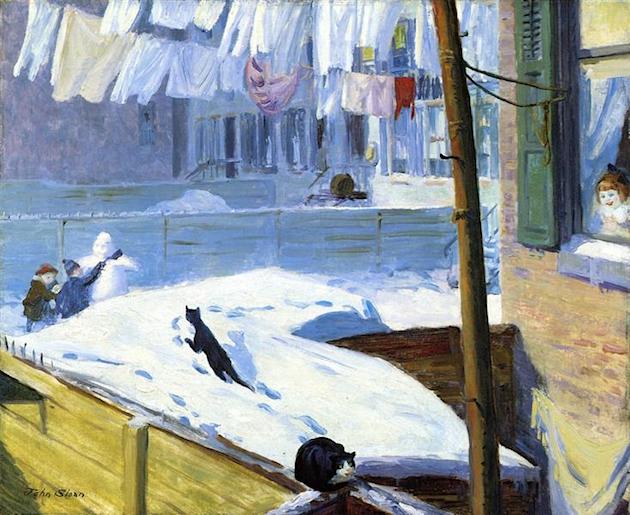

John French Sloan Backyards, Greenwich Village 1926

Berlusconi

https://twitter.com/i/status/1624894337283723266

Ohio

The massive explosion and poisoning of American citizens should be a much bigger story….why isn’t the media talking about Ohio more?

— Alex Stein #99 (@alexstein99) February 12, 2023

https://twitter.com/i/status/1624938064207290368

Footage on the ground from East Palestine, Ohio (February 10, 2023) following the controlled burn of the extremely hazardous chemical Vinyl Chloride that spilled during a train derailment (volume warning) pic.twitter.com/tGURLaFVTO

— More Shower Thoughts (@more_shower) February 13, 2023

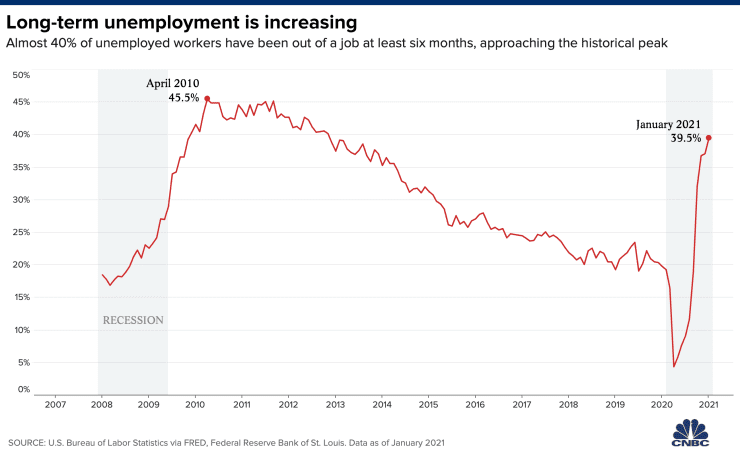

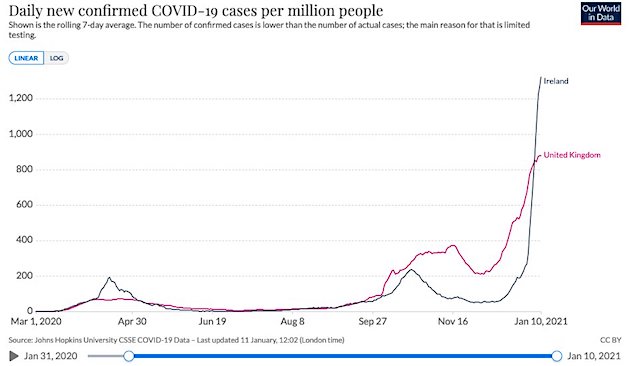

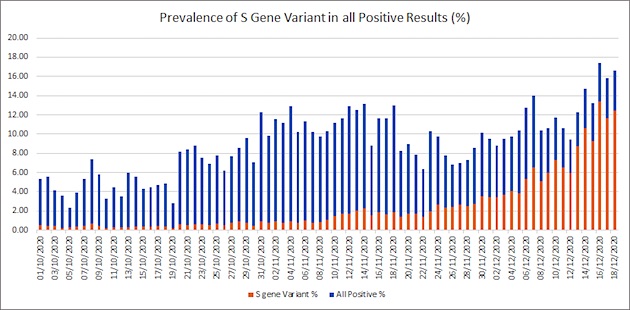

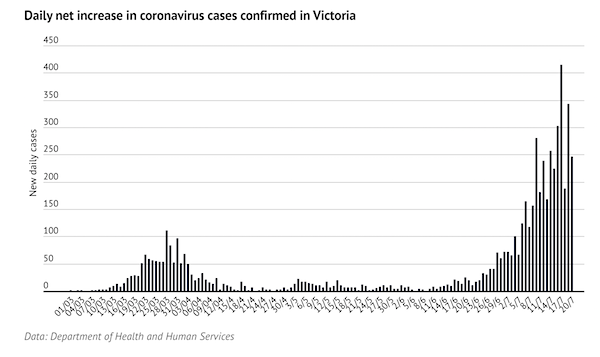

Campbell

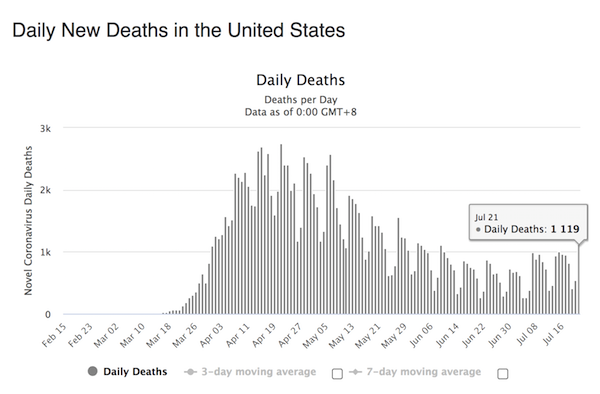

Dr John Campbell on excess deaths around the world.

Australia 9%,

Denmark 30%

England 20%

France 25%

Germany 43%

Hungary 11%

Ireland 20%

Netherlands 37%

Norway 28%

New Zealand 17%

Poland 21%

Scotland 13%

South Korea 18%

Switzerland 12%

Taiwan 25%

United States 12% pic.twitter.com/LQ6QTZPk9X— Janey (@_Janey_J) February 12, 2023

Canberra

https://twitter.com/i/status/1624874491141824512

A Message to Germans—Nord Stream Bombing

If Ukraine were a democracy, Medvedchuk would have a loud voice.

• Medvedchuk Sees No Prospects For Minsk-3 (TASS)

Viktor Medvedchuk, leader of the Opposition Platform For Life party, which is outlawed in Ukraine, said on Sunday that he sees no perspectives for signing the third Minsk agreements.”As for possible Minsk-3, I see categorically no perspectives. Regrettably, the Minsk agreements have sunk into oblivion,” he told Belarus’ STV television channel.According to Medvedchuk, peace settlement in Ukraine “is possible only when several conditions are met.” But, in his words, “Ukraine has practically ceased to exist as a state.” “It is impossible to say now what can happen and how, whether there will be any peace talks,” he stressed.The Zelensky regime “has armed itself with a policy of neo-Nazism,” he said.

“The Western ideology, which has been imposed on the Ukrainian people, its authorities since 2005, when [Viktor] Yushchenko came to power, has been fed for all these years by Western money, ideology and democracy, which has led, as we see, to tens of thousands of human deaths, the destruction of Ukraine and the fighting Zelensky continues at the head of criminal authorities, until the last Ukrainian.” These actions, in his words, are evidently geared to create an “anti-Russia.” “To create and popularize the policy of anti-Russian hysteria, untamed Russophobia. And it is not easy to destroy it all,” he said, “Today, it is necessary to explode the myth that this neo-Nazism is supported by Ukrainians. It is not supported by those from nine to twelve million Ukrainians who have fled the country. It is not supported by millions staying in Ukraine, who, regrettably, have been driven under the bench, have been intimidates, threatened with repression, criminal prosecution, torture and violence,” Medvedchuk stressed.

According to the politician, the Other Ukraine political movement has been set up to tell the world community that many Ukrainians want normalization of relations with Russia. “So that, the voice of other Ukraine is heard in the world and is not represented by Zelensky who is traveling around the globe, using all possible venues with only one goal: to show that the Ukrainian people is allegedly consolidated and he is representing this people,” he said. He noted that “millions of Ukrainians have been forced to flee the country because of the policy of Zelensky’s criminal regime.” “Today, it is necessary to consolidate those Ukrainians who are against Zelensky’s criminal policy. We want his criminal regime to sink into oblivion. And it implies enormous work we have begun and will do to break the information space which has misted the thoughts and conscience of the Ukrainians filling it with anti-Russian hysteria,” he explained.

And that will have connsequences.

• US Officials Basically Admit They Blew Up Nord Stream – Lavrov (RT)

US officials are basically admitting that they were behind the sabotage of the Nord Stream pipelines, which was perpetrated to prevent rapprochement between Moscow and Berlin, Russian Foreign Minister Sergey Lavrov has said. “The US decided that we [Russia] have been cooperating too well with Germany over the past 20 or 30 years; or rather, the Germans cooperated with us too well,” he said in an interview published on the Foreign Ministry’s website on Sunday. The “powerful alliance” based on Russian energy resources and German technology “began to threaten the monopoly position of many American corporations,” Lavrov explained. So, Washington decided to destroy this alliance between Moscow and Berlin, and did it “literally” by attacking the pipelines, which were built to deliver Russian gas to Europe through Germany, he added.

“American officials are basically admitting that the explosions that occurred at Nord Stream 1 and 2 were their doing. They even speak about it with joy,” the foreign minister stated. Lavrov was likely referring to a confession made by US Under Secretary of State for Political Affairs Victoria Nuland during a Senate hearing in late January. “I am, and I think the administration is, very gratified to know that Nord Stream 2 is now… a hunk of metal at the bottom of the sea,” she said at that time. “The vileness of Western politicians is well known,” Lavrov continued, suggesting that “the plan, which is now being implemented through ‘inciting’ Ukraine against Russia and waging a war by the entire West against Russia by means of Ukraine, is to a large extent aimed at preventing a new rapprochement between Germany and Russia.”

The comments by Russia’s top diplomat come just days after iconic American investigative journalist Seymour Hersh released a bombshell report, blaming Washington for sabotaging the Nord Stream pipelines last year. According to an informed source who talked to Hersh, explosives were planted at the pipelines in the Baltic Sea back in June 2022 by US Navy divers under the guise of a NATO exercise. They were detonated in late September, rendering the key European energy infrastructure inoperable. US National Security Council spokeswoman Adrienne Watson denied the report by the Pulitzer Prize-winning journalist, calling it “utterly false and complete fiction.” No one among high-ranking American officials has even commented on the accusations made by Hersh.

For months, the Russian authorities have been pointing to the fact that the only side to benefit from the destruction of Nord Stream was the US, which has seen supplies of its more expensive liquefied natural gas to Europe increase massively since the explosions.

He’s selling his country by the pound.

• JP Morgan Reaches Agreement With Zelenskyy On Rebuilding Infrastructure (Fox)

J.P. Morgan, the nation’s largest bank, has signed a memorandum of understanding with Ukraine’s president Volodymyr Zelenskyy with the eye on attracting private capital for a new investment fund to rebuild Ukraine’s infrastructure that has been destroyed in its war with Russia, FOX Business has learned. J.P. Morgan bankers spent most of last week meeting with Zelenskyy and his senior staff in Ukraine where they discussed the creation of a fund seeded with $20 billion to $30 billion in private capital, according to people with direct knowledge of the matter. Other ideas discussed with the Ukrainian president were the creation of a bank administered by Wall Street firms that would make investments in oil refineries, roads, bridges and other pieces of economic infrastructure destroyed in Vladimir Putin’s year-long campaign to annex the country and rebuild the old Soviet Union, these people add.

J.P. Morgan bankers were on the ground in Kyiv and other cities, dodging bombs, and witnessing firsthand how the war has crippled the country’s economy. After a series of meetings with various ministers, they met directly with Zelenskyy on Friday night. As a gesture of goodwill on the eve of Sunday’s Super Bowl, the bankers also presented Zelenskyy with a New England Patriots jersey with the number “91,” to signify the year Ukraine gained independence from the old Soviet Union, these people say. FOX Business is the first to report the possible creation of an investment fund and bank to help rebuild the country. People with knowledge of the matter say the plans for a fund or a bank are in the nascent stages and subject to change. J.P. Morgan declined to comment. The big bank is expected to make an announcement about its work in Ukraine on Monday.

[..] Privately, J.P. Morgan bankers met with Zelenskyy for hours last week, providing him with ideas on how to attract private capital. They also recommended that he invite major CEOs, like Apple’s Tim Cook, to the country to discuss economic development and that he meet with GOP lawmakers, such as the new House Speaker Kevin McCarthy, R-Calif. Some Republicans are skeptical about the billions in US aid being sent to the country, these people add. They also said that weeding out corruption and eliminating graft in government will be key to attracting private capital. Zelenskyy was said to be receptive to the advice and understood that at some point the vast amounts of western aid to the country will come to an end and that private capital – which will demand a return for its investment – will be needed to rebuild, these people say.

“..the tenth sanctions package will only be suitable for causing further damage to us Europeans, similar to the previous nine ones.”

• Hungary Slams EU Push To Arm Ukraine (RT)

The European Union’s calls to keep supporting Ukraine with arms shipments will only prolong the conflict with Russia, the Hungarian foreign minister said on Sunday. Speaking to radio Kossuth, Peter Szijjarto commented on recent remarks by the President of the European Parliament, Roberta Metsola, who pushed for fighter jets and long-range weapons to be sent to Kiev. According to the minister, EU lawmakers’ decisions on Ukraine “have generally caused damage to Europe,” and further weapons deliveries will only worsen the hostilities. He went on to blast the EU legislature, claiming that its “credibility is practically zero.” Szijjarto pointed to a recent graft scandal as proof that the EU parliament is “one of the most corrupt organizations in the world.”

He was referring to the recent arrest of the parliament’s former vice president, Eva Kaili, who has been charged with taking bribes from Qatar in exchange for illegally lobbying the interests of the Gulf state. Szijjarto noted that in Western countries, war rhetoric sounds “incomparably louder than the rhetoric of peace,” while nations outside “the transatlantic bubble” tend to prefer peace to a deadly conflict. The minister went on to question the West’s anti-Russia sanctions. He argued that they have failed to force Moscow to end the conflict, while Europe’s economy has “faced incredible difficulties,” and that “the tenth sanctions package will only be suitable for causing further damage to us Europeans, similar to the previous nine ones.” Since the start of large-scale hostilities in Ukraine almost a year ago, Hungary, which is heavily dependent on Russian energy, has been critical of Western sanctions against Moscow. It has also refused to support Kiev with weapons, or allow arms transfers across its border with Ukraine.

https://twitter.com/i/status/1624791254553841665

And that’s why Samantha Power is in Budapest. They should throw her out.

• Samantha Power is in Hungary, Seeding Another Color Revolution (CTH)

Hungary has been in the crosshairs of the Biden/Obama administration ever since Prime Minister Viktor Orban refused to align with the WEF Western Democracies in their quest for regime change in Russia. As the NATO led western alliance assembled to use Ukraine as a proxy war against Russia, Hungarian Prime Minister Orban would not join. In early April 2022, Hungarian Prime Minister Viktor Orban was overwhelmingly reelected, despite the massive efforts against him by the European Union, western and euro-centric multinational globalists. As a result of the victory, Brussels was furious at the Hungarian people. Associated Press – […] “Orban — a fierce critic of immigration, LGBTQ rights and “EU bureaucrats” — has garnered the admiration of right-wing nationalists across Europe and North America.”

Within the statements reported from his 2022 victory speech, Prime Minister Orban warned citizens of the NATO and western allied countries about the manipulation of Ukraine and how he views the Zelenskyy regime: […] “while speaking to supporters on Sunday, Orban singled out Zelenskyy as part of the “overwhelming force” that he said his party had struggled against in the election — “the left at home, the international left, the Brussels bureaucrats, the Soros empire with all its money, the international mainstream media, and in the end, even the Ukrainian president.”This put Hungarian Prime Minister Viktor Orban in the crosshairs of the western alliance, specifically the EU and U.S. bureaucrats who use their power, position and intelligence apparatus to manipulate foreign nations. A year later and now we see USAID Administrator Samantha Power in Hungary openly discussing her seeding of the NGO’s and political activist systems in order to generate yet another color revolution.

Samantha Power, the wife of Cass Sunstein, is well known as the Obama/Biden administration’s advance operative who uses her position in U.S. government to influence activism in targeted nations. Hungary is now her target. Why is eliminating Hungarian Prime Minister Viktor Orban now the goal of the Biden administration. Well, a reminder: • Hungary warned citizens of the west about the New World Order, created through Ukraine. • Hungary continued to purchase Russian oil and natural gas. Zelenskyy and the Western alliance were furious. • Hungary said they would continue energy purchases in Rubles if that is what Russia demanded.

We will not enable escalation of conflict that may lead to WW3.”

• Elon Musk Explains Purpose Of Starlink In Ukraine (RT)

SpaceX CEO Elon Musk has revealed the rationale behind the company’s decision to restrict the use of its Starlink internet system by the Ukrainian military. He doesn’t want the conflict to escalate into World War III, he said. The explanation was part of Musk’s response to astronaut Scott Kelly, who is a vocal supporter of the Ukrainian cause. Kelly urged restoration of full functionality of the system. The restriction announced last week bars the Ukrainian military from using Starlink to pilot drones, which SpaceX President Gwynne Shotwell described as “weaponization” of the product. Musk said Kelly was “smart enough not to swallow media & other propaganda bs” and pointed out that Starlink remained available for military communications in Ukraine, even though as a private company SpaceX had the right to switch the terminals off.

“We’re trying hard to do the right thing, where the ‘right thing’ is an extremely difficult moral question,” Musk stated. “We will not enable escalation of conflict that may lead to WW3.” The Starlink system was hailed by US officials as a gamechanger for the Ukrainian military, providing a reliable communication system that Russia allegedly could not disrupt through hacking. But Musk has provoked the ire of Kiev on several occasions, including by proposing a peace plan in October that would have required Ukraine to make concessions to Russia. He faced criticism and insults from Ukrainian officials in response.

Responding to the Starlink change, Mikhail Podoliak, an aide to Ukrainian President Vladimir Zelensky, declared that Musk and Shotwell had only two options: they could either be on Ukraine’s side and not seek “ways to do harm” or be counted as pro-Russian. The same official previously claimed that the Musk-owned social media platform Twitter was limiting the reach of Ukrainian government accounts and helping “Russian propaganda.” Podoliak offered no evidence to support the claim, but threatened regulatory action.

And if you tax us on them, we will refuse to invest.

• Big Oil Rakes In Record Profits (RT)

Oil giants Shell, BP, Exxon Mobil, Chevron and TotalEnergies posted a combined profit of $196.3 billion last year, according to the companies’ earnings reports. A record-high result for the oil industry, the sum tops the economic output of most countries. French oil giant TotalEnergies was the last to report on its earnings, announcing on Wednesday that its full-year profit in 2022 was $36.2 billion, double its total for 2021. US oil major Chevron and British giants BP and Shell also reported record-high results earlier this month, while Exxon’s $56 billion-profit marked a historic high for the entire Western oil industry. The record-setting earnings came as a result of a spike in fossil fuel prices last year. However, criticism of the industry for hoarding money while consumers are struggling to pay soaring energy bills has intensified.

“Given that we’re entering a global recession and that most of us know people who are struggling, we must all call out profiteering like this,” Alice Harrison from advocacy group Global Witness, told CNBC, calling for “an increased windfall tax to help those struggling to pay their bills.” Human rights group Amnesty International said the oil majors’ profits are “patently unjustifiable” and “an unmitigated disaster.” “The billions of dollars of profits being made by these oil corporations must be adequately taxed so that governments can address effectively the rising cost of living for most vulnerable populations,” said the group’s secretary general Agnes Callamard. US President Joe Biden called Big Oil’s record earnings “outrageous” in his State of the Union address on Tuesday. The head of state noted that the companies invested “too little of that profit” into efforts to stem the surge in energy prices, and proposed raising the tax on corporate stock buybacks four times to boost long-term investment.

Oil companies, however, have been arguing that windfall taxes could hinder investment. “Windfall taxes or price caps simply erode confidence in that investment stability and so I do worry about some of the moves being made. I think there is a different approach that needs to be had which is to really draw investment capital at a time when we need to be able to embed energy security into the broader energy system here in Europe,” Shell CEO Wael Sawan said last week. This opinion was mirrored by Amin Nasser, head of the world’s largest energy company Saudi Aramco, who told CNBC that higher taxes are “not helpful for [the companies] in order to have additional investment.” “They need to invest in the sector, they need to grow the business, in alternatives and in conventional energy, and they need to be helped,” he added.

These are Big Oil’s record profits.

• Europe’s Spend On Energy Crisis Nears 800 Billion Euros (RT)

European countries’ bill to shield households and companies from soaring energy costs has climbed to nearly 800 billion euros, researchers said on Monday, urging countries to be more targeted in their spending to tackle the energy crisis. European Union countries have now earmarked or allocated 681 billion euros in energy crisis speding, while Britain allocated 103 billion euros and Norway 8.1 billon euros since September 2021, according to the analysis by think-tank Bruegel. The 792-billion-euro total compares with 706 billion euros in Bruegel’s last assessment in November, as countries continue through winter to face the fallout from Russia cutting off most of its gas deliveries to Europe in 2022.

Germany topped the spending chart, allocating nearly 270 billion euros – a sum that eclipsed all other countries. Britain, Italy and France were the next highest, although each spent less than 150 billion euros. Most EU states spent a fraction of that. On a per capita basis, Luxembourg, Denmark and Germany were the biggest spenders. The spending earmarked by the countries on the energy crisis is now in the same league as the EU’s 750-billion-euro COVID-19 recovery fund. Agreed in 2020, that saw Brussels take on joint debt and pass it onto the bloc’s 27 member states to cope with the pandemic. The energy spending update comes as countries debate EU proposals to loosen state aid rules further for green technology projects, as Europe seeks to compete with subsidies in the United States and China.

“Now, this was an act of war, pure and simple. Curiously enough, it was against Germany.”

• Ray McGovern Comments on Sy Hersh (Garland Nixon)

I know him to be a meticulous reporter, winner of five Polk Awards, Pulitzer Prize, you name it. Back in the day when honest reporters were so honored. This piece has all the earmarks of Sy’s meticulous approach, and he clearly has a very good source who felt a, well, he felt a constitutional obligation to honor his or her oath to the Constitution of the United States, which is the supreme oath any of us take. And that is to make sure that you tell the truth, especially when the Constitution is being violated. Now, this was an act of war, pure and simple. Curiously enough, it was against Germany. And curiously enough, President Joseph Biden, at a press conference in the presence of the chancellor of Germany, Olaf Scholz, said this is going to happen if Russia invaded Ukraine. And, of course, he was asked, well, how do you do this? I mean, how can you how can you be so confident that Nordstrom will be killed and Biden said, well, just, you know, trust me, it’s going to happen.

And so she, bilingual, the Reuters reporter, turned to Scholz – and this is not widely available now for obvious reasons – and she said, well, I mean, do you agree with that? I mean, hello, how do you feel about this? And this hack, this political hack said: we do everything together. We do everything together. We will be together on this now. So that’s available now. It’s available. Not Sy Hersh’s piece yet, but that interview is available in Germany. You know, I describe Olaf Scholz as kind of the epitome of the abused spouse. Stands there and is abused not only by his master, Joe Biden, but also by this hack that he has as foreign minister. Her name is Baerbock. She is the the most vociferous of all the people saying that we are at war. That’s what she said. We are at war with Russia.

So the question will be: it has been 90 years, count them, nine zero years since the Nazis were making a push for power in Germany. What happened? The Reichstag, the German parliament building was burned down at the end of January, 1933. What happened? The Germans caved. The Nazis didn’t have a majority, but they scared the living daylights out of German citizens. First of all, Social Democrats gave in. Next to fall, the Zentrum party, the Catholic Party. No one spoke up. We know the rest of the story. All right. Now, sometimes history is replete with ironies. Here it is exactly to the month, 90 years later. Will the German people acquiesce in their industry, and then their bodies being frozen out this winter? Or will they rise up and say: “Look, Mr Scholz, you don’t know what the hell you’re doing, and neither does Baerbock. Get out of here!”, and replace that government?

“It is clear that… getting rid of cash not only touches on issues of transparency, simplicity or security… but also carries a huge danger of totalitarian surveillance..”

• Cashless Society? Not in Switzerland (R.)

Swiss citizens will get the chance to try to ensure their economy never becomes cashless, a pressure group said, after collecting enough signatures on Monday to trigger a popular vote on the issue. The Free Switzerland Movement (FBS) says cash is playing a shrinking role in many economies, as electronic payments become the default for transactions in increasingly digitised societies, making it easier for the state to monitor its citizens’ actions. It wants a clause added to Switzerland’s currency law, which governs how the central bank and government manage the money supply, stipulating that a “sufficient quantity” of banknotes or coins must always remain in circulation.

There is no evidence of moves towards a cashless society by Swiss authorities. FBS said it had garnered over 111,000 signatures in support of the measure, above the 100,000 needed to trigger a popular vote. Under Switzerland’s system of direct democracy, the proposal would become law if approved by voters, though government and parliament would decide how that law was implemented.

“It is clear that… getting rid of cash not only touches on issues of transparency, simplicity or security… but also carries a huge danger of totalitarian surveillance,” FBS president Richard Koller said on the group’s website. He also views Switzerland as a European standard-bearer for the defence of cash, as pushing through such guarantees in the European Union would entail the “almost impossible” process of securing approval from all 27 member states. Accelerated by the impact of COVID-19 lockdowns, the trend towards increased cashless payments was evident as far back as 2017, when an Ipsos study found more than a third of Europeans and Americans would happily go without cash and 20 per cent pretty much did so already.

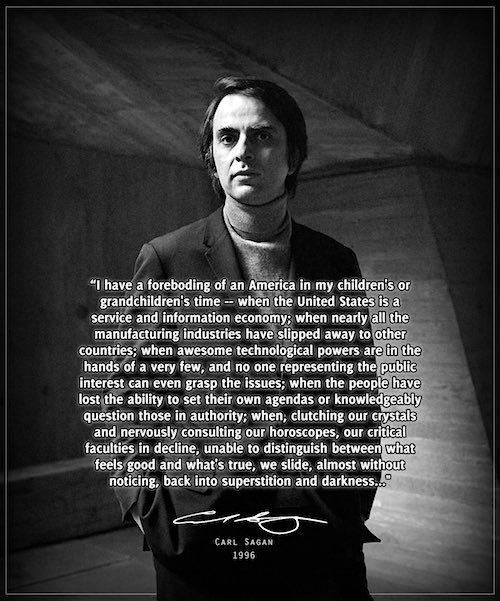

“Madness born of greed gets classified as ‘a higher form of civilization’..”

A fairer economy would avoid excessive exploitation and extremes of inequality; it would also avoid any systemic negligence in the upbringing of the next generation. Such an economy would be in harmony with the living economics of nature, which has sustained life on earth from ‘day one’. Sadly, that worthy goal remains out of reach as long as people proclaim loudly that ‘greed is good’. We may consider a specific recent example. The subprime mortgage crisis in the US was caused by the fact that greedy but naïve people were cheated and exploited by greedy and cunning people. Naturally, the former were in much larger numbers, since that is a characteristic of economic exploitation.

That entire episode of ‘mega-greed’ – including the ensuing government bailouts – damaged the overall economy of the country and worsened the deep schisms running through the society. After studying such episodes of ‘mega-greed’, it would be difficult to argue that ‘greed is good’. The so-called ‘modern science’ of Economics is totally out of sync with living economics, which is the true economics of Mother Nature. The ‘fake science’ of Economics keeps inconvenient costs out of its books of accounts, and always comes up with wrong diagnoses and wrong prognoses. Nonetheless, because of the ignorance and greed of political leaders, this ‘fake science’ rules the roost.

We must hope for a smooth transition from the economics of death to living economics. However, far too much psychic energy has already been invested in the unnatural theories which justify exploitation of nature, exploitation of fellow human beings, and economic gain through bloody conflict. A painful denouement, or catharsis, is therefore inevitable – as has happened many times in human history. As before, such periods of violent house-cleaning are followed by rationalizations, often based on hoary books. A competition ensues among ‘scholars’ to show who is cleverer, or which hoary books have been proved right. Madness born of greed gets classified as ‘a higher form of civilization’.

The damage becomes too large to ignore…

• UK Holds ‘Secret’ Cross-Party Brexit Summit (RT)

High-ranking officials from opposite ends of the UK political spectrum have held ‘secret’ discussions designed to navigate a path out of various economic and strategic problems posed by Brexit, according to a report by The Observer. Documents from the meeting obtained by the British newspaper say that the talks were held under the primary topic: “How can we make Brexit work better with our neighbours in Europe?” The newspaper quoted a source who stated it to have been a “constructive meeting” which discussed at length economic problems presented by Brexit which come at a time of rising inflation and energy prices. “The main thrust of it was that Britain is losing out, that Brexit is not delivering, our economy is in a weak position,” the source said.

The summit, which reportedly took place on Thursday and Friday, was attended by members of both the ‘Leave’ and ‘Remain’ campaigns, including senior Tory Michael Gove and several members of Keir Starmer’s Labour shadow cabinet. It also included figures from investment banking company Goldman Sachs and Angus Lapsley, the NATO assistant secretary general for defense policy and planning. Gove, who was a central voice in the ‘Leave’ movement in 2016, is also understood to have been “honest” about problems presented as a result of the vote, though he maintained a position that Brexit will prove to be a good choice long-term. The documents detailing the summit also said that “rejoining the EU will not be on the agenda” but noted that the UK and EU share common goals when it comes to the energy and technology sectors, the relationship with Washington, and “containing Russian aggression”.

They also raised questions about the benefits of closer links between the UK and the 27-member European bloc. The Northern Ireland protocol, which aims to prevent a hard border between Northern Ireland and the Republic of Ireland without affecting trading ties between the UK and EU, is currently a central issue in Brussels and was also prominently discussed at the summit, The Observer wrote. The matter remains unresolved several years after Brexit came into effect. The nature of the talks reflects wider concerns from within the UK political ecosystem that Brexit will continue to damage the UK economy, as well as its strategic influence across the globe. The Office for Budget Responsibility has predicted that Brexit will reduce the UK’s GDP per capita by a factor of 4% over 15 years from 2016.

Character murder.

• The Pain of Listening To Twitter Censorship Testimony (Naomi Wolf)

It is incredible to me, as someone who was raised in an American meritocracy, and who has until very recently believed in American meritocracy, that a group of nonentities in Twitter, in collusion with nonentities at CDC (hi there, Carol Crawford), the White House and the US Dept. of the Census — were able thus so simply, and at such immediate, nuclear scale, to destroy the reputation of someone identified since 1990 as a major American voice. So: this can happen to any American voice. These ill-dressed, ill-spoken, banal careerist ciphers, cost me so much. I re-trained for almost a decade, in the middle of my life, to teach. It is all I had ever really wanted to do with my life. Now I will never be able to be the only thing I ever wanted to be — a Professor of English Literature at a university.

I am now sixty. It’s too late for me. Twitter, in collusion with the Biden administration, cost me my hard-won lifelong dream. I’ve been maligned and censored by Twitter since 2021. Even if the company eventually settles my lawsuit against it, and even though Mr Musk has “let” me back on the platform, that would be, this is, no victory. Twitter has not sent an advisory to all of the news outlets around the world that depicted me, at Twitter’s own direction, as crazy, that they were wrong to have done so; there has been no press release stating that they erred, and that I was right, and that they are sorry for wrongly abusing my reputation — and for destroying women and babies. No, forever I will remain “deplatformed from Twitter for misinformation” in the cybersphere, even though it is finally being established that sadly I was deplatformed for telling God’s truth.

It is unlikely that any university at this point would see past the grotesque imprint on my bio that Twitter, via the White House, CDC and perhaps the FBI, has taken care to embed in my bio, and in articles about me, around the world. It is unlikely, too, that I will ever recoup the six figure investments that investors withdrew from my company when Twitter, colluding with the government, was orchestrating the shredding of my reputation. It is unlikely that a 35 years career and legacy online of what had been seen until very recently as a life of significant accomplishment, can ever be re-established. I try never to complain in public. I try never to show self-pity or weakness, at least not to my enemies. But Twitter’s attacks on me are not over, and I am simply sick of the damage these mediocrities have done to me, and continue to try to do.

President Kennedy?!

• I’m forming a Super PAC to Draft RFK Jr. To Run For President (Steve Kirsch)

The federal agencies are so brain damaged it will take major surgery to fix them. Congress clearly isn’t up to the task. We need new leadership in the White House. I can’t think of anyone more qualified to clean up the mess and unite the country than RFK Jr. So I’m putting together a Super PAC to encourage him to run for President on the Democratic side against Biden. If you’d like to help out, please fill out the form here. There will be both volunteer and paid opportunities available. If you have worked for a Super PAC before, it’s especially helpful to me if you register, even if your time is limited.

Romania

https://twitter.com/i/status/1624682043555852289

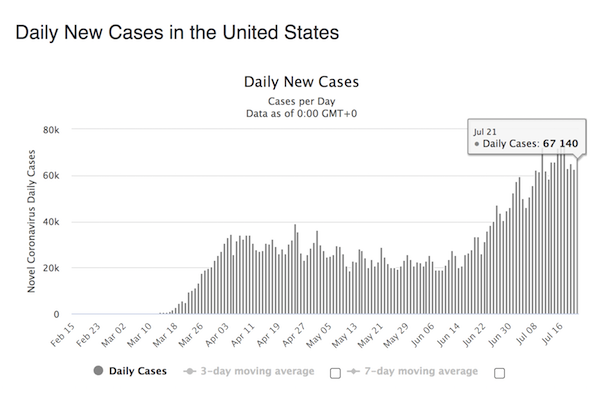

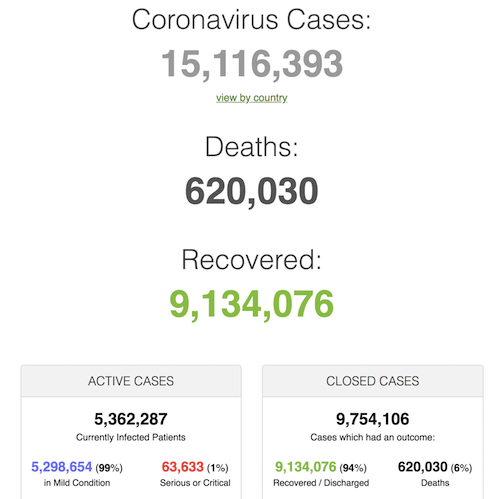

Distraction

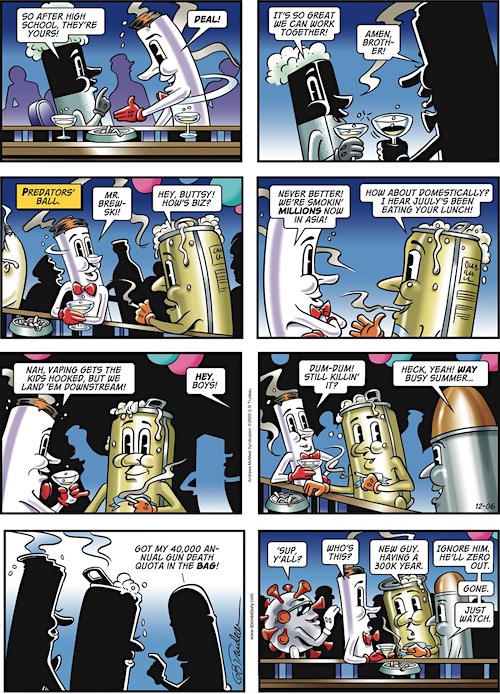

Are The UFOs Just A Big Distraction From All Of This? pic.twitter.com/CKt8c10rnk

— Red Voice Media (@redvoicenews) February 12, 2023

O’Keefe

https://twitter.com/i/status/1624882242202787842

Shrooms

Mushrooms release millions of microscopic spores into the wind to propagate.

Credit: Villareal C. Jojopic.twitter.com/Ktl5BSVhwI

— Wonder of Science (@wonderofscience) February 12, 2023

Seal nose

https://twitter.com/i/status/1624720584243351552

Octopus

A diver helps an octopus trade his plastic cup for a seashellpic.twitter.com/a3gSnXETfw

— Fascinating (@fasc1nate) February 13, 2023

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.