Stanley Kubrick High Wire Act 1948

Think tanks will say anything if you pay them enough. But still this is quite the ‘report’. And it’s about Britain of all places!

Millenials will get NO pensions. They may get a UBI when the time comes, but people will have to wake up for that to happen.

• Millennials Will Have Similar Pensions To Baby Boomers – Thinktank (G.)

Young adults will have retirement incomes similar to today’s pensioners, according to analysis which rejects widespread pessimism about the financial prospects for millennials. Men in their 40s will suffer a fall in their retirement incomes compared with today’s pensioners, but the generation behind them will see their incomes recover, analysis by the Resolution Foundation found. It said the average pension for a man will be about £310 a week in 2020, taking into account state and private pensions. This will fall to about £285 in the mid 2040s in real terms “before building again to about £300 a week by the end of the 2050s”.

For women, there will be no dip in pension income but a small improvement over time. The thinktank forecasts that average pensions incomes for women, typically lower than those of men because of lower pay and career breaks, will be about £225 a week in 2020, then rising to about £235 by the mid-2030s and staying at that level going forward. The analysis defies the popular view that today’s pensioners are a “golden generation” who benefited from final-salary pensions. It said that while pensioner incomes have risen sharply this century to match or even surpass those of working people, these levels can be broadly maintained in the future. The upbeat assessment is in sharp contrast to other a stream of reports which paint Britain’s pensions as among the worst in the developed world, with young workers facing penury in retirement.

Resolution said “auto enrolment”, the government scheme in which workers are automatically defaulted into paying into a private pension scheme, will be the chief driver behind a recovery in pension income. But the thinktank acknowledged that today’s younger generation are unlikely to build up the housing wealth acquired by baby boomers – people born between the early 1940s and mid-1960s – from the huge increase in house prices, and will not be entitled to a state pension until they are older than the current generation of retirees.

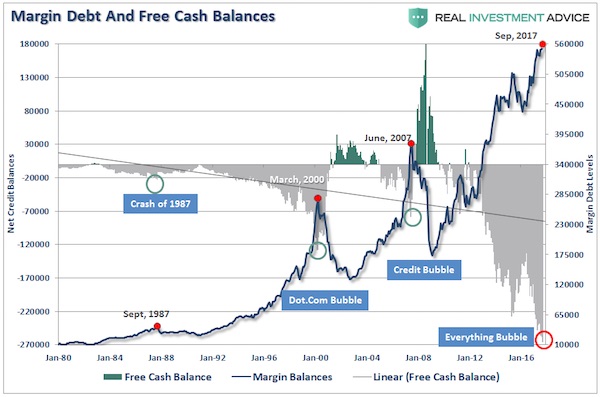

Margin calls. Coming soon to a theater near you.

• The Perfect Storm – Of The Coming Market Crisis (Roberts)

Of course, as investors begin to get battered by the “volatility and junk bond storms,” the subsequent decline in equity valuations begins to trigger “margin calls.” As the markets decline, there will be a slow realization “this decline” is something more than a “buy the dip” opportunity. As losses mount, the anxiety of those “losses” mounts until individuals seek to “avert further loss” by selling. There are two problems forming. The first is leverage. While investors have been chasing returns in the “can’t lose” market, they have also been piling on leverage in order to increase their return. It is often stated that margin debt is “nothing to worry about” as they are simply a function of market activity and have no bearing on the outcome of the market.

That is a very short-sighted view. By itself, margin debt is inert. Investors can leverage their existing portfolios and increase buying power to participate in rising markets. While “this time could certainly be different,” the reality is that leverage of this magnitude is “gasoline waiting on a match.” When an “event” eventually occurs, it creates a rush to liquidate holdings. The subsequent decline in prices eventually reaches a point which triggers an initial round of margin calls. Since margin debt is a function of the value of the underlying “collateral,” the forced sale of assets will reduce the value of the collateral further triggering further margin calls. Those margin calls will trigger more selling forcing more margin calls, so forth and so on.

Imposing a 70% loss on creditors sounds like a confidence breaker to me.

• Markets Get Wake-Up Call From China’s Post-Congress Deleveraging Moves (R.)

The pace at which Beijing is announcing deleveraging reforms following last month’s Communist Party Congress is a wake-up call for investors in Chinese markets: risk just got real. Sweeping new rules for the asset management industry, a crackdown on micro loans and losses imposed on the creditors of the state-owned Chongqing Iron & Steel are not yet a “Big Bang” of reforms. Some of the measures were well flagged and will only kick in 2019. But they are sending a signal to markets that policymakers are serious about deleveraging, something that has been urged by the INF and ratings agencies for years and flagged as a top priority by President Xi Jinping at the party congress.

Debt markets reacted first, with benchmark 10-year borrowing costs hitting three-year highs above 4% and yield spreads between government and corporate debt widening as policymakers appear more tolerant of defaults. Last week, the debt sell-off spilled over into equities, which saw their worst day in 19 months, and markets have since weakened further. [..] Two weeks ago, the central bank and the top regulators for banking, insurance, securities and foreign exchange announced unified rules covering asset management. The aim was to close loopholes that allow regulatory arbitrage, reduce leverage levels, eliminate the implicit guarantees some financial institutions offer against investment losses and rein in shadow banking.

Last week, a top-level Chinese government body issued an urgent notice to provincial governments urging them to suspend regulatory approval for new internet micro-lenders in a bid to curb household debt, which is currently low but rising rapidly. In the meantime, creditors of Chongqing Iron & Steel took a 70% loss in a debt-to-equity swap restructuring of nearly 40 billion yuan ($6 billion) of debt. [..] Debt-to-equity swaps are complex operations that are harder to undo than a missed bond payment and analysts say the move signals a clear path for tackling high corporate debt levels, which the BIS estimates at 1.6 times the size of the economy. “If you own the wrong stuff you’re in trouble because they are not going to bail you out any more,” said Joshua Crabb at Old Mutual Global Investors.

Round it off to an even 100%, why don’t you.

• Chance Of US Stock Market Correction Now At 70% – Vanguard (CNBC)

Don’t panic, but there is now a 70% chance of a U.S. stock market correction, according to research conducted by fund giant Vanguard Group. There is always the risk of a correction in stocks, but the Vanguard research shows that the current probability is 30% higher than what has been typical over the past six decades. Vanguard, which manages roughly $5 trillion in assets and is a proponent of long-term investing, isn’t sounding the alarm bells to scare investors out of the market. But according to Vanguard’s chief economist Joe Davis, investors do need to be prepared for a significant downturn.

“It’s about having reasonable expectations,” Davis said. “Having a 10% negative return in the U.S. market in a calendar year has happened 40% of the time since 1960. That goes with the territory of being a stock investor.” He added, “It’s unreasonable to expect rates of returns, which exceeded our own bullish forecast from 2010, to continue.” In its annual economic and investing outlook published last week, Vanguard told investors to expect no better than 4% to 6% returns from stocks in the next five years, its least bullish outlook since the post-financial crisis recovery began. Contributing to that outlook are market indicators that suggest “a little froth” in the market, according to the Vanguard chief economist.

“The risk premium, whether corporate bond spreads or the shape of yield curve, or earnings yields for stocks, have continued to compress,” Davis said. “We’re starting to see, for first time … some measures of expected risk premiums compressed below areas where we think it can be associated with fair value.” Many market participants have worried in recent months about the flattening in the yield curve — the spread between 2-year note yields and 10-year yields — at the lowest level since before the financial crisis. Meanwhile, the spread between junk bond yields and Treasurys recently has moved closer to the level before the financial crash than the long-term historical average.

Bitcoin at the water cooler.

I’m not so sanguine about Bitcoin’s supposed impregnability, nor about many of its other appealing claims. The Mt. Gox affair of 2014 must be forgotten now, but back then some sharpie hacked 850,000 Bitcoins (valued over $450,000,000) out of the exchange, which was processing almost two-thirds of all the Bitcoin trades in the world. Mt. Gox went out of business. Bitcoin tanked and then traded sideways for three years until (coincidentally?) the Golden Golem of Greatness was elected Leader of the Free World. Hmmmm….. Not many readers understand the first thing about block-chain math, your correspondent among them. But I am aware that the supposed safety of Bitcoin lies in its feature of being an algorithm distributed among a network of computers world-wide, so that it kind of exists everywhere-and-nowhere at the same time, a highly-valued ghost in the techno-industrial meta-machine.

However, the electric energy required for “mining” each Bitcoin — that is, the computations required for updating the block-chain network — is enough to boil almost 2000 liters of water. This is happening world-wide, and a lot of the Bitcoin “mining” is powered by coal-burning electric plants, making it the first Steampunk currency. If Bitcoin were to keep rising to $1,000,000 per unit, as many investors hope and pray, there wouldn’t be enough electric power in the world to keep it going. Pardon me if I seem skeptical about the whole scheme. Even without Bitcoin bringing extra demand onto the scene, America’s electrical grid is already an aging rig of rags and tatters. There are a lot of ways that the service could be interrupted, perhaps for a long time in the case of an electric magnetic pulse (EMP). I’m not convinced that crypto-currencies are beyond the clutches of government, either.

Around the world, in their campaign to digitize all money, there must be a deep interest in either hijiking existing block-chains, or creating official government Bit-monies to seal the deal of total control over financial transactions they seek. Anyway, there are already over 1300 private cryptos and, apparently, a theoretically endless ability to create ever new ones — though the electricity required does seem to be a limiting factor. Maybe governments will shut them down for being energy-hogs. My personal take on the phenomenon is that it represents the high point of techno-narcissism — the idea that technology is now so magical that it over-rides the laws of physics. That, for me, would be the loudest “sell” signal. I’d just hate to be in that rush to the exits. And who knows what kind of rush to other exits it could inspire.

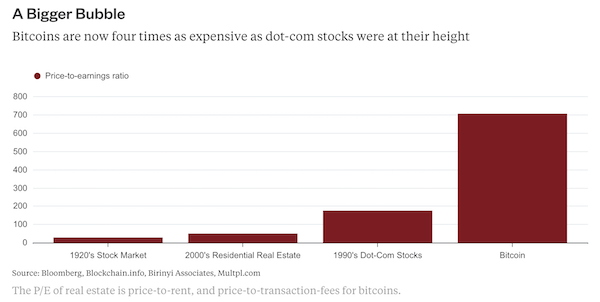

No problem is you think bitcoin is not a bubble.

• Bitcoin Bubble Makes Dot-Com Look Rational (BBG)

Even compared with some extreme bubbles, bitcoins, which continued its climb toward $10,000 Monday afternoon, look bloated. Take dot-com stocks, which were the biggest bubble of the past few decades, and likely the largest in stock market history. At the height of the dot-com stock bubble, the technology-heavy Nasdaq stock index had a price-to-earnings ratio of 175. In the past year, bitcoins have generated transaction fees of nearly $219 million. And at $9,600 a piece, the total value of all bitcoins – their market cap – now tops $155 billion. That gives bitcoins the equivalent of a trailing P/E ratio of 708. That means based on valuation, bitcoins are four times more expensive than dot-com stocks were at the height of their bubble.

Valuation, though, is not what pops bubbles. Supply does. The dot-com bubble, like all bubbles, was driven by the fact that there were relatively few publicly traded internet stocks in the mid-1990s, just as investors were getting excited about them. So prices of the stocks that were public soared. Companies not actually in the internet business added “.com” to their names, or announced a web strategy, and those stocks rose as well. But from 1997 to 2000, there were $44 billion in initial public offerings of new dot-com stocks. Eventually the supply of dot-com companies became large and dubious enough that the bubble burst and the hot air holding up all the stocks rushed out.

The same will happen with bitcoin. The question is when. The combined market value of all digital currencies is just $300 billion. As my colleague David Fickling pointed out, that relatively tiny market cap of bitcoin compared with other asset classes means that a small amount of money coming out of say U.S. stocks, which have a market cap of more than $20 trillion, could send the price of bitcoin soaring. Just a 5 percentage point shift away from gold and into bitcoin could drive the price of the digital currency up by another 33%. But it’s not clear that the people who want the protection of owning gold would be comfortable with bitcoin instead. The percentage of stock investors interested or able to invest their 401(k) in bitcoin is likely small as well, though surely, as in all bubbles, growing.

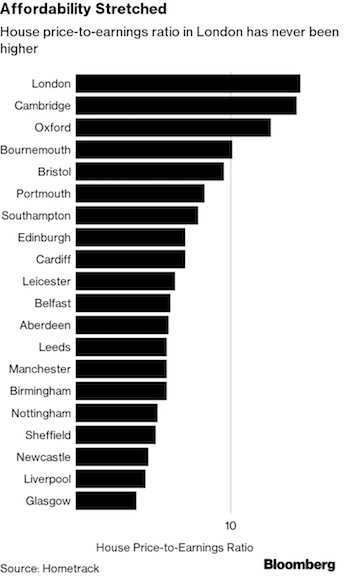

Britain is a class society. Might as well have castes.

• London Homes Are Now Less Affordable Than Ever Before (BBG)

London homes are less affordable than ever before, despite slowing price growth and government attempts to cut the cost of housing for first-time buyers. It now costs the average Londoner 14.5 times their annual salary to purchase a home, the highest level on record, according to a report Tuesday by researcher Hometrack. Cambridge, Oxford and the English seaside town of Bournemouth also have price-to-earnings ratios in the double digits, the report shows. “Unaffordability in London has reached a record high, despite a material slowdown in the rate of house-price growth over the last year,” Richard Donnell, research director at Hometrack, said in an interview. “The gap between average earnings and house prices in the capital has never been wider.”

Even with the recent slowdown, the average cost of a first home in the U.K. capital is still up 66% since 2012 as supply fails to meet the demand from domestic buyers and overseas investors. Spiraling values have caused the number of younger buyers in the capital to fall, something that Chancellor of the Exchequer Philip Hammond sought to address last week when he abolished stamp duty for first-time buyers of homes worth up to 300,000 pounds ($400,290). London house prices rose an average 3% in the year ending October to 496,000 pounds, less than half the 7.7% growth rate of a year earlier, Hometrack said. The researcher defined London as the 46 boroughs in and around the U.K. capital.

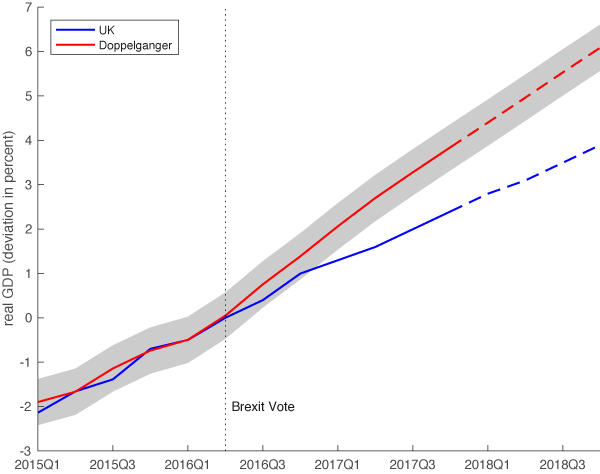

Not sure a comprehensive study is even possible.

• £300 Million A Week: The Output Cost Of The Brexit Vote (VoxEU)

There is huge variation in the estimated cost of Brexit. Most studies forecast that a reduction in trade or a fall in foreign direct investment (FDI) – or both – will reduce output. For instance, HM Treasury (2016) uses a gravity model to assess the economic impact in several scenarios, and concludes that losses could be up to 6% of GDP in the long term. Yet the future relationship between the UK and the EU is highly uncertain (Baldwin 2016). As a result, estimating the cost of Brexit is difficult. Different assumptions about the deal that the UK will lead to different cost estimates.

That’s why we take a different approach in a recent paper (Born et al. 2017). Rather than making set of assumptions which are bound to be controversial, and using them to forecast the economic costs of Brexit, we measure the actual output loss from the UK’s decision to leave the EU. Our approach does not depend on having the right model for the British, the European, or even the global economy. We do not assume a particular Brexit deal, or construct specific scenarios for the outcome of the negotiations. Instead we create a transparent, unbiased, and entirely-data driven ‘Brexit cost tracker’ that relies on synthetic control methods (Abadie and Gardeazabal 2003).

[..] We then use the doppelganger of the pre-Brexit UK economy to quantify the cost of the Brexit vote. As the doppelganger is not treated with the Brexit vote, it will continue to evolve in a similar way to how the pre-Brexit economy would have evolved if the referendum had never happened. It shows, in other words, the counterfactual performance of the UK economy, and the divergent output paths between the UK economy and its doppelganger capture the effect of the referendum. This ‘synthetic control method’ has been successfully applied to study similar one-off events, such as German reunification and the introduction of tobacco laws in the US (Abadie et al. 2010, 2015).

Figure 2 zooms into the post-Brexit period. We find that the economic costs of the Brexit vote are already visible. By the third quarter of 2017, the economic costs of the Brexit vote are about 1.3% of GDP. The cumulative output loss is £19.3 billion. As 66 weeks have passed between the referendum and the end of the Q3 2017 (our last GDP data point), the average output cost is almost £300 million on a per-week basis.

The Tories are not going to win this.

• The Irish Question May Yet Save Britain From Brexit (G.)

It was always there for all to see, the great Celtic stone cross barring the way to Brexit. Finally, as crunch day nears, the government and its Brextremists have to confront what was always a roadblock to their fantasies. They pretended it was nothing. Reviving that deep-dyed, centuries-old contempt for the Irish, they have dismissed it with an imperial fly-whisk as a minor irritation. No longer. On 14 December, the time comes when the EU decides whether the UK has made “sufficient progress” on cash, citizens’ rights … and the Irish border. This roadmap was long ago agreed, and yet as the day approaches there is no plan for that 310-mile stretch with its 300 road crossings. The Irish government, which never wanted the UK to leave, demands, as it always did, that no hard border disrupts trade and breaks the Good Friday agreement.

Why would they expect anything else, when Theresa May herself made that one of her “red lines”? But she made three incompatible pledges: no single market, no customs union and no hard border, an impossible conundrum no nearer resolution than the day she uttered it. Labour’s Keir Starmer keeps pointing to the needless trap she jumped into: why not, like Labour, keep those options on the table? The Brexiteers turn abusive: the Irish are holding Britain to “ransom” and “blackmail” by conducting an “ambush”. The Sun leader told the taoiseach, Leo Varadkar, to “shut your gob and grow up”, and to stop “disrespecting 17.4 million voters of a country whose billions stopped Ireland going bust as recently as 2010”.

Brexit fanatic Labour MP Kate Hoey yesterday adopted a Trump-style demand that Ireland builds a wall and pays for it – for a border they never wanted. The Ukip MEP Gerald Batten tweeted: “UK threatened by Ireland. A tiny country that relies on UK for its existence …” and: “Ireland is like the weakest kid in the playground sucking up to the EU bullies.” Brexiteers, thrashing around, accuse the Irish of using the border crisis as a devious plot to further a united Ireland. But Varadkar rightly says he is not using a veto. There is complete unity among the EU 27: no hard border, loud and clear. He is right not to let this slip to the next stage without a written-in-blood pledge.

Class society.

• The Fat Cats Have Got Their Claws Into Britain’s Universities (G.)

Scandals aren’t meant to happen in British universities. Parliament, tabloid newsrooms, the City … those we expect to spew out sleaze. Not the gown-wearing, exam-sitting, quiet-in-the-library surrounds of higher education. Yet we should all be scandalised by what is happening in academia. It is a tale of vast greed and of vandalism – and it is being committed right at the top, by the very people who are meant to be custodians of these institutions. If it continues, it will wreck one of the few world-beating industries Britain has left. Big claims, I know, but easily supportable. Let me start with greed. You may have heard of Professor Dame Glynis Breakwell. As vice-chancellor of Bath University, her salary went up this year by £17,500 – which is to say, she got more in just one pay rise than some of her staff earn in a year.

Her annual salary and benefits now total over £468,000, not including an interest-free car loan of £31,000. Then there’s the £20,000 in expenses she claimed last year, with almost £5,000 for the gas bill – and £2 for biscuits. I knew there had to be a reason they call them rich tea. Breakwell is now the lightning rod for Westminster’s fury over vice-chancellor pay. As the best paid in Britain, she’s the vice-chancellor that Tony Blair’s former education minister, Andrew Adonis, tweets angrily about. She’s the focus of a regulator’s report that slams both her and the university. She’s already had to apologise to staff and students for a lack of transparency in the university’s pay processes – and may even be forced out this week.

But she’s not the only one. The sector is peppered with other vice-chancellors on the make. At Bangor University, John Hughes gets £245,000 a year – and lives in a grace-and-favour country house that cost his university almost £750,000, including £700-worth of Laura Ashley cushions. Two years ago, the University of Bolton gave its head, George Holmes, a £960,000 loan to buy a mansion close by. The owner of both a yacht and a Bentley, Holmes enjoys asking such questions as: “Do you want to be successful or a failure?” Yet as the Times Higher Education observed recently, he counts as a failure, having overseen a drop last year in student numbers, even while being awarded an 11.5% pay rise.

The marriage meant to make you forget Brexit.

• Prince Harry Can Bring His Foreign Spouse To UK – 1/3 Of Britons Can’t (Ind.)

Prince Harry is in a privileged position as he celebrates his engagement to US-born Meghan Markle, not only because he is royalty, but because he is part of a percentage of the population who can afford to marry a spouse from outside of the European Economic Area (EEA). Immigration rules introduced in 2012 under then-Home Secretary Theresa May set a minimum earnings threshold of £18,600 for UK citizens to bring a non-EEA spouse or partner to live here with them. The Migration Observatory in Oxford estimates that 40 per cent of Brits in full or part-time employment don’t earn enough to meet this threshold, narrowing the marriage choices of a significant proportion of the population.

The income requirement doesn’t just disadvantage minimum wage earners, but also the young, women and those with caring responsibilities, who are less likely to meet the threshold. Where you live matters too; Londoners earn higher salaries than those living outside the south-east of the country. But even within London, there are disparities – around 41 per cent of non-white UK citizens working in London earn below the income threshold compared to 21 per cent of those who identify as white. Consider that before hailing the dawn of a new post-racial era in the UK with Meghan Markle, who is mixed race, marrying into the Royal family. The £18,600 figure was calculated as the minimum income amount necessary to avoid a migrant becoming a “burden on the state”.

This makes sense in theory, but economics cannot be the only metric in a system that deals with people’s lives. The committee tasked with setting the amount was not asked to take into account other metrics, such as the wellbeing of UK citizens, permanent residents and their families. The question we need to ask ourselves is, should love have a price tag? Is it right or fair that Prince Harry and those who earn above the minimum wage are a select percentage of the population who can marry whoever they choose? The price of bringing your spouse to the UK rises with every child you include on your application, giving rise to “Skype families” who cannot afford or are otherwise unable to reunite and have to stay in touch over Skype. In 2015, the Children’s Commissioner reported that up to 15,000 children are affected by this rule, most of whom are British citizens. Families are put under immense stress and anxiety.

This is what you call organized crime. There are laws covering that.

• Wells Fargo Bankers Overcharged Clients For Higher Bonuses (CNBC)

Evidence that embattled bank Wells Fargo had swindled some of its clients emerged in a June conference call led by its managers, according to two employees who were present during the call, The Wall Street Journal reported Monday.The revelation, based on an internal assessment, reportedly came following years of rumors within the bank. Of the approximately 300 fee agreements for foreign exchange trades reviewed internally by Wells Fargo, only about 35 firms were billed the price they had been quoted, the employees told the Journal.

Wells Fargo charged one of the highest trading fees — at least two to eight times higher than industry standards, according to the bank’s employees and others in the sector, the Journal reported. The latest case shares important similarities to Wells Fargo’s ongoing sales scandal: Under a highly unusual policy, employees’ bonuses were tied to how much revenue they brought in, the report said. The practice reportedly led retail employees to open as many as 3.5 million fake accounts, in a controversy first brought to light last year.

I kid you not: this article is ‘supported by the Rockefeller Foundation”.

• Sao Paulo’s Homeless Seize The City (G.)

On the wall of an abandoned and occupied hotel in central Sao Paulo is a mural of a fiercely feral creature – part cat, part rat, part alien – that bears a red revolutionary banner with a single word: Resistencia! The surrounding courtyard is daubed with slogans of defiance – “10 years of struggle!”, “Whoever doesn’t struggle is dead” – and the initials MMLJ (the Movement of Residents Fighting for Justice). Young boys kick a ball against a wall decorated with a giant photograph of masked, armed protesters. In the surrounding blocks, 237 low-income families talk, cook, clean, watch TV, shop, practice capoeira, study literacy, sleep and go about their daily lives in Brazil’s most famous illegal squat.

This is the Maua Occupation, a trailblazer for an increasingly organised fair-housing movement that has reignited debate about whether urban development should aim at gentrification or helping the growing ranks of people forced to live on the street and in the periphery. When the Santos Dumont hotel was first taken over on the 25 March 2007, there were very few organised squats in South America’s biggest city. But recession, inequality and increasing political polarisation have turned the occupation movement into one of the most dynamic forces in the country. There are now about 80 organised squats in the city centre and its environs, including high-rise communities and centres of radical art.

The periphery is home to many more, such as the giant “Povos Sem Medo” (People Without Fear) cluster of 8,000 tents in the Sao Bernardo do Campo district. The burst of energy and activism has been compared to the key transitional periods for other major cities in the 1970s, 80s and 90s. “We are now seeing a boom of squatting in Sao Paulo that is like those once seen in New York, Berlin and Barcelona,” said Raquel Rolnik, a former UN Special Rapporteur and architect who has worked in the housing sector for more than three decades. “What is happening here is not unique but it is happening on a very wide scale.”