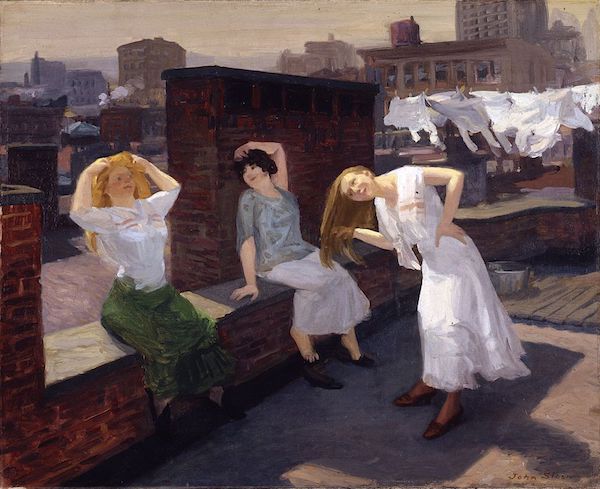

John French Sloan Sunday, Women Drying Their Hair 1912

The gag order has to come off!

TRUMP: “This is a rigged trial. It's coming from the White House.”

— Benny Johnson (@bennyjohnson) April 19, 2024

Excellent.

Jordan Peterson On Elon Musk.

Thank you @DavidCarbutt_ and team for putting this together!@jordanbpeterson @elonmusk pic.twitter.com/IO0ey0wVm6

— Farzad (@farzyness) April 19, 2024

Elon reality

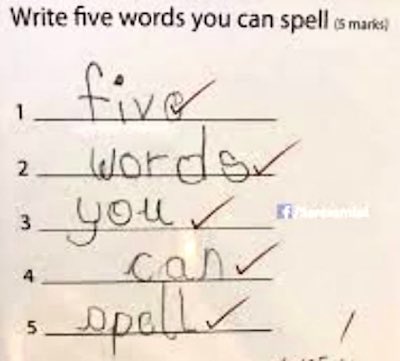

One of the strongest arguments for us being in a simulation pic.twitter.com/lHo1xJA5rT

— Historic Vids (@historyinmemes) April 19, 2024

Robotaxi

"Our dedicated robo taxi products will have quasi-infinite demand. The way we are gonna manufacture the robo taxi is itself revolutionary. It will be by far the highest units per hour of any vehicle production ever." pic.twitter.com/EGEhcT3Lzl

— DogeDesigner (@cb_doge) April 19, 2024

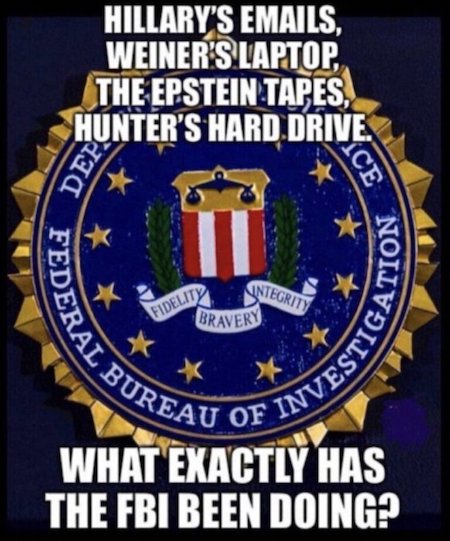

Tucker Nixon

NEW: Tucker Carlson explains how the FBI and CIA conducted a coup to take out President Richard Nixon with help from journalist Bob Woodward.

“Richard Nixon was taken out by the FBI and CIA, and with the help of Bob Woodward.”

“[Woodward] was that guy. And who is his main… pic.twitter.com/K8Yt9zy9Qk

— Collin Rugg (@CollinRugg) April 20, 2024

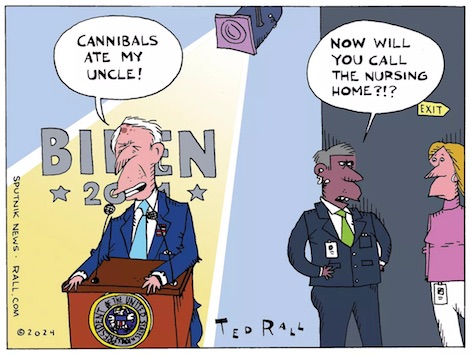

Kennedy meme

These people are terrifyingly familiar pic.twitter.com/9QbY2Kbf0v

— James Hirsen (@thejimjams) April 20, 2024

Blame the women? You’d think not, but then you see Hillary, Pelosi, Fani, Laetitia et al. With “Joe Biden” as the male role model. Maybe Jim has a point.

• Batshit Crazy America (James Howard Kunstler)

Before the saints come marching in, the human archetypes strut down the avenue in their revealing regalia. Do you know why the archetypal batshit crazy women of the Democratic Party adore “Joe Biden?” I’ll tell you: because he represents perfectly and exactly the “patriarchy” they revile in his floridly comic senescence. “Joe Biden” is the patriarchy disabled, feeble, feckless, impotent, and reduced to inanity. He would be pitiful if the patriarchy itself were not so contemptible. This is exactly how the batshit crazy women want it to look. Do you wonder why “progressive” (i.e. batshit crazy) elite class women seem so unperturbed about the conspicuous number of rapes committed by “newcomers,” as they style illegal border-jumpers these days, who are by an overwhelming percentage “military-age men”? Because, having functionally transformed the ranks of American men into eunuchs, they relish the arrival of so many wild and lustful fellows on the scene, as long as post the imagined bodice-ripping exploits they can be dominated and domesticated — turned into so many swimming pool cleaners and busboys to be ordered around.

Of course, much of that archetypal psychodrama is only played out in the batshit crazy mind of batshit crazy women; for the sake of decorum it is never acted-out. The lurid, shameful fantasies are instead displaced onto Donald Trump, the archetypal “Big Daddy” who so insolently evaded the castration shears of Hillary Clinton — with the help of Russian arch-rapist “Putin” — and keeps on coming at the batshit-crazy women like Jason Voorhees, the psycho-killer in the Friday the 13th horror series (Qu’est-ce que c’est, ladies?) Proof of Mr. Trump’s rapey-ness has been finally and formally declared in the E. Jean Carroll defamation trial. It’s certified, you see, though the trial itself was a joke of performative pretense. All you really need is a cast of characters, including the judge, Lewis Kaplan, who are sufficiently deranged and degenerate to carry out the performance.

New York State Attorney General Letitia James was up next to attempt the financial castration of Mr. Trump with an artfully concocted civil case that magically transformed a normal real estate transaction into a victimless fraud (say, what?), prompting the Rumpelstiltskin-like Judge Arthur Engoron to declare an unprecedented cash penalty of $354-million, designed to enable the confiscation and forced sale of Mr. Trump’s buildings. That hasn’t quite worked yet, and may never work, given how appeals courts up to SCOTUS might view the malicious prosecution based on Ms. James’s repeated campaign promise to. . . pin something on Trump. Batshit crazy “progressives” have managed to not notice how inconsistent with American legal precedent this case was — because they held all the levers of power in New York State: governorship, legislature, and AG’s office, and their power to do whatever they liked was all that mattered.

For the moment Judge Juan Merchan presides over Manhattan DA Alvin Bragg’s fake case of 34 clerical misdemeanors (past the statute of limitations on them), repurposed as felonies committed for the intention of breaking some federal election law (unspecified). Last time I checked, county courts have no jurisdiction over federal law, most particularly unspecified federal law, which is to say no law at all. The question nobody has asked or answered is: what is the flaw in our system of jurisprudence that allows such an insane and preposterous case to play out so harmfully? I can only suppose that this is what happens when ethics and moral codes are brutally excised from the larger culture that law is but one part of. It is the way of Homo sapiens that moral codes derive generally from the supervision of fathers in the upbringing of human young and, later on, as children develop into adults, these codes are archetypally re-enacted and enforced by men in the greater social matrix. Why? Because it requires a strong sense of boundaries. Boundaries are the essence of the “patriarchy.”

Remove men from the scene, or castrate them politically, and you are sure to end up with a problem knowing right from wrong. We’re apparently subject now to the misrule of women with boundary problems who, for one reason or another, rebelled against Daddy and never got over it. It’s a peculiar irony — so far unexplicated by the hierophants of social theory — that the more affluent and successful Daddy was, the more he was hated for it by his female offspring. The result of all that is the Democratic Party of our time as run by the batshit crazy women, fearful of sex and its consequence (babies), paradoxically subject to biological promptings and unable to find suitable mates among the men they’ve turned into eunuchs of one sort or another; resentful of the dull managerial jobs that have replaced the anathematized “jobs” of motherhood; filled with rage and revenge fantasies which, because of their boundary problems, have now extended to willing the destruction of our country. It’s an uninviting view of what’s happened to us, but there it is, like so much meat on the table.

“..you truly have to wonder about what miniature minds like Congressman Johnson’s are actually thinking..”

• Speaker Johnson’s Ignominious Betrayal (David Stockman)

Speaker Johnson’s ignominious betrayal of fiscal sanity might well be the death knell for the GOP. He is apparently risking his speakership on behalf of $95 billion of foreign aid boondoggles that Uncle Sam cannot remotely afford, and which actually provide zero benefit to the homeland security of America. And we do mean zero, as in nothing, nichts, nada, nyet and nugatory, as we amplify below. What Johnson’s impending Waterloo means, therefore, is not merely the prospect of another wild and wooly succession battle, but actually that there is no point at all in the preservation of a Republican majority and GOP House Speaker. After all, the Washington GOP has become so infected with neocon warmongers and careerist pols who spend a lifetime basking in the imperial projects and pretensions of the world’s War Capital that apparently the best the House GOP caucus could do when it ejected the previous careerist deep stater from the Speaker’s chair was to tap the dim-witted nincompoop who currently occupies it.

The Republican party is thus truly beyond redemption. As JFK once said about the CIA, its needs to be splintered into a thousand pieces and swept into the dustbin of history. Indeed, when you look at the calamitous fiscal trajectory embedded in the CBO’s latest 30-year fiscal outlook, you truly have to wonder about what miniature minds like Congressman Johnson’s are actually thinking. That is to say, the latest CBO report published in March presumes that there will never be another recession and no inflation flare-up, interest rate spike, global energy dislocation, prolonged Forever War or any other imaginable crisis ever again—just smooth economic sailing for the next 30 years. And yet, and then. Even by the math of this Rosy Scenario on steroids the public debt will reach $140 trillion at minimum by 2054. In turn, that would cause interest payments on the public debt with rates no higher than those which prevailed between 1986 and 1997 to reach $10 trillion per year.

You simply don’t need paragraphs, pages and whole monographs worth of analysis and amplification to understand where that is going. The nation’s fisc is now on the cusp of descending into the maws of a doomsday machine. So how in the world do these elements of Johnson’s offering make even the remotest sense? Speaker Johnson’s Foreign Aid Boondoggle: Indo-Pacific aid: $8.1 billion. Israel: $26.4 billion. Ukraine: $60.8 billion. Total: $95.3 billion. Apparently, it’s because Johnson and a good share of the Washington GOP have succumbed wholesale to neocon paranoia, stupidity, lies and hollow excuses for warmongering. For crying out loud, Putin has no interest in molesting the Poles, to say nothing of storming the Brandenburg Gate in Berlin. He is certainly no Ghandi, but well more than smart enough to recognize that with Russia’s GDP of $2.2 trillion and war budget of $80 billion there would be no point in going to war with NATO’s $45 trillion of GDP and combined war budgets in excess of $1.2 trillion.

Likewise, China’s $50 trillion debt-ridden Ponzi would collapse in months if its $3.5 trillion flow of export earnings were disrupted after attempting to land its single modern aircraft carrier on the California coast. And Iran has no nukes, no intercontinental range missiles and a GDP equal to 130 hours of US annual output. So, some Axis of evil! Yet that’s exactly what the Speaker said this morning after going to too many Deep State briefings and apparently having his own johnson yanked once too often. The Swamp creatures surely see the lad’s naivete and blithering ignorance as a gift that doesn’t stop giving. That is to say, a “mark” who knows nothing at all about the world from sources not stamped, “Top Secret (lies)”.

Speaker Mike Johnson: “We’re going to stand for freedom and make sure that Putin doesn’t march through Europe… we’re the greatest Nation on the planet, and we have to act like it”, This is a critical time right now, a critical time on the world stage. I can make a selfish decision and do something that’s different but I’m doing here what I believe to be the right thing. “I think providing lethal aid to Ukraine right now is critically important. I really do. I really do believe the intel and the briefings that we’ve gotten. I believe Xi, Vladimir Putin and Iran really are an axis of evil. I think they’re in coordination on it. “So I think that Vladimir Putin would continue to march through Europe if he were allowed. I think he might go to the Balkans next. I think he might have a showdown with Poland or one of our NATO allies.

That’s just after one half-assed strike.

• Oil Prices Spike After Israel Strikes Iran (RT)

Global prices for crude oil jumped by as much as 3.5% shortly after Israel carried out a series of strikes on Iran in the early hours of Friday. Both oil benchmarks soared over $3 a barrel in early trading before retreating. By 12:00 GMT, Brent crude oil futures for June delivery were down $0.50 at $86.63 per barrel. The May contract for US West Texas Intermediate (WTI) dropped $0.43, or 0.52%, to $82.30 per barrel. Israel launched an attack on Iranian territory in the early morning hours, a senior US official confirmed in an interview with ABC News. Al Jazeera reported that Iranian state television had also confirmed the strikes, and that air defenses had been activated. Flights across several areas, including Tehran and Isfahan, were suspended.

The attack, the latest tit-for-tit exchange between the two nations, came nearly a week after Iran unleashed a barrage of 300 aerial drones and missiles on Israel. The shelling was conducted in response to a suspected Israeli strike on an Iranian consular building in Syria that killed 12 people, including three senior Iranian military officers. Tehran believes Israel was behind the bombing, although West Jerusalem has neither claimed nor denied responsibility. Iran is the world’s seventh largest oil producer, according to the US Energy Information Administration, and the third-largest OPEC member. It produces around 3.2 million barrels of crude per day, and last year ranked as the world’s second largest source of oil supply growth after the US.

The spike in oil prices is seen by analysts as a self-evident market reaction to mounting concerns about a renewed escalation of hostilities between Israel and Iran. “Rising geopolitical risk premiums translate to a risk-off environment at this juncture with a heightened risk of oil supply disruption at least in the short-term,” Kelvin Wong, an analyst at OANDA in Singapore, told Reuters. Earlier this week, energy experts at Bank of America warned that an all-out war between Israel and Iran, which will inevitably impact energy infrastructure and disrupt Iranian crude supplies, is expected to drive oil prices up by $30-$40 per barrel. Increased tensions in the region could also jeopardize shipping through the Strait of Hormuz between Oman and Iran. About a fifth of the world’s total oil supply passes through the crucial shipping route.

There are plenty warmongers on all sides. But for now they’ve been subdued.

• Only Hamas Wants Bigger War As Iran, Israel Signal Strikes ‘Done’ (ZH)

There has been no Iranian response against Israel for the overnight Israeli retaliation attack on the Islamic Republic. US officials have since confirmed that it was in fact an Israeli attack, yet all the while Iran’s leaders are trying desperately to downplay it, saying it inflicted no damage, and that several reported explosions were actually the result of Iran’s air defenses intercepting a few drones, particularly over the city of Isfahan, site of a key nuclear facility. Importantly, as we predicted, Tehran is saying it has no plans for further retaliation following the oddly toothless, performative response from Israel. Officially, Iran and its state media are even referring to the attack incident as having been done by “infiltrators” while not readily naming Israel, also declaring that the aggression ‘failed’. So far, it is looking like none of Iran’s nuclear facilities were actually hit. Reuters has called Iran’s stance “a response that appeared gauged towards averting region-wide war.”

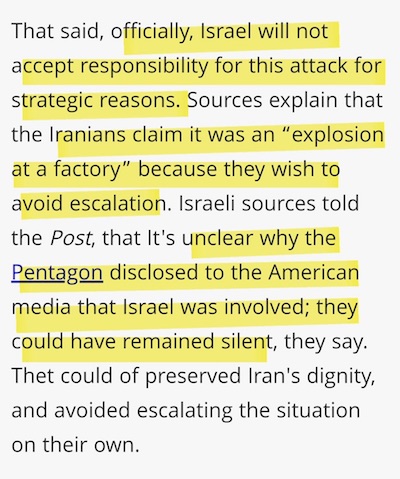

US Secretary of State Antony Blinken in a fresh statement sought to emphasize that the United States was not involved in any offensive operations against Iran, nor did he confirm Israel was behind it during the remarks, and the West continues to urge restraint by both sides. The Washington Post is also acknowledging Iranian media’s muted response in wake of overnight events: “Iranian state media was muted in its response to the attack, saying its air defense systems had intercepted “three small drones” in Isfahan province. There was no damage to Iran’s nuclear sites, including those in Isfahan, the International Atomic Energy Agency said Friday morning. Isfahan is the site of Iran’s largest nuclear research complex; the area is home to a military base.” Israeli national security officials were cited in the The Jerusalem Post on Friday as saying, “An eye for an eye, a tooth for a tooth. Israel retaliated where they were attacked.” However, JPost additionally noted some strange qualifiers, suggesting both sides are taking a ‘nothing to see here folks’ approach:

“That said, officially, Israel will not accept responsibility for this attack for strategic reasons. Sources explain that the Iranians claim it was an “explosion at a factory” because they wish to avoid escalation. Israeli sources told the Post that it’s unclear why the Pentagon disclosed to the American media that Israel was involved; they could have remained silent, they say. They could have preserved Iran’s dignity and avoided escalating the situation on their own.” An earlier Bloomberg report disclosed that Israel had informed the White House on Thursday that a military strike on Iran was being planned in “the next 24-48 hours.” Bloomberg is now reporting Friday morning that “an Iranian military official signaled Tehran doesn’t feel compelled to react to the blasts which US officials say were caused by Israeli strikes, with semi-official Mehr agency quoting Army Commander-in-Chief Abdolrahim Mousavi saying Tehran has already reacted to Israeli threats.”

Iran’s President Ebrahim Rais made a planned speech on Friday and did not mention the overnight attack on Iranian soil, only the last Saturday offensive operations against Israel: “Operation True Promise led to authority, unity and cohesion in the country,” Raisi said. “Today, all political groups and factions believe that this response was necessary and a big honour for the country,” the Iranian president added, saying nothing further about the Israeli attack just hours prior. There’s only one group at this point that appears to be disappointed that it’s over: “HAMAS OFFICIAL SAYS ISRAELI AGGRESSION ON IRAN IS AN ESCALATION AGAINST THE REGION”. “HAMAS OFFICIAL CALLS FOR EXPANDING ENGAGEMENT AGAINST ISRAEL OVER WAR OF GENOCIDE IN GAZA AND ESCALATION IN THE REGION.” Hamas leadership likely thought this is the start of the ‘big war’ in Gaza’s defense – which still possibly may come – but at this point of “cooler heads” prevailing is no longer looking likely.

“While the attention of the world is focused on Gaza, abuses in the West Bank, fueled by decades of impunity and complacency among Israel’s allies, are soaring.”

• Israeli Settlers, Soldiers ‘Wiping Palestinian Communities Off the Map (CD)

Israeli soldiers have either passively watched or participated in the uprooting of at least seven communities in the West Bank since October of last year, Human Rights Watch said Wednesday in a new report documenting surging settler violence in the occupied Palestinian territory. The rights group interviewed dozens of eyewitnesses and examined video footage showing harassment and other abuse of Palestinians in the West Bank “by men in Israeli military uniforms carrying M16 assault rifles.” Following the Hamas-led October 7 attack on southern Israel, the Israeli military drafted more than 5,000 settlers into “regional defense” units in the West Bank, Haaretzreported earlier this year.

The Israeli newspaper noted that “alongside this large-scale mobilization, the [Israel Defense Forces] has distributed some 7,000 weapons to the battalions as well as to settlers who were not recruited into the army but received them as civilians whom the army considers eligible to carry military arms.” HRW’s investigation found that “armed settlers, with the active participation of army units, repeatedly cut off road access and raided Palestinian communities, detained, assaulted, and tortured residents, chased them out of their homes and off their lands at gunpoint or coerced them to leave with death threats, and blocked them from taking their belongings.” “Israeli settlers and soldiers are literally wiping Palestinian communities off the map,” said Omar Shakir, HRW’s Israel and Palestine director.

“While the attention of the world is focused on Gaza, abuses in the West Bank, fueled by decades of impunity and complacency among Israel’s allies, are soaring.” The new report comes days after Israeli settlers—escorted by IDF soldiers—went on their latest destructive and deadly rampage in the West Bank, killing at least two Palestinians, injuring dozens, and setting homes and vehicles ablaze. At least 20 households were displaced after Israeli settlers burned down their homes. The wave of settler violence came after a missing 14-year-old Israeli boy was found dead in the area around the West Bank city of Ramallah. The Israeli military said the boy was killed in a “terrorist attack.”

Since October 7, according to the United Nations, Israeli settlers have launched more than 720 attacks on Palestinians in the West Bank, displacing at least 206 households comprised of 1,244 people—including 603 children. Israeli soldiers in uniform have been present at many of the attacks. “Settlers and soldiers have displaced entire Palestinian communities, destroying every home, with the apparent backing of higher Israeli authorities,” Bill Van Esveld, associate children’s rights director at HRW, said in a statement Wednesday. “While the attention of the world is focused on Gaza, abuses in the West Bank, fueled by decades of impunity and complacency among Israel’s allies, are soaring.”

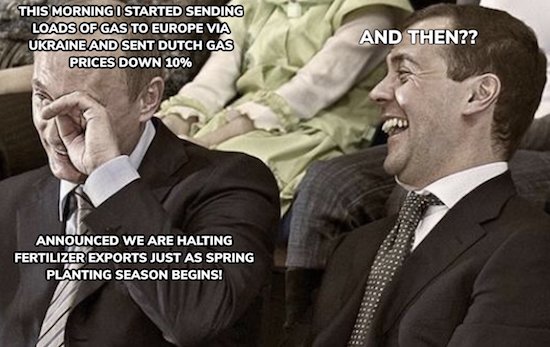

Warsaw and Kiev had a nice story on Russia wanting to get him. Medvedev turned that around.

• West Plotting To Assassinate Zelensky – Medvedev (RT)

Allegations that a Polish man was plotting with Moscow to assassinate Ukrainian President Vladimir Zelensky are a sign that Kiev’s Western backers want to “liquidate” the Ukrainian leader, former Russian President Dmitry Medvedev has claimed. On Thursday, Polish officials reported the arrest of a man who is accused of trying to provide sensitive information to the Russian intelligence services. The information could have been used in an attempt to kill Zelensky, Warsaw and Kiev have claimed. “An attempt on the life of the chief Banderite [Zelensky] in Poland? That is truly serious,” Medvedev, who serves as deputy head of the Russian Security Council, wrote on social media on Friday in response to the claims. “It may be the first piece of evidence that people in the West have made a decision to liquidate him. Be afraid, clown!”

The term ‘Banderite’ refers to the Ukrainian nationalist movement of Stepan Bandera, which was responsible for the ethnic cleansing of Poles during World War II. The Nazi collaborator is considered a national hero in modern Ukraine. The Polish citizen, identified as Pawel K. by the National Prosecutor’s Office in Warsaw, faces up to eight years in jail if convicted on charges of attempting to work with a foreign power against national interests. Specifically, Pawel K. is accused of trying to share information with Moscow about Rzeszow–Jasionka Airport in southeastern Poland. The facility is used to ship weapons and munitions that NATO members donate to Ukraine to fight Russia.

Polish officials, however, have claimed that his tips could “among other things” have helped Moscow plan a hit on Zelensky during a visit to Poland. Kiev’s successor to the KGB, the SBU, repeated the allegations in a statement of its own. Warsaw has claimed Pawel K. was in contact with Russian nationals who are “directly involved” in the Ukraine conflict. Polish authorities were tipped off about the alleged threat by Ukrainian security services. Zelensky has told Western media that Russia has been trying to kill him for years, with multiple attempts prevented by his security detail. However, former Israeli Prime Minister Naftali Bennett said that Russian President Vladimir Putin personally assured him in March 2022 that Moscow would not kill Zelensky.

“This is a military whirlpool that can drag Europe to the bottom. Brussels is playing with fire..”

• The West ‘One Step Away’ From Sending Troops to Ukraine – Orban (Sp.)

The West is one step away from deploying military forces in Ukraine, which could mean an end for Europe, Hungarian Prime Minister Viktor Orban said on Friday. “We are one step away from the West sending troops to Ukraine. This is a military whirlpool that can drag Europe to the bottom. Brussels is playing with fire,” Orban said at an event dedicated to the start of the campaign before the European Parliament elections, aired by the HirTV broadcaster. European leaders have “already got involved” in the conflict in Ukraine, they call it “their war”, and Europe has already spent about 100 billion euros ($106 billion) on Ukraine, Orban mentioned. French President Emmanuel Macron riled up his NATO allies, especially Germany, when he said in February that Western leaders had discussed sending troops to Ukraine. While no consensus had been reached, nothing could be ruled out, he added. Moscow warned that any threat from NATO would meet a response.

“..talks with Vladimir Zelensky are off the table, as they would lead nowhere..”

• Russia Ready For Ukraine Talks, But Not With Zelensky – Lavrov (TASS)

Russia’s signals that it is ready to negotiate on Ukraine are “not just for show,” but talks with Vladimir Zelensky are off the table, as they would lead nowhere, Russian Foreign Minister Sergey Lavrov said in an interview with radio stations Sputnik, Govorit Moskva (Moscow speaking) and Komsomolskaya Pravda. “We are fully convinced that we need to continue the special military operation. We indicate our readiness for negotiations not just for show. This is indeed the truth, but talking to Zelensky is pointless for many reasons,” he said.

The first negotiations between Russia and Ukraine after the start of the special military operation took place in early March 2022 in Belarus, but they did not bring tangible results. On March 29, 2022, the next round took place in Istanbul, when Moscow for the first time received from Kiev the principles of a possible future agreement recorded on paper. It included, in particular, obligations on the neutral, non-aligned status of Ukraine and its refusal to deploy foreign weapons, including nuclear weapons, on its territory. However, the negotiation process was interrupted by Ukraine unilaterally.

Zero trust left.

• No Ceasefire With Ukraine Even If Talks Start – Lavrov (RT)

Russia has no intention of ceasing hostilities with Ukraine even if the two countries engage in peace talks, as Kiev has proven itself to be an unreliable actor, Foreign Minister Sergey Lavrov has said. In an interview with Russian media on Friday, the diplomat stressed that Moscow does not trust the leadership in Kiev. “We have said that we are ready for the negotiations, but – unlike the Istanbul story – we will not make any pauses in the fighting during the negotiations. The process must go on,” he said. The two sides have not directly talked to each other since their sit-down in Istanbul in late March 2022. Russia, which initially expressed satisfaction with results of the meeting and withdrew its forces from the outskirts of Kiev as a goodwill gesture, later accused Ukraine of backtracking on all progress achieved in Türkiye, saying it had lost trust in Kiev’s negotiators.

The foreign minister noted that a major obstacle to any peace process that Ukrainian President Vladimir Zelensky “forbid himself from negotiating” with the current authorities in Moscow. He was referring to a decree that Zelensky signed in the fall of 2022, which banned his government from any talks with his Russian counterpart Vladimir Putin. The realities on the ground have changed “significantly” since the time when the Istanbul negotiations took place, and “those realities must be taken into account,” Lavrov stressed. He clarified that he was talking not only about the situation on the frontline, where Russian forces have recently been making gains, but also the fact that the People’s Republics of Donetsk and Lugansk, and the Kherson and Zaporozhye Regions, which joined Russia as a result of referendums in the fall 2022, are now parts of the country in line with the Constitution. “Everybody should understand this very well,” the diplomat stressed.

Lavrov said it is “absolutely clear” to Moscow that Kiev and its Western backers “do not understand this and… are not even ready to look for any hypothetical compromises.” Since late 2022, Zelensky has been promoting his so-called ‘peace formula,’ which calls for Russia to withdraw from all territories claimed by Kiev and pay reparations, and for the formation of a war crimes tribunal. The Russian foreign minister again outright rejected the plan, calling it an “ultimatum” that provided for no alternative solutions.

WhatsApp, Threads, Telegram and Signal

• Apple Removes Popular Messaging Apps In China (RT)

Apple has pulled several popular messaging apps from its storefront in China at the request of the government in Beijing over alleged national security concerns, the US-tech giant announced on Friday. Meta’s WhatsApp and Threads apps, as well as messaging services Telegram and Signal, are no longer available for download on the AppStore in China, Bloomberg reported. The Wall Street Journal has claimed that Korean Line has also been made inaccessible to Chinese users. Before their removal, none of the apps were widely used in China, where Tencent’s WeChat is the overwhelmingly dominant service.

In a statement to Reuters on Friday, Apple said China’s Cyberspace Administration had requested the removal of instant messengers from the App Store for reasons of national security, but stressed that the apps remain available on all other storefronts. The US-based tech giant noted that it is obliged to comply with the laws of the countries in which it operates, even if it does not agree with them. At the same time, other Meta apps such as Facebook, Instagram, and Messenger are still available for download on the Chinese AppStore. However, as was the case with the removed messaging apps, it is still difficult to access these platforms without special proxy tools such as a virtual private network (VPN) to circumvent Beijing’s Great Firewall.

The four removed apps remain available in China’s two special administrative regions of Hong Kong and Macau, Reuters noted. While the specific reasons for the request to remove the apps remain unknown, the step may be tied to a law passed in China last year which requires all apps operating in the country to register with the local regulatory body. In August, Chinese authorities called on foreign developers to adhere to this rule by the end of March 2024 or be forced to remove their apps from the marketplace.

”We now have reality-immune kids. The digital revolution is the foundation for our coming Age of Tyranny..”

• This Is What The Digital Revolution Brought Us (Paul Craig Roberts)

Your information is everywhere on the internet. It is in your banking, financial, credit card, cell phone, internet, utility, and online purchase accounts and in the accounts of these companies’ service providers. Your information is in more places than you can imagine. The internet system is easy to hack, because it was created as an open system for the military. Depending on what thieves gain access to, they may make purchases on your current credit cards and/or drain your bank accounts. Identity thieves can also use all or some of your data to open new credit or loan accounts – and then let the unpaid debts pile up. By opening a lot of new accounts in a short period of time, thieves can lower your credit score. The repercussions of a low credit score are immense. The FBI, the NSA can put kiddie porn on your computer and arrest you.

We can be spied on without warrants in violation of the Constitution. Cyber security does not exist. It is a myth. The digital revolution has totally destroyed our constitutional right to privacy and has left us insecure to every kind of malevolent event. The shifting of all custom relations costs to the customer, resulting in service users spending endless time with a robot trying to correct service and account problems. Problems previously handled in 3 minutes now take 3 hours, sometimes three days. The digital revolution has brought us kids who have never played outside in the sunshine and live in a world of video games. We now have reality-immune kids. The digital revolution is the foundation for our coming Age of Tyranny. The developers of the digital revolution are humanity’s worse enemies. The only solution is to bring back the analogue days.

Nunes et al are more tech- and finance savvy than thought.

• Trump Media Stock Spikes After CEO Pens “Naked” Short Letter (ZH)

Shares of Trump Media spiked on Friday after the company alerted the Nasdaq to ‘potential market manipulation’ from ‘naked’ short selling of its stock. The warning came as the company, which trades under the symbol $DJT, offered shareholders detailed instructions on how to prevent someone from loaning out their shares to short sellers. In a Friday morning letter to Nasdaq CEO Adrena Friedman, CEO Devin Nunes noted that as of Wednesday, “DJT appears on Nasdaq’s ‘Reg SHO threshold list,’ which is indicative of unlawful trading activity.” “This is particularly troubling given that ‘naked’ short selling often entails sophisticated market participants profiting at the expense of retail investors,” Nunes continued. In his letter, Nunes pointed to circumstantial evidence – including DJT being the most expensive stock to short in the US, which he said would give brokers “significant financial incentive to lend non-existent shares,” CNBC reports. The letter also links to a CNBC article which delves into the high premiums brokers were charging short sellers for loans of DJT to sell.

$DJT CEO going full “Ape”. Never go full Ape. pic.twitter.com/clicSGJiwJ

— Diogenes (@WallStCynic) April 19, 2024

“I write to bring your attention to potential market manipulation of the stock of Trump Media & Technology Group Corp,” wrote Nunes. “As you know, ‘naked’ short selling — selling shares of a stock without first borrowing the shares of stock deemed difficult to locate — is generally illegal pursuant to Securities and Exchange Commission (‘SEC’) Regulation SHO,” the letter continues. “Data made available to us indicate that just four market participants have been responsible for over 60% of the extraordinary volume of DJT shares traded: Citadel Securities, VIRTU Americas, G1 Execution Services, and Jane Street Capital,” Nunes said, adding: “In light of the foregoing, and Nasdaq’s obligation and commitment to protect the interests of retail investors, please advise what steps you can take to foster transparency and compliance by ensuring market makers are adhering to Reg SHO, requiring brokers to disclose their ’Net Short” positions, and preventing the lending of shares that do not exist.” Shares of DJT began spiking premarket, and were up as much as 11%.

A risky position to take. From March 12: “A former Boeing employee has been found dead in the US days before he was due to give evidence in a whistleblower lawsuit against the aerospace giant. [..] John Barnett, a 62-year-old former Boeing quality manager was found dead in his car, allegedly from a self inflicted wound, in a hotel parking lot – seven years after retiring from a 32-year career with the group.”

• Boeing Whistleblower Threatened With ‘Physical Harm’ – CNN (RT)

Hundreds of people could die unless American aerospace giant Boeing addresses critical safety issues, a whistleblower has told the US Senate, also claiming that he was threatened with “physical violence” for going public, CNN has reported. Sam Salehpour, an engineer at Boeing, told two Senate committee hearings on Wednesday that he has been voicing safety concerns for several years but has been “ignored” and told “not to create delays.” “The safety problems I have observed at Boeing, if not addressed, could result in a catastrophic failure of a commercial airplane that would lead to the loss of hundreds of lives,” he said. His testimony comes as Boeing grapples with the fallout from a major safety crisis. Fears were raised after an incident on a 737 MAX in January, when an Alaska Airlines flight bound for California from Portland, Oregon, had to turn back after a door panel blew off at 16,000 feet (4,900 meters), injuring several of the 171 passengers aboard and sucking clothing and cell phones out of the aircraft.

After raising concerns, Salehpour said “I was told not to create delays. I was told, frankly, to shut up.” There is “no safety culture” at Boeing, he claimed, alleging that employees who raise the alarm are “ignored, marginalized, threatened, sidelined and worse.” The engineer insisted he was testifying due to his confidence that Boeing was “putting out defective airplanes.” He cited alleged practices by the planemaker, including people jumping on pieces of the airplane to correct misalignment between sections of jets. Salehpour has reportedly urged Boeing to ground all 787 jets for inspection. The US Federal Aviation Administration said it is investigating the allegations that Boeing took shortcuts to reduce production bottlenecks while making the 787. Salehpour also raised issues about the production of the 777, another wide-body jet.

Boeing did not have any witnesses at either hearing, according to CNN, but at a briefing earlier this week the company defended its production standards. The manufacturer said that in 13 years of service, the 787 fleet has safely transported over 850 million passengers on more than 4.2 million flights, while the 777 fleet has safely flown more than 3.9 billion passengers around the world. Boeing President and CEO Dave Calhoun announced in March that he will step down by the end of the current year, in a move seen as major management shakeup.

Halving. “The final halving is expected to occur in 2140..”

• Impending Event Could Push Price Of Bitcoin Into Stratosphere (RT)

The price of Bitcoin, the world’s highest-valued cryptocurrency, surged past $64,000 on Friday, rebounding from a drop below the $60,000 mark. The crypto continues to experience volatility ahead of an upcoming ‘halving’ event, which has sparked controversy over its potential impact. The latest Bitcoin halving – a mechanism to limit supply that takes place every four years – is expected late on Friday night or early Saturday. Halving is when the rewards for Bitcoin miners are slashed in half to slow the supply of the crypto into the market. This time, the reward for mining new bitcoins will decrease from 6.25 bitcoins to 3.125. The final halving is expected to occur in 2140, when the number of bitcoins circulating will reach the theoretical maximum supply of 21 million. As of March 2024, about 19.65 million bitcoins were in circulation, leaving just around 1.35 million to be released via mining rewards.

Experts say the impending halving event comes with heightened expectations that the reduced amount of bitcoin entering into circulation will create a kind of supply shock that will drive prices up. The last halving, in 2020, preceded a five-fold increase in Bitcoin’s price, following a pattern that has seen record-breaking rallies for the cryptocurrency after each previous such event, in 2016 and 2012, respectively. “The halving helps naturally increase price due to supply and demand over a medium- to long-term outlook, which in turn brings new people in as the price increases past previous all-time highs. So, indirectly, it plays a huge part in shaping investor sentiment and market speculation,” Danny Scott, chief executive of crypto platform CoinCorner, told The Independent. “Historically, the value of Bitcoin has increased after each halving event. This trend is likely to continue during the current market cycle, considering the high amount of institutional interest,” according to Kadan Stadelmann, Chief Technology Officer of blockchain firm Komodo Platform.

In January, the US Securities and Exchange Commission approved the first ever Bitcoin spot exchange-traded funds (ETFs), bringing billions of dollars’ worth of institutional investment to the market for the first time. This increase in demand, combined with the upcoming reduction in supply, has led some analysts to believe that Bitcoin could hit new heights in the coming months. Despite some kind of volatility in recent weeks, Bitcoin remains a strongly performing asset, up 40% so far in 2024 and more than double where it was at the same time last year. Investors anticipate the price could break above its previous all-time high of $70,105, reached last month. Meanwhile, the founder of Draper Associates, Tim Draper, has projected the halving could even push the price of Bitcoin as high as $250,000 by July.

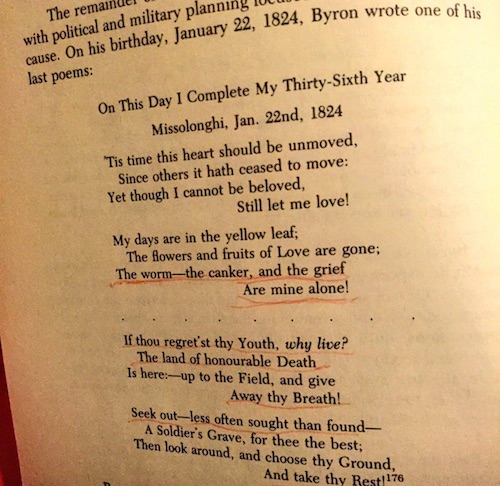

Lord Byron died April 19 1824 in Missolonghi, Greece. This is one of his last poems.

RFK Gates

Bill Gates asked the Danish government to support DTP vaccination for 161 million African children, claiming it saved 30 million lives. After conducting their own studies, the Danish government discovered that vaccinated girls died at 10 times the rate of unvaccinated girls. pic.twitter.com/E6PrQVzwQb

— Wide Awake Media (@wideawake_media) April 19, 2024

Capybara

https://twitter.com/i/status/1781232167109980375

Jaguar Lion

Oh nothing, just a Jaguar and Lion cuddling! pic.twitter.com/umfh5q2Azj

— Nature is Amazing ☘️ (@AMAZlNGNATURE) April 19, 2024

Cow jump

These cows jumping over a wooden fence pic.twitter.com/AAQdc8NiN6

— Nature is Amazing ☘️ (@AMAZlNGNATURE) April 19, 2024

Deer hunter

A hunter while aiming at a deer, pulls down his weapon, and she peacefully approaches him. pic.twitter.com/8ZzF0qAm4i

— Nature is Amazing ☘️ (@AMAZlNGNATURE) April 19, 2024

Turtle

This Man found, raised, and nurturer a Snapping turtle from the time it was the size of a thumb nail. Now it's a big softy. pic.twitter.com/ciLArdeDlA

— Nature is Amazing ☘️ (@AMAZlNGNATURE) April 19, 2024

Skidding

Legend has it the lion is still skidding to this day pic.twitter.com/Wgi8AXuvYG

— Nature is Amazing ☘️ (@AMAZlNGNATURE) April 19, 2024

Elephant, cubs

Elephant attacks the lioness but spares cubs pic.twitter.com/cF4FRyy5PX

— Nature is Amazing ☘️ (@AMAZlNGNATURE) April 19, 2024

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.