Julie Edgley Immature white tailed eagle.

Two mass shootings in the US, Iran seizes another tanker and police in France and Hogn Kong chase protesters. Must be Sunday.

Well, yes, it’s been about plunder for as long as our ‘civilization’ exists. We prefer to use other terms, that’s all.

• An Economy Based on Plunder (PCR)

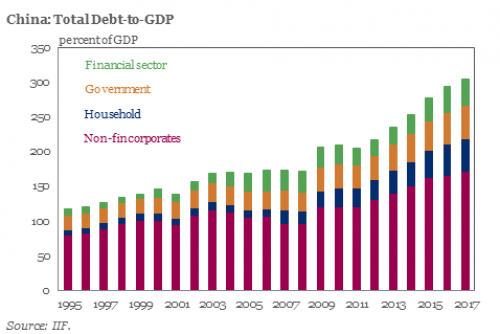

Capitalists have claimed responsibility for America’s past economic success. Let’s begin by setting the record straight. American success had little to do with capitalism. This is not to say that the US would have had more success with something like Soviet central planning. Prior to 1900 when the frontier was closed, America’s success was a multi-century long success based on the plunder of a pristine environment and abundant natural resources. Individuals and companies were capitalized simply by occupying the land and using the resources present. As the population grew and resources were depleted, the per capita resource endowment declined.

America got a second wind from World War I, which devastated European powers and permitted the emergence of the US as a budding world power. World War II finished off Europe and put economic and financial supremacy in Washington’s hands. The US dollar seized the world reserve currency role from the British pound, enabling the US to pay its bills by printing money. The world currency role of the dollar, more than nuclear weapons, has been the source of American power. Russia has equal or greater nuclear weapons power, but it is the dollar not the ruble that is the currency in which international payments are settled. The world currency role made the US the financial hegemon.

This power together with the IMF and World Bank enabled the US to plunder foreign resources the way vanishing American resources had been plundered. We can conclude that plunder of natural resources and the ability to externalize much of the cost have been major contributors right through the present day to the success of American capitalism. [..] Essentially, capitalism is a plunder mechanism that generates short-run profits by externalizing long-run costs. It exhausts natural resources, including air, land, and water, for temporary profits while imposing most of its costs, such as pollution, on the environment.

And economics is designed to justify the plunder.

• Economics Is A Failing Discipline Doing Great Harm (Simms)

[..] neoclassical economics has so deeply entrenched the notion that markets are better than all other ways of organising life, that decisions escape rational scrutiny. Academic economists will tell you that their discipline offers a far more complex picture of the world. But, at the policy level, what tilts a spending decision one way or the other is the simple power of the seeming “folk wisdom” that markets are best. It becomes the rule of thumb. They might look less good if the assumptions on which the equilibrium models that got us here were more widely known. The idea of perfect markets under perfect competition, for example, asks us to believe in a world where everybody knows everything, there are an infinite number of companies, no barriers to setting up a business, where any product can stand in for any other (say, a banana for a tractor) and, crucially, there are no “externalities” (economic speak for “consequences”) from production or consumption.

All models use a few simplifying assumptions, but those underpinning mainstream economics more often distort and detach from reality. It’s one of the reasons why students have rebelled, forming groups to demand that universities take a more pluralistic approach to teaching economics. Katie Kedward left a banking job in the City for ethical reasons and sought a degree that would make sense of economics. Despairing at the unreality of mainstream courses, she found a rare exception: a master’s in ecological economics at the University of Leeds. The course, though, isn’t even taught in the economics department but the School of Earth and Environment. That’s why new groups are emerging to promote heterodox economics, which draws on the insights of the study of complexity, neuro and behavioural science, ecology, feminism and the core economy of family, mutualism and community.

Yeah, don’t just sit there, do something instead. Like seize Joe’s wealth.

• Joe Biden To Millennials: Stop Complaining (HPo)

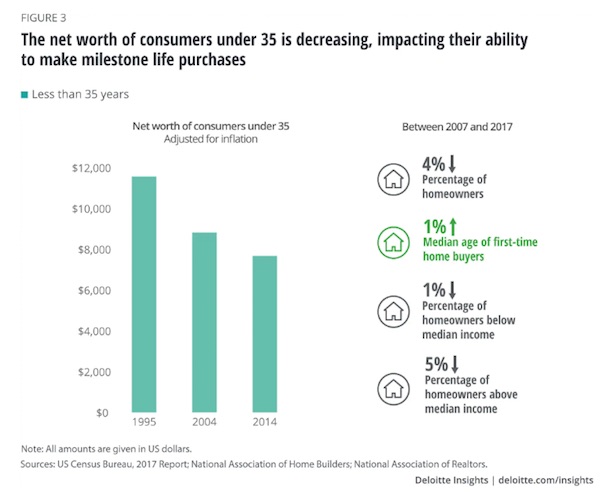

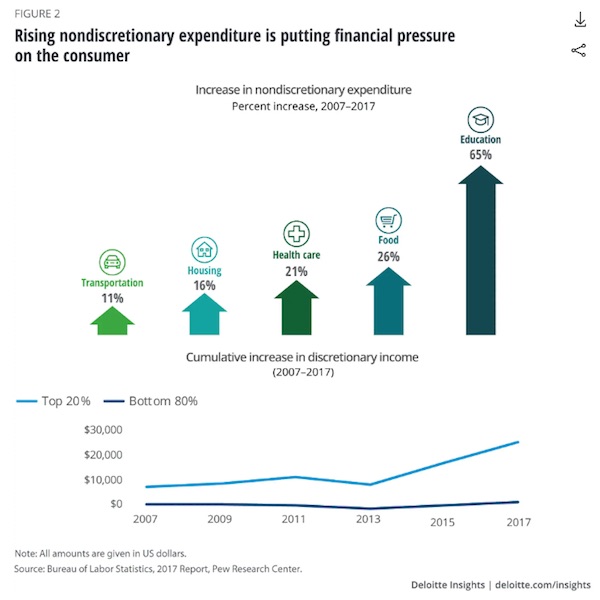

Former Vice President Joe Biden has a message for the millennial generation: Stop complaining if you aren’t going to engage with politics. The 2020 Democratic presidential contender stood by the skepticism he expressed last year when asked about young adults’ belief that they face outsize hurdles to secure housing and pay off debt. “I have no empathy for it. Give me a break,” Biden said in January 2018. Asked to explain what he meant, Biden began talking about his personal experience growing up with “very modest means” and how he felt upon learning about a study that found relatively few young people today would consider running for political office.

“We have an obligation to get engaged,” Biden said at Saturday’s AFSCME forum, co-moderated by HuffPost. “You all have an obligation to get engaged.” “Don’t tell me how bad it is. Change it. Change it. Change it,” he said. He added: “My generation did it.” = Biden drew some criticism the first time he went after millennials, more than a year before he announced his candidacy. Conservative New York Times opinion writer and climate denier Bret Stephens later sided with Biden in a column criticizing the millennial generation, which Stephens said specializes in “histrionic self-pity and moral self-righteousness.”

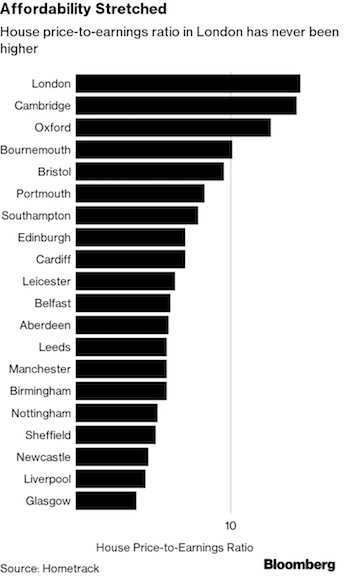

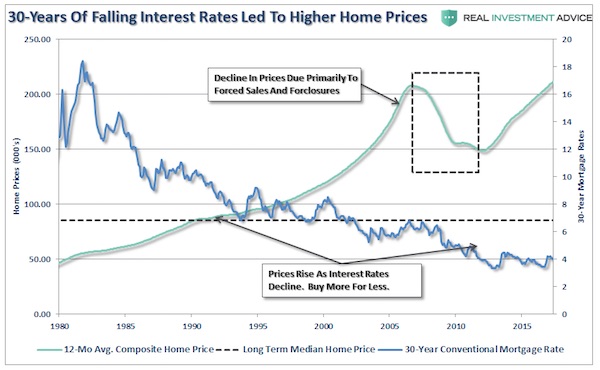

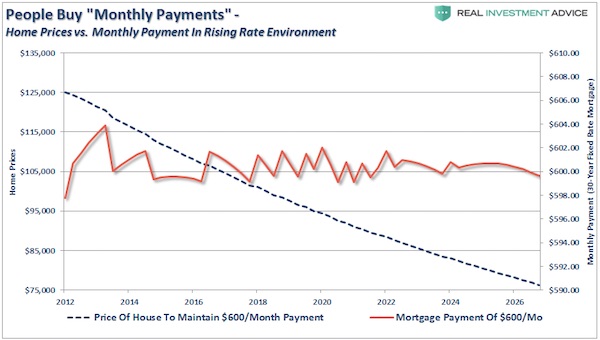

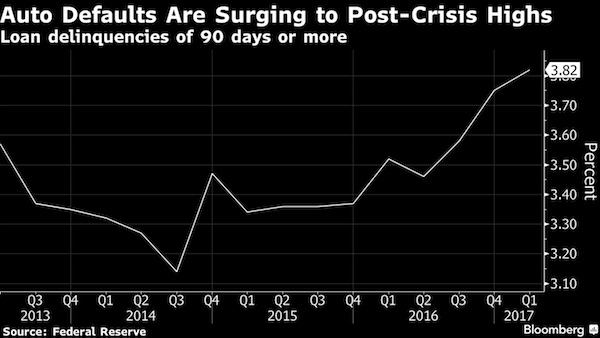

As HuffPost’s Michael Hobbes reported in 2017, there is a large amount of research and data that paints a bleak financial future for young people, many of whom are already reporting that they’re finding themselves priced out of the housing market. Although Biden has consistently polled highest among the wide field of 2020 Democratic presidential contenders, his supporters skew older and more moderate. At the forum, he went on to say, “I just don’t want people telling me on a college campus, ‘Oh, woe is me, I’ve got it so bad.’ … Come on.”

Checkmate?

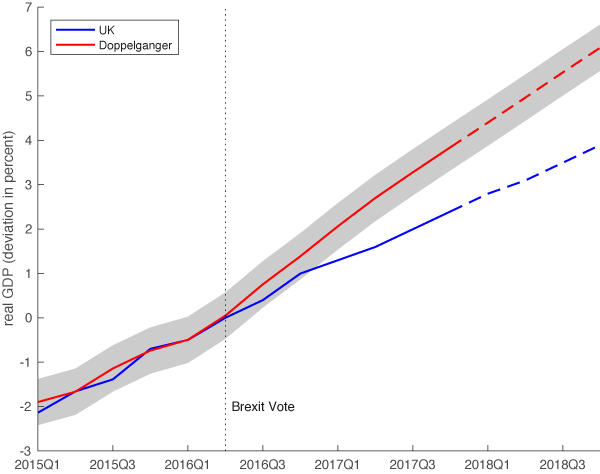

• Dominic Cummings: UK Lawmakers Can’t Stop No-Deal Brexit (R.)

Lawmakers will be unable to stop a no-deal Brexit on Oct. 31 by bringing down Britain’s government in a vote of no confidence next month, Prime Minister Boris Johnson’s top aide has advised, according to the Sunday Telegraph. Dominic Cummings, one of architects of the 2016 campaign to leave the European Union, told ministers that Johnson could schedule a general election after the Oct. 31 Brexit deadline if he loses a vote of no confidence in parliament, the newspaper said, citing sources. Johnson has promised to lead Britain out of the EU on Oct. 31 with or without a deal but has a working majority of just one after his Conservative Party lost a parliamentary seat on Friday.

Some of his lawmakers have hinted they would vote against him to prevent a no-deal Brexit — a rising prospect that has sent the pound tumbling to 30-month lows against the dollar over the last few days. Lawmakers are unable to table a motion of no confidence before next month because the House of Commons is in recess until Sept. 3. “(Lawmakers) don’t realise that if there is a no-confidence vote in September or October, we’ll call an election for after the 31st and leave anyway,” Cummings was quoted by one of the Sunday Telegraph’s sources as saying. Johnson has said he would prefer to the leave the EU with a deal but has rejected the Irish backstop — an insurance policy to prevent the return of a hard border between the Irish Republic and Northern Ireland — which the EU says is key to any agreement.

“..the special counsel’s office spent $25 million digging for Russian infiltrators in the White House.”

• Justice Dept Bill Comes Due For Russiagate Costs (RT)

Nearly two years of fruitlessly hunting for collusion between US President Donald Trump’s campaign and the Russian government cost the country $31.7 million, the Justice Department has revealed. The cost of special counsel Robert Mueller’s 22-month probe was released in a Justice Department accounting report on Friday. While the last six months of the investigation, which concluded in May with Mueller’s resignation, cost “only” $6.5 million as he began sending prosecutors home and writing up the 448-page report, turning the full force of the country’s investigative apparatus against a president and his campaign isn’t cheap. From May 2017 to September 2018, the special counsel’s office spent $25 million digging for Russian infiltrators in the White House.

Some $2.4 million of the last phase’s expenses would have been spent anyway on Department salaries, according to the report, but the itemized breakdown provides an interesting window into the bureaucratic swamp that produced the pricey nothingburger. “Transportation of Things” may have cost just $229, but Justice Department employees billed the government for $235,812 to work out of the special counsel’s office instead of their own offices (filed under “Travel and Transportation of Persons”). While the special counsel investigation infamously turned up no proof of the promised Russian collusion, that did not stop Trump’s political opponents from attempting to reframe the expensive endeavor as a victory – based on the handful of process crimes levied against Trump associates – or a “roadmap to impeachment,” since Mueller did not explicitly say Trump should not be prosecuted and outlined 10 potential scenarios of obstruction of justice.

Adding insult to injury, several key “facts” in the report have already been proven wrong or misleading, such as the identity of Konstantin Kilimnik, who Mueller described as having links to Russian intelligence but who was actually a US State Department asset. And last month, a federal judge found that Mueller had utterly failed to prove that the company running the “troll farm” that supposedly committed “sweeping and systematic” interference in US elections on behalf of the Russian government had any government connections at all.

Who’s powerful enough to remain hidden?

• Celebrities, Royals, Politicians Fear Release Of Jeffrey Epstein Files (Tel.)

In Room 270, the records management unit, on the second floor of an imposing granite and marble courthouse in lower Manhattan, 167 documents totaling more than 2,000 pages are being kept under lock and key. But they are about to be unsealed and made public – making a host of important people around the world, including celebrities, politicians and royals, very nervous. The files contain explosive allegations in the case of Giuffre v Maxwell, in which Virginia Giuffre, a woman who claims to have been Jeffrey Epstein’s teenage “sex slave”, sued Ghislaine Maxwell, a British socialite and the billionaire’s former girlfriend, for defamation.

The case was settled in May 2017 on the eve of the trial but the details were not disclosed and the final judgment and supporting documents were sealed, with the court noting the “highly sensitive nature of the underlying allegations.” According to other court documents that have been published, Ms Giuffre has made allegations of sexual abuse against “numerous prominent American politicians, powerful business executives, foreign presidents, a well known Prime Minister, and other world leaders.” An appeal to unseal the rest of the documents was launched by the Miami Herald newspaper, which has spearheaded media investigations into Epstein. It was rejected three times. But last month the US Court of Appeals for the Second Circuit ordered their release, ruling that the public’s right to know outweighed the privacy rights of the high-profile individuals named.

It what may be an indication of the fame of those individuals, the judges made a striking plea to the media to “exercise restraint” in reporting the allegations about to come to light. They also allowed parties involved to apply for minor redactions, delaying the release. Another delay is possible as Miss Maxwell has launched an appeal to keep the documents sealed, her lawyers arguing that a full release would trigger a “furious feeding frenzy.” They wrote: “Plaintiff Giuffre made numerous allegations of sexual, if not criminal, conduct against a wide range of third parties. Because of the media no reference to anyone in this case is benign: a reference to any person is toxic and lethal to that person’s reputation. Facts and truth are all but irrelevant.”

Prince Andrew, Virginia Roberts Giuffre and Ghislaine Maxwell in 2001

Have you no shame?

• California Scrubs Controversial Kamala Harris-Era Arrest Reports (ZH)

The California Department of Corrections and Rehabilitation has scrubbed arrest records from Sen. Kamala Harris’s controversial tenure as the state’s top law enforcement official, according to the Washington Free Beacon. The purge was conducted during a ‘routine website redesign,’ removing public access to several key incarceration reports. Twice a year, the CDCR releases information about the number of new individuals incarcerated in the California prison system as part of its “Offender Data Points” series. These reports provide important information on demographics, sentence length, offense type, and other figures relevant to criminal justice and incarceration.

Until recently, these reports were publicly available at the CDCR’s website. A search using archive.org’s Wayback Machine reveals that as of April 25, 2019—the most recent indexed date—ODP reports were available dating back to the spring of 2009. As of August 2019, the same web page now serves only a single ODP report, the one for Spring 2019. The pre-2019 reports have been removed. -Washington Free Beacon During the Democratic debates on Wednesday night, Rep. Tulsi Gabbard (D-HI) excoriated Harris’s record as California Attorney General, rattling off a laundry list of ‘inconvenient’ facts – such as the 1,500-plus Californians Harris sent to prison for marijuana-related offenses, blocking evidence that would have freed an innocent man from death row until forced to do so by the courts, and using prison inmates as cheap labor. Harris did not refute any of Gabbard’s statements.

The now-scrubbed records were used by the Free Beacon in prior reporting – “specifically the finding that more than 120,000 black and Latino Californians were sent to prison while she was in the State A.G.’s office.” A CDCR employee claims that the changes have nothing to do with Harris’s campaign, and were instead prompted by California law AB 434 which ‘sets standards for web accessibility.’

Reeks too much of fear-mongering to me. Alastair Crooke can theorize all he wants.

• America’s Elites: Fractured and At Odds with Each Other (Crooke)

Something is ‘up’. When two Financial Times columnists – pillars of the western Establishment – raise a warning flag, we must take note: Martin Wolf was first off, with a piece dramatically headlined: The looming 100-year, US-China Conflict. No ‘mere’ trade war, he implied, but a full-spectrum struggle. Then his FT colleague Edward Luce, pointed out that Wolf’s “argument is more nuanced than the headline. Having spent part of this week among leading policymakers and thinkers at the annual Aspen Security Forum in Colorado,” Luce writes, “I am inclined to think Martin was not exaggerating. The speed with which US political leaders of all stripes have united behind the idea of a ‘new cold war’ is something that takes my breath away. Eighteen months ago the phrase was dismissed as fringe scaremongering. Today it is consensus.”

A significant shift is underway in US policy circles, it seems. Luce’s final ‘take’ is that “it is very hard to see what, or who, is going to prevent this great power rivalry from dominating the 21st century”. It is clear that there is indeed now a clear bi-partisan consensus in the US on China. Luce is surely right. But that is far from being the end of it. A collective psychology of belligerence seems to be taking shape, and, as one commentator noted, it has become not just a great-power rivalry, but a rivalry amongst ‘Beltway’ policy wonks to show “who has the bigger dick”.

And quick to demonstrate this, at Aspen (after others had unveiled their masculinity on China and Iran), was the US envoy for Syria (and deputy US National Security Adviser), James Jeffrey: A US policy boiled down to one overriding component: ‘hammering Russia’. “Hammering Russia” (he insisted repeatedly), will continue until President Putin understands there is no military solution in Syria (he said with heightened verbal emphasis). Russia falsely assumes that Assad has ‘won’ war: “He hasn’t”, Jeffrey said. And the US is committed to demonstrating this fundamental ‘truth’.

We must change it to preserve our own mental health.

• We Must Change Food Production To Save The World (G.)

Attempts to solve the climate crisis by cutting carbon emissions from only cars, factories and power plants are doomed to failure, scientists will warn this week. A leaked draft of a report on climate change and land use, which is now being debated in Geneva by the Intergovernmental Panel on Climate Change (IPCC), states that it will be impossible to keep global temperatures at safe levels unless there is also a transformation in the way the world produces food and manages land. Humans now exploit 72% of the planet’s ice-free surface to feed, clothe and support Earth’s growing population, the report warns. At the same time, agriculture, forestry and other land use produces almost a quarter of greenhouse gas emissions.

In addition, about half of all emissions of methane, one of the most potent greenhouse gases, come from cattle and rice fields, while deforestation and the removal of peat lands cause further significant levels of carbon emissions. The impact of intensive agriculture – which has helped the world’s population soar from 1.9 billion a century ago to 7.7 billion – has also increased soil erosion and reduced amounts of organic material in the ground. In future these problems are likely to get worse. “Climate change exacerbates land degradation through increases in rainfall intensity, flooding, drought frequency and severity, heat stress, wind, sea-level rise and wave action,” the report states. It is a bleak analysis of the dangers ahead and comes when rising greenhouse gas emissions have made news after triggering a range of severe meteorological events.

[..] The new IPCC report emphasises that land will have to be managed more sustainably so that it releases much less carbon than at present. Peat lands will need to be restored by halting drainage schemes; meat consumption will have to be cut to reduce methane production; while food waste will have to be reduced. Among the measures put forward by the report is the proposal of a major shift towards vegetarian and vegan diets. “The consumption of healthy and sustainable diets, such as those based on coarse grains, pulses and vegetables, and nuts and seeds … presents major opportunities for reducing greenhouse gas emissions,” the report states.

First since 1780.

• The Sea Eagle Has Landed – Centuries After It Disappeared (G.)

Sea eagles have returned to the Isle of Wight 239 years after they were last seen there. Six chicks brought from Scotland were taken to the island last month as part of a programme to reintroduce the birds to England’s south coast. Also known as white-tailed eagles, the birds will be released into the wild in the next few weeks. Over the next five years 60 young sea eagles – which grow to have a wingspan of up to 2.4 metres (8ft) and are Britain’s largest bird of prey – will be released on the island in a programme approved by Nature England. It is hoped the birds will begin breeding there by 2024.

“Sea eagles were once a common sight in England and southern Europe but were lost centuries ago,” said Roy Dennis, who has pioneered the reintroduction of the birds to Britain. “This project aims to reverse that situation by restoring them to their ancestral nesting places.” Dennis added that the last pair of sea eagles in England bred on Culver Cliff on the Isle of Wight in 1780. A spokesperson for Forestry England said the new chicks had been doing well since their arrival and that once their health had been checked they would be released into the wild at several different locations in the next few weeks.

White tailed eagle. Photo:Arturo de Frias Marques

Assange: The persecution