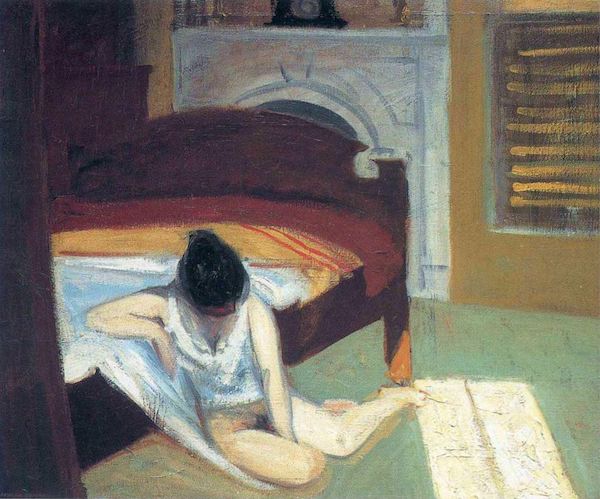

Edward Hopper Summer interior 1909

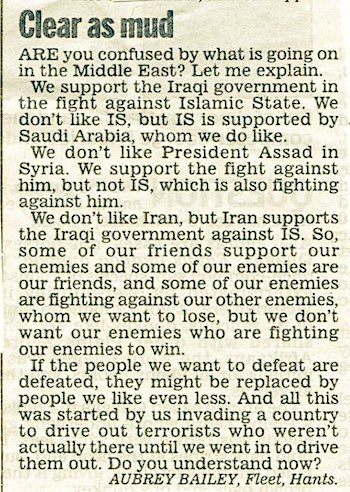

Think this is from France. Could be anywhere though. It’s the simplicity that counts.

Twitter thread.

We’re going to see lockdowns implemented just to hide the fact that it’s the vaccinated who get infected most. If you lock down before that becomes public knowledge, you can still blame the virus itself.

• Something Really Odd Is Going On (CR)

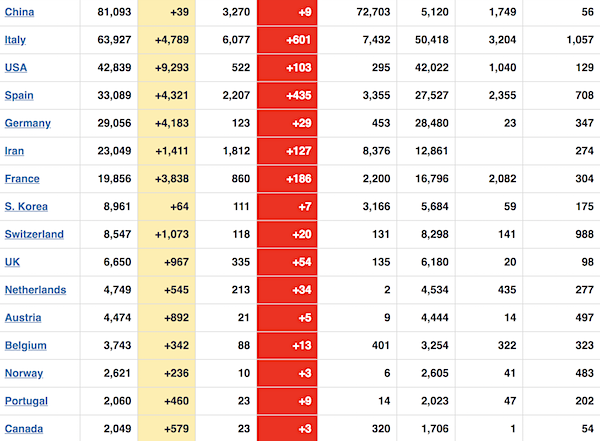

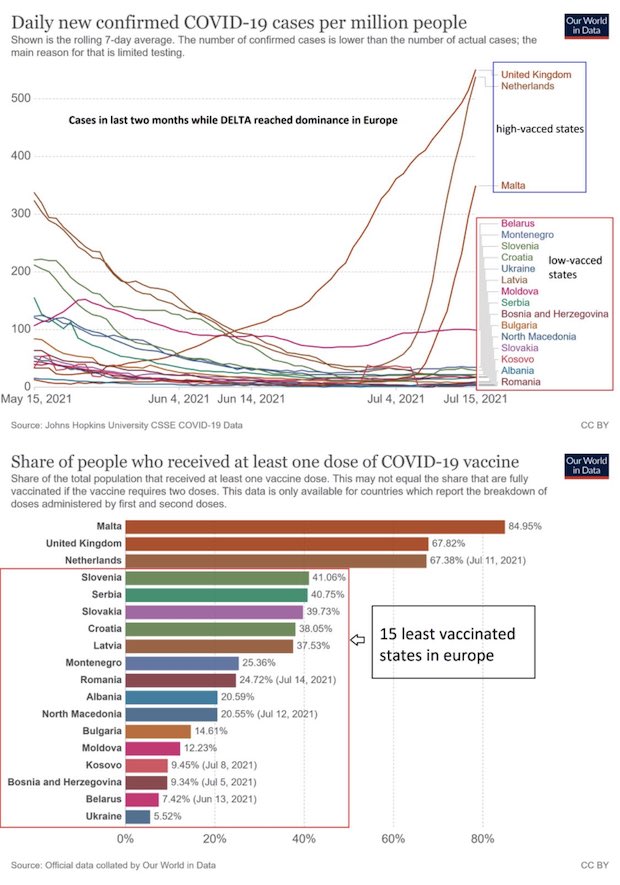

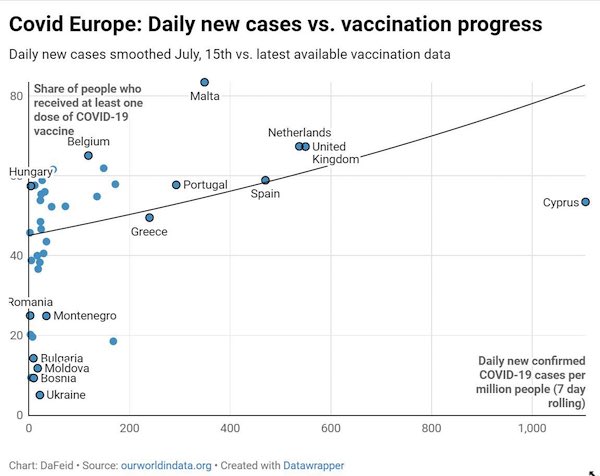

Something really odd is going on: In Europe we are seeing surges at many places where most of the population has already been vaccinated. At the same time, the 15 least vaccinated countries don‘t seem to face any problem. At some point, denying this problem will get painful.

Also take a look at what went on in the 15 most vaccinated countries worldwide:

Time to count hospitalizations only. “Cases” has become meaningless.

• As Covid Cases Rise, Gibraltar Tightens Rules On Isolation (GBC)

The rules which require close contacts of a positive case to self-isolate have been tightened in view of the increase in the number of active cases of COVID-19 in Gibraltar. 32 new cases were confirmed on Friday, bringing the total number of active cases up to 164. Of the new cases, 29 are vaccinated, and only three are unvaccinated. There is one case in the Covid ward, but none in Critical Care or ERS. There are now 574 in self-isolation. Up until now, a vaccinated close contact of a positive case didn’t need to self-isolate. That person could leave home as long as a mask was worn in all settings, and could even continue to go to work depending on the circumstances of the workplace.

Those rules have now changed. The Delta variant of the virus is more contagious and therefore spreads more quickly – this means that if someone in a household contracts the disease, the likelihood is that other members of that same household will follow. Household contacts of a positive case are now required to self-isolate whether they have been vaccinated or not. The Contact Tracing Bureau will at first circulate a text message to all known contacts. This will be followed by a telephone call to each of them where the details surrounding the nature of the contact will be discussed, looked at more closely and new instructions issued accordingly.

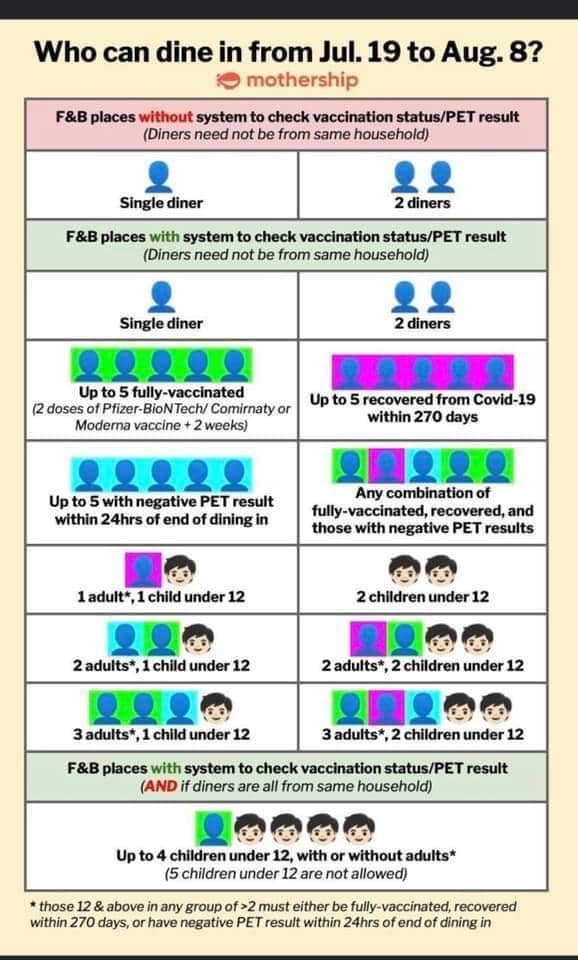

“..the “Happy Badge” that only gives access to weddings and similar events with more than 100 guests to those who are vaccinated, recovered or holders of a recent negative coronavirus test.”

But you just said half of the current virus carriers are vaccinated! And they can still go to weddings?

• Pfizer Covid Vaccine Significantly Less Effective Against Delta Variant (JP)

The effectiveness of the Pfizer vaccine against the Delta variant is “weaker” than health officials hoped, Prime Minister Naftali Bennett said Friday, as 855 people tested positive for coronavirus and more countries were added to the list of places having high infection rates. “We do not know exactly to what degree the vaccine helps, but it is significantly less,” Bennett said. The prime minister held a meeting of top health officials and ministers to discuss the next steps for managing the virus in light of the numbers in Israel and what Bennett described as “the Delta mutation leaping forward around the world, including in vaccinated countries such as Britain, Israel and the US.”

He said that in “Britain, in recent days, we have seen a jump in the number of children who are being hospitalized on a daily basis. This is a development that we are aware of; we are dealing with it rationally and responsibly.” The highest number of coronavirus cases since March was diagnosed on Thursday, with 1.52% of tests returning positive, the Health Ministry said in a Friday announcement. While the spike in daily cases continues, the increase in serious morbidity has remained limited. Of those infected, 52 were in serious condition, two less than the day before. A week earlier, there were 41. In April, with about 5,900 active cases, similar to the current number, more than 340 patients were in serious condition.

The likely explanation is that among the current virus carriers, some 2,000 are schoolchildren, and half of them were fully vaccinated. Both groups are very unlikely to develop severe forms of the disease, even though it occasionally happens. At the moment, around 60% of the patients in serious conditions were vaccinated. “Percent of cases that turn critically ill is now 1.6%, compared to 4% at a similar stage in the 3rd wave when there were no vaccines,” Prof. Eran Segal, a computational biologist at the Weizmann Institute of Science who advises the coronavirus cabinet, tweeted on Friday. He said that “In case of continued increase in cases, many more cases will be needed than in the 3rd wave to reach similarly high numbers of critically ill patients in the hospitals. This will contribute significantly to population-level immunity.”

[..] .. the ministers agreed to prepare for enforcing the “Happy Badge” that only gives access to weddings and similar events with more than 100 guests to those who are vaccinated, recovered or holders of a recent negative coronavirus test. The system is only relevant for indoor gatherings where food and drinks are served and people both sit and stand. There will be no cap on participants, and people will be required to wear masks.

In almost very country, estimates of people vaccinated are grossly exaggerated.

• Biden’s Vaccine “Strike Force” Plan Stinks Of Desperation (Smith)

In the meantime, Biden has shipped over 500 million covid vaccine doses overseas in June while at the same time claiming that the US was on track to meet his 70% vaccination goal by July 4th. Needless to say this never happened. The Biden admin now claims that the US population is now 67% vaccinated, and if this was actually true then it would be very close to meeting Anthony Fauci’s original guidelines for herd immunity. So why all the frantic hype about unvaccinated people? Firstly, Fauci has continually moved the goal posts for herd immunity to the point that he is now telling the public to ignore herd immunity altogether and that the only option is to get EVERYONE vaccinated. Many of us in the liberty media said this is exactly what he would do, and he has proven to be incredibly predictable.

Secondly, the CDC vaccination numbers seem to be inflated in order to create a manufactured consensus. While claiming an overall vaccination rate of 67%, CDC stats indicate a maximum of around 184 million Americans with at least one dose, then indicate 160 million people with a double dose. Yet, according to the Mayo Clinic data map, only four states have a vaccination rate of 67% or more, all in the Northeast. Even California and New York are well under 67%, and the vast majority of states are sitting at around 50% or less. Frankly, I don’t believe the CDC vaccine numbers at all. New dosage numbers are plunging across the US according to state officials; anyone who hasn’t been jabbed by now is not going to get jabbed unless they are forced to. There are no long lines for vaccines. No wait times.

The CDC has even removed the wait time between doses. And still, CVS and Walgreens have been throwing away expired doses by the hundreds of thousands. If we look at the CDC stats for full vaccination we are closer to 51% of the total US population, which matches more accurately with the Mayo Clinic state statistics. There is no indication that this percentage will be growing beyond the 51% mark anytime soon, if the stats are accurate at all. This means that at least half the US population is in defiance of the program. This is probably why Fauci and Biden have become more aggressive in their vaccination agenda the past month. If they were getting the nearly 70% vax rates they claim, then they would not be stomping their feet indignantly over unvaccinated people.

The stats show a HUGE number of Americans are refusing to take the jab – There’s a vast army of us out there, and this is a good thing. Why? Because there is simply no reason to take the experimental mRNA vaccine.

Don’t be fooled by Facebook protesting this. This is a multi-headed monster.

• Biden Says Social Media Misinformation On Covid ‘Killing People’ (Y!)

President Joe Biden said Friday that social media misinformation about Covid-19 and vaccinations is “killing people” and the White House said Facebook needs to clean up its act. “They’re killing people. The only pandemic we have is among the unvaccinated. And they’re killing people,” Biden told reporters at the White House, as he left for a weekend at the presidential retreat in Camp David. The White House is turning up the pressure on social media companies to weed out what officials say is widely spread misinformation on coronavirus vaccinations. According to US health officials, a current spike in Covid-19 deaths and illnesses around the country is almost exclusively hitting people who remain unvaccinated.

“There is a clear message that is coming through: this is becoming a pandemic of the unvaccinated,” Centers for Disease Control and Prevention director Rochelle Walensky told reporters on Friday. Many of those refusing vaccinations, despite the ease of availability throughout the United States, have said they do not trust the shots. Skepticism is being fueled both by false posts spread by anti-vaccine activists online and by Republican politicians claiming the vaccinations are part of attempts at government control. White House Press Secretary Jen Psaki said that Facebook and others are not doing enough to push back. “Everybody has a role to play in making sure there’s accurate information,” she said.

Psaki said the White House was taking a more active approach in calling out what it sees as misinformation but insisted that Facebook in particular should react more quickly in taking down problematic posts. “There’s about 12 people who are producing 65 percent of anti-vaccine misinformation on social media platforms. All of them remain active on Facebook, despite some even being banned on other platforms,” Psaki said, without identifying those dozen posters. The White House has “proposed that they create a robust enforcement strategy that bridges their properties and provides transparency about the rules,” she said.

Must make AG Garland nervous too.

• White House Admits to Flagging Posts For Facebook (Turley)

We have previously discussed the extensive censorship programs maintained by Big Tech, including companies like Twitter and Facebook taking sides in major controversies from gender identification to election fraud to Covid-19. The rise of corporate censors has combined with a heavily pro-Biden media to create the fear of a de facto state media that controls information due to a shared ideology rather than state coercion. That concern has been magnified by demands from Democratic leaders for increased censorship, including censoring political speech, and now word that the Biden Administration has routinely been flagging material to be censored by Facebook.

White House Press Secretary Jen Psaki admitted that the Biden administration is working with Facebook to flag “problematic” posts that “spread disinformation” on COVID-19. She explained that the Administration has created “aggressive” policing systems to spot “misinformation” to be “flagged” for the social media companies. Obviously, anyone can object to postings. There is a greater danger when the government has a systemic process for aggressively flagging material to be censored. The real problem however is with the censorship system itself. We have seen how there needs to be little coordination between political figures and the media to maintain controlled narratives in public debates and discussions. The concern is obvious that this allows for a direct role of the government in a massive censorship program run by private companies.

There have been repeated examples of the censoring of stories that were embarrassing or problematic for the Biden Administration. Even when Twitter expressed regret for the censoring of the Hunter Biden laptop story before the election, there was an immediate push back for greater censorship from Democrats. The concern is that these companies are taking to heart calls from Democratic members for increased censorship on the platform. CEO Jack Dorsey previously apologized for censoring the Hunter Biden story before the election. However, rather than addressing the dangers of such censoring of news accounts, Senator Chris Coons pressed Dorsey to expand the categories of censored material to prevent people from sharing any views that he considers “climate denialism.”

Likewise, Senator Richard Blumenthal seemed to take the opposite meaning from Twitter, admitting that it was wrong to censor the Biden story. Blumenthal said that he was “concerned that both of your companies are, in fact, backsliding or retrenching, that you are failing to take action against dangerous disinformation.” Accordingly, he demanded an answer to this question: “Will you commit to the same kind of robust content modification playbook in this coming election, including fact checking, labeling, reducing the spread of misinformation, and other steps, even for politicians in the runoff elections ahead?” “Robust content modification” seems the new Orwellian rallying cry in our society.

The same problems have arisen on Covid stories. For a year, Big Tech has been censoring those who wanted to discuss the origins of pandemic. It was not until Biden admitted that the virus may have originated in the Wuhan lab that social media suddenly changed its position. Facebook only recently announced that people on its platform will be able to discuss the origins of Covid-19 after censoring any such discussion.

The back channel coordination with Facebook further supports the view that this is a de facto state-supporting censorship program. That is the basis for the recent lawsuit by former President Donald Trump. As I have previously noted, there is ample basis for objection to this arrangement but the legal avenue for challenges is far from clear. The lawsuit will face difficult, if not insurmountable, problems under existing law and precedent. There is no question companies like Twitter are engaging in raw censorship. It is also true that these companies have censored material with a blatantly biased agenda, taking sides on scientific and social controversies. A strong case can be made for stripping these companies of legal protections since they are no longer neutral platforms. However, private businesses are allowed to regulate speech as a general matter. It will take considerable heavy lifting for a court to order this injunctive relief.

“The very first element of evidence for any medical intervention of any sort is that you can personally benefit from it. This must be established with scientific certainty — not that you get antibodies from the shot but that you actually get a material benefit in excess of where you were in terms of risk before you got jabbed”

.

• Sorry, But No. And I Do Mean *NO* (Denninger)

We must force the existing manufacturers and FDA to prove that giving someone a vaccine if they have pre-existing resistance has value to them in reducing serious or fatal outcomes, and by how much. 80% of the population had known resistance to Covid-19 before the virus got here. The study establishing this was first published in the summer and then, peer-reviewed, was released in September before the first jab went into the first arm. We knew this had to be true all the way back to Diamond Princess and I reported on that fact but we did not know why; June told us why, and September scientifically established both the fact and the reasons for it beyond reasonable challenge. If the companies and FDA, whether through malice, speed or incompetence destroyed the ability to collect and analyze that data by polluting the data set it all must stop now …

… because there is no way to easily detect if you’re in that 80% and if, by January, you hadn’t gotten seriously sick the odds are very high you are in that resistant and cannot become seriously ill with Covid-19 simply because the odds of you having being exposed by then are overwhelming. The very first element of evidence for any medical intervention of any sort is that you can personally benefit from it. This must be established with scientific certainty — not that you get antibodies from the shot but that you actually get a material benefit in excess of where you were in terms of risk before you got jabbed. It is wildly unethical, immoral and constitutes gross malpractice to advise anyone to take a medical treatment from which there is no reasonable possibility of benefit. This was intentionally not done before we issued EUAs due to “Warp Speed” — that is, speed (and profit) came before proof of benefit.

We must force both pharma and the regulators, along with our government at all levels to account for now-apparent, clear and outrageous failure of the existing shots along with the flat-out lies being told today as regards their efficacy. Specifically, 100 out of 700 (1/7th) of the crew on the HMS Queen Elizabeth have become infected with Covid-19. Every one of the crew was fully vaccinated and thus any attempt to blame this on “plague rats” that aren’t vaccinated is obvious bull****. I note that this rate of infection (14%) is within statistical spitting distance for population pre-existing resistance as documented in June of 2020 (80%) which strongly implies that the jabs are very close to worthless if not completely worthless in preventing both infection and transmission.

Through March of 2021 just 24 military personnel in the US have died allegedly from Covid out of nearly 170,000 cases, or a rate of approximately 0.014%; as such “serious and fatal” events on the HMS QE are unlikely even if nobody had been vaccinated. In short the British Military jabbed everyone and put them at risk of severe or fatal adverse effects for zero benefit; the existing shots have no statistically-material benefit in preventing either infection or transmission of the virus. In addition we have known since the polio vaccine development that using non-sterilizing vaccines during an active outbreak causes mutational adaptation and escape and thus is dangerous. It is for this reason that IPV (non-sterilizing) was followed by OPV (sterilizing) in the United States until well after there was no circulating polio in America. There is no longer any scientific dispute in this regard and anyone claiming otherwise is a lying sack of crap. All alleged “public health” justification for the existing shots has been conclusively and scientifically destroyed by this event and, in addition the shots have now been conclusively identified as placing the population at severe and direct risk of mutational escape.

We must identify and publish detailed, de-identified associated harms from the jabs and norm them to the population segment and existing morbidities as a whole. Every health insurance company in the private sector and CMS (Medicare and Medicaid) have this data and, since the vaccine rollout is in fact not “free” if you’re insured (it’s billed to your insurance company) the firms know conclusively what events coincided with or were closely associated with these shots and how that compares with their last five years of data in the same population and morbidity segments. In short the data across over 150 million Americans does exist to show what, if anything, is happening and at what rate. This excess forms the denominator of harms from the shots.

This is not a function of nor can it be dismissed as “clinical judgment”; there are many reports of doctors refusing to make entries into VAERS or otherwise dodging that the jabs are related to new illnesses, hospitalizations and concerns. I don’t care what a doctor thinks; I care very much about who’s getting paid to do what and how that has changed over the last eight months. Until that data is released to the public under penalty of life in prison if falsified or otherwise misrepresented there must be no further activity with regards to these shots. THE PEOPLE MUST HAVE THE DENOMINATOR — THAT IS, THE ADVERSE EVENT NUMBER, AGAINST THE NUMBER OF VACCINATED PERSONS BOTH FOR DEATH AND ANY OTHER SERIOUS CONDITION INVOLVING A HOSPITAL ADMISSION OR TRIP TO THE EMERGENCY ROOM.

We must have full, free and open access to inexpensive and known safe drugs for early interdiction as an option. This means Ivermectin, Budesonide and HCQ + Doxycycline or Zpak for starters. All of these are drugs that are known to be quite safe, they are all off-patent and inexpensive and it must be the choice of the patient whether to use them if suspected or confirmed infected. It is their ass, not the doctor’s, and thus their choice. Any doctor who refuses must lose their license. Any medical group that promotes or enforces a policy adverse to this must be destroyed, literally and to an individual employee, director and officer, as they have and are killing people for money. This is especially true when there are no approved treatments under full FDA protocol and Remdesivir, which is under EUA, has twice proved worthless in formal studies, a third now shows it causes harm and yet the EUA is still there and it is still being recommended and used. Whether said drugs are inferior, equal or superior to a vaccine is immaterial. It is the patient’s decision.

“Jacob Marley in Uncle Sam drag..”

• Enemies of the People (Kunstler)

America is oh so problematic! You people are working a little too hard to think for yourselves — you basket of deplorable, brain-damaged, flyover gorks — so pardon us while we remove your impure thoughts from the nation’s thought-spaces. We will do your thinking for you, because 1) we know better, and 2) we say so…. Can you see now how things are working perfectly toward an autumn explosion of, shall we say, unpleasant disagreeableness?

Meanwhile, “Joe Biden” and “Biden allied groups” have engineered the US intel and security agencies to label anyone and anything that opposes the shutdown of wrong-think as “white supremacist domestic terrorism.” the FBI officially tweets: “Family members and peers are often best positioned to witness signs of mobilization to violence. Help prevent homegrown violent extremism. Visit https://go.usa.gov/x6mjf to learn how to spot suspicious behaviors and report them to the #FBI.” Nice set-up. Thus, Nancy Pelosi and Merrick Garland’s year-to-date production of the “Capitol Insurrection” pageant, and the captivity, in solitary confinement for months on end, in defiance of habeas corpus, of January Sixth’s hapless, selfie-snapping trespassers. That should prevent any outfit beside BLM and Antifa from mounting mostly peaceful protests, especially against “Joe Biden’s” creeping totalitarianism.

Yet, the flop-sweat is running like a babbling brook from end-to-end down Pennsylvania avenue as, in actual fact, the “Joe Biden” show lurches into its final act — which will be the collapse of the “Joe Biden” show in an odoriferous heap of bad faith and criminality. The specter of election audits is getting to the animatronic teleprompter-reader heading the federal regime. His chamberlains foolishly sent him out to Philadelphia this week to squelch any rising sentiment among PA state legislators to audit alleged ballot irregularities of 11/3/20. “Joe B’s” legitimacy is shredding and he looks more and more like a mere ghoul in the Oval Office, Jacob Marley in Uncle Sam drag, wailing and whispering of his political sins.

In Philly, the poor boob said, “For those who challenge the results and question the integrity of the election: No other election has ever been held under such scrutiny and such high standards!” That mouthful was followed by an even bigger gulp: “The Big Lie is just that: a big lie.” Did he know what he said there? (Cue: Joseph Goebbels spinning in grave with admiration.) The utterance was the perfect companion to his Big Brag on the campaign trail last October, saying, “We have put together, I think, the most extensive and inclusive voter fraud organization in the history of American politics.” Indeed, you did, Joe — or, at least, your worker bees in the DNC did, with, perhaps, some help from the Deep State’s Intel Community.

Milley’s a few cents short of a buck.

• ‘If I Was Going To Do A Coup, It Wouldn’t Be With Him’ (RT)

Former President Donald Trump has issued a scathing rebuke of US General Mark Milley, after book excerpts revealed Milley had allegedly compared Trump’s supporters to Nazis and planned to resist a hypothetical “coup” by Trump. Excerpts from an upcoming book by Washington Post reporters Carol Leonnig and Philip Rucker describe how, in the aftermath of the 2020 election, as Trump disputed Joe Biden’s victory, Milley, the nation’s highest military officer, summoned the rest of the Pentagon’s top brass to discuss the possibility of Trump attempting to use them in a “coup” attempt to stay in power. Milley, according to the excerpts seen by CNN, drew on numerous World War II cliches, comparing Trump’s rhetoric of a ‘rigged’ election to “the gospel of the Fuhrer,” his supporters to the Nazi “brownshirts,” and Trump himself as “the classic authoritarian leader with nothing to lose.”

As Milley and his deputies discussed the possibility of Trump’s supporters directly attacking Washington DC, he flexed his military muscles. “They may try, but they’re not going to f**king succeed,” he reportedly said. “You can’t do this without the military. You can’t do this without the CIA and the FBI. We’re the guys with the guns.” Trump issued a lengthy response on Thursday. “I never threatened, or spoke about, to anyone, a coup of our Government,” the former president said in a press release. “So ridiculous! Sorry to inform you, but an Election is my form of ‘coup,’ and if I was going to do a coup, one of the last people I would want to do it with is General Mark Milley.”

[..] Trump’s statement went on to list more of the former president’s grievances with Milley, beginning with a typically Trumpian explanation for how the general got his job: “He got his job only because the world’s most overrated general, James Mattis, could not stand him, had no respect for him, and would not recommend him,” Trump explained, referring to his former Defense Secretary Jim Mattis. “To me the fact that Mattis didn’t like him, just like Obama didn’t like him and actually fired Milley, was a good thing, not a bad thing. I often act counter to people’s advice who I don’t respect.”

He still has his job.

• Hunter Biden Prosecutor Paused Investigation Before Election (NYP)

The top federal prosecutor in Delaware decided to pause a criminal investigation of Hunter Biden months before the 2020 election to prevent the public from learning about it, according to a report. US Attorney David Weiss, appointed by former President Donald Trump, decided not to seek search warrants or issue grand jury subpoenas so as not to “alert the public to the existence of the case in the middle of a presidential election,” Politico reports. The prosecutor’s office reportedly was torn over whether to continue its probe or pause it due to the election, and Weiss, who remains in his job leading the case, sided with those who wanted to wait. “To his credit, he listened,” an unnamed source told the publication.

The Justice Department’s role in the case has faced criticism from Trump allies, who note that a Delaware computer repairman gave the FBI a laptop formerly belonging to Hunter Biden in December 2019, according to records first reported by The Post. In the final months of the 2020 presidential race, The Post revealed a trove of emails from Hunter Biden’s laptop that appeared to link his then-candidate father to his foreign business ventures in China and with Ukrainian energy company Burisma. The emails revealed that the younger Biden introduced a top Burisma executive to his father, then vice president, less than a year before the elder Biden admittedly pressured Ukrainian officials into firing a prosecutor who was investigating the company.

The water-damaged MacBook Pro — which bore a sticker from the Beau Biden Foundation — was dropped off for repair at a Delaware computer shop in April 2019, but the individual who dropped it off never returned to pick it up. It was seized by the FBI in December of that year. In addition to his Ukrainian connections, other emails on the computer showed Hunter discussing potential business deals with China’s largest private energy company. One deal seemed to draw considerable attention from the younger Biden, who called it “interesting for me and my family.” Senate Republicans revealed the findings of their investigation into Hunter Biden’s overseas business dealings in September. They said the Obama administration ignored “glaring warning signs” when the then-vice president’s son joined the board of Burisma when he had no energy experience.

Excellent by Ann Pettifor.

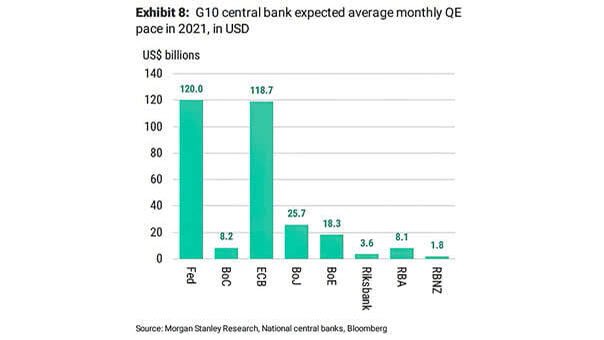

• Quantitative Easing: How The World Got Hooked On Magicked-up Money (Pettifor)

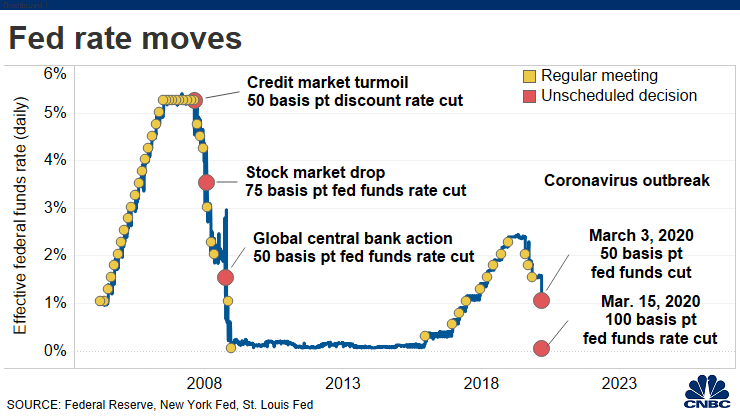

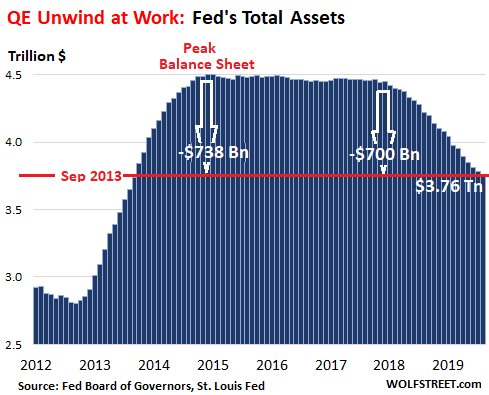

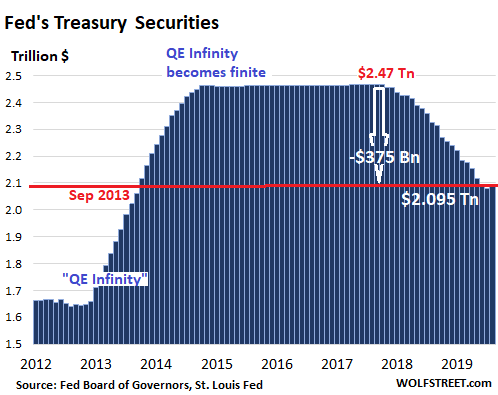

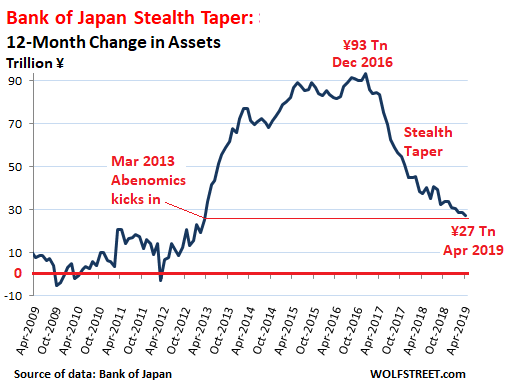

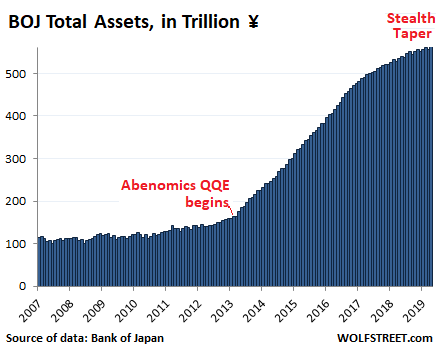

Central banks—backed by royal charters and the state—have always had the power to create credit and expand the money supply. They have, since at least the founding of the Bank of England in 1694, provided credit to their clients in government and in commercial banks, accepting collateral in exchange for the money they create—a routine process known in the jargon as Open Market Operations (OMOs). They can run OMOs in reverse, too, selling the securities on their balance sheets in exchange for cash, taking money out of circulation, contracting the supply and raising its “price”—the rate of interest. Through such means, central banks have long used their power of credit creation to help fund the government, keep commercial banks afloat and then, from the 20th century, to keep the economy in balance too.

At one level, QE is just another name for OMOs—newly “minted” electronic money is paid into the accounts of the central bank’s clients, who in exchange offer up collateral in the form of bonds. By buying them up, central bankers contract the supply of bonds in the market, which raises their price or, equivalently, lowers their yield—the interest that’s paid on them. In that way, the process puts downward pressure on the borrowing costs of governments and other debtors. So what’s really new here? The difference between OMOs and QE is in the scale and the wider array of assets involved. Whereas OMOs typically purchase short-term government debt, QE programmes snap up government debt of all maturities, including long-term bonds. In the US, the EU and UK, central banks also extended the definition of eligible collateral to include riskier corporate bonds, and began buying them up too.

As to the scale, already by 2009 the Bank of England had purchased bonds to the value of £200bn. By August 2016, after the Brexit vote, purchases rose to £445bn. During the market’s grave March 2020 wobble, purchases rose to £645bn. By November 2020, the bank had acquired assets of £895bn. This stock of purchases is now equivalent to about half the annual flow of UK national income. Moreover, with QE, the old two-way traffic of OMOs seems to have become a one-way street. While central bankers are acquiring bonds, they are not, as yet, selling them back into the market. The fear is that doing so would flood it, slashing bond prices and forcing up their yields—making it harder for borrowers, not least governments, to service their debts.

“President Xi had phoned Biden on his special “red phone” that lets him speak directly to his friend Joe to get more tips on how to rule his people with an iron fist.”

• Xi Jealous Of Biden Admin’s Ability To Censor Speech On Social Media (BBee)

In a candid statement today, President Xi Jinping admitted he’s “actually pretty jealous” of the United States government’s ability to censor information it doesn’t like over social media. Sources close to the ruler of China’s communist party and government said he was “fairly envious” of how effective the U.S. system of censorship works. He was particularly impressed with how the Biden White House doesn’t even have to censor information themselves, but can simply flag posts as problematic and private companies will jump to take care of dissenters automatically. Even President Xi usually has to “lift a finger” to censor someone, so he’s pretty jealous of the way the U.S. is handling censorship of “misinformation.”

“Honestly, I’m impressed, and a little jealous,” said China’s dictator after he heard Press Secretary Jen Psaki say the White House flags posts for Facebook to remove and that someone who gets banned on one social network should get banned on all of them. “And I thought I had absolute control over the speech of my people! This is next-level stuff. Really quite something.” “And having a private company do it so the people can’t complain about freedom of speech – brilliant. My hat is off to the United States.” At publishing time, President Xi had phoned Biden on his special “red phone” that lets him speak directly to his friend Joe to get more tips on how to rule his people with an iron fist.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

“The trouble with fighting for human freedom is that one spends most of one’s time defending scoundrels. For it is against scoundrels that oppressive laws are first aimed, and oppression must be stopped at the beginning if it is to be stopped at all.”

– H. L. Mencken

So the Kids are now calling the Vaccines “clot shots”

And the ambulances “Jab Cabs”

WH controls narrative

https://twitter.com/i/status/1416194845924802563

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.