is also proving insufficient to protect older people, according to U.K. government figures published last week that showed fully vaccinated older age groups now had higher infection rates than unvaccinated younger age groups.

In what context do you send someone that you know the other side absolutely despises?

• Victoria Nuland Is In Moscow Negotiating The Status Of Ukraine’s Donbass (ZH)

Look who’s back in Eastern Europe – this time forced to deal directly with the Kremlin after a half-decade of military and political stalemate in war-torn eastern Ukraine. Victoria “F*ck The EU” Nuland is currently in Moscow for high-level talks with top Russian officials. Among multiple tense issues, there’s reportedly been progress on the situation in eastern Ukraine, related to working out a potential lasting political settlement leading to the cessation of violence there. As Biden’s Under Secretary for Political Affairs, Nuland kicked off three days of talks Tuesday and into Wednesday with Yury Ushakov, the top foreign policy aide to Putin. Interestingly the Kremlin agreed to a temporary lifting of travel sanctions against her just to enter the country for the meeting.

After initial meetings, Nuland hailed “the frank, productive review” of US-Russia relations, noting that the two sides are “committed to a stable, predictable relationship,” according to a US Embassy statement. On Tuesday after her arrival she had met with Deputy Foreign Minister Sergey Ryabkov, reportedly for more than an hour-and-a-half. The US side has indicated “no breakthroughs” in US-Russia relations as of yet, which comes after a year of sanctions and counter-sanctions targeting diplomats and mutual restrictions on media entities. It’s among the highest level meetings since Putin and Biden’s June summit in Geneva where the two leaders pledged better, frank and open communication – given Nuland is the number three highest official at the State Department.

While the American delegation hasn’t commented to this level of specifics, Russian media is citing Kremlin deputy chief of staff Dmitry Kozak as saying after Wednesday meetings that “A thorough and constructive dialogue took place regarding the settlement of the conflict in south-east Ukraine.” Kozak told the top daily newspaper Kommersant that there’s general agreement over mutual recognition of special autonomy for Donbass – where the Russia-backed, self-proclaimed Donetsk People’s Republic and Lugansk People’s Republic have been in a military stalemate with Ukrainian national forces for the past six years: “It was confirmed that the Minsk agreements remain the only basis for a settlement,” he continued. “During the talks, the US confirmed its position… that significant progress towards the settlement of the conflict is unlikely without any agreement on future parameters of Donbass autonomy. In other words, giving the region a special status within Ukraine.”

You’ll own nothing and you’ll be happy.

• The Hidden $150 Trillion Agenda Behind The Climate Change “Crusade” (ZH)

Responding rhetorically to the key question, “how much will it cost?”, BofA cuts to the case and writes $150 trillion over 30 years – some $5 trillion in annual investments – amounting to twice current global GDP! At this point the report gets good because since it has to be taken seriously, it has to also be at least superficially objective. And here, the details behind the numbers, do we finally learn why the net zero lobby is so intent on pushing this green utopia – simple answer: because it provides an endless stream of taxpayer and debt-funded “investments” which in turn need a just as constant degree of debt monetization by central banks.

Consider this: the covid pandemic has so far led to roughly $30 trillion in fiscal and monetary stimulus across the developed world. And yet, not even two years later, the effect of this $30 trillion is wearing off, yet despite the Biden’s admin to keep the Covid Crisis at bay, threatening to lock down society at a moment’s notice with the help of the complicit press, the population has made it clear that it will no longer comply with what is clear tyranny of the minority. And so, the establishment needs a new perpetual source (and use) of funding, a crisis of sorts, but one wrapped in a virtuous, noble facade. This is where the crusade against climate change comes in.

Much digital ink has been spilled on the philosophy and debate behind the green movement, and we won’t bore you with the details, but we will instead focus on the very clear, and very tangible financial consequences of a world where the establishment agrees, whether with democratic support or not, to allocate $5 trillion in new capital toward some nebulous cause of “fighting global warming.” Here are the highlights from Bank of America:

• Will it be inflationary? Yes, expect 1-3% pa shock. This is for the next 30 years… over and on top of any already present inflation!

• What are the bottlenecks? Geopolitics, climate wars and EM.

• Do we have the resources? Nickel and Lithium are just two that could be in deficit as soon as 2024.

• Is green technology really green? Not really (see below).Drilling down on the absolutely staggering costs, at an estimated $150 trillion over 30 years, boosting funding sources to $5tn a year is equivalent to the entire US tax base, or 3x the COVID-19 stimulus this decade. Here are the details: The energy transition to a net zero greenhouse gas (GHG) economy by 2050 will be a very expensive exercise, estimated by the IEA at $150tn of total investment, over a period of 30 year. At $5tn p.a, the IEA see it costing as much as the entire US tax base every year for 30 years. Not high enough for you? Hang on then because… BNEF has a higher estimate that the total investment needed for energy supply and infrastructure could be as high as $173tn through 2050, or up to $5.8tn annually, which is nearly three times the amount invested on an annual basis today.

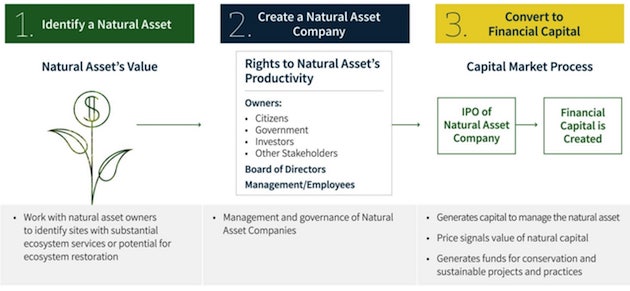

Nature exists to be exploited.

• Wall Street’s Takeover of Nature Advances with Launch of New Asset Class (Webb)

Last month, the New York Stock Exchange (NYSE) announced it had developed a new asset class and accompanying listing vehicle meant “to preserve and restore the natural assets that ultimately underpin the ability for there to be life on Earth.” Called a natural asset company, or NAC, the vehicle will allow for the formation of specialized corporations “that hold the rights to the ecosystem services produced on a given chunk of land, services like carbon sequestration or clean water.” These NACs will then maintain, manage and grow the natural assets they commodify, with the end of goal of maximizing the aspects of that natural asset that are deemed by the company to be profitable.

Though described as acting like “any other entity” on the NYSE, it is alleged that NACs “will use the funds to help preserve a rain forest or undertake other conservation efforts, like changing a farm’s conventional agricultural production practices.” Yet, as explained towards the end of this article, even the creators of NACs admit that the ultimate goal is to extract near-infinite profits from the natural processes they seek to quantify and then monetize. NYSE COO Michael Blaugrund alluded to this when he said the following regarding the launch of NACs: “Our hope is that owning a natural asset company is going to be a way that an increasingly broad range of investors have the ability to invest in something that’s intrinsically valuable, but, up to this point, was really excluded from the financial markets.”

Framed with the lofty talk of “sustainability” and “conservation”, media reports on the move in outlets like Fortune couldn’t avoid noting that NACs open the doors to “a new form of sustainable investment” which “has enthralled the likes of BlackRock CEO Larry Fink over the past several years even though there remain big, unanswered questions about it.” Fink, one of the world’s most powerful financial oligarchs, is and has long been a corporate raider, not an environmentalist, and his excitement about NACs should give even its most enthusiastic proponents pause if this endeavor was really about advancing conservation, as is being claimed.

The creation and launch of NACs has been two years in the making and saw the NYSE team up with the Intrinsic Exchange Group (IEG), in which the NYSE itself holds a minority stake. IEG’s three investors are the Inter-American Development Bank, the Latin America-focused branch of the multilateral development banking system that imposes neoliberal and neo-colonalist agendas through debt entrapment; the Rockefeller Foundation, the foundation of the American oligarch dynasty whose activities have long been tightly enmeshed with Wall Street; and Aberdare Ventures, a venture capital firm chiefly focused on the digital healthcare space. Notably, the IADB and the Rockefeller Foundation are closely tied to the related pushes for Central Bank Digital Currencies (CBDCs) and biometric Digital IDs.

Support the Automatic Earth in virustime; donate with Paypal, Bitcoin and Patreon.